Fraud Detection And Prevention Market Report

Published Date: 31 January 2026 | Report Code: fraud-detection-and-prevention

Fraud Detection And Prevention Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Fraud Detection and Prevention market, detailing insights into market size, trends, growth forecasts, and regional breakdowns for the years 2023 to 2033.

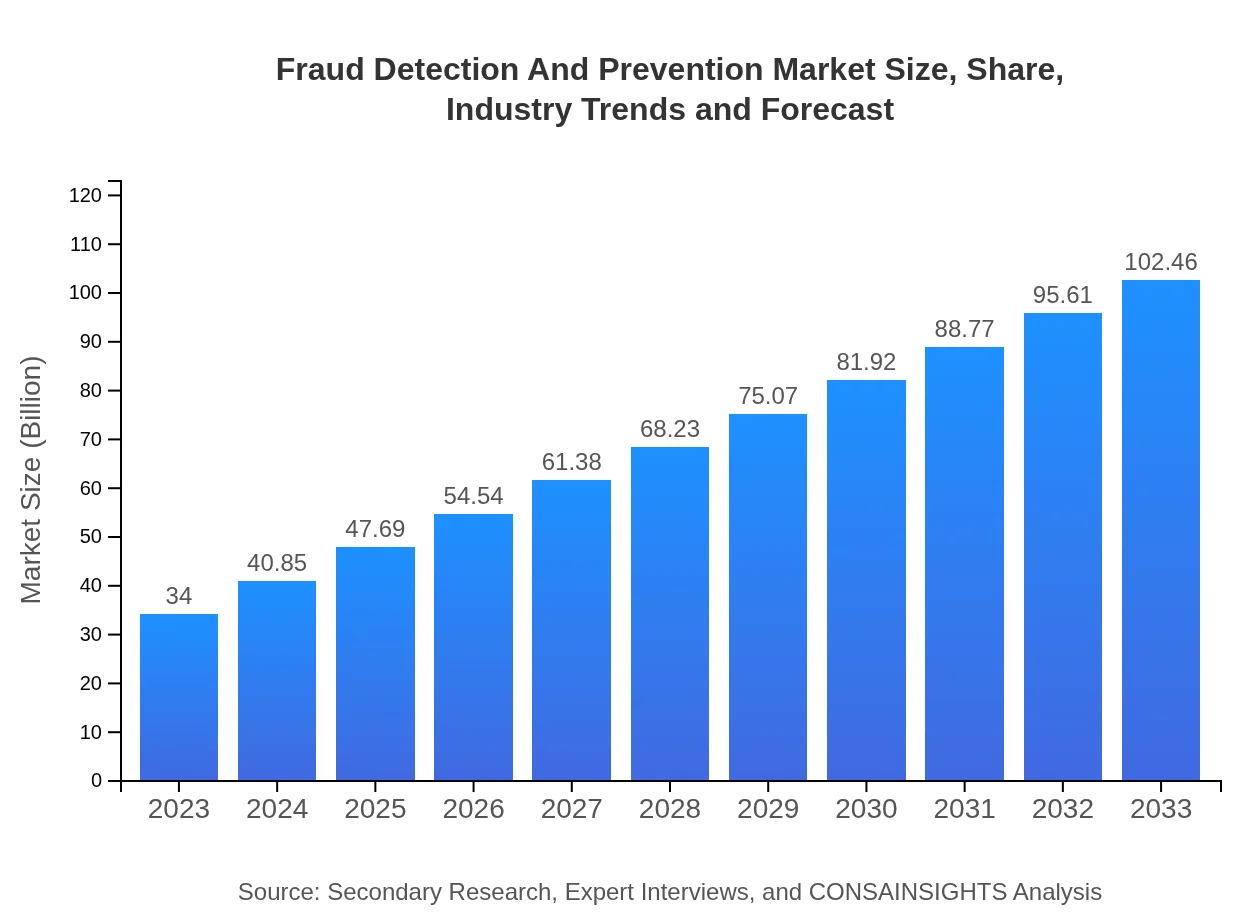

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $34.00 Billion |

| CAGR (2023-2033) | 11.2% |

| 2033 Market Size | $102.46 Billion |

| Top Companies | IBM Corporation, SAS Institute Inc., FICO (Fair Isaac Corporation), Experian, Oracle Corporation |

| Last Modified Date | 31 January 2026 |

Fraud Detection And Prevention Market Overview

Customize Fraud Detection And Prevention Market Report market research report

- ✔ Get in-depth analysis of Fraud Detection And Prevention market size, growth, and forecasts.

