Garden Pesticides Market Report

Published Date: 02 February 2026 | Report Code: garden-pesticides

Garden Pesticides Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Garden Pesticides market, covering market trends, size, growth forecasts from 2023 to 2033, and insights into regional dynamics, key players, and technological advancements.

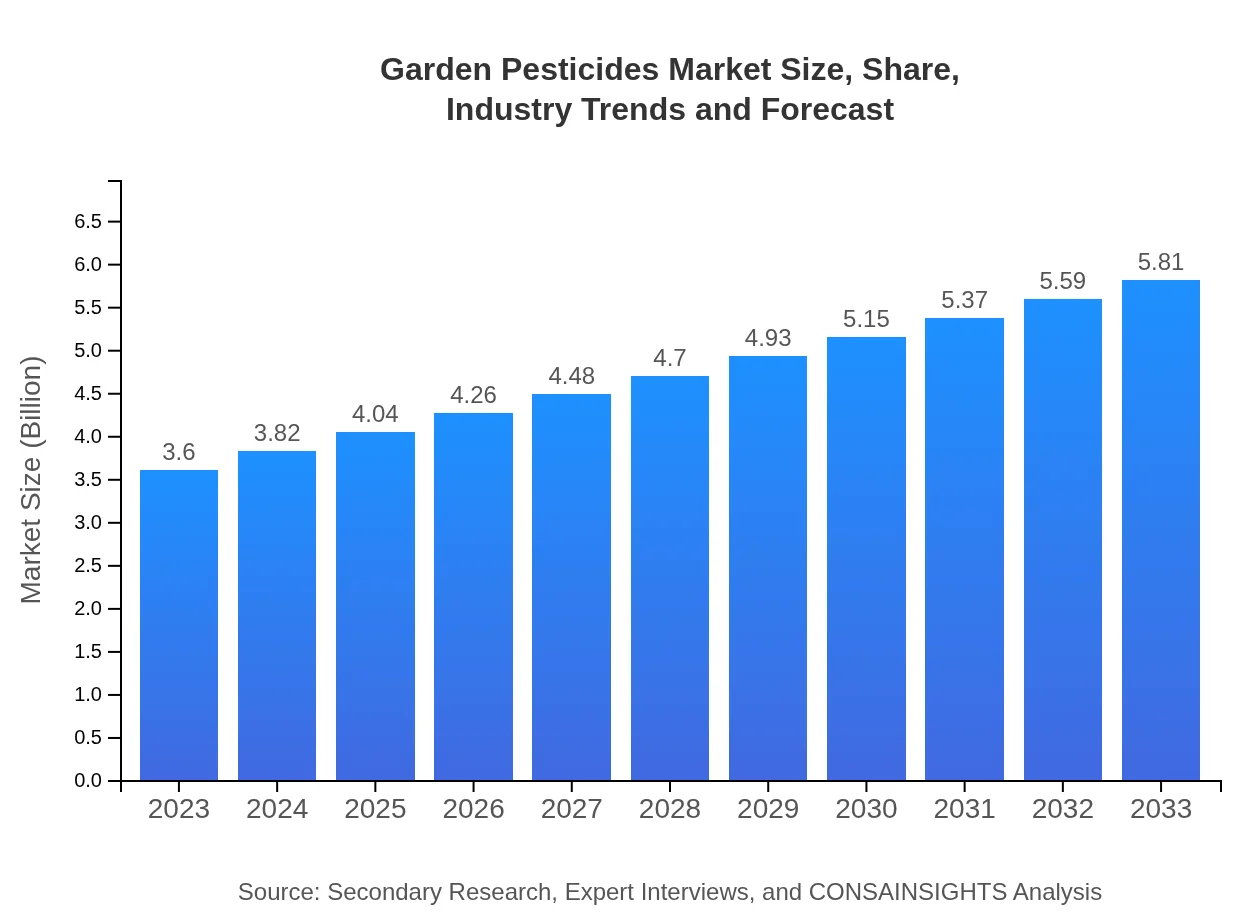

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.60 Billion |

| CAGR (2023-2033) | 4.8% |

| 2033 Market Size | $5.81 Billion |

| Top Companies | BASF SE, Syngenta AG, Dow AgroSciences, Monsanto (now part of Bayer), ADAMA Agricultural Solutions |

| Last Modified Date | 02 February 2026 |

Garden Pesticides Market Overview

Customize Garden Pesticides Market Report market research report

- ✔ Get in-depth analysis of Garden Pesticides market size, growth, and forecasts.

