Friction Materials Market Report

Published Date: 02 February 2026 | Report Code: friction-materials

Friction Materials Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Friction Materials market, focusing on current trends, market size, and forecasts from 2023 to 2033. It includes insights into regional dynamics, segmentation, and key industry players to guide strategic decisions.

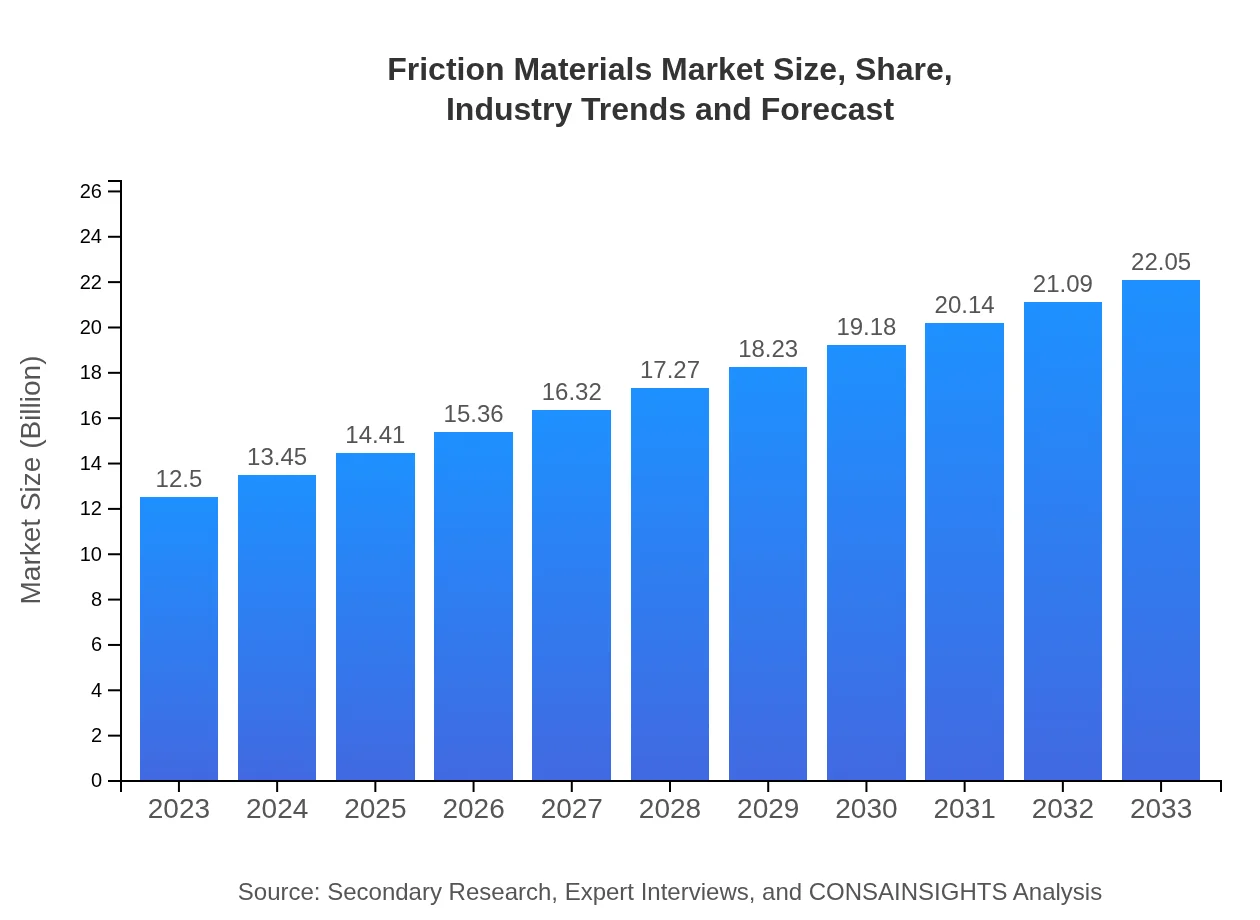

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.50 Billion |

| CAGR (2023-2033) | 5.7% |

| 2033 Market Size | $22.05 Billion |

| Top Companies | Brembo S.p.A., Ferodo, Akebono Brake Industry Co., Ltd., Honeywell International Inc. |

| Last Modified Date | 02 February 2026 |

Friction Materials Market Overview

Customize Friction Materials Market Report market research report

- ✔ Get in-depth analysis of Friction Materials market size, growth, and forecasts.

