Fungicidal Seed Treatment Market Report

Published Date: 02 February 2026 | Report Code: fungicidal-seed-treatment

Fungicidal Seed Treatment Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Fungicidal Seed Treatment market. It includes market size, trends, projections for 2023-2033, and insights into regional dynamics, technologies, and key players shaping this industry.

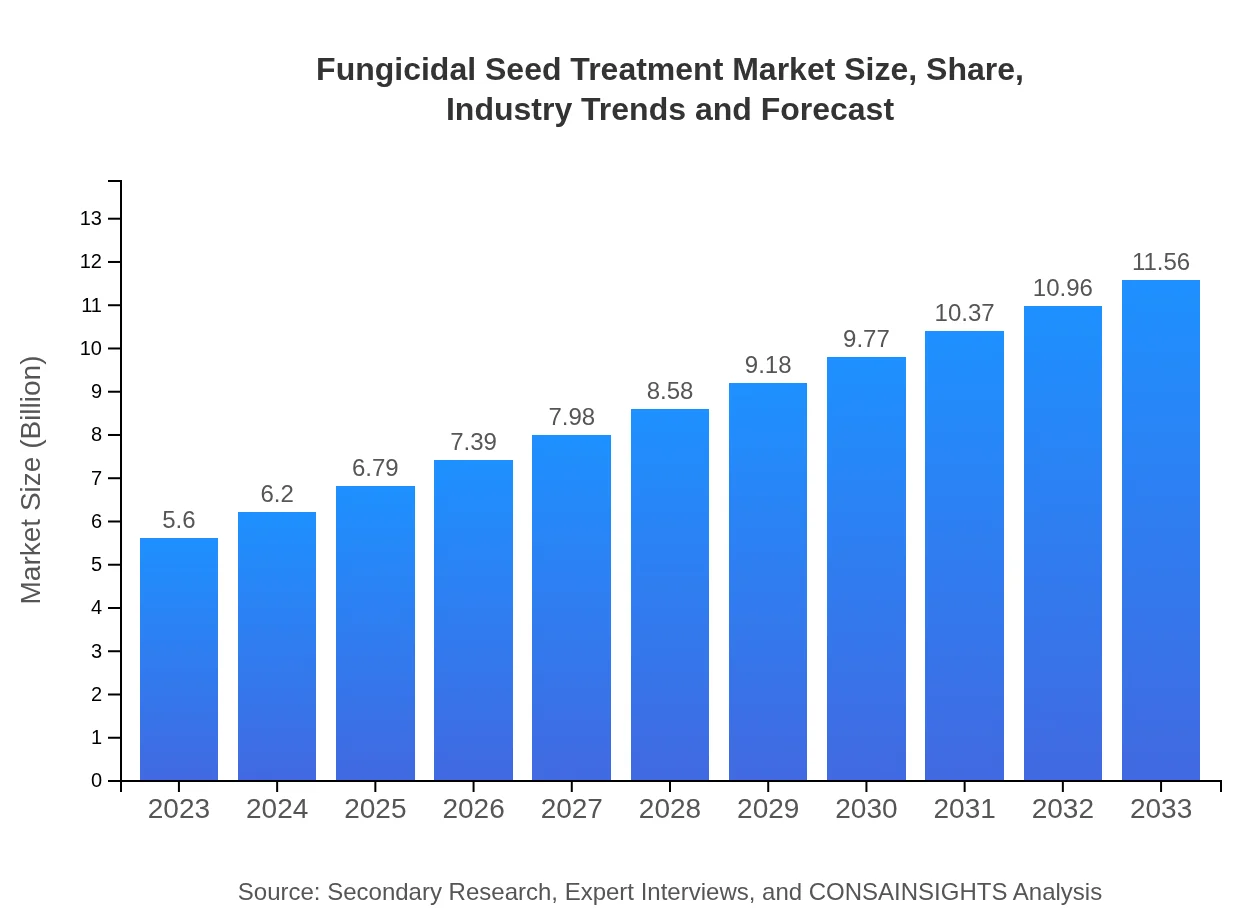

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 7.3% |

| 2033 Market Size | $11.56 Billion |

| Top Companies | BASF SE, Syngenta AG, Bayer AG, Corteva Agriscience, FMC Corporation |

| Last Modified Date | 02 February 2026 |

Fungicidal Seed Treatment Market Overview

Customize Fungicidal Seed Treatment Market Report market research report

- ✔ Get in-depth analysis of Fungicidal Seed Treatment market size, growth, and forecasts.