- ✔ Understand Garden Pesticides's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Garden Pesticides

What is the Market Size & CAGR of Garden Pesticides market in 2023?

Garden Pesticides Industry Analysis

Garden Pesticides Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Garden Pesticides Market Analysis Report by Region

Europe Garden Pesticides Market Report:

The European market size is currently valued at $0.88 billion, with projected growth to $1.42 billion by 2033. The emphasis on sustainable gardening and stringent environmental regulations are key factors contributing to this growth.Asia Pacific Garden Pesticides Market Report:

In 2023, the Asia-Pacific Garden Pesticides market is estimated at $0.70 billion and projected to reach $1.13 billion by 2033. This growth is driven by increasing agricultural activities and urban gardening trends in countries like India and China, paired with rising awareness of sustainable pest management.North America Garden Pesticides Market Report:

In North America, the market size is projected to rise from $1.31 billion in 2023 to $2.11 billion by 2033. This growth is propelled by the high demand for garden pesticides among homeowners and landscape professionals, alongside a strong trend towards organic products.South America Garden Pesticides Market Report:

The South American market stands at $0.36 billion in 2023, expected to grow to $0.58 billion by 2033. This growth reflects the expanding market for chemicals in large-scale farming, particularly in Brazil and Argentina, driven by the need for increased agricultural productivity.Middle East & Africa Garden Pesticides Market Report:

The Middle East and Africa market is expected to grow from $0.35 billion in 2023 to $0.57 billion by 2033. Oil-rich nations are investing in sustainable agriculture, which has stimulated demand for adequate pest control products.Tell us your focus area and get a customized research report.