- ✔ Understand Friction Materials's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Friction Materials

What is the Market Size & CAGR of Friction Materials market?

Friction Materials Industry Analysis

Friction Materials Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Friction Materials Market Analysis Report by Region

Europe Friction Materials Market Report:

Europe’s market is set to rise from $3.46 billion in 2023 to $6.10 billion by 2033. The region’s focus on sustainability and transitions to electric vehicles are key drivers, alongside the established automotive industry that demands innovative braking solutions.Asia Pacific Friction Materials Market Report:

The Asia Pacific market is projected to grow from $2.52 billion in 2023 to $4.44 billion by 2033. This growth is largely fueled by increasing automotive production in countries like China and India, alongside rigorous safety standards that drive demand for high-quality friction materials. The region's expansion into electric vehicles also boosts growth opportunities.North America Friction Materials Market Report:

North America shows a robust growth forecast from $4.63 billion in 2023 to $8.17 billion in 2033, led by the United States. Heavy investments in automotive innovation, coupled with stringent regulations regarding safety and emissions, will drive the demand for advanced friction materials in this region.South America Friction Materials Market Report:

In South America, the market is expected to increase from $0.57 billion in 2023 to $1.00 billion by 2033. Economic growth and rising vehicle ownership contribute to this trend, as well as the modernization of transportation infrastructure that necessitates higher safety standards.Middle East & Africa Friction Materials Market Report:

The Middle East and Africa's Friction Materials market is expected to grow from $1.32 billion in 2023 to $2.33 billion by 2033. Growing infrastructure projects and emerging automotive sectors are fueling the demand for reliable friction materials to support heavy machinery and transportation sectors.Tell us your focus area and get a customized research report.

