Frozen Bakery Additives Market Report

Published Date: 31 January 2026 | Report Code: frozen-bakery-additives

Frozen Bakery Additives Market Size, Share, Industry Trends and Forecast to 2033

This report offers an in-depth analysis of the Frozen Bakery Additives market, covering insights on market size, growth rates, regional breakdowns, key industry players, and future trends from 2023 to 2033.

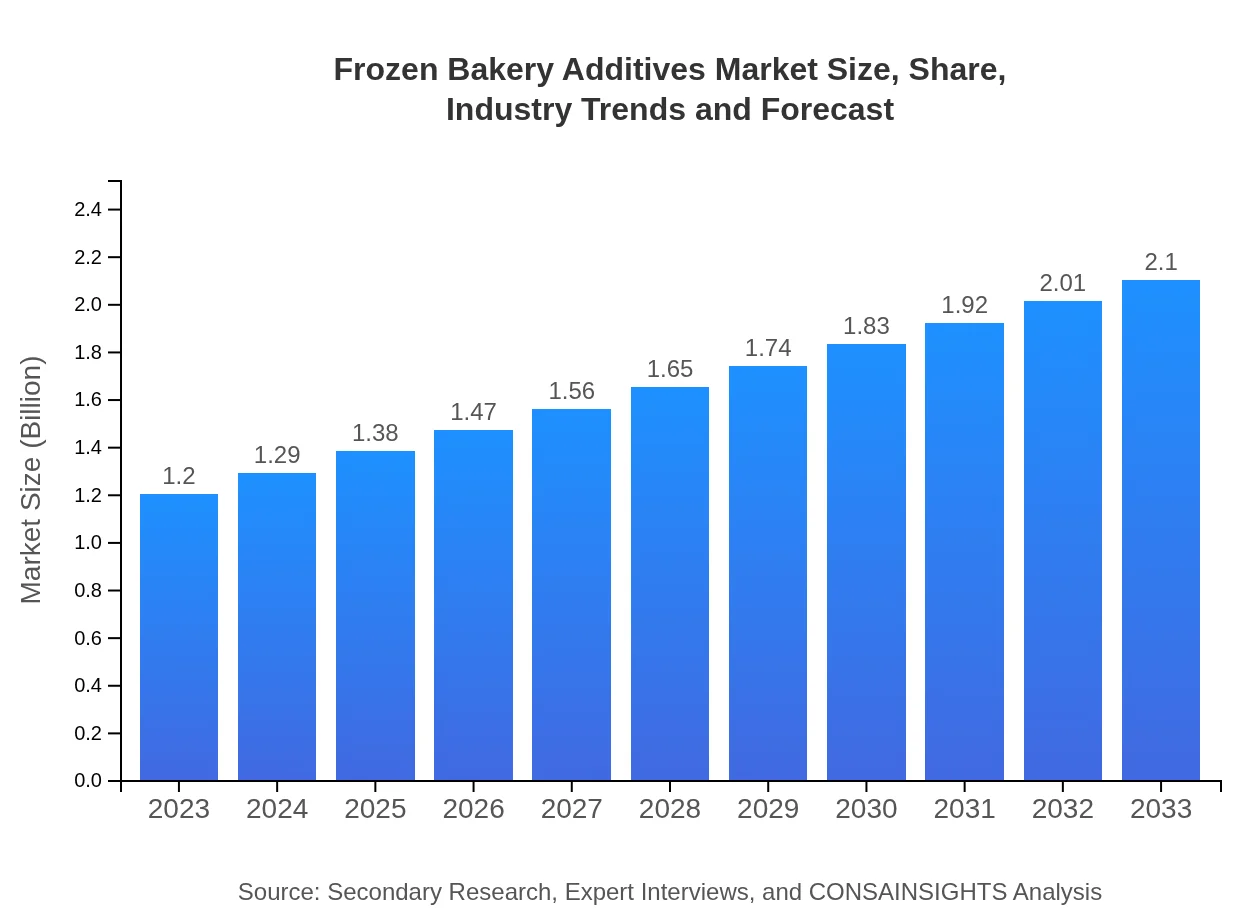

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.20 Billion |

| CAGR (2023-2033) | 5.6% |

| 2033 Market Size | $2.10 Billion |

| Top Companies | ADM, Cargill, Inc., DuPont de Nemours, Inc., Kerry Group, Univar Solutions |

| Last Modified Date | 31 January 2026 |

Frozen Bakery Additives Market Overview

Customize Frozen Bakery Additives Market Report market research report

- ✔ Get in-depth analysis of Frozen Bakery Additives market size, growth, and forecasts.

