Functional Ingredients Market Report

Published Date: 31 January 2026 | Report Code: functional-ingredients

Functional Ingredients Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Functional Ingredients market, including market trends, segmentation, growth forecasts, and regional analysis from 2023 to 2033. Insights cover market size, segmentation by ingredient type, application, and distribution channels.

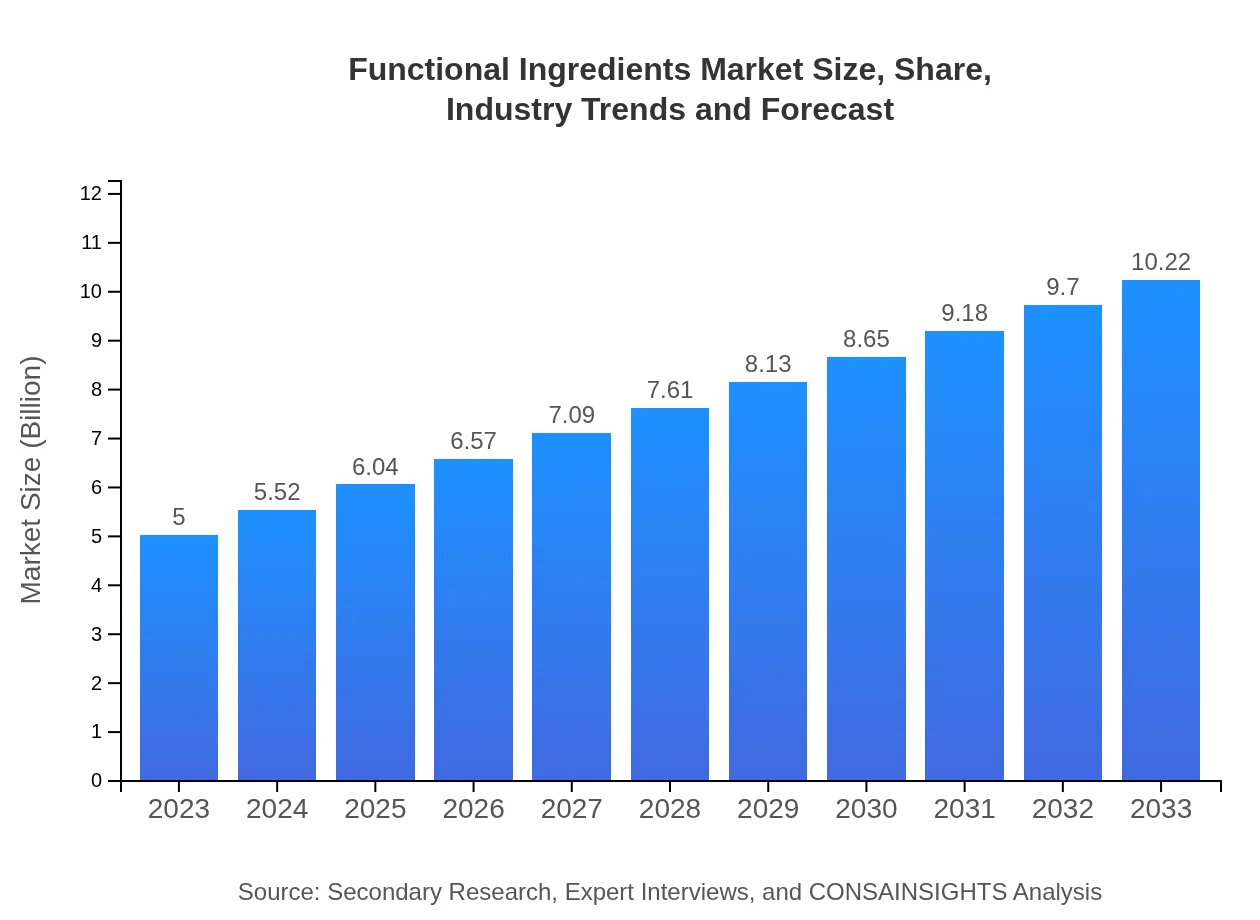

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.00 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $10.22 Billion |

| Top Companies | BASF SE, DuPont de Nemours, Inc., Archer Daniels Midland Company, Ginkgo BioWorks, Otsuka Pharmaceutical Co. Ltd. |

| Last Modified Date | 31 January 2026 |

Functional Ingredients Market Overview

Customize Functional Ingredients Market Report market research report

- ✔ Get in-depth analysis of Functional Ingredients market size, growth, and forecasts.

