Fortifying Agent Market Report

Published Date: 31 January 2026 | Report Code: fortifying-agent

Fortifying Agent Market Size, Share, Industry Trends and Forecast to 2033

This report explores the global Fortifying Agent market, providing insights into market dynamics, size forecasts, industry analyses, and segment performance from 2023 to 2033, focusing on key trends and growth drivers.

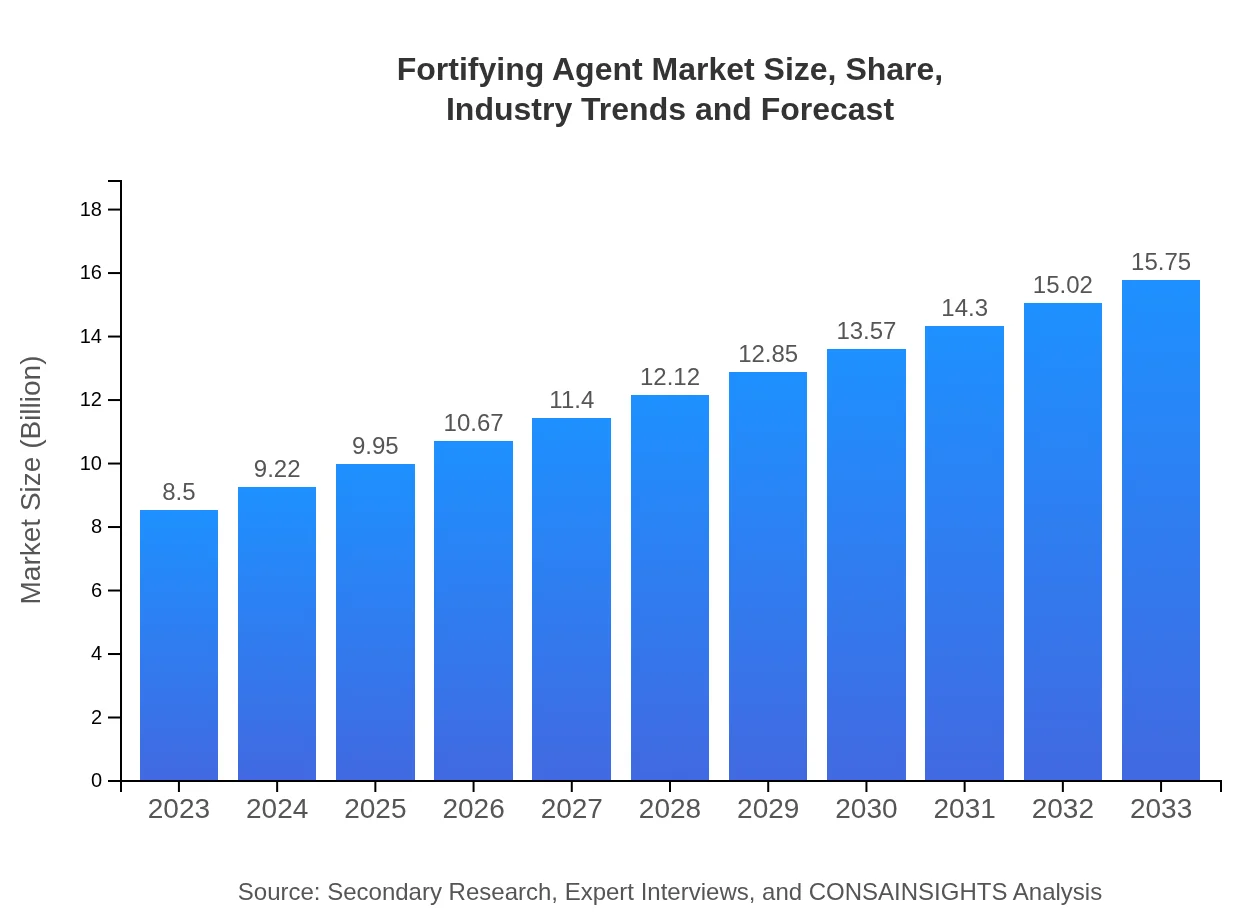

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $8.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $15.75 Billion |

| Top Companies | BASF SE, Nutraceutical International Corporation, Du Pont de Nemours, Inc., Cargill Inc. |

| Last Modified Date | 31 January 2026 |

Fortifying Agent Market Overview

Customize Fortifying Agent Market Report market research report

- ✔ Get in-depth analysis of Fortifying Agent market size, growth, and forecasts.

