Fraud Detection And Prevention And Anti Money Laundering Market Report

Published Date: 31 January 2026 | Report Code: fraud-detection-and-prevention-and-anti-money-laundering

Fraud Detection And Prevention And Anti Money Laundering Market Size, Share, Industry Trends and Forecast to 2033

This report offers a comprehensive analysis of the Fraud Detection and Prevention and Anti-Money Laundering market, focusing on market size, trends, technology impacts, and regional insights from 2023 to 2033.

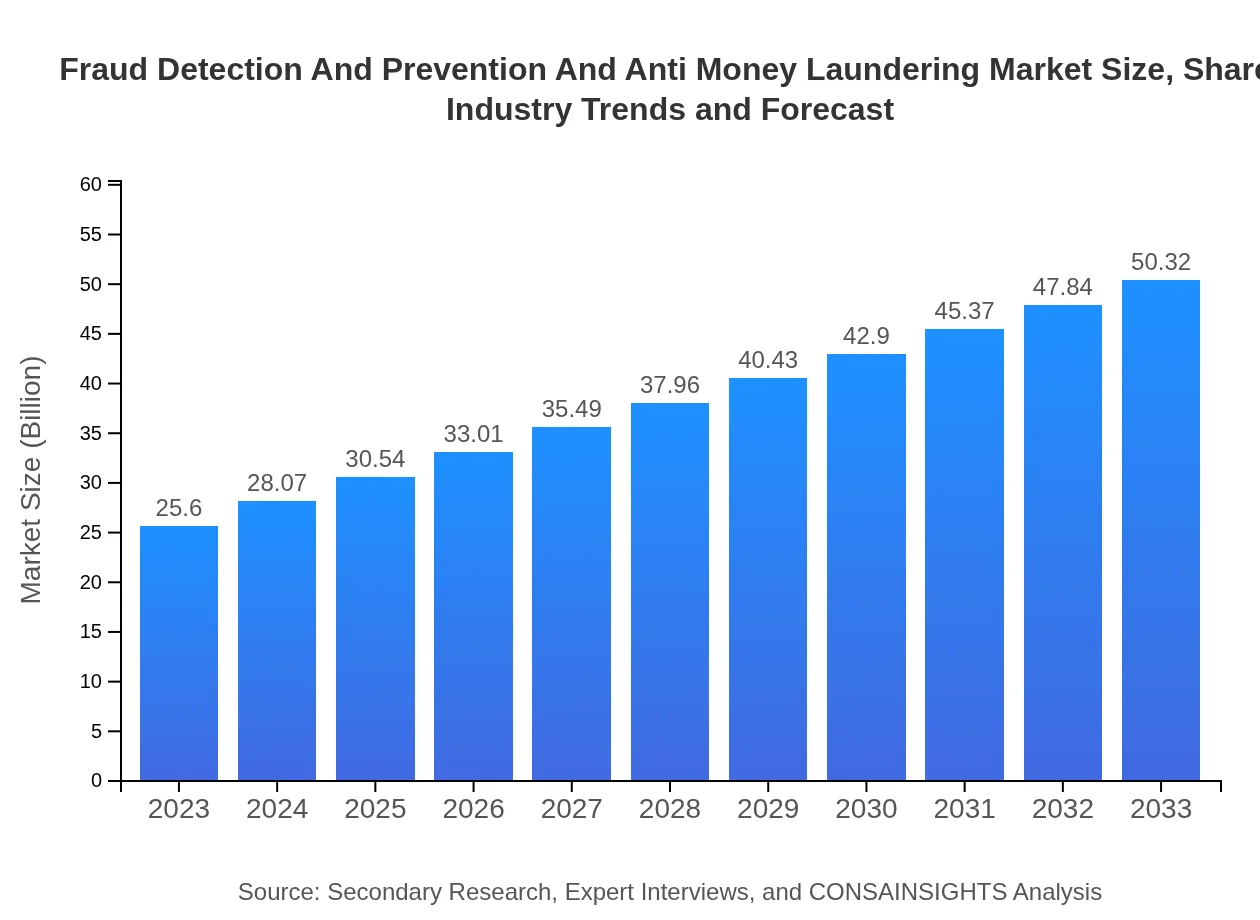

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $25.60 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $50.32 Billion |

| Top Companies | SAS Institute, FICO, Oracle, NICE Actimize |

| Last Modified Date | 31 January 2026 |

Fraud Detection And Prevention And Anti Money Laundering Market Overview

Customize Fraud Detection And Prevention And Anti Money Laundering Market Report market research report

- ✔ Get in-depth analysis of Fraud Detection And Prevention And Anti Money Laundering market size, growth, and forecasts.

