Fpga Market Report

Published Date: 22 January 2026 | Report Code: fpga

Fpga Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the FPGA market, covering insights, market size, growth forecasts, and industry analysis from 2023 to 2033, aiding stakeholders in strategic planning and decision-making.

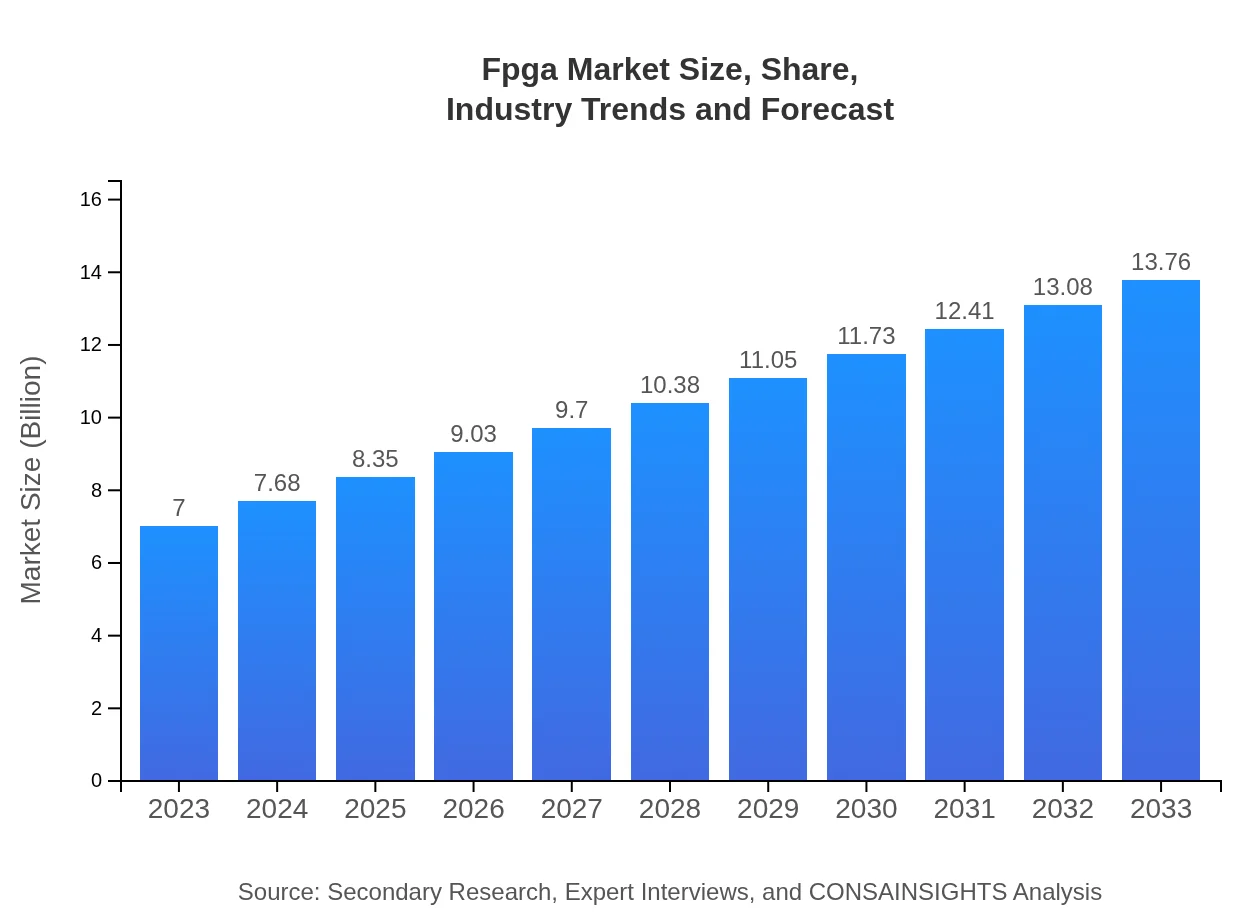

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $7.00 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $13.76 Billion |

| Top Companies | Xilinx, Inc., Intel Corporation, Lattice Semiconductor Corporation, Microsemi Corporation |

| Last Modified Date | 22 January 2026 |

FPGA Market Overview

Customize Fpga Market Report market research report

- ✔ Get in-depth analysis of Fpga market size, growth, and forecasts.

