Fruit Vegetable Crop Protection Market Report

Published Date: 02 February 2026 | Report Code: fruit-vegetable-crop-protection

Fruit Vegetable Crop Protection Market Size, Share, Industry Trends and Forecast to 2033

This market report provides insights into the Fruit Vegetable Crop Protection industry, covering market size, trends, segmentation, and forecasts from 2023 to 2033, along with an analysis of regional markets and key industry players.

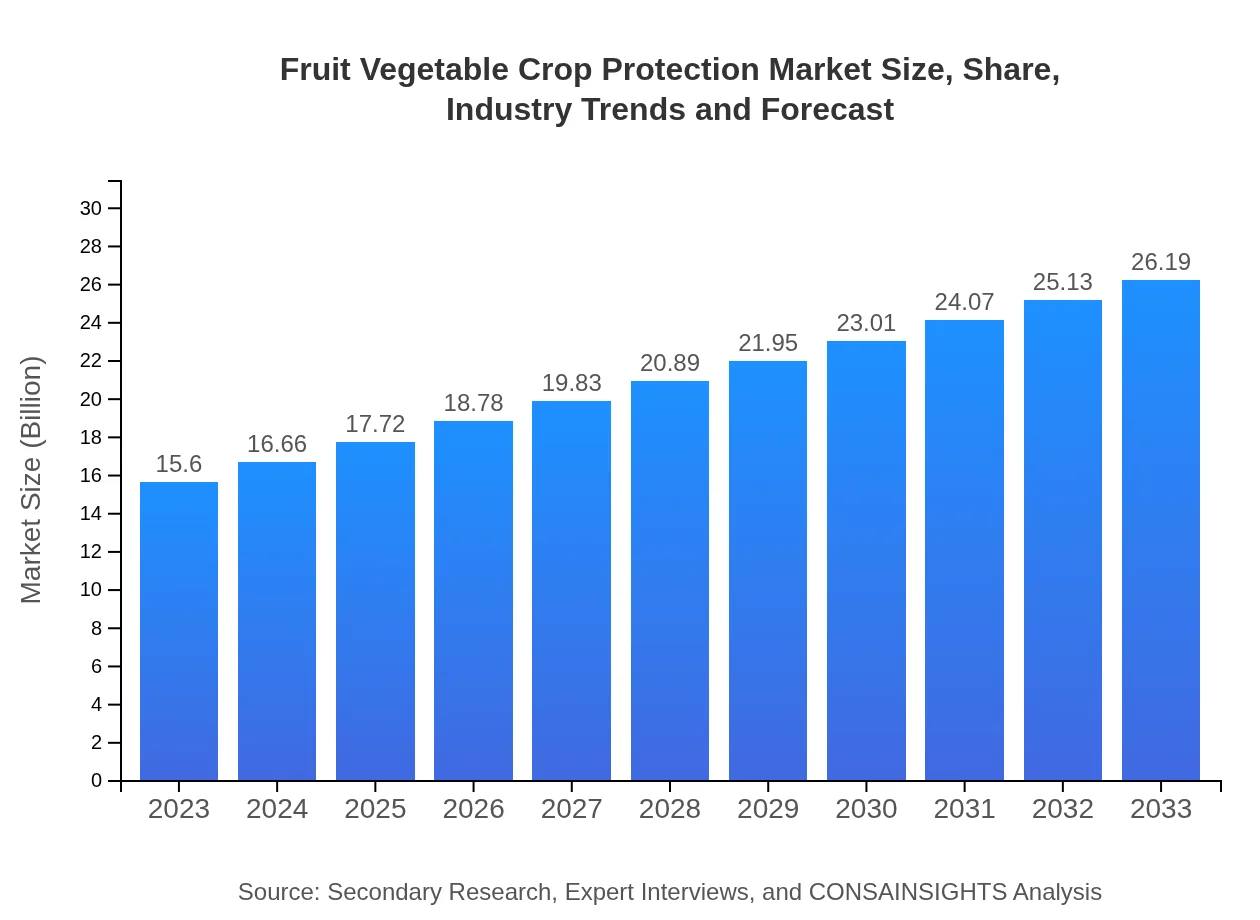

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.60 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $26.19 Billion |

| Top Companies | BASF, Syngenta, FMC Corporation, Corteva Agriscience, Dow AgroSciences |

| Last Modified Date | 02 February 2026 |

Fruit Vegetable Crop Protection Market Overview

Customize Fruit Vegetable Crop Protection Market Report market research report

- ✔ Get in-depth analysis of Fruit Vegetable Crop Protection market size, growth, and forecasts.

