Freighter Aircraft Market Report

Published Date: 03 February 2026 | Report Code: freighter-aircraft

Freighter Aircraft Market Size, Share, Industry Trends and Forecast to 2033

This market report covers detailed insights on the Freighter Aircraft sector, focusing on market dynamics, trends, and forecasts for the period 2023-2033. It highlights significant growth opportunities and regional developments within the industry.

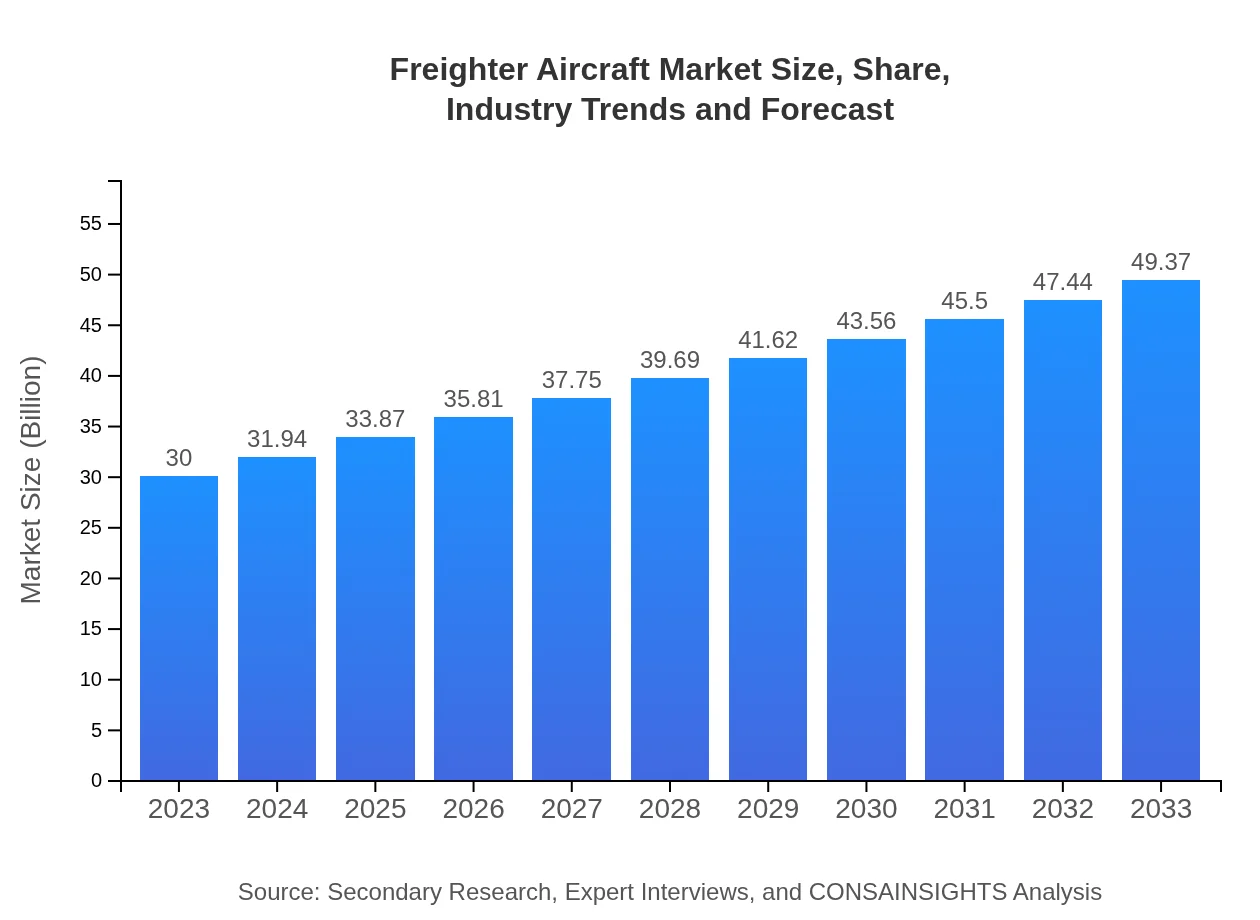

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $30.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $49.37 Billion |

| Top Companies | Boeing , Airbus, Lockheed Martin, Antonov Airlines, DHL Aviation |

| Last Modified Date | 03 February 2026 |

Freighter Aircraft Market Overview

Customize Freighter Aircraft Market Report market research report

- ✔ Get in-depth analysis of Freighter Aircraft market size, growth, and forecasts.

