Freight Management System Market Report

Published Date: 22 January 2026 | Report Code: freight-management-system

Freight Management System Market Size, Share, Industry Trends and Forecast to 2033

This report analyzes the Freight Management System market, providing insights into market size, growth trends, and forecasts from 2023 to 2033. It covers segmentation, regional analysis, industry dynamics, and the role of leading players.

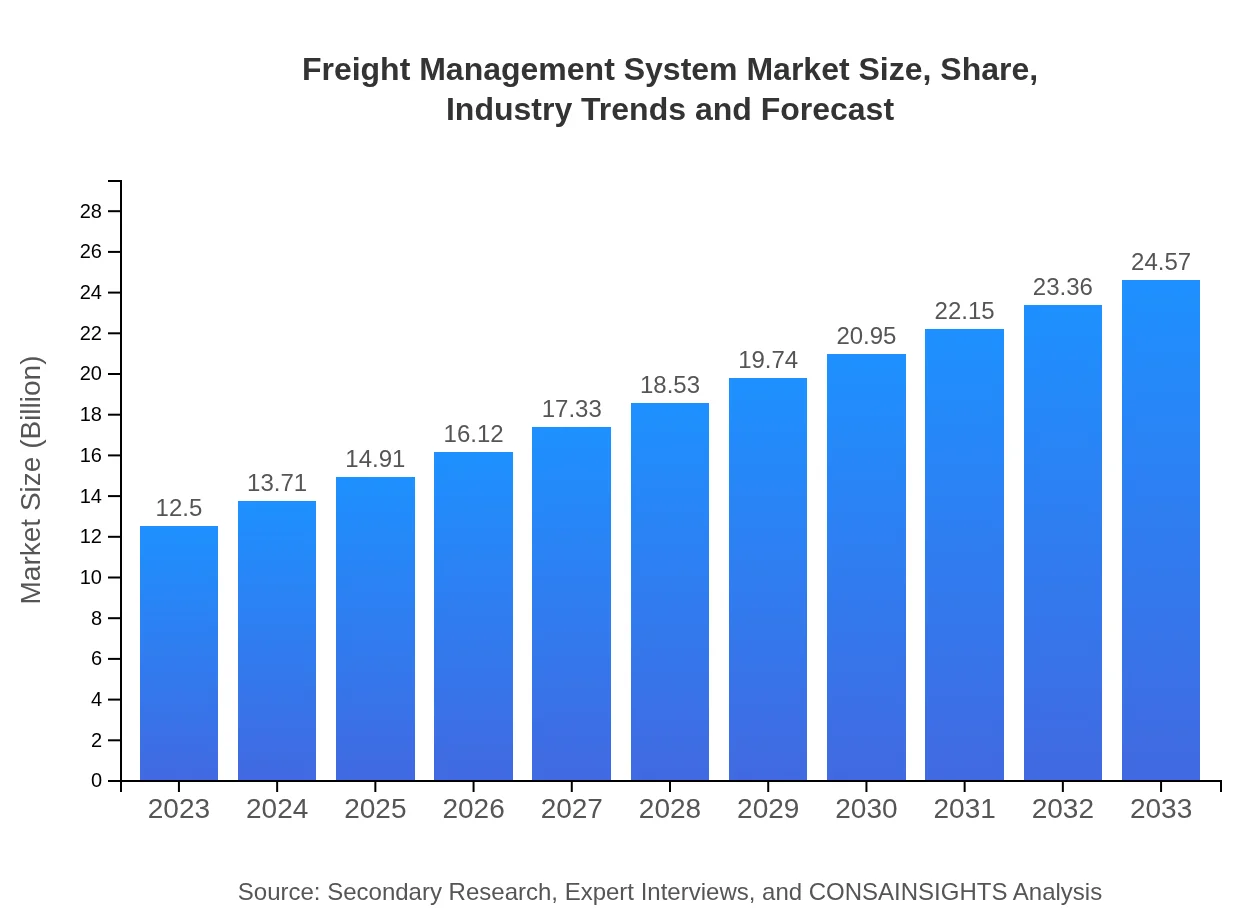

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $24.57 Billion |

| Top Companies | SAP SE, Oracle Corporation, C.H. Robinson, JDA Software |

| Last Modified Date | 22 January 2026 |

Freight Management System Market Overview

Customize Freight Management System Market Report market research report

- ✔ Get in-depth analysis of Freight Management System market size, growth, and forecasts.