- ✔ Understand Fraud Detection And Prevention And Anti Money Laundering's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Fraud Detection And Prevention And Anti Money Laundering

What is the Market Size & CAGR of Fraud Detection And Prevention And Anti Money Laundering market in 2023?

Fraud Detection And Prevention And Anti Money Laundering Industry Analysis

Fraud Detection And Prevention And Anti Money Laundering Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Fraud Detection And Prevention And Anti Money Laundering Market Analysis Report by Region

Europe Fraud Detection And Prevention And Anti Money Laundering Market Report:

Europe's market will grow from $6.90 billion in 2023 to $13.55 billion by 2033. Stringent regulations around AML and robust financial sectors are propelling investments in advanced fraud detection technologies.Asia Pacific Fraud Detection And Prevention And Anti Money Laundering Market Report:

The Asia Pacific region is projected to grow significantly, with the market expected to reach $9.73 billion by 2033, up from $4.95 billion in 2023. This growth is fueled by rapid digitalization and the rising adoption of mobile payment systems.North America Fraud Detection And Prevention And Anti Money Laundering Market Report:

The North American market is the largest, forecasted to reach $19.16 billion by 2033 from $9.75 billion in 2023. Major advancements in technology and a strong regulatory framework contribute to the region being a leader in fraud detection and prevention.South America Fraud Detection And Prevention And Anti Money Laundering Market Report:

In South America, the market is expected to increase from $1.85 billion in 2023 to $3.63 billion by 2033. The focus on regulatory compliance and the need for secure transactions are key drivers of this growth.Middle East & Africa Fraud Detection And Prevention And Anti Money Laundering Market Report:

The Middle East and Africa market is expected to rise from $2.16 billion in 2023 to $4.24 billion by 2033. Increasing awareness about fraud risks and regulatory compliance requirements are the main growth factors within this region.Tell us your focus area and get a customized research report.