- ✔ Understand Freighter Aircraft's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Freighter Aircraft

What is the Market Size & CAGR of Freighter Aircraft market in 2023?

Freighter Aircraft Industry Analysis

Freighter Aircraft Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Freighter Aircraft Market Analysis Report by Region

Europe Freighter Aircraft Market Report:

In Europe, the market was valued at $7.47 billion in 2023 and is expected to expand to $12.30 billion by 2033. The region's focus on sustainability and modernizing air fleets is set to amplify growth within the sector.Asia Pacific Freighter Aircraft Market Report:

In the Asia-Pacific region, the Freighter Aircraft market is valued at $6.23 billion in 2023 and is expected to reach $10.25 billion by 2033. Growth is primarily driven by increasing trade routes, infrastructure development, and a rising demand for e-commerce and express delivery services.North America Freighter Aircraft Market Report:

North America holds the largest share in the Freighter Aircraft market, valued at $11.21 billion in 2023 and projected to grow to $18.46 billion by 2033. The robust logistics framework and the booming e-commerce sector significantly fuel this growth.South America Freighter Aircraft Market Report:

The Freighter Aircraft market in South America was valued at $2.57 billion in 2023, anticipated to grow to $4.23 billion by 2033. Factors contributing to this growth include burgeoning trade volumes and improvements in air logistics capabilities across the continent.Middle East & Africa Freighter Aircraft Market Report:

The Freighter Aircraft market in the Middle East and Africa stood at $2.51 billion in 2023, with projections of reaching $4.13 billion by 2033. Increasing investment in logistics infrastructure and expanding trade routes contribute to a positive outlook for the region.Tell us your focus area and get a customized research report.