- ✔ Understand Fruit Vegetable Crop Protection's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Fruit Vegetable Crop Protection

What is the Market Size & CAGR of Fruit Vegetable Crop Protection market in 2023?

Fruit Vegetable Crop Protection Industry Analysis

Fruit Vegetable Crop Protection Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Fruit Vegetable Crop Protection Market Analysis Report by Region

Europe Fruit Vegetable Crop Protection Market Report:

Europe is expected to increase its market size from $4.06 billion in 2023 to $6.81 billion by 2033. Regulatory frameworks promoting sustainable agricultural practices and declining tolerance towards chemical-based pesticides are key drivers for growth. Furthermore, the European Union’s Green Deal initiatives are expected to propel the demand for environmentally friendly products.Asia Pacific Fruit Vegetable Crop Protection Market Report:

The Asia-Pacific region is projected to witness robust growth, evolving from a market size of $2.97 billion in 2023 to $4.99 billion by 2033. The regions' agricultural reliance, coupled with increased pest incidence due to climatic changes, is driving demand for advanced crop protection methods. Also, the rising income levels in countries like India and China are propelling a shift towards high-value crop production.North America Fruit Vegetable Crop Protection Market Report:

North America holds one of the largest shares of the Fruit Vegetable Crop Protection market, estimated to grow from $5.93 billion in 2023 to $9.95 billion in 2033. The increase in organic farming and stringent regulations on pesticide use are significant factors contributing to market growth in this region. Technological advancements in precision agriculture are also playing a pivotal role.South America Fruit Vegetable Crop Protection Market Report:

In South America, the market is expected to grow from $0.88 billion in 2023 to $1.48 billion by 2033. This growth is largely attributed to the region’s agricultural exports and the adoption of integrated pest management techniques, which are becoming vital in tackling increasing pest resistance issues among traditional chemical treatments.Middle East & Africa Fruit Vegetable Crop Protection Market Report:

The Middle East and Africa region is set to experience growth from $1.76 billion in 2023 to $2.95 billion by 2033. Increasing investments in agricultural technologies and a growing population are necessitating improved crop protection measures. This region’s unique challenges, including water scarcity and arid climates, demand tailored solutions for effective pest management.Tell us your focus area and get a customized research report.