- ✔ Understand Frozen Bakery Additives's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Frozen Bakery Additives

What is the Market Size & CAGR of Frozen Bakery Additives market in 2023?

Frozen Bakery Additives Industry Analysis

Frozen Bakery Additives Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Frozen Bakery Additives Market Analysis Report by Region

Europe Frozen Bakery Additives Market Report:

In Europe, the market is valued at USD 0.32 billion in 2023, forecasted to grow to USD 0.56 billion by 2033. The region is witnessing a surge in demand for organic and clean-label products, with strict regulations pushing manufacturers towards innovative, healthier solutions.Asia Pacific Frozen Bakery Additives Market Report:

In 2023, the Asia Pacific market for Frozen Bakery Additives is valued at USD 0.23 billion, projected to grow to USD 0.41 billion by 2033. The region's growth is driven by increasing urbanization, consumer trends toward convenience foods, and a robust baking sector fueled by local and international brands enhancing their product portfolios.North America Frozen Bakery Additives Market Report:

North America holds a prominent share in the market, with an estimated size of USD 0.46 billion in 2023, expanding to USD 0.81 billion by 2033. The robust food service sector, rising demand for frozen ready-to-eat meals, and health-conscious consumer behavior are key growth drivers.South America Frozen Bakery Additives Market Report:

The South American market is relatively smaller, valued at USD 0.04 billion in 2023, expected to reach USD 0.07 billion by 2033. Growth is influenced by evolving consumer preferences and increased demand for baked goods amid rising disposable incomes.Middle East & Africa Frozen Bakery Additives Market Report:

The Middle East and Africa market size is approximately USD 0.14 billion in 2023, anticipated to increase to USD 0.25 billion by 2033. As the region diversifies its food sectors, there is growing interest in frozen bakery products, bolstering the demand for additives.Tell us your focus area and get a customized research report.

