Fresh Processed Meat Products Market Report

Published Date: 31 January 2026 | Report Code: fresh-processed-meat-products

Fresh Processed Meat Products Market Size, Share, Industry Trends and Forecast to 2033

This report analyzes the Fresh Processed Meat Products market, providing insights into market size, trends, and forecasts from 2023 to 2033. It covers industry dynamics, regional breakdowns, and key players within the market, facilitating informed decision-making.

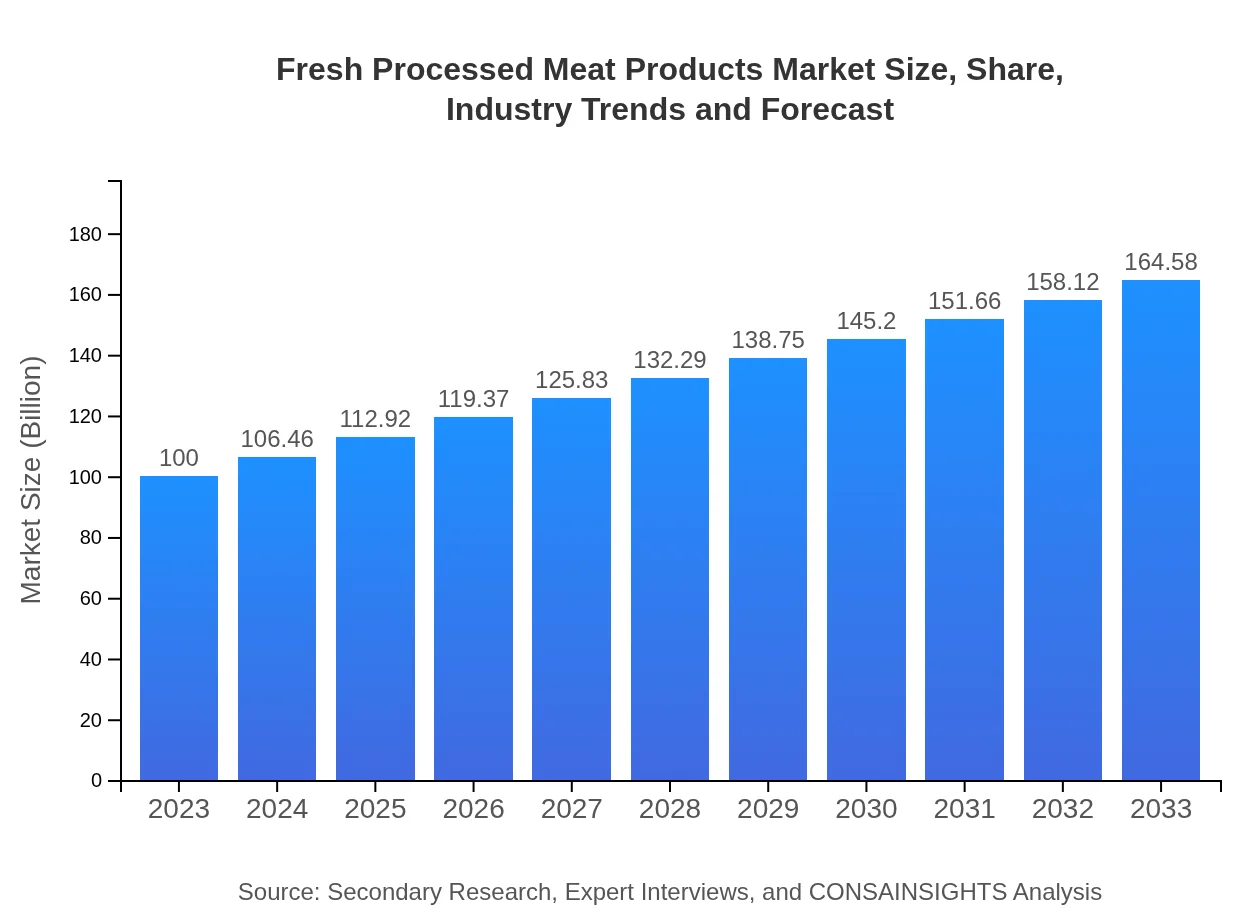

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $100.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $164.58 Billion |

| Top Companies | Tyson Foods, Inc., Hormel Foods Corporation, JBS S.A., Smithfield Foods, Inc., Porky’s Fresh Meat Co. |

| Last Modified Date | 31 January 2026 |

Fresh Processed Meat Products Market Overview

Customize Fresh Processed Meat Products Market Report market research report

- ✔ Get in-depth analysis of Fresh Processed Meat Products market size, growth, and forecasts.