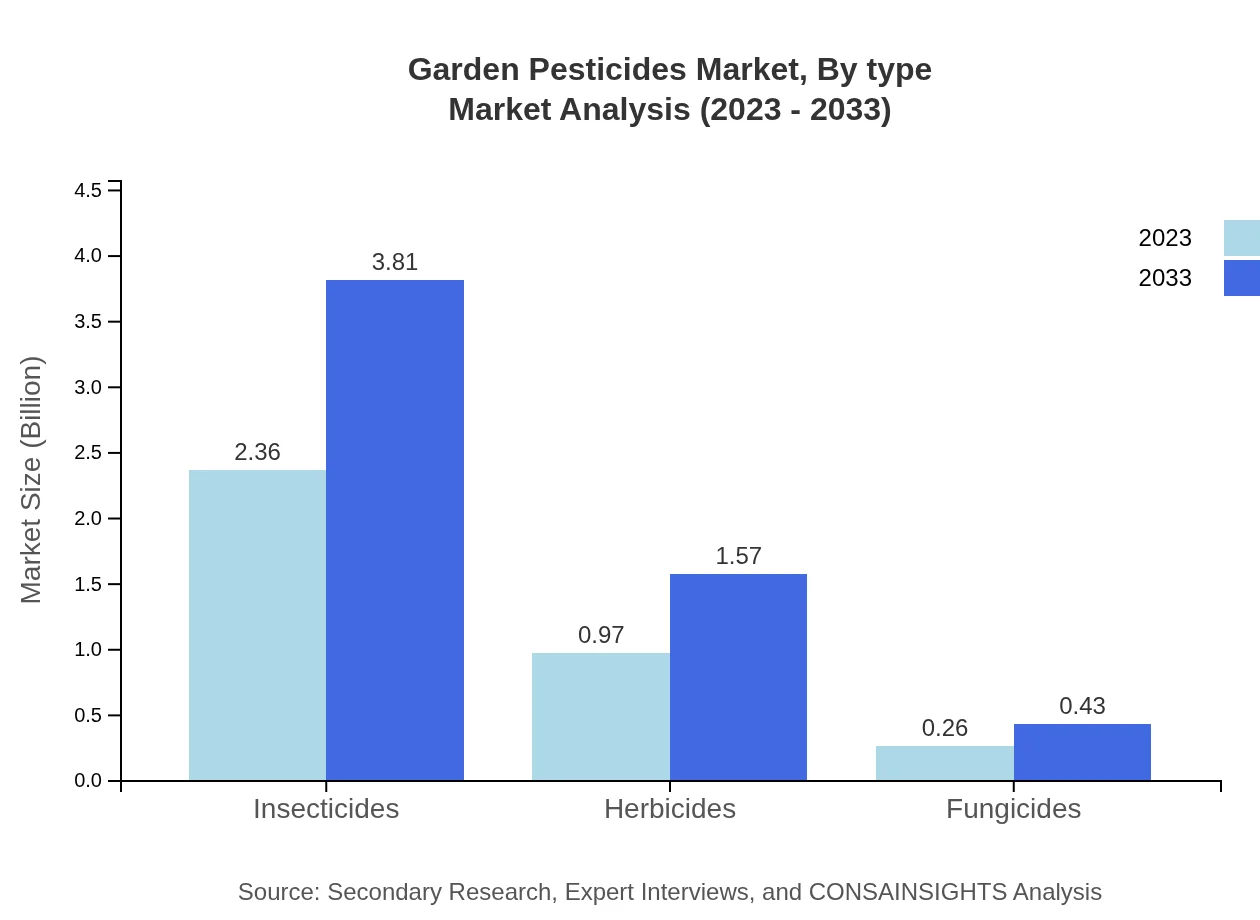

Garden Pesticides Market Analysis By Type

Insecticides dominate the market, registering a size of $2.36 billion in 2023, projected to rise to $3.81 billion by 2033, accounting for a consistent 65.58% market share throughout the period. Herbicides follow, with a market size expanding from $0.97 billion to $1.57 billion (27.06% share). Fungicides represent a smaller segment with a projected growth from $0.26 billion to $0.43 billion (7.36% share).