- ✔ Understand Fungicidal Seed Treatment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Fungicidal Seed Treatment

What is the Market Size & CAGR of Fungicidal Seed Treatment market in 2023 and 2033?

Fungicidal Seed Treatment Industry Analysis

Fungicidal Seed Treatment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Fungicidal Seed Treatment Market Analysis Report by Region

Europe Fungicidal Seed Treatment Market Report:

Europe's fungicidal seed treatment market was valued at $1.53 billion in 2023 and is estimated to reach $3.15 billion by 2033. Regulatory support for sustainable agriculture and emphasis on food quality in countries such as Germany and France drive this region's market.Asia Pacific Fungicidal Seed Treatment Market Report:

The Asia Pacific region represented a market size of $1.07 billion in 2023, projected to reach $2.20 billion by 2033. The growth is driven by the high agricultural activity in countries like India and China, alongside an increasing need for disease-resistant crop varieties.North America Fungicidal Seed Treatment Market Report:

The North American market stood at $1.88 billion in 2023, with projections of $3.89 billion by 2033, fueled by technological innovations and robust agricultural frameworks, primarily seen in the U.S. and Canada.South America Fungicidal Seed Treatment Market Report:

In South America, the market was valued at $0.46 billion in 2023, expected to grow to $0.95 billion by 2033. The agronomic practices in Brazil and Argentina are pivotal for this growth, linked to their vast agricultural landscapes and production of staple crops.Middle East & Africa Fungicidal Seed Treatment Market Report:

The Middle East and Africa market reported a size of $0.67 billion in 2023, anticipated to achieve $1.38 billion by 2033. The growing agricultural practices driven by food security concerns are laying the groundwork for market expansion in this region.Tell us your focus area and get a customized research report.

