Gas Chromatography Market Report

Published Date: 31 January 2026 | Report Code: gas-chromatography

Gas Chromatography Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the Gas Chromatography market, providing insights on market trends, sizes, and forecasts for the period from 2023 to 2033. It covers essential industry analysis, regional breakdowns, market segmentation, and an overview of major players shaping the market landscape.

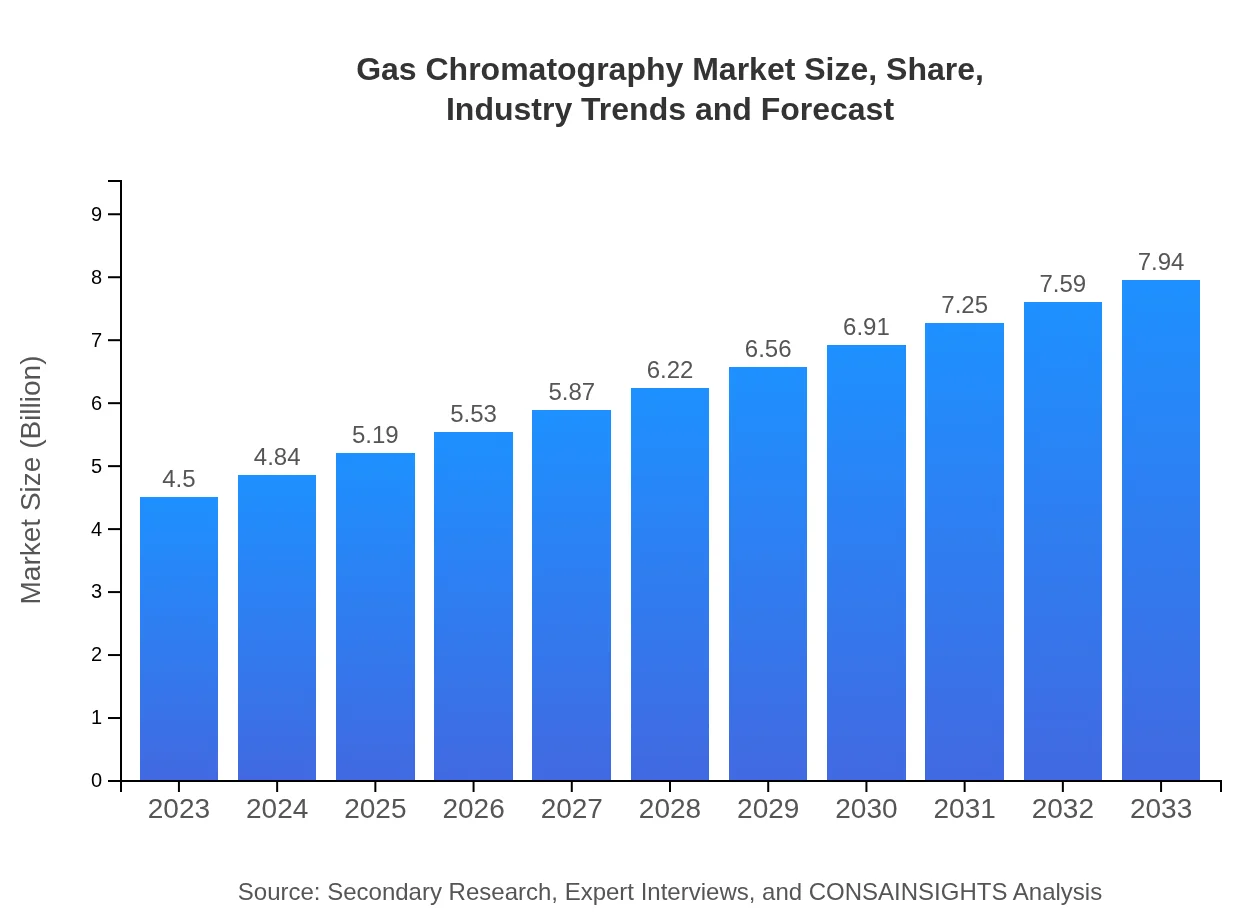

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $4.50 Billion |

| CAGR (2023-2033) | 5.7% |

| 2033 Market Size | $7.94 Billion |

| Top Companies | Agilent Technologies, Thermo Fisher Scientific, PerkinElmer |

| Last Modified Date | 31 January 2026 |

Gas Chromatography Market Overview

Customize Gas Chromatography Market Report market research report

- ✔ Get in-depth analysis of Gas Chromatography market size, growth, and forecasts.

