Frozen Snacks Market Report

Published Date: 31 January 2026 | Report Code: frozen-snacks

Frozen Snacks Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Frozen Snacks market, examining its current state, growth prospects, and key trends from 2023 to 2033. Valuable insights on regional performance, market segmentation, and leading players offer a roadmap for future opportunities.

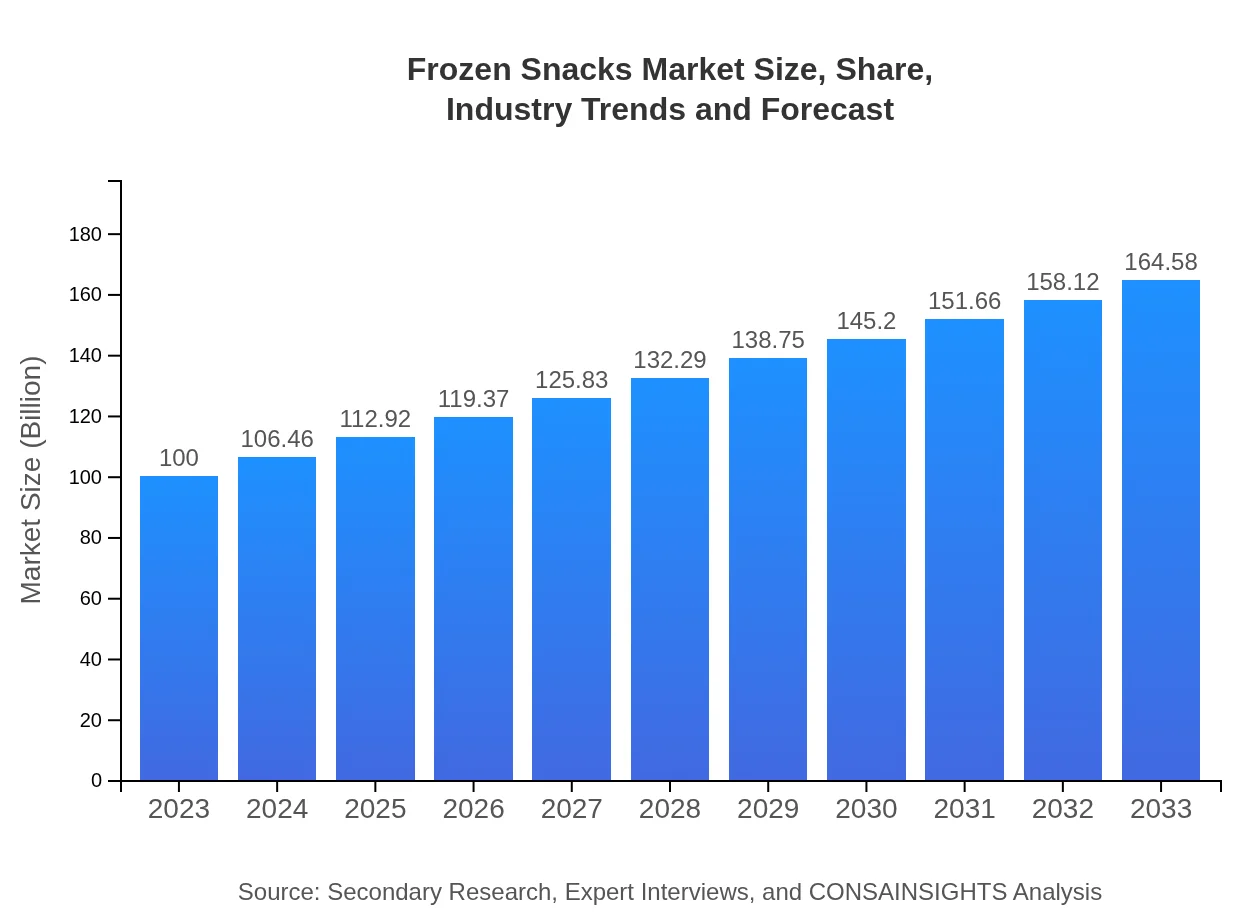

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $100.00 Million |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $164.58 Million |

| Top Companies | Nestlé, Conagra Brands, Uncle Ben’s, McCain Foods |

| Last Modified Date | 31 January 2026 |

Frozen Snacks Market Overview

Customize Frozen Snacks Market Report market research report

- ✔ Get in-depth analysis of Frozen Snacks market size, growth, and forecasts.