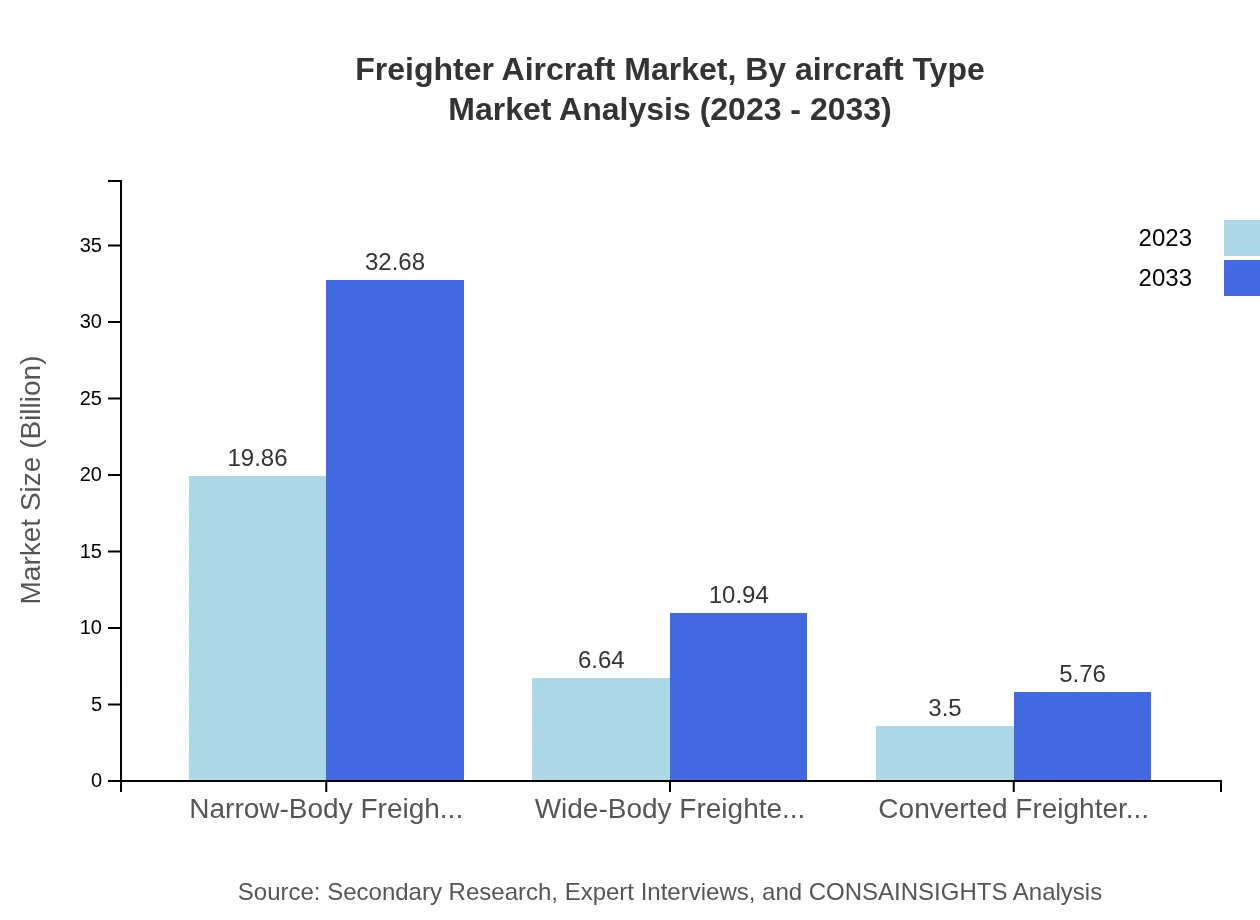

Freighter Aircraft Market Analysis By Aircraft Type

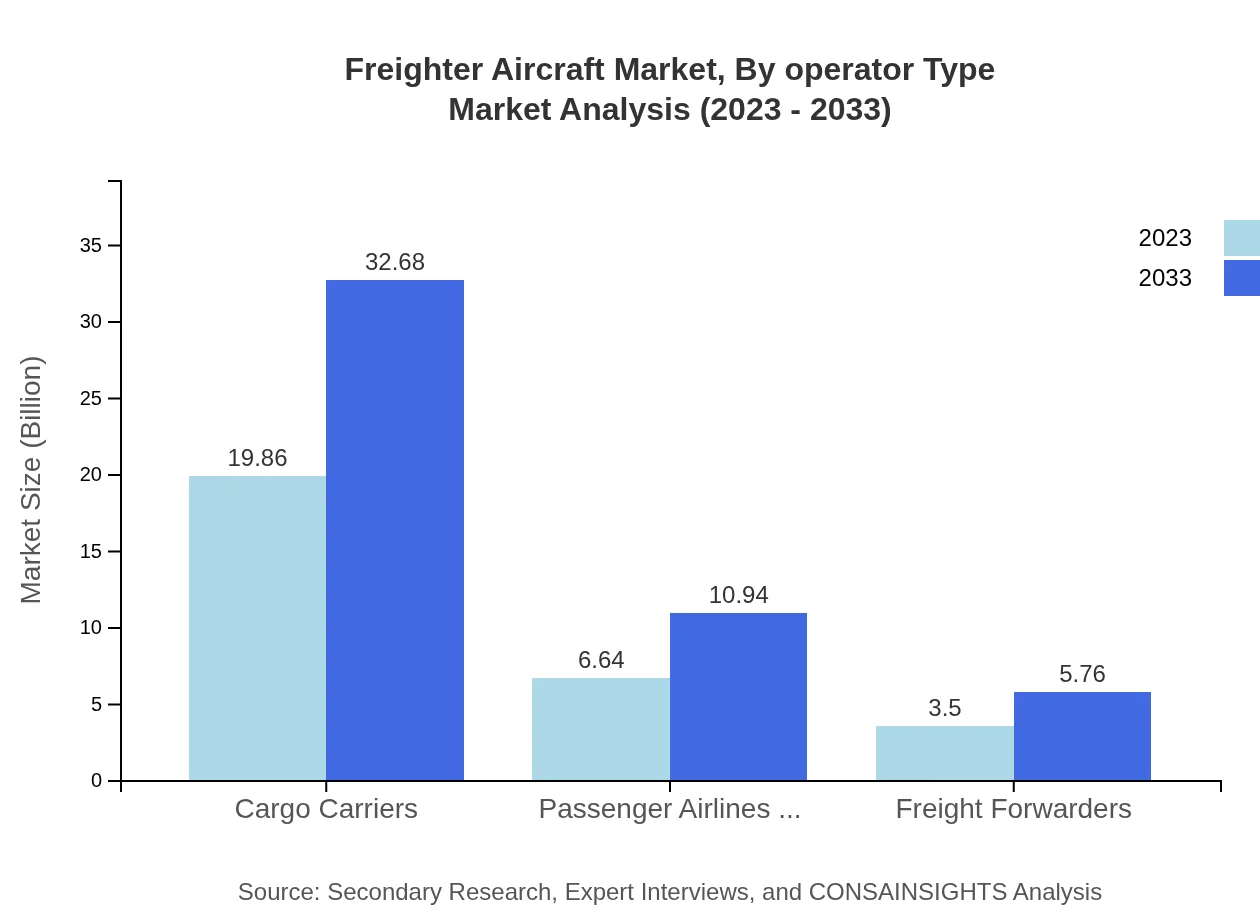

The Freighter Aircraft market, segmented by aircraft type, showcases significant demand for Narrow-Body Freighter Aircraft, which accounts for over 66% of the market share valued at $19.86 billion in 2023, projected to rise to $32.68 billion by 2033. Wide-body and converted freighter aircraft also demonstrate growth but to a lesser extent.