- ✔ Understand Fpga's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Fpga

What is the Market Size & CAGR of FPGA market in 2023?

FPGA Industry Analysis

FPGA Market Segmentation and Scope

Tell us your focus area and get a customized research report.

FPGA Market Analysis Report by Region

Europe Fpga Market Report:

The European FPGA market, starting at $1.71 billion in 2023, is forecast to grow to $3.37 billion in 2033, driven by advancements in automotive and industrial automation sectors.Asia Pacific Fpga Market Report:

In 2023, the FPGA market in the Asia Pacific is valued at approximately $1.48 billion and is expected to grow to $2.90 billion by 2033, driven by the region's rapid industrialization and technological adoption primarily in countries like China, Japan, and South Korea.North America Fpga Market Report:

North America, with a market size of $2.66 billion in 2023, is anticipated to reach $5.24 billion by 2033, heavily influenced by the presence of leading technology firms and a strong focus on R&D.South America Fpga Market Report:

The South American FPGA market is projected to expand from $0.48 billion in 2023 to $0.94 billion by 2033, as growing investments in telecommunication infrastructure and rising consumer demand stimulate the market.Middle East & Africa Fpga Market Report:

The Middle East and Africa FPGA market is expected to grow from $0.67 billion in 2023 to $1.31 billion by 2033, with increasing technological investments in various sectors enhancing demand.Tell us your focus area and get a customized research report.

