Ftth Equipment Market Report

Published Date: 31 January 2026 | Report Code: ftth-equipment

Ftth Equipment Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Ftth Equipment market from 2023 to 2033, focusing on market trends, regional insights, segmentation, and forecast data. It offers key insights and valuable data for stakeholders and decision-makers in the industry.

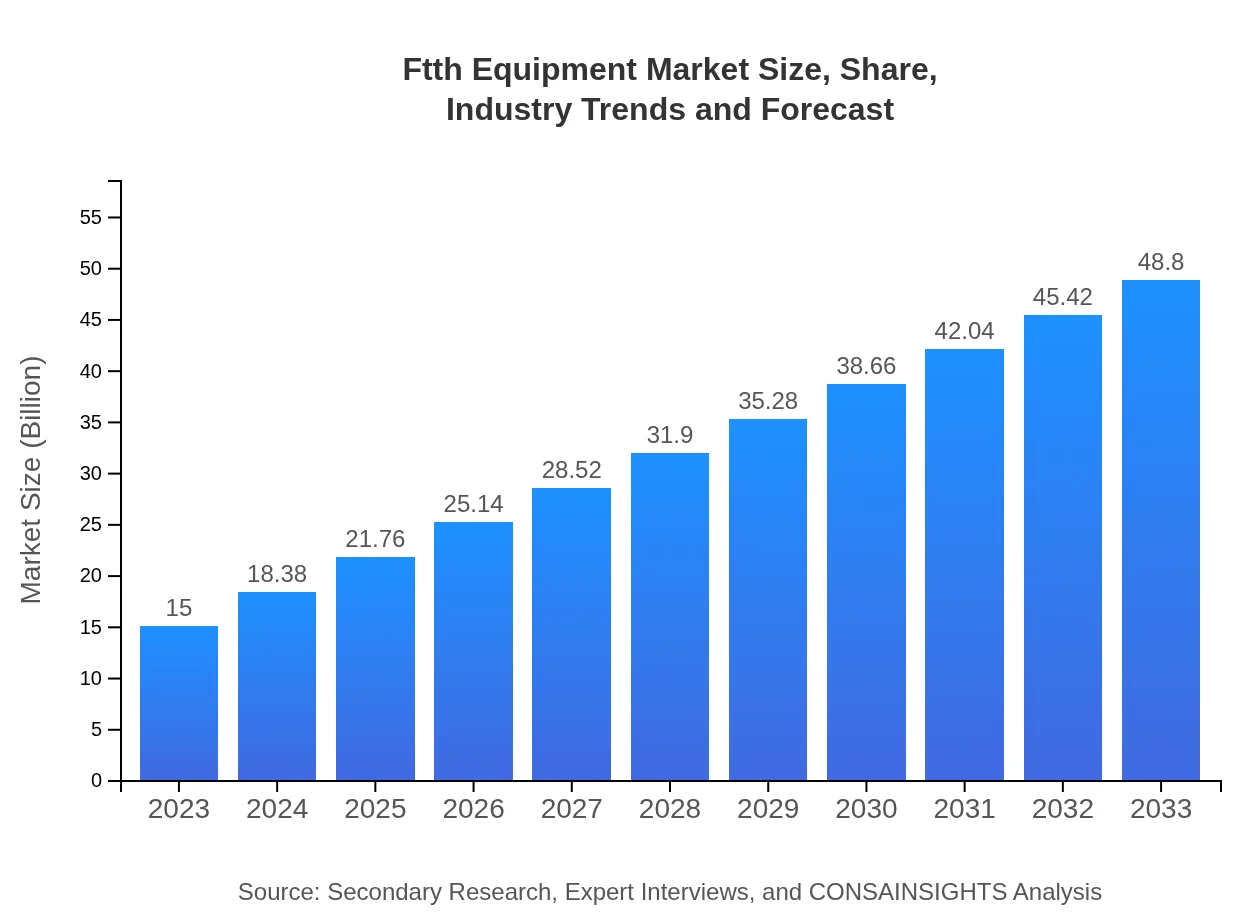

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.00 Billion |

| CAGR (2023-2033) | 12% |

| 2033 Market Size | $48.80 Billion |

| Top Companies | Cisco Systems, Inc., Nokia Corporation, Huawei Technologies Co., Ltd., Calix, Inc., Adtran, Inc. |

| Last Modified Date | 31 January 2026 |

Ftth Equipment Market Overview

Customize Ftth Equipment Market Report market research report

- ✔ Get in-depth analysis of Ftth Equipment market size, growth, and forecasts.