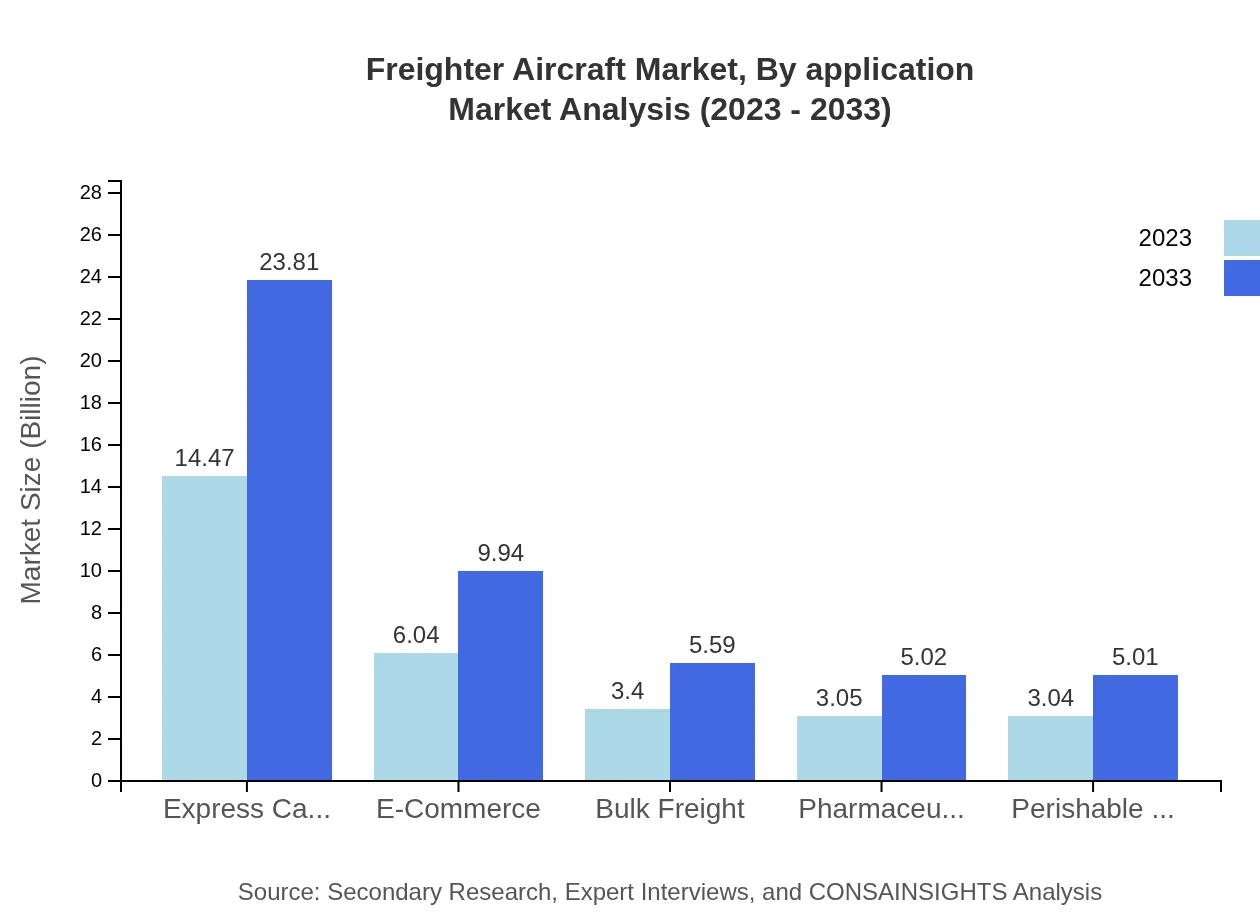

Freighter Aircraft Market Analysis By Application

The market, when segmented by application, reveals strong performance in Express Cargo, valued at $14.47 billion in 2023 and expected to grow to $23.81 billion by 2033. E-commerce and pharmaceuticals also represent lucrative segments, indicating a steady demand for freighter aircraft.

