Frozen Bakery Market Report

Published Date: 31 January 2026 | Report Code: frozen-bakery

Frozen Bakery Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the frozen bakery market, covering market trends, size, regional insights, segmentation, and key players from 2023 to 2033.

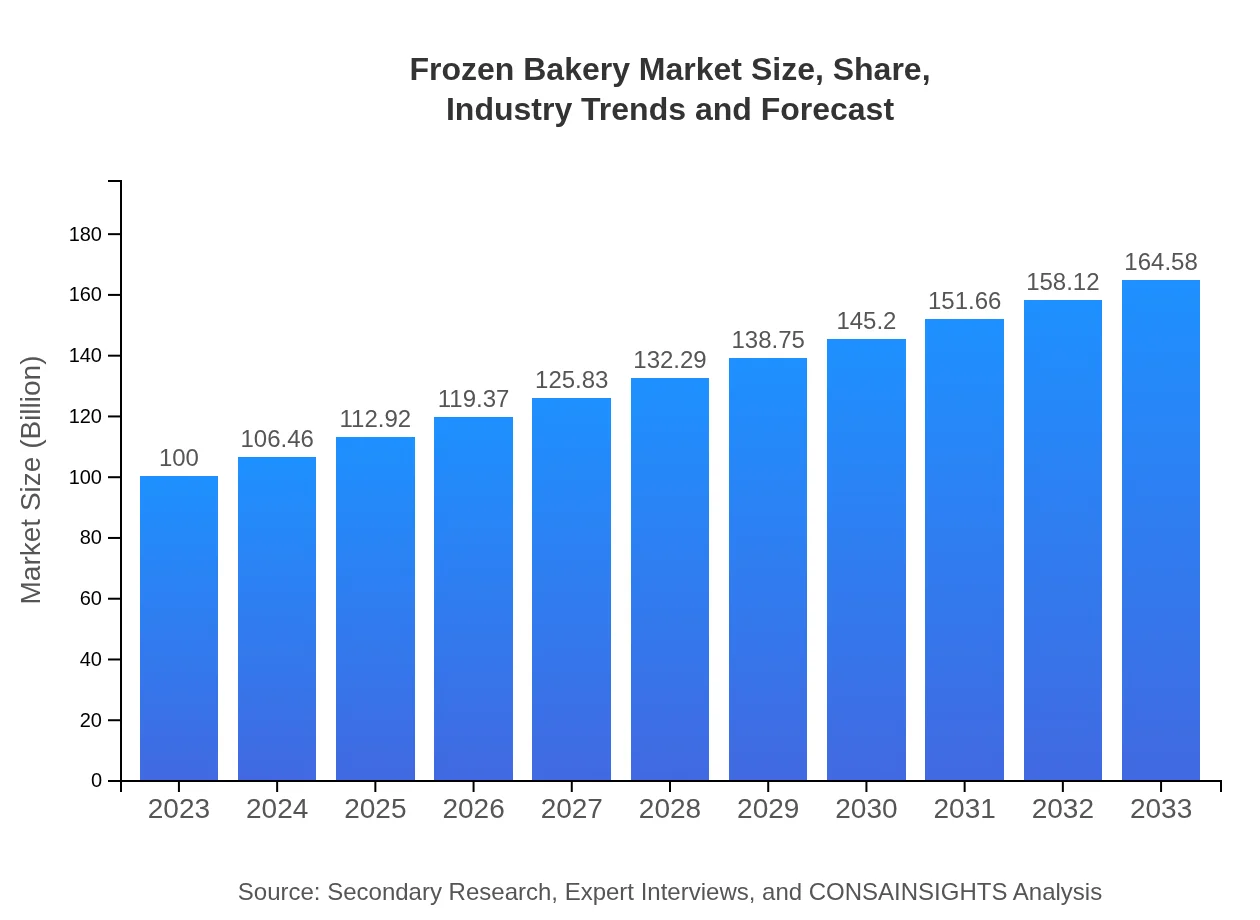

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $100.00 Million |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $164.58 Million |

| Top Companies | ConAgra Foods, Flowers Foods, Grupo Bimbo, Nestlé |

| Last Modified Date | 31 January 2026 |

Frozen Bakery Market Overview

Customize Frozen Bakery Market Report market research report

- ✔ Get in-depth analysis of Frozen Bakery market size, growth, and forecasts.