- ✔ Understand Ftth Equipment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ftth Equipment

What is the Market Size & CAGR of Ftth Equipment market in 2023 and 2033?

Ftth Equipment Industry Analysis

Ftth Equipment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ftth Equipment Market Analysis Report by Region

Europe Ftth Equipment Market Report:

Europe's FTTH Equipment market is set to expand from $4.50 billion in 2023 to $14.65 billion by 2033. The region is characterized by high penetration rates in countries like Sweden and Spain that are prioritizing fiber infrastructure to meet growing connectivity needs. Initiatives such as the European Digital Strategy are also propelling investments in digital networks.Asia Pacific Ftth Equipment Market Report:

The Asia Pacific FTTH Equipment market is projected to grow from $3.15 billion in 2023 to $10.24 billion by 2033, benefitting from enhanced internet penetration and government initiatives to improve digital infrastructure. Countries like China and Japan lead in deploying FTTH networks, driving significant investments in advanced fiber optic technologies.North America Ftth Equipment Market Report:

North America shows a robust growth trajectory, with the FTTH Equipment market projected to grow from $5.01 billion in 2023 to $16.31 billion by 2033. The US remains a leader in FTTH deployment, with significant investments in fiber networks and rising consumer demand for high-speed internet access, spurred by remote work practices and streaming services.South America Ftth Equipment Market Report:

In South America, the FTTH Equipment market size is expected to increase from $1.09 billion in 2023 to $3.55 billion by 2033. The growth is driven by expanding broadband access and increasing investments in telecommunications infrastructure, particularly in Brazil and Argentina, which are focusing on advancing their digital capabilities.Middle East & Africa Ftth Equipment Market Report:

The Middle East and Africa region is witnessing growth in the FTTH Equipment market, increasing from $1.25 billion in 2023 to $4.05 billion by 2033. Countries in the Gulf Cooperation Council (GCC) are rapidly adopting fiber technologies to enhance their telecommunications networks, driven by government agendas to build smart cities and improve connectivity.Tell us your focus area and get a customized research report.