- ✔ Understand Fortifying Agent's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Fortifying Agent

What is the Market Size & CAGR of Fortifying Agent market in 2023 and 2033?

Fortifying Agent Industry Analysis

Fortifying Agent Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Fortifying Agent Market Analysis Report by Region

Europe Fortifying Agent Market Report:

Europe's Fortifying Agent market is projected to grow from $2.59 billion in 2023 to $4.80 billion in 2033, driven by increasing regulations on food safety and a growing emphasis on health and wellness among consumers. Innovations in product formulations also support market growth.Asia Pacific Fortifying Agent Market Report:

The Asia Pacific region is anticipated to witness significant growth in the Fortifying Agent market, projecting a rise from $1.56 billion in 2023 to $2.90 billion in 2033. The increasing demand for fortified food and beverages in countries with substantial populations like India and China is a key driver. Furthermore, government initiatives promoting health and wellness contribute to this growth.North America Fortifying Agent Market Report:

North America holds a prominent share in the Fortifying Agent market, expected to grow from $3.30 billion in 2023 to $6.12 billion by 2033. The high adoption of dietary supplements and an aging population driving health-centric purchases are major growth factors for this region.South America Fortifying Agent Market Report:

In South America, the market is relatively underdeveloped, with projected values moving from -$0.02 billion in 2023 to -$0.04 billion in 2033. Economic factors and regulatory challenges hinder growth, though there is potential for recovery with rising health trends and demand for nutritional products.Middle East & Africa Fortifying Agent Market Report:

In the Middle East and Africa, the Fortifying Agent market is expected to rise from $1.06 billion in 2023 to $1.97 billion in 2033. Urbanization and increased health awareness are key factors contributing to this growth, alongside shifts in dietary habits.Tell us your focus area and get a customized research report.