- ✔ Understand Freight Management System's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Freight Management System

What is the Market Size & CAGR of Freight Management System market in 2023?

Freight Management System Industry Analysis

Freight Management System Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Freight Management System Market Analysis Report by Region

Europe Freight Management System Market Report:

The European market for Freight Management Systems is expected to more than double, growing from $3.64 billion in 2023 to $7.15 billion in 2033. European companies are increasingly adopting digital solutions due to regulatory pressures and the push for sustainability in logistics. The region's focus on reducing carbon footprints through optimized logistics systems is also a significant growth catalyst.Asia Pacific Freight Management System Market Report:

The Asia Pacific region is expected to witness substantial growth, with the market size projected to reach $4.72 billion by 2033 from $2.40 billion in 2023. The demand for efficient logistics solutions driven by rapid industrial growth, especially in countries like China and India, is a significant growth factor. Increased international trade and investment in infrastructure are also contributing to this trend.North America Freight Management System Market Report:

North America maintains a significant share of the Freight Management System market, projected to reach $8.96 billion by 2033 up from $4.56 billion in 2023. The growth is mainly fueled by technological advancements and a strong logistics infrastructure. The U.S. is a key player, with a focus on integrating digital solutions in freight management to enhance operational efficiency.South America Freight Management System Market Report:

In South America, the market is predicted to grow from $1.13 billion in 2023 to $2.21 billion in 2033. Growth drivers include increasing trade activities and the development of the logistics sector. Countries like Brazil are enhancing their logistics capabilities to support economic growth, creating a favorable environment for Freight Management Systems.Middle East & Africa Freight Management System Market Report:

In the Middle East and Africa, the market is expected to grow from $0.78 billion in 2023 to $1.52 billion by 2033. Key contributing factors include infrastructural development and increasing investments in logistics. As regional trade increases, companies are looking to enhance freight processes, thereby driving demand for advanced management systems.Tell us your focus area and get a customized research report.