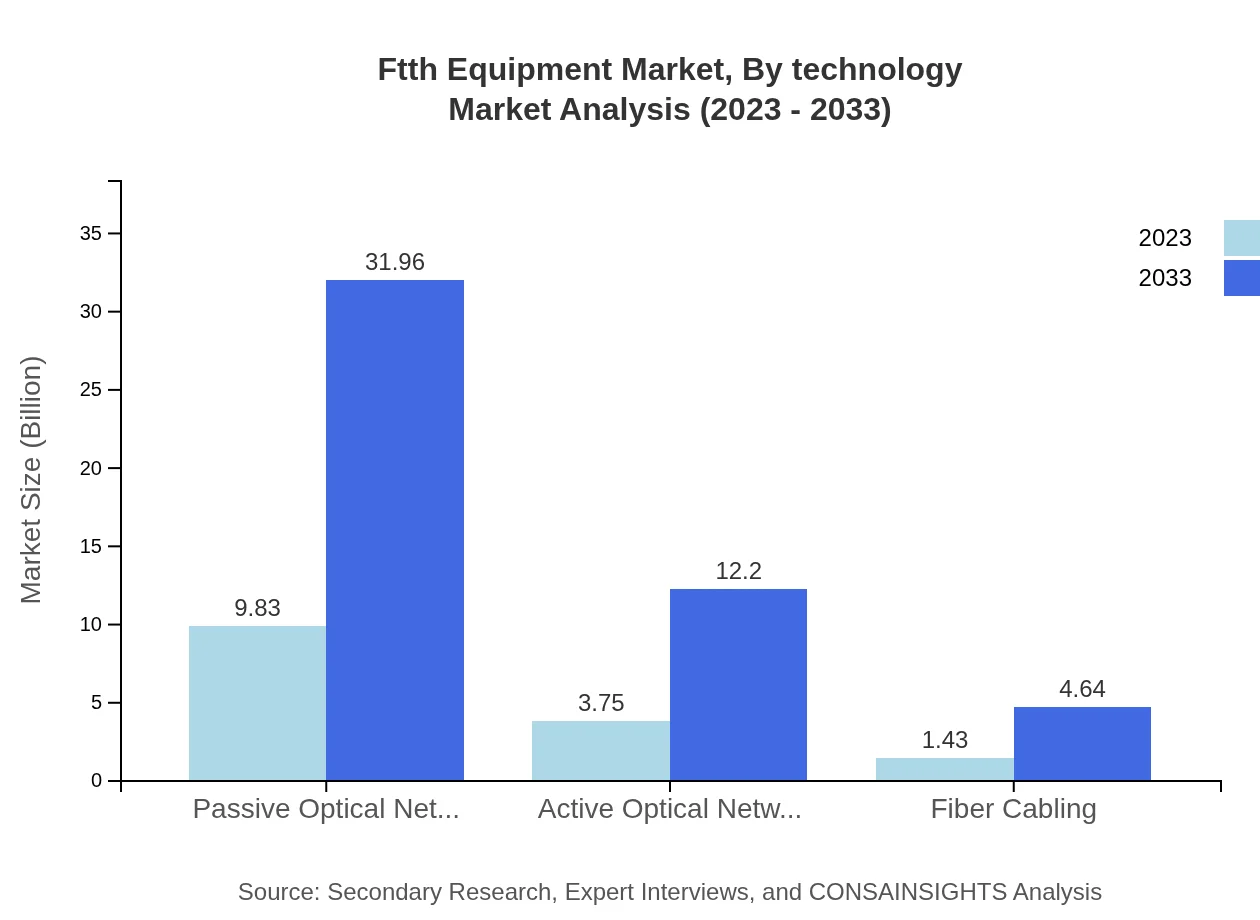

Ftth Equipment Market Analysis By Technology

In the FTTH Equipment market, the Passive Optical Network (PON) segment dominates due to its efficiency and cost-effectiveness in bandwidth distribution. PON accounts for approximately 65.5% of the market share in 2023, expected to remain stable through 2033, driven by continuous technological enhancements. The Active Optical Network (AON) segment, while smaller at 25%, is witnessing growth as enterprises seek more flexible bandwidth solutions.

