Fungicide Market Report

Published Date: 02 February 2026 | Report Code: fungicide

Fungicide Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Fungicide market, covering insights on market size, growth rates, segment performance, and regional analyses from 2023 to 2033.

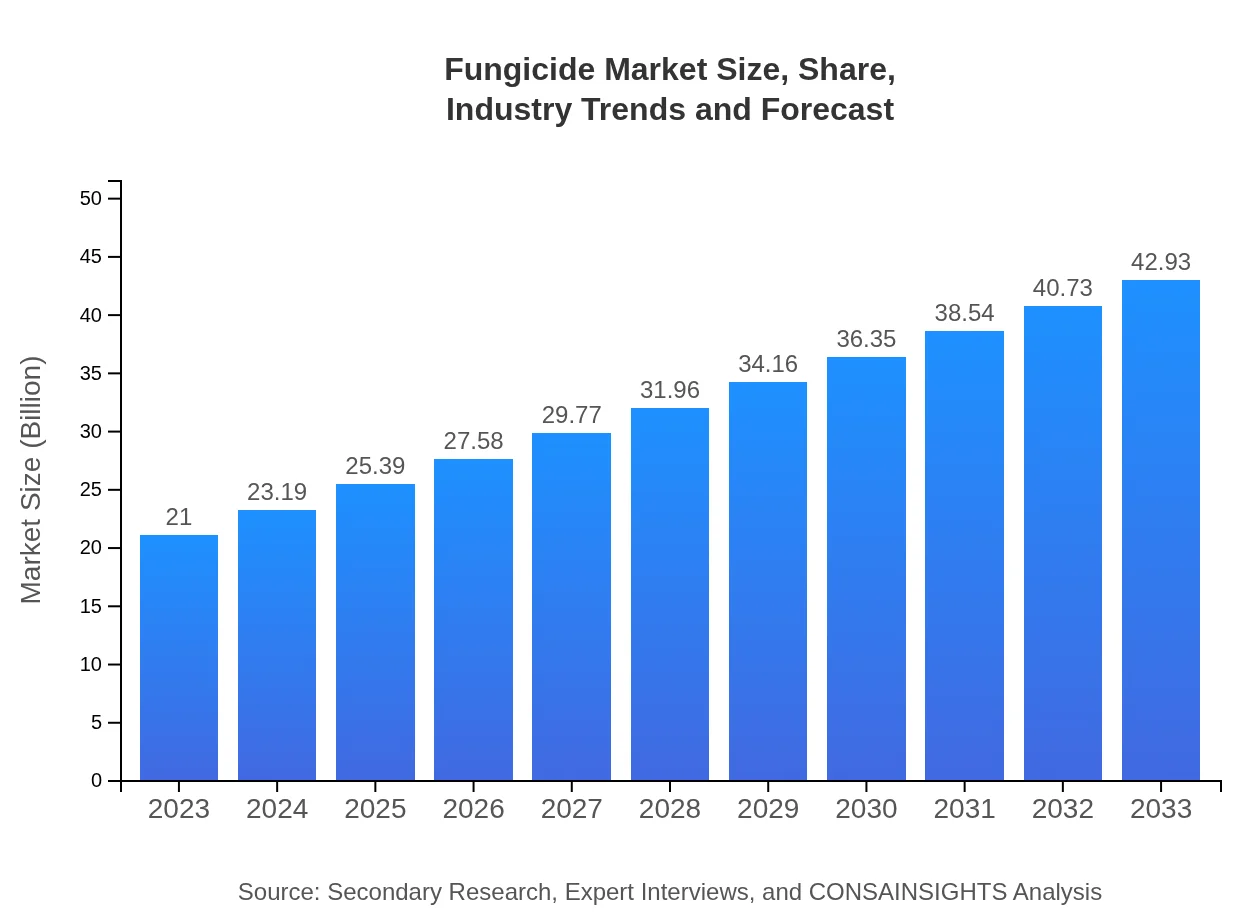

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $21.00 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $42.93 Billion |

| Top Companies | Bayer AG, Syngenta, Corteva Agriscience, FMC Corporation, Monsanto Company |

| Last Modified Date | 02 February 2026 |

Fungicide Market Overview

Customize Fungicide Market Report market research report

- ✔ Get in-depth analysis of Fungicide market size, growth, and forecasts.

