Gas Detection Equipment Market Report

Published Date: 31 January 2026 | Report Code: gas-detection-equipment

Gas Detection Equipment Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Gas Detection Equipment market, including market size, trends, and forecasts from 2023 to 2033. It highlights technological advancements, regional insights, and the performance of various segments within the industry.

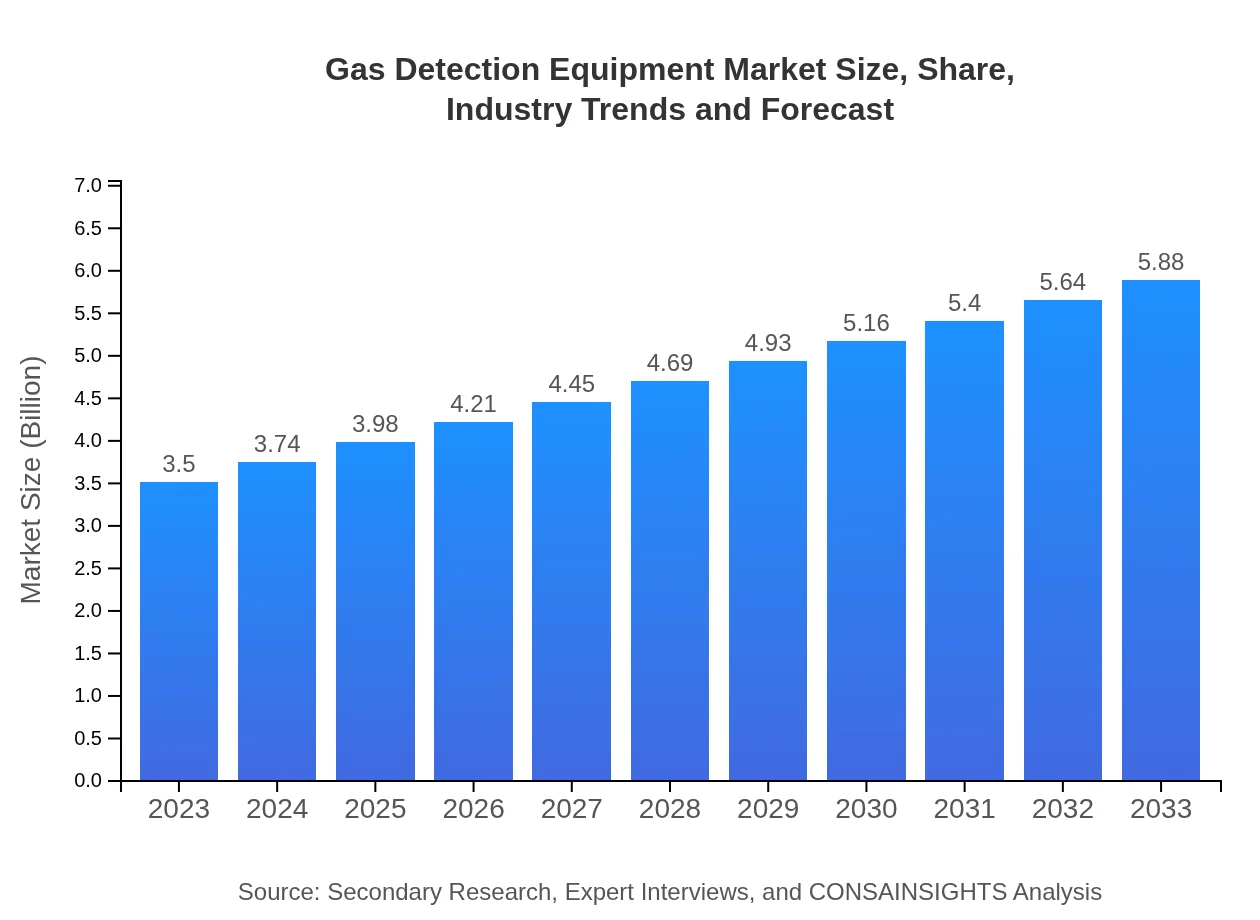

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $5.88 Billion |

| Top Companies | Honeywell Analytics, MSA Safety Incorporation, Drägerwerk AG, Industrial Scientific Corporation |

| Last Modified Date | 31 January 2026 |

Gas Detection Equipment Market Overview

Customize Gas Detection Equipment Market Report market research report

- ✔ Get in-depth analysis of Gas Detection Equipment market size, growth, and forecasts.