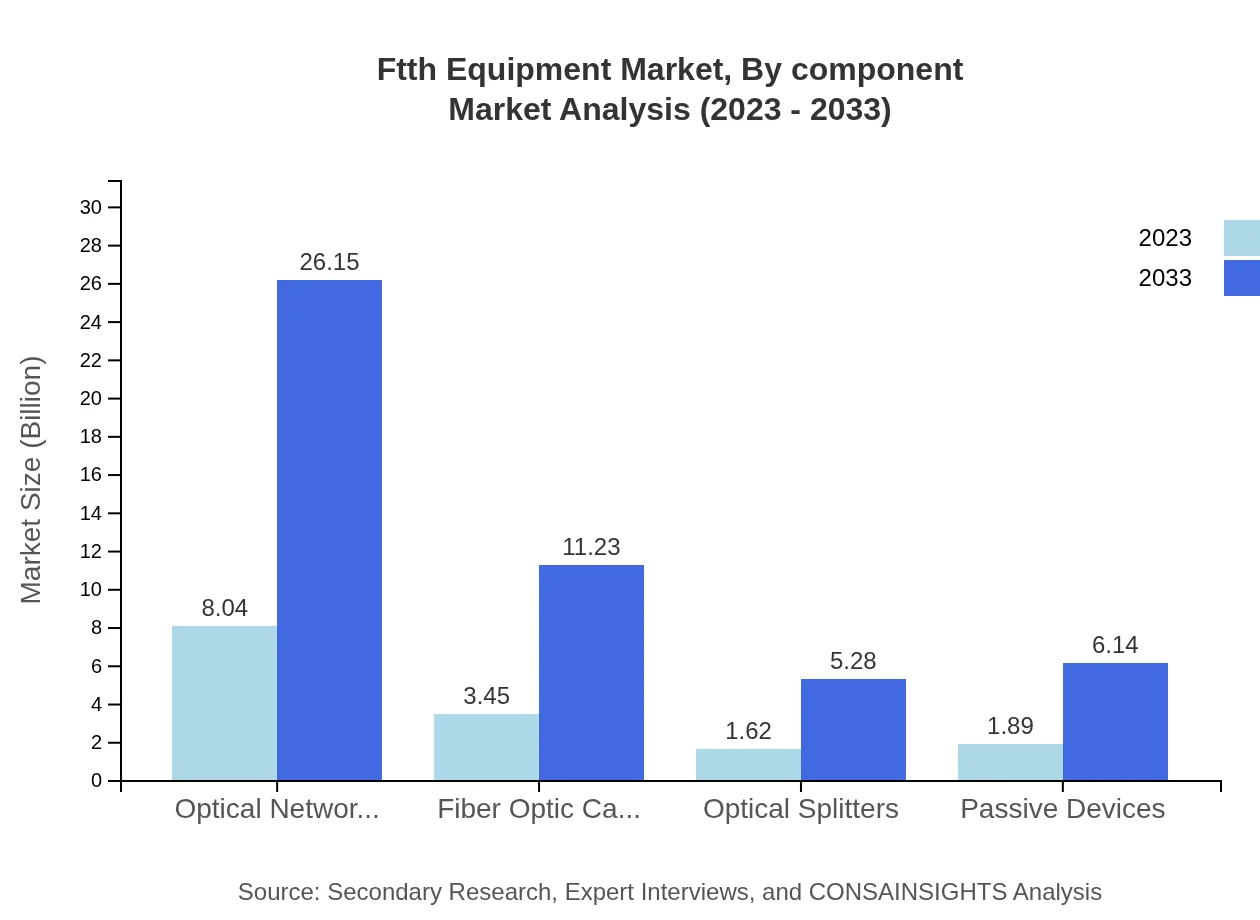

Ftth Equipment Market Analysis By Component

The FTTH Equipment market is heavily influenced by key components such as Optical Network Units (ONUs), which comprise a significant portion at 53.58% market share in 2023, expected to grow substantially. Fiber Optic Cables and Optical Splitters also play crucial roles in the infrastructure. The demand for advanced passive devices is increasing as operators seek more efficient solutions.