- ✔ Understand Fungicide's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Fungicide

What is the Market Size & CAGR of Fungicide market in 2023?

Fungicide Industry Analysis

Fungicide Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Fungicide Market Analysis Report by Region

Europe Fungicide Market Report:

Europe leads the Fungicide market with a valuation of $7.39 billion in 2023, expected to double to $15.11 billion by 2033. Stringent EU regulations and a strong emphasis on sustainable farming practices favor the growth of biological fungicides.Asia Pacific Fungicide Market Report:

The Asia Pacific region accounted for a market size of $3.45 billion in 2023, projected to reach $7.05 billion by 2033. Growing agricultural output and an increasing awareness of crop protection in countries like India and China drive this growth. The shift towards sustainable agriculture is also shaping market trends.North America Fungicide Market Report:

North America’s market stood at $7.06 billion in 2023, with projections to reach $14.43 billion by 2033. The regulations favoring the use of advanced fungicide technologies and the high adoption of precision agriculture techniques are key growth factors in this region.South America Fungicide Market Report:

In South America, the Fungicide market was valued at $0.27 billion in 2023 and is anticipated to grow to $0.55 billion by 2033. Countries like Brazil and Argentina are significant contributors due to their extensive agricultural lands and increased usage of crop protection products.Middle East & Africa Fungicide Market Report:

The market in the Middle East and Africa was valued at $2.83 billion in 2023 and is projected to reach $5.80 billion by 2033. Increased agricultural development and investments in agrochemical solutions are helping drive market expansion.Tell us your focus area and get a customized research report.