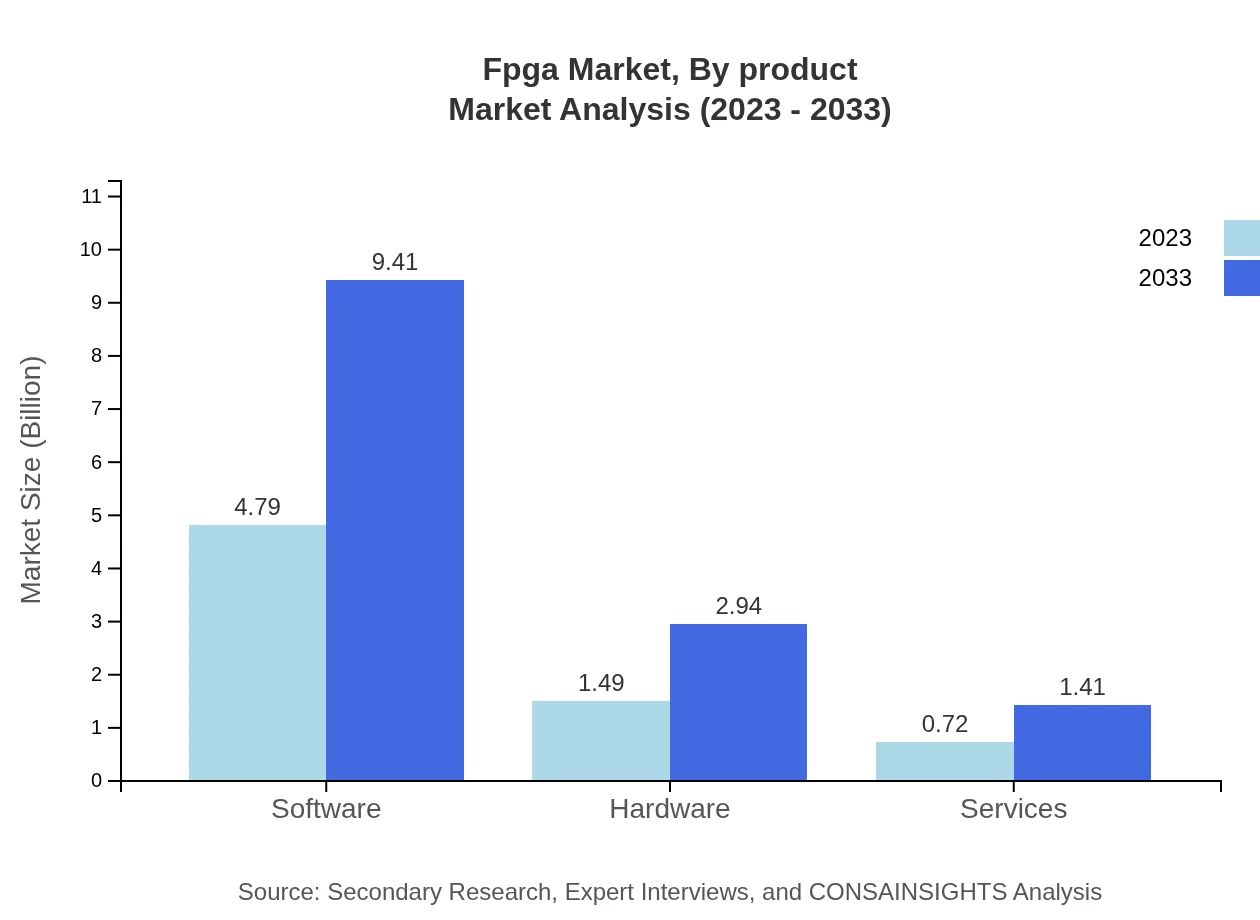

Fpga Market Analysis By Product

The FPGA market is predominantly segmented into three categories: SRAM-based FPGAs, flash-based FPGAs, and anti-fuse FPGAs. SRAM-based FPGAs hold the largest market share due to their versatility and efficiency in high-speed applications. Flash-based FPGAs are gaining traction owing to their reprogrammability and lower power consumption, while anti-fuse FPGAs are preferred in applications requiring high security.