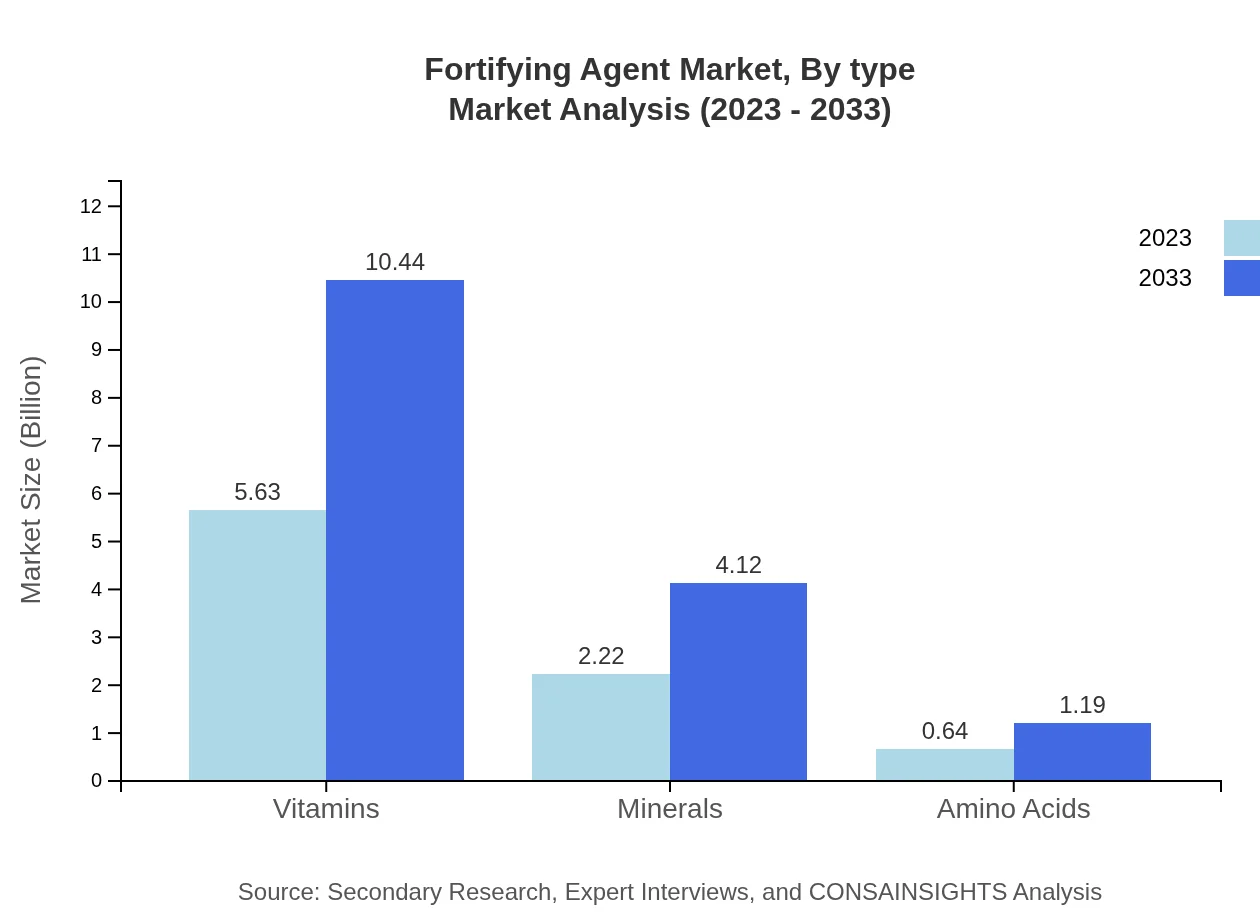

Fortifying Agent Market Analysis By Type

In terms of type, vitamins dominate the Fortifying Agent market, accounting for approximately 66.26% of the total market in 2023. This segment is projected to expand from $5.63 billion to $10.44 billion until 2033. Minerals follow with a significant share of 26.17%, forecasted to grow from $2.22 billion to $4.12 billion. Other segments like amino acids, while smaller, contribute to the market with their growing relevance in personalized nutrition.