- ✔ Understand Frozen Snacks's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Frozen Snacks

What is the Market Size & CAGR of Frozen Snacks market in 2023?

Frozen Snacks Industry Analysis

Frozen Snacks Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Frozen Snacks Market Analysis Report by Region

Europe Frozen Snacks Market Report:

Europe's Frozen Snacks market is expected to expand from $29.07 billion in 2023 to $47.84 billion by 2033. The region sees a strong focus on convenience products, as well as an increasing trend towards organic frozen foods, reflecting health-conscious consumer behavior.Asia Pacific Frozen Snacks Market Report:

The Frozen Snacks market in the Asia Pacific is projected to grow from $19.10 billion in 2023 to $31.43 billion by 2033, driven by a growing middle class and urbanization. Consumers in this region are increasingly adopting Western eating habits, leading to higher consumption of frozen foods, particularly frozen vegetables and snacks.North America Frozen Snacks Market Report:

The North American market, a major contributor to the Frozen Snacks segment, is anticipated to grow from $36.78 billion in 2023 to $60.53 billion by 2033. The demand is fueled by the fast-paced lifestyles of consumers and the rising trend of meal prepping using frozen snack options.South America Frozen Snacks Market Report:

In South America, the market is expected to rise from $8.63 billion in 2023 to $14.20 billion in 2033. Key factors include the increasing penetration of modern retail formats and growing health awareness, encouraging consumers to choose frozen fruits and vegetables for their nutritional benefits.Middle East & Africa Frozen Snacks Market Report:

The Middle East and Africa market is projected to grow from $6.42 billion in 2023 to $10.57 billion by 2033, supported by rising disposable incomes and an increasing inclination towards convenience foods among the working population.Tell us your focus area and get a customized research report.