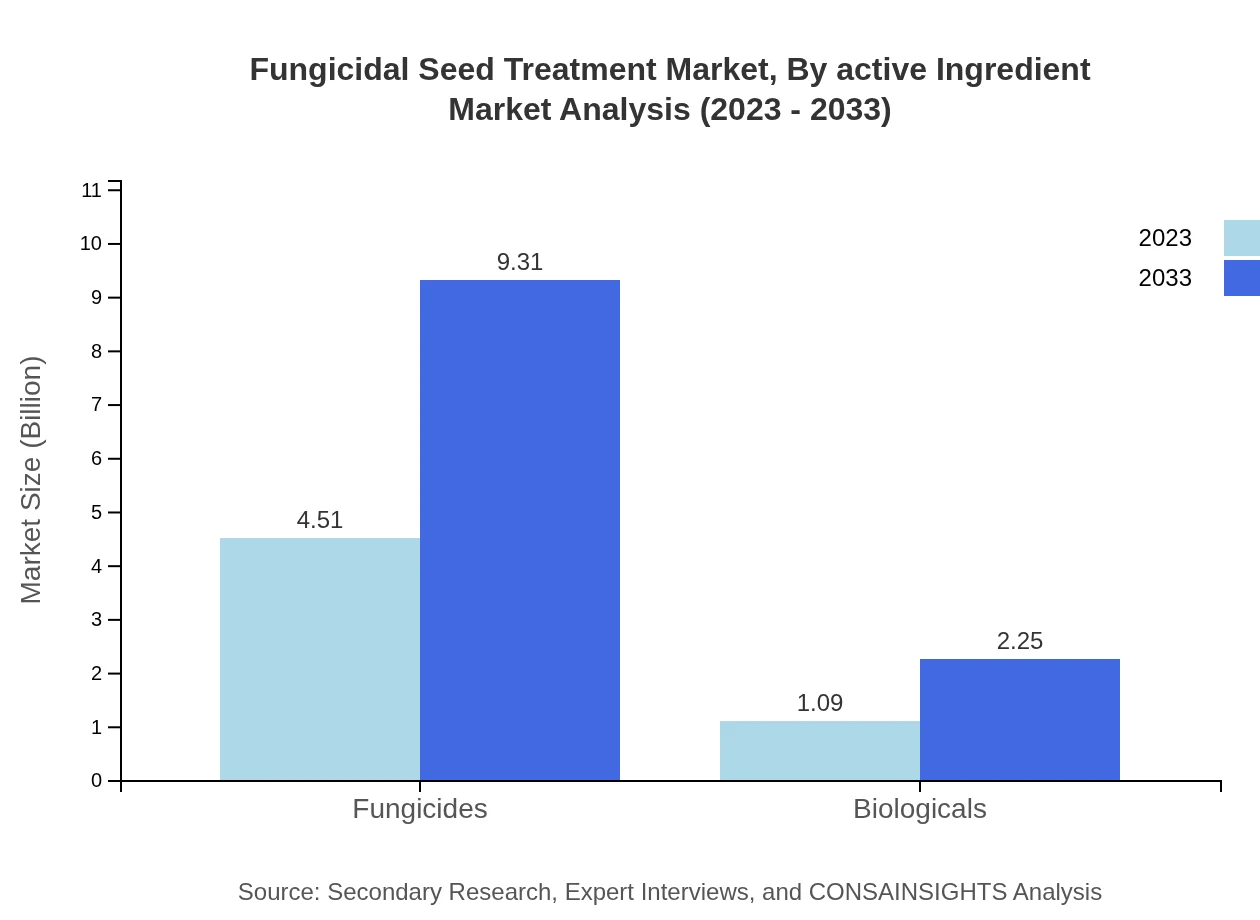

Fungicidal Seed Treatment Market Analysis By Active Ingredient

The active ingredients in fungicidal seed treatments largely encompass synthetic fungicides, biologicals, and seed coatings. In 2023, the market for synthetic fungicides held a significant share of 80.57%, reflecting a robust reliance on chemical treatments for disease control. Biologicals are emerging due to increasing popularity for organic farming, yet they captured 19.43% of the market in 2023, showing room for growth.