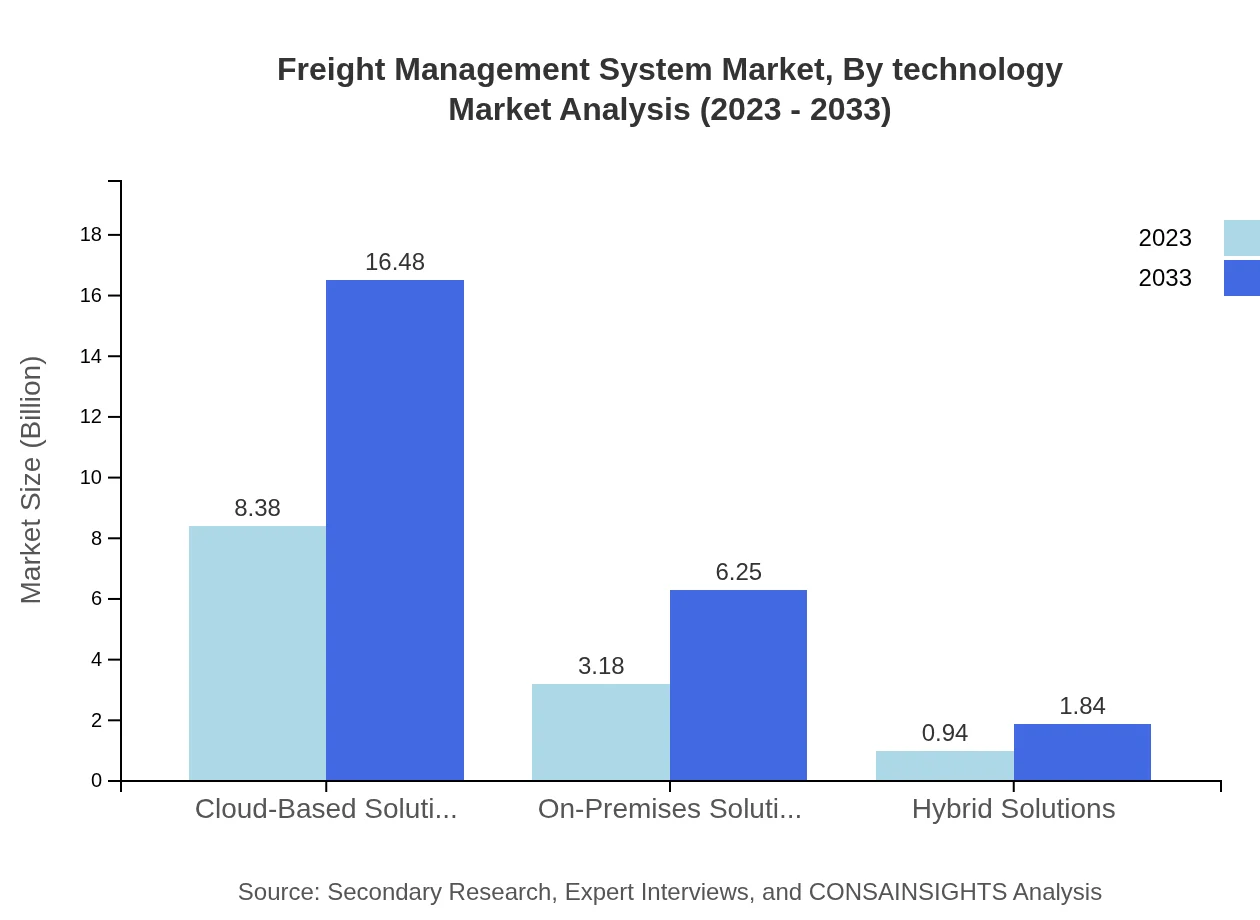

Freight Management System Market Analysis By Technology

The technology segment of the Freight Management System market includes cloud-based solutions, on-premises solutions, and hybrid solutions. Cloud-based solutions dominate the market due to their cost-effectiveness and scalability, valued at $8.38 billion in 2023, projected to reach $16.48 billion by 2033, holding a market share of 67.08%. On-premises solutions are valued at $3.18 billion in 2023 and expected to grow to $6.25 billion by 2033, capturing a share of 25.43%. Hybrid solutions are gaining traction, anticipated to grow from $0.94 billion in 2023 to $1.84 billion in 2033, with a share of 7.49%.

