Gas Detectors Market Report

Published Date: 31 January 2026 | Report Code: gas-detectors

Gas Detectors Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Gas Detectors market from 2023 to 2033, highlighting key insights, trends, and data concerning market growth, segmentation, and technology advancements.

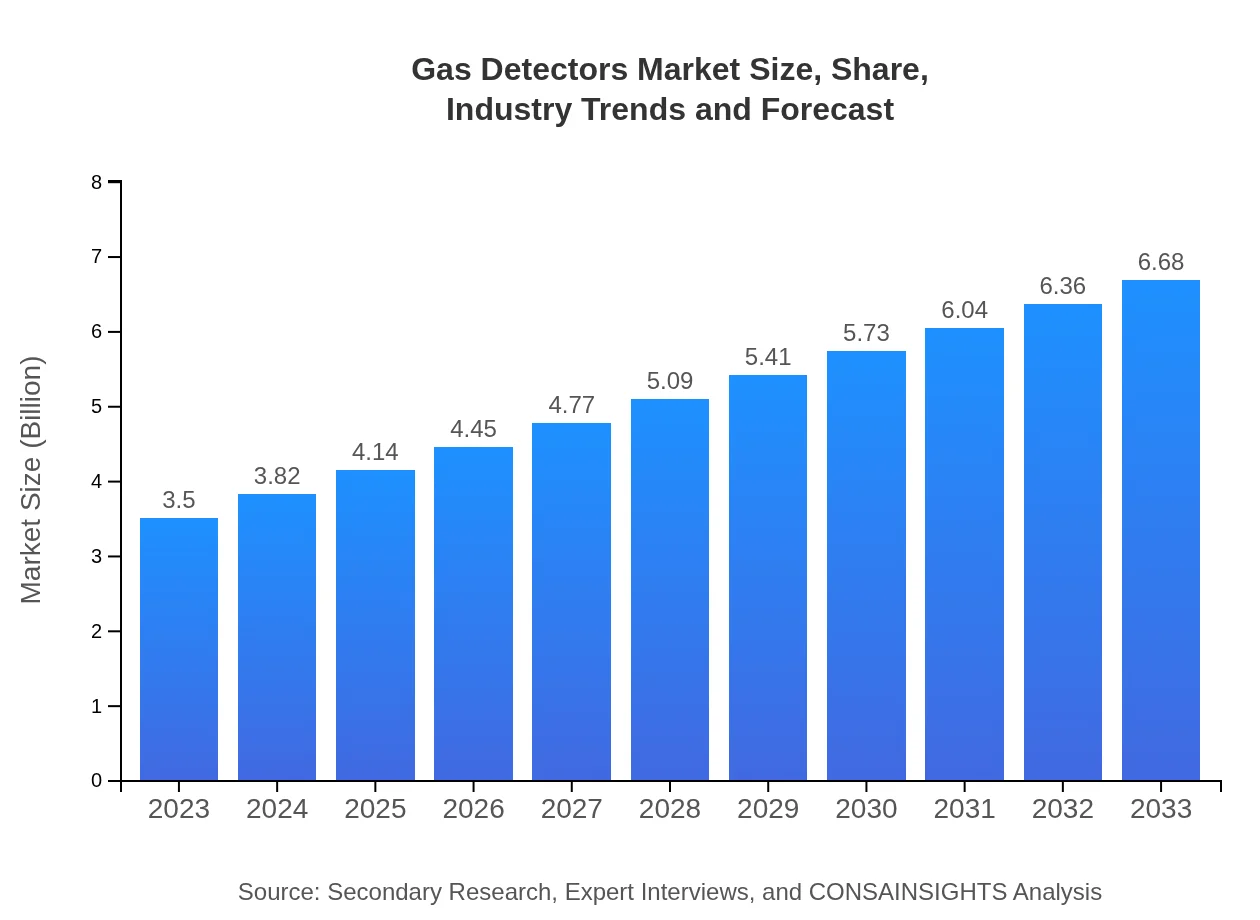

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 6.5% |

| 2033 Market Size | $6.68 Billion |

| Top Companies | Honeywell International Inc., MSA Safety Incorporated, Drägerwerk AG & Co. KGaA, Industrial Scientific Corporation |

| Last Modified Date | 31 January 2026 |

Gas Detectors Market Overview

Customize Gas Detectors Market Report market research report

- ✔ Get in-depth analysis of Gas Detectors market size, growth, and forecasts.

- ✔ Understand Gas Detectors's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Gas Detectors

What is the Market Size & CAGR of Gas Detectors market in 2023?

