Gas Analyzer Sensor And Detector Market Report

Published Date: 31 January 2026 | Report Code: gas-analyzer-sensor-and-detector

Gas Analyzer Sensor And Detector Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Gas Analyzer Sensor and Detector market, focusing on trends, technologies, and regional insights for the forecast period 2023 to 2033.

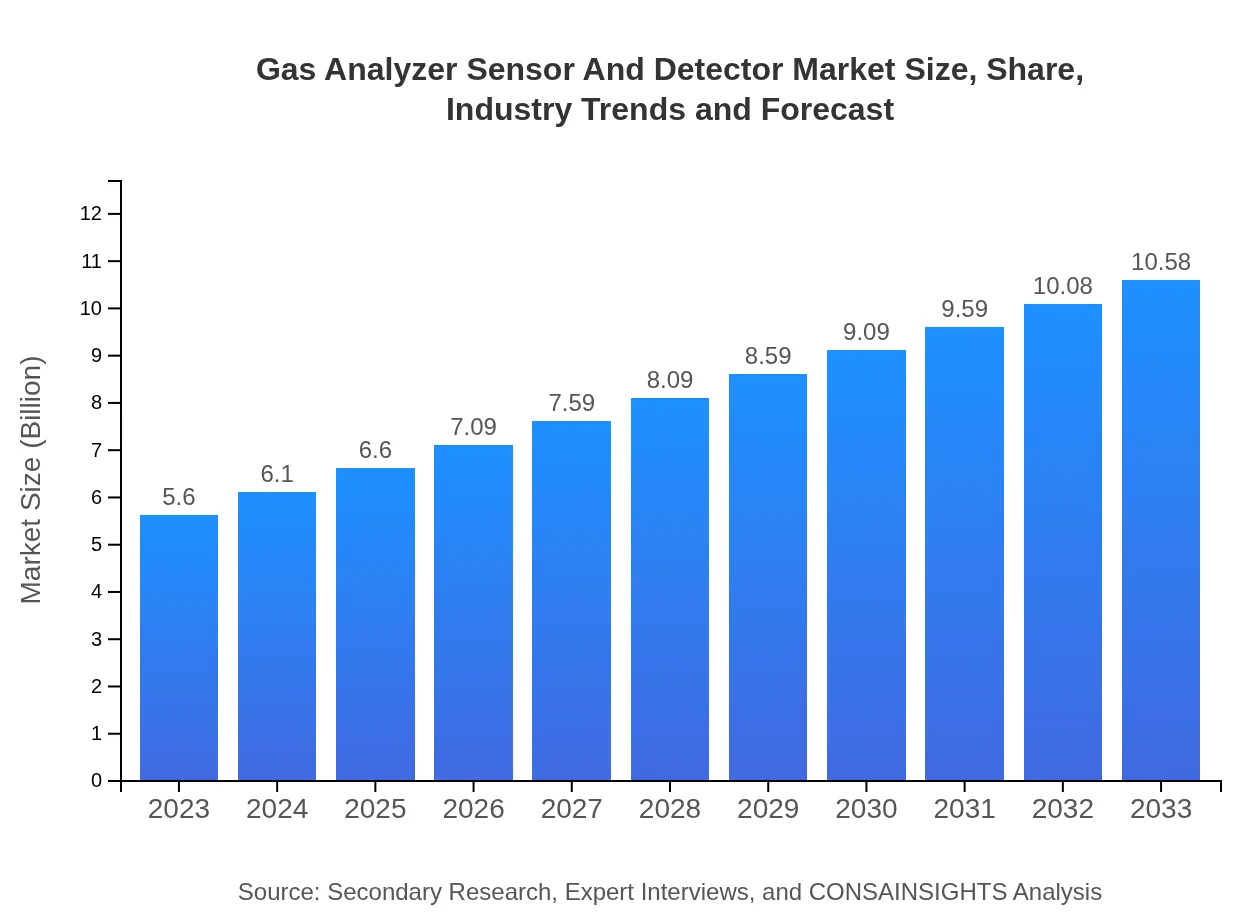

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 6.4% |

| 2033 Market Size | $10.58 Billion |

| Top Companies | Honeywell International Inc., Siemens AG, Emerson Electric Co., Ametek, Inc., Thermo Fisher Scientific Inc. |

| Last Modified Date | 31 January 2026 |

Gas Analyzer Sensor And Detector Market Overview

Customize Gas Analyzer Sensor And Detector Market Report market research report

- ✔ Get in-depth analysis of Gas Analyzer Sensor And Detector market size, growth, and forecasts.