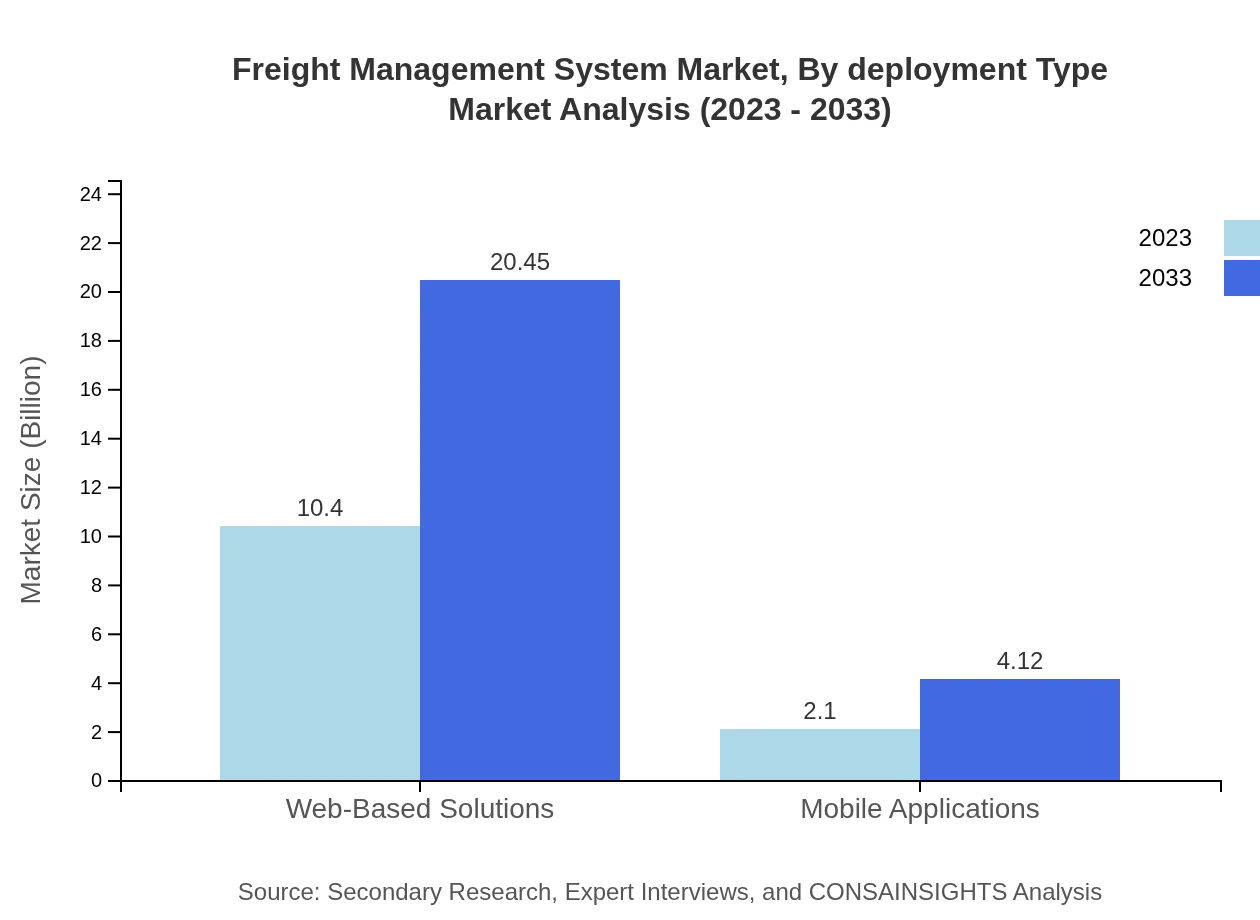

Freight Management System Market Analysis By Deployment Type

The deployment type segment showcases cloud-based, on-premises, and hybrid models. Cloud-based deployment leads with a significant share, driven by an increasing preference for flexibility and reduced operational costs. The projected growth reflects the wider adoption of software-as-a-service (SaaS) solutions by organizations looking to streamline their logistics operations efficiently.