- ✔ Understand Gas Detection Equipment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Gas Detection Equipment

What is the Market Size & CAGR of Gas Detection Equipment market in 2023?

Gas Detection Equipment Industry Analysis

Gas Detection Equipment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Gas Detection Equipment Market Analysis Report by Region

Europe Gas Detection Equipment Market Report:

Europe represents a mature market, with the value expected to increase from $1.06 billion in 2023 to $1.78 billion by 2033. Significant investments in environmental monitoring and safety standards guarantee steady growth. Countries like Germany and the UK are leading technological advancements in gas detection.Asia Pacific Gas Detection Equipment Market Report:

In 2023, the Asia Pacific gas detection equipment market is valued at $0.72 billion and is projected to grow to $1.21 billion by 2033. The growth is fueled by industrial growth, particularly in China and India, where manufacturing and energy sectors are expanding rapidly. The increasing awareness of safety protocols and regulations is also boosting market demand.North America Gas Detection Equipment Market Report:

North America holds a significant position in the gas detection equipment market, valued at $1.14 billion in 2023 and projected to reach $1.91 billion by 2033. The focus on industrial safety and compliance with strict Occupational Safety and Health Administration (OSHA) regulations ensure robust market expansion in the U.S. and Canada.South America Gas Detection Equipment Market Report:

The South America region is currently valued at $0.11 billion in 2023, expected to rise to $0.18 billion by 2033. Although smaller in comparison to other regions, growth is anticipated due to rising investments in industrial safety and environmental regulations. Brazil and Argentina are leading in implementing gas detection technologies.Middle East & Africa Gas Detection Equipment Market Report:

The Middle East and Africa market is valued at $0.47 billion in 2023 and will reach approximately $0.80 billion by 2033. The growth is driven by advancements in oil and gas exploration activities which necessitate stringent safety measures. Furthermore, increased awareness about workplace safety regulations is becoming prominent.Tell us your focus area and get a customized research report.