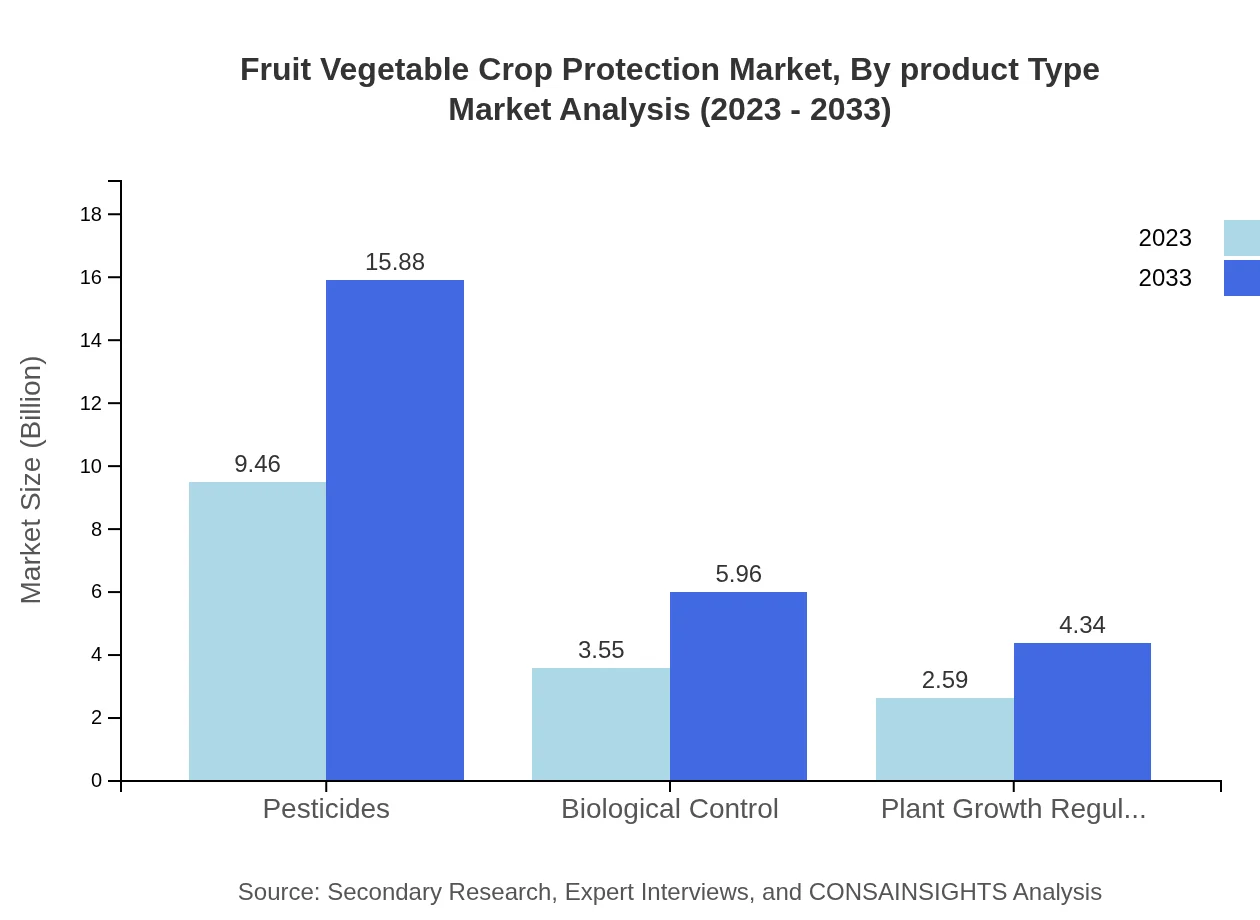

Fruit Vegetable Crop Protection Market Analysis By Product Type

In 2023, the market size for pesticides is estimated at $9.46 billion, with projections to reach $15.88 billion by 2033, indicating a dominant share of approximately 60.65%. Biological control methods contribute significantly at $3.55 billion in 2023, growing to $5.96 billion by 2033 with a 22.76% market share. Plant growth regulators and eco-friendly products also show steady growth, highlighting the market's shift towards sustainability.