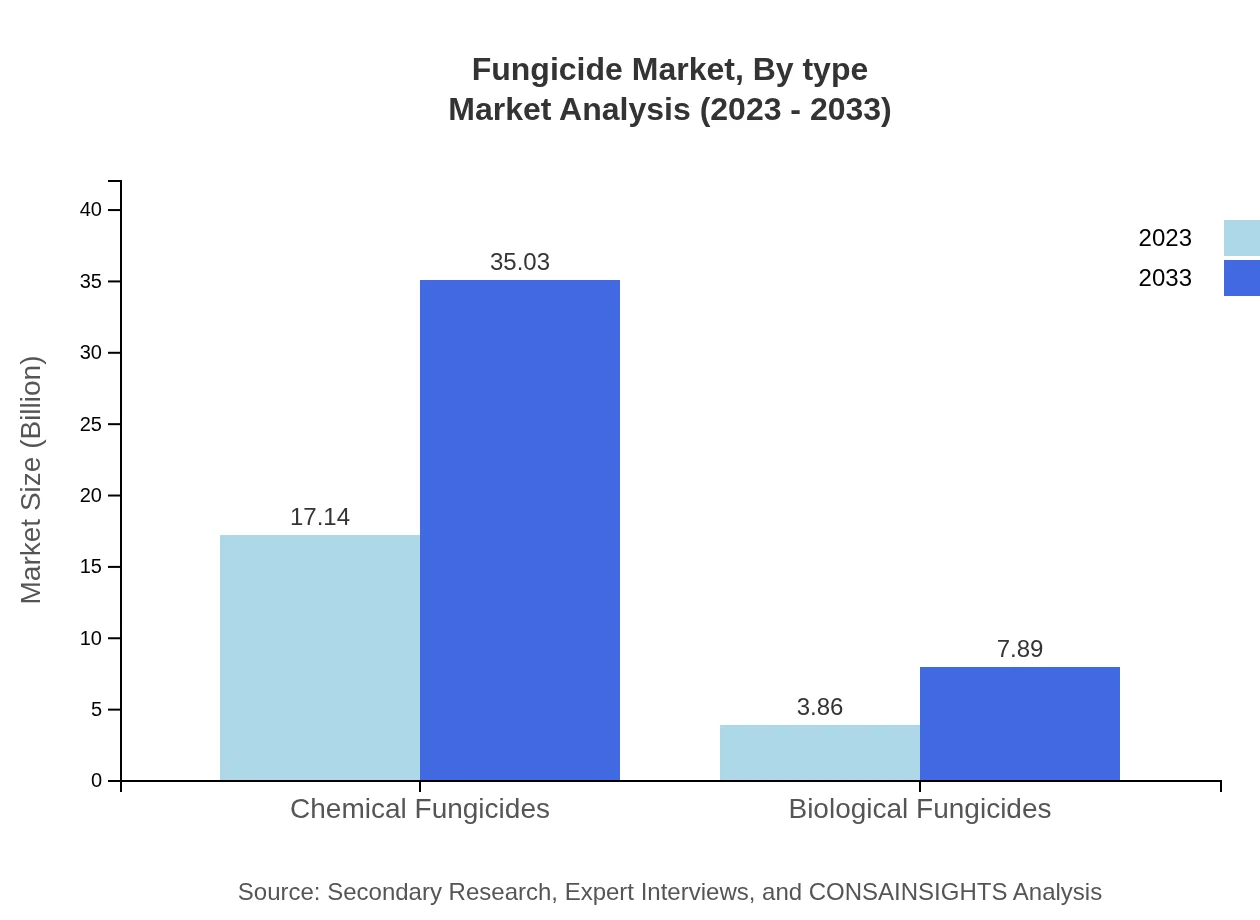

Fungicide Market Analysis By Type

The Fungicide market by type is dominated by Chemical Fungicides, representing approximately $17.14 billion in market size in 2023, with an expected rise to $35.03 billion by 2033. Biological Fungicides are emerging as a significant segment, valued at $3.86 billion in 2023 and expected to reach $7.89 billion by 2033, owing to the increasing demand for eco-friendly products.