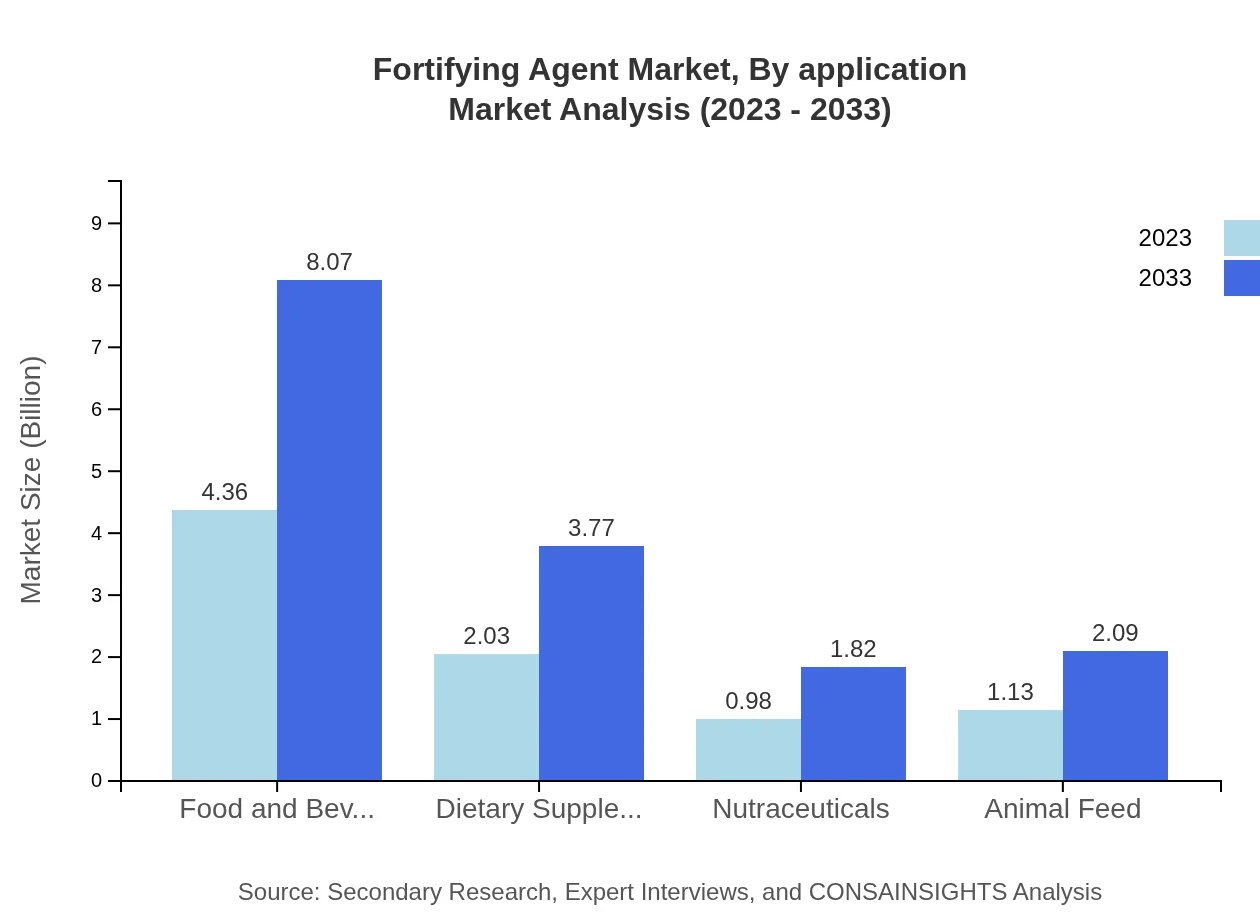

Fortifying Agent Market Analysis By Application

The food and beverage application segment is the largest, comprising 51.24% of the market in 2023 and projected to follow a similar trajectory until 2033, reaching $8.07 billion. Dietary supplements also hold a significant portion at 23.93%, with expected growth paralleling that of food products. Nutraceuticals and animal feed segments are growing moderately as consumer preferences shift towards functional and health-oriented products.