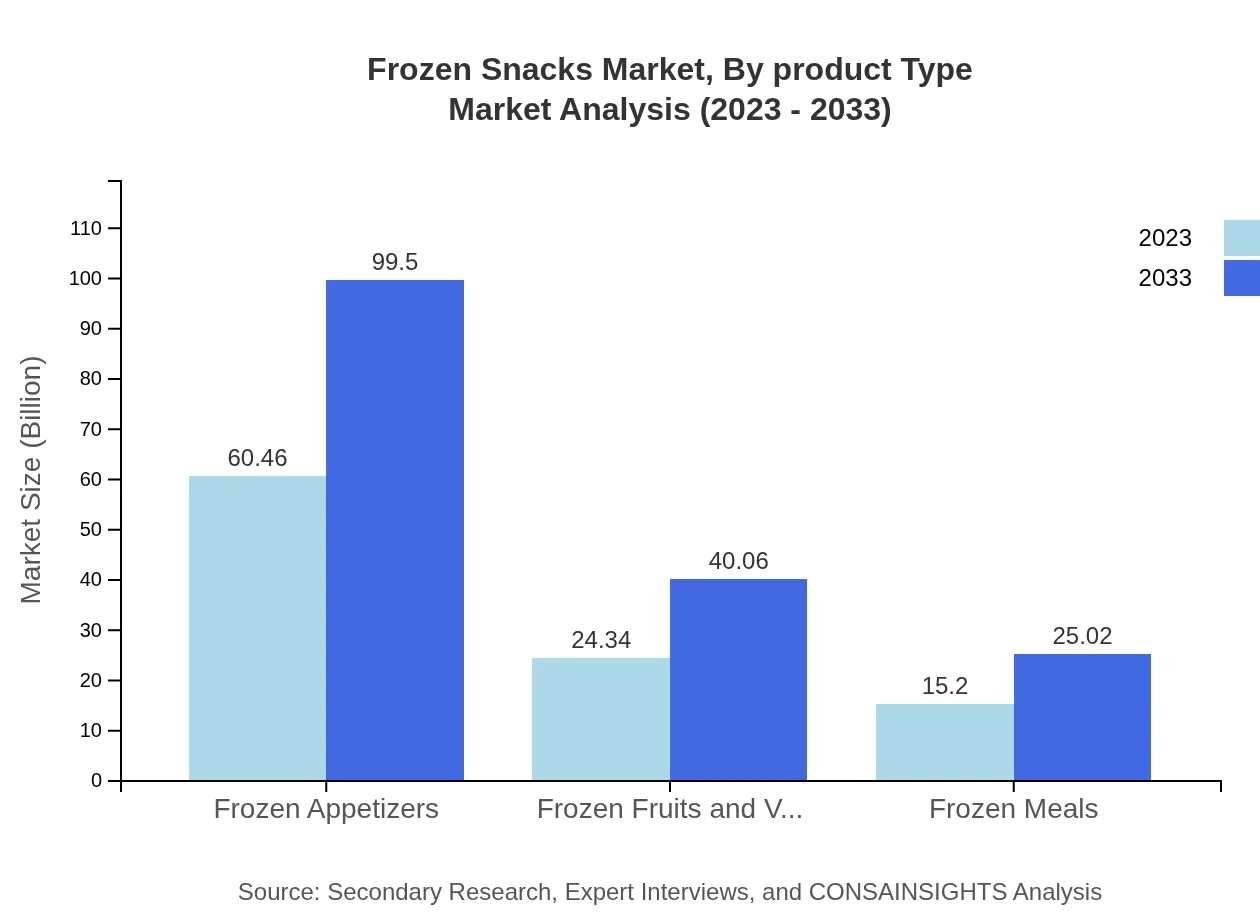

Frozen Snacks Market Analysis By Product Type

In 2023, the Frozen Appetizers segment generates $60.46 billion, projected to reach $99.50 billion by 2033. Frozen Meals, with a market size of $15.20 billion in 2023, will grow to $25.02 billion by 2033. Frozen Fruits and Vegetables follow with $24.34 billion today, expected to expand to $40.06 billion in the forecast period.