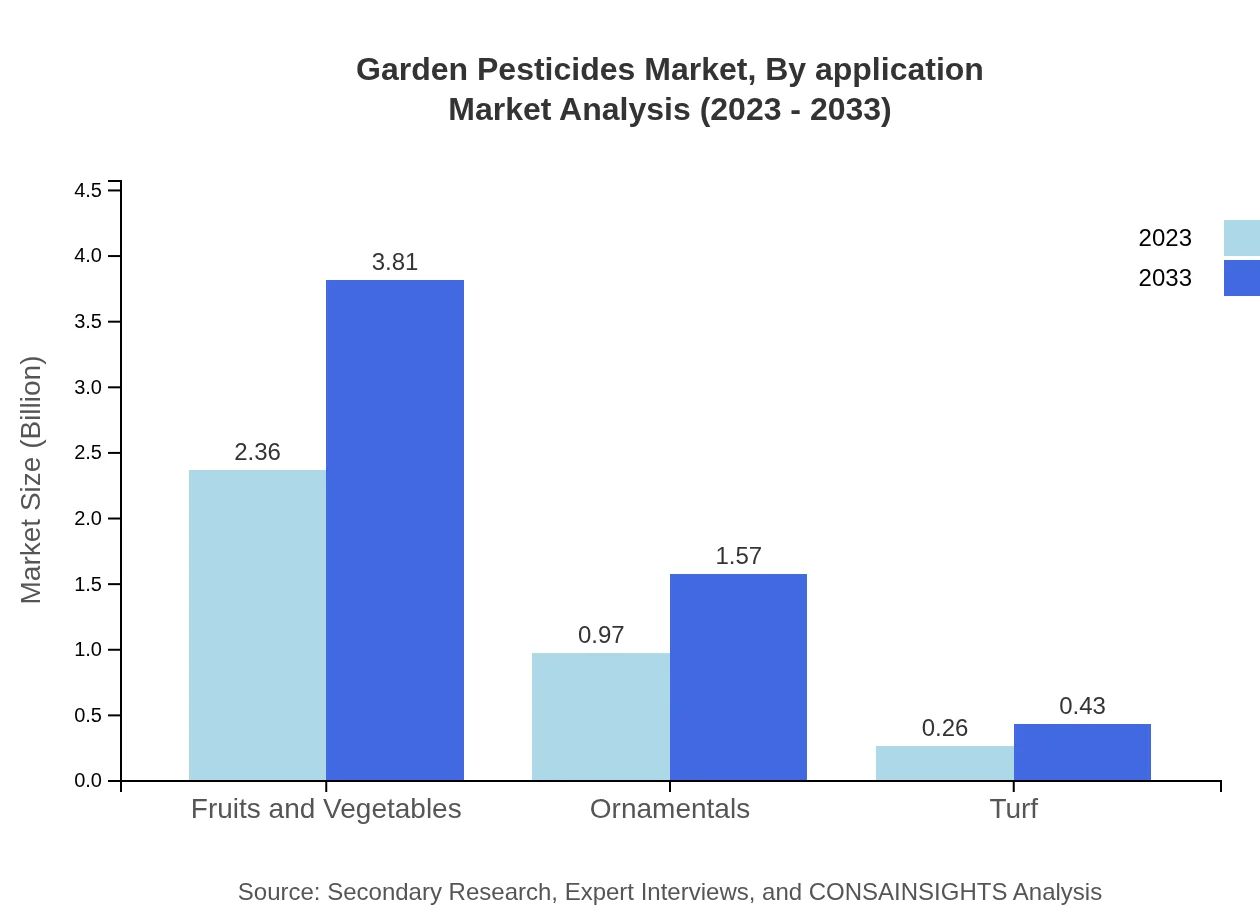

Garden Pesticides Market Analysis By Application

In terms of application, Fruits and Vegetables lead with a market size of $2.36 billion in 2023, forecasted to grow to $3.81 billion by 2033 (65.58% share). Ornamentals also show strong growth, from $0.97 billion to $1.57 billion (27.06% share). Turf applications occupy a smaller segment with projections moving from $0.26 billion to $0.43 billion (7.36% share).