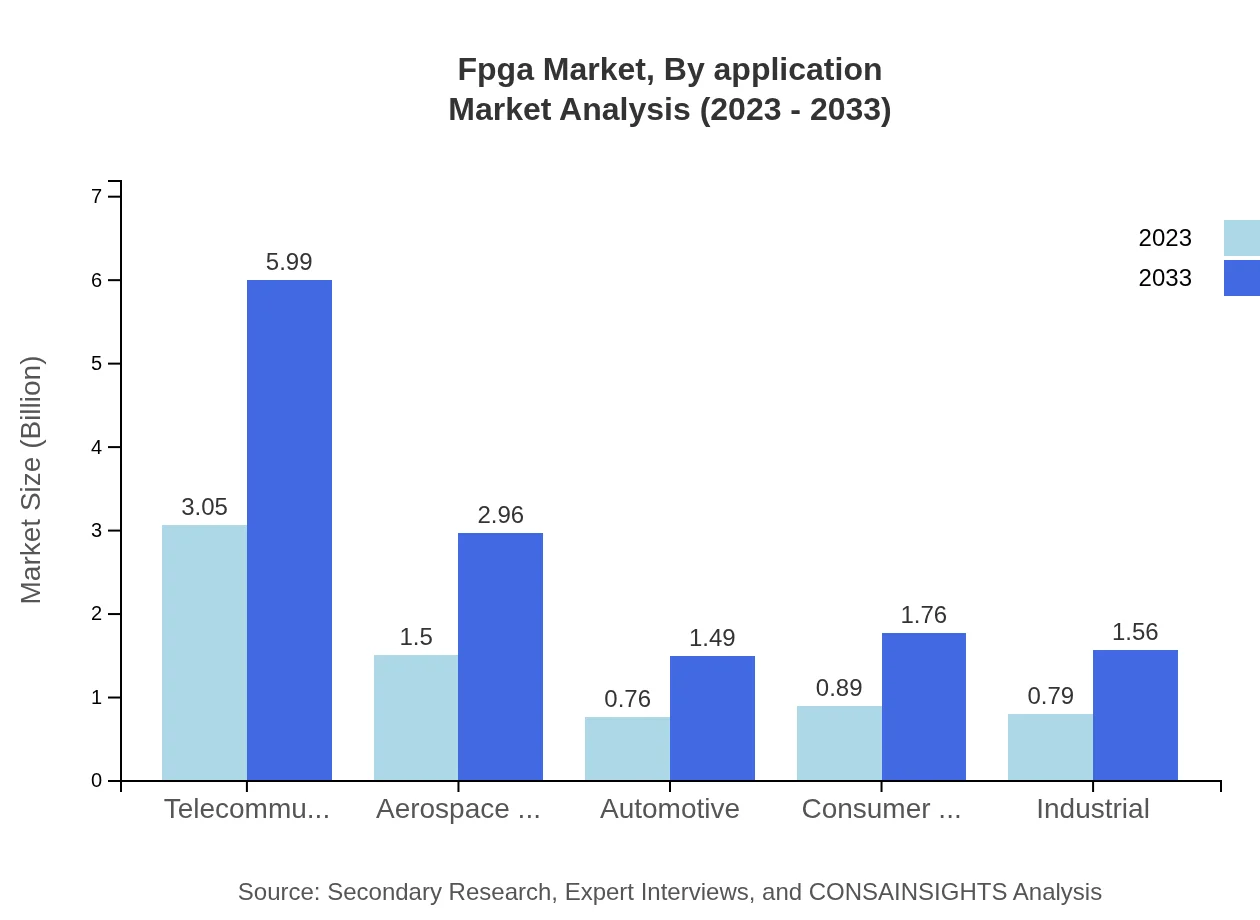

Fpga Market Analysis By Application

Segmented by application, the major end-users include telecommunications, automotive, industrial automation, and consumer electronics. Telecommunications currently dominates the FPGA market, accounting for 55.78% market share in 2023, driven by the demand for high-speed data processing solutions.