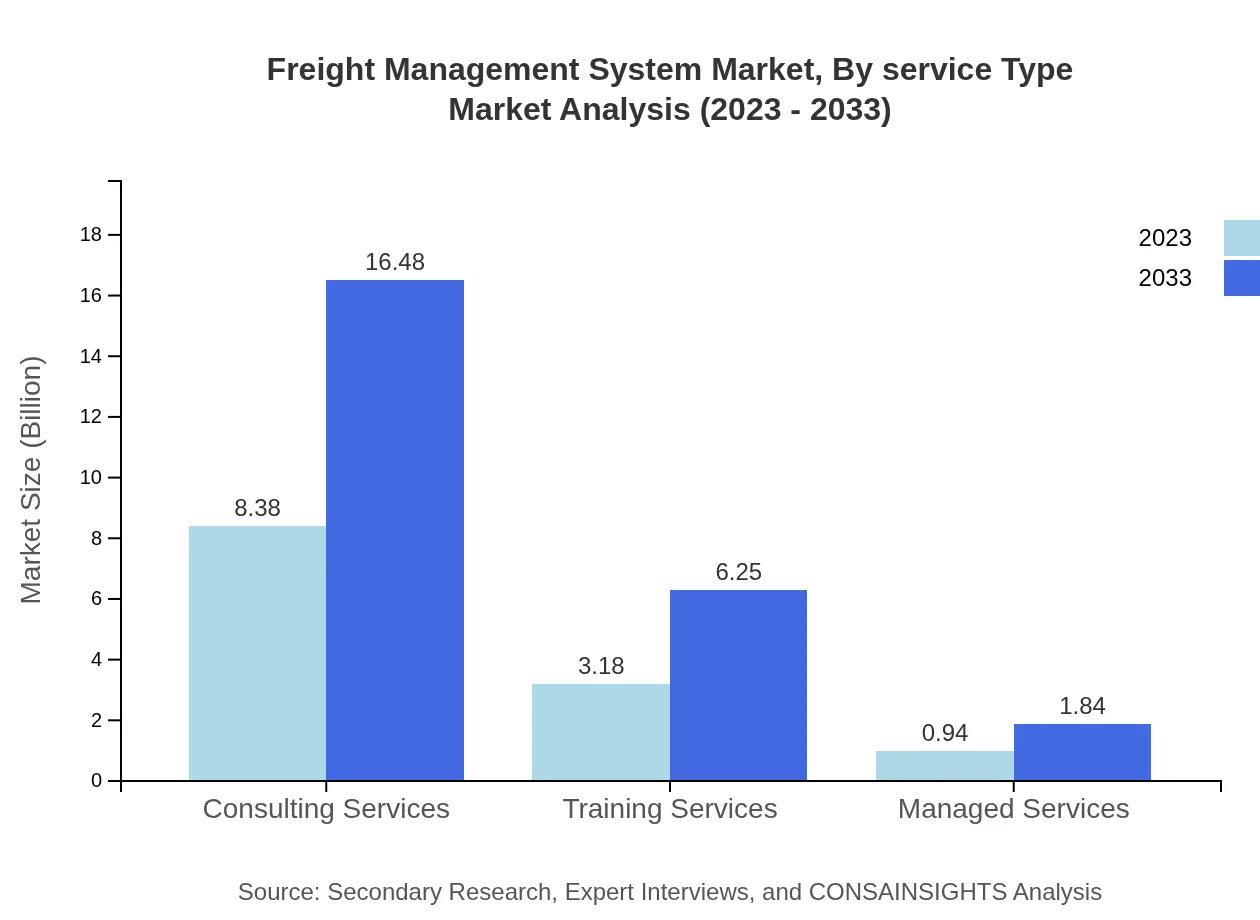

Freight Management System Market Analysis By Service Type

Service types in the Freight Management System market include consulting services, training services, and managed services. Consulting services, valued at $8.38 billion in 2023, are expected to double to $16.48 billion by 2033, representing a significant share of 67.08%. Training services follow with a market size growing from $3.18 billion in 2023 to $6.25 billion in 2033, sharing 25.43%. Managed services are gradually emerging with an expected increase from $0.94 billion in 2023 to $1.84 billion by 2033, holding a share of 7.49%.