- ✔ Understand Fresh Processed Meat Products's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Fresh Processed Meat Products

What is the Market Size & CAGR of Fresh Processed Meat Products market in 2023?

Fresh Processed Meat Products Industry Analysis

Fresh Processed Meat Products Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Fresh Processed Meat Products Market Analysis Report by Region

Europe Fresh Processed Meat Products Market Report:

The European market is projected to grow from $29.36 billion in 2023 to $48.32 billion by 2033, influenced by stringent food safety regulations, an increased focus on high-quality meat products, and a robust foodservice sector. Countries like Germany and the UK are leading in market growth, reflecting strong consumer preferences for fresh processed meats.Asia Pacific Fresh Processed Meat Products Market Report:

In the Asia Pacific region, the Fresh Processed Meat Products market is projected to grow from $19.21 billion in 2023 to $31.62 billion by 2033, driven by urbanization, increased disposable incomes, and changing dietary habits favoring meat consumption. Countries like China and India are emerging as significant contributors to this growth due to their large populations and increased preference for convenience foods.North America Fresh Processed Meat Products Market Report:

North America represents one of the largest markets, with a forecasted increase from $36.13 billion in 2023 to $59.46 billion by 2033. The growth in this region is supported by heightened consumer awareness about health, increased demand for organic and fresh meat products, and significant investments in food processing technologies.South America Fresh Processed Meat Products Market Report:

South America's market is expected to rise from $9.69 billion in 2023 to $15.95 billion by 2033. Factors such as rising meat production, preference for fresh meats, and the growth of the foodservice industry are propelling market growth. Brazil, as one of the largest meat consumers, plays a vital role in the region's dynamics.Middle East & Africa Fresh Processed Meat Products Market Report:

The Middle East and Africa market is expected to increase from $5.61 billion in 2023 to $9.23 billion by 2033, driven by population growth, rising disposable incomes, and the expanding fast-food sector. The growth in urban areas and increasing demand for internationally branded meat products are anticipated to drive this market further.Tell us your focus area and get a customized research report.