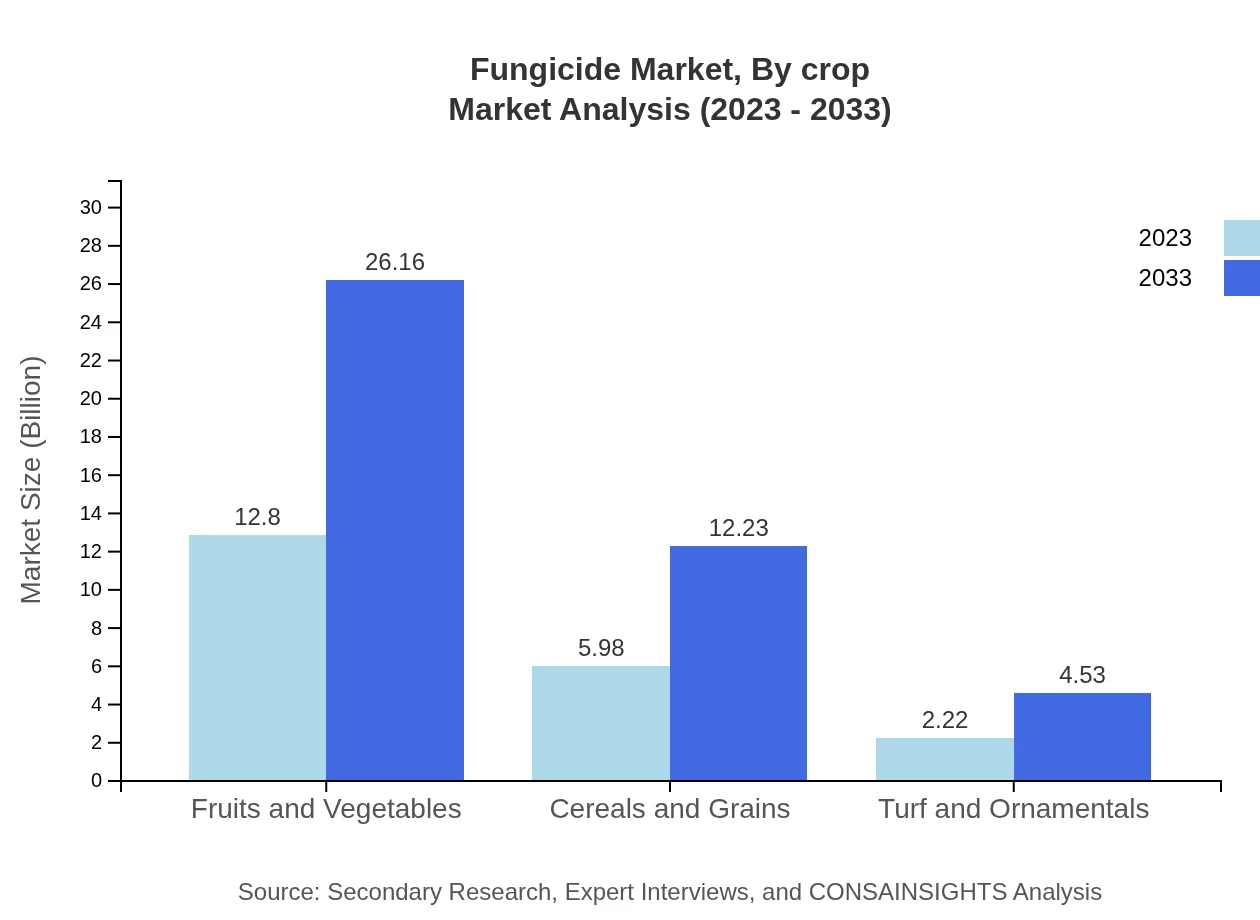

Fungicide Market Analysis By Crop

Fruits and Vegetables considerably lead the Fungicide market with a size of $12.80 billion in 2023, and projected to grow to $26.16 billion by 2033. Cereals and Grains are another substantial segment, estimating $5.98 billion in 2023, reaching $12.23 billion by 2033, reflecting increasing demand for health and food security.