- ✔ Understand Fraud Detection And Prevention's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Fraud Detection And Prevention

What is the Market Size & CAGR of Fraud Detection And Prevention market in 2023?

Fraud Detection And Prevention Industry Analysis

Fraud Detection And Prevention Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Fraud Detection And Prevention Market Analysis Report by Region

Europe Fraud Detection And Prevention Market Report:

Europe's market is valued at $9.16 billion in 2023, growing to $27.59 billion by 2033. The increasing regulatory requirements and a greater focus on customer privacy are prompting organizations to invest significantly in fraud detection measures across sectors like finance and e-commerce.Asia Pacific Fraud Detection And Prevention Market Report:

In 2023, the Asia Pacific fraud detection and prevention market is valued at $7.27 billion and is expected to grow to $21.91 billion by 2033. The rising adoption of technology and increasing financial transaction volumes in countries like China and India are key factors driving this growth. Additionally, government initiatives to enhance cybersecurity are expected to elevate market demand.North America Fraud Detection And Prevention Market Report:

North America holds a dominant position in the fraud detection and prevention market with a size of $11.22 billion in 2023, expected to reach $33.82 billion by 2033. The region benefits from advanced technology adoption, stringent data protection laws, and the presence of numerous key market players dedicated to innovation in fraud prevention.South America Fraud Detection And Prevention Market Report:

The South American market for fraud detection and prevention is anticipated to grow from $3.37 billion in 2023 to $10.16 billion by 2033. The growing e-commerce sector and increased mobile banking usage are propelling demand for FDP solutions, as businesses seek to protect customer data and enhance online security.Middle East & Africa Fraud Detection And Prevention Market Report:

The Middle East and Africa market's size of $2.98 billion in 2023 is projected to grow to $8.98 billion by 2033. Growing internet penetration and an increase in financial transactions are compelling businesses in the region to prioritize fraud management strategies, coupled with rising awareness of technological investments.Tell us your focus area and get a customized research report.