- ✔ Understand Gas Analyzer Sensor And Detector's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Gas Analyzer Sensor And Detector

What is the Market Size & CAGR of Gas Analyzer Sensor And Detector market in 2023?

Gas Analyzer Sensor And Detector Industry Analysis

Gas Analyzer Sensor And Detector Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Gas Analyzer Sensor And Detector Market Analysis Report by Region

Europe Gas Analyzer Sensor And Detector Market Report:

Europe's Gas Analyzer Sensor and Detector market is expected to expand from $1.77 billion in 2023 to $3.35 billion by 2033, driven by stringent emission standards and a growing emphasis on workplace safety.Asia Pacific Gas Analyzer Sensor And Detector Market Report:

The Asia Pacific region is anticipated to witness significant growth in the Gas Analyzer Sensor and Detector market, from a market size of $1.09 billion in 2023 to approximately $2.05 billion by 2033. This expansion can be attributed to rapid industrialization, booming manufacturing sectors, and heightened focus on environmental monitoring.North America Gas Analyzer Sensor And Detector Market Report:

North America leads the market with a size projected to grow from $1.90 billion in 2023 to $3.59 billion by 2033. Stringent regulatory frameworks and innovative technology adoption are key drivers of growth in this region.South America Gas Analyzer Sensor And Detector Market Report:

In South America, the market is expected to grow from $0.35 billion in 2023 to $0.67 billion by 2033. Increased regulations regarding pollution control and safety measures in mining and oil extraction sectors are propelling demand for gas analyzers.Middle East & Africa Gas Analyzer Sensor And Detector Market Report:

The market in the Middle East and Africa is estimated to grow from $0.49 billion in 2023 to around $0.92 billion by 2033. Driving factors include rising investments in oil and gas exploration and growing industrial activities across various sectors.Tell us your focus area and get a customized research report.