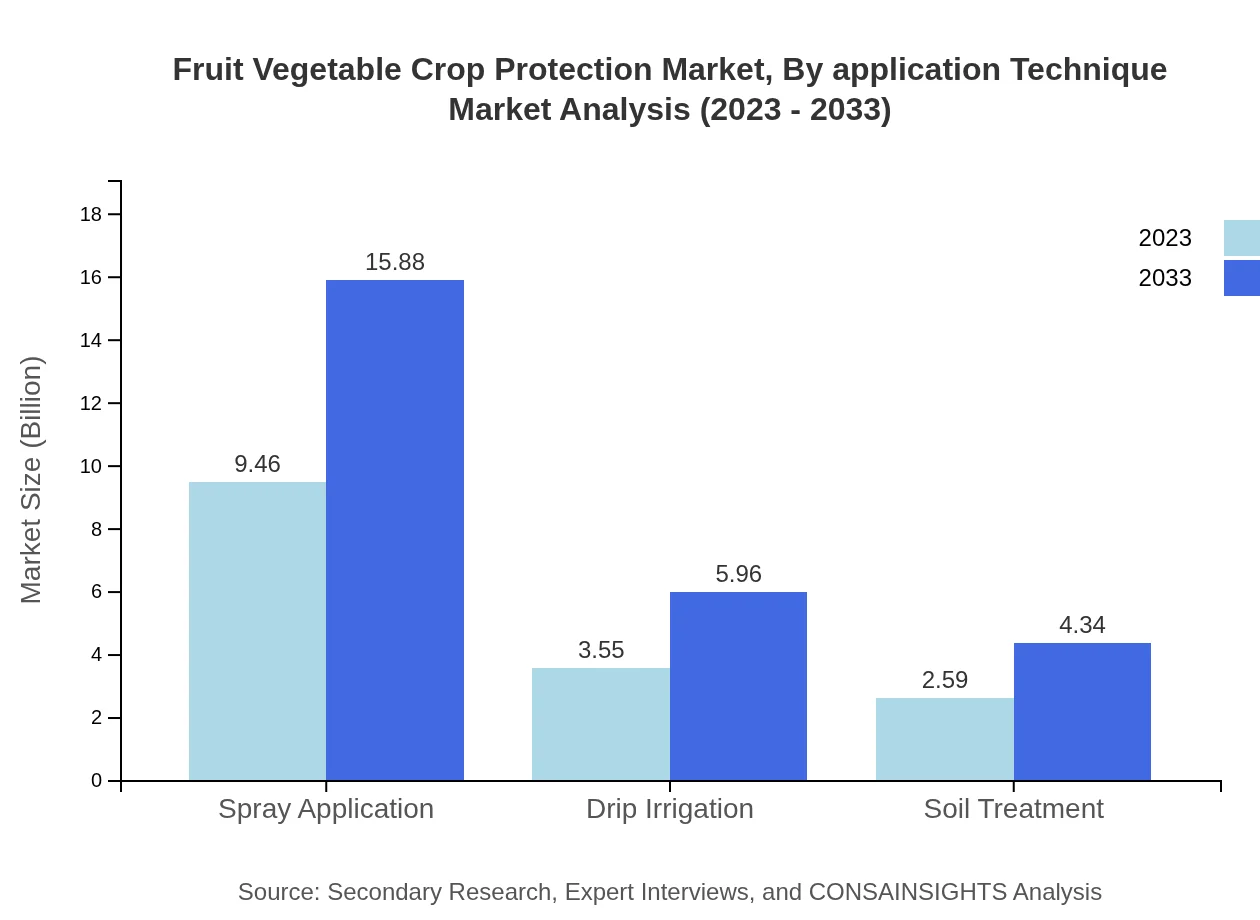

Fruit Vegetable Crop Protection Market Analysis By Application Technique

The major application techniques dominating the market include spray application, which stands at $9.46 billion in 2023 and is expected to rise to $15.88 billion by 2033. Drip irrigation techniques and soil treatments, worth $3.55 billion and $2.59 billion respectively in the same base year, are also gaining traction as growers seek efficient and effective ways to manage their crops.