- ✔ Understand Frozen Bakery's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Frozen Bakery

What is the Market Size & CAGR of Frozen Bakery market in 2023?

Frozen Bakery Industry Analysis

Frozen Bakery Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Frozen Bakery Market Analysis Report by Region

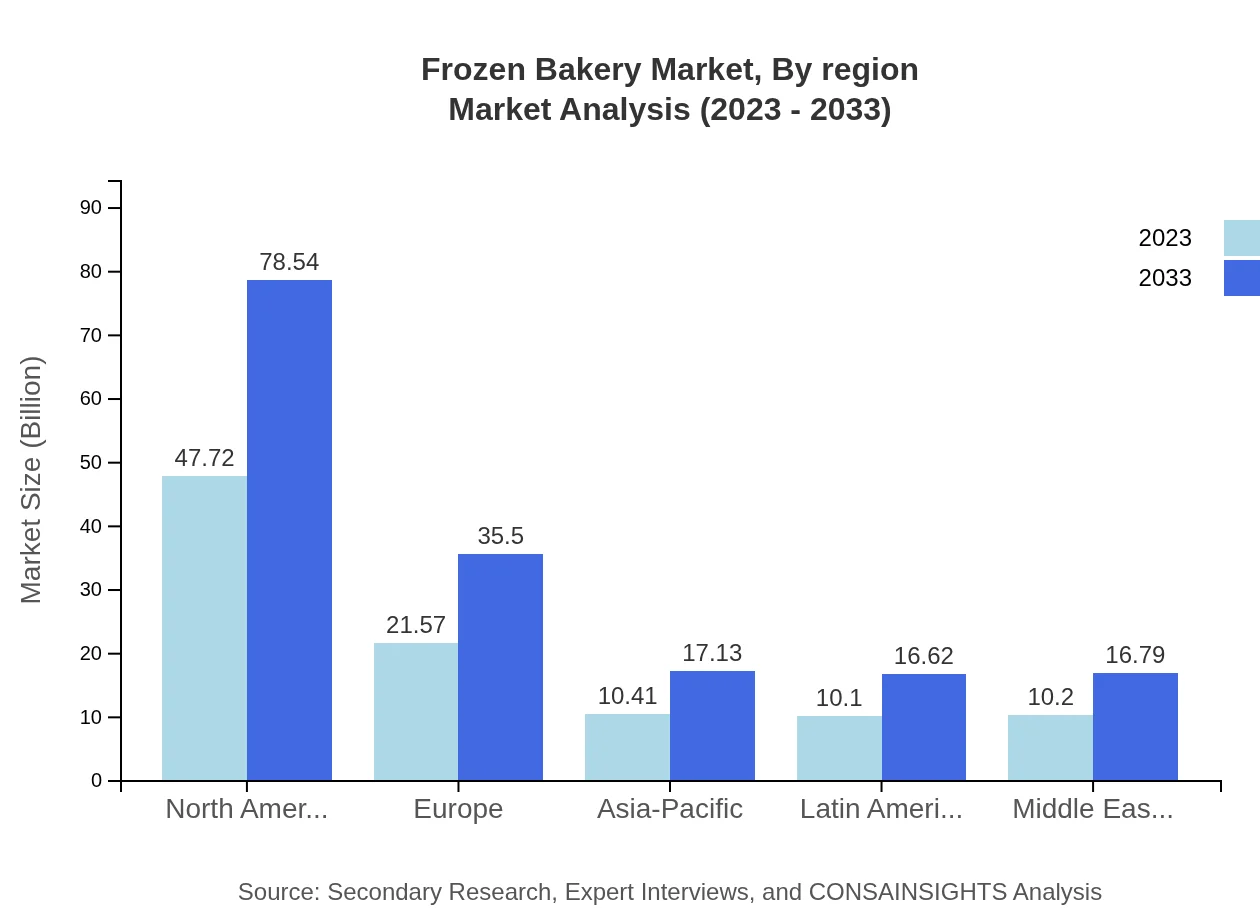

Europe Frozen Bakery Market Report:

The European frozen bakery market is valued at $33.58 billion in 2023 and is anticipated to grow to $55.26 billion by 2033. Factors such as high consumer spending power, a penchant for convenience foods, and an extensive range of products influence this growth.Asia Pacific Frozen Bakery Market Report:

In 2023, the Asia Pacific frozen bakery market is valued at approximately $17.74 billion, growing to $29.20 billion by 2033. The region's growth is driven by urbanization, increased disposable income, and a growing western fast-food culture, which is influencing bakery consumption patterns.North America Frozen Bakery Market Report:

North America dominates with a market size of $35.92 billion in 2023, expected to grow to $59.12 billion by 2033. The U.S. is the key contributor, driven by the popularity of frozen food among consumers seeking convenience, further supported by retail innovations.South America Frozen Bakery Market Report:

The Latin American market is valued at $2.21 billion in 2023 and is projected to reach $3.64 billion by 2033. The demand in this region is supported by a young population seeking convenient food options and the increasing adoption of frozen products amid busy lifestyles.Middle East & Africa Frozen Bakery Market Report:

This region presents a market size of $10.55 billion in 2023, forecasting to increase to $17.36 billion by 2033. The growth is spearheaded by rising urban populations and the introduction of western dining trends, which are fostering the consumption of bakery products.Tell us your focus area and get a customized research report.