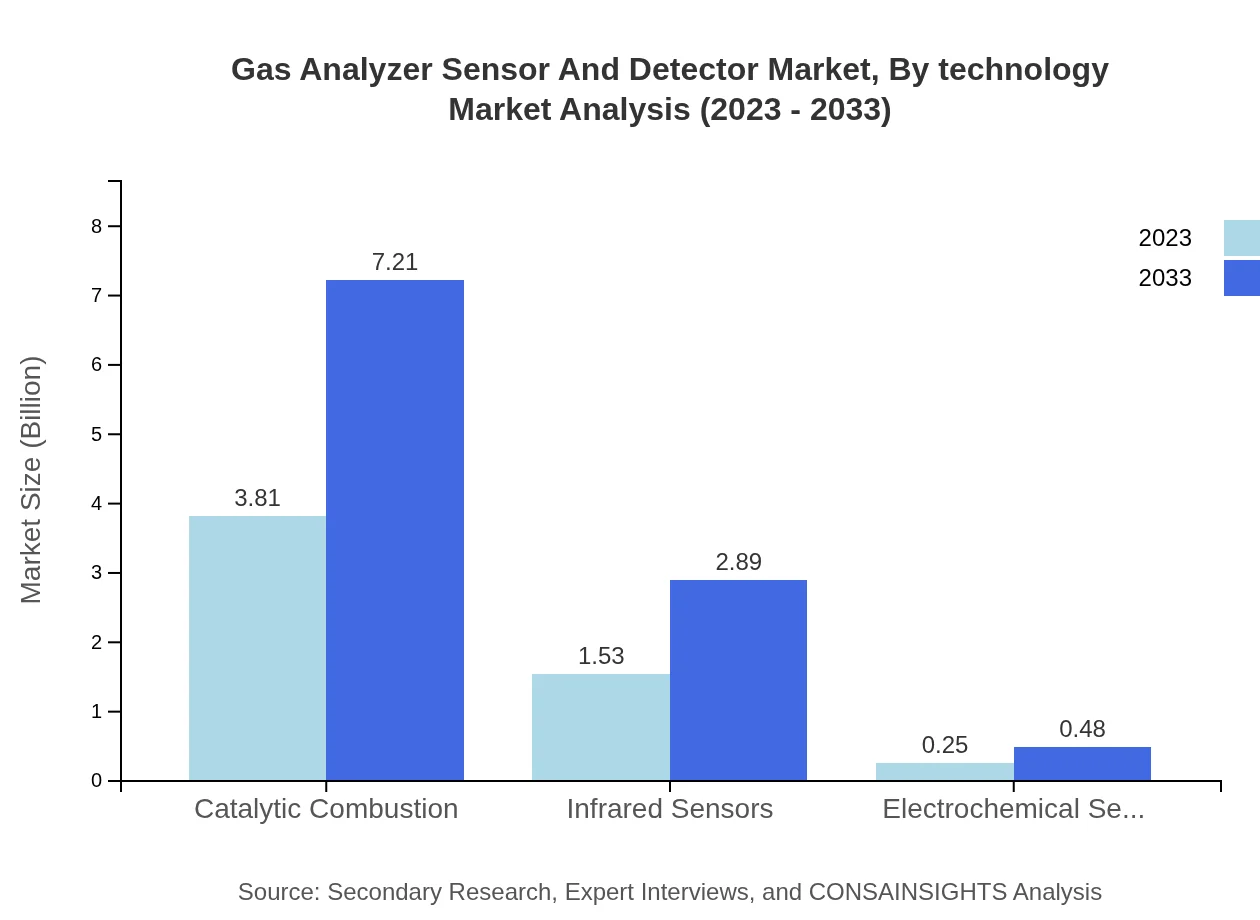

Gas Analyzer Sensor And Detector Market Analysis By Technology

The technological landscape of the Gas Analyzer Sensor and Detector market includes segments such as catalytic combustion which holds a share of 68.11% in 2023, projected to grow to 68.11% by 2033, and infrared sensors with a market share of 27.35% for the same period. Electrochemical sensors, although smaller, are gaining traction due to their precision in detecting specific gases.