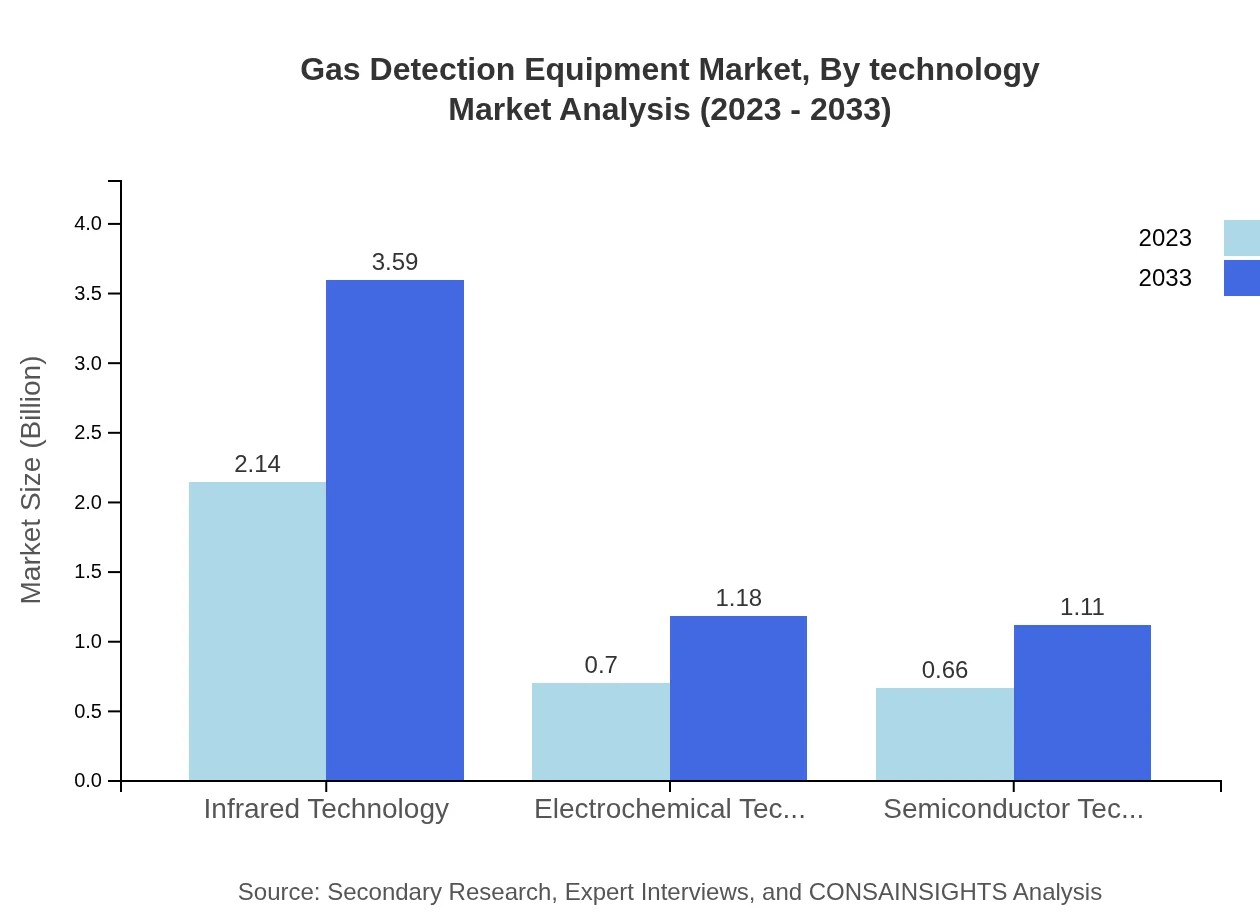

Gas Detection Equipment Market Analysis By Technology

In 2023, the gas detection equipment market is majorly driven by Infrared Technology, accounting for $2.14 billion and expected to grow to $3.59 billion by 2033, representing a 61.06% market share. Following this, Electrochemical Technology holds a significant stake with $0.70 billion, growing to $1.18 billion (20.1% share), and Semiconductor Technology, starting at $0.66 billion and reaching $1.11 billion (18.84% share) by 2033.