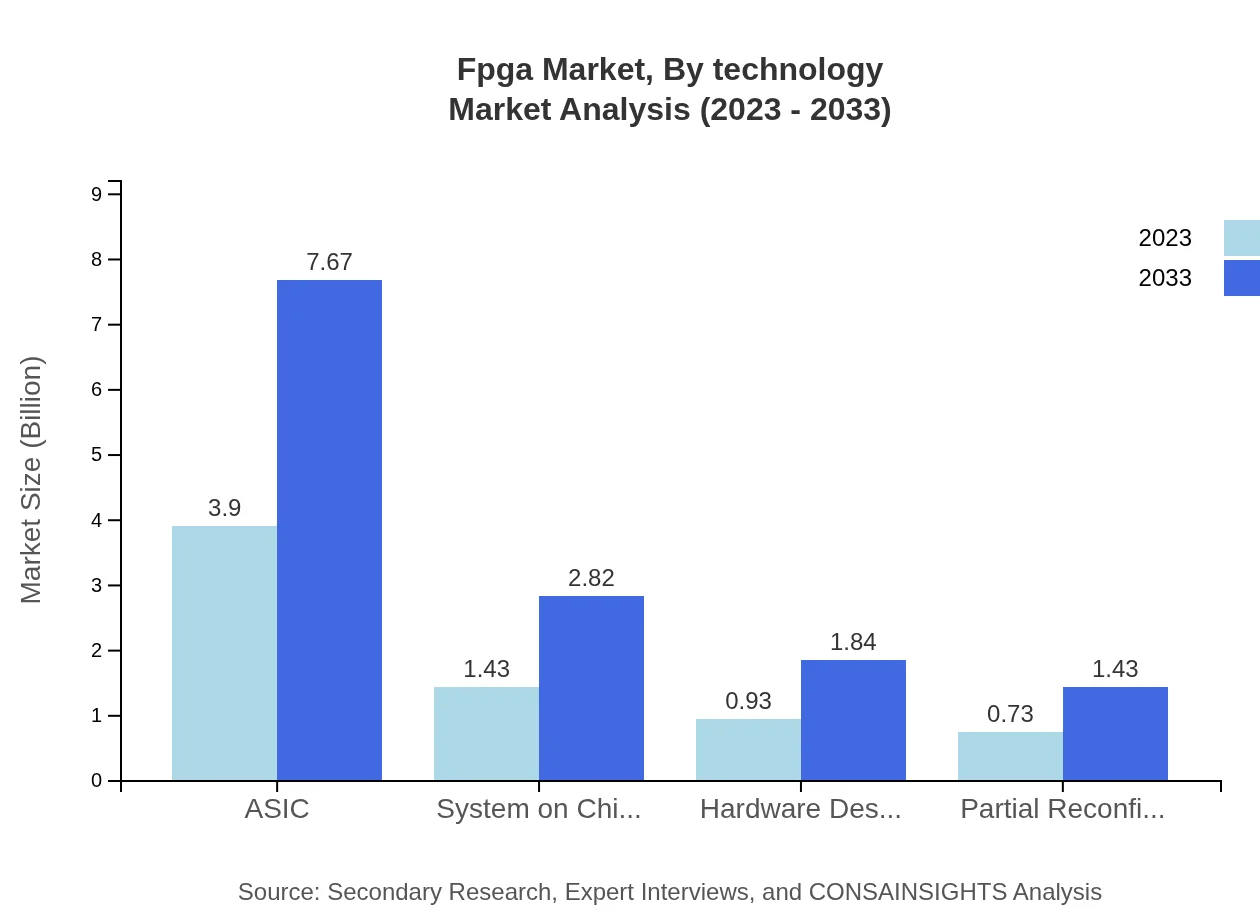

Fpga Market Analysis By Technology

Key technologies in the FPGA market encompass digital signal processing (DSP), embedded FPGAs, and partially reconfigurable FPGAs. The DSP segment continues to innovate with better signal processing capabilities, thus expanding its applicability across sectors.