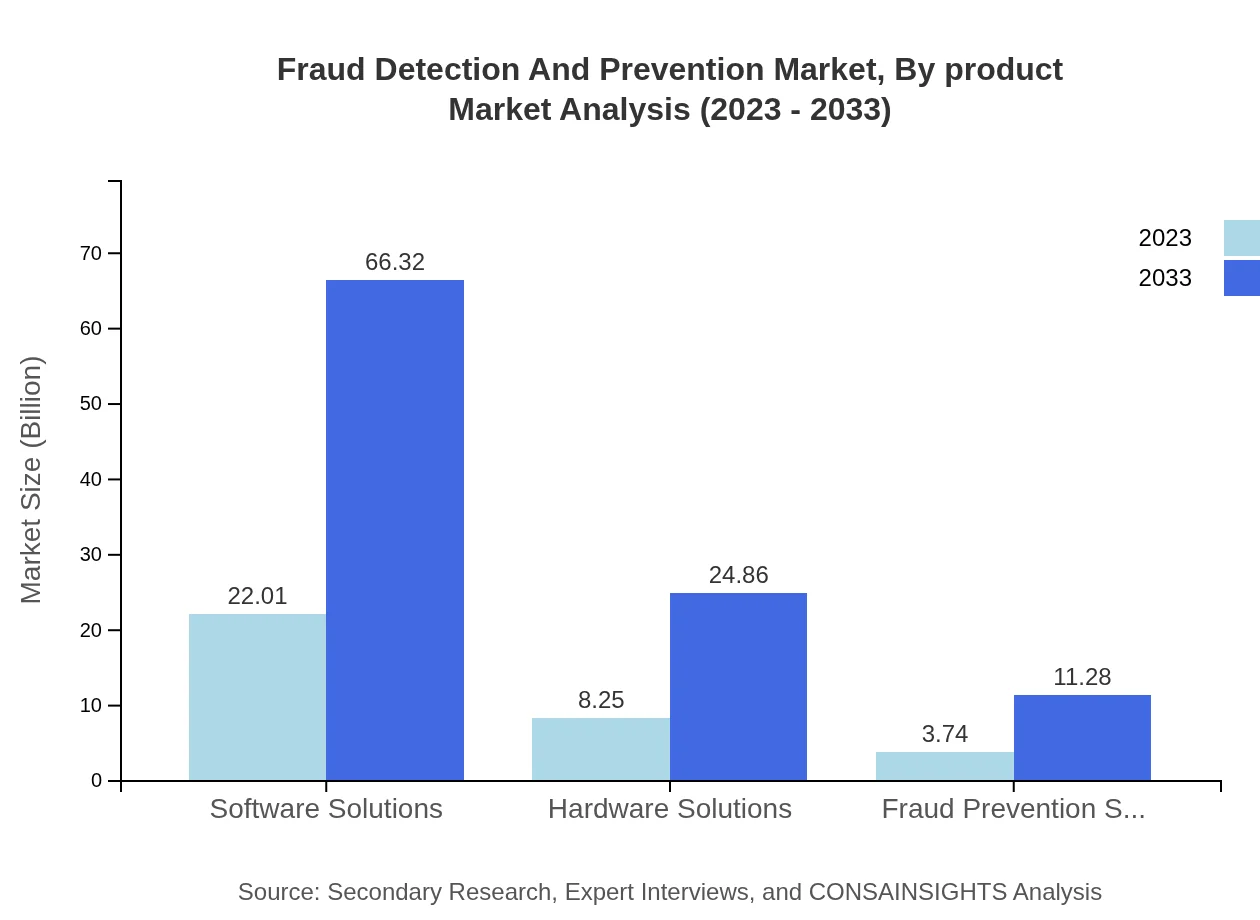

Fraud Detection And Prevention Market Analysis By Product

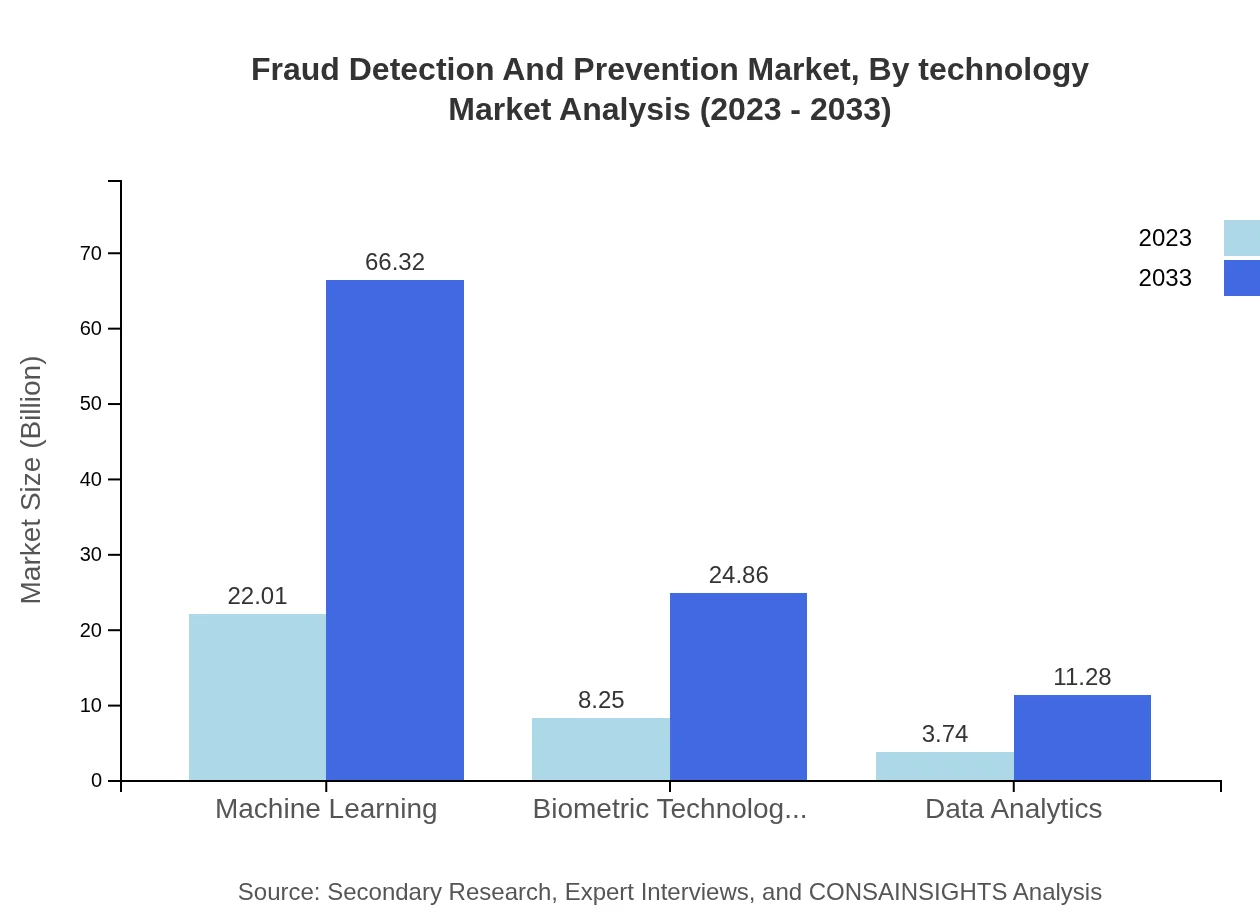

The Fraud Detection and Prevention market is dominated by software solutions, which accounted for $22.01 billion in 2023 and is expected to grow to $66.32 billion by 2033, holding a significant market share of 64.73%. Hardware solutions and fraud prevention services also play vital roles, contributing $8.25 billion and $3.74 billion in 2023, respectively, while witnessing substantial growth over the forecast period.