- ✔ Understand Gas Chromatography's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Gas Chromatography

What is the Market Size & CAGR of Gas Chromatography market in 2023?

Gas Chromatography Industry Analysis

Gas Chromatography Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Gas Chromatography Market Analysis Report by Region

Europe Gas Chromatography Market Report:

The European market for Gas Chromatography is poised for steady growth, with an estimated valuation of $1.23 billion in 2023, projected to grow to $2.17 billion by 2033. The growth is supported by strict environmental regulations and the robust pharmaceutical industry in countries like Germany, France, and the UK.Asia Pacific Gas Chromatography Market Report:

The Asia-Pacific region is witnessing rapid growth in the Gas Chromatography market, primarily driven by increasing investments in healthcare and pharmaceuticals. In 2023, the market size is approximately $0.87 billion, expected to grow to $1.53 billion by 2033, reflecting a significant CAGR. Countries such as China, India, and Japan are emerging as key players, bolstered by innovations and expanding research facilities.North America Gas Chromatography Market Report:

North America leads the Gas Chromatography market, with an estimated size of $1.70 billion in 2023, expected to reach $2.99 billion by 2033. The U.S. is a major contributor, driven by robust research activities in pharmaceuticals and environmental analytics, along with high technology adoption and regulatory compliance requirements.South America Gas Chromatography Market Report:

In South America, the Gas Chromatography market is relatively smaller, with a market size of $0.18 billion in 2023, projected to increase to $0.33 billion by 2033. Demand is driven mainly by environmental testing and food safety applications. Challenges include economic fluctuations impacting healthcare spending.Middle East & Africa Gas Chromatography Market Report:

In the Middle East and Africa, the Gas Chromatography market is expected to grow from $0.52 billion in 2023 to $0.91 billion by 2033. The demand is driven by increasing focus on quality control in food testing and environmental analysis, alongside growing investments in the healthcare sector.Tell us your focus area and get a customized research report.