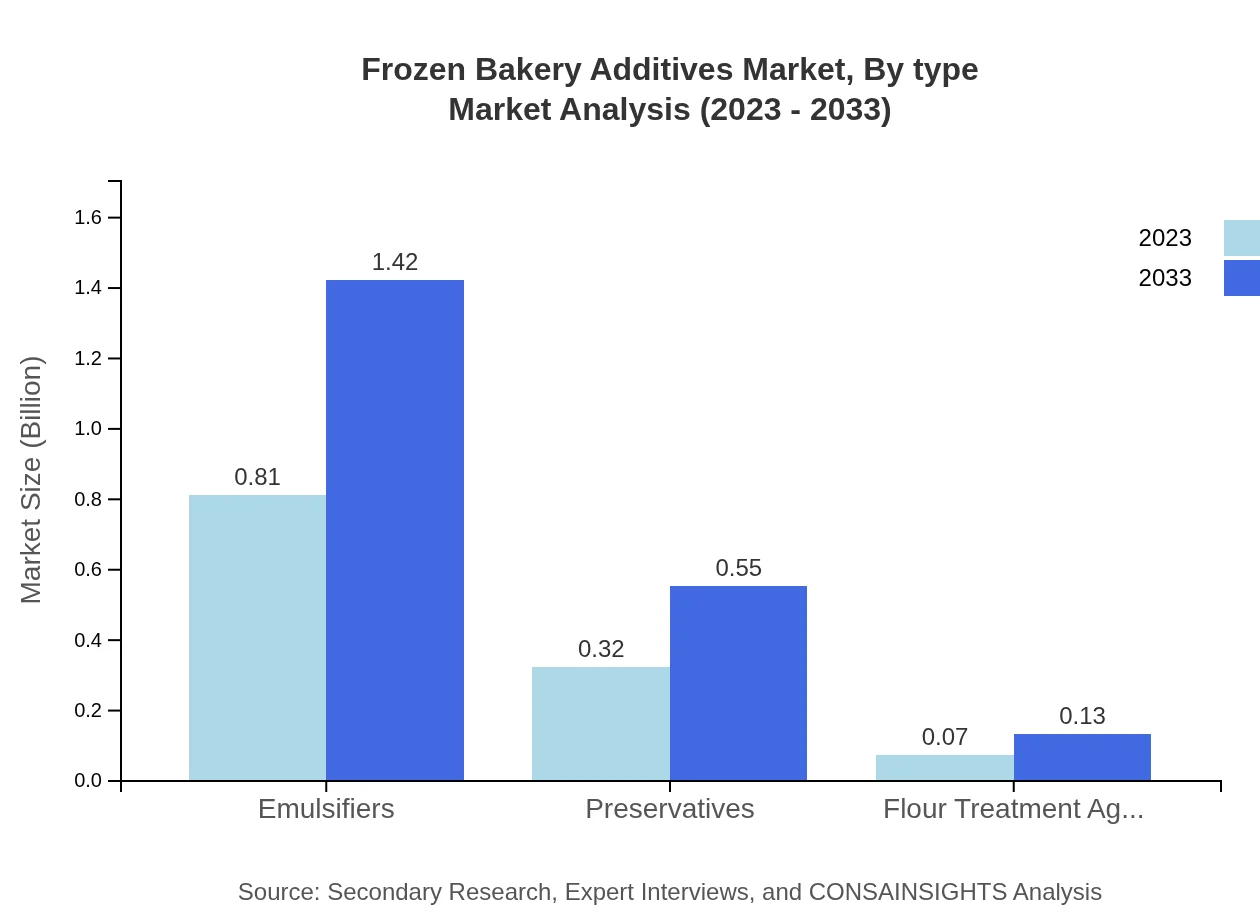

Frozen Bakery Additives Market Analysis By Type

The market may be categorized into various types including emulsifiers, preservatives, and texture improvers. Each type contributes uniquely to product quality and consumer satisfaction. For instance, emulsifiers account for a significant portion of the market, with a size of USD 0.81 billion in 2023 projected to reach USD 1.42 billion by 2033.

