Fractional Flow Reserve Market Report

Published Date: 31 January 2026 | Report Code: fractional-flow-reserve

Fractional Flow Reserve Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Fractional Flow Reserve (FFR) market, including insights on market size, growth forecasts from 2023 to 2033, industry trends, and regional analyses.

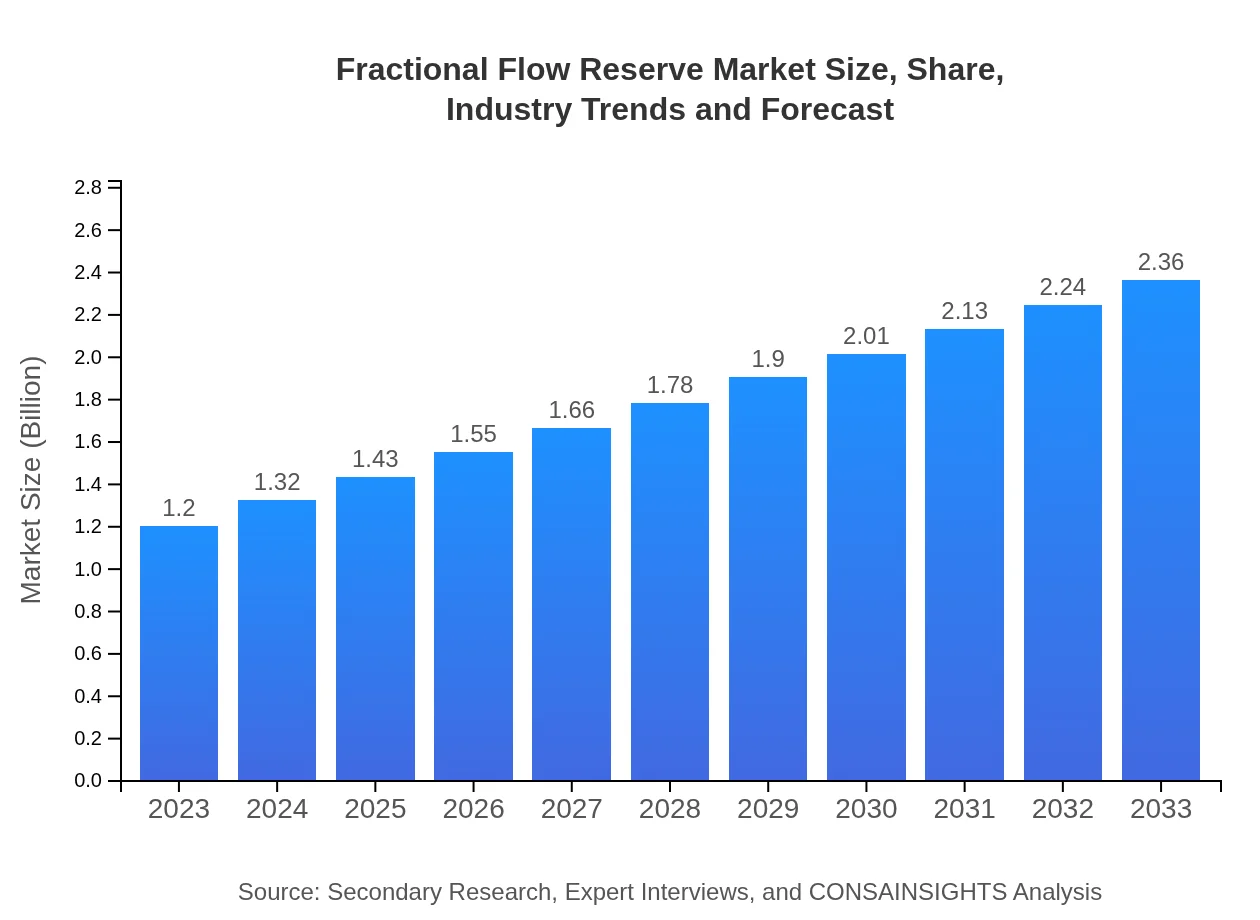

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.20 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $2.36 Billion |

| Top Companies | Abbott Laboratories, Philips Healthcare, Boston Scientific, Medtronic , Siemens Healthineers |

| Last Modified Date | 31 January 2026 |

Fractional Flow Reserve Market Overview

Customize Fractional Flow Reserve Market Report market research report

- ✔ Get in-depth analysis of Fractional Flow Reserve market size, growth, and forecasts.