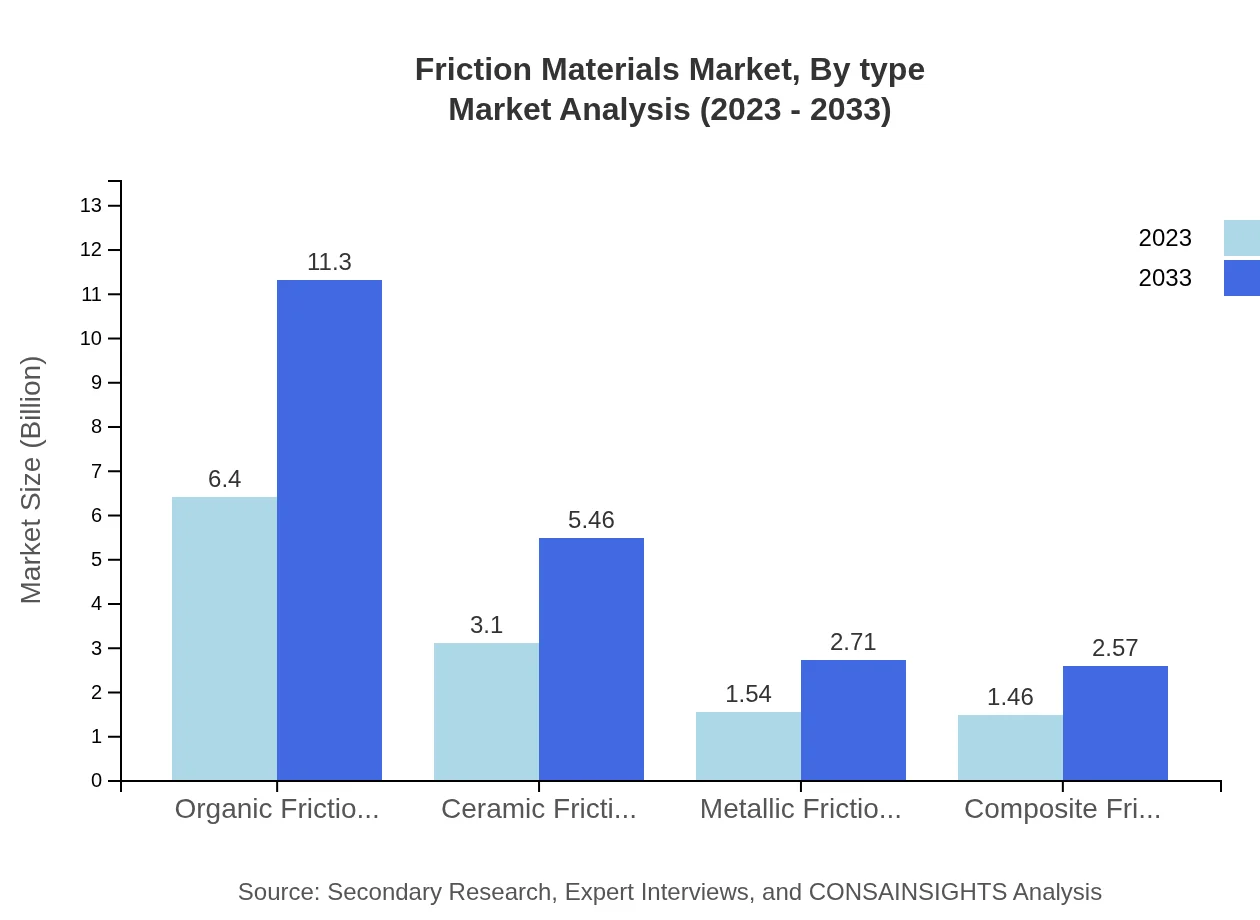

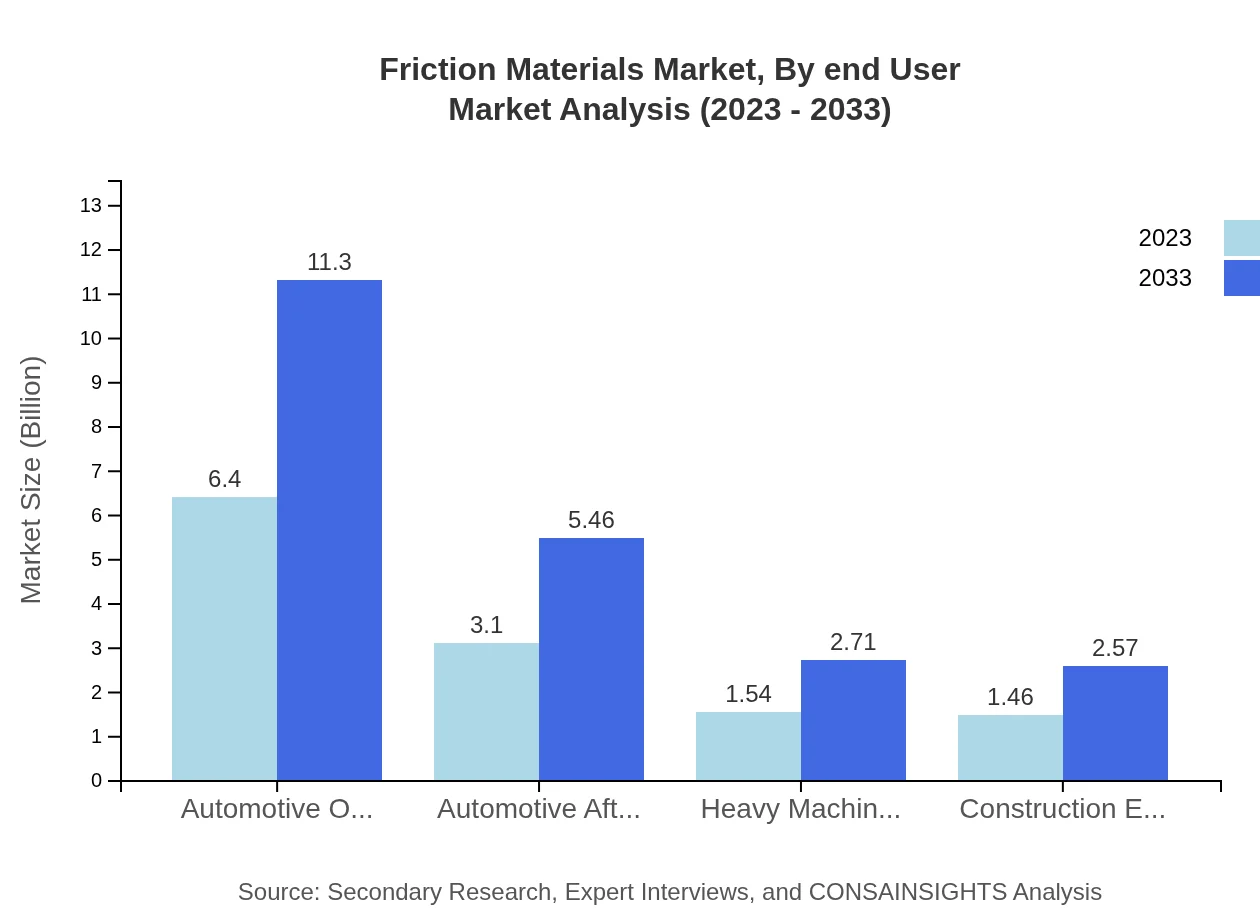

Friction Materials Market Analysis By Type

The Friction Materials market by type segments into organic, ceramic, metallic, and composite materials. Organic friction materials hold a dominant position with a market size of $6.40 billion in 2023, increasing to $11.30 billion by 2033, representing 51.24% market share. Ceramic materials follow with $3.10 billion and a projection of $5.46 billion in 2033, while metallic friction materials contribute $1.54 billion, expected to grow to $2.71 billion. Composite friction materials also show growth, moving from $1.46 billion to $2.57 billion in the same period.