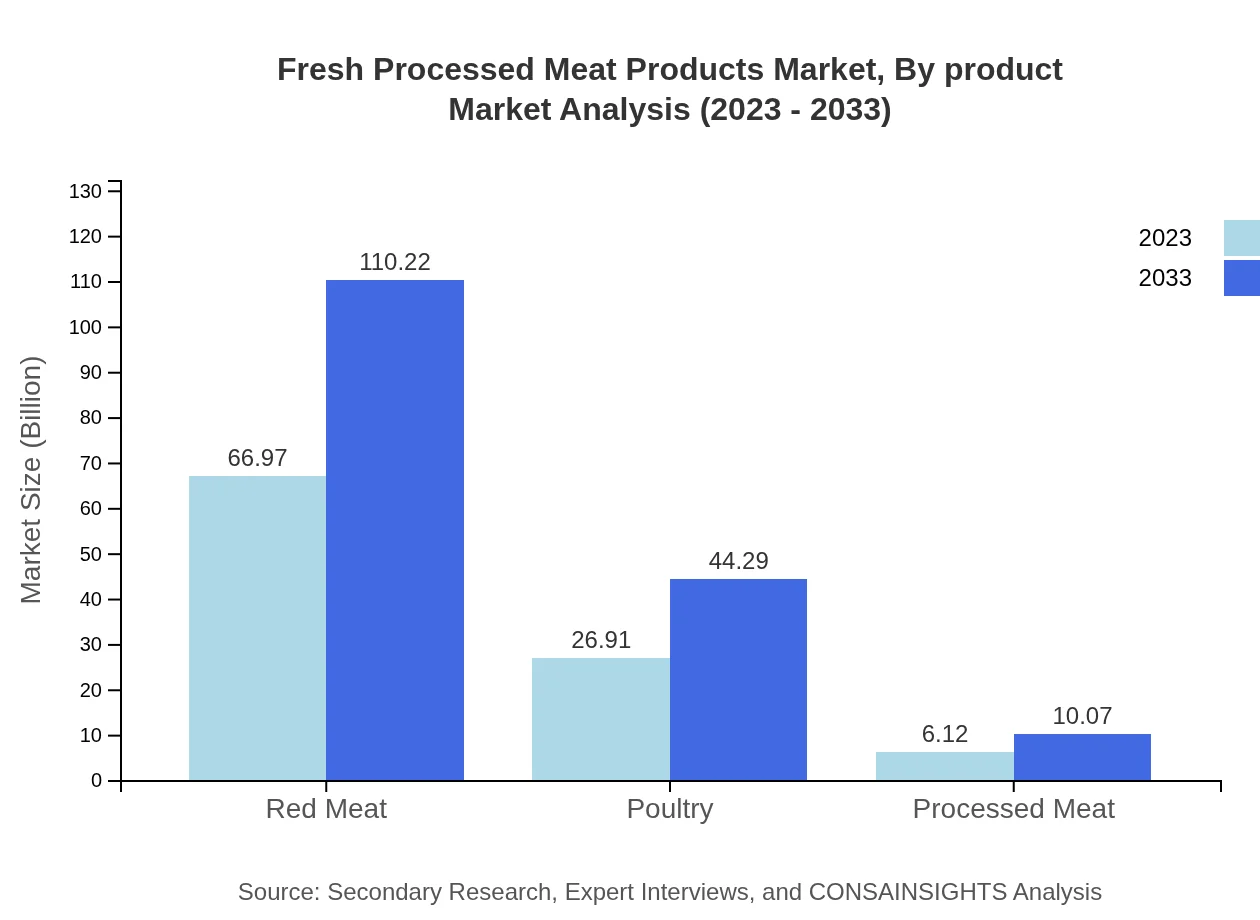

Fresh Processed Meat Products Market Analysis By Product

In the product type segment, red meat dominates the market, projected to grow from $66.97 billion in 2023 to $110.22 billion by 2033. Poultry follows, with a growth from $26.91 billion to $44.29 billion. Processed meat types are relatively smaller but show potential for growth as convenience becomes increasingly relevant.