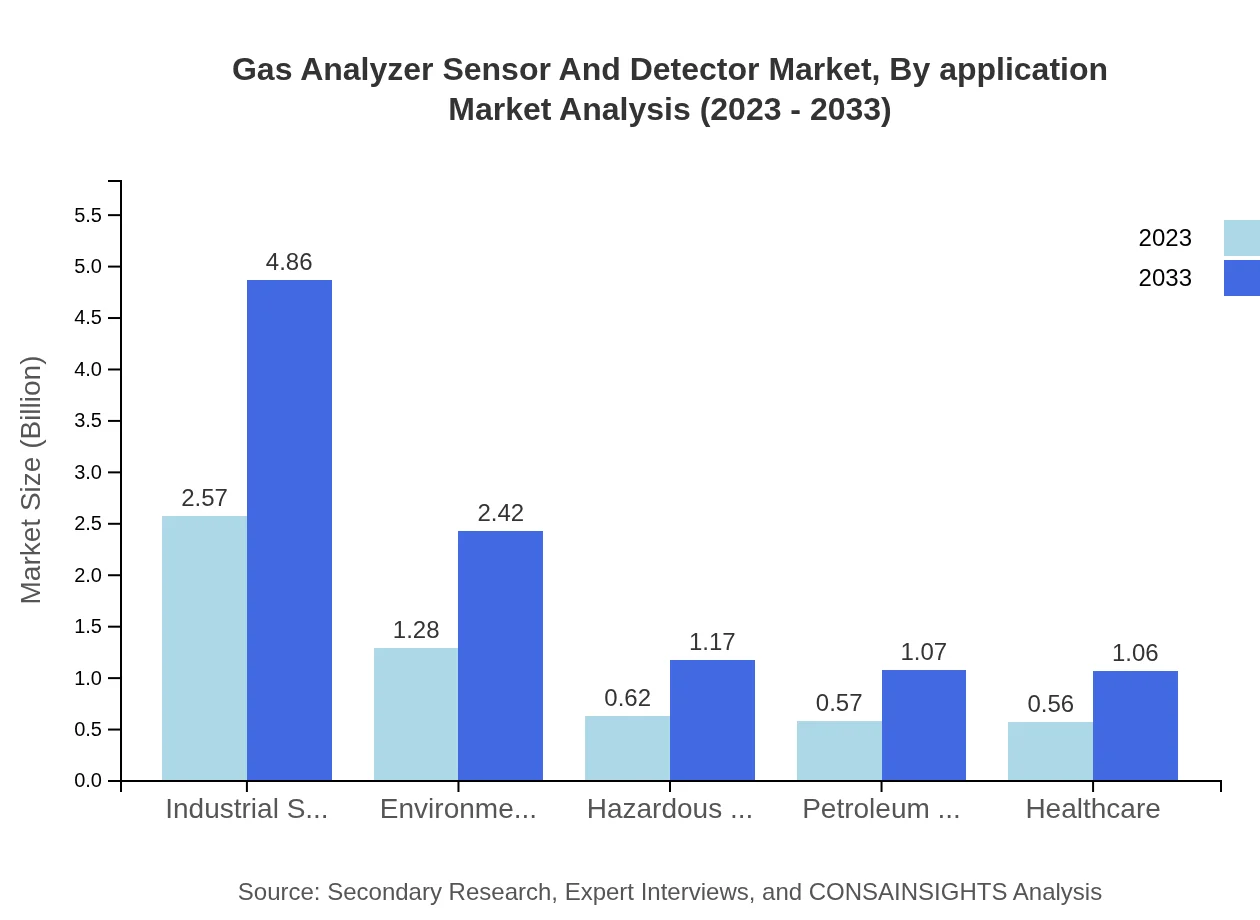

Gas Analyzer Sensor And Detector Market Analysis By Application

Applications for gas analyzers include industrial safety (45.93% share), environmental monitoring (22.88% share), and healthcare (10.09% share), reflecting the broad relevance of gas detection across critical sectors. The demand for high-quality air monitoring is driving innovations to fulfill stringent safety requirements.