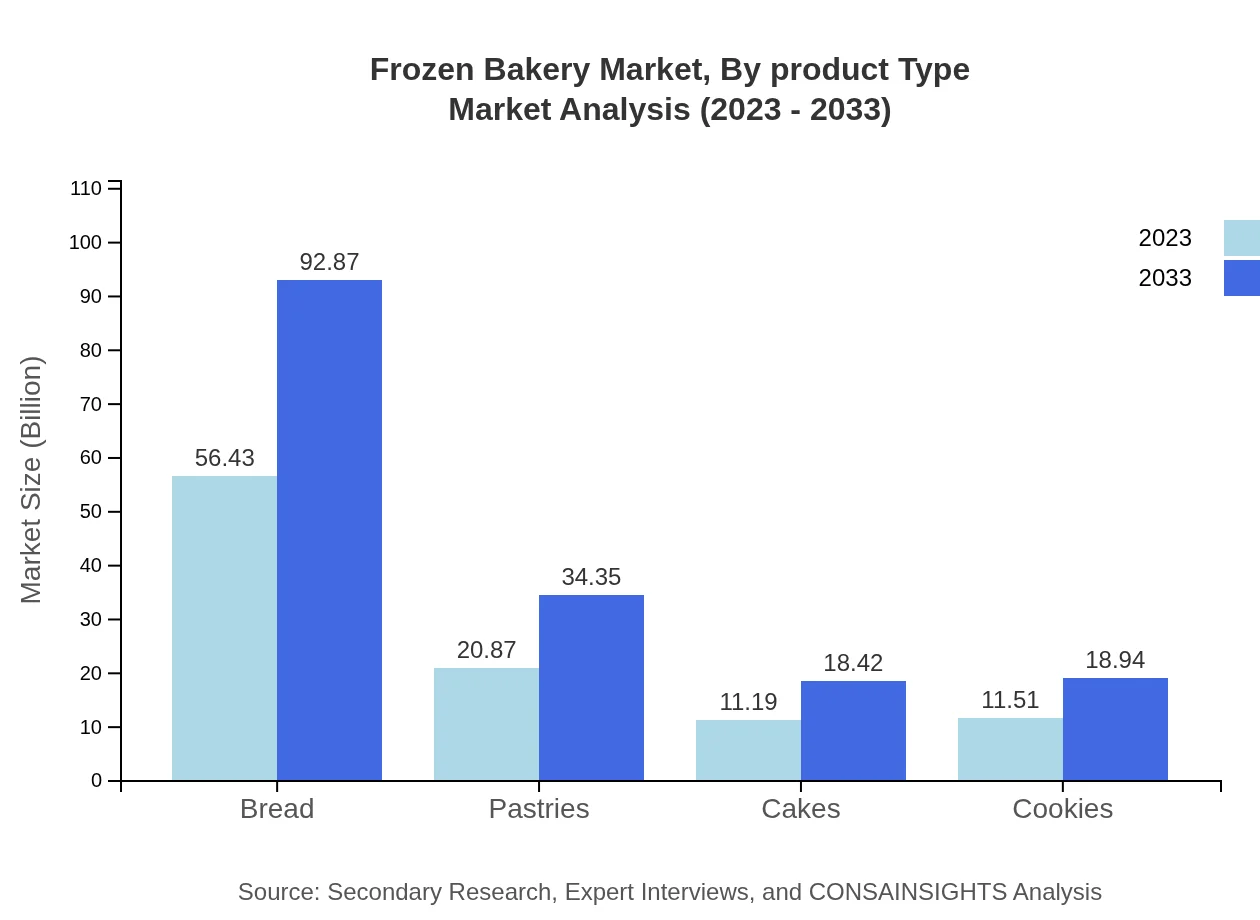

Frozen Bakery Market Analysis By Product Type

In the frozen bakery market by product type, frozen bread is the largest segment valued at $56.43 billion in 2023, growing to $92.87 billion by 2033. Pastries follow, with a market size of $20.87 billion in 2023 and projected growth to $34.35 billion. Cookies and cakes, although smaller segments, also show robust growth potential, driven by consumer demand for convenient yet indulgent options.