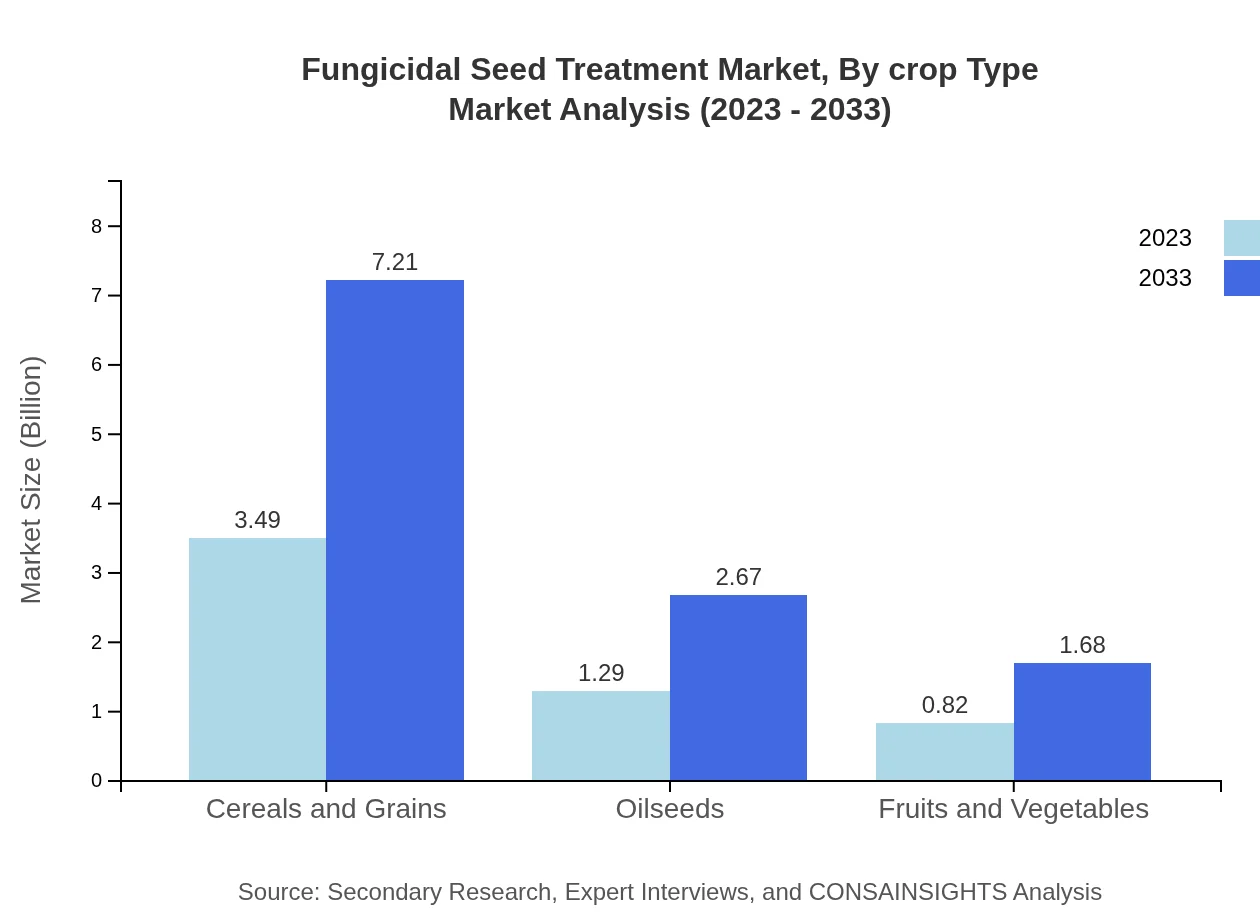

Fungicidal Seed Treatment Market Analysis By Crop Type

Cereals and grains represent the largest segment, accounting for 62.36% of the market in 2023, with expectations for steady growth driven by increased demand for rice and wheat. Oilseeds, with a 23.08% share, and fruits and vegetables, representing 14.56%, also show potential for expansion as diverse agricultural practices proliferate.