- ✔ Understand Functional Ingredients's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Functional Ingredients

What is the Market Size & CAGR of Functional Ingredients market in 2023?

Functional Ingredients Industry Analysis

Functional Ingredients Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Functional Ingredients Market Analysis Report by Region

Europe Functional Ingredients Market Report:

Europe is witnessing a remarkable growth trajectory, increasing from $1.31 billion in 2023 to $2.69 billion by 2033. The European market is also characterized by robust regulations that promote safety and efficacy in functional ingredients, driving consumer trust.Asia Pacific Functional Ingredients Market Report:

The Asia Pacific region exhibits significant growth, projected to expand from $0.99 billion in 2023 to $2.02 billion by 2033. The demand in this region is powered by a growing middle-class population emphasizing health and wellness and a shift towards more health-oriented dietary habits, particularly in countries like China and India.North America Functional Ingredients Market Report:

North America commands a substantial market share, with the market size expected to grow from $1.77 billion in 2023 to $3.63 billion in 2033. The US and Canada are leading the market due to high consumer health awareness and a well-established health supplement market.South America Functional Ingredients Market Report:

In South America, the Functional Ingredients market is also on the rise, expected to increase from $0.47 billion in 2023 to $0.95 billion by 2033. This growth is attributed to the rising interest in organic and natural ingredients among consumers and an increase in health-related food products.Middle East & Africa Functional Ingredients Market Report:

The Middle East and Africa show promising growth prospects in the Functional Ingredients market, with expectations to grow from $0.46 billion in 2023 to $0.93 billion by 2033. Factors such as rising disposable incomes and health consciousness among consumers are pivotal in driving this trend.Tell us your focus area and get a customized research report.