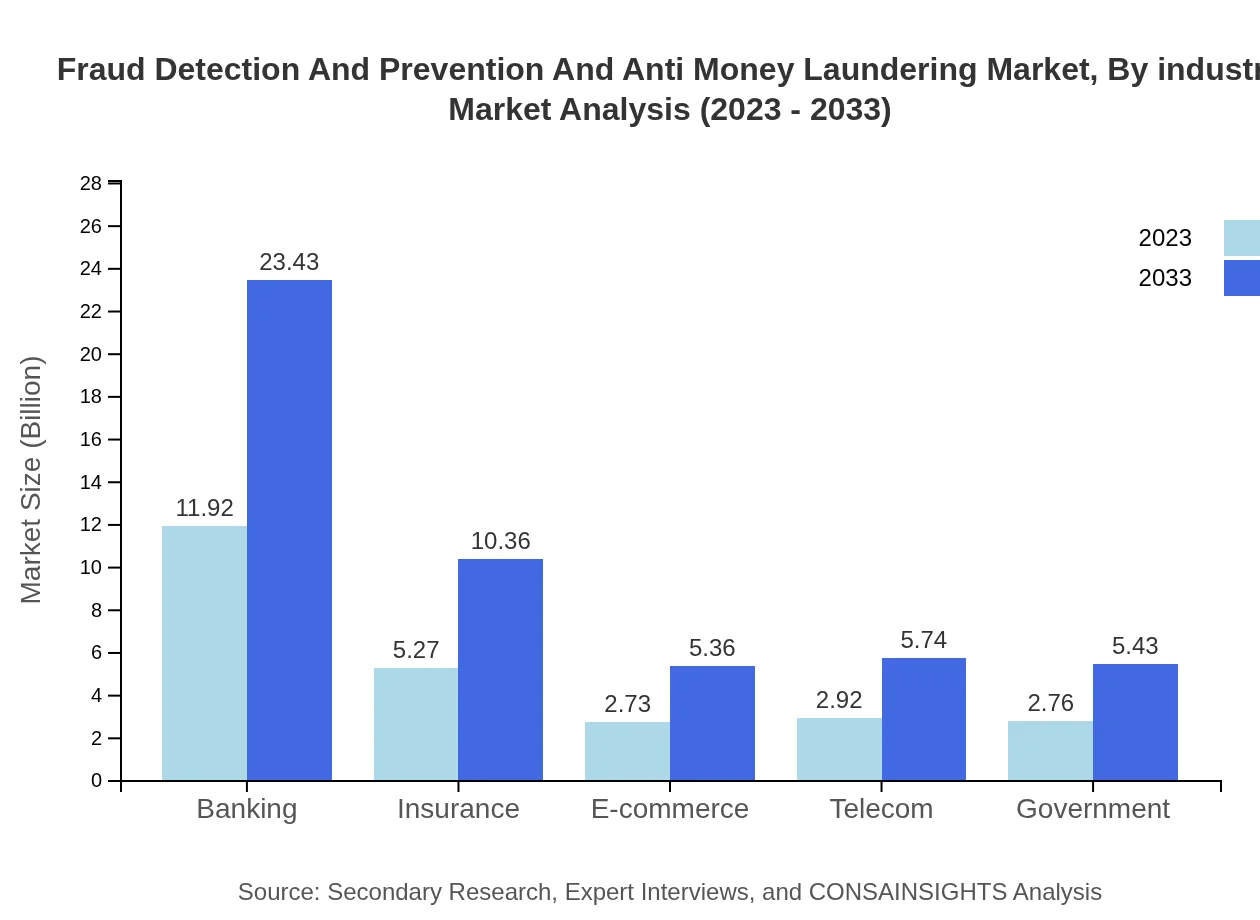

Fraud Detection And Prevention And Anti Money Laundering Market Analysis By Industry

The Banking sector remains the largest end-user, projected to grow from $11.92 billion in 2023 to $23.43 billion by 2033, capturing 46.56% of the market share throughout the forecast period. Insurance also sees significant growth, from $5.27 billion to $10.36 billion, holding 20.59% share. Other significant sectors include e-commerce, telecom, and government, reflecting the diverse application of fraud detection technologies across industries.