- ✔ Understand Fractional Flow Reserve's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Fractional Flow Reserve

What is the Market Size & CAGR of Fractional Flow Reserve market in 2023?

Fractional Flow Reserve Industry Analysis

Fractional Flow Reserve Market Segmentation and Scope

Tell us your focus area and get a customized research report.

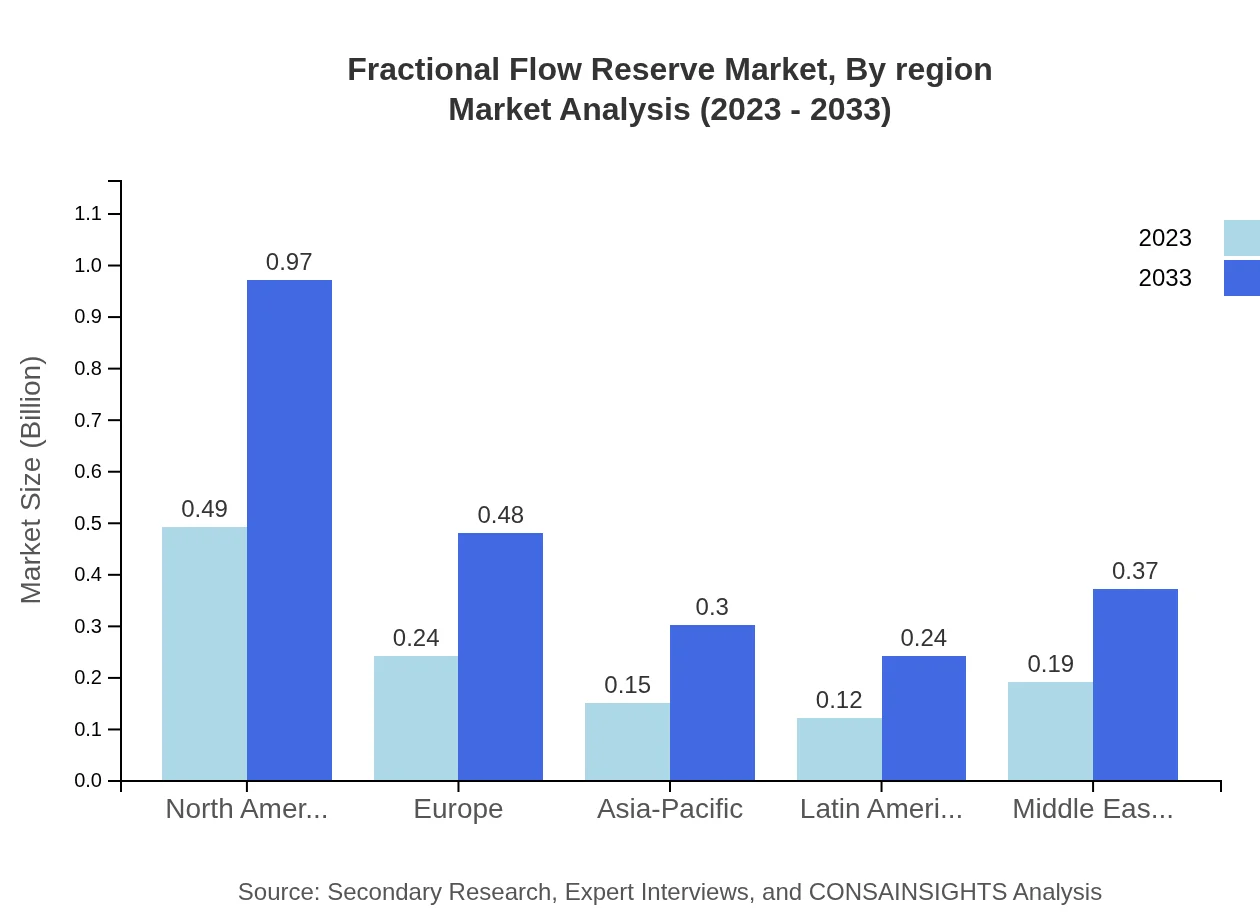

Fractional Flow Reserve Market Analysis Report by Region

Europe Fractional Flow Reserve Market Report:

In Europe, the FFR market is expected to grow from USD 0.38 billion in 2023 to USD 0.74 billion by 2033, buoyed by increasing adoption of minimally invasive procedures and growing government initiatives supporting cardiac care.Asia Pacific Fractional Flow Reserve Market Report:

In the Asia Pacific region, the Fractional Flow Reserve market is projected to grow from USD 0.23 billion in 2023 to USD 0.45 billion in 2033. The growth is driven by increasing healthcare expenditures and rising awareness of advanced medical technologies.North America Fractional Flow Reserve Market Report:

North America holds a significant portion of the FFR market, projected to rise from USD 0.44 billion in 2023 to USD 0.87 billion in 2033. Advances in technology and a higher prevalence of cardiac conditions are key drivers of this market segment.South America Fractional Flow Reserve Market Report:

The South American Fractional Flow Reserve market size is anticipated to increase from USD 0.02 billion in 2023 to USD 0.04 billion in 2033 as improvements in healthcare infrastructure and rising disease prevalence motivate investments in high-quality diagnostic solutions.Middle East & Africa Fractional Flow Reserve Market Report:

The Middle East and Africa region anticipate a market increase from USD 0.13 billion in 2023 to USD 0.26 billion in 2033. Despite challenges such as varying healthcare access, rising investments in healthcare infrastructure may provide growth opportunities.Tell us your focus area and get a customized research report.