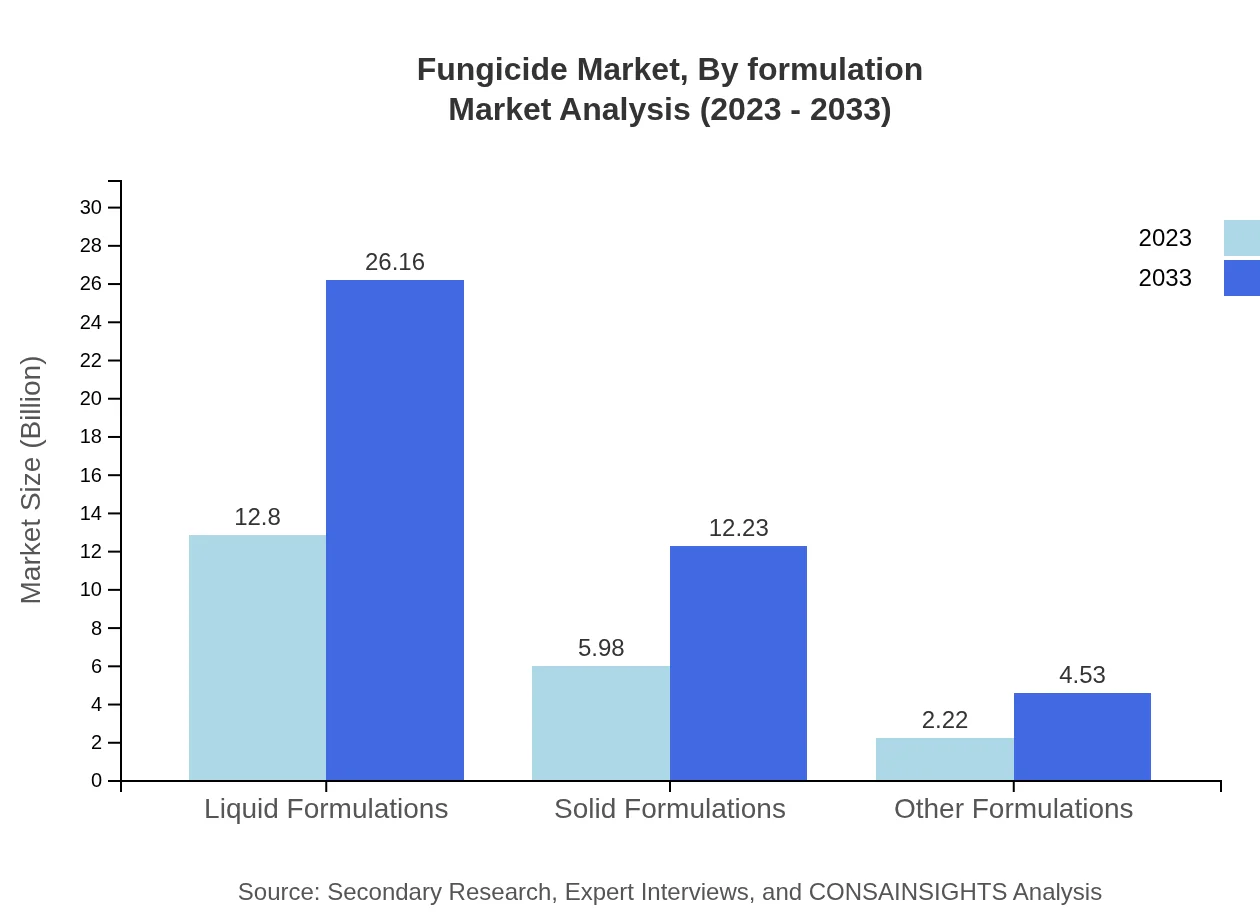

Fungicide Market Analysis By Formulation

Liquid Formulations dominate the Fungicide market with $12.80 billion in size in 2023, projected to reach $26.16 billion by 2033. Solid formulations follow with a size of $5.98 billion in 2023, expected to grow to $12.23 billion over the forecasted period.