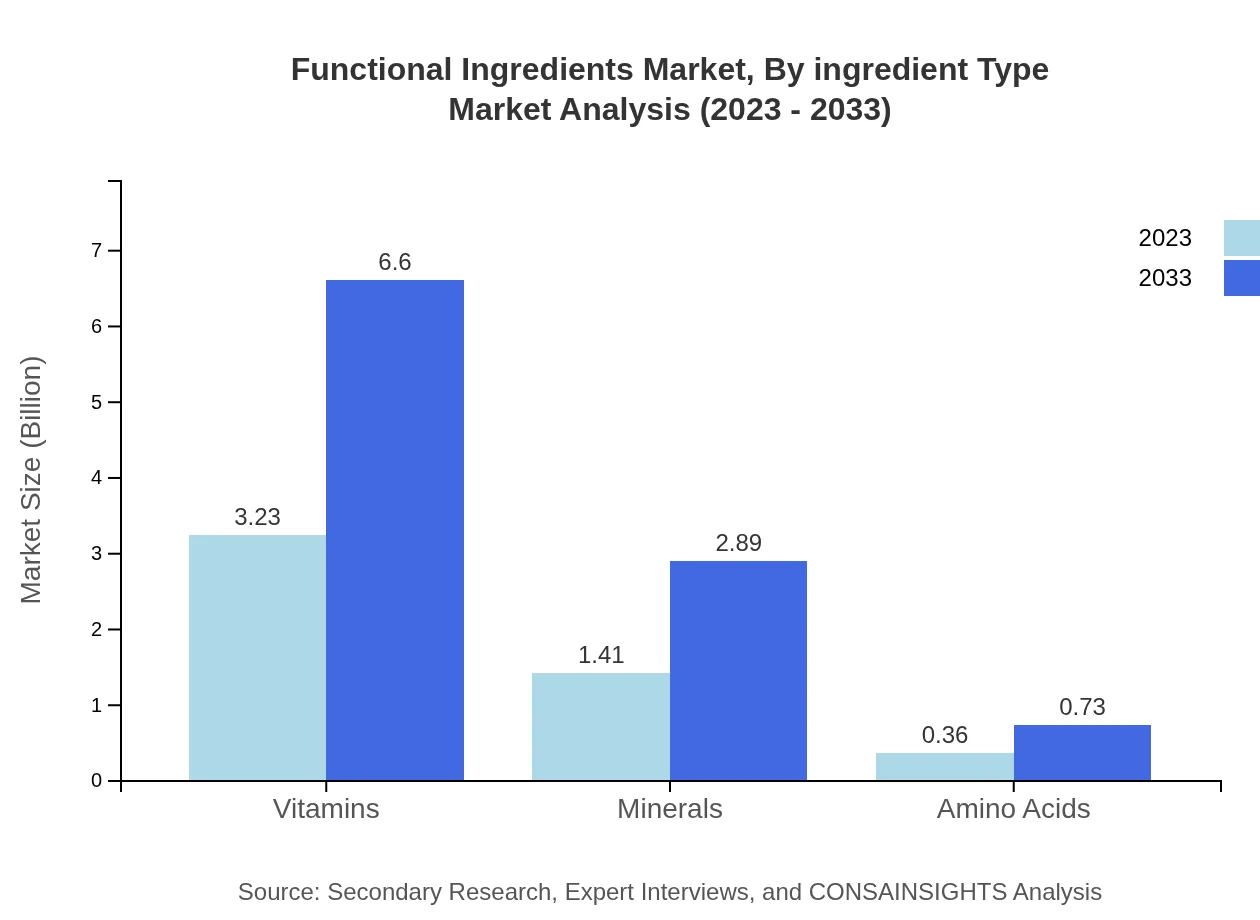

Functional Ingredients Market Analysis By Ingredient Type

The market by ingredient type is dominated by vitamins, which accounted for approximately $3.23 billion in 2023 and is projected to reach $6.60 billion by 2033, with a market share of 64.54%. Following vitamins, minerals contribute significantly to the market, starting at $1.41 billion in 2023 and reaching $2.89 billion by 2033, holding 28.29% market share. Other notable segments include amino acids and probiotics which are gaining traction due to their associated health benefits.

