Functional Nonmeat Ingredients Market Report

Published Date: 31 January 2026 | Report Code: functional-nonmeat-ingredients

Functional Nonmeat Ingredients Market Size, Share, Industry Trends and Forecast to 2033

This report evaluates the Functional Nonmeat Ingredients market, providing insights into market dynamics from 2023 to 2033, including size, growth trends, and regional performance, along with a comprehensive analysis of key industry players and market segmentation.

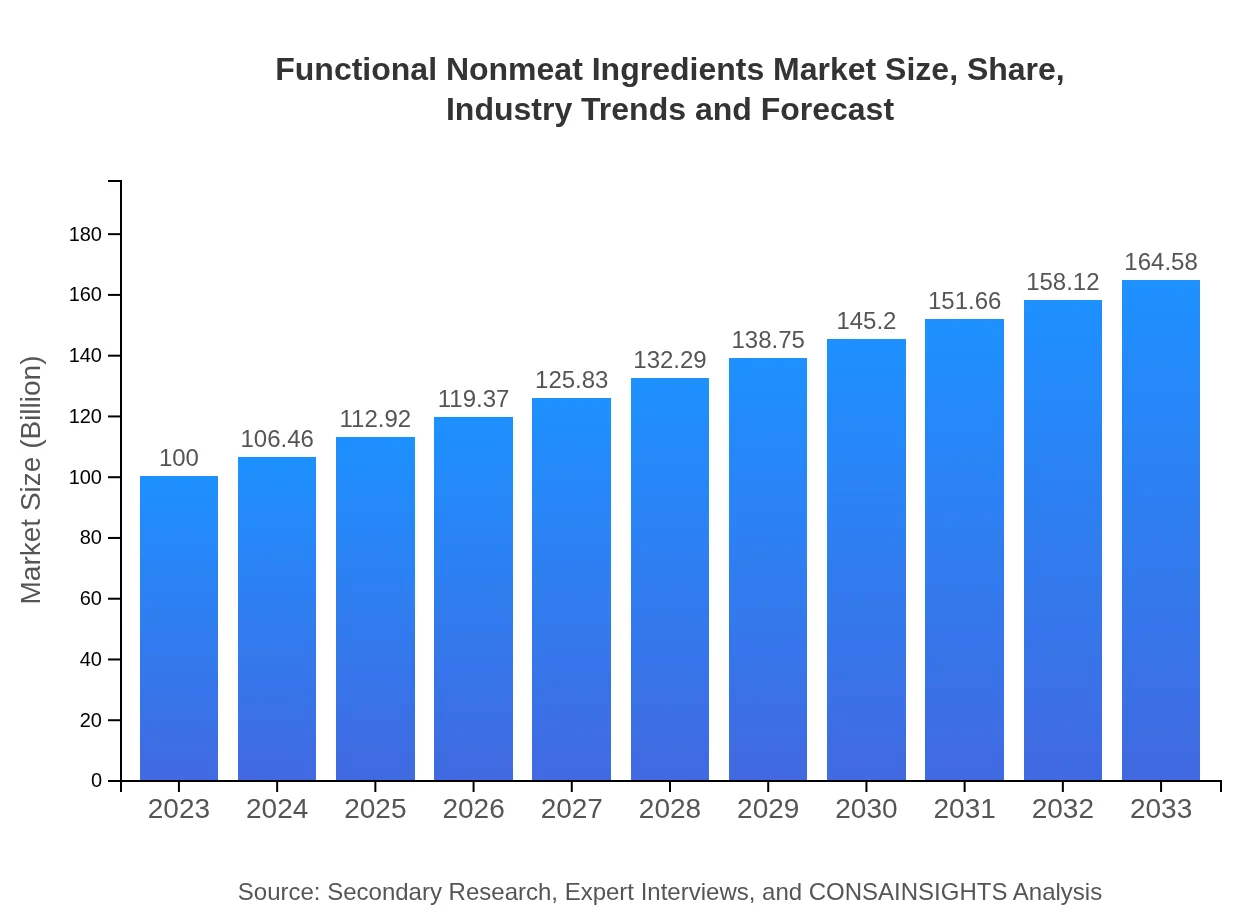

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $100.00 Million |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $164.58 Million |

| Top Companies | Ingredion Incorporated, DuPont de Nemours, Inc., Cargill, Incorporated, Archer Daniels Midland Company |

| Last Modified Date | 31 January 2026 |

Functional Nonmeat Ingredients Market Overview

Customize Functional Nonmeat Ingredients Market Report market research report

- ✔ Get in-depth analysis of Functional Nonmeat Ingredients market size, growth, and forecasts.