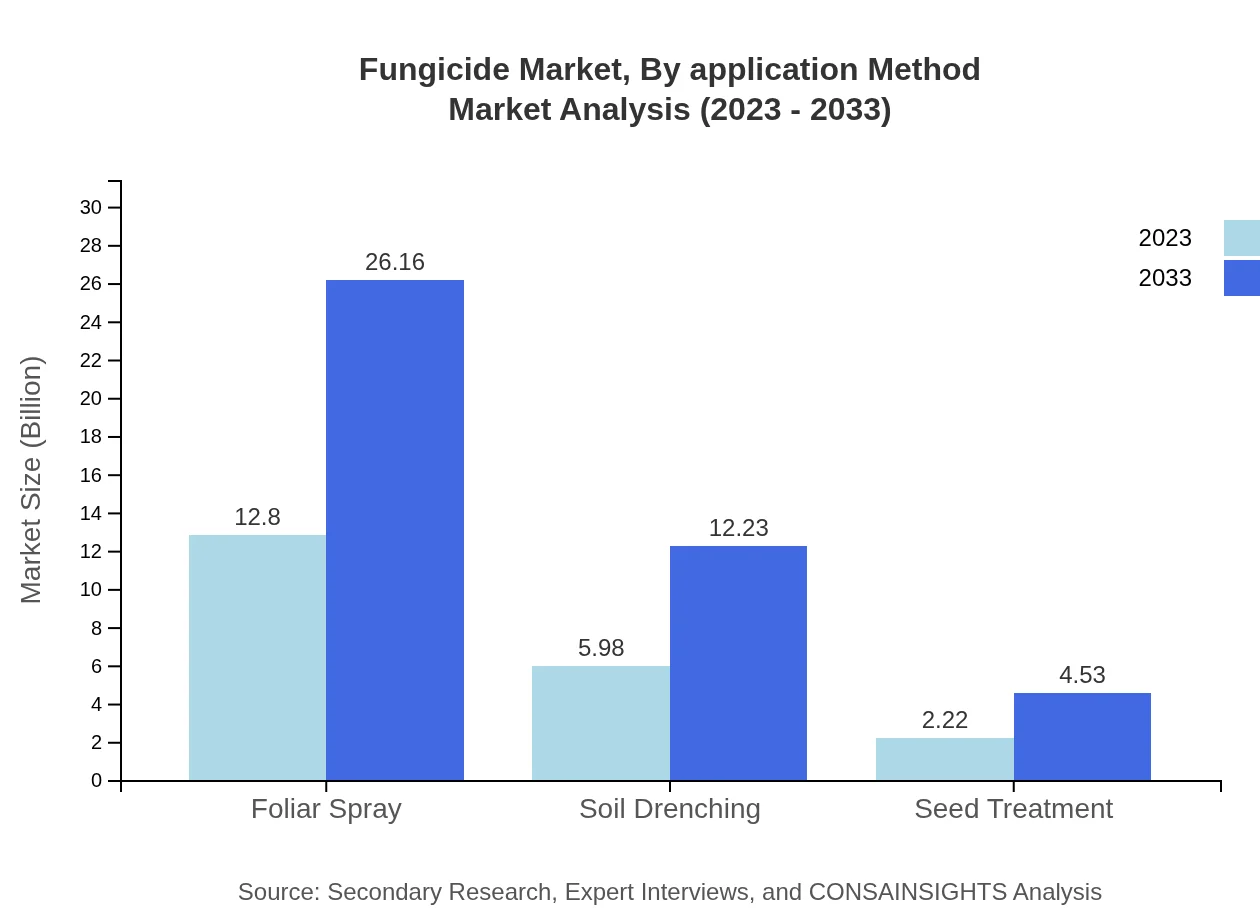

Fungicide Market Analysis By Application Method

Foliar Spray leads the application methods with a market size of $12.80 billion in 2023, projected to grow to $26.16 billion by 2033. Soil Drenching and Seed Treatment also play significant roles, with sizes of $5.98 billion and $2.22 billion respectively in 2023.

Fungicide Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Fungicide Industry

Bayer AG:

Bayer is known for its advanced crop science solutions and is a leading player in the global fungicide market, offering a wide range of chemical and biological fungicides.Syngenta:

Syngenta is focused on sustainable agricultural practices and provides innovative fungicide products aimed at improving yield and crop health.Corteva Agriscience:

Corteva specializes in providing agricultural products and solutions, including a diverse range of fungicides that cater to different crop needs.FMC Corporation:

FMC Corporation is a major player in agricultural science known for its high-performance fungicides that target specific crop diseases.Monsanto Company:

Now part of Bayer, Monsanto has a strong legacy in providing innovative seed and crop protection solutions including a range of fungicides.We're grateful to work with incredible clients.

FAQs

What is the market size of fungicide?

The global fungicide market is valued at approximately $21 billion in 2023, with a projected growth at a CAGR of 7.2% through 2033, reflecting significant demand and innovation in agricultural practices.

What are the key market players or companies in this fungicide industry?

Key players in the fungicide market include global firms such as BASF, Syngenta, Bayer, and FMC Corporation, all of whom contribute significantly to market developments and advancements in fungicide technology.

What are the primary factors driving the growth in the fungicide industry?

Growth in the fungicide industry is driven by increasing agricultural output demands, the need for pest resilience, advancements in fungicide formulations, and the expanding adoption of integrated pest management practices.

Which region is the fastest Growing in the fungicide market?

Asia Pacific is the fastest-growing region in the fungicide market, escalating from $3.45 billion in 2023 to $7.05 billion by 2033, driven by enhanced agricultural initiatives and increasing awareness of crop protection.

Does ConsaInsights provide customized market report data for the fungicide industry?

Yes, ConsaInsights offers customized market reports tailored to specific requirements within the fungicide industry, ensuring businesses receive comprehensive insights relevant to their strategic needs.

What deliverables can I expect from this fungicide market research project?

Expect detailed market analysis reports, segment insights, geographical data, competitive analysis, and trends forecasts from the fungicide market research project to aid informed decision-making.

What are the market trends of fungicide?

Current trends in the fungicide market include a shift towards biological fungicides, an increase in liquid formulations, and heightened focus on sustainable agricultural practices that promote environmental health.