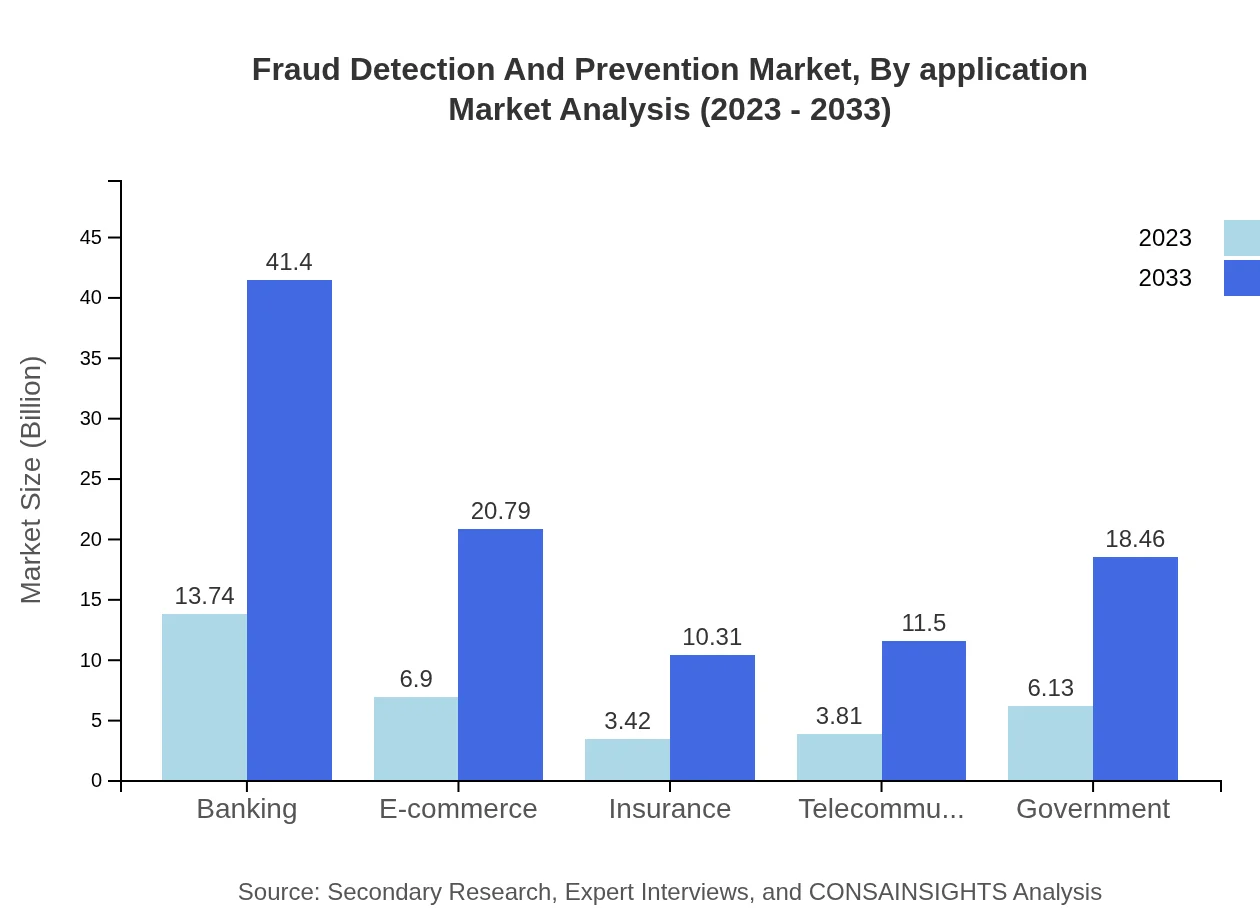

Fraud Detection And Prevention Market Analysis By Application

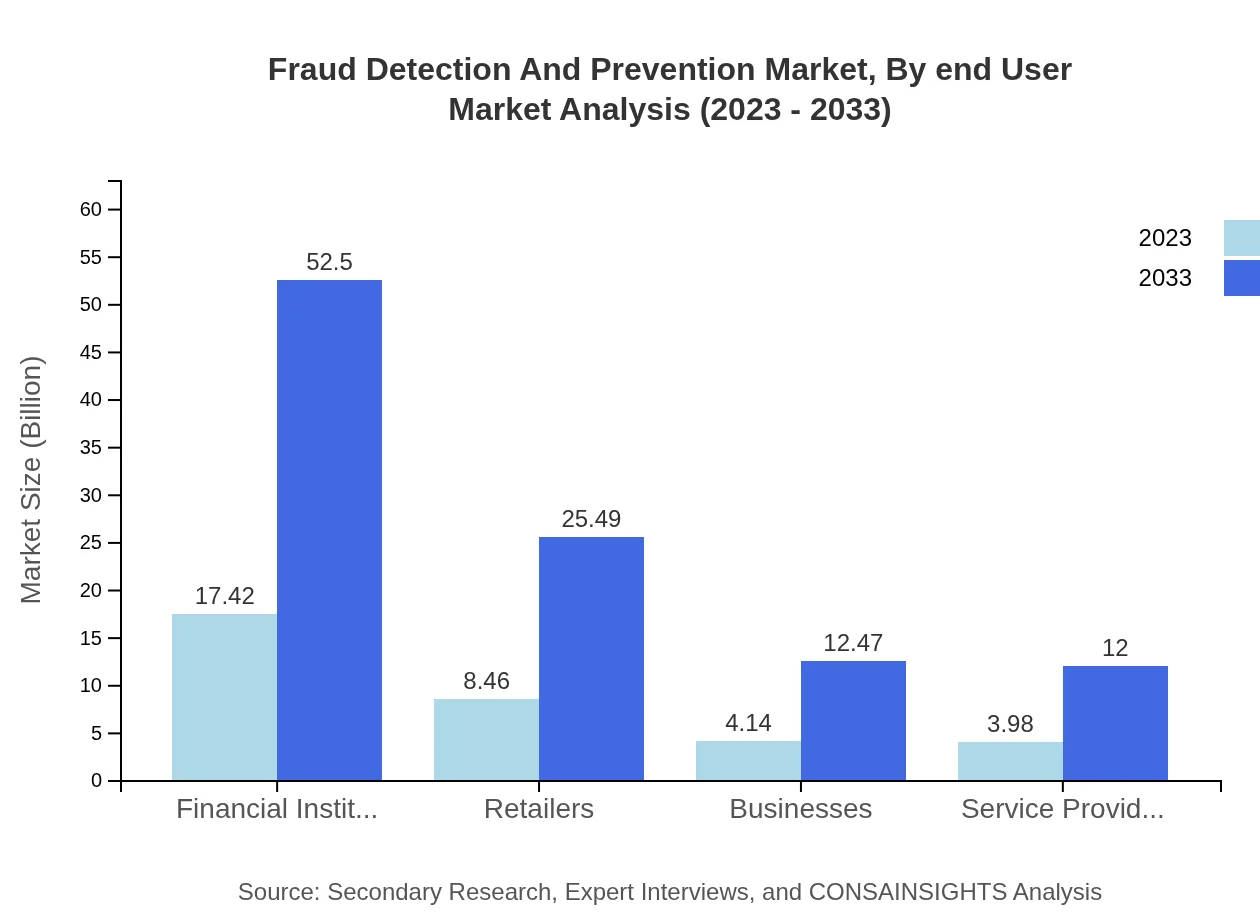

In 2023, financial institutions hold a substantial market size of $17.42 billion and are anticipated to grow to $52.50 billion by 2033. Retailers follow with $8.46 billion, increasing to $25.49 billion within the same timeframe. E-commerce, insurance, and telecommunications sectors are also rapidly adopting FDP solutions.