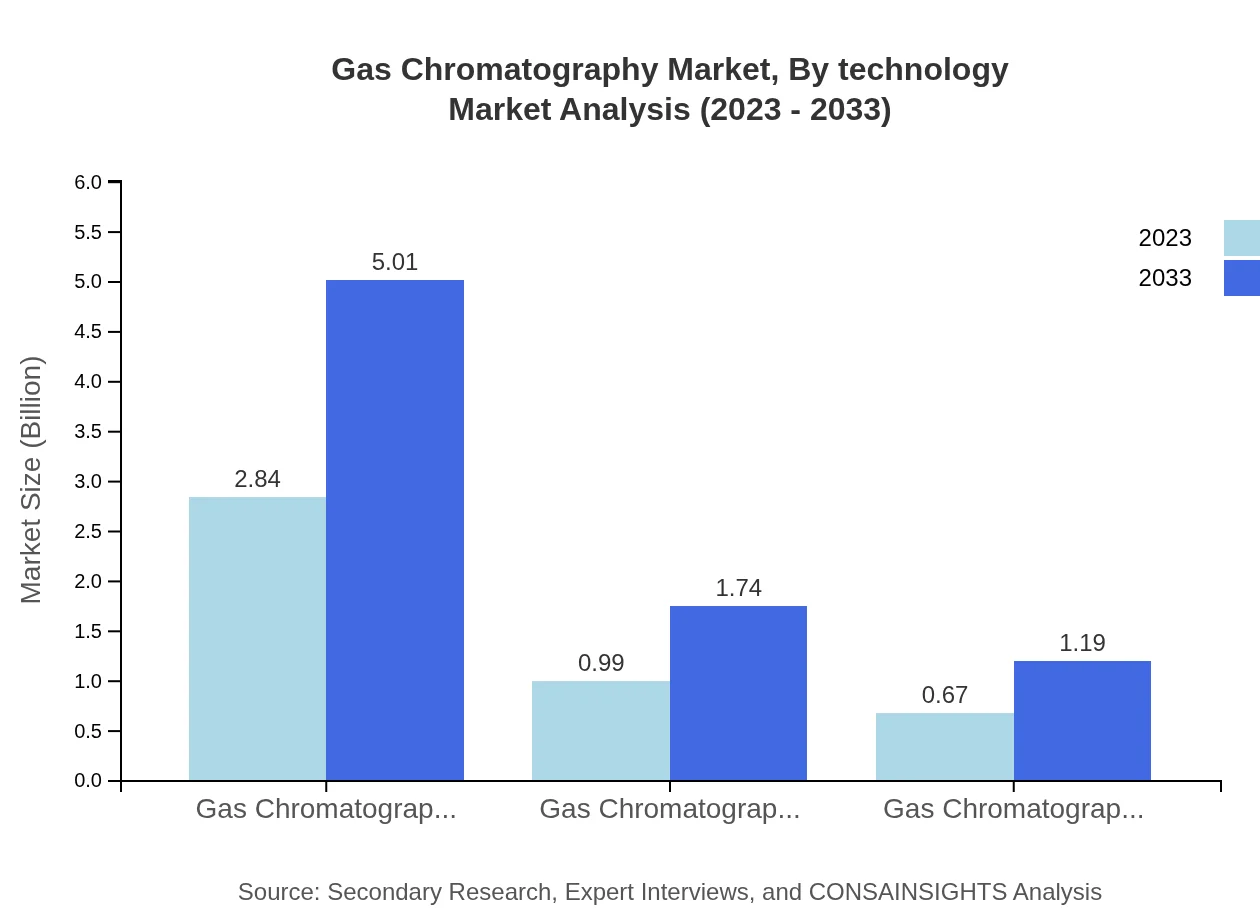

Gas Chromatography Market Analysis By Technology

The Gas Chromatography market by technology comprises multiple components, including Gas Chromatography-Mass Spectrometry (GC-MS) and Gas Chromatography-Flame Ionization Detector (GC-FID). In 2023, instruments capture a market size of $3.66 billion, with an expected growth to $6.46 billion by 2033, representing a dominant share of 81.4%.