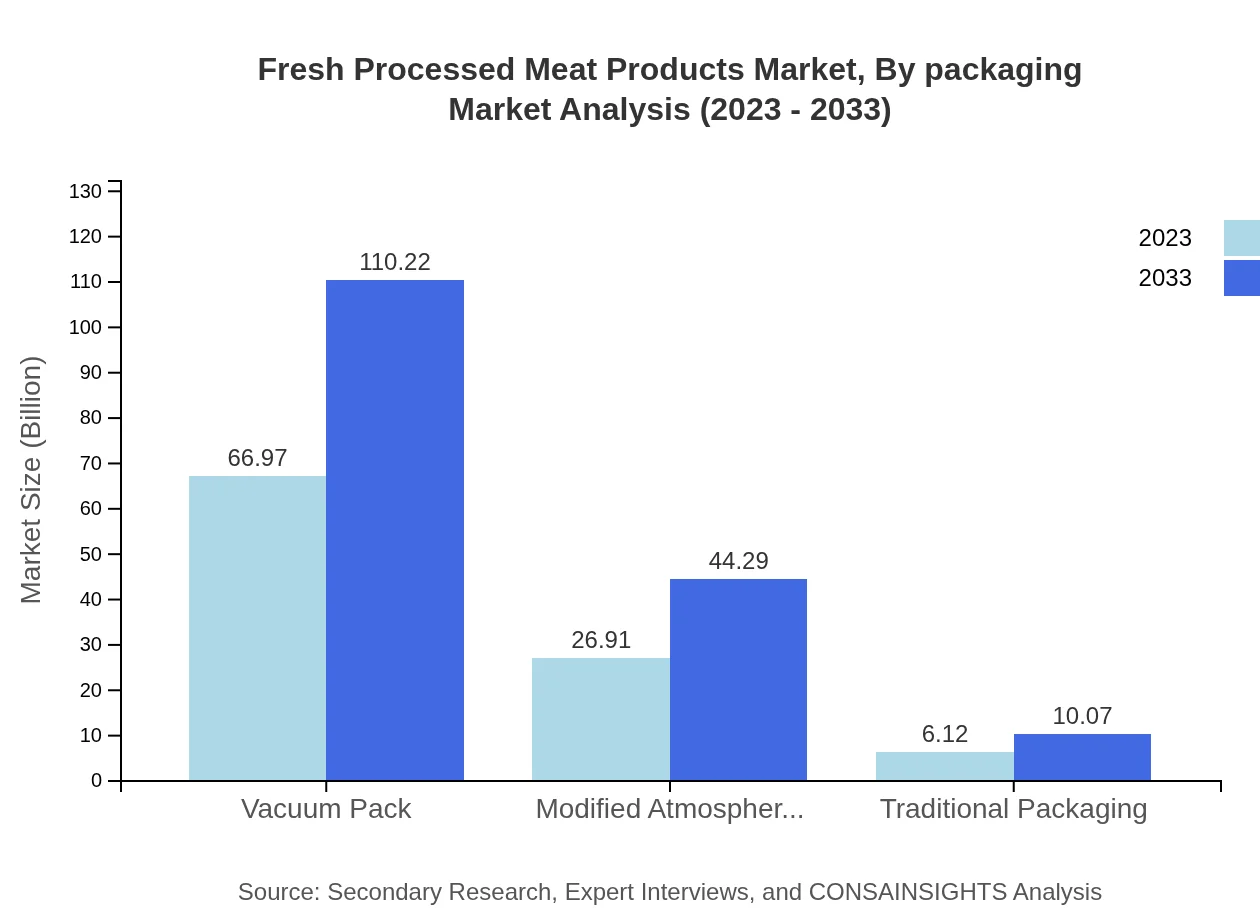

Fresh Processed Meat Products Market Analysis By Packaging

Vacuum packing is the leading packaging method, expected to grow from $66.97 billion in 2023 to $110.22 billion by 2033. Modified atmosphere packaging (MAP) is also gaining traction, with implications for longer shelf life and quality maintenance, anticipating growth from $26.91 billion to $44.29 billion.