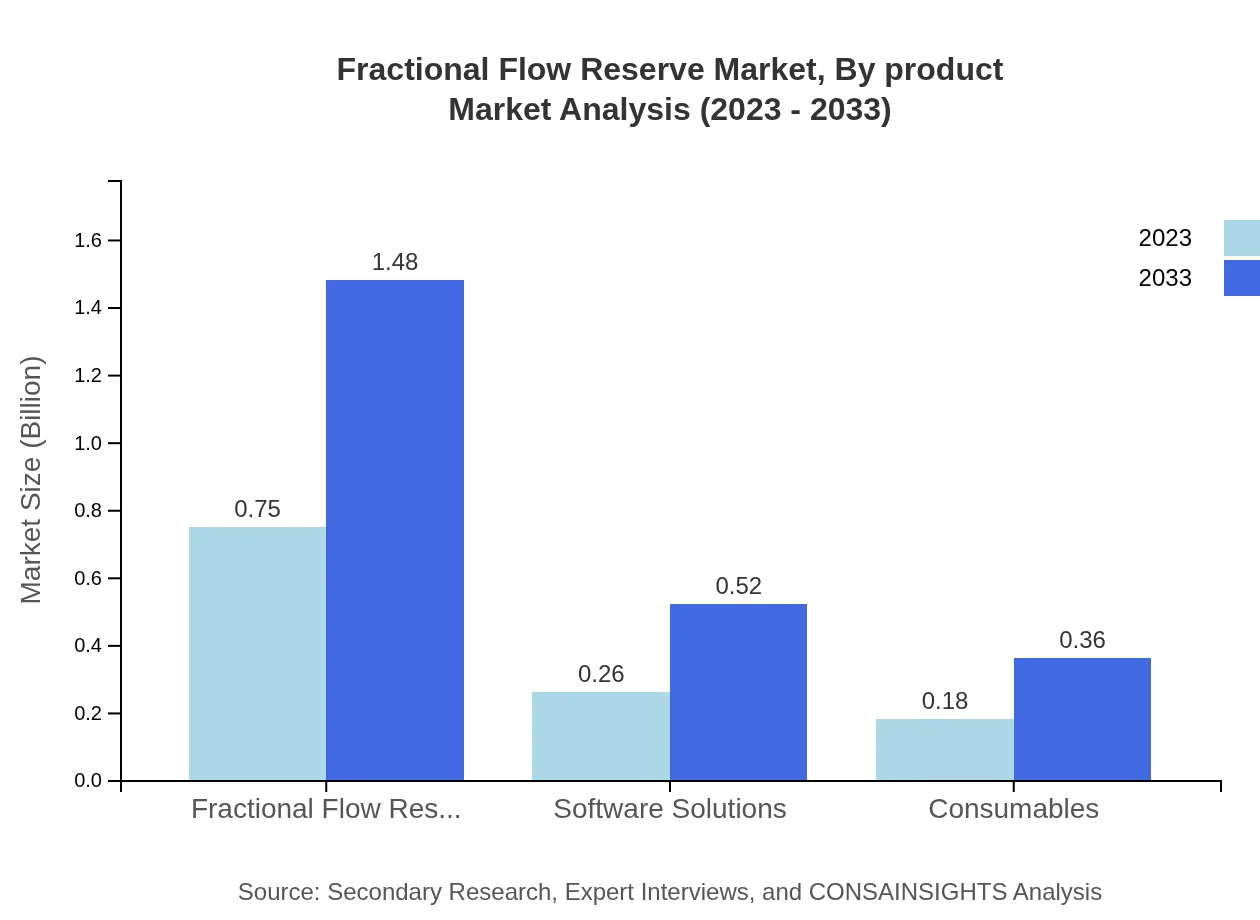

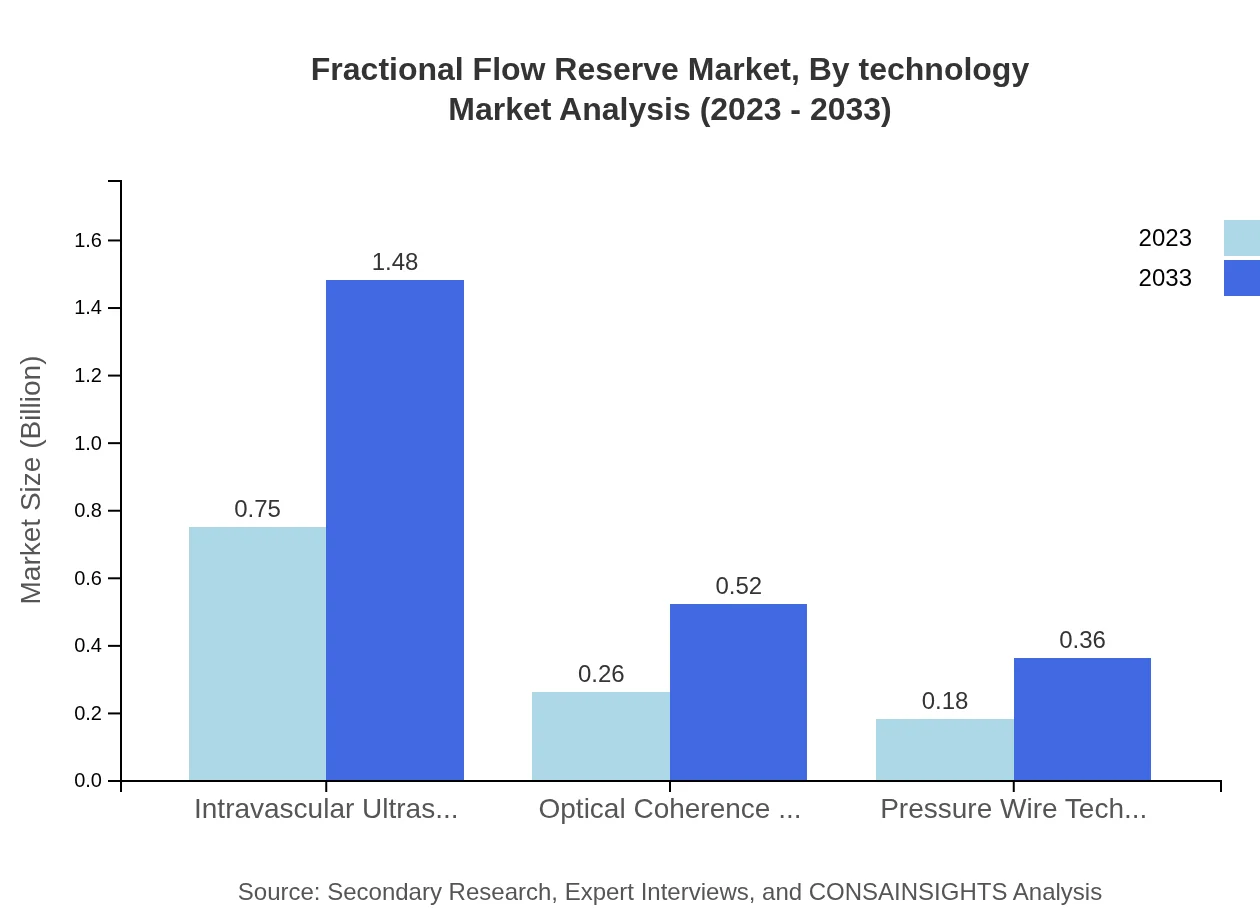

Fractional Flow Reserve Market Analysis By Product

The Fractional Flow Reserve market by product consists primarily of FFR devices, software solutions, and consumables. FFR devices held the largest market share in 2023, valued at approximately USD 0.75 billion, and is projected to grow to USD 1.48 billion by 2033. This segment is vital for providing actionable pressure measurements during diagnostic procedures. Software solutions followed, with a market value of USD 0.26 billion in 2023, highlighting the integration of IT in monitoring and analysis processes.