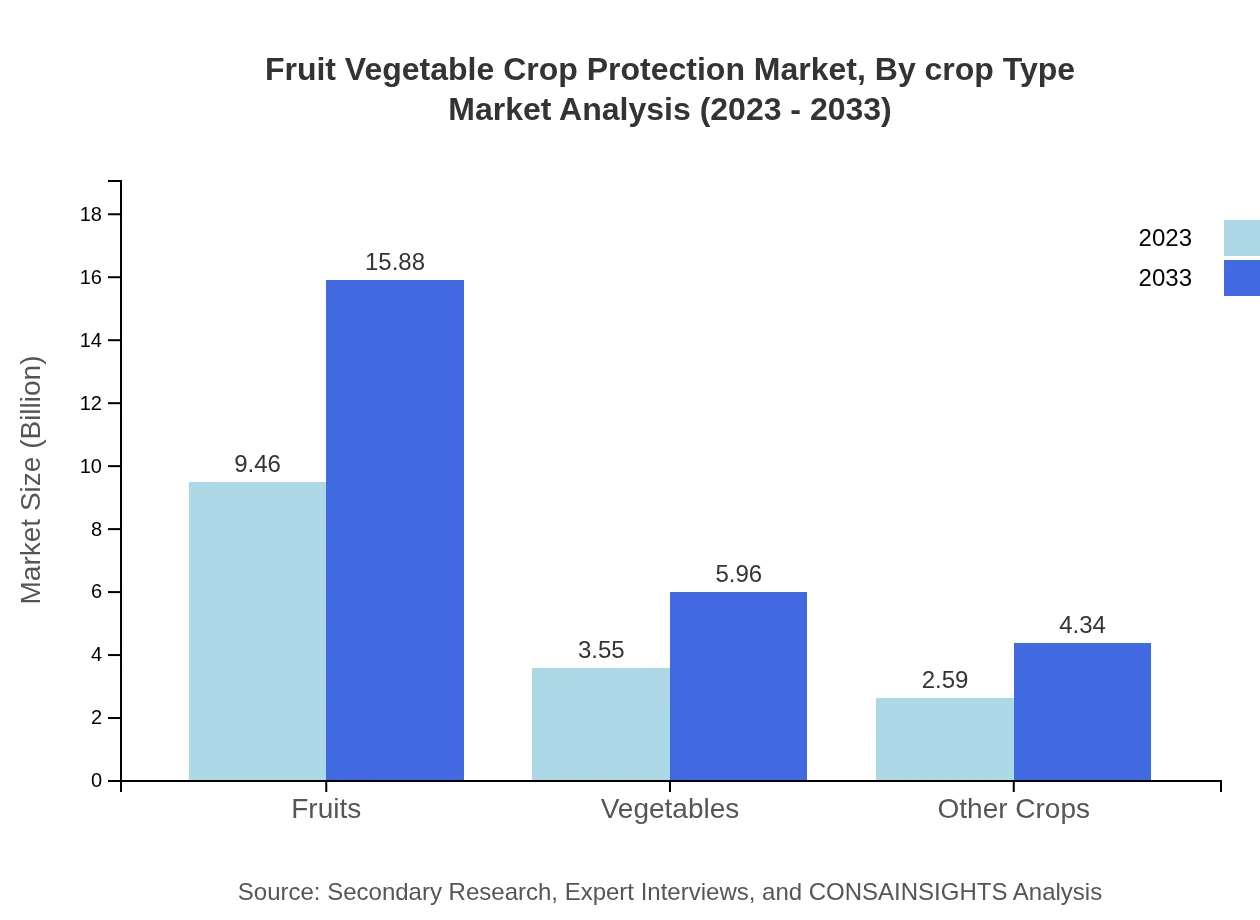

Fruit Vegetable Crop Protection Market Analysis By Crop Type

The crop type segmentation indicates that the market for fruits is currently valued at $9.46 billion in 2023, set to grow to $15.88 billion by 2033, maintaining a strong share. Vegetables are projected to increase from $3.55 billion to $5.96 billion. Other crops also present a growing opportunity, emphasizing the diverse needs of the agricultural sector.