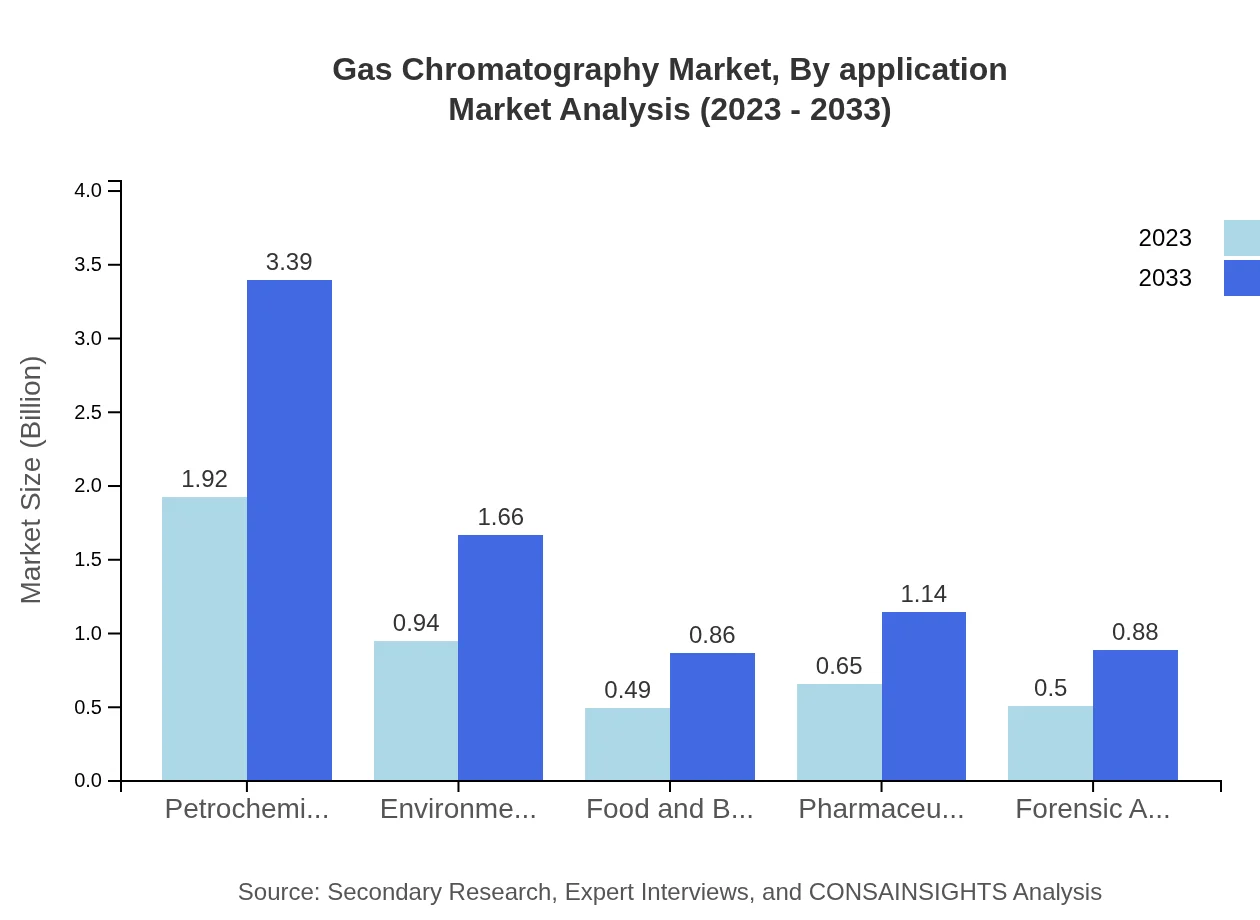

Gas Chromatography Market Analysis By Application

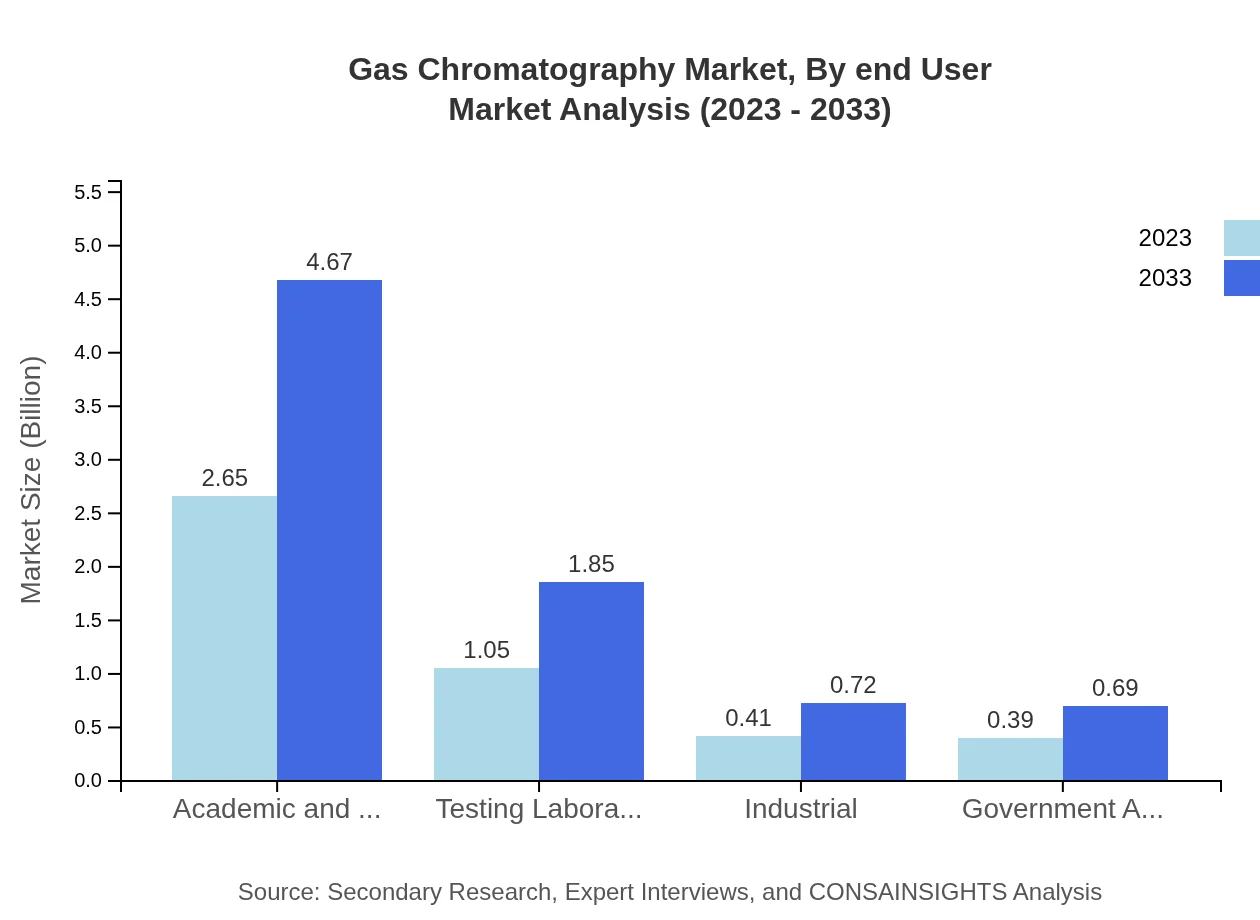

The application segment of Gas Chromatography is vital for various sectors. For instance, the academic and research institutions segment has a market size of $2.65 billion in 2023, anticipated to reach $4.67 billion by 2033, comprising a significant share of 58.84%.

Gas Chromatography Market Analysis By End User

In the end-user segment, the pharmaceutical industry leads with a market size of $0.65 billion in 2023, projected to reach $1.14 billion by 2033, holding a share of 14.37%. Additionally, industries such as food and beverage testing and petrochemicals exhibit significant market presence.