- ✔ Understand Functional Nonmeat Ingredients's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Functional Nonmeat Ingredients

What is the Market Size & CAGR of Functional Nonmeat Ingredients market in 2023?

Functional Nonmeat Ingredients Industry Analysis

Functional Nonmeat Ingredients Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Functional Nonmeat Ingredients Market Analysis Report by Region

Europe Functional Nonmeat Ingredients Market Report:

Europe, valuing at $32.21 billion in 2023 and expected to reach $53.01 billion by 2033, is characterized by high consumer awareness regarding healthy eating habits. The European market is also leading in product innovation concerning plant-based and functional foods, compelling manufacturers to adopt advanced ingredient solutions.Asia Pacific Functional Nonmeat Ingredients Market Report:

The Asia Pacific region is burgeoning with growth, having a market size of approximately $19.12 billion in 2023, expected to expand to $31.47 billion by 2033. The rising popularity of plant-based diets, coupled with an increase in health awareness, is fueling this growth. Additionally, urbanization and an increase in dollar spending on food products are also contributing factors.North America Functional Nonmeat Ingredients Market Report:

North America commands the largest market share with a valuation of $33.56 billion in 2023, projected to rise to $55.23 billion by 2033. The robust demand for plant-based food products and established distribution channels are significant contributors to its market leadership. Health-conscious consumers are pushing food manufacturers toward innovative ingredient solutions.South America Functional Nonmeat Ingredients Market Report:

In South America, the market is set to grow from $3.84 billion in 2023 to $6.32 billion by 2033. Increasing incidences of lifestyle diseases and a rising trend toward plant-based diets are driving the demand for functional ingredients. The region is also witnessing a surge in local producers emphasizing the use of natural and functional nonmeat ingredients.Middle East & Africa Functional Nonmeat Ingredients Market Report:

The Middle East and Africa market is witnessing growth from $11.27 billion in 2023 to $18.55 billion by 2033, supported by the rising number of health-conscious consumers and awareness about balanced diets. The growing hospitality industry in this region also plays a major role in enhancing the demand for functional ingredients.Tell us your focus area and get a customized research report.