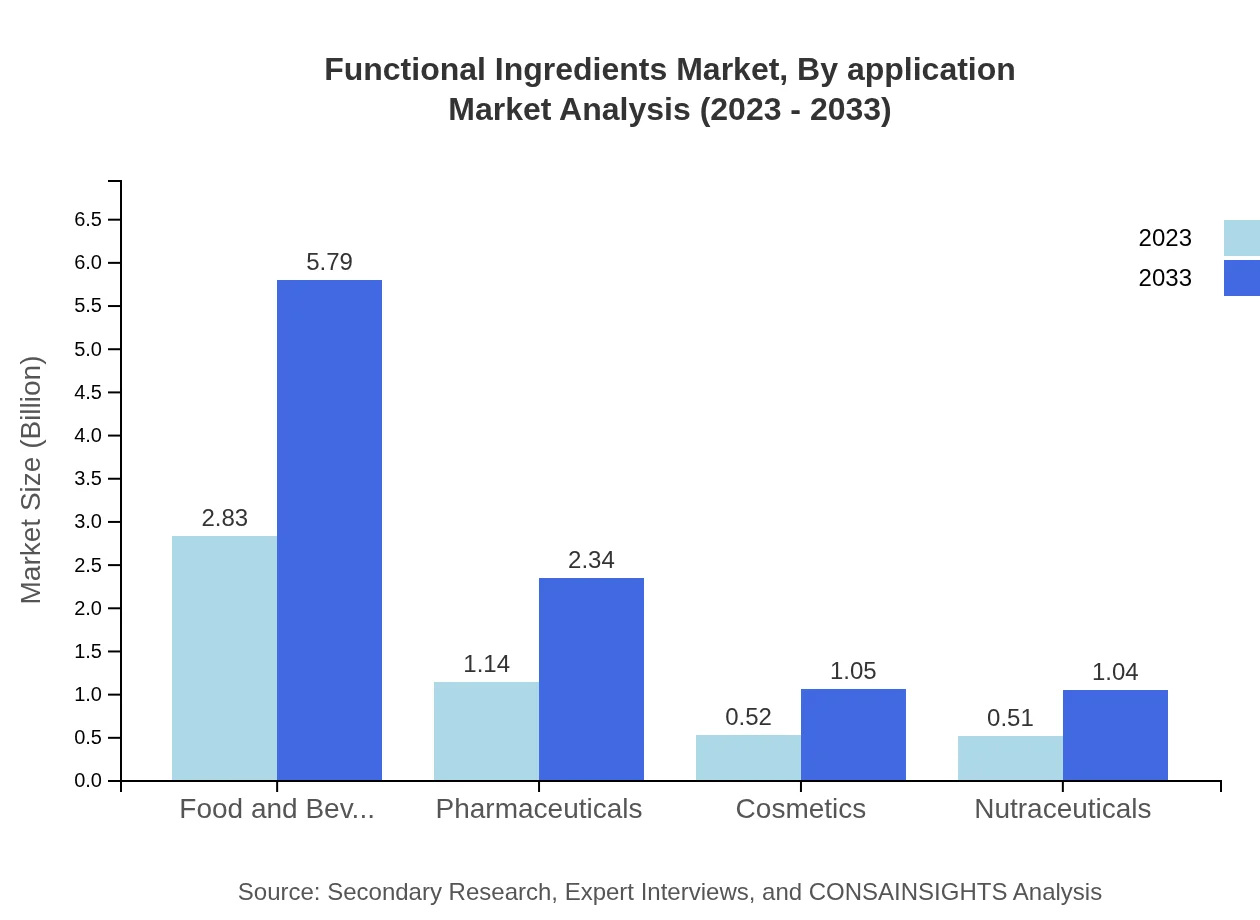

Functional Ingredients Market Analysis By Application

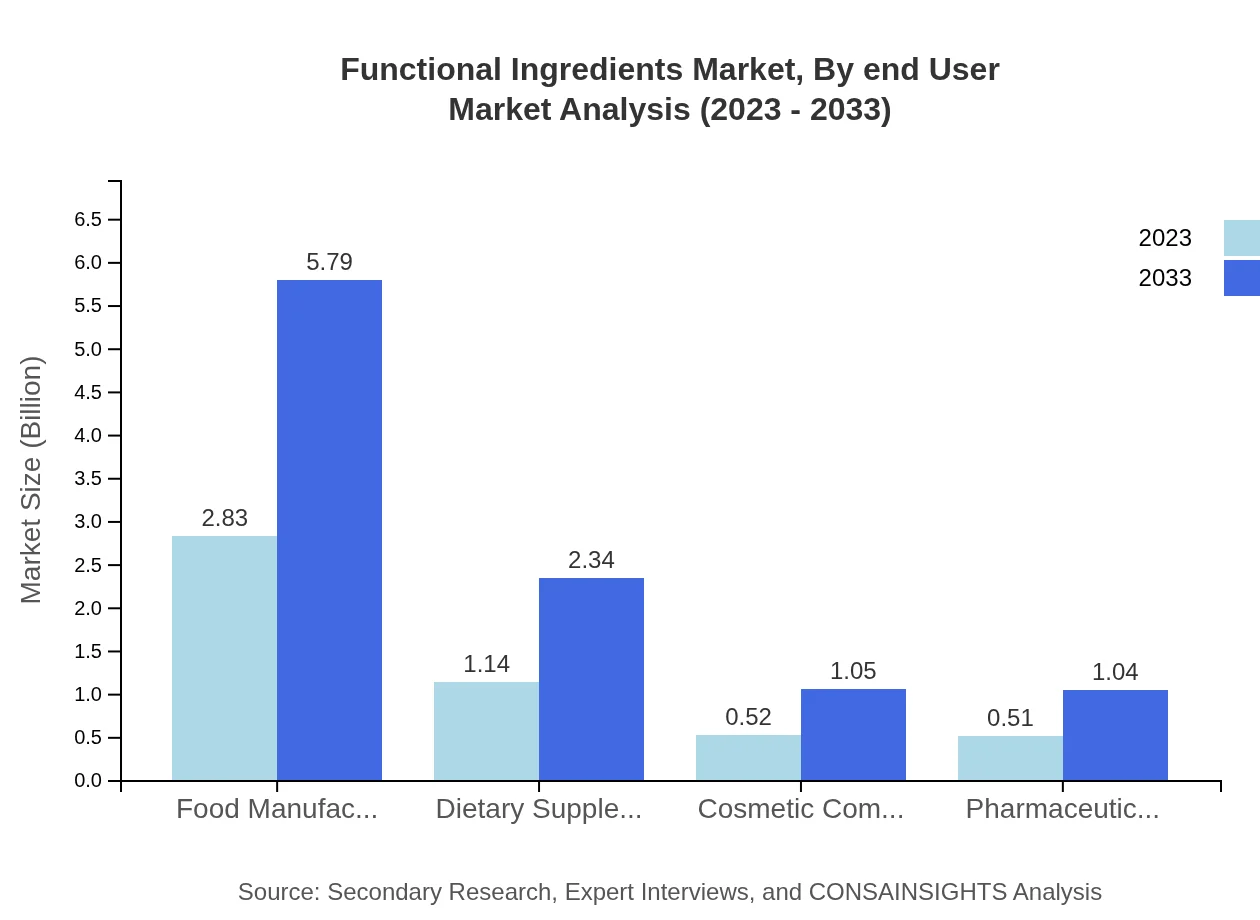

The food and beverage sector predominates the application segment, representing $2.83 billion in 2023, highlighting its significant role in incorporating functional ingredients, expanding to $5.79 billion by 2033 with a stable share of 56.64%. Dietary supplements are also critical, initially valued at $1.14 billion and expected to double by 2033, indicating the rising inclination towards self-medication and preventive health.