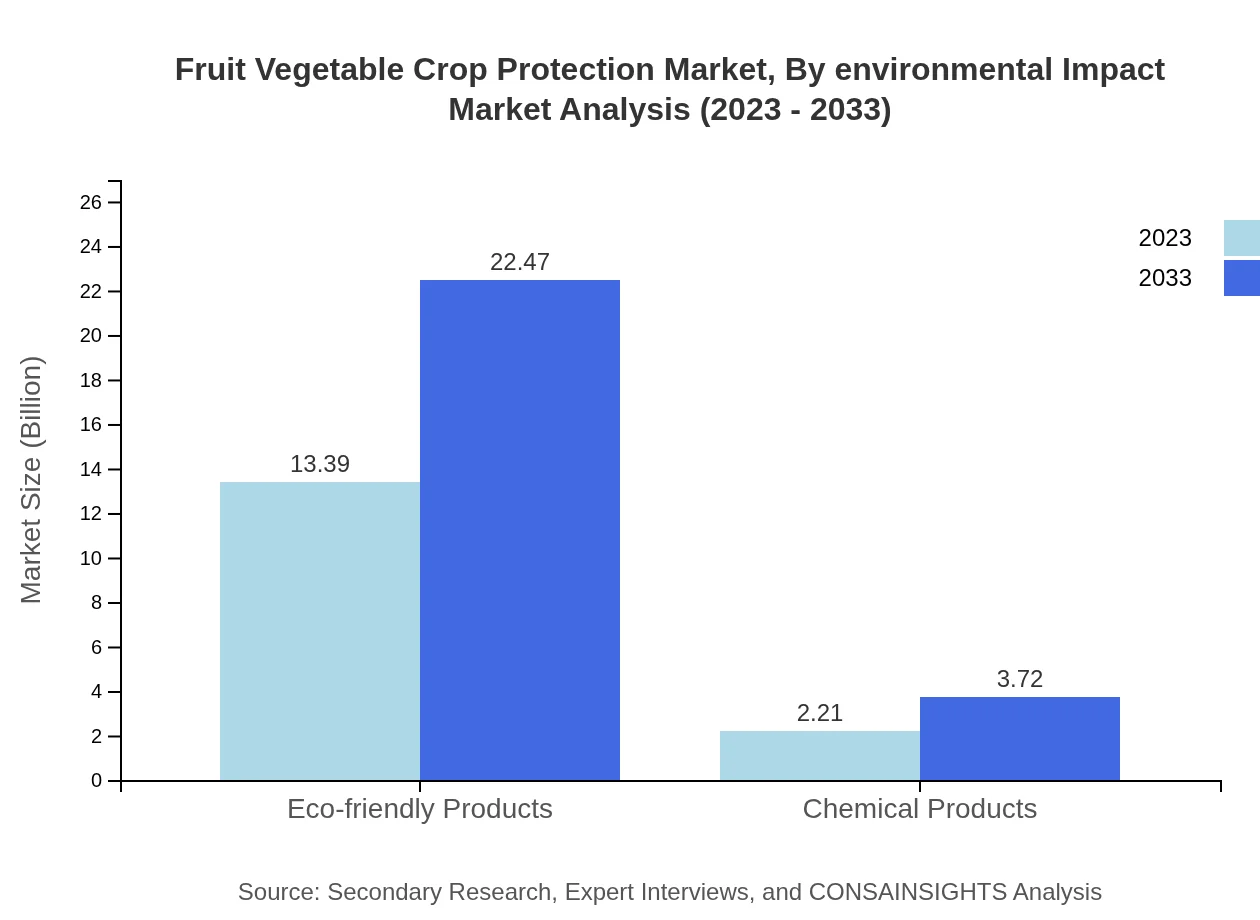

Fruit Vegetable Crop Protection Market Analysis By Environmental Impact

With rising ecological concerns, the market is increasingly recognizing eco-friendly products, estimated at $13.39 billion in 2023. This segment will likely grow to $22.47 billion by 2033, commanding 85.81% of the market share. In contrast, chemical products, while still significant, are expected to occupy a smaller market segment as regulations tighten against harmful agricultural inputs.