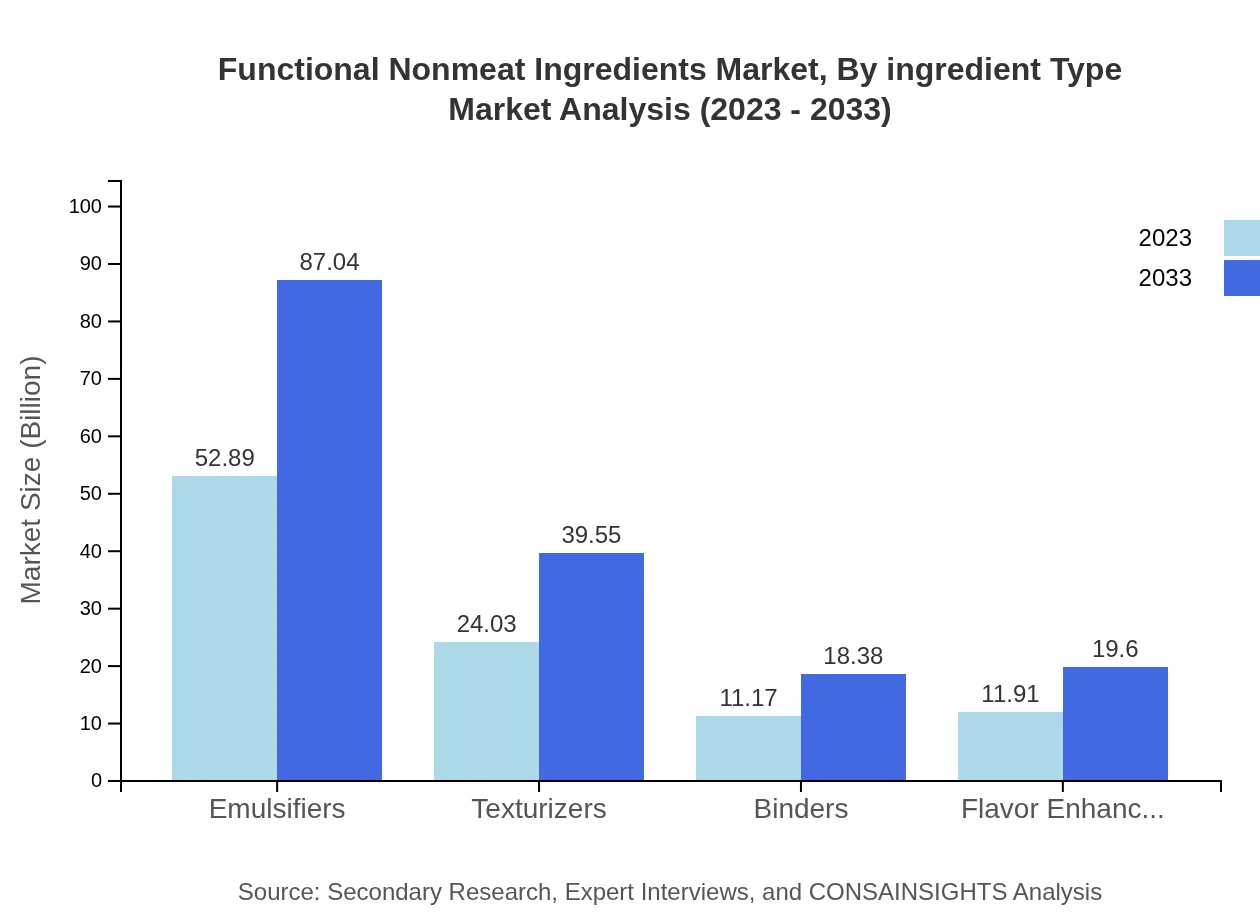

Functional Nonmeat Ingredients Market Analysis By Ingredient Type

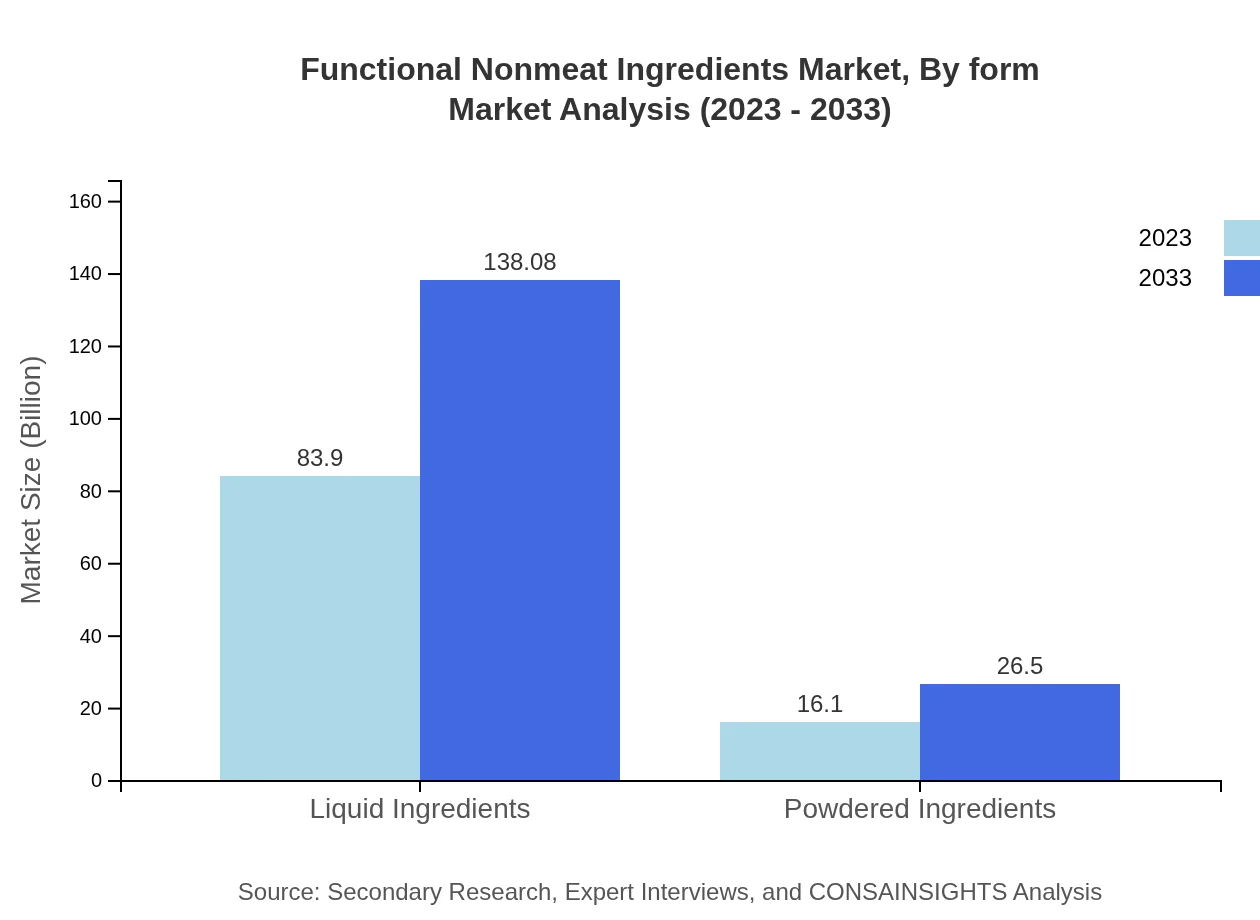

Liquid Ingredients valued at $83.90 billion in 2023 and projected to grow to $138.08 billion by 2033. Powdered Ingredients, on the other hand, are expected to expand from $16.10 billion in 2023 to $26.50 billion by 2033. Notably, emulsifiers, texturizers, and flavor enhancers are critical in various applications, contributing significantly to the market size.