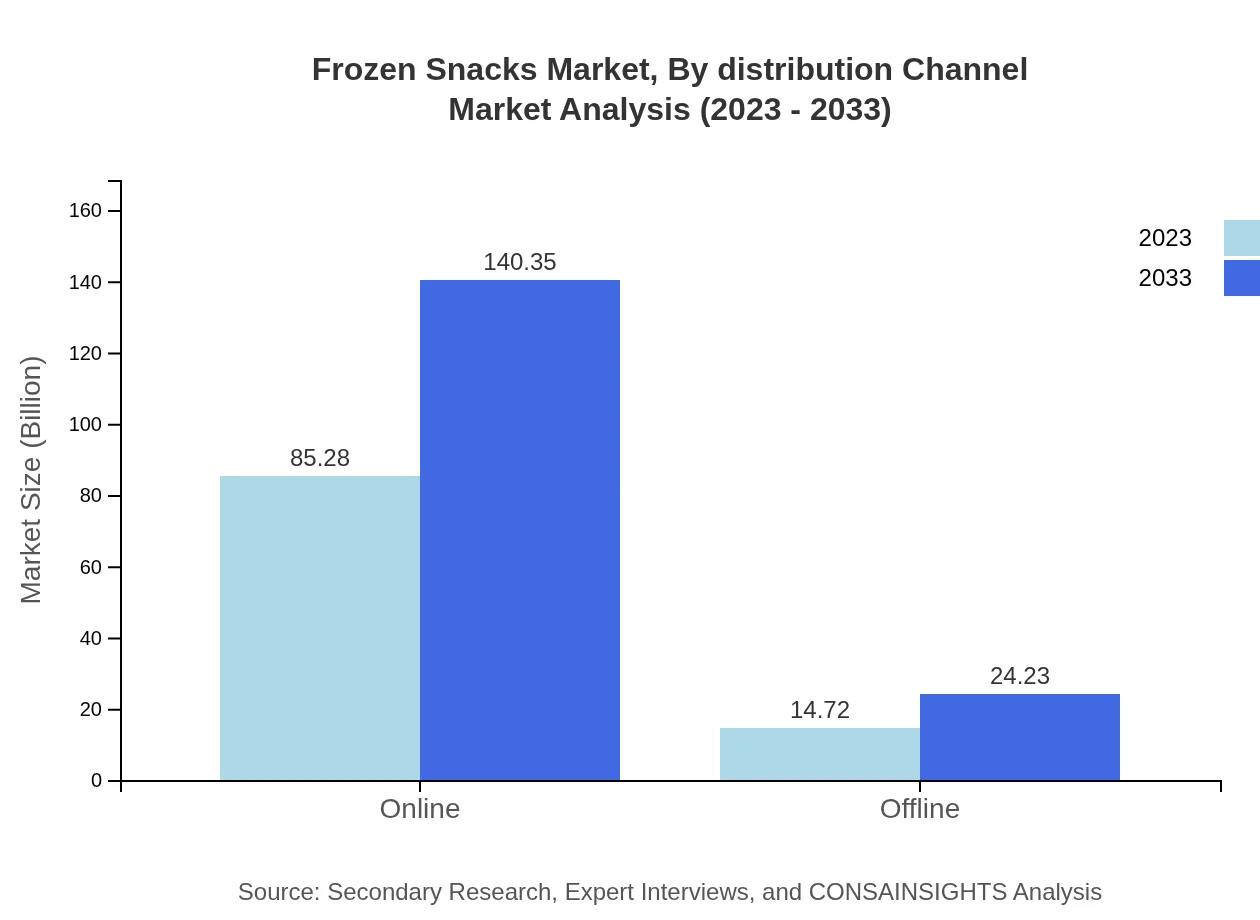

Frozen Snacks Market Analysis By Distribution Channel

Online sales of Frozen Snacks market are worth $85.28 billion in 2023, predicted to grow to $140.35 billion by 2033, reflecting a significant shift towards e-commerce. Offline channels currently hold a market of $14.72 billion, expected to increase to $24.23 billion.