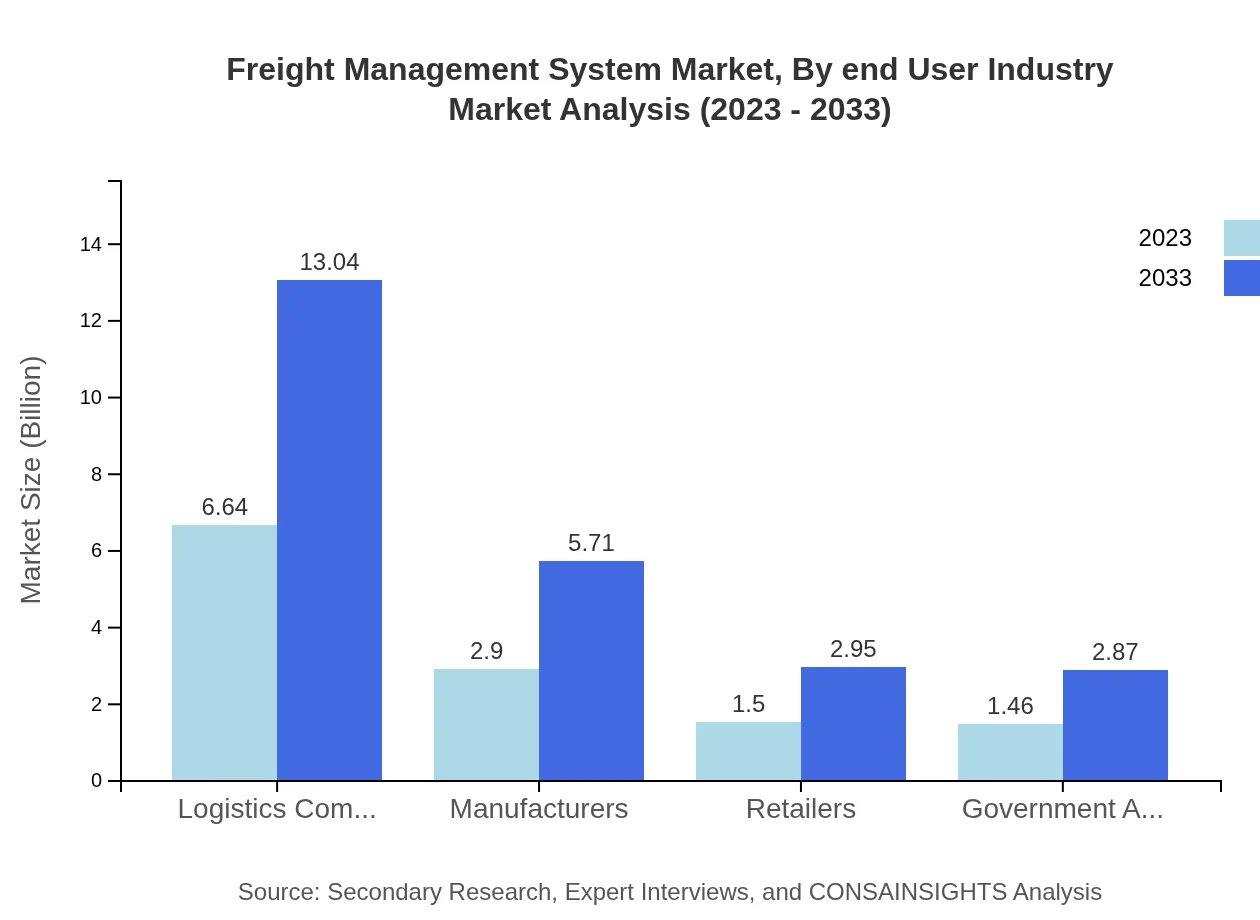

Freight Management System Market Analysis By End User Industry

The end-user industry segment comprises logistics companies, manufacturers, retailers, and government agencies. Logistics companies dominate the market size at $6.64 billion in 2023, set to grow to $13.04 billion by 2033, accounting for 53.09% of the total market. Manufacturers and retailers are also significant contributors, with their sizes expected to reach $5.71 billion and $2.95 billion, respectively, by 2033. Government agencies will enhance their operations with advanced FMS solutions, rising from $1.46 billion in 2023 to $2.87 billion by 2033.

Freight Management System Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Freight Management System Industry

SAP SE:

A leader in enterprise software, SAP offers comprehensive FMS solutions focusing on integrating logistics and supply chain functionalities.Oracle Corporation:

Provides advanced FMS tools as part of its extensive suite of cloud applications, enabling businesses to enhance visibility and logistics management.C.H. Robinson:

A global leader in logistics, C.H. Robinson offers sophisticated freight and transportation solutions integrated with cutting-edge technology.JDA Software:

Specializing in supply chain management solutions, JDA provides innovative FMS tools focused on efficiency and operational excellence.We're grateful to work with incredible clients.

FAQs

What is the market size of freight Management System?

The global freight management system market is valued at approximately $12.5 billion in 2023, with a projected CAGR of 6.8%, indicating substantial growth potential until 2033.

What are the key market players or companies in this freight Management System industry?

Key players in the freight management system industry include prominent logistics companies and technology providers that specialize in supply chain management solutions and software development.

What are the primary factors driving the growth in the freight management system industry?

Growth in the freight management system industry is driven by the rise in e-commerce, advancements in logistics technologies, and increasing demand for efficient supply chain management practices.

Which region is the fastest Growing in the freight management system?

Among regions, North America is the fastest-growing market, expected to expand from $4.56 billion in 2023 to $8.96 billion by 2033, followed by Europe and Asia Pacific.

Does ConsaInsights provide customized market report data for the freight management system industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs, delivering detailed insights and data analysis for the freight management system industry.

What deliverables can I expect from this freight management system market research project?

Expect comprehensive deliverables including market size estimates, growth forecasts, segmentation analysis, competitive landscape reviews, and insights into market trends.

What are the market trends of freight management system?

Current market trends in the freight management system sector include the increasing adoption of cloud-based solutions, automation in logistics, and a shift towards more sustainable practices.