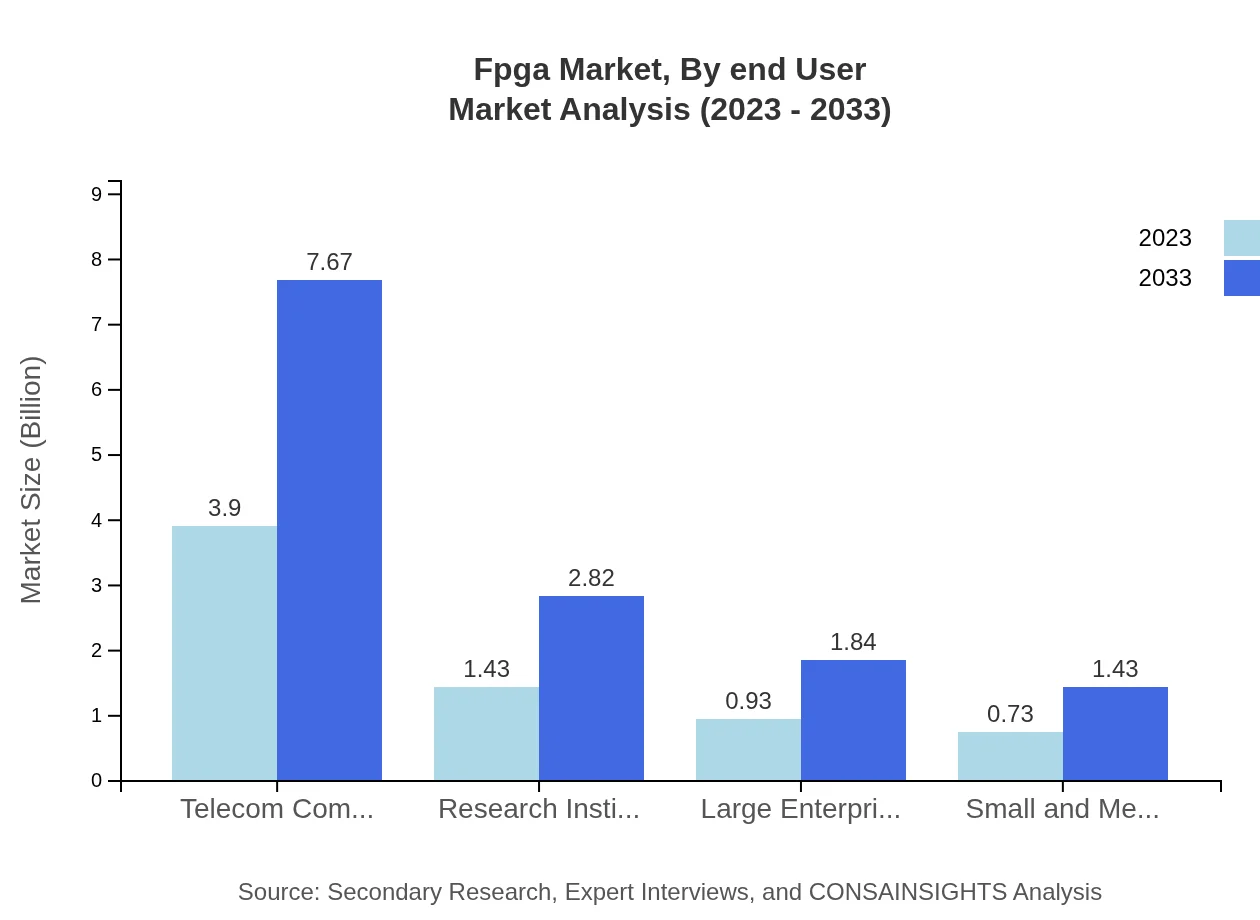

Fpga Market Analysis By End User

The FPGA market serves various end-user industries, including aerospace and defense, automotive, telecommunications, and consumer electronics. The aerospace and defense sector is projected to maintain a significant share, driven by the demand for high-reliability and high-performance systems.