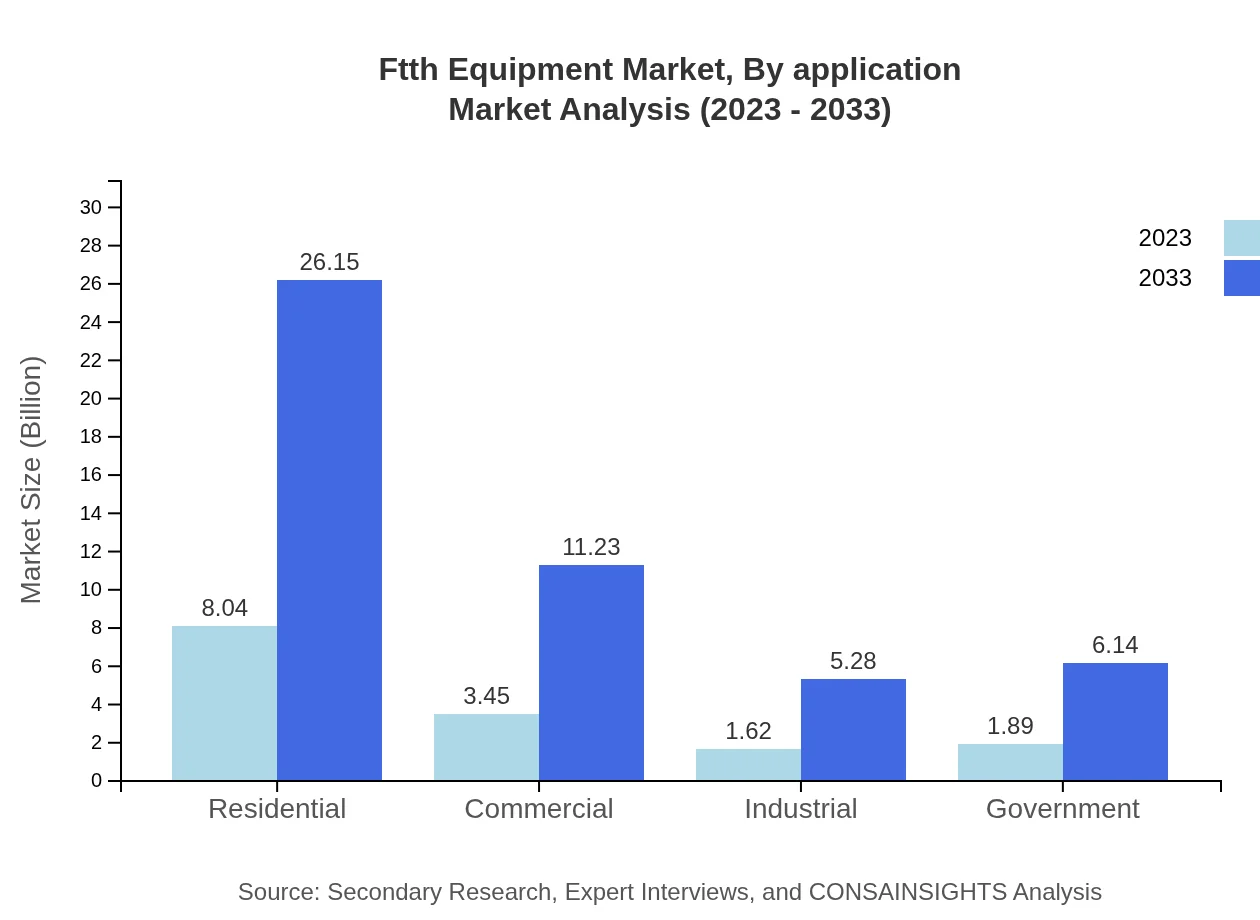

Ftth Equipment Market Analysis By Application

The residential sector is the largest application segment, holding over 53.58% of the market share in 2023, showing robust growth due to rising internet demands from households. The commercial segment follows, driven by digital transformation initiatives, enhancing overall connectivity solutions for businesses, while government applications are also gaining traction, promoting broadband access.