Functional Nonmeat Ingredients Market Analysis By Application

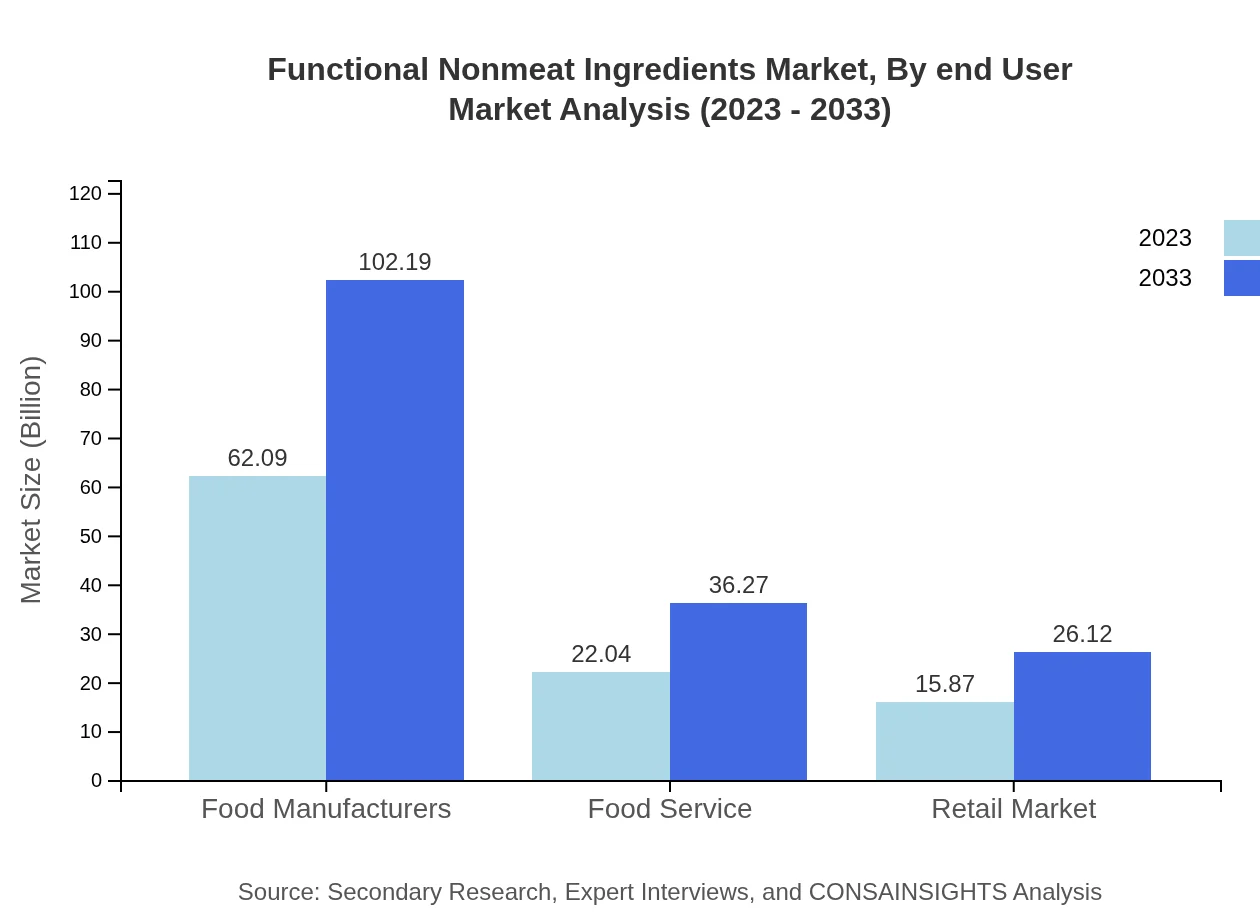

The market by application is significantly driven by Food Manufacturers, which comprised $62.09 billion in 2023, expected to grow to $102.19 billion by 2033. Food Service valued at $22.04 billion is also growing, as is the Retail Market, forecasted to advance from $15.87 billion in 2023 to $26.12 billion by 2033.