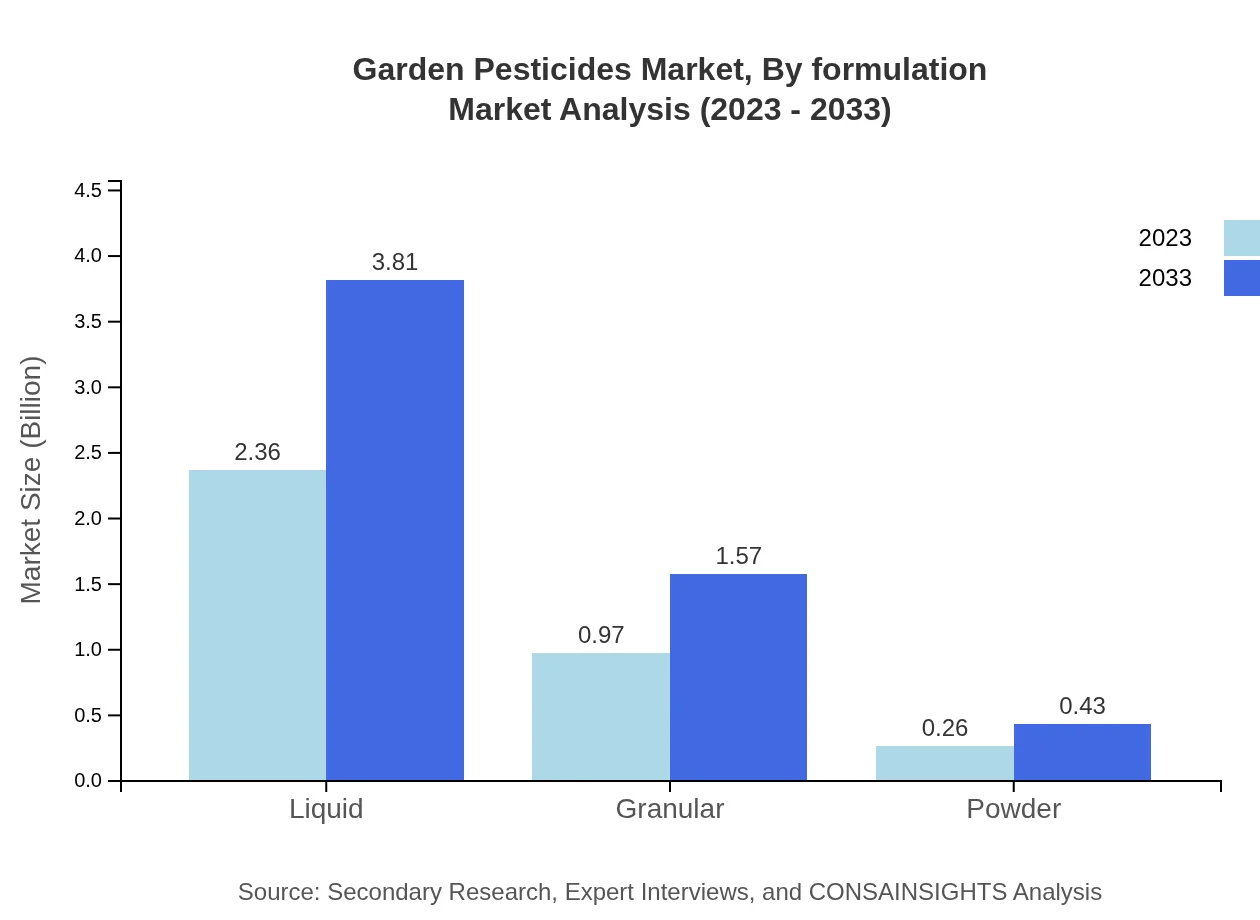

Garden Pesticides Market Analysis By Formulation

Liquid formulations dominate the garden pesticides market with a revenue of $2.36 billion in 2023, expected to increase to $3.81 billion by 2033 (65.58% share). Granular formulations are valued at $0.97 billion, projected to grow to $1.57 billion (27.06% share), while powdered formulations consist of a lesser market size, expected to rise from $0.26 billion to $0.43 billion (7.36% share).