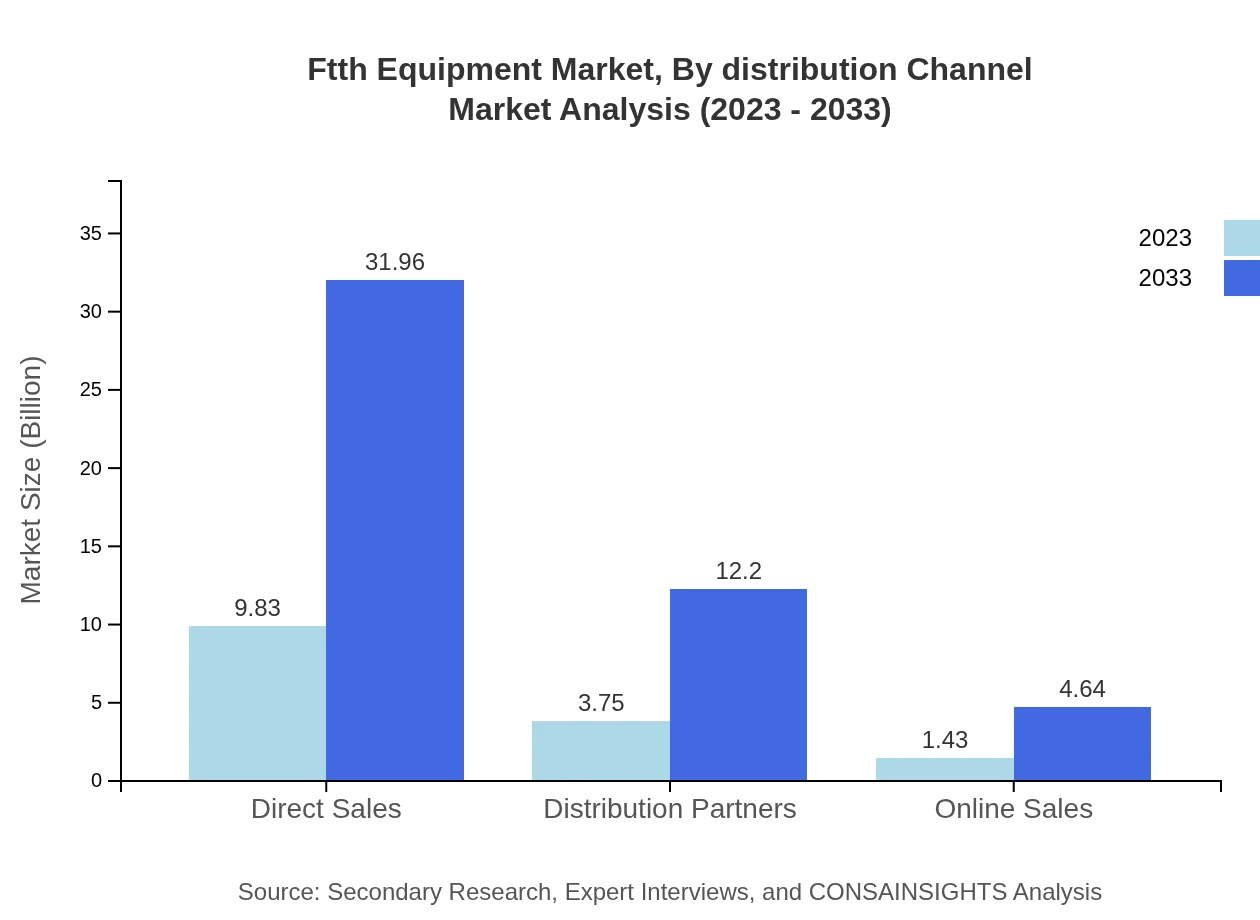

Ftth Equipment Market Analysis By Distribution Channel

Direct Sales lead in the distribution channels, comprising around 65.5% of total sales in 2023, reflecting direct engagement with customers. Distribution partners and online sales channels are also prominent, growing slowly as e-commerce becomes more entrenched in equipment sales, providing flexibility for customers.

Ftth Equipment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ftth Equipment Industry

Cisco Systems, Inc.:

A leader in networking solutions, Cisco offers a comprehensive range of FTTH equipment, including routers and switches that optimize broadband delivery.Nokia Corporation:

Nokia specializes in telecommunications equipment and services, focusing heavily on innovations in fiber optics and network efficiency.Huawei Technologies Co., Ltd.:

Huawei is a major player in FTTH solutions, providing comprehensive network equipment and services tailored for broadband operators globally.Calix, Inc.:

Calix is renowned for its cloud and software solutions that enhance the performance and management of residential broadband networks.Adtran, Inc.:

Adtran offers advanced networking solutions focusing on fiber connectivity and network transformation for service providers.We're grateful to work with incredible clients.

FAQs

What is the market size of FTTH equipment?

The FTTH Equipment market is projected to reach $15 billion in 2033, growing from $5 billion in 2023, reflecting a CAGR of 12% over the period, underscoring significant expansion in the telecommunications infrastructure.

What are the key market players or companies in the FTTH equipment industry?

The FTTH equipment sector features major players like Nokia, Huawei, Cisco, ZTE, and Fujitsu, which are key innovators, driving advances in fiber-optic technology and expanding service capabilities globally.

What are the primary factors driving the growth in the FTTH equipment industry?

Growth in the FTTH equipment industry is primarily driven by rising demands for high-speed internet, the proliferation of cloud services, and increased investments in telecommunications infrastructure globally, catering to both residential and commercial needs.

Which region is the fastest Growing in the FTTH equipment market?

The fastest-growing region in the FTTH equipment market is North America, with projected growth from $5.01 billion in 2023 to $16.31 billion by 2033, indicating robust investments in fiber-optic network expansion.

Does ConsaInsights provide customized market report data for the FTTH equipment industry?

Yes, ConsaInsights offers customized market report data tailored to client-specific needs in the FTTH equipment industry, ensuring insightful analytics and strategic recommendations based on the latest market trends.

What deliverables can I expect from this FTTH equipment market research project?

From the FTTH equipment market research project, you can expect comprehensive reports, data analytics, market forecasts, competitive landscape reviews, and strategic insights tailored to support decision-making processes.

What are the market trends of FTTH equipment?

Key trends in the FTTH equipment market include increasing demand for higher bandwidth solutions, advancements in passive optical networks (PON), and a shift towards more sustainable and energy-efficient technologies.