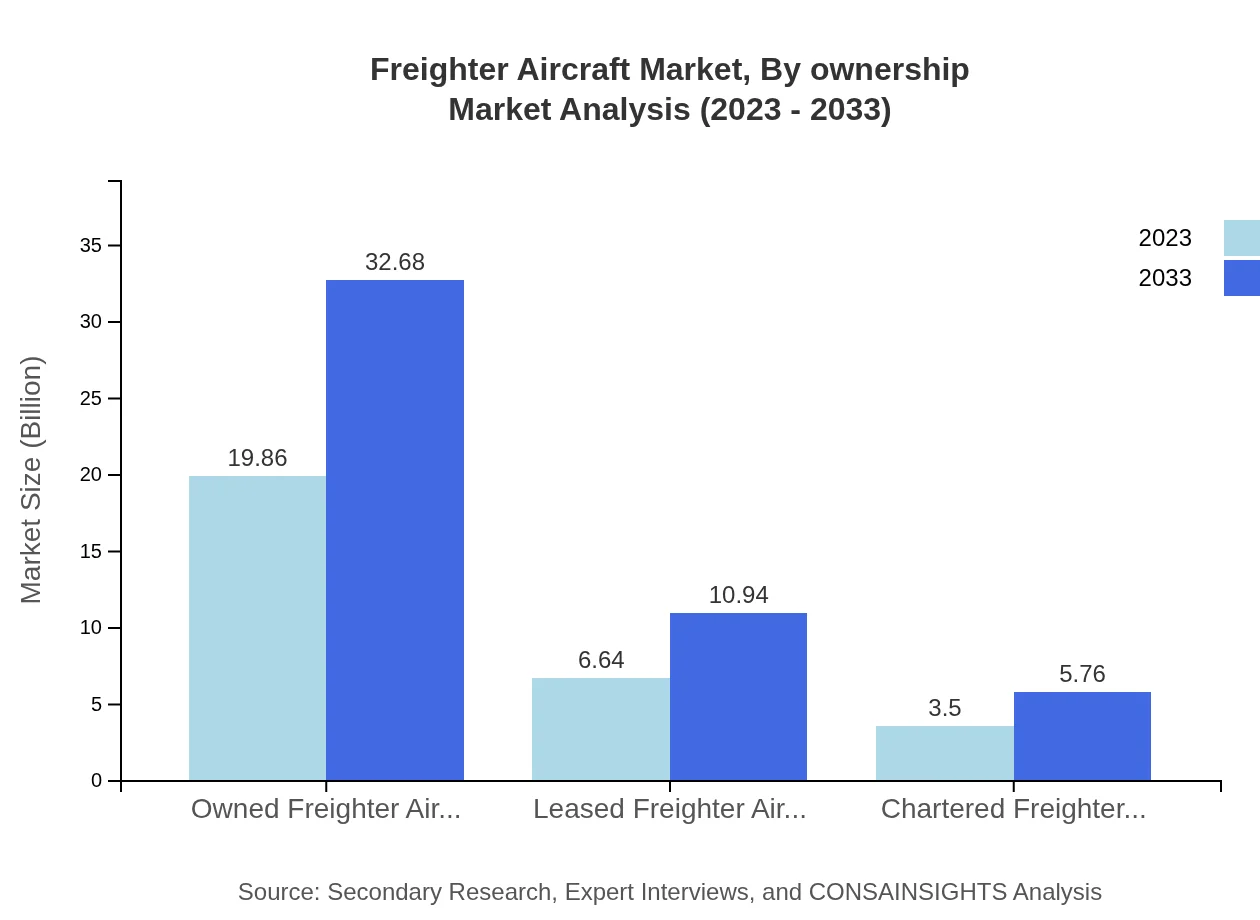

Freighter Aircraft Market Analysis By Ownership

Ownership segmentation indicates that owned freighter aircraft dominate with a market size of $19.86 billion in 2023, expected to increase to $32.68 billion by 2033. Leased and chartered aircraft represent 22.15% and 11.66% market shares respectively, showcasing varied business models within the industry.