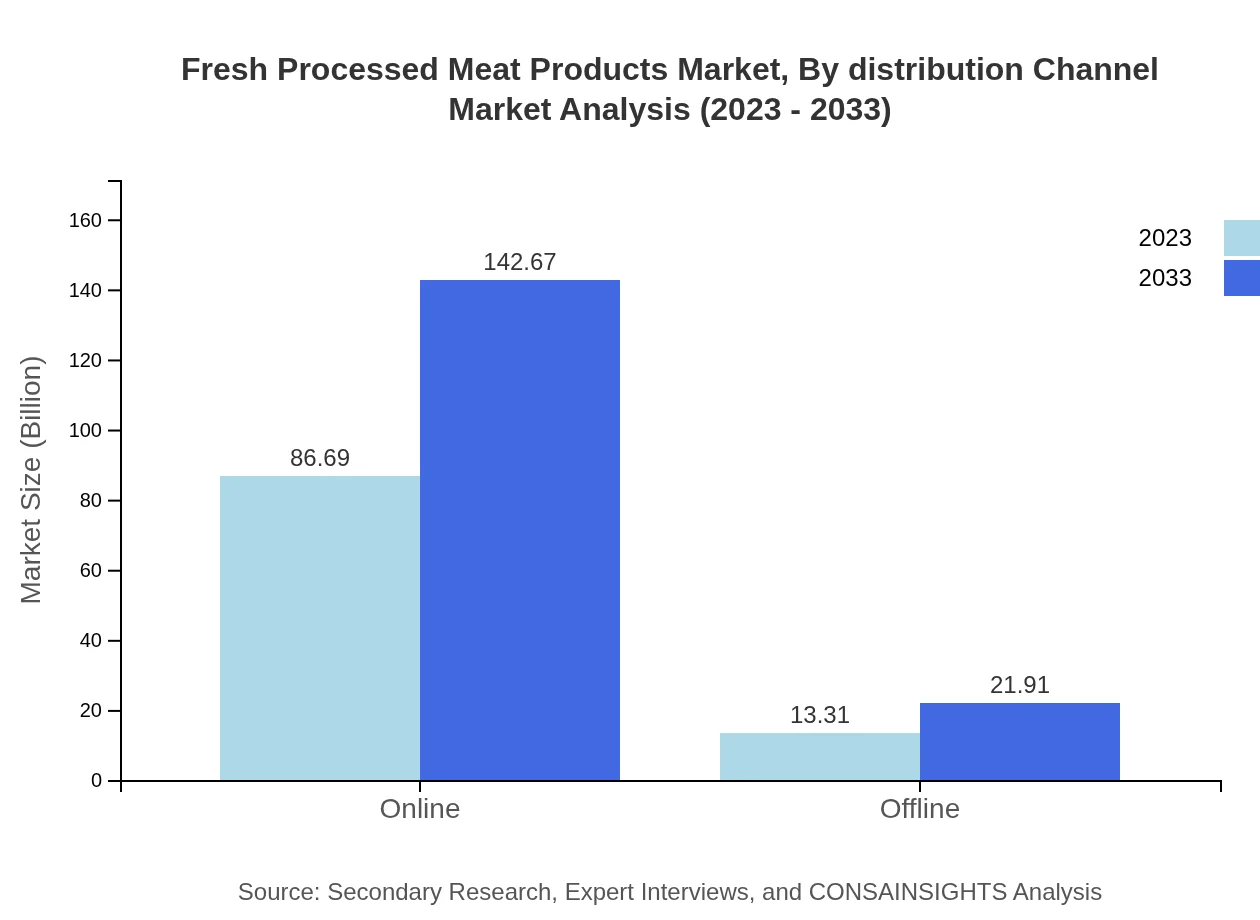

Fresh Processed Meat Products Market Analysis By Distribution Channel

Online sales channels represent the largest market share and are expected to grow from $86.69 billion in 2023 to $142.67 billion by 2033. Offline distribution, primarily consisting of traditional brick-and-mortar stores, retains significant customer loyalty, growing from $13.31 billion to $21.91 billion.