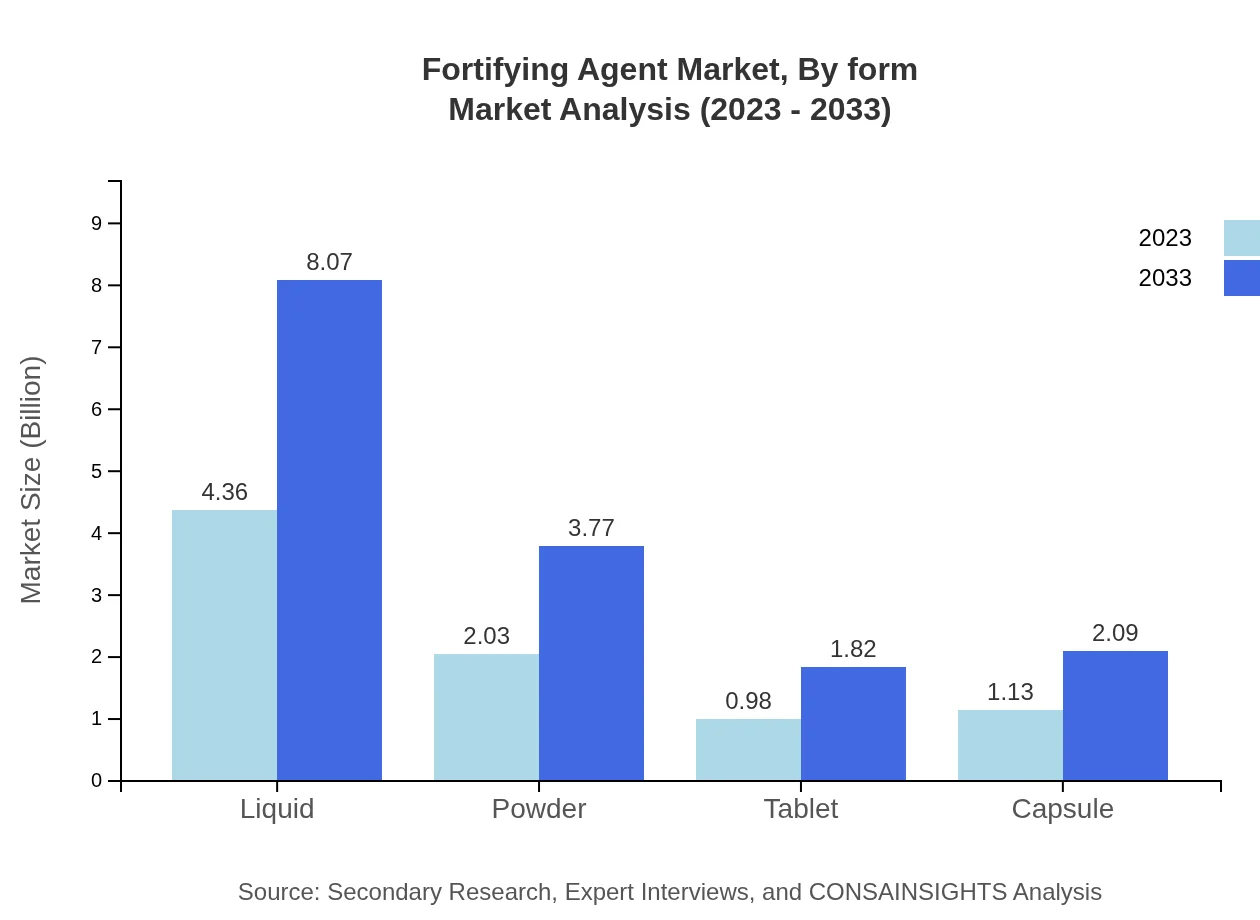

Fortifying Agent Market Analysis By Form

Liquid forms of fortifying agents hold the largest market share, accounting for 51.24% and are expected to grow significantly, doubling from $4.36 billion in 2023 to $8.07 billion by 2033. Powder and capsule forms follow, with powders expected to grow to $3.77 billion and capsules to $2.09 billion, reflecting growing consumer preference for varied formats of nutritional products.