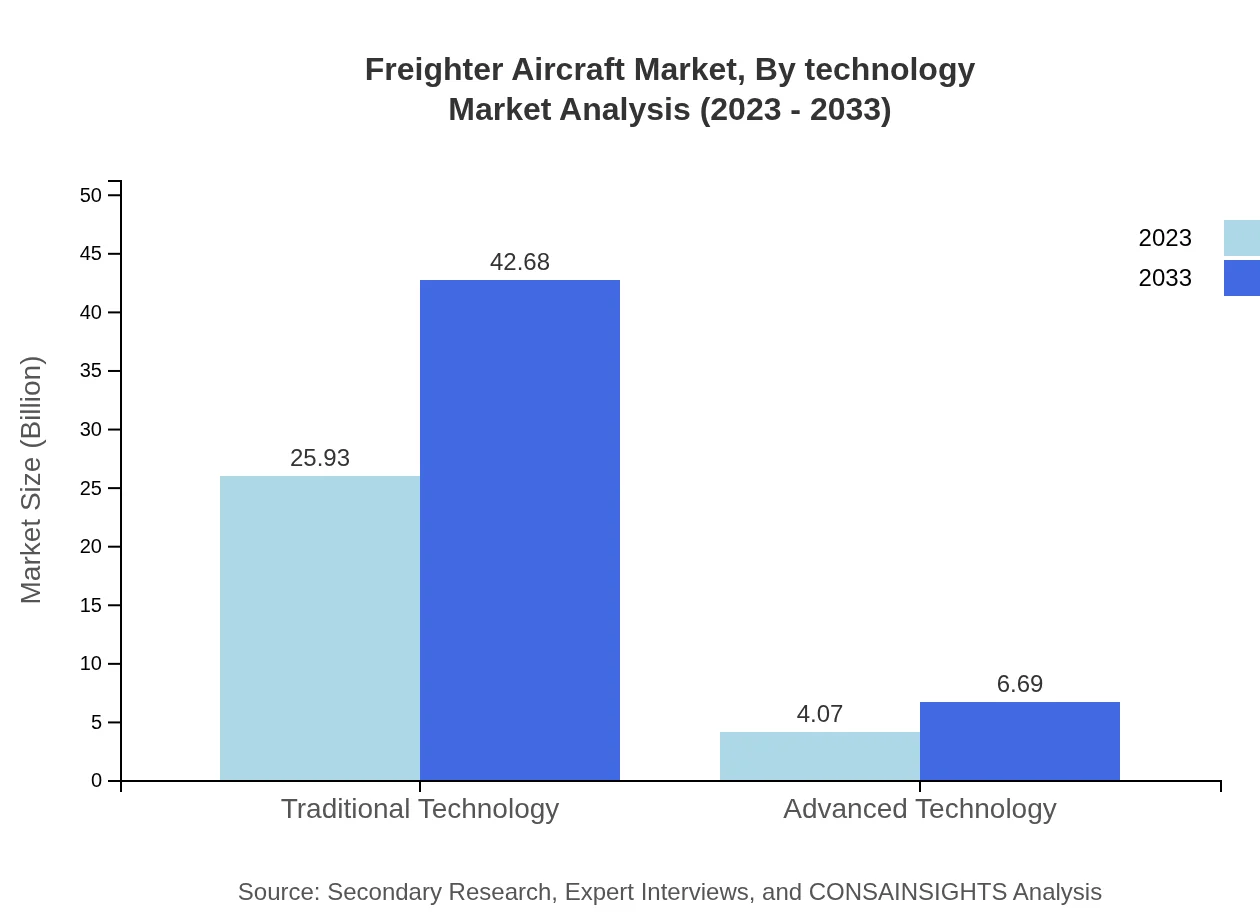

Freighter Aircraft Market Analysis By Technology

The technology segment is characterized by the prevalence of traditional technology which held a market size of $25.93 billion in 2023, projected to grow to $42.68 billion by 2033. Advanced technologies, although smaller at $4.07 billion in 2023, are expected to gain traction as innovations foster operational efficiencies.

Freighter Aircraft Market Analysis By Operator Type

Freight Forwarders represent another key segment, with a market size of $3.50 billion in 2023 expected to reach $5.76 billion by 2033. This reflects the increasing trend of major logistic firms investing in dedicated freighter fleets.

Freighter Aircraft Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Freighter Aircraft Industry

Boeing :

Boeing is a leading manufacturer of freighter aircraft, offering a versatile range of cargo planes including the 737, 767, and the 777F, capitalizing on advanced technology and design.Airbus:

Airbus competes heavily in the freighter segment with its A330 and A310 freighters, focusing on efficiency and fuel-saving technologies, catering to increasing cargo demands.Lockheed Martin:

Lockheed Martin, through its versatile C-130 aircraft, serves military and civil transportation markets, providing solutions for different freight needs across the industry.Antonov Airlines:

Antonov, with its AN-124 and AN-225 models, serves specialized freight demands, focusing on oversized cargo transportation globally.DHL Aviation:

As a major player in air freight logistics, DHL Aviation operates a substantial fleet of freighter aircraft, emphasizing reliable and timely delivery services across regions.We're grateful to work with incredible clients.

FAQs

What is the market size of freighter Aircraft?

The global freighter aircraft market is currently valued at approximately $30 billion and is expected to grow at a CAGR of 5% from 2023 to 2033. This growth is driven by increasing demand for air cargo services.

What are the key market players or companies in this freighter Aircraft industry?

Key players in the freighter aircraft industry include Boeing, Airbus, FedEx, UPS Airlines, and Atlas Air. These companies lead the market through innovation and expanding their fleets of freighter aircraft to meet rising demand.

What are the primary factors driving the growth in the freighter Aircraft industry?

Growth in the freighter aircraft industry is driven by increasing e-commerce activities, globalization of supply chains, and the rising demand for rapid delivery services. Additionally, advancements in aircraft technologies contribute significantly to growth.

Which region is the fastest Growing in the freighter Aircraft?

North America is the fastest-growing region in the freighter aircraft market, with an expected growth from $11.21 billion in 2023 to $18.46 billion in 2033. Europe and Asia Pacific also exhibit significant growth during this period.

Does ConsaInsights provide customized market report data for the freighter Aircraft industry?

Yes, ConsaInsights offers customized market reports for the freighter aircraft industry. These reports can be tailored to specific business needs, providing detailed analyses and insights relevant to individual requirements and market segments.

What deliverables can I expect from this freighter Aircraft market research project?

From this research project, you can expect comprehensive reports including market size data, segment analysis, competitive landscape overviews, and forecasts. Additional insights on market trends and regional growth drivers will also be included.

What are the market trends of freighter Aircraft?

Key trends in the freighter aircraft market include increasing automation, a rise in demand for express and e-commerce cargo services, and the transition towards more advanced and efficient aircraft technologies, which is expected to reshape the industry.