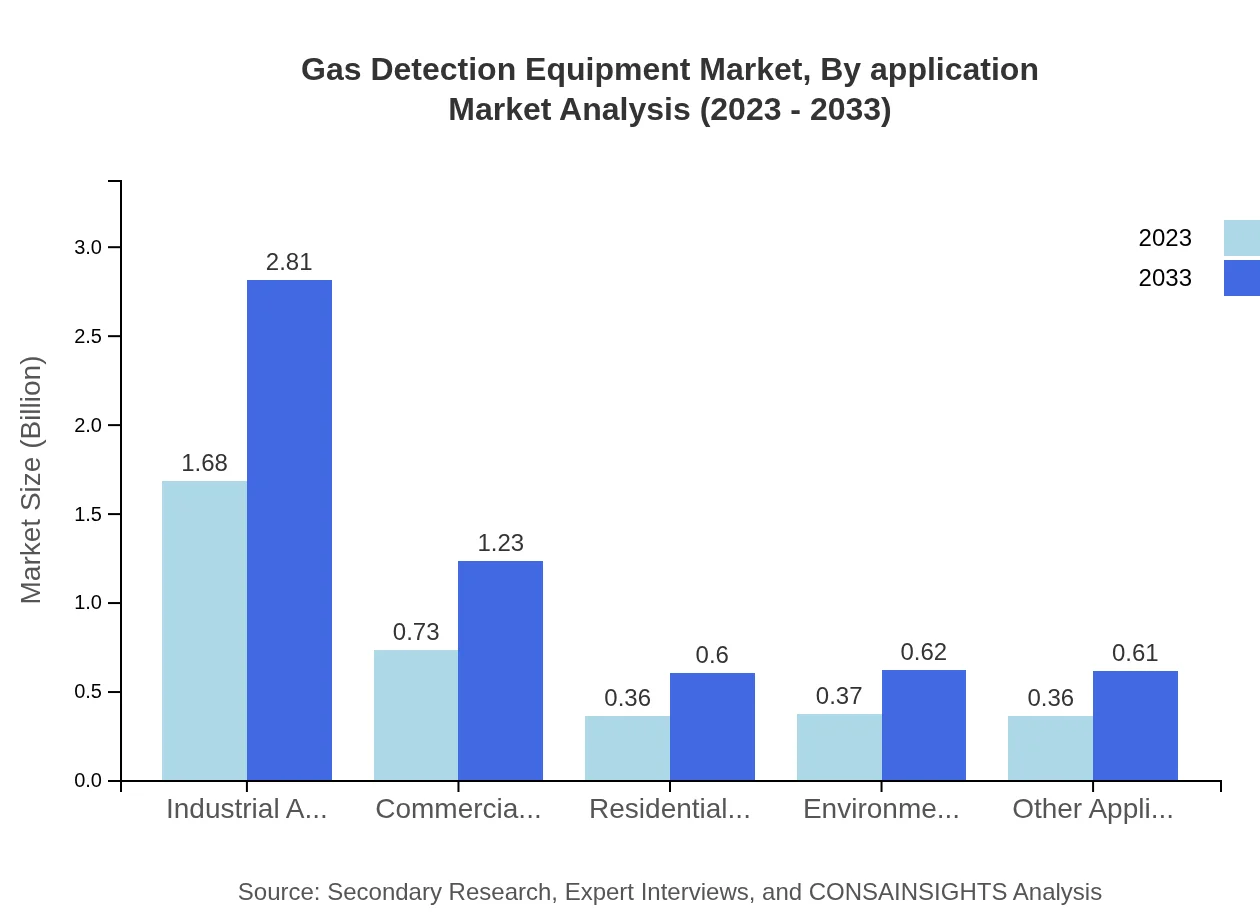

Gas Detection Equipment Market Analysis By Application

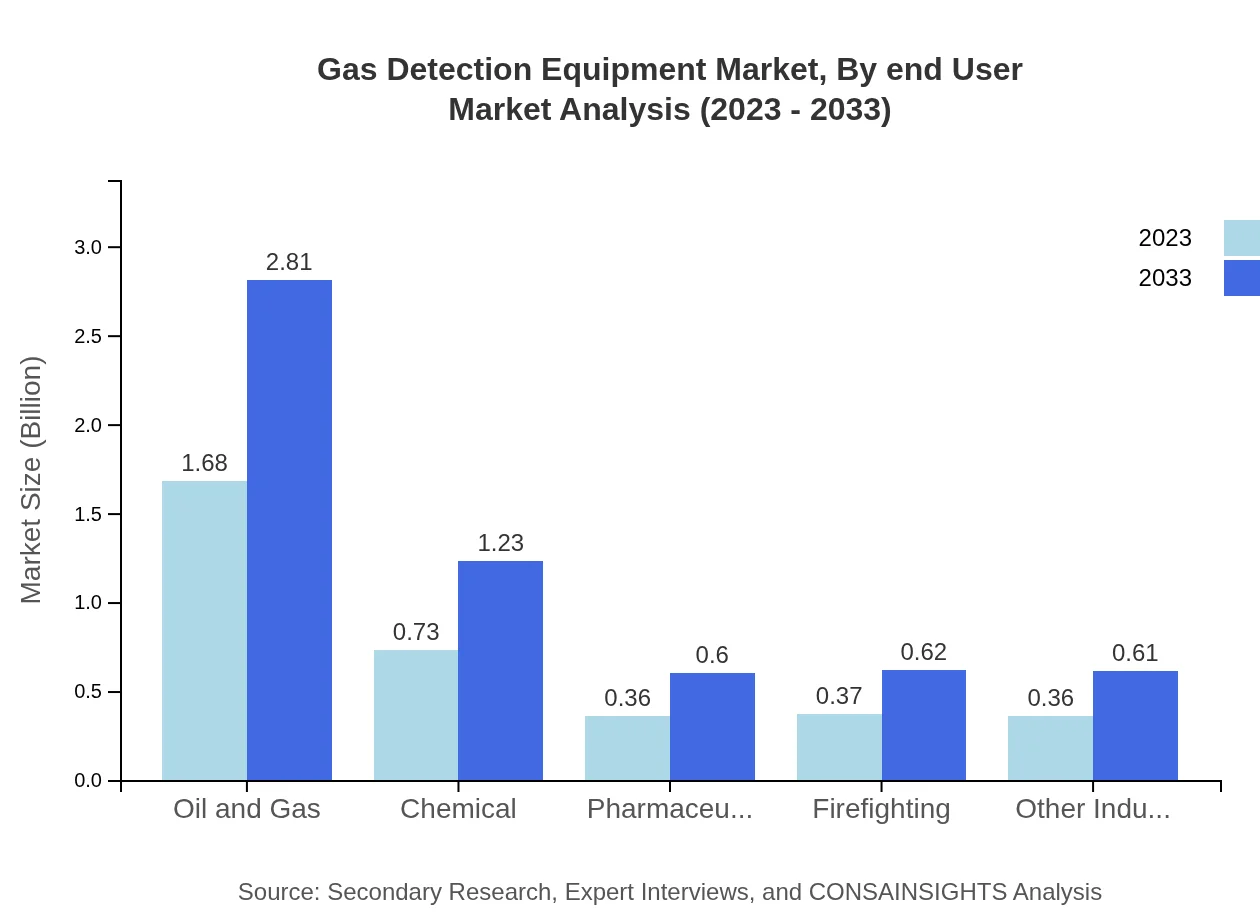

The market is predominantly segmented into applications such as Oil and Gas, Chemical, and Environmental Industries. The Oil and Gas sector stands out with a market size of $1.68 billion in 2023, projected to increase to $2.81 billion by 2033, accounting for a 47.89% share. The Chemical sector, valued at $0.73 billion, is expected to grow to $1.23 billion by 2033 (20.94% share). Similarly, Environmental Applications also reflect considerable potential with rapid growth expected in the upcoming years.