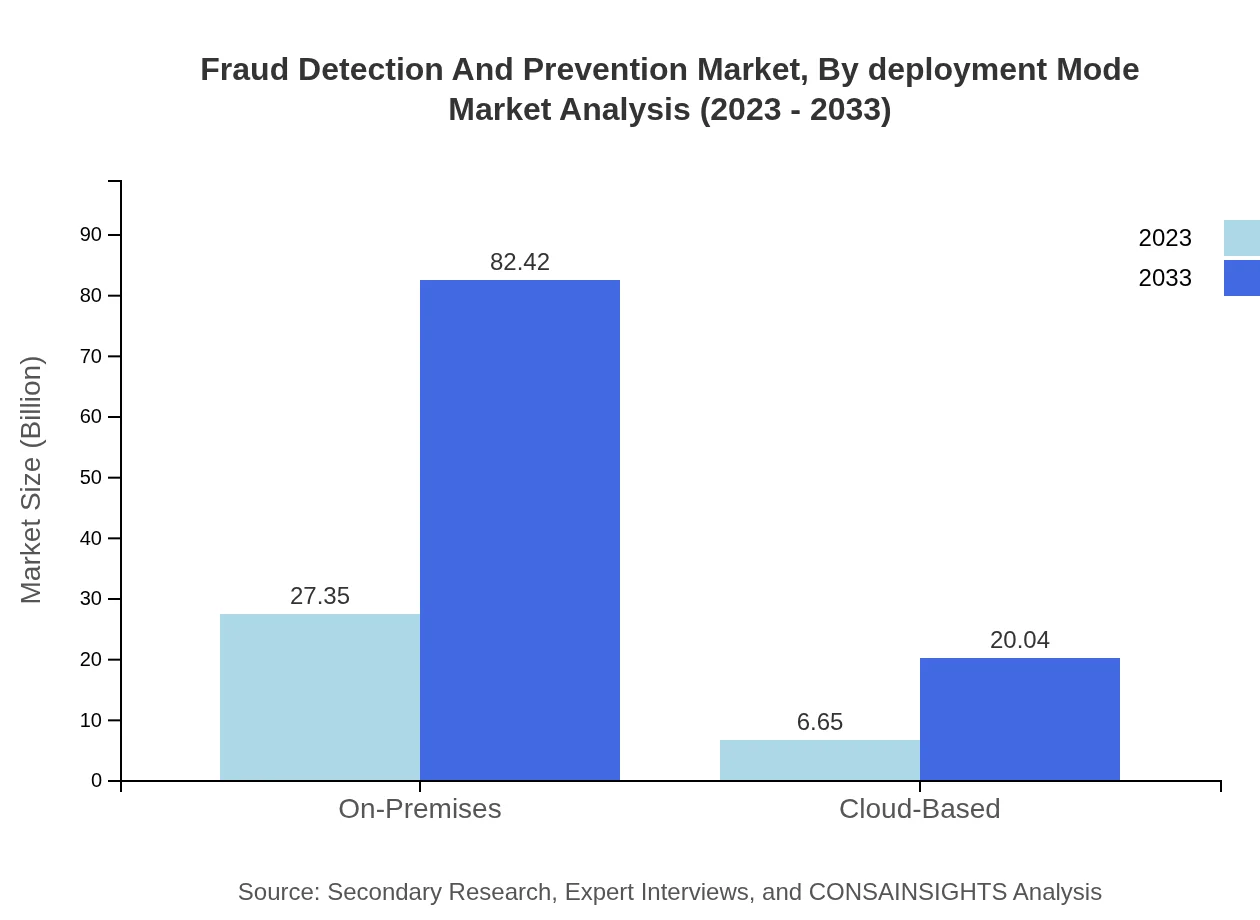

Fraud Detection And Prevention Market Analysis By Deployment Mode

The on-premises deployment mode dominates the market with a size of $27.35 billion in 2023, projected to reach $82.42 billion by 2033. Cloud-based solutions, while smaller at $6.65 billion in 2023, are expected to grow to $20.04 billion, attributed to the increasing trend of digital transformation and lower IT infrastructure costs.

Fraud Detection And Prevention Market Analysis By End User

The primary end-users of FRAUD detection solutions include financial institutions, contributing $17.42 billion in 2023 and expected to escalate to $52.50 billion by 2033. Other significant end-users include government agencies and service providers, all striving for enhanced security measures against fraudulent activities.

Fraud Detection And Prevention Market Analysis By Technology

Machine learning technologies are leading the market with a size of $22.01 billion in 2023, expected to triple to $66.32 billion by 2033, showcasing its importance in real-time fraud detection. Biometric technologies and data analytics are also witnessing rapid growth as they enhance the efficacy of traditional detection methods.

Fraud Detection And Prevention Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Fraud Detection And Prevention Industry

IBM Corporation:

IBM provides advanced big data analytics and cognitive solutions to help organizations combat fraud efficiently, leveraging AI and machine learning.SAS Institute Inc.:

SAS is renowned for its analytics solutions that empower businesses to identify and prevent fraud through sophisticated modeling techniques.FICO (Fair Isaac Corporation):

FICO markets fraud detection technologies that analyze transaction patterns and identify anomalies in real-time to minimize fraud loss.Experian:

Experian offers a comprehensive suite of fraud detection services, focusing on marketing insights and data-driven strategies to enhance security.Oracle Corporation:

Oracle's advanced fraud detection solutions are integrated with cloud capabilities, providing real-time insights for risk management in transactions.We're grateful to work with incredible clients.

FAQs

What is the market size of fraud Detection And Prevention?

The fraud detection and prevention market is currently valued at approximately $34 billion, with a projected compound annual growth rate (CAGR) of 11.2% over the next decade, indicating strong growth and demand in this sector.

What are the key market players or companies in this fraud Detection And Prevention industry?

Key players in the fraud detection and prevention industry include companies like IBM, Oracle, SAS Institute, FICO, and NICE Actimize, which are leaders in providing innovative software solutions and fraud prevention services.

What are the primary factors driving the growth in the fraud Detection And Prevention industry?

The growth in the fraud detection and prevention industry is primarily driven by increasing cybercrime incidents, the adoption of digital banking, regulatory compliance requirements, and advancements in artificial intelligence and machine learning technologies.

Which region is the fastest Growing in the fraud Detection And Prevention market?

The Asia-Pacific region is currently the fastest-growing market for fraud detection and prevention, with a growth from $7.27 billion in 2023 to $21.91 billion by 2033, driven by high internet penetration and rapid digital transformation.

Does ConsaInsights provide customized market report data for the fraud Detection And Prevention industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs and requirements within the fraud detection and prevention industry, ensuring valuable insights that align with individual business strategies.

What deliverables can I expect from this fraud Detection And Prevention market research project?

Deliverables from the fraud detection and prevention market research project include comprehensive market analysis, segment data, competitor assessments, trend predictions, and actionable insights, all designed to support informed decision-making.

What are the market trends of fraud Detection And Prevention?

Current market trends in fraud detection and prevention include increased investment in machine learning technologies, growing demand for cloud-based solutions, and heightened focus on data analytics to improve fraud detection outcomes.