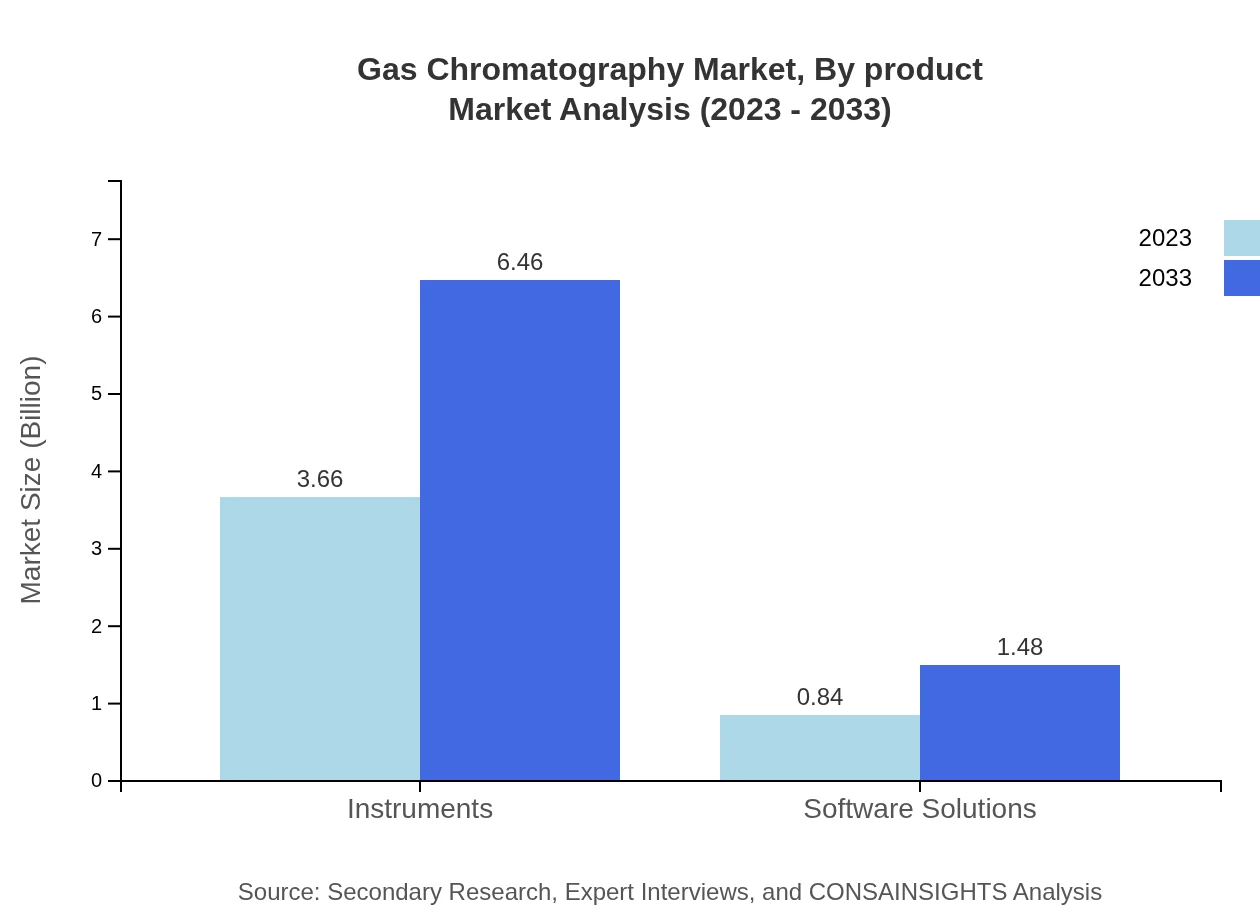

Gas Chromatography Market Analysis By Product

Product types in Gas Chromatography, particularly GC-MS and GC-FID, manifest robust growth. GC-MS commands a market size of $2.84 billion in 2023, expected to grow to $5.01 billion by 2033, with a substantial share of 63.09%.