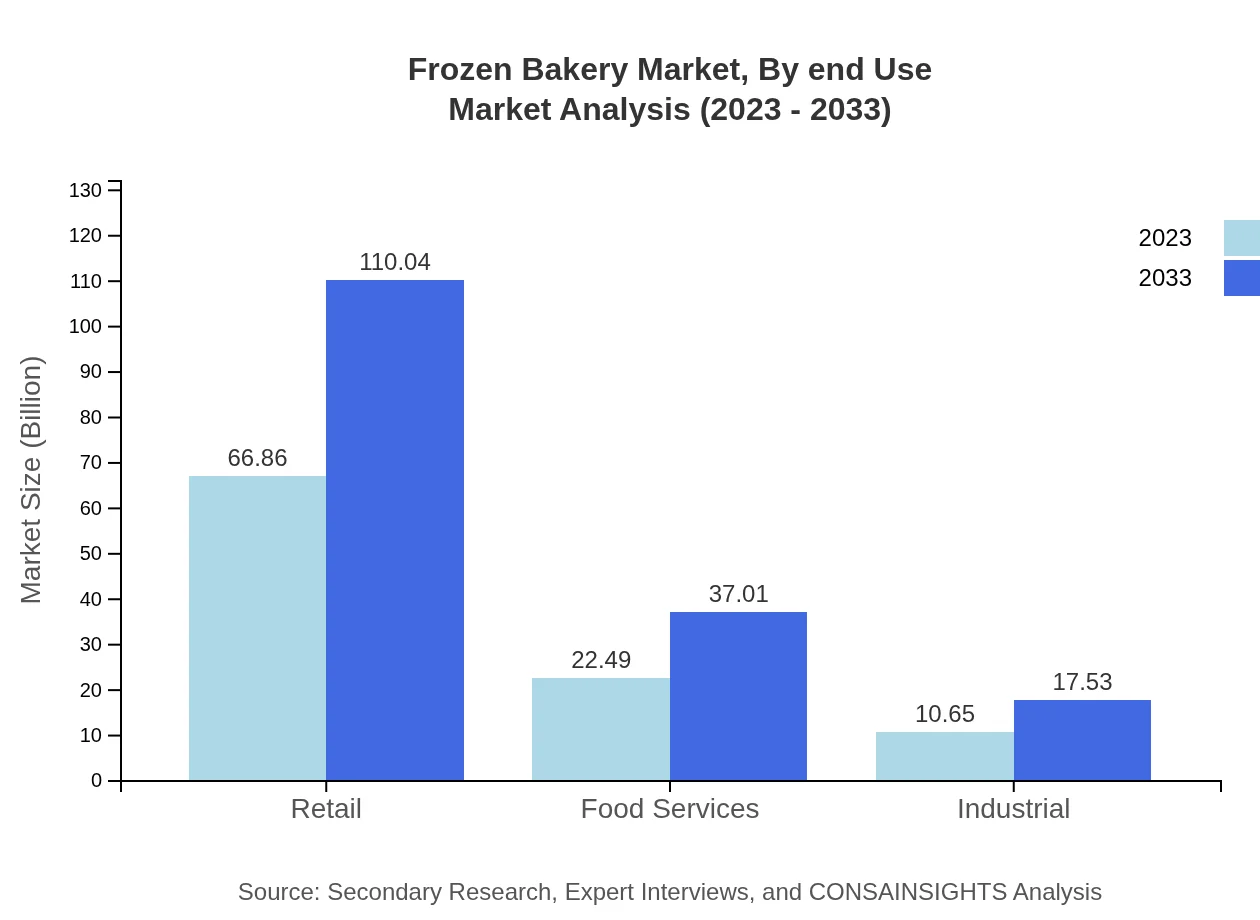

Frozen Bakery Market Analysis By End Use

Retail leads the frozen bakery market with a share of 66.86% in 2023, expected to rise to 110.04 billion by 2033. In comparison, food service segments account for 22.49% of the market, projected to grow to 37.01 billion by 2033, fueled by an uptick in dining out and takeaway services.

Frozen Bakery Market Analysis By Region

North America, Europe, and Asia Pacific are the major contributors to the frozen bakery market, with North America leading in market size followed closely by Europe. However, Asia Pacific is emerging rapidly as consumer preferences shift toward frozen options.