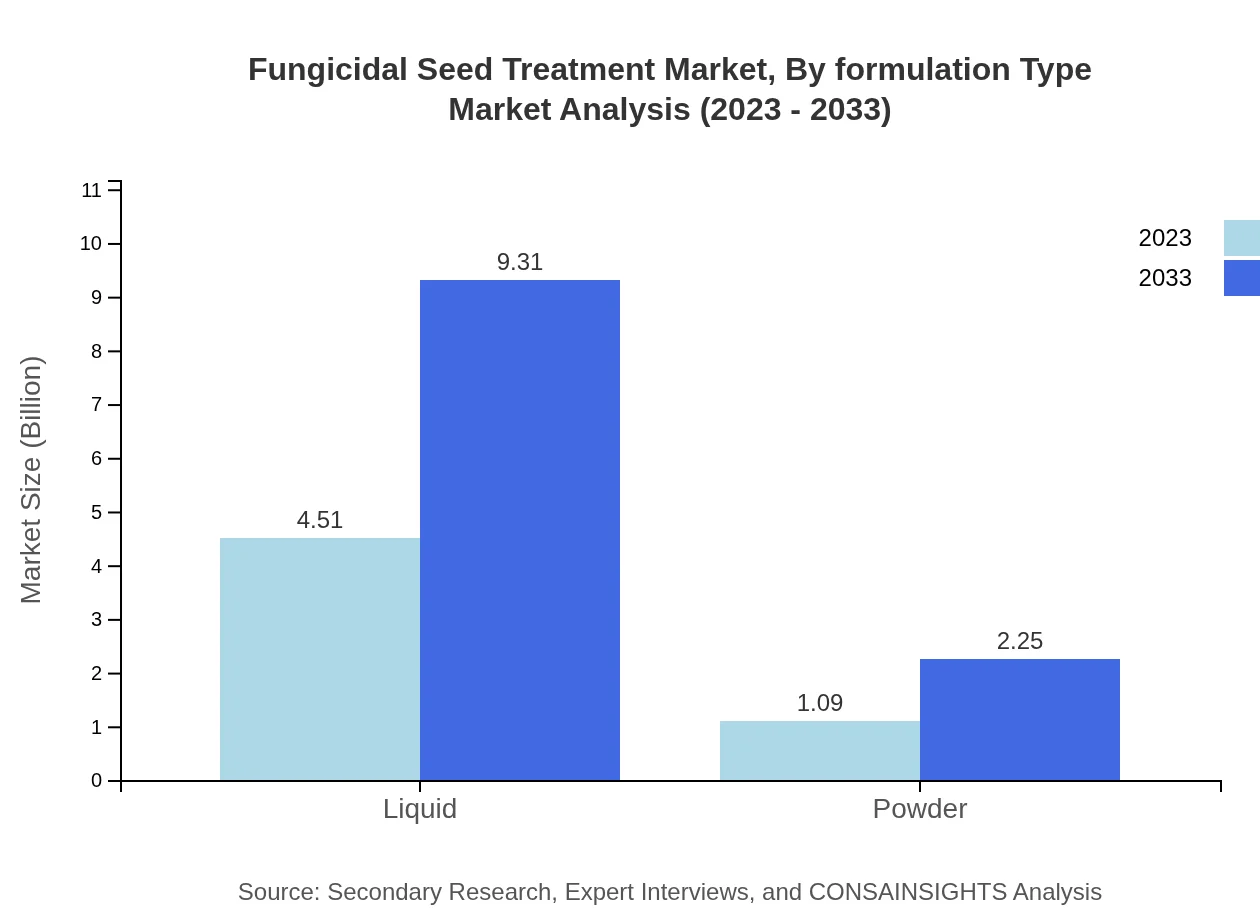

Fungicidal Seed Treatment Market Analysis By Formulation Type

The formulation type segment includes liquid and powder forms, with liquid formulations making up 80.57% of the market in 2023 as they are easier to apply and typically provide better coverage. Solid powder formulations hold a smaller share at 19.43% but are favored in specific applications where granular consistency is advantageous.