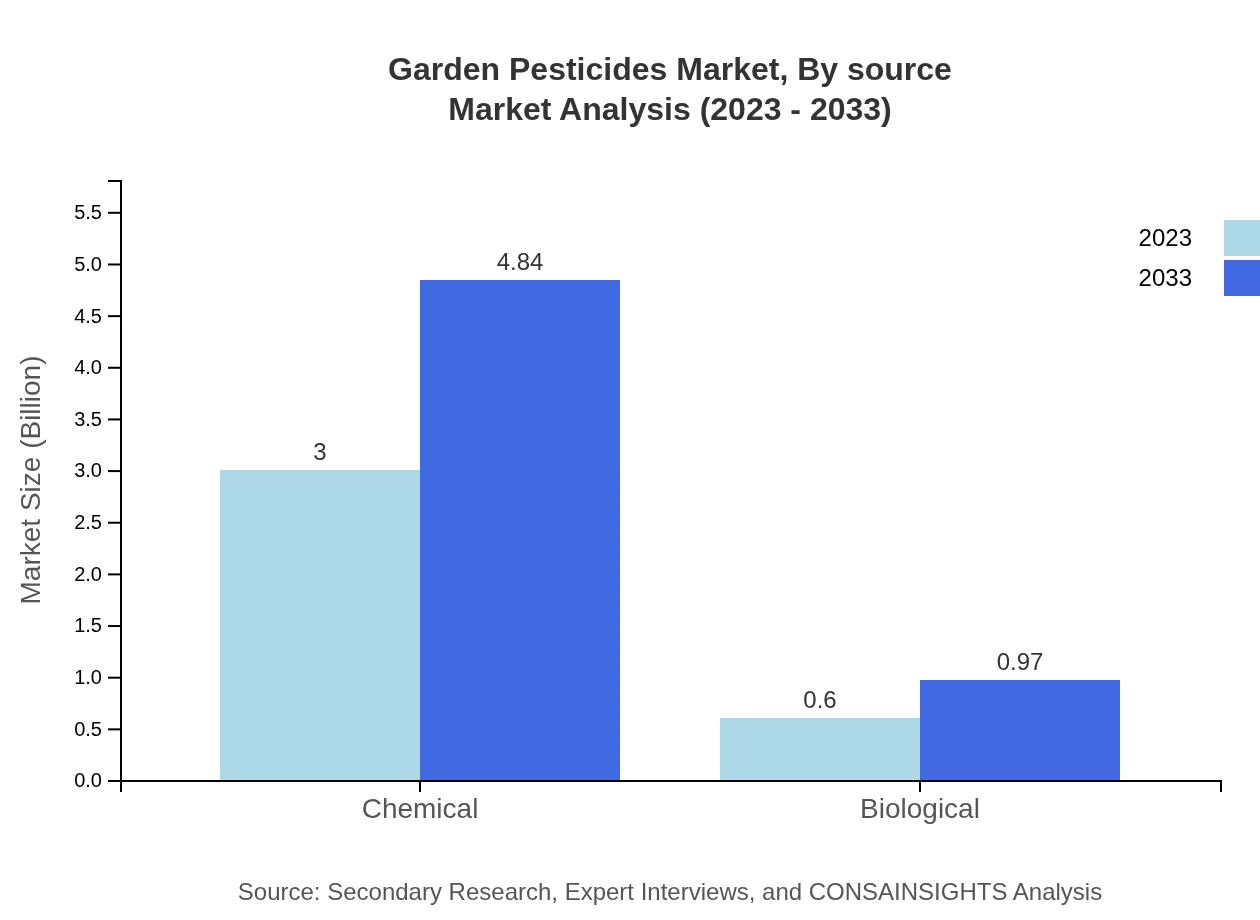

Garden Pesticides Market Analysis By Source

Chemical pesticides significantly prevail in the market, with a size of $3.00 billion in 2023, predicted to grow to $4.84 billion by 2033, maintaining an 83.37% market share. Biological sources have a modest size, moving from $0.60 billion to $0.97 billion, representing a 16.63% share.