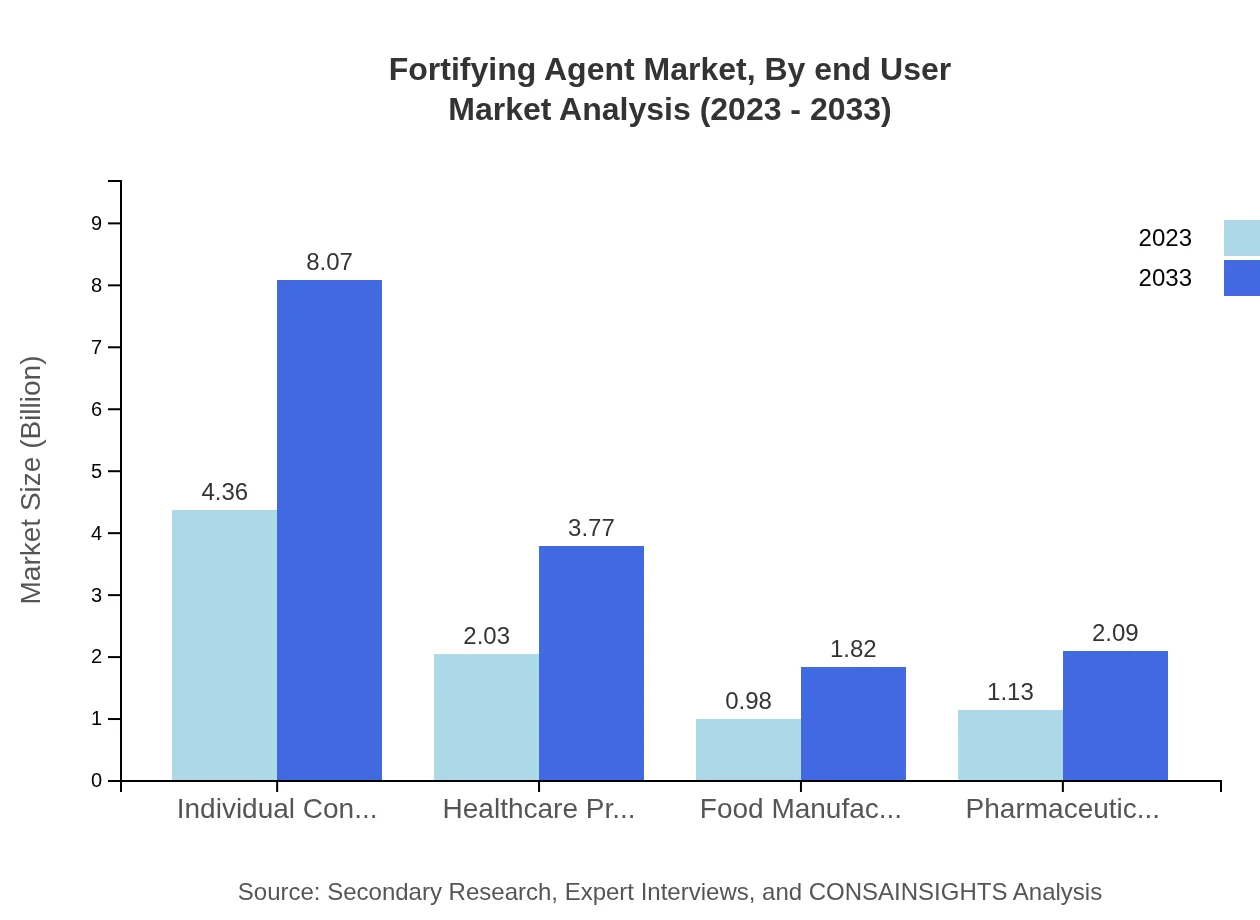

Fortifying Agent Market Analysis By End User

Individual consumers represent a significant share (51.24%) of market demand, demonstrating the trend of self-medication and personalized nutrition. Healthcare providers account for 23.93%, while food manufacturers and pharmaceutical companies represent 11.58% and 13.25% respectively. As health trends continue impacting consumer choices, these segments are poised for further growth.

Fortifying Agent Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Fortifying Agent Industry

BASF SE:

BASF is one of the largest chemical producers in the world, providing a wide array of fortifying agents, particularly in the vitamin and mineral segments. The company's commitment to innovation and sustainable practices positions it as a market leader.Nutraceutical International Corporation:

Nutraceutical focuses on premium-quality nutritional and dietary supplements, holding a strong position in the Fortifying Agent segment with a robust portfolio that includes several fortified product lines tailored for various markets.Du Pont de Nemours, Inc.:

DuPont offers a range of nutritional ingredients that support the fortification of food and beverages, emphasizing innovative solutions that enhance product diets to cater to health-conscious consumers.Cargill Inc.:

Cargill is a key player in the global food sector, providing fortifying agents designed primarily for the food production industry, supporting a variety of applications such as animal nutrition and human food fortification.We're grateful to work with incredible clients.

FAQs

What is the market size of fortifying Agent?

The fortifying agent market is valued at approximately $8.5 billion in 2023, with a projected CAGR of 6.2% leading to significant growth by 2033.

What are the key market players or companies in this fortifying Agent industry?

Key players in the fortifying agent market include major pharmaceutical and nutrition companies focusing on innovative formulations, sustainable sourcing, and global distribution networks to capture diverse market segments.

What are the primary factors driving the growth in the fortifying Agent industry?

Growth in the fortifying agent market is driven by rising health awareness, increased consumer demand for nutritional supplements, and regulatory support for fortified food products promoting public health.

Which region is the fastest Growing in the fortifying Agent?

The North American region is expected to be the fastest-growing market for fortifying agents, with the market projected to rise from $3.30 billion in 2023 to $6.12 billion by 2033.

Does ConsaInsights provide customized market report data for the fortifying Agent industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs, allowing clients to access detailed insights on market dynamics, trends, and competitive landscapes.

What deliverables can I expect from this fortifying Agent market research project?

From the fortifying agent market research project, clients can expect detailed reports, market analysis, forecasts, trend assessments, and strategic recommendations tailored to their business needs.

What are the market trends of fortifying Agent?

Current trends in the fortifying agent market include a shift towards innovative delivery formats like liquids and tablets, with a strong emphasis on health-focused formulations and sustainable manufacturing practices.