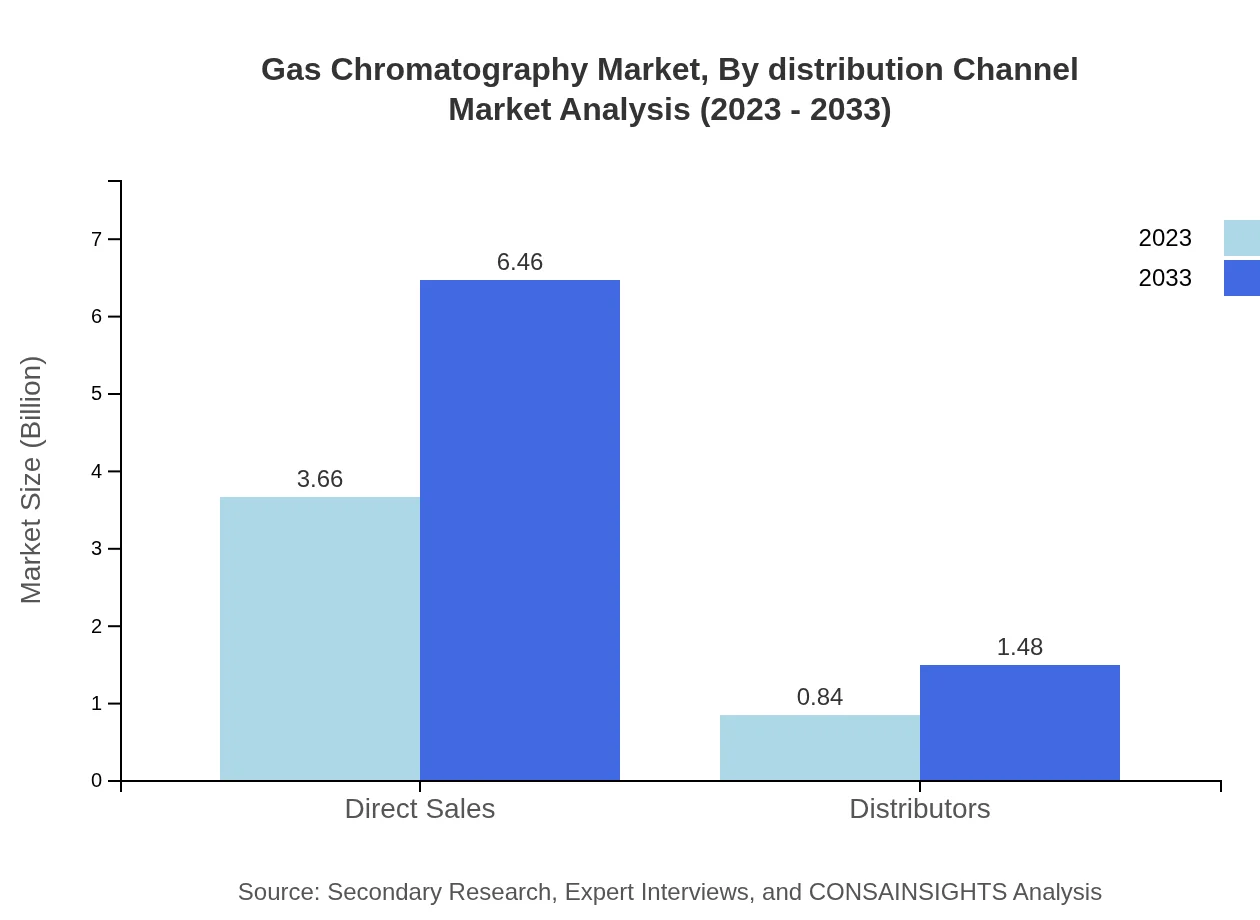

Gas Chromatography Market Analysis By Distribution Channel

The distribution channels for Gas Chromatography primarily involve direct sales and distributors. Direct sales dominate with a market size of $3.66 billion in 2023, with consistent growth expected, maintaining a market share of 81.4%.

Gas Chromatography Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Gas Chromatography Industry

Agilent Technologies:

A leader in the analytical instrument market, Agilent Technologies supplies various Gas Chromatography products, enhancing accuracy and efficiency in analysis.Thermo Fisher Scientific:

A global leader providing innovative instruments, software, and services that support laboratory analysis and increase productivity in the Gas Chromatography space.PerkinElmer:

Known for their advanced analytical instruments, PerkinElmer offers comprehensive solutions catering to diverse sectors, including environmental and food safety.We're grateful to work with incredible clients.

FAQs

What is the market size of gas chromatography?

The global gas chromatography market was valued at approximately $4.5 billion in 2023, with a projected CAGR of 5.7% from 2023 to 2033, indicating robust growth driven by various applications in sectors such as environmental analysis and pharmaceuticals.

What are the key market players or companies in the gas chromatography industry?

Key market players in the gas chromatography industry include Agilent Technologies, Thermo Fisher Scientific, PerkinElmer, and Waters Corporation, each contributing significantly to product innovation and market expansion through advanced technologies.

What are the primary factors driving the growth in the gas chromatography industry?

Factors driving growth in the gas chromatography market include increased demand in environmental protection regulations, advancements in analytical techniques, and rising applications in pharmaceuticals and food safety, enhancing the need for precise testing.

Which region is the fastest Growing in the gas chromatography market?

The Asia-Pacific region is the fastest-growing area in the gas chromatography market. It is expected to grow from $0.87 billion in 2023 to $1.53 billion in 2033, driven by increasing industrialization and stringent regulatory frameworks.

Does ConsaInsights provide customized market report data for the gas chromatography industry?

Yes, ConsaInsights offers customized market report data for the gas chromatography industry, tailored to meet specific client needs across various application domains and regional markets, ensuring relevant insights for strategic decision-making.

What deliverables can I expect from this gas chromatography market research project?

From the gas chromatography market research project, clients can expect comprehensive reports including market analysis, trend forecasts, competitive landscape insights, segmented data, and actionable recommendations for strategic business planning.

What are the market trends of gas chromatography?

Current trends in the gas chromatography market include the rise of automation in laboratories, the growing integration of AI for data analysis, and an increasing focus on environmentally-friendly analytical practices, reflecting broader industry shifts.