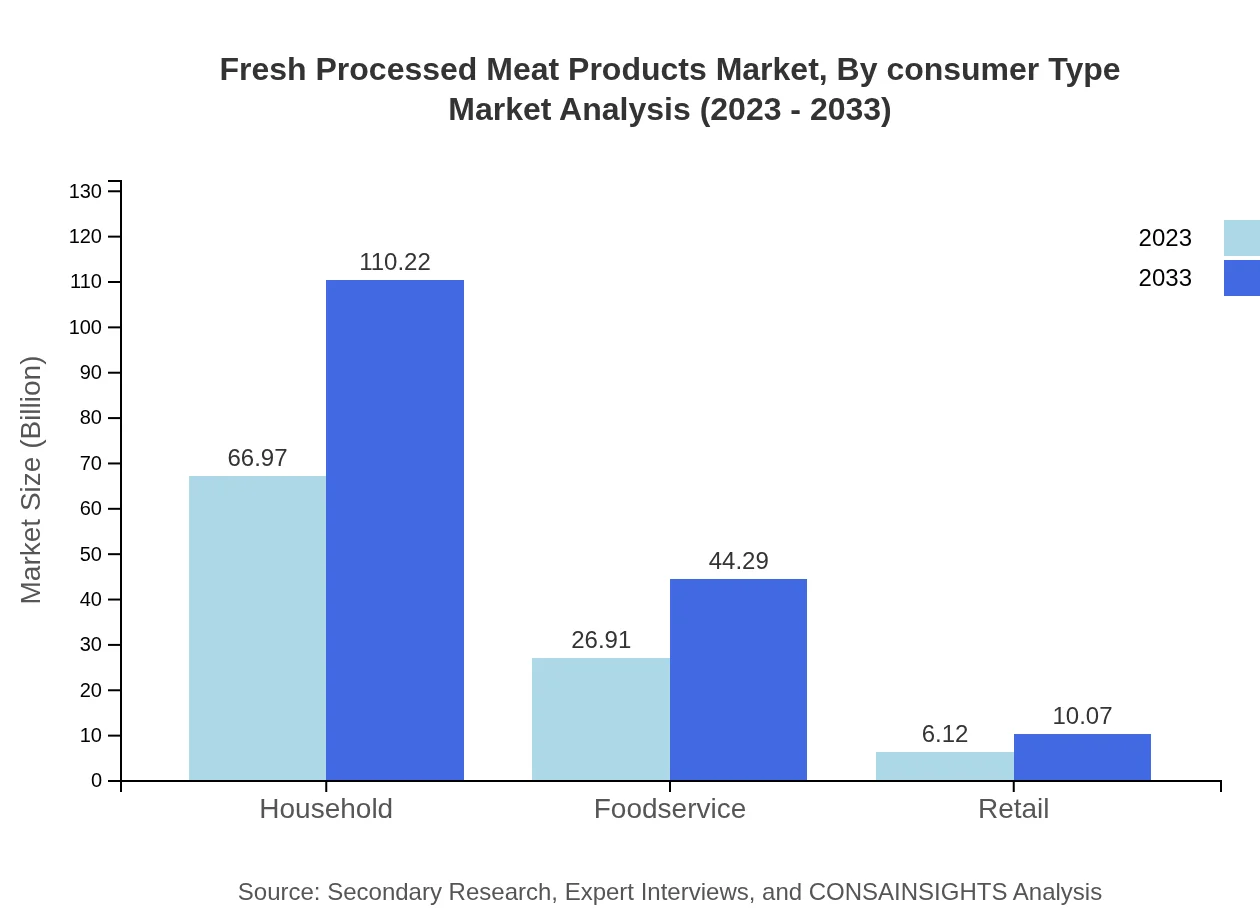

Fresh Processed Meat Products Market Analysis By Consumer Type

Households form the largest consumer segment, with a market size of $66.97 billion in 2023 expected to scale up to $110.22 billion by 2033. The foodservice industry, growing from $26.91 billion to $44.29 billion, plays an important role in driving demand through increased menu options.