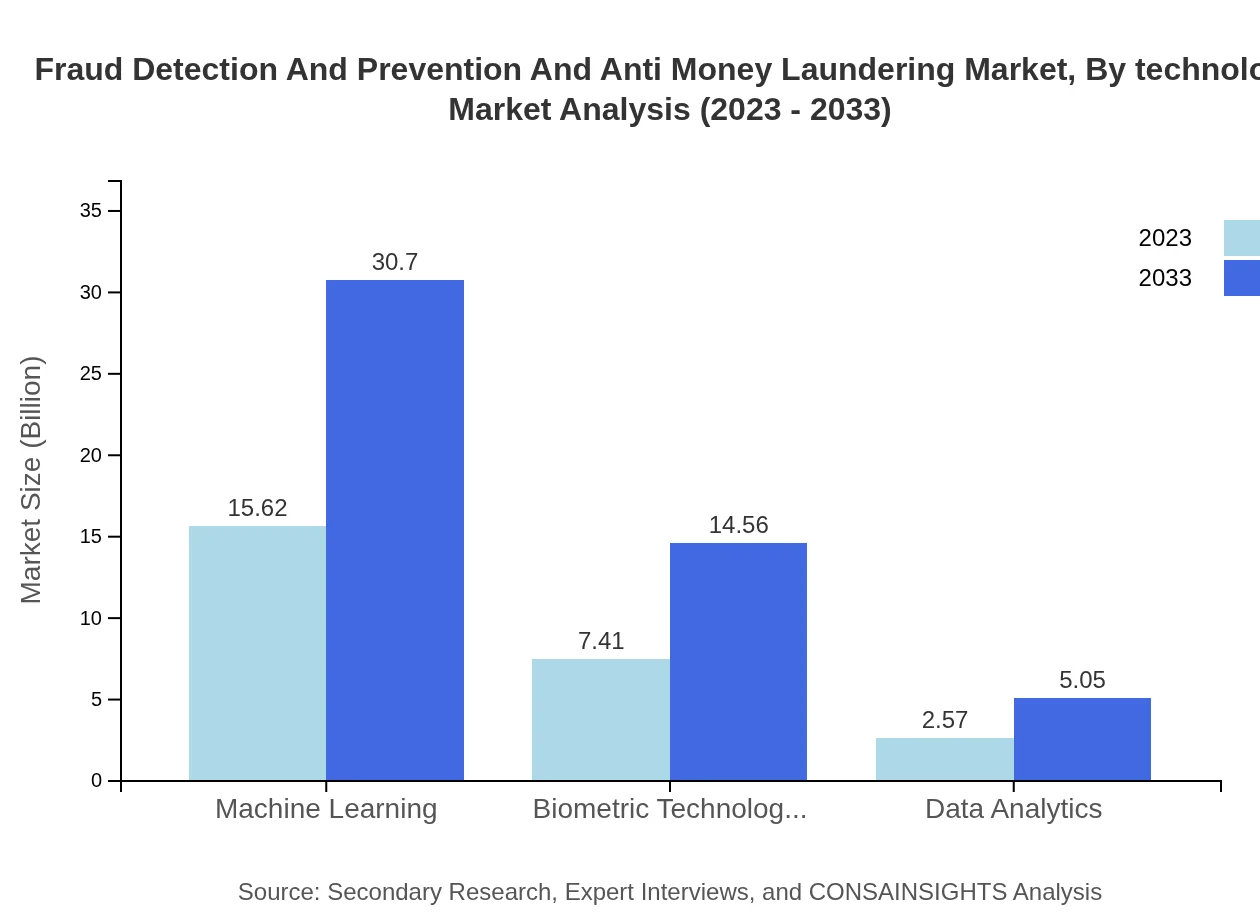

Fraud Detection And Prevention And Anti Money Laundering Market Analysis By Technology

Software solutions dominate the technology segment, expected to increase from $21.99 billion in 2023 to $43.22 billion by 2033 (85.9% market share). Machine learning technologies will also show remarkable growth, from $15.62 billion to $30.70 billion, constituting 61.02% of the market share as advancements continue to enhance fraud detection.