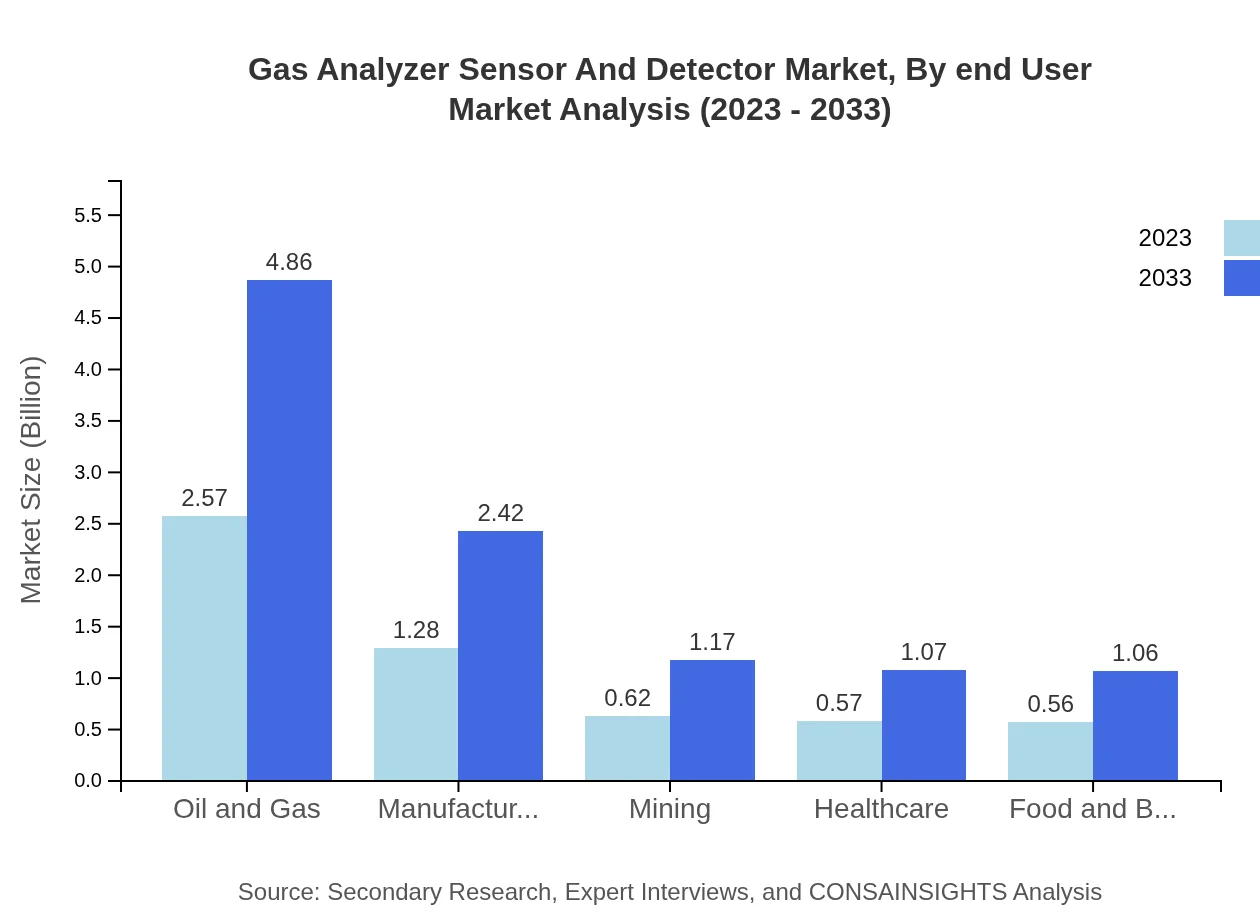

Gas Analyzer Sensor And Detector Market Analysis By End User

End-user industries such as Oil and Gas (45.93% share) and Manufacturing (22.88% share) are significant drivers of the gas analyzer market, leveraging high-quality sensors for compliance with safety standards and minimizing environmental impact.