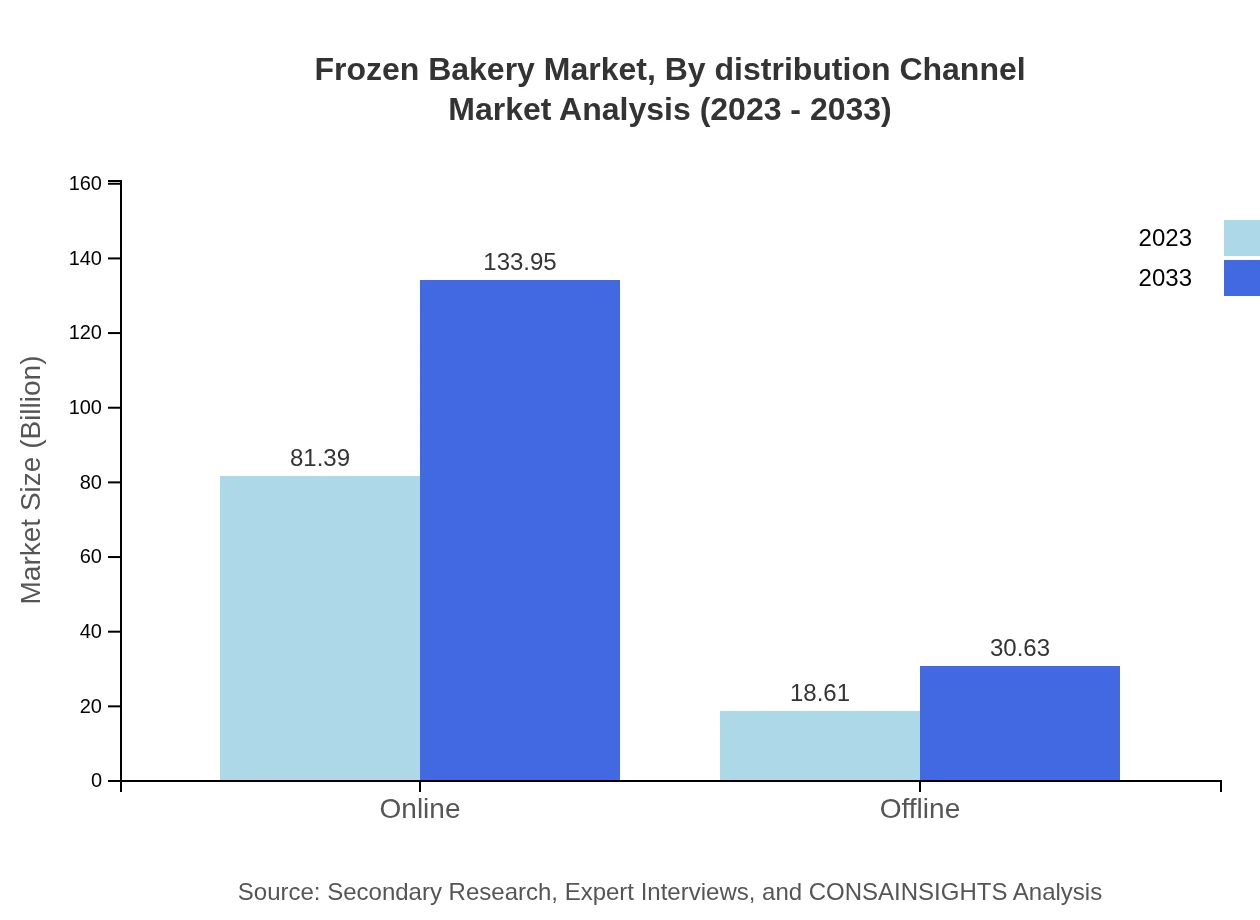

Frozen Bakery Market Analysis By Distribution Channel

Online sales channels are notably growing, with a market size projected to shift from $81.39 billion in 2023 to $133.95 billion by 2033. Offline sales, while still significant, are also showing growth but at a slower pace, with expected numbers of $18.61 billion by 2033.