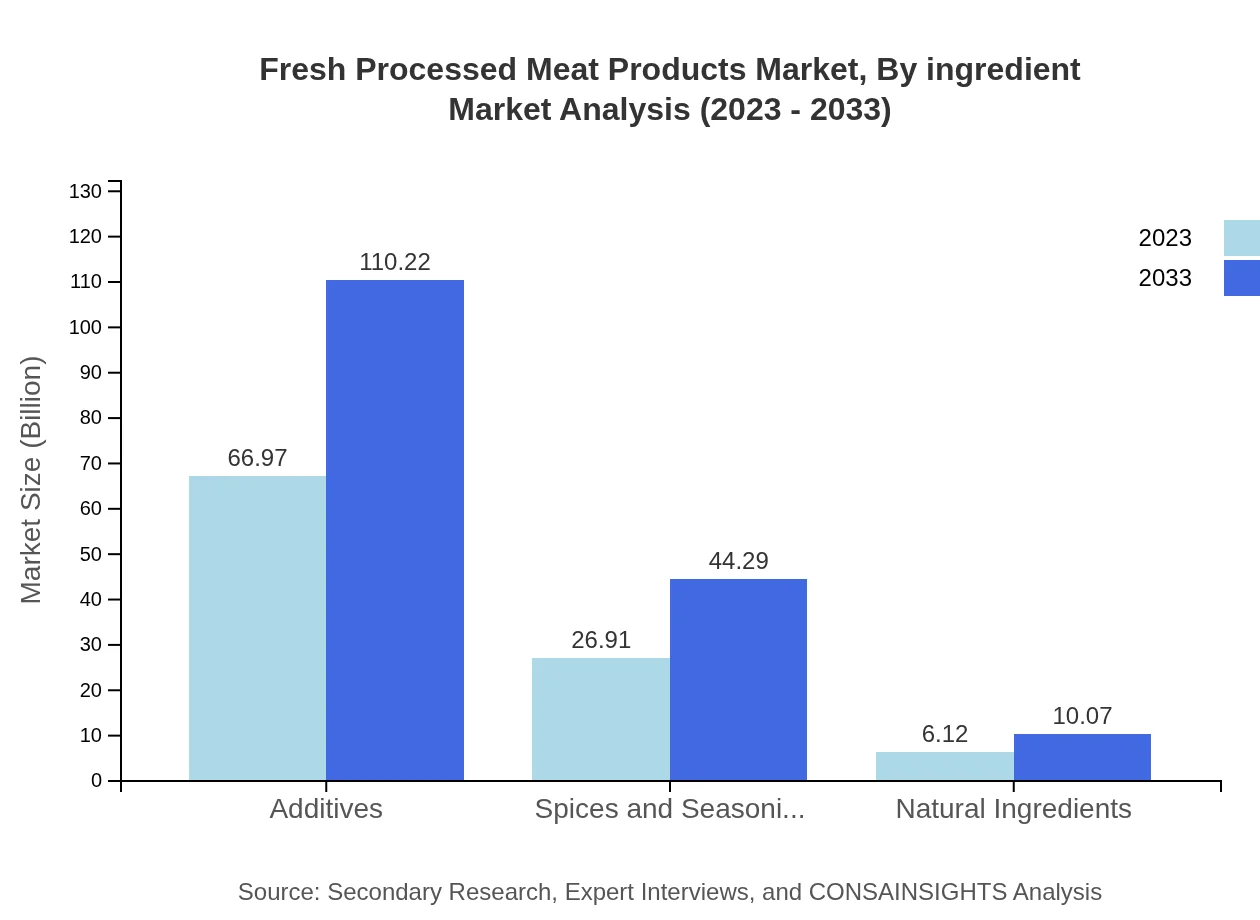

Fresh Processed Meat Products Market Analysis By Ingredient

The use of additives remains significant, with a size from $66.97 billion in 2023 to $110.22 billion in 2033. The inclusion of natural ingredients is also increasingly prominent, growing from $6.12 billion to $10.07 billion, reflecting consumer demand for healthier and clean-label products.

Fresh Processed Meat Products Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Fresh Processed Meat Products Industry

Tyson Foods, Inc.:

A leading company in the processed meat sector, known for its extensive range of products, including chicken, beef, and pork, and committed to sustainability.Hormel Foods Corporation:

Specializes in meat and food products, known for innovation in deli meats and refrigerated foods, while focusing on quality.JBS S.A.:

One of the largest meat processing companies globally, offering a wide variety of fresh processed meats with a focus on international markets.Smithfield Foods, Inc.:

A division of WH Group, Smithfield is noted for its offering of various pork products, prioritizing quality and sustainability.Porky’s Fresh Meat Co.:

An emerging player known for its high-quality pork products and fresh meats, focusing on local supply chains.We're grateful to work with incredible clients.

FAQs

What is the market size of fresh Processed Meat Products?

The fresh processed meat products market is valued at approximately $100 billion in 2023, with a projected CAGR of 5%. By 2033, the market size is expected to grow significantly, reflecting increasing consumer demand globally.

What are the key market players or companies in the fresh Processed Meat Products industry?

Key players in the fresh processed meat products industry include major food manufacturers and distributors who lead the market through innovation in production, sustainability, and distribution practices. Their influence shapes overall market dynamics.

What are the primary factors driving the growth in the fresh processed meat products industry?

Growth in the fresh processed meat products market is primarily driven by changing consumer preferences for convenient foods, increased health awareness, and advancements in meat processing technologies. Additionally, rising disposable incomes catalyze higher consumption rates.

Which region is the fastest Growing in the fresh processed meat products?

The fastest-growing region in the fresh processed meat products market is North America, with an estimated market size of $36.13 billion in 2023, projected to reach $59.46 billion by 2033. Europe and Asia Pacific also show considerable growth rates.

Does Consainsights provide customized market report data for the fresh Processed Meat Products industry?

Yes, Consainsights offers customized market report data tailored to specific needs in the fresh processed meat products industry, enabling clients to gain insights relevant to their market segment, geographic focus, and strategic goals.

What deliverables can I expect from this fresh Processed Meat Products market research project?

Deliverables from this market research project include comprehensive reports detailing market size, growth forecasts, key players, regional analyses, and strategic recommendations across various meat product segments and distribution channels.

What are the market trends of fresh Processed Meat Products?

Notable trends in the fresh processed meat products market include a shift towards healthier options, increasing demand for organic and natural products, and the rise of e-commerce as a key distribution channel for meat products.