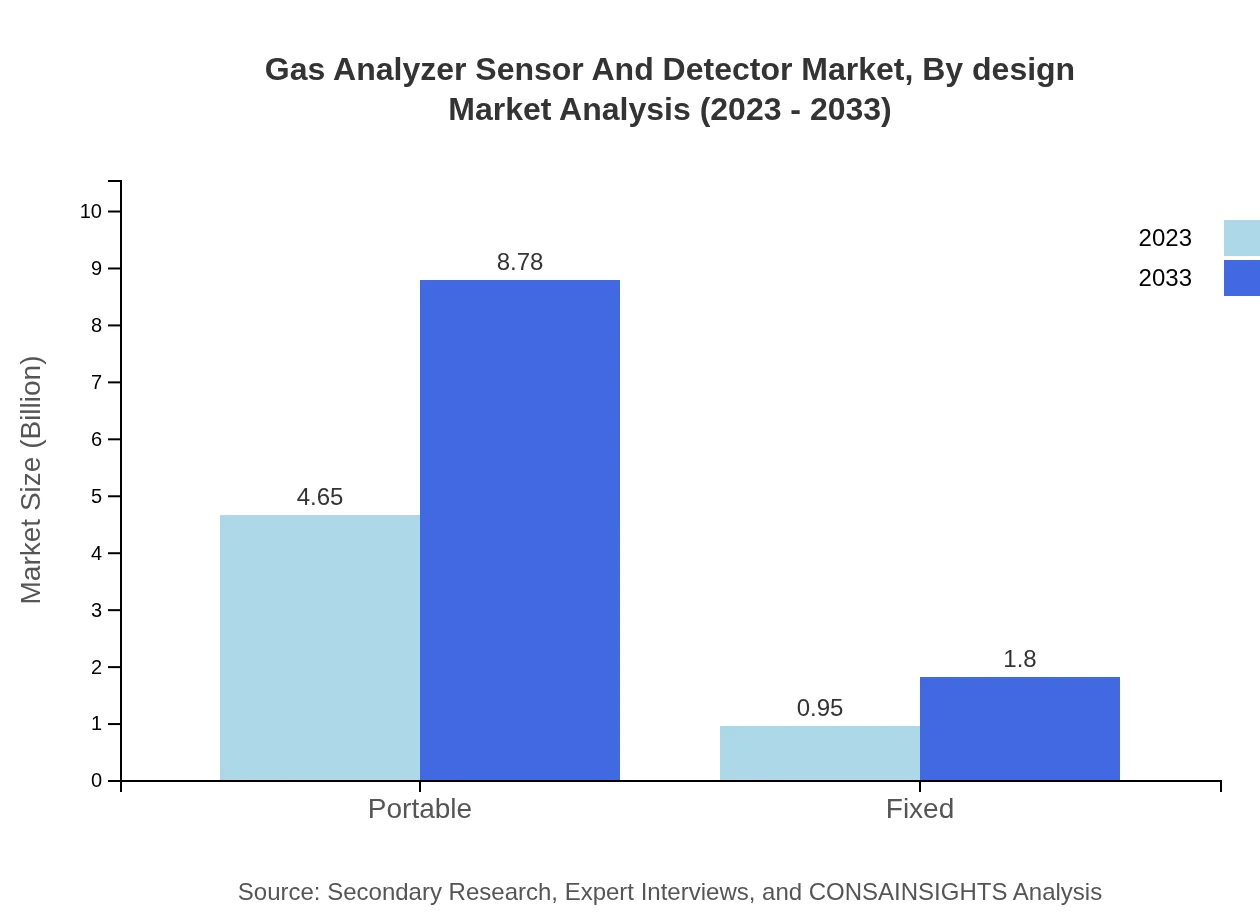

Gas Analyzer Sensor And Detector Market Analysis By Design

The market is composed of portable gas analyzers, which cover a large share of 83% in 2023 and maintain this share through 2033, alongside fixed systems which occupy the remaining segment of the market, valued at approximately $0.95 billion in 2023 and expected to grow to $1.80 billion.