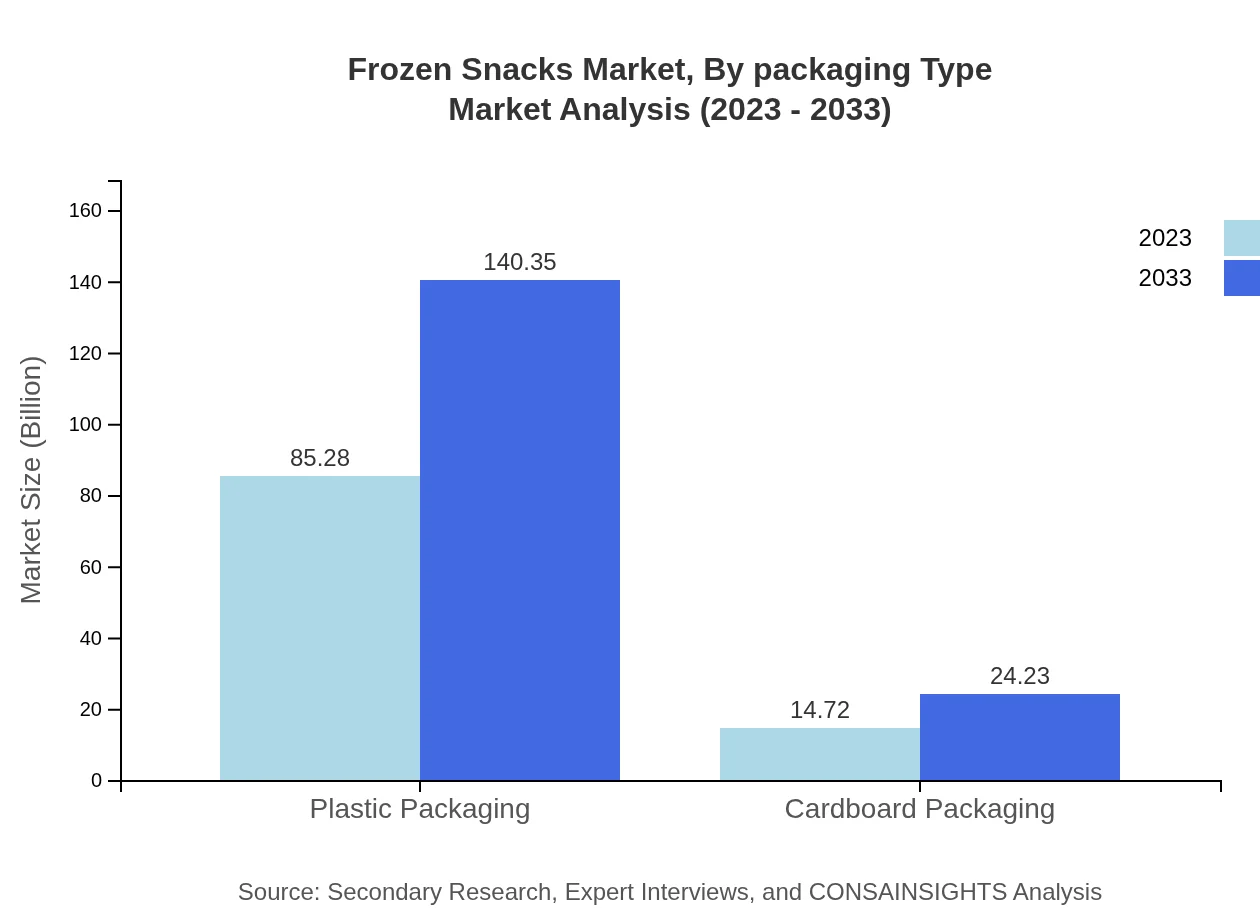

Frozen Snacks Market Analysis By Packaging Type

Plastic Packaging dominates the segment at $85.28 billion in 2023, aiming for $140.35 billion by 2033. Cardboard Packaging, currently valued at $14.72 billion, is also set to increase to $24.23 billion, supported by the push for sustainable packaging solutions.