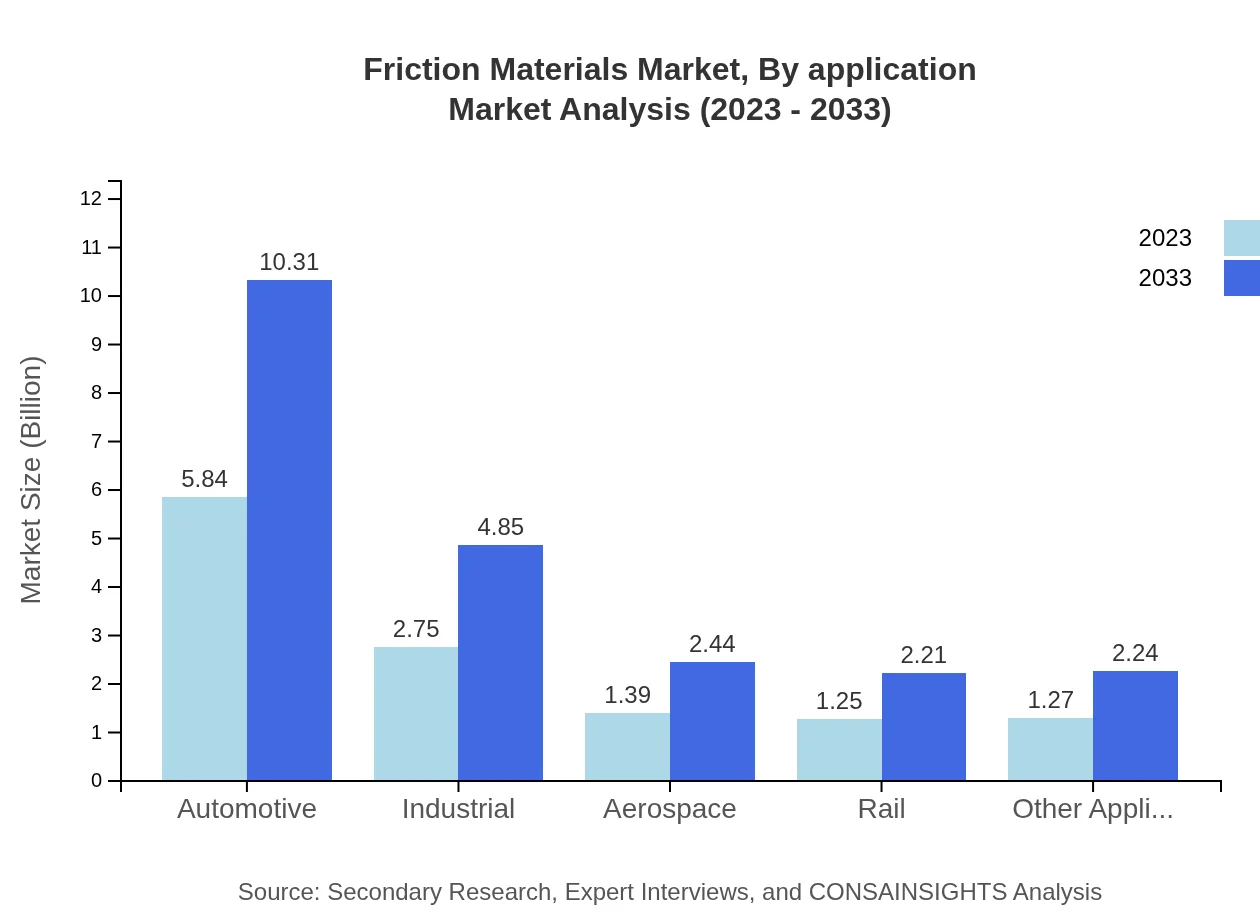

Friction Materials Market Analysis By Application

Key applications of friction materials include automotive OEM, automotive aftermarket, heavy machinery, construction equipment, aerospace, and rail. The automotive OEM segment leads with a current size of $6.40 billion, anticipated to reach $11.30 billion, capturing 51.24% of the market share. The automotive aftermarket is projected to grow from $3.10 billion to $5.46 billion, while heavy machinery and construction also show strong presence and growth potentials.