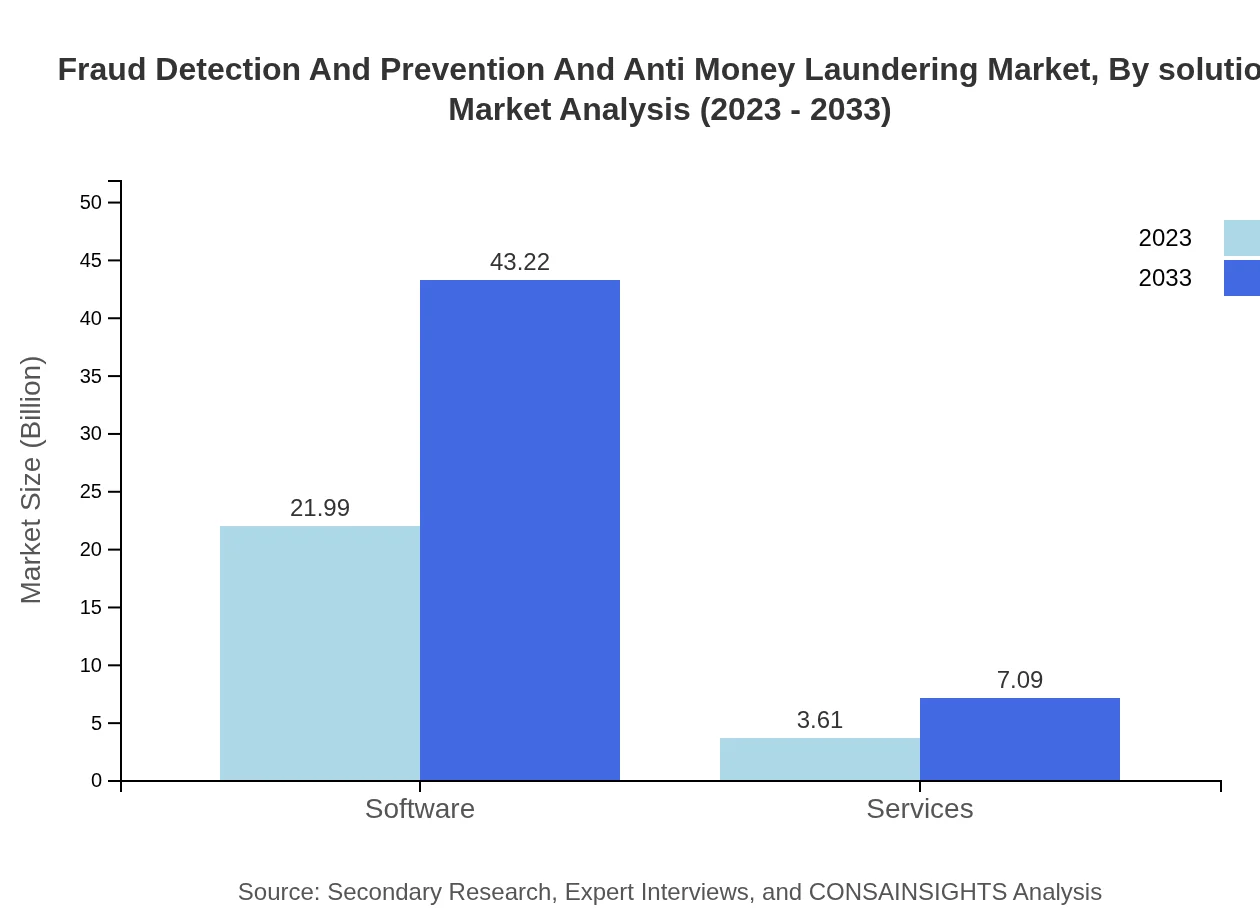

Fraud Detection And Prevention And Anti Money Laundering Market Analysis By Solution

The solutions available in the Fraud Detection and Prevention space are segmented into software and services, with software leading significantly at $21.99 billion in 2023. Services accompanying the software solutions are expected to grow from $3.61 billion to $7.09 billion, representing a 14.1% share in 2023, indicating a decreasing share in comparison to solution software.