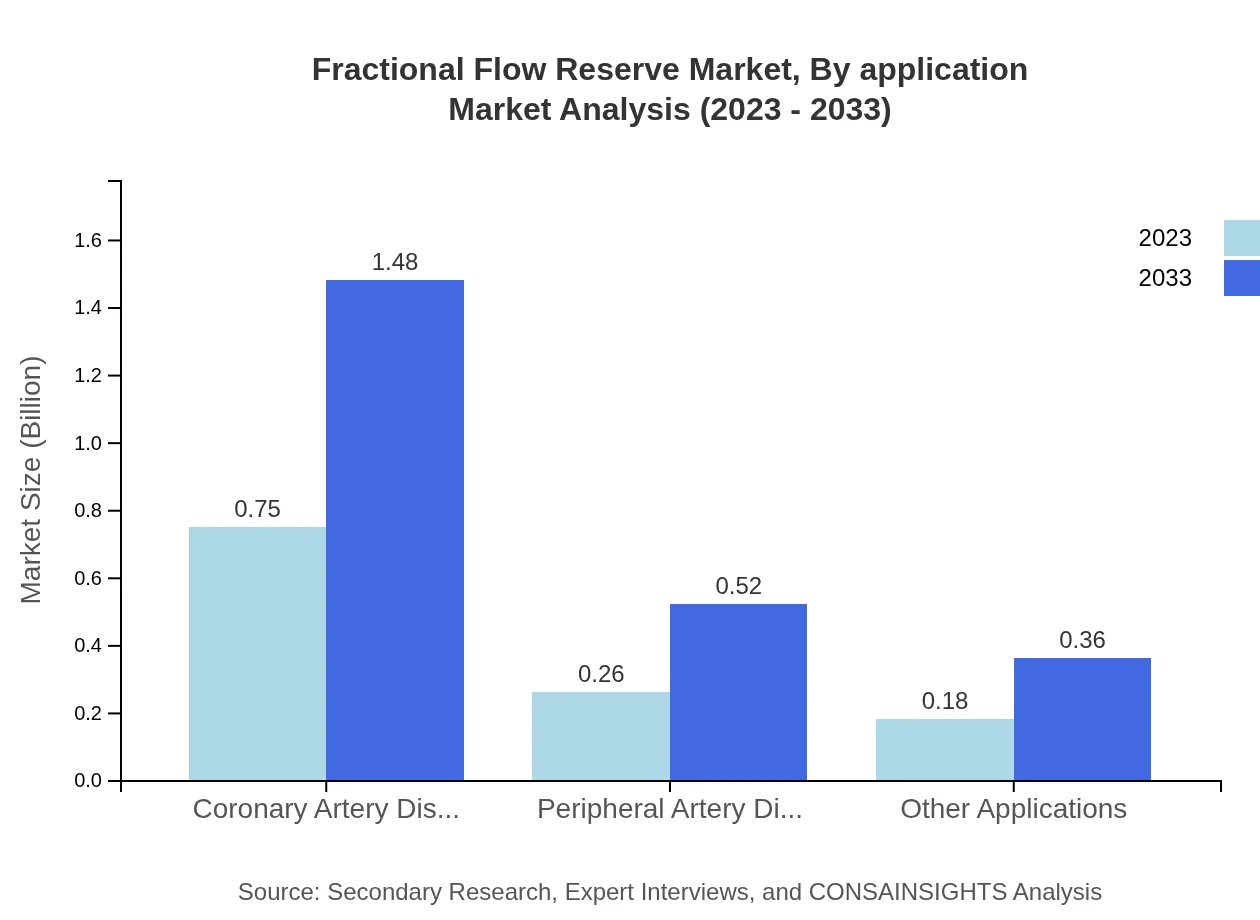

Fractional Flow Reserve Market Analysis By Application

The application segment for FFR includes Coronary Artery Disease (CAD), Peripheral Artery Disease (PAD), and other cardiovascular conditions. The CAD segment dominates this market, contributing significantly to revenue generation due to the higher prevalence of CAD cases worldwide. In 2023, this segment was valued at USD 0.75 billion, expected to reach USD 1.48 billion by 2033.