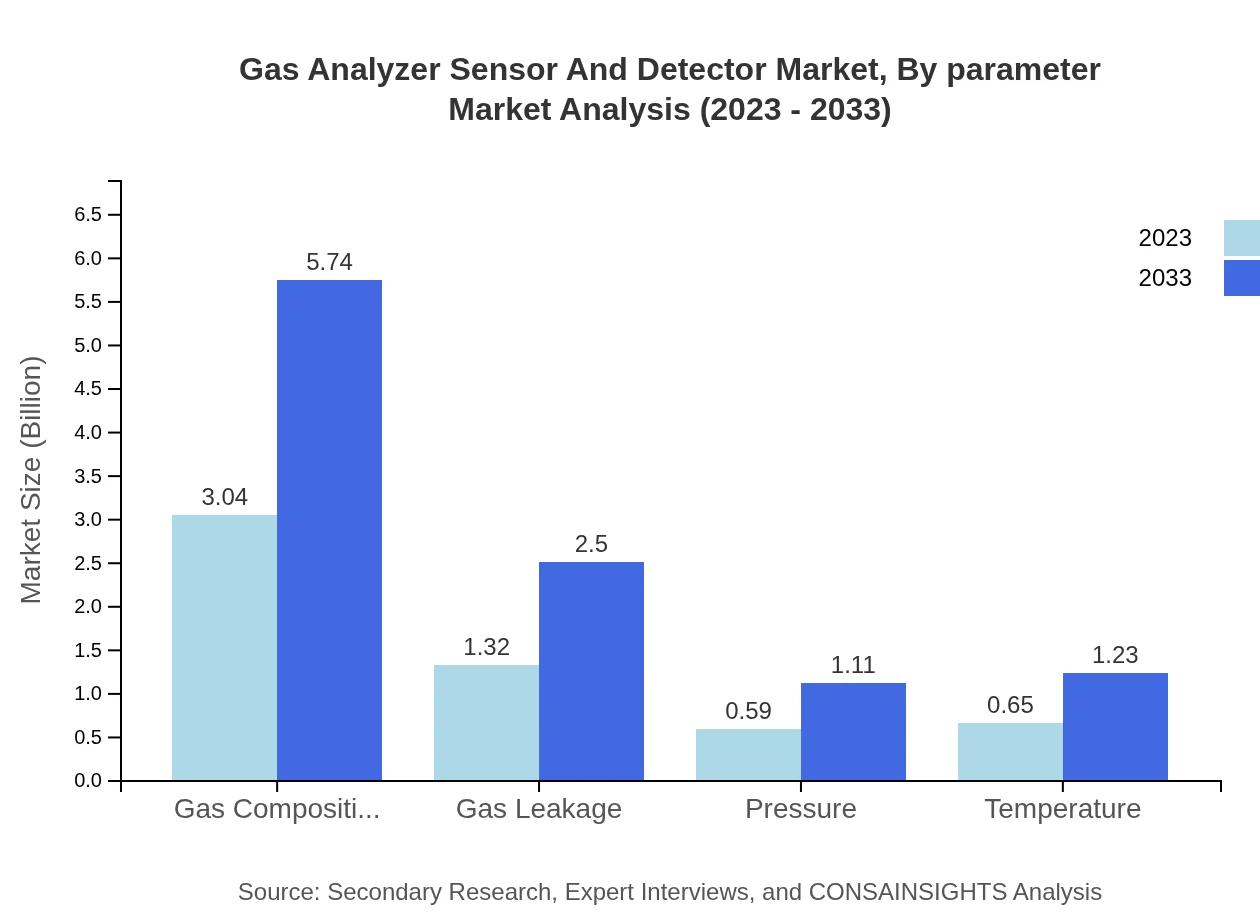

Gas Analyzer Sensor And Detector Market Analysis By Parameter

Parameters monitored include gas composition, gas leakage, pressure, and temperature. Gas composition, holding a 54.29% share, is projected to expand correspondingly, reinforcing the critical nature of these measurements in ensuring safety and regulatory compliance.

Gas Analyzer Sensor And Detector Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Gas Analyzer Sensor And Detector Industry

Honeywell International Inc.:

Specializing in gas sensing technologies and safety solutions, Honeywell is a major player known for their vast range of gas analyzers designed for various applications.Siemens AG:

Siemens offers advanced gas measurement systems that cater to numerous industries, providing robust solutions for safety and environmental monitoring.Emerson Electric Co.:

With a focus on innovation, Emerson provides smart gas analysis solutions that incorporate the latest in sensing technologies for enhanced accuracy and reliability.Ametek, Inc.:

Ametek specializes in high-performance gas analyzers and detectors, serving markets such as oil and gas, manufacturing, and environmental monitoring.Thermo Fisher Scientific Inc.:

Thermo Fisher is renowned for its analytical instruments, including gas analyzers that are widely utilized in laboratory and industrial settings.We're grateful to work with incredible clients.

FAQs

What is the market size of gas Analyzer Sensor And Detector?

The global gas analyzer sensor and detector market is valued at approximately $5.6 billion in 2023, with a projected CAGR of 6.4% from 2023 to 2033, leading to substantial growth in various segments.

What are the key market players or companies in this gas Analyzer Sensor And Detector industry?

Key players in the gas analyzer sensor and detector market include brands such as Siemens AG, Emerson Electric Co., Honeywell International Inc., and Teledyne Technologies, which contribute significantly to innovation and market dynamics.

What are the primary factors driving the growth in the gas Analyzer Sensor And Detector industry?

Growth drivers for the gas analyzer sensor and detector market include stringent environmental regulations, increased industrial safety concerns, and the rising demand for accurate gas monitoring in various applications, enhancing the need for advanced detection technologies.

Which region is the fastest Growing in the gas Analyzer Sensor And Detector?

Asia Pacific is the fastest-growing region, projected to grow from $1.09 billion in 2023 to $2.05 billion by 2033. Europe and North America also show significant growth, emphasizing global market opportunities.

Does ConsaInsights provide customized market report data for the gas Analyzer Sensor And Detector industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the gas analyzer sensor and detector industry, ensuring clients receive relevant insights and analysis for informed decision-making.

What deliverables can I expect from this gas Analyzer Sensor And Detector market research project?

Deliverables from the gas analyzer sensor and detector market research project include comprehensive market analysis reports, segment insights, competitive landscape assessments, and future growth projections, tailored to your business needs.

What are the market trends of gas Analyzer Sensor And Detector?

Current market trends include the growing adoption of portable detection systems, advancements in sensor technologies such as infrared and electrochemical sensors, and an increased focus on industrial safety and environmental monitoring.