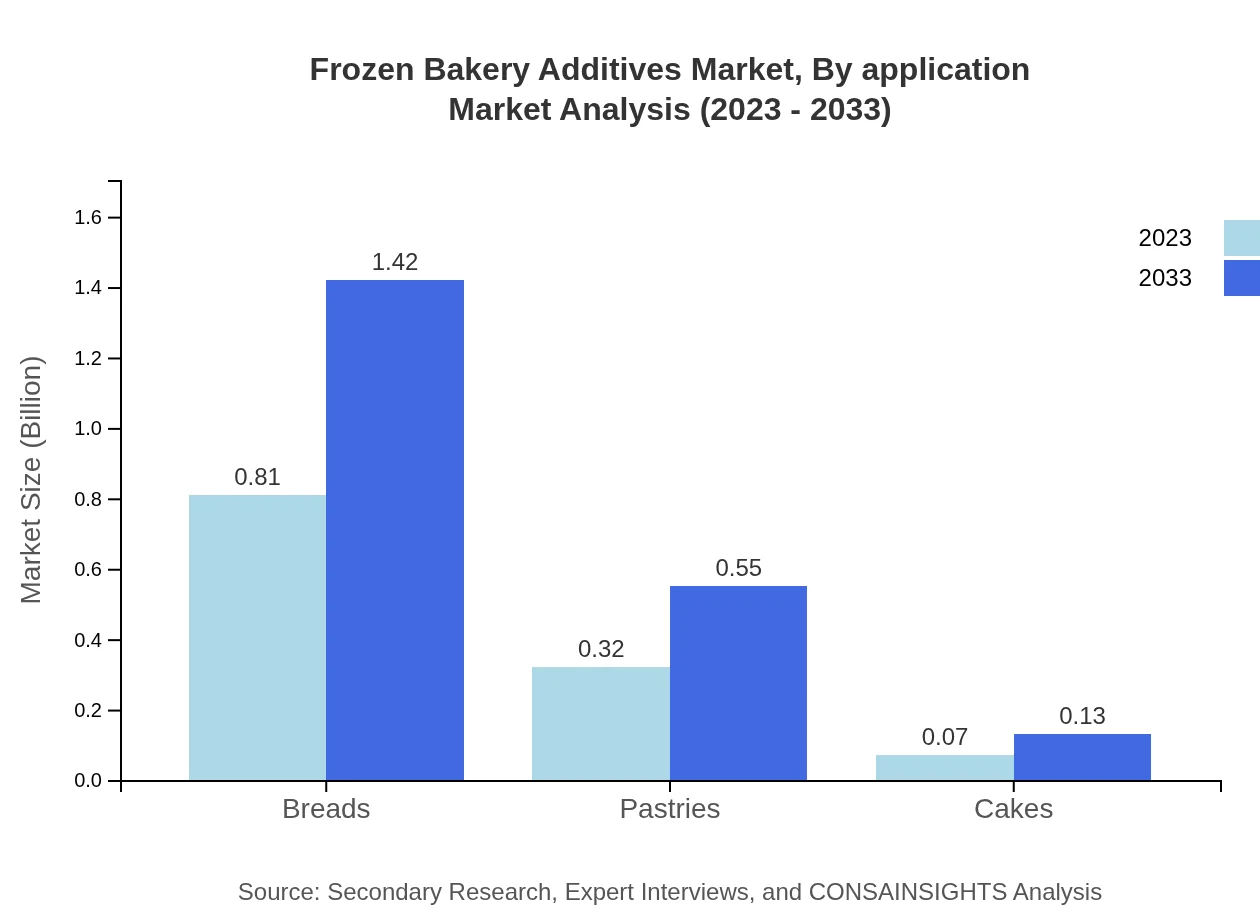

Frozen Bakery Additives Market Analysis By Application

Applications in the Frozen Bakery Additives market include bread, pastries, cakes, and more. Breads capture the largest market share, driven by consumer staples in bakery products. The segment's size is valued at USD 0.81 billion in 2023 and expected to reach USD 1.42 billion by 2033.