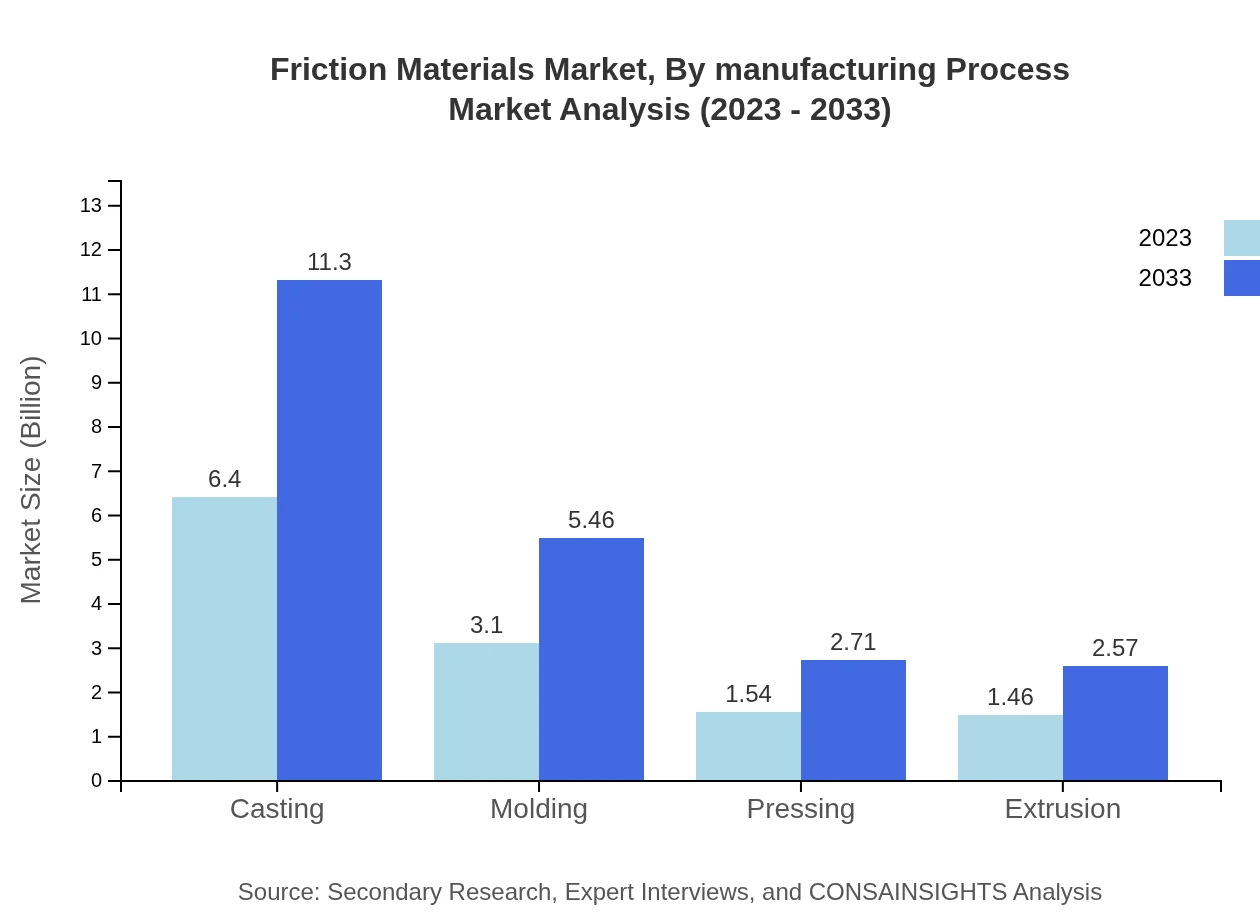

Friction Materials Market Analysis By Manufacturing Process

Manufacturing processes for friction materials include casting, molding, pressing, and extrusion. Casting stands out with a significant market size of $6.40 billion in 2023, increasing to $11.30 billion by 2033. Molding represents a vital part of the market, growing from $3.10 billion to $5.46 billion. Pressing and extrusion also contribute noteworthy figures, indicating diverse manufacturing capabilities in producing friction materials.

Friction Materials Market Analysis By End User

End-users of friction materials cover a wide range, including automotive, industrial, aerospace, and rail sectors. The automotive industry commands a majority market share at 46.75%, with projected growth from $5.84 billion in 2023 to $10.31 billion by 2033. The industrial sector follows closely with a growth from $2.75 billion to $4.85 billion, reflecting its integral role in machinery and equipment operations.

Friction Materials Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Friction Materials Industry

Brembo S.p.A.:

A leading manufacturer of automotive brake systems and components, Brembo focuses on advanced friction materials to enhance vehicle safety.Ferodo:

Part of the Tenneco Inc., Ferodo specializes in high-quality friction materials for a wide range of vehicle applications, known for innovative product solutions.Akebono Brake Industry Co., Ltd.:

Akebono is a prominent manufacturer of braking systems and friction materials that serve automotive and industrial applications globally.Honeywell International Inc.:

Honeywell provides advanced braking systems and is recognized for its research-driven approach to friction materials manufacturing.We're grateful to work with incredible clients.

FAQs

What is the market size of friction materials?

The friction materials market is projected to reach a size of $12.5 billion by 2033, growing at a compound annual growth rate (CAGR) of 5.7% from its current valuation.

What are the key market players or companies in this friction materials industry?

The friction materials industry features major players like Honeywell Friction Materials, Federal-Mogul, and Valeo, leading in product innovation and market share, contributing to the growth of this competitive sector.

What are the primary factors driving the growth in the friction materials industry?

Key factors driving growth include increasing automotive production, demand for eco-friendly products, and advancements in material technology, promoting durability and performance in various applications.

Which region is the fastest Growing in the friction materials market?

The fastest-growing region in the friction materials market is expected to be North America, with its market size rising from $4.63 billion in 2023 to $8.17 billion by 2033.

Does ConsaInsights provide customized market report data for the friction materials industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs, ensuring insightful analysis and strategic recommendations for stakeholders in the friction materials industry.

What deliverables can I expect from this friction materials market research project?

Deliverables include comprehensive market analysis reports, segment insights, competitive landscape evaluations, and strategic recommendations to guide business decisions in the friction materials sector.

What are the market trends of friction materials?

Current market trends include a shift towards organic friction materials, increased use in electric vehicles, and innovations focusing on performance efficiency and sustainability, shaping future industry dynamics.