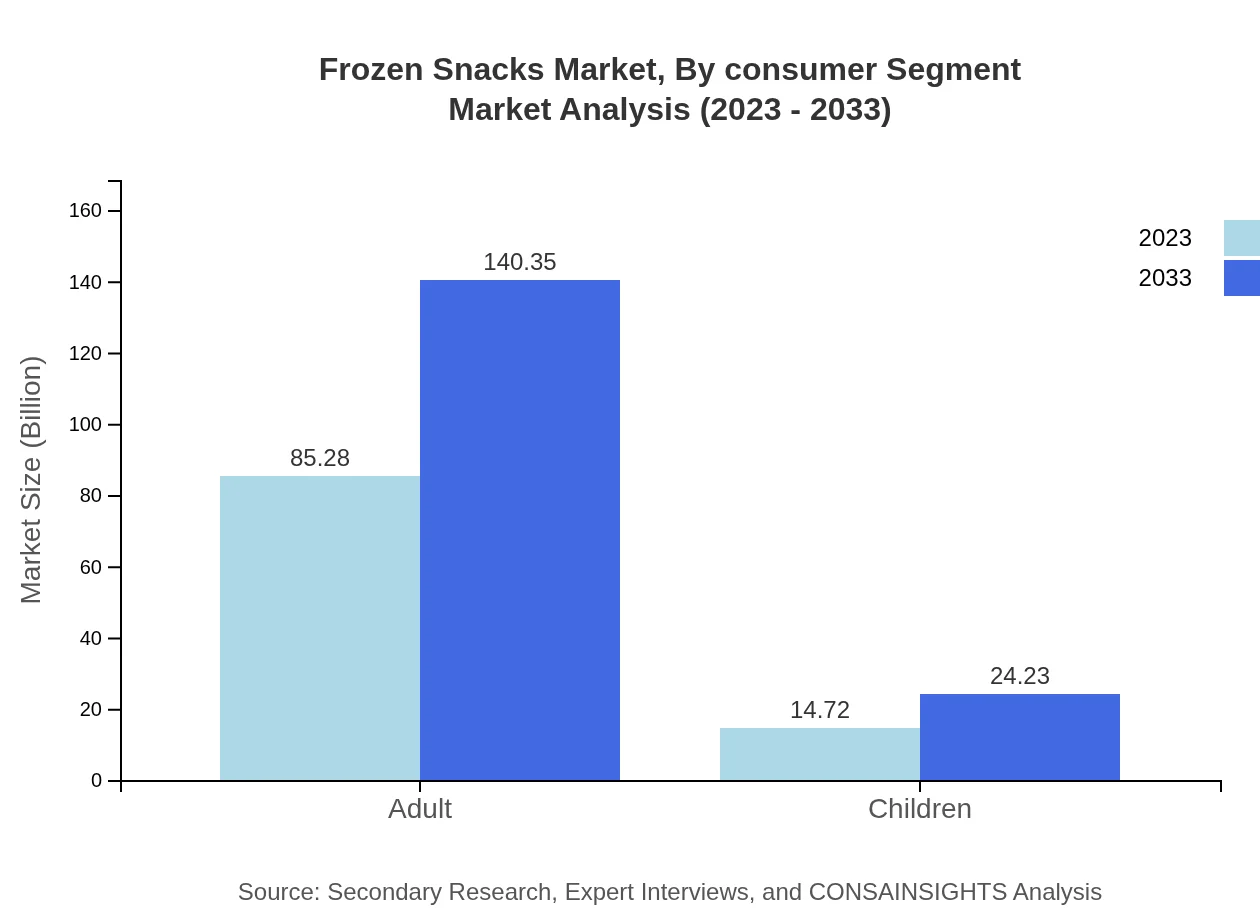

Frozen Snacks Market Analysis By Consumer Segment

The Adults segment leads the market with $85.28 billion in 2023, aiming for $140.35 billion by 2033, while the Children segment, presently at $14.72 billion, targets $24.23 billion as health-conscious products gain traction among younger consumers.