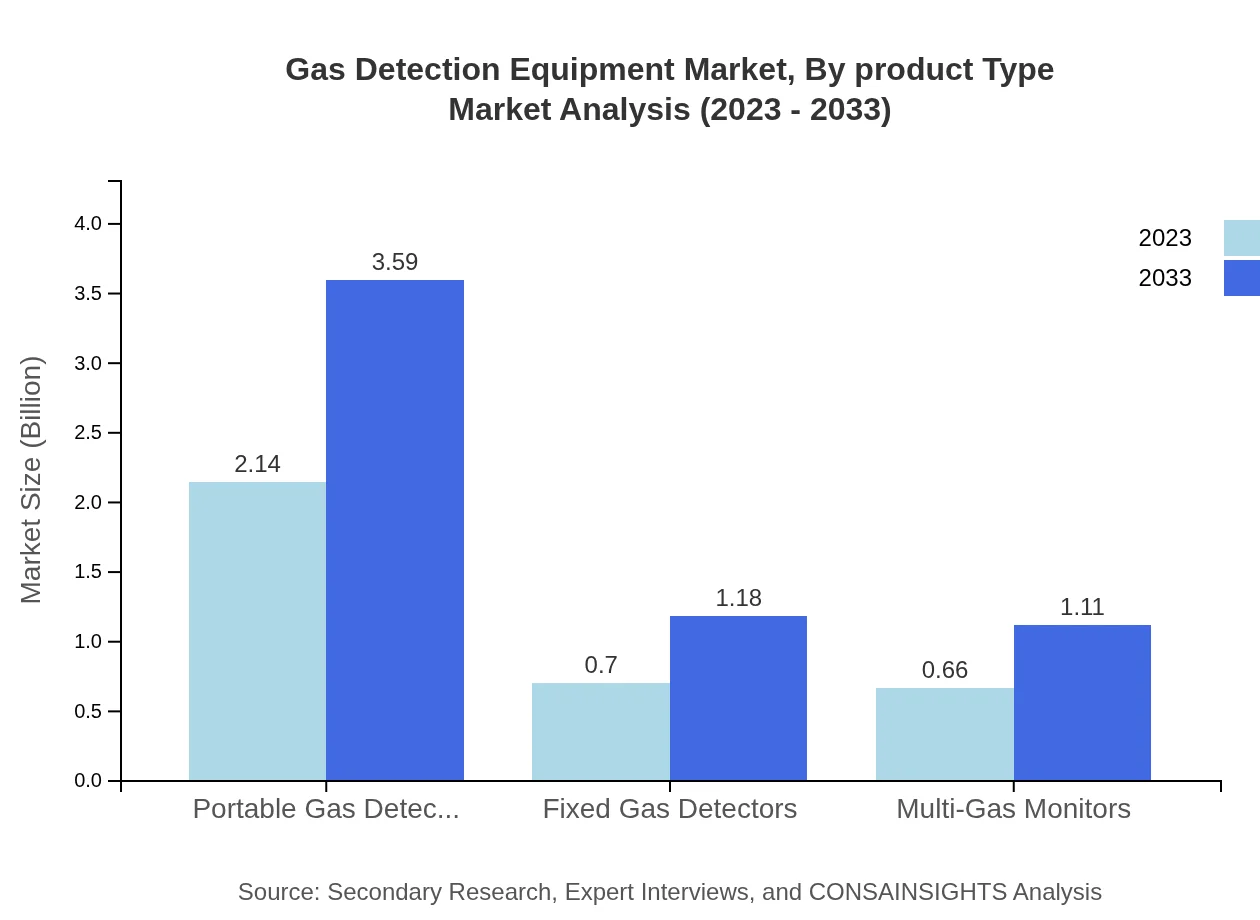

Gas Detection Equipment Market Analysis By Product Type

Portable Gas Detectors are dominating the market with a size of $2.14 billion in 2023, expected to reach $3.59 billion by 2033, maintaining a 61.06% market share. Fixed Gas Detectors follow with a projected growth from $0.70 billion to $1.18 billion (20.1% share) while Multi-Gas Monitors, representing a niche segment, will grow from $0.66 billion to $1.11 billion, maintaining an 18.84% share in the market.

Gas Detection Equipment Market Analysis By End User

The industrial applications, primarily in Oil and Gas, account for a significant share of the gas detection equipment market with a size of $1.68 billion in 2023, expected to grow to $2.81 billion (47.89% share). The commercial applications sector is also relevant, starting at $0.73 billion and projected to reach $1.23 billion by 2033 (20.94% share). Households and environmental applications are additionally indicating increasing market importance.

Gas Detection Equipment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Gas Detection Equipment Industry

Honeywell Analytics:

A forefront player in the gas detection industry, Honeywell provides advanced detection technologies and innovations, ensuring optimal safety in industrial applications.MSA Safety Incorporation:

MSA is a key provider of safety products, including gas detection equipment, and is recognized for integrating cutting-edge technologies to enhance user safety and compliance.Drägerwerk AG:

Dräger is known for its innovative gas detection solutions aimed at various industries. The company focuses on high-quality products that meet international safety standards.Industrial Scientific Corporation:

Specializes in portable gas detection equipment, Industrial Scientific emphasizes user-friendly devices integrated with modern technologies for immediate threat response.We're grateful to work with incredible clients.

FAQs

What is the market size of gas Detection Equipment?

The gas detection equipment market is valued at approximately $3.5 billion in 2023, with a projected growth trajectory leading to an estimated size of $5.7 billion by 2033, reflecting a CAGR of 5.2% during this period.

What are the key market players or companies in this gas Detection Equipment industry?

Major players in the gas detection equipment market include Honeywell Analytics, Drägerwerk AG, MSA Safety, and RKI Instruments. These companies drive innovation and maintain a competitive edge in technology and product offerings.

What are the primary factors driving the growth in the gas Detection Equipment industry?

Key growth factors include increased industrial safety regulations, technological advancements in detection systems, rising demand from the oil and gas sector, and expanding applications in environmental monitoring and safety protocols.

Which region is the fastest Growing in the gas Detection Equipment?

Asia Pacific is the fastest-growing region for gas detection equipment, with market growth from $0.72 billion in 2023 to $1.21 billion by 2033. This highlights a significant investment in safety infrastructure in emerging markets amid industrial growth.

Does ConsaInsights provide customized market report data for the gas Detection Equipment industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the gas detection equipment industry, ensuring clients receive relevant insights and analysis pertinent to their unique business challenges and objectives.

What deliverables can I expect from this gas Detection Equipment market research project?

Expect comprehensive deliverables, including detailed market analysis reports, segment performance insights, competitive landscape assessments, regional growth trends, and future market projections tailored to your business needs within the gas detection equipment sector.

What are the market trends of gas Detection Equipment?

Current market trends include increased adoption of portable detection devices, integration of IoT and smart technologies, focus on compliance with stringent safety regulations, and strategic partnerships for enhanced product development in the gas detection industry.