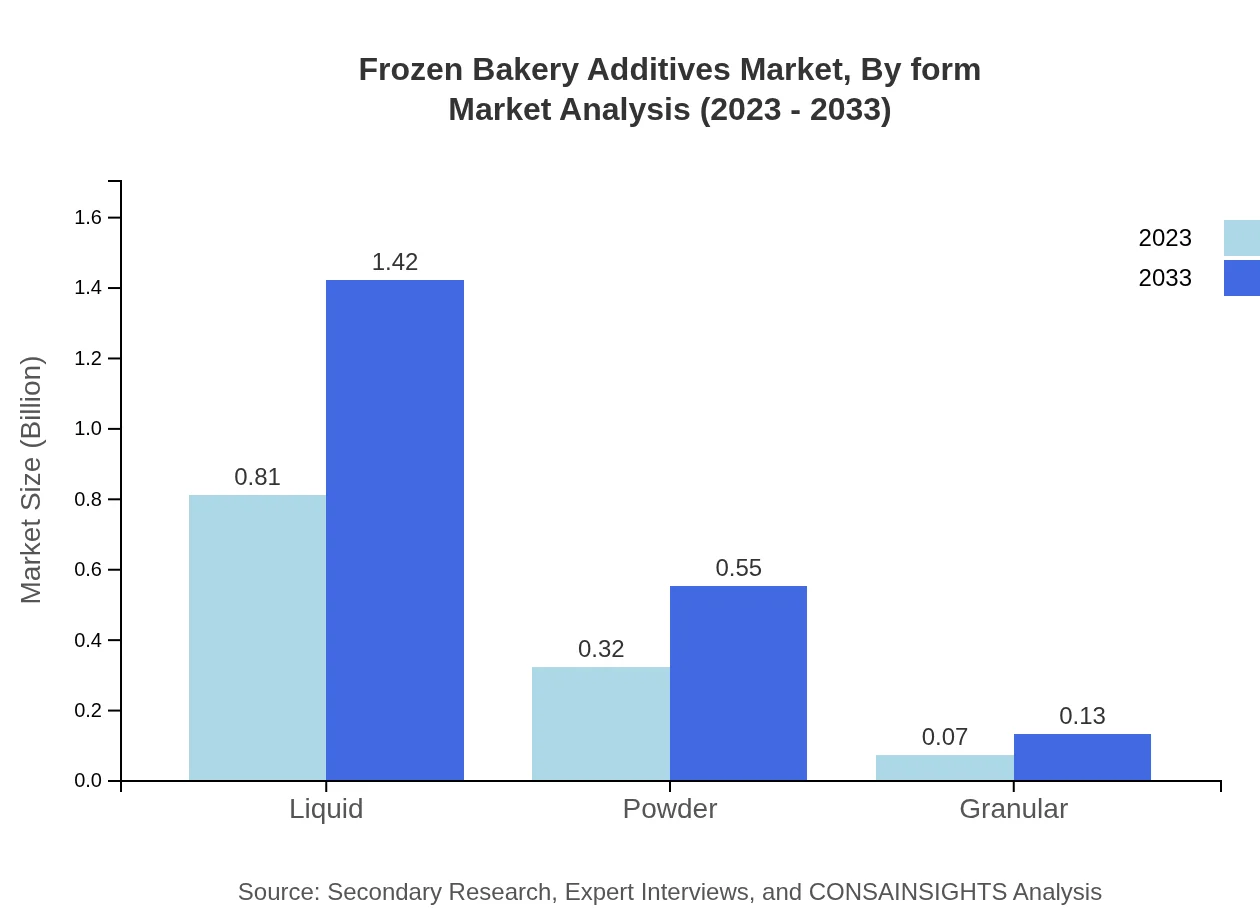

Frozen Bakery Additives Market Analysis By Form

The additives come in liquid, powder, and granular forms, with liquid additives being the most prevalent. In 2023, liquid additives represent a market size of USD 0.81 billion, continuing to dominate the sector with anticipated growth to USD 1.42 billion by 2033.