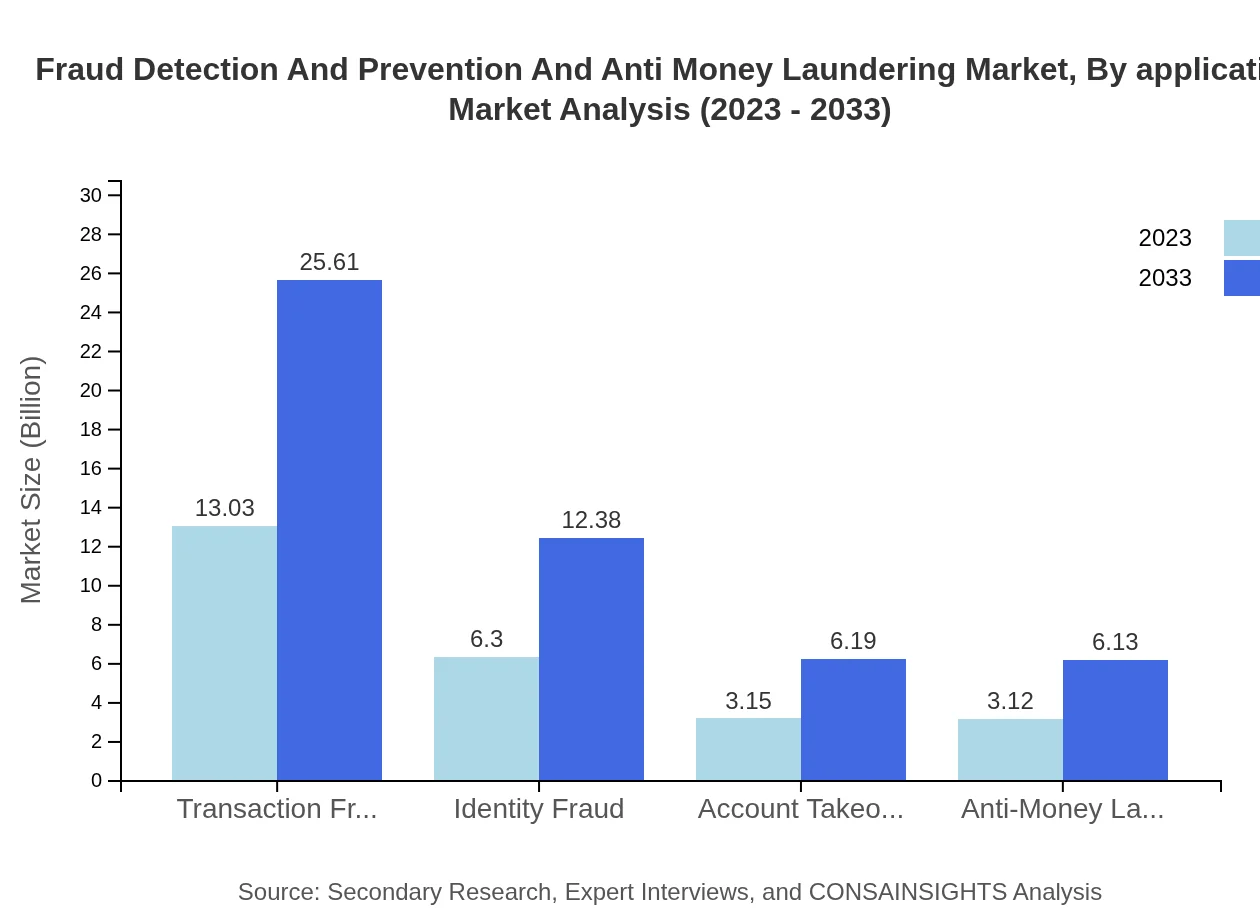

Fraud Detection And Prevention And Anti Money Laundering Market Analysis By Application

Key applications in fraud detection include transaction fraud, identity fraud, and account takeover. Transaction fraud is the largest segment, growing from $13.03 billion to $25.61 billion (50.9% market share), while identity fraud and account takeover segments show growth from $6.30 billion to $12.38 billion and from $3.15 billion to $6.19 billion, respectively.