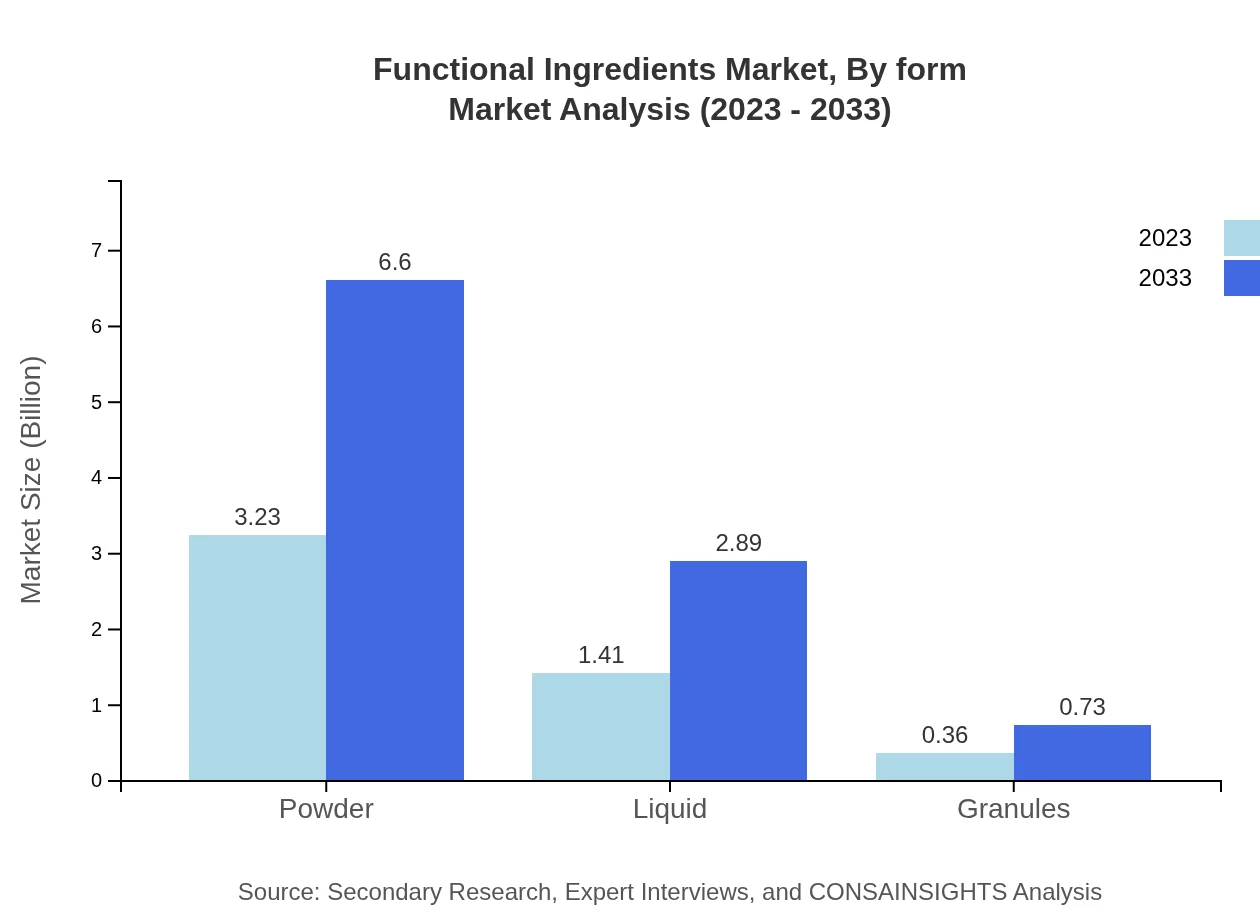

Functional Ingredients Market Analysis By Form

In the form segmentation, powder forms lead the market with a size of $3.23 billion in 2023, surging to $6.60 billion by 2033, maintaining a substantial share of 64.54%. Liquids also represent a significant portion, growing from $1.41 billion to $2.89 billion within the forecast period. Granules occupy a smaller share but are expected to see a gradual increase in relevance among manufacturers aiming for product diversity.

Functional Ingredients Market Analysis By End User

Food manufacturers are the largest end-users, with a market size of $2.83 billion in 2023 and expected growth to $5.79 billion by 2033, dominating with a 56.64% share. This indicates consistent demand from food and beverage industries to enhance product value. Dietary supplement companies are also significant players, expected to grow to $2.34 billion due to rising health awareness.