Fruit Vegetable Crop Protection Market Analysis By Region Development

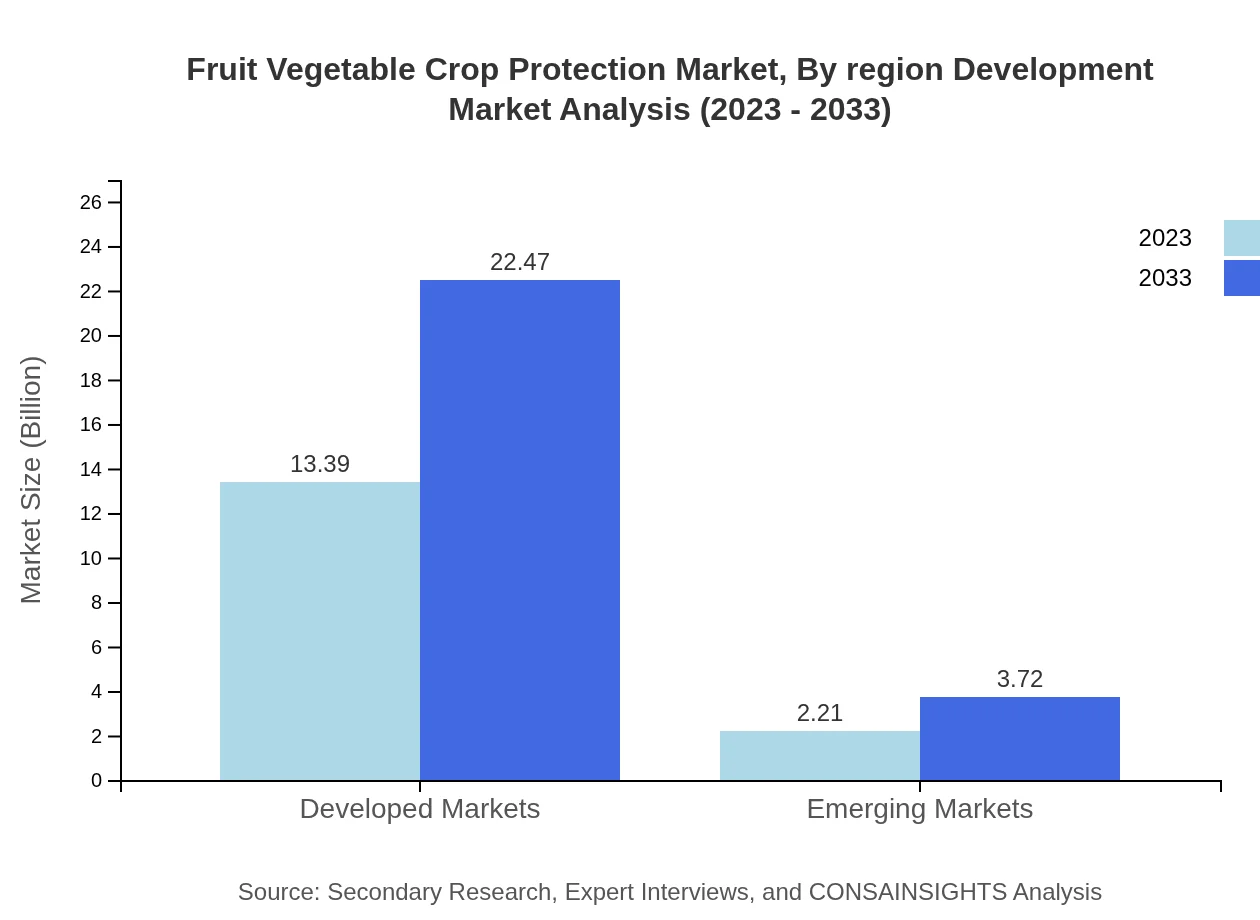

Developed markets are currently valued at $13.39 billion in 2023 with an impressive growth trajectory to $22.47 billion by 2033. Emerging markets, although significantly smaller at $2.21 billion in 2023, are projected to grow to $3.72 billion, showcasing an evolving landscape with increasing technological adoption and agricultural investments.

Fruit Vegetable Crop Protection Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Fruit Vegetable Crop Protection Industry

BASF:

BASF is a global leader in the chemical industry offering a wide range of crop protection products including pesticides and fungicides. Their commitment to sustainable agriculture solutions is a core aspect of their business model, driving significant innovation in eco-friendly crop management.Syngenta:

Syngenta specializes in crop protection and seed products, investing heavily in R&D to develop effective and environmentally responsible solutions. With a strong presence in the global market, Syngenta's technologies aim to increase farm productivity while minimizing environmental impact.FMC Corporation:

FMC Corporation is known for its comprehensive portfolio of crop protection chemicals along with sustainable solutions aimed at enhancing crop yield and quality. Their focus on innovation in agricultural technologies positions them well in the competitive market landscape.Corteva Agriscience:

Corteva Agriscience focuses on seed and crop protection solutions, delivering innovative products and services designed to support farmers. Their commitment to sustainability and stewardship in agriculture makes them a key player in the market.Dow AgroSciences:

Dow AgroSciences offers a diverse range of crop protection products, emphasizing integrated pest management and innovative technologies to address growing agricultural challenges. Their solutions are designed to support more sustainable farming practices.We're grateful to work with incredible clients.

FAQs

What is the market size of fruit Vegetable Crop Protection?

The global fruit-vegetable-crop-protection market is projected to reach $15.6 billion by 2033, growing at a CAGR of 5.2%. The market shows robust demand due to increasing agricultural activities worldwide, with significant investments in crop protection technologies.

What are the key market players or companies in this fruit Vegetable Crop Protection industry?

Key players in the fruit-vegetable-crop-protection industry include companies like Bayer Crop Science, Syngenta, Corteva Agriscience, BASF SE, and FMC Corporation. These companies lead with innovative solutions and extensive distribution networks globally.

What are the primary factors driving the growth in the fruit Vegetable Crop Protection industry?

Growth in the fruit-vegetable-crop-protection industry is primarily driven by factors such as a rising global population, increasing crop diseases, advancements in agricultural technology, and growing consumer preference for pest-free produce. Sustainable practices are also gaining traction.

Which region is the fastest Growing in the fruit Vegetable Crop Protection?

The Asia Pacific region is the fastest-growing market for fruit-vegetable-crop-protection, expected to grow from $2.97 billion in 2023 to $4.99 billion by 2033. This growth is fueled by increasing agricultural practices and demand for food security.

Does ConsaInsights provide customized market report data for the fruit Vegetable Crop Protection industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the fruit-vegetable-crop-protection industry. This includes in-depth analyses based on current market trends, competitive landscape, and regional outlook.

What deliverables can I expect from this fruit Vegetable Crop Protection market research project?

Deliverables from the fruit-vegetable-crop-protection market research project include comprehensive reports detailing market size, growth forecasts, competitive analysis, key trends, and segment-wise data. Executive summaries and visual data presentations will also be provided.

What are the market trends of fruit Vegetable Crop Protection?

Current trends in the fruit-vegetable-crop-protection market include an emphasis on eco-friendly products, increased adoption of precision agriculture technologies, and a shift toward biological pest control solutions. These trends align with global sustainability goals.