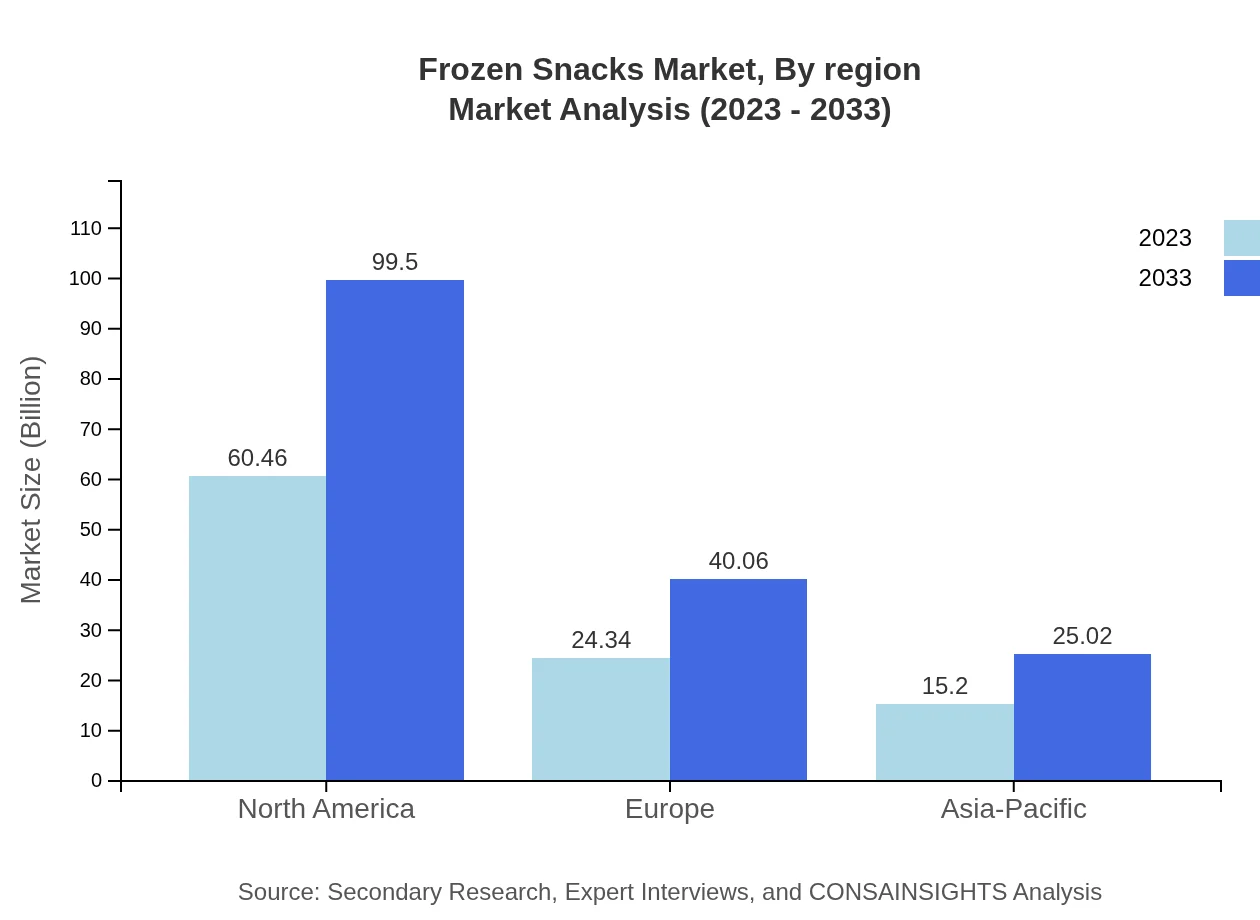

Frozen Snacks Market Analysis By Region

Regional analysis shows North America leads the market, followed by Europe, Asia Pacific, South America, and the Middle East and Africa. Each region shows different growth drivers, with North America focusing on convenience and Europe prioritizing health-focused products.

Frozen Snacks Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Frozen Snacks Industry

Nestlé:

A global leader in the food industry, Nestlé has a significant footprint in the frozen snacks market, offering a wide range of products that cater to evolving consumer preferences.Conagra Brands:

Known for its diversified product portfolio, Conagra Brands focuses on innovative frozen snacks and meals that resonate with busy consumers, solidifying its position in the market.Uncle Ben’s:

Uncle Ben’s, now a part of Mars, Inc., is recognized for its frozen rice and meal solutions, appealing to consumers seeking hassle-free meal options.McCain Foods:

Specializing in frozen potato products, McCain Foods is a major player in the frozen snacks arena, known for its focus on quality and consumer preferences.We're grateful to work with incredible clients.

FAQs

What is the market size of Frozen Snacks?

As of 2023, the frozen snacks market is valued at approximately $100 million, with a projected Compound Annual Growth Rate (CAGR) of 5%. By 2033, the market size is expected to grow significantly, reflecting increasing consumer demand.

What are the key market players or companies in the Frozen Snacks industry?

Major players in the frozen snacks industry include well-known food brands and manufacturers involved in producing and distributing frozen food products. These companies actively innovate to cater to consumer preferences and focus on expanding distribution networks.

What are the primary factors driving the growth in the Frozen Snacks industry?

The growth of the frozen snacks market is driven by rising consumer demand for convenient meal options, busy lifestyles, and the increase in health-conscious eating. Additionally, innovations in product offerings and packaging have played a crucial role in attracting customers.

Which region is the fastest Growing in the Frozen Snacks market?

The North America region is the fastest-growing for frozen snacks, projected to increase from $36.78 million in 2023 to $60.53 million in 2033. Europe and Asia-Pacific also show substantial growth potential, indicating a rising global appetite for frozen snacks.

Does ConsaInsights provide customized market report data for the Frozen Snacks industry?

Yes, ConsaInsights offers tailored market report data for the frozen snacks industry, allowing clients to gain insights specific to their needs. Customized reports can cover market trends, competitive analysis, and consumer behavior, based on individual requirements.

What deliverables can I expect from this Frozen Snacks market research project?

From the frozen snacks market research project, you can expect comprehensive reports that include market size, segmentation analysis, competitive landscape, growth forecasts, and insightful data that can drive strategic decision-making.

What are the market trends of Frozen Snacks?

Key trends in the frozen snacks market include growing popularity of plant-based options, innovative flavors, and an increase in online sales channels. Sustainability in packaging is also becoming a focal point as consumers prioritize eco-friendly products.