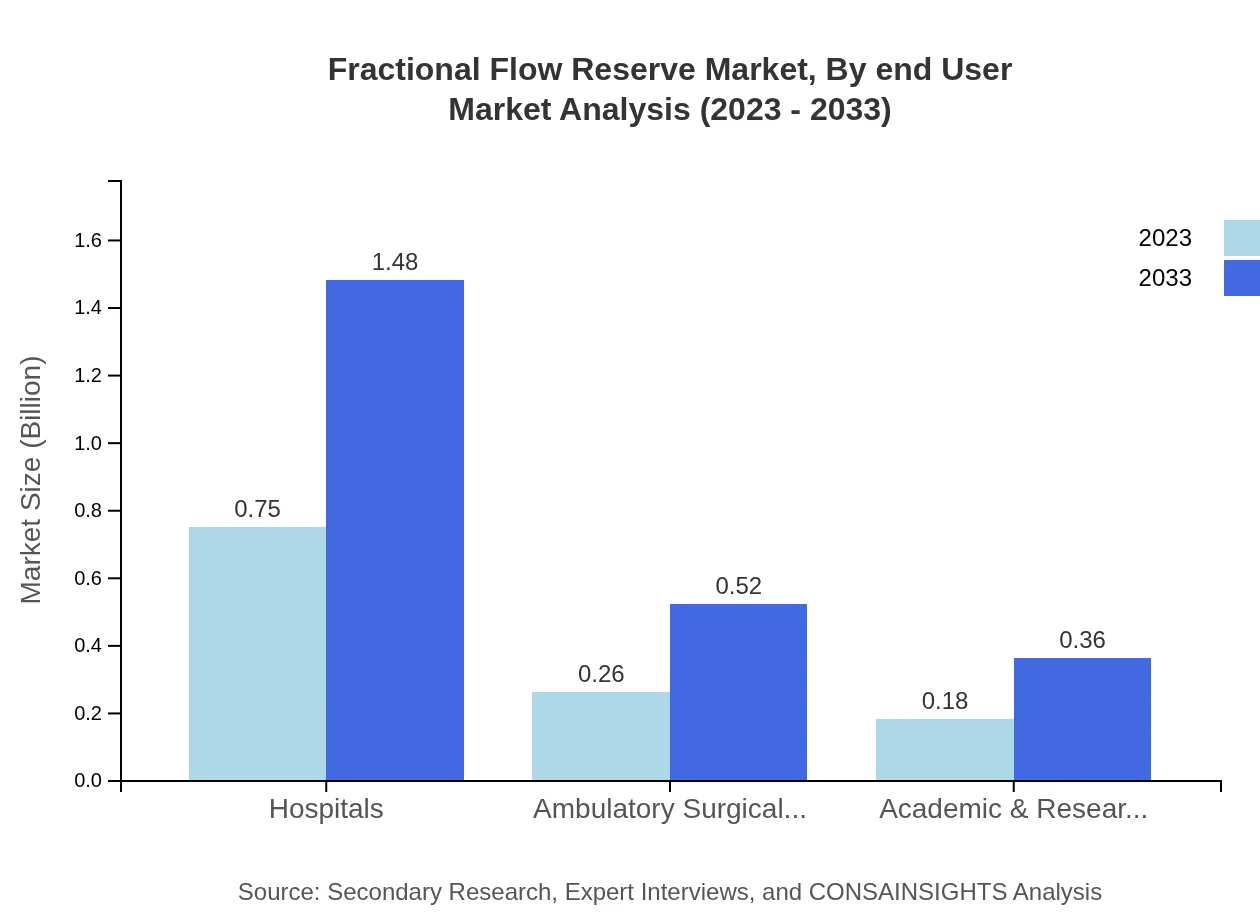

Fractional Flow Reserve Market Analysis By End User

End-users of the FFR market primarily include hospitals, ambulatory surgical centers, and academic & research institutes, with hospitals accounting for a significant market share. In 2023, hospitals comprised 62.78% of the market, with a share projected to remain stable at 62.78% through 2033.

Fractional Flow Reserve Market Analysis By Region

The market landscape varies by region, with North America maintaining the largest market share of 40.99% in 2023. Europe follows closely with 20.37%, while the Asia-Pacific region holds a share of 12.62%. Collectively, these regions contribute significantly to the market dynamics, driven by their respective healthcare system developments and technological advancements.

Fractional Flow Reserve Market Analysis By Technology

The FFR market also witnesses considerable advancements in technology, particularly through intravascular ultrasound and optical coherence tomography. The incorporation of these technologies enhances the accuracy of FFR measurements, ensuring better outcomes for patients. The increasing focus on precision medicine further drives technology adoption and innovation in the field.

Fractional Flow Reserve Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Fractional Flow Reserve Industry

Abbott Laboratories:

A leading player in the medical device industry, Abbott is renowned for its FFR products and commitment to innovation, improving patient outcomes in coronary interventions.Philips Healthcare:

Philips offers a range of imaging and diagnostic solutions, including advanced FFR capabilities, enhancing clinical decision-making and procedural efficiency.Boston Scientific:

Boston Scientific is a global leader in interventional medicine, known for its innovative FFR technologies and dedication to advancing cardiovascular health.Medtronic :

Medtronic's contributions to the FFR market are significant, providing state-of-the-art solutions for the evaluation and treatment of coronary artery conditions.Siemens Healthineers:

Siemens Healthineers specializes in diagnostic and therapeutic imaging, delivering robust FFR systems as part of their cardiovascular portfolio.We're grateful to work with incredible clients.

FAQs

What is the market size of fractional Flow Reserve?

The fractional flow reserve market is valued at approximately $1.2 billion in 2023, with a projected annual growth rate (CAGR) of 6.8% through to 2033.

What are the key market players or companies in this fractional Flow Reserve industry?

Key players in the fractional flow reserve market include major medical device manufacturers and innovative technology firms specializing in cardiac imaging and pressure wire systems.

What are the primary factors driving the growth in the fractional Flow Reserve industry?

Factors driving growth include increasing prevalence of coronary artery disease, advancements in technology, and growing adoption of minimally invasive procedures in cardiology.

Which region is the fastest Growing in the fractional Flow Reserve?

North America is the fastest-growing region in the fractional flow reserve market, expected to grow from $0.44 billion in 2023 to $0.87 billion by 2033.

Does ConsaInsights provide customized market report data for the fractional Flow Reserve industry?

Yes, ConsaInsights offers tailored market report data for the fractional flow reserve industry, accommodating specific client research needs and interests.

What deliverables can I expect from this fractional Flow Reserve market research project?

Deliverables include detailed market analysis reports, segment breakdowns, competitive landscape assessments, and region-specific growth forecasts.

What are the market trends of fractional Flow Reserve?

Current market trends show a shift toward innovative technologies, increased focus on diagnostics, and a rise in demand for non-invasive assessment techniques.