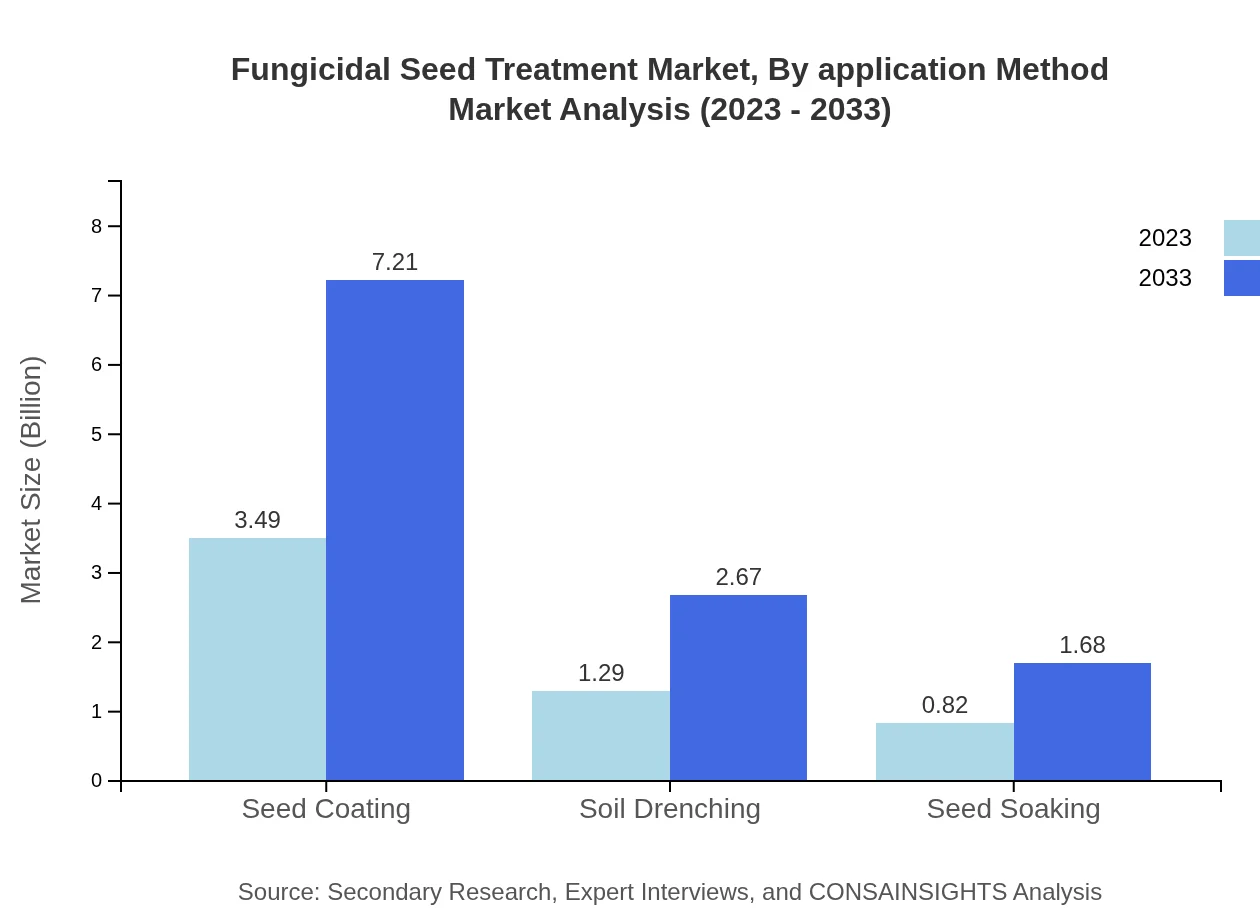

Fungicidal Seed Treatment Market Analysis By Application Method

The primary application methods are seed coating, soil drenching, and seed soaking. Seed coating dominates the market with over 62.36% in 2023, attributed to its effectiveness and ease of use. Soil drenching and seed soaking methods, although less common, are important alternatives for targeting specific fungal issues.