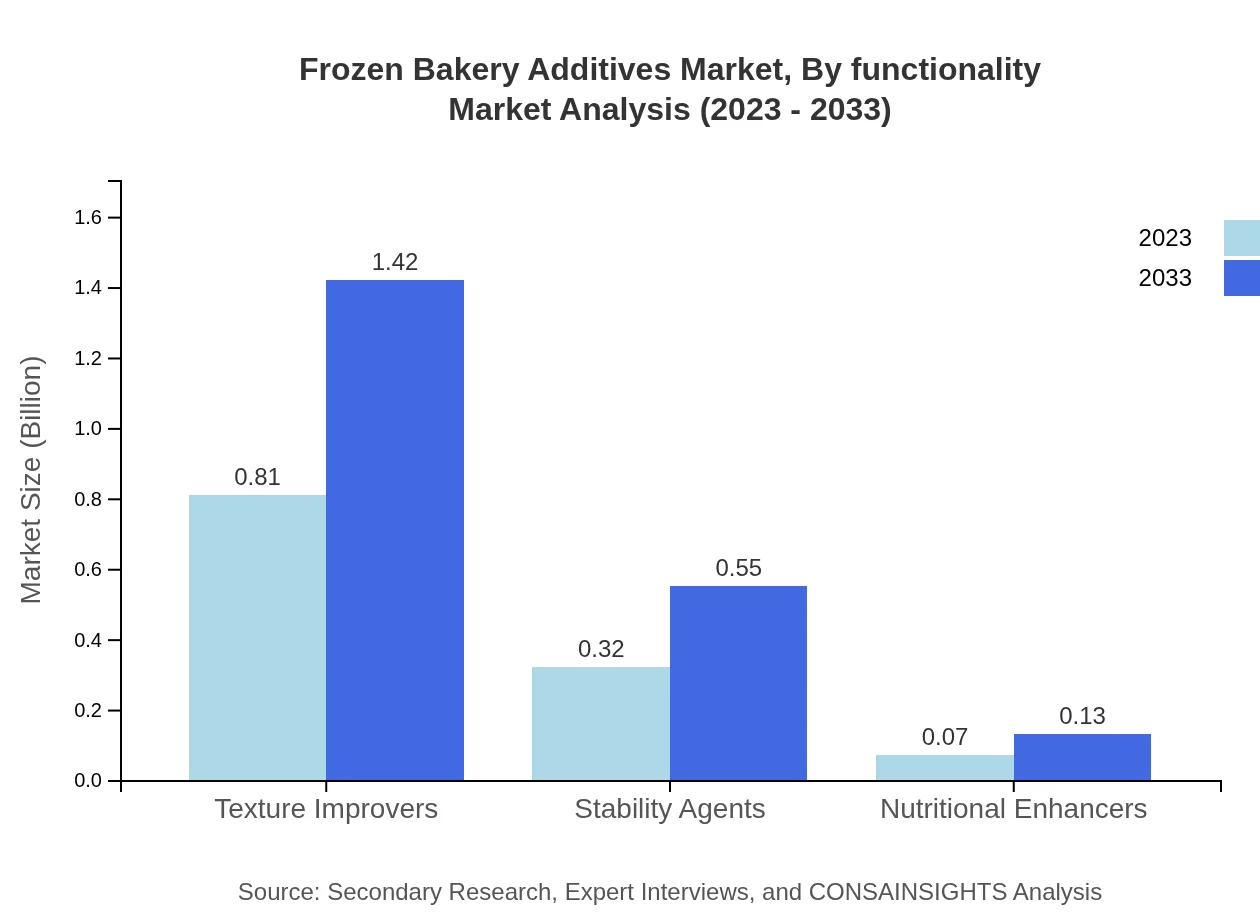

Frozen Bakery Additives Market Analysis By Functionality

The functionality of frozen bakery additives is crucial in determining their acceptance in the industry. Texturizing agents, stability agents, and nutritional enhancers each serve significant roles in product formulation. Texturizers are expected to see substantial growth, from USD 0.81 billion in 2023 to USD 1.42 billion by 2033.

Frozen Bakery Additives Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Frozen Bakery Additives Industry

ADM:

Archer Daniels Midland Company, a leading global food processing and agricultural services company, provides a wide range of bakery ingredients and additives that enhance product quality.Cargill, Inc.:

Cargill is a global provider of food, agricultural, financial, and industrial products and services, offering innovative frozen bakery solutions and specialized additives to improve taste and texture.DuPont de Nemours, Inc.:

DuPont is a science and technology company known for producing high-performance ingredients and bakery products, focusing on health and nutrition enhancement.Kerry Group:

Kerry Group offers a wide spectrum of ingredients and solutions for food manufacturers, with innovations in frozen bakery additives that enhance flavor and shelf stability.Univar Solutions:

Univar is a global chemical distributor with a strong portfolio in bakery ingredients, providing essential additives that support the food industry.We're grateful to work with incredible clients.

FAQs

What is the market size of frozen Bakery Additives?

The global market size for frozen bakery additives is projected to reach $1.2 billion by 2033, growing at a CAGR of 5.6%. This growth reflects increased demand for convenience products in the baked goods sector.

What are the key market players or companies in this frozen Bakery Additives industry?

Key players in the frozen bakery additives industry include multinational corporations and niche manufacturers focusing on innovative ingredient solutions. They are involved at various levels from raw ingredient supply to end-product development.

What are the primary factors driving the growth in the frozen Bakery Additives industry?

Growth in the frozen bakery additives industry is driven by changing consumer preferences for convenience foods, advancements in food technology, and an increase in the retail distribution of frozen bakery products.

Which region is the fastest Growing in the frozen Bakery Additives?

The Asia Pacific region is projected to be the fastest-growing market for frozen bakery additives, expanding from $0.23 billion in 2023 to $0.41 billion by 2033, fueled by rising disposable incomes and urbanization.

Does ConsaInsights provide customized market report data for the frozen Bakery Additives industry?

Yes, ConsaInsights offers customized market report data for the frozen bakery additives industry, catering to specific client needs and providing tailored insights to support strategic decision-making.

What deliverables can I expect from this frozen Bakery Additives market research project?

Deliverables from the frozen bakery additives market research project will include comprehensive reports, data analyses, trend forecasts, and strategic recommendations tailored specifically for stakeholder needs.

What are the market trends of frozen Bakery Additives?

Key trends in the frozen bakery additives market include increased demand for natural and clean-label ingredients, adoption of innovative processing technologies, and focus on enhancing product quality and shelf-life.