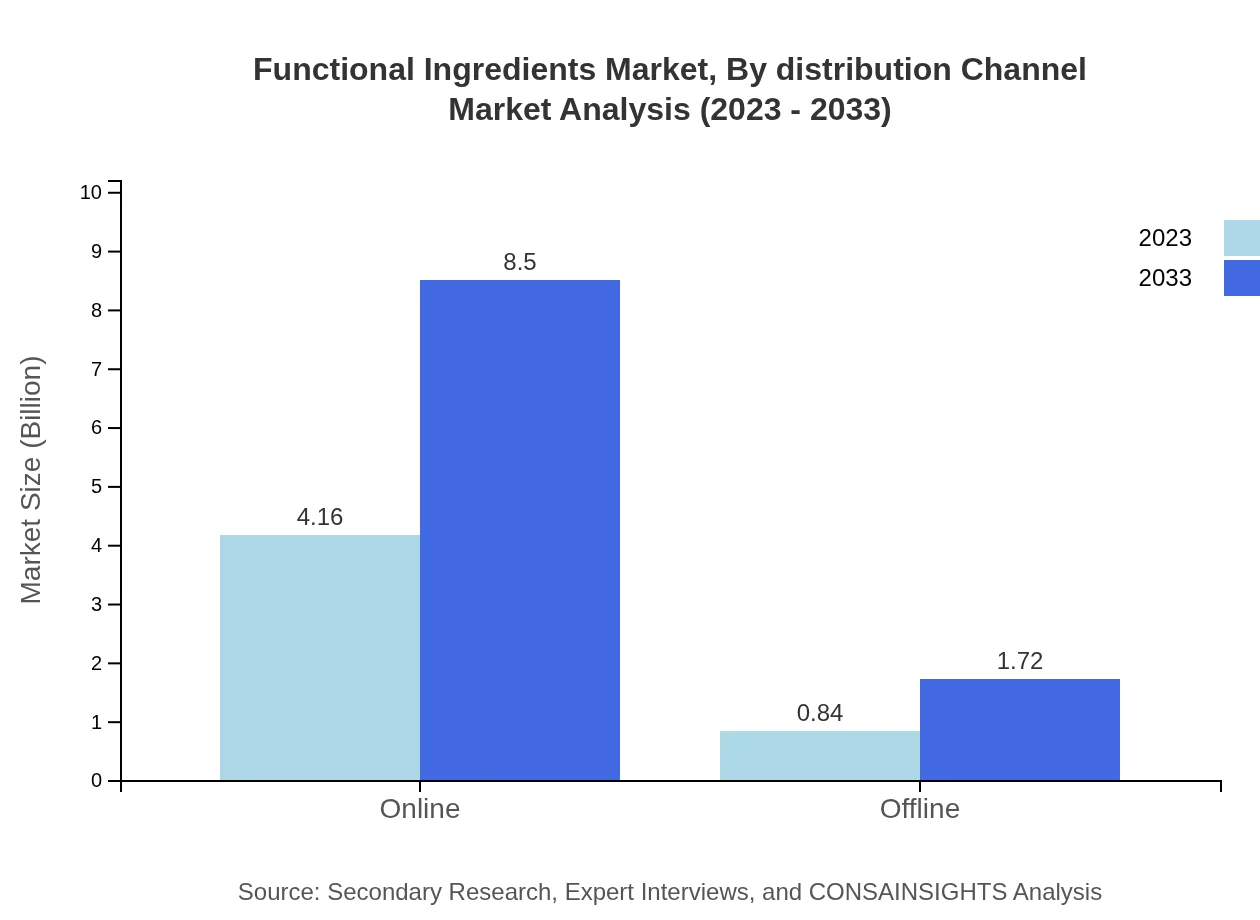

Functional Ingredients Market Analysis By Distribution Channel

The distribution channel analysis indicates a strong preference for online sales, accounting for $4.16 billion in 2023 and growing to $8.50 billion by 2033, representing 83.19% share. Offline channels, while lesser-used, still show potential growth, increasing from $0.84 billion to $1.72 billion as consumers continue to seek personalized shopping experiences.

Functional Ingredients Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Functional Ingredients Industry

BASF SE:

A leading global chemical company, BASF offers a wide range of functional ingredients for food, pharmaceuticals, and personal care, known for its innovative solutions and sustainability initiatives.DuPont de Nemours, Inc.:

DuPont is a key player in the functional ingredients market, providing high-quality products backed by rigorous science and research aimed at enhancing product formulations across various industries.Archer Daniels Midland Company:

One of the world's largest agricultural processors and food ingredient providers, ADM focuses on functional ingredients that improve product quality while actively promoting health benefits.Ginkgo BioWorks:

Specializing in biotechnology, Ginkgo offers a platform for programming cells to produce cultured functional ingredients, emphasizing sustainability and precision fermentation.Otsuka Pharmaceutical Co. Ltd.:

Otsuka is known for its contributions to health and wellness, producing functional ingredients particularly in dietary supplements and pharmaceuticals with a strong focus on research.We're grateful to work with incredible clients.

FAQs

What is the market size of functional Ingredients?

The functional ingredients market is projected to reach approximately $5 billion in 2023, with a compound annual growth rate (CAGR) of 7.2%, indicating a robust growth trajectory through 2033.

What are the key market players or companies in this functional Ingredients industry?

Key players in the functional ingredients market include prominent companies specializing in nutraceuticals and food manufacturing. Innovation and product development are central strategies employed by these organizations to capture market share.

What are the primary factors driving the growth in the functional Ingredients industry?

Growth is primarily driven by rising health consciousness among consumers, increasing demand for natural ingredients, and the burgeoning nutraceuticals market. Additionally, advancements in technology and research enhance the efficacy of functional ingredients.

Which region is the fastest Growing in the functional Ingredients?

The Asia Pacific region is experiencing rapid growth within the functional ingredients market, projected to expand from $0.99 billion in 2023 to $2.02 billion by 2033, highlighting a strong CAGR bolstered by increasing population and health awareness.

Does ConsaInsights provide customized market report data for the functional Ingredients industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the functional ingredients industry, ensuring comprehensive insights that align with unique business objectives and strategic goals.

What deliverables can I expect from this functional Ingredients market research project?

Deliverables include detailed market analysis, growth forecasts, competitive landscape assessments, segmented insights, and tailored recommendations, all designed to empower strategic decision-making and enhance market positioning.

What are the market trends of functional Ingredients?

Current trends include a shift towards plant-based ingredients, increasing consumer demand for transparency in sourcing, and an emphasis on product fortification. Additionally, online sales channels are gaining prominence as e-commerce thrives in this sector.