Functional Nonmeat Ingredients Market Analysis By End User

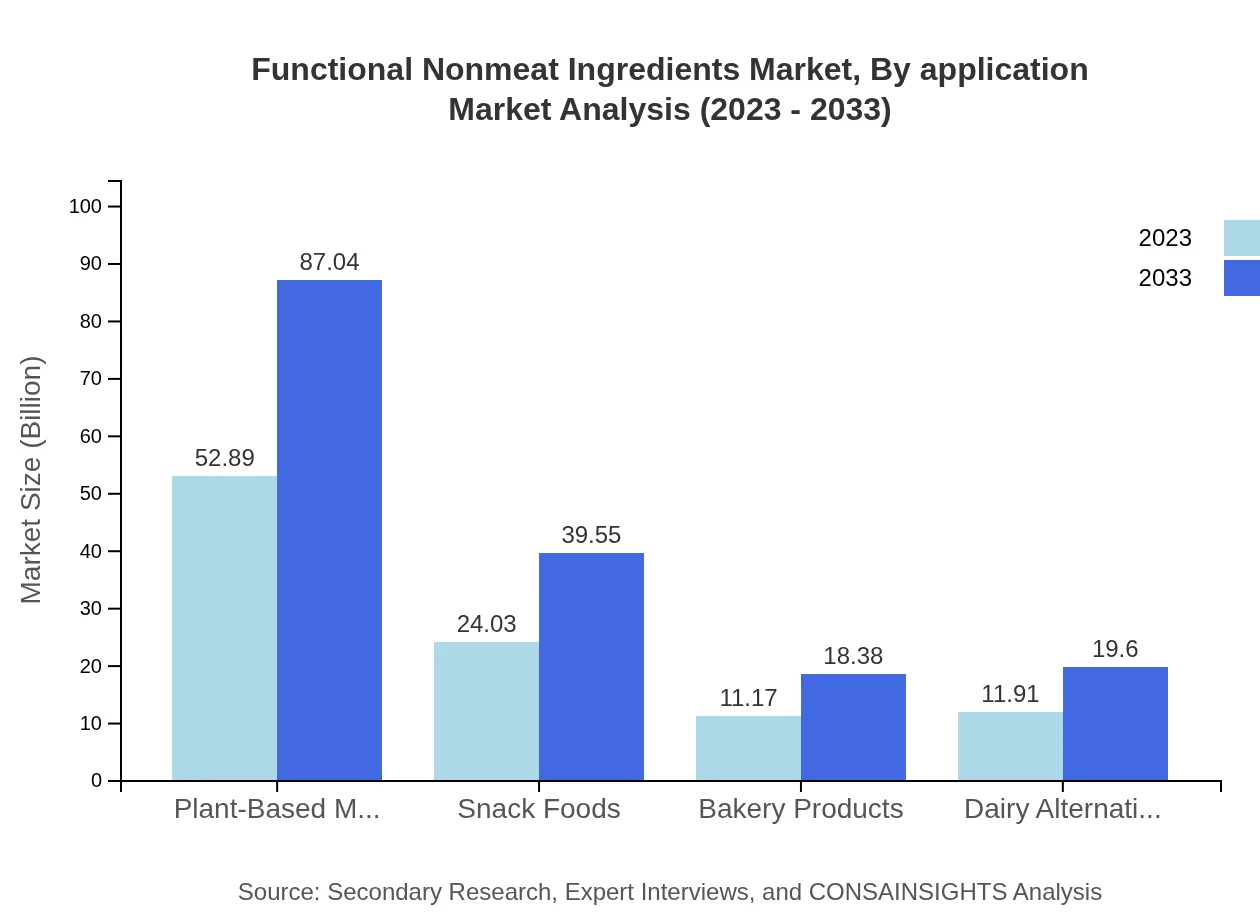

End-users are diversified across several sectors including Plant-Based Meat, which is set to see substantial growth from $52.89 billion in 2023 to $87.04 billion by 2033, alongside continued interest in Snack Foods and Dairy Alternatives, indicating robust growth dynamics within this market.

Functional Nonmeat Ingredients Market Analysis By Form

The market by form exhibits diverse needs: for instance, Emulsifiers and Texturizers are both experiencing growth, with Emulsifiers increasing from $52.89 billion to $87.04 billion, while Texturizers rise from $24.03 billion to $39.55 billion through 2033. Binders and flavor enhancers also maintain a steady performance.

Functional Nonmeat Ingredients Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Functional Nonmeat Ingredients Industry

Ingredion Incorporated:

A leading global ingredient solutions company, Ingredion offers innovative and multifunctional ingredients across various food applications enhancing texture and flavor.DuPont de Nemours, Inc.:

Known for its advancements in food technology, DuPont supplies a range of functional ingredients aimed at improving nutrition and sustainability in food products.Cargill, Incorporated:

Cargill is a major player in supplying a broad array of functional ingredients and additives, emphasizing food safety and nutritional quality.Archer Daniels Midland Company:

ADM has committed to sustainable practices in food production and offers a rich portfolio of plant-based ingredients used in nonmeat products.We're grateful to work with incredible clients.

FAQs

What is the market size of Functional Nonmeat Ingredients?

The Global Functional Nonmeat Ingredients market is currently valued at approximately $100 million and is projected to grow at a CAGR of 5% over the next decade, indicating robust growth potential and strong market demand.

What are the key market players or companies in this Functional Nonmeat Ingredients industry?

Key players in the Functional Nonmeat Ingredients market include prominent companies and manufacturers that lead in production, supply, and innovation within the industry, although specific names are not detailed here.

What are the primary factors driving the growth in the Functional Nonmeat Ingredients industry?

Growth in the Functional Nonmeat Ingredients industry is driven by increasing consumer demand for plant-based products, health awareness, and innovations in food technology that enhance texture and flavor without using meat.

Which region is the fastest Growing in the Functional Nonmeat Ingredients market?

The fastest-growing region in the Functional Nonmeat Ingredients market is Europe, with projections showing market growth from $32.21 million in 2023 to $53.01 million by 2033, reflecting an increasing trend toward plant-based diets.

Does ConsaInsights provide customized market report data for the Functional Nonmeat Ingredients industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the Functional Nonmeat Ingredients industry, ensuring clients receive targeted insights relevant to their business objectives.

What deliverables can I expect from this Functional Nonmeat Ingredients market research project?

Deliverables for the Functional Nonmeat Ingredients market research project typically include detailed market analyses, regional breakdowns, competitive assessments, and forecasts, ensuring comprehensive insights for strategic decision-making.

What are the market trends of Functional Nonmeat Ingredients?

Current trends in the Functional Nonmeat Ingredients market include a shift towards clean label products, increasing investments in plant-based alternatives, and growing consumer preferences for sustainable and nutritious food options.