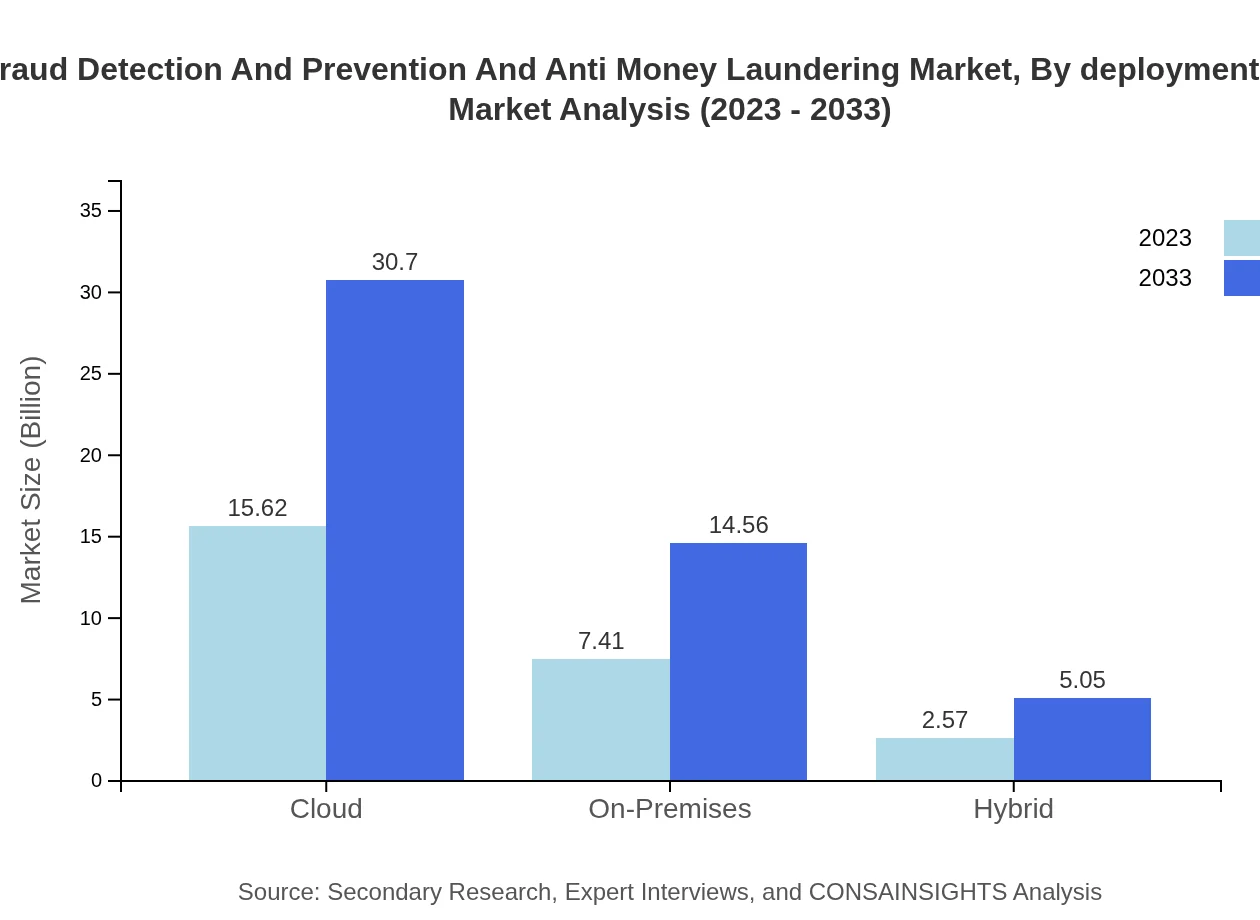

Fraud Detection And Prevention And Anti Money Laundering Market Analysis By Deployment Model

The market is distinctly segmented into cloud-based, on-premises, and hybrid models. Cloud services dominate the deployment field, with expected growth from $15.62 billion to $30.70 billion (61.02% market share), while on-premises solutions will also show marked growth from $7.41 billion to $14.56 billion, evidencing the shift towards more versatile cloud services.

Fraud Detection And Prevention And Anti Money Laundering Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Fraud Detection And Prevention And Anti Money Laundering Industry

SAS Institute:

SAS provides advanced analytics solutions that help organizations detect and prevent fraud and manage risk effectively. Their expertise in data analytics aids businesses in AML compliance.FICO:

FICO is a leading provider of analytics and decision management software that focuses on fraud detection services primarily for banking and insurance sectors.Oracle:

Oracle's offerings include comprehensive solutions for risk management, fraud detection, and prevention solutions across various industries, enhancing compliance and reducing exposure to fraud.NICE Actimize:

NICE Actimize specializes in financial crime and compliance software, offering analytics-driven solutions to detect and prevent fraud and manage AML compliance effectively.We're grateful to work with incredible clients.

FAQs

What is the market size of fraud Detection And Prevention And Anti Money Laundering?

The fraud detection and prevention and anti-money laundering market is valued at approximately $25.6 billion in 2023, with a projected CAGR of 6.8% from 2023 to 2033, indicating a robust growth trajectory in the coming years.

What are the key market players or companies in the fraud Detection And Prevention And Anti Money Laundering industry?

Key players in the fraud detection and anti-money laundering space include major tech firms and financial institutions that offer advanced software solutions, analytical services, and compliance technologies that combat evolving fraudulent activities.

What are the primary factors driving the growth in the fraud detection and prevention and anti Money laundering industry?

The growth is fueled by increasing digital financial transactions, stricter regulatory frameworks globally, rising incidence of cyber fraud, and advancements in artificial intelligence and machine learning applications tailored for fraud detection.

Which region is the fastest Growing in the fraud Detection And Prevention And Anti Money Laundering?

North America stands out as the fastest-growing region, with its market expected to increase from $9.75 billion in 2023 to $19.16 billion by 2033, spurred by heightened regulatory scrutiny and technological adoption.

Does ConsaInsights provide customized market report data for the fraud detection and prevention and anti Money laundering industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs, ensuring clients receive detailed insights relevant to their operational strategies and market positioning within the fraud prevention landscape.

What deliverables can I expect from this fraud Detection And Prevention And Anti Money Laundering market research project?

Expect deliverables such as comprehensive market analysis reports, competitive landscape assessments, forecast data, segment insights, and customized information tailored to specific business needs and strategic decisions.

What are the market trends of fraud Detection And Prevention And Anti Money Laundering?

Market trends include increased adoption of machine learning algorithms, integration of biometric solutions, a rise in demand for real-time transaction monitoring, and progressive shifts towards cloud-based solutions in fraud detection frameworks.