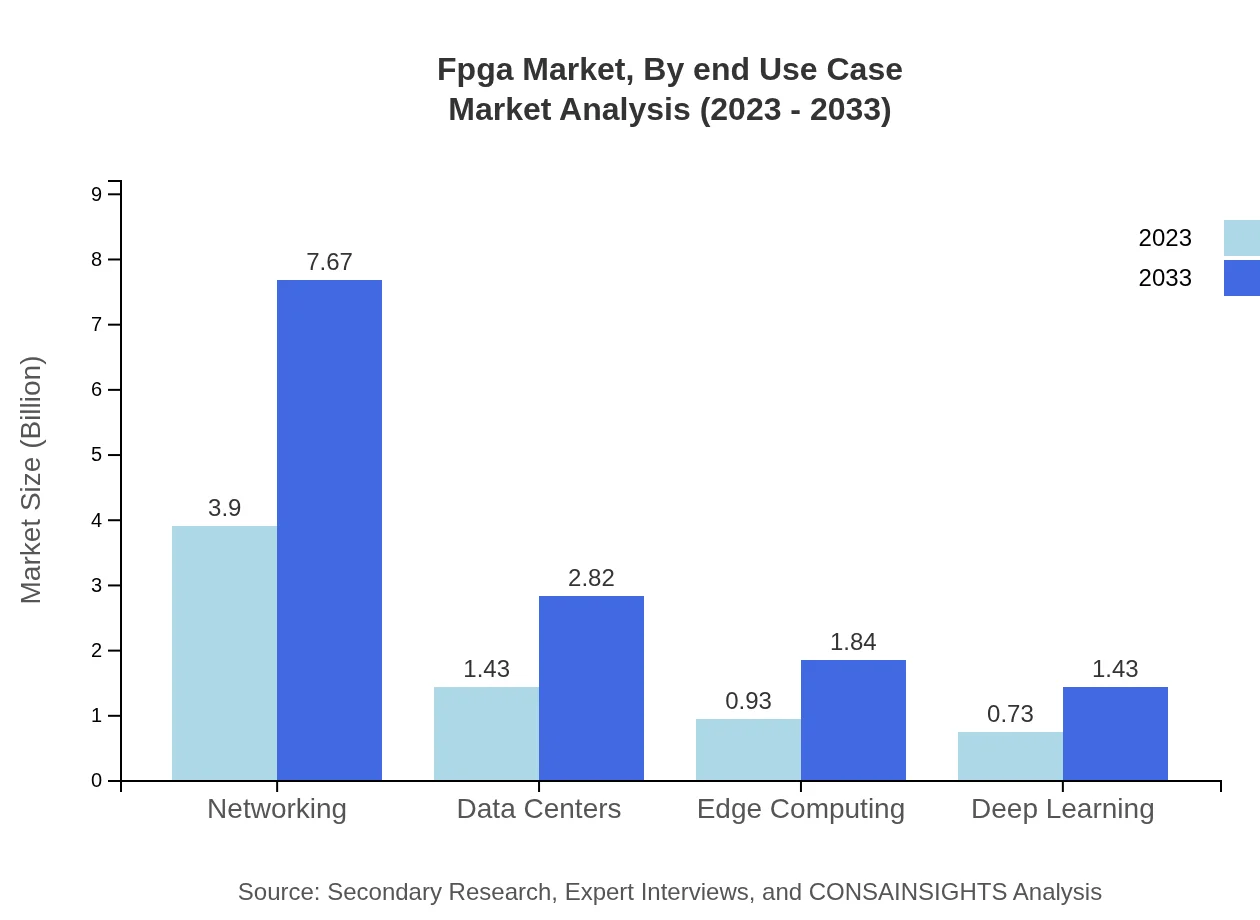

Fpga Market Analysis By End Use Case

Significant end-use cases of FPGAs are in network processing, security, automotive applications, and data centers. The surge in data-driven applications such as AI, cloud computing, and IoT is reinforcing the necessity for sophisticated FPGAs to process and analyze vast amounts of data in real-time.

FPGA Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in FPGA Industry

Xilinx, Inc.:

A leader in the FPGA industry, known for their innovative products and solutions that drive performance in various applications, Xilinx has pioneered the industry's first adaptive computing power.Intel Corporation:

Through its acquisition of Altera, Intel has strengthened its position in the FPGA market, offering highly integrated solutions that enhance performance and efficiency in data centers and networking.Lattice Semiconductor Corporation:

Specializes in low-power FPGAs, catering to consumer electronics and industrial segments. Their focus on cost-effective and energy-efficient solutions has positioned them as a key player in the market.Microsemi Corporation:

A subsidiary of Microchip Technology, Microsemi focuses on developing FPGAs with built-in security features for critical applications, particularly in the aerospace and defense sectors.We're grateful to work with incredible clients.

FAQs

What is the market size of the FPGA industry?

The FPGA market is projected to reach approximately $7 billion by 2033, growing at a CAGR of 6.8% from 2023. This growth is driven by increasing demand for high-performance computing applications globally.

What are the key market players or companies in the FPGA industry?

The FPGA industry features prominent players such as Xilinx, Intel, Lattice Semiconductor, and Microchip Technology. These companies are recognized for their innovative FPGA solutions and hold significant market shares contributing to industry growth.

What are the primary factors driving the growth in the FPGA industry?

Key growth drivers in the FPGA industry include advancements in technology, increasing automation in industries, rising demand for high-performance computing, and the surge in the adoption of FPGAs in telecommunications and data center applications.

Which region is the fastest Growing in the FPGA market?

Asia Pacific is anticipated to be the fastest-growing region in the FPGA market, projected to grow from $1.48 billion in 2023 to $2.90 billion by 2033, fueled by expanding technology sectors and investment in telecommunications.

Does ConsaInsights provide customized market report data for the FPGA industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the FPGA industry, encompassing in-depth analysis and insights into market trends, growth opportunities, and competitive landscapes.

What deliverables can I expect from this FPGA market research project?

Expect comprehensive deliverables from the FPGA market research project, including detailed reports, data segmentation, trend analysis, and strategic recommendations that support informed decision-making for stakeholders.

What are the market trends of the FPGA sector?

Current market trends in the FPGA sector include increased deployment in edge computing and AI applications, along with a rise in the demand for FPGA-based solutions in diverse industries such as automotive, industrial, and telecom.