Garden Pesticides Market Analysis By Distribution Channel

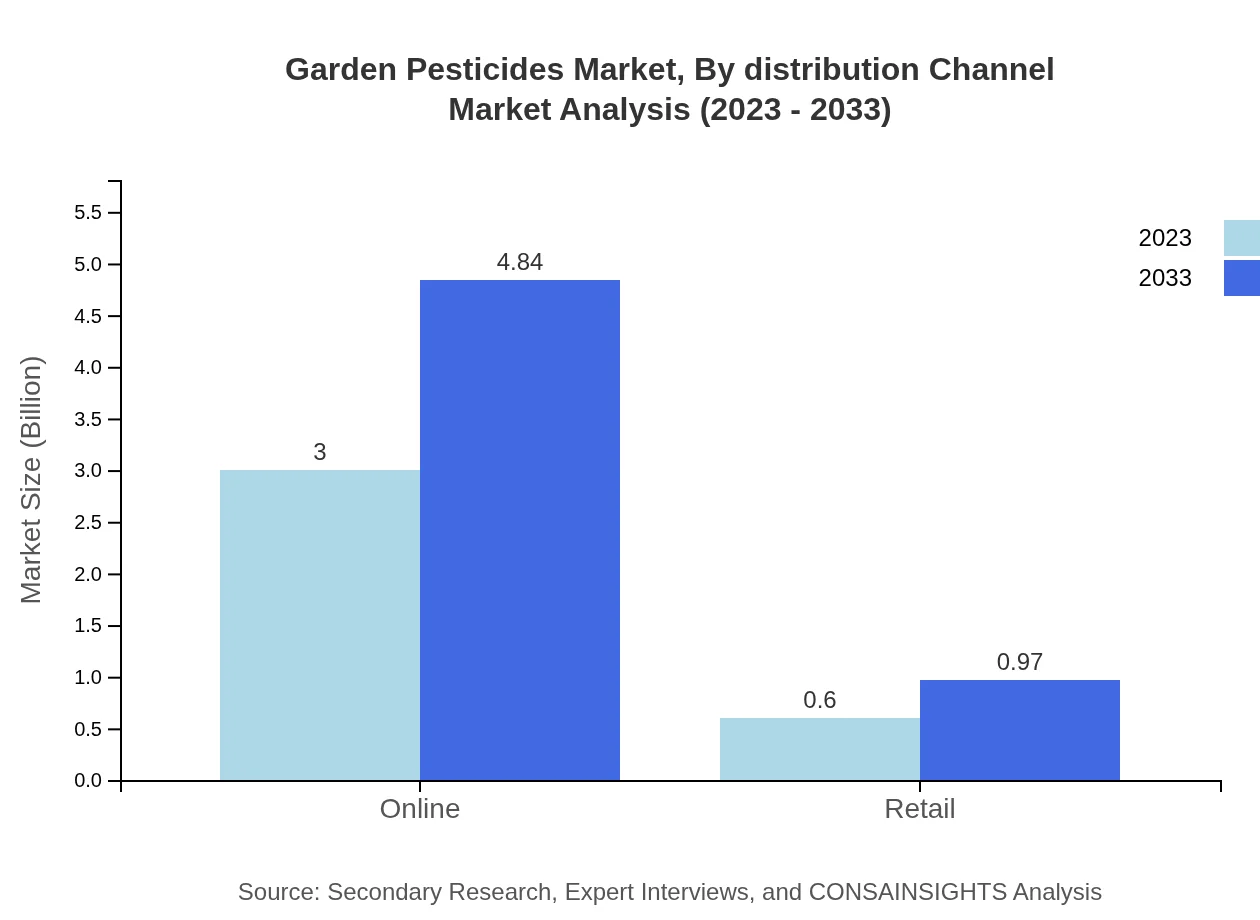

Online sales represent a significant channel, with a market size forecasted to rise from $3.00 billion in 2023 to $4.84 billion by 2033 (83.37% share). Retail channels are crucial as well, moving from $0.60 billion to $0.97 billion, showing a 16.63% share.

Garden Pesticides Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Garden Pesticides Industry

BASF SE:

A leader in chemical and crop protection solutions offering a comprehensive range of pesticides for various applications in the gardening sector.Syngenta AG:

Known for its extensive portfolio, Syngenta develops innovative and sustainable pesticide products to support agriculture and gardening.Dow AgroSciences:

Specializing in crop protection, Dow AgroSciences provides a robust selection of products for the garden pesticide market.Monsanto (now part of Bayer):

With a strong emphasis on sustainability, Monsanto/Bayer utilizes science and technology to create effective gardening solutions.ADAMA Agricultural Solutions:

ADAMA focuses on simplifying plant protection to make their crop protection products more accessible to gardeners worldwide.We're grateful to work with incredible clients.

FAQs

What is the market size of garden Pesticides?

The global garden pesticides market is valued at approximately $3.6 billion in 2023. It is expected to grow at a CAGR of 4.8%, projecting significant expansion in the coming years.

What are the key market players or companies in this garden Pesticides industry?

Key market players in the garden pesticides industry include companies like Bayer, Syngenta, BASF, Adama, and Dow AgroSciences. These companies significantly influence market trends with their diverse product offerings.

What are the primary factors driving the growth in the garden pesticides industry?

Growth in the garden pesticides market is driven by increasing home gardening trends, rising awareness about pest control, and the demand for organic produce, significantly contributing to market expansion.

Which region is the fastest Growing in the garden pesticides?

The fastest-growing region in the garden pesticides market is North America, where the market size is expected to increase from $1.31 billion in 2023 to $2.11 billion by 2033.

Does ConsaInsights provide customized market report data for the garden pesticides industry?

Yes, ConsaInsights offers customized market report data tailored to the garden pesticides industry, allowing businesses to access specific insights relevant to their needs.

What deliverables can I expect from this garden pesticides market research project?

From this market research project, expect detailed reports including market size, trends, forecasts, competitive analysis, and insights into various segments within the garden pesticides industry.

What are the market trends of garden pesticides?

Current trends in the garden pesticides market include a shift towards biological products, increasing preference for eco-friendly solutions, and the growing popularity of online retail channels for purchasing pesticides.