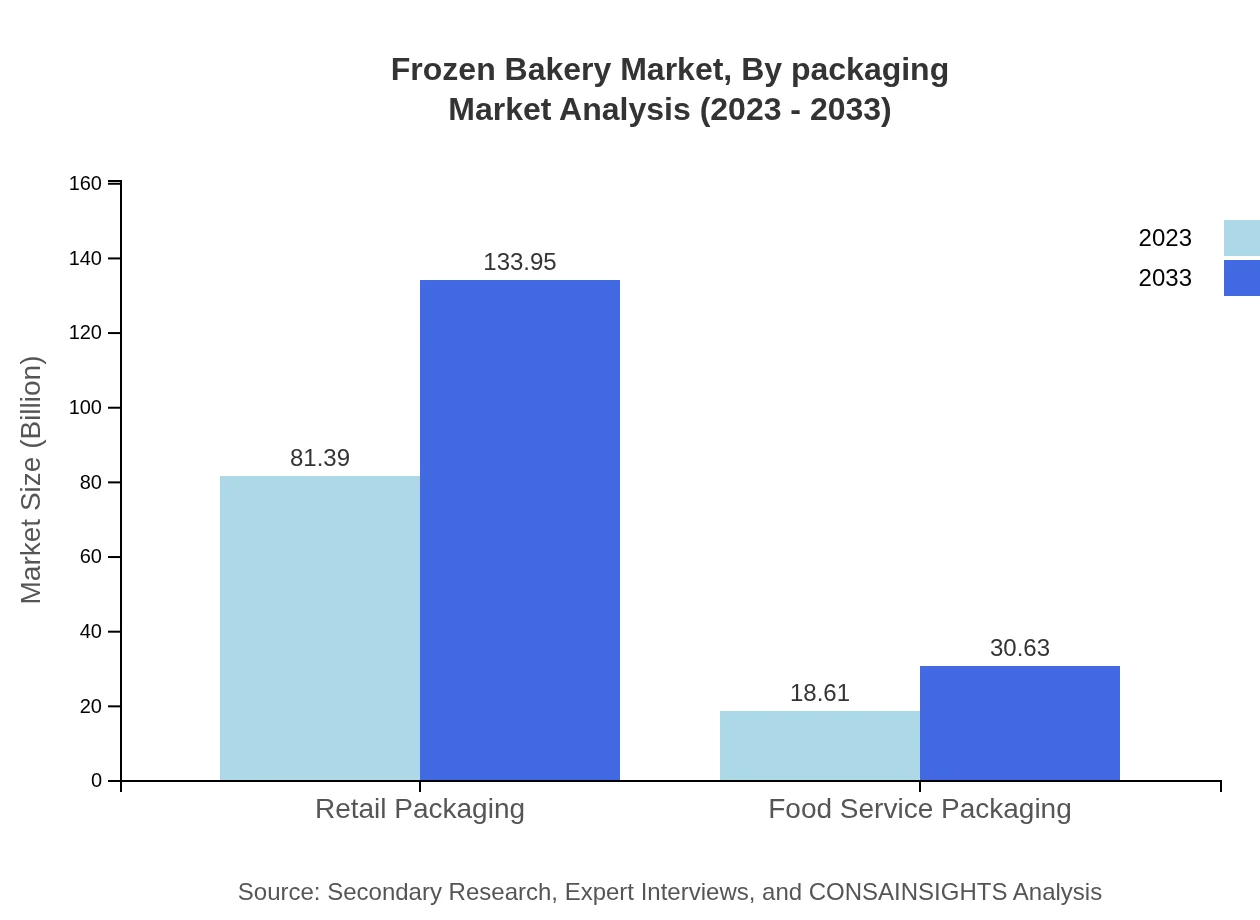

Frozen Bakery Market Analysis By Packaging

Packaging trends in the frozen bakery market indicate a significant shift toward retail packaging, growing from $81.39 billion in 2023 to $133.95 billion by 2033. This shift is driven by consumer desire for sustainable and informative packaging that enhances product appeal.

Frozen Bakery Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Frozen Bakery Industry

ConAgra Foods:

A leading company in the frozen bakery sector, ConAgra offers a diverse range of frozen foods including baked goods, contributing significantly to the advancement of product quality and innovation.Flowers Foods:

Flowers Foods is known for its extensive line of frozen bread and bakery goods, leveraging its robust distribution network to enhance market reach and consumer accessibility.Grupo Bimbo:

As one of the largest bakery companies globally, Grupo Bimbo has made significant inroads in the frozen bakery market, focusing on high-quality, health-conscious products.Nestlé:

Nestlé is expanding its footprint in the frozen bakery segment through strategic acquisitions and product innovations focused on convenient meals.We're grateful to work with incredible clients.

FAQs

What is the market size of frozen Bakery?

The global frozen bakery market is approximately valued at $100 million in 2023, with a projected compound annual growth rate (CAGR) of 5% through 2033. This growth reflects an increasing demand for convenient bakery products.

What are the key market players or companies in this frozen Bakery industry?

Key market players in the frozen bakery industry include well-established companies such as Aryzta AG, Groupo Bimbo, and ConAgra Foods, each contributing significantly to product innovation and market reach.

What are the primary factors driving the growth in the frozen Bakery industry?

Drivers of growth in the frozen bakery sector include rising consumer preferences for convenience foods, increasing demand for ready-to-eat products, and advancements in freezing technology, which enhance product quality and shelf life.

Which region is the fastest Growing in the frozen Bakery?

North America is currently the fastest-growing region in the frozen bakery market, projected to rise from $35.92 million in 2023 to $59.12 million by 2033, influenced by high consumer demand and innovative product offerings.

Does ConsaInsights provide customized market report data for the frozen Bakery industry?

Yes, ConsaInsights offers tailored market report data for the frozen bakery industry, allowing clients to obtain insights specific to their needs, including market trends, consumer behavior, and competitive landscape.

What deliverables can I expect from this frozen Bakery market research project?

Clients can expect comprehensive deliverables, including in-depth market analysis, growth forecasts, key company profiles, competitive strategies, and segment-specific insights to inform decision-making and strategic planning.

What are the market trends of frozen Bakery?

Current trends in the frozen bakery market include a growing emphasis on health-conscious products, increased online sales channels, and a rise in innovative bakery offerings, such as gluten-free options and artisan-style pastries.