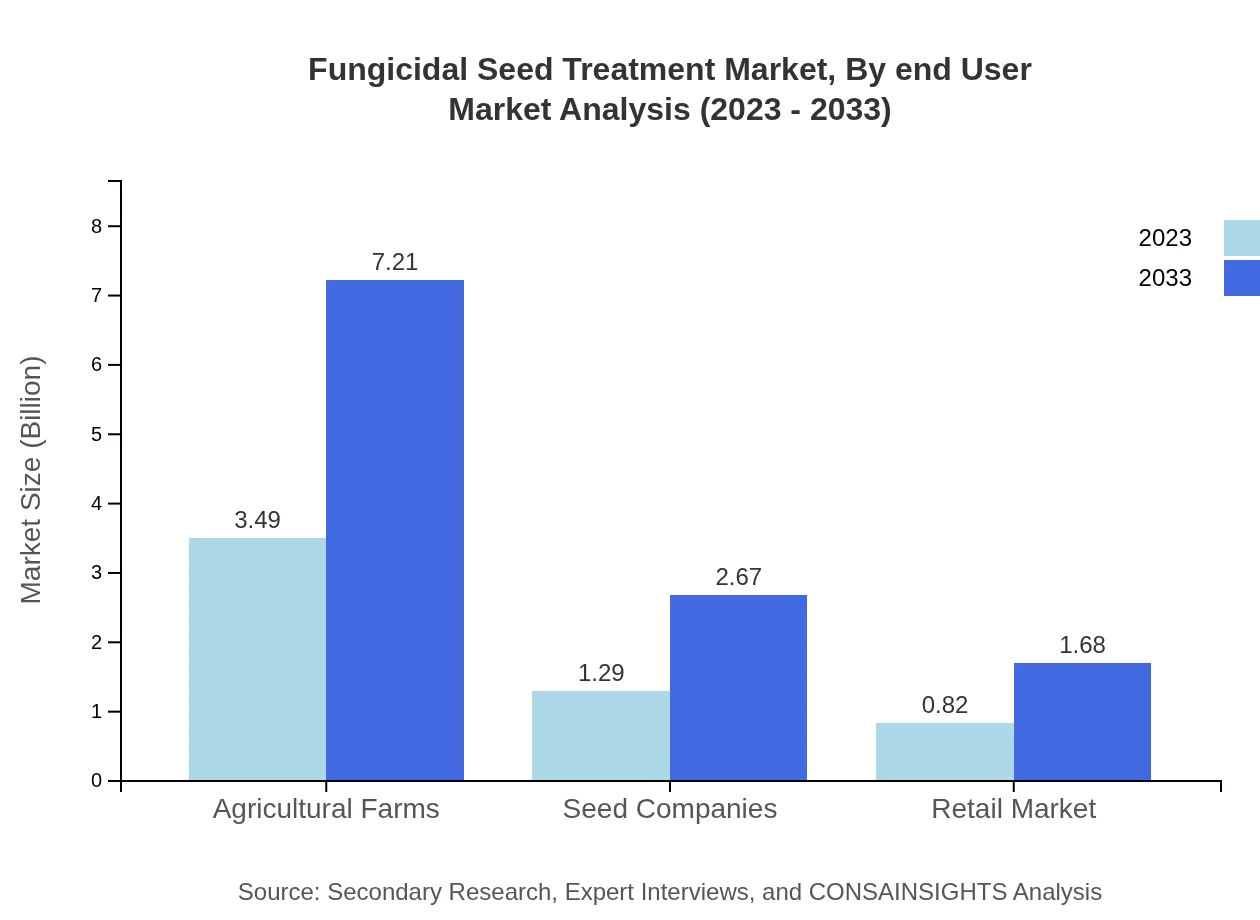

Fungicidal Seed Treatment Market Analysis By End User

End-users include agricultural farms, seed companies, and retail markets. Agricultural farms held the largest market share of 62.36% in 2023, indicating heavy reliance on fungicidal treatments to boost crop yields and combat diseases. Seed companies and retail markets are also significant, making up 23.08% and 14.56% respectively.

Fungicidal Seed Treatment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Fungicidal Seed Treatment Industry

BASF SE:

BASF is a leading global chemical company, offering innovative agricultural solutions, including advanced fungicidal treatments aimed at improving crop protection.Syngenta AG:

Syngenta focuses on sustainable agriculture, developing a variety of crop protection products including fungicides to enhance seed health and yields.Bayer AG:

Bayer is a global enterprise with core competencies in life sciences, particularly in crop science, providing effective fungicidal solutions for seed treatments.Corteva Agriscience:

Corteva specializes in innovative seed technologies and crop protection products, including fungicidal seed treatments that comply with sustainable practices.FMC Corporation:

FMC offers a diverse portfolio of agricultural products including effective fungicides designed for seed treatment applications targeting various crops.We're grateful to work with incredible clients.

FAQs

What is the market size of fungicidal seed treatment?

The global fungicidal seed treatment market is projected to reach USD 5.6 billion by 2033, growing at a CAGR of 7.3%. This growth reflects an increasing awareness of crop protection technologies and sustainable agricultural practices.

What are the key market players or companies in the fungicidal seed treatment industry?

Key players in the fungicidal seed treatment market include Bayer AG, Syngenta AG, BASF SE, and Corteva Agriscience. These companies lead in innovation, product development, and market share, facilitating advancements in seed treatment technologies.

What are the primary factors driving the growth in the fungicidal seed treatment industry?

Growth in the fungicidal seed treatment market is driven by rising demand for high-yielding and disease-resistant crops, increasing adoption of sustainable agricultural practices, and stringent regulations on chemical pesticides, which promote eco-friendly seed treatments.

Which region is the fastest Growing in the fungicidal seed treatment market?

Asia Pacific is anticipated to be the fastest-growing region in the fungicidal seed treatment market, with the market expanding from USD 1.07 billion in 2023 to USD 2.20 billion by 2033, primarily due to increasing agricultural activities.

Does Consainsights provide customized market report data for the fungicidal seed treatment industry?

Yes, Consainsights offers customized market report data tailored to client needs in the fungicidal seed treatment industry, ensuring comprehensive insights and facilitating informed decision-making based on specific market segments.

What deliverables can I expect from this fungicidal seed treatment market research project?

Expect detailed market analysis reports, segment-wise data, competitive landscape assessments, regional market insights, and future projections. Deliverables also include actionable recommendations and strategic advice tailored to industry dynamics.

What are the market trends of fungicidal seed treatment?

Key trends in the fungicidal seed treatment market include increased adoption of biological fungicides, innovation in coating technologies, focus on integrated pest management strategies, and growing demand for organic farming solutions, highlighting sustainability.