Gas Detectors Industry Analysis

Gas Detectors Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Gas Detectors Market Analysis Report by Region

Europe Gas Detectors Market Report:

Europe's Gas Detectors market is forecasted to grow from $1.23 billion in 2023 to $2.34 billion by 2033, driven by stringent environmental regulations and proactive safety protocols across industries, especially in chemical manufacturing.Asia Pacific Gas Detectors Market Report:

In the Asia Pacific region, the Gas Detectors market is expected to grow from $0.58 billion in 2023 to $1.10 billion by 2033, illustrating a significant increase in industrial development and enhanced safety regulations that are driving demand for gas detection solutions.North America Gas Detectors Market Report:

In North America, the market size will increase from $1.22 billion in 2023 to $2.32 billion by 2033. The region's robust regulatory framework and investments in safety equipment in various industries contribute to strong market performance.South America Gas Detectors Market Report:

The South American market for Gas Detectors is projected to grow from $0.24 billion in 2023 to $0.46 billion in 2033. This growth is fueled by expanding oil and gas operations and a heightened awareness of environmental protection.Middle East & Africa Gas Detectors Market Report:

The Middle East and Africa region is poised for growth, with market size expanding from $0.24 billion in 2023 to $0.45 billion by 2033. The oil and gas sector's focus on safety standards promotes the adoption of advanced gas detection technologies.Tell us your focus area and get a customized research report.

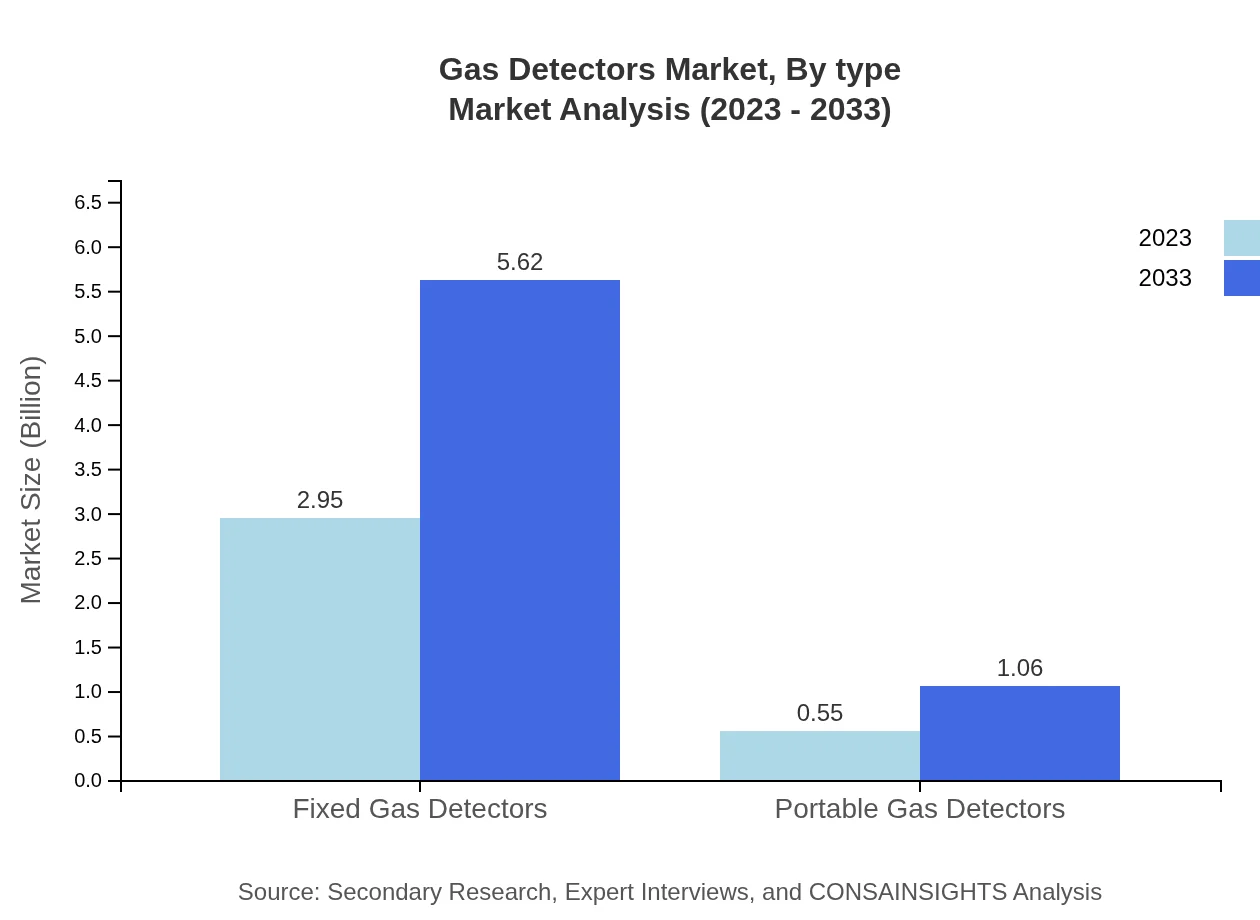

Gas Detectors Market Analysis By Type

Fixed Gas Detectors hold a significant portion of the market, with a projected growth from $2.95 billion in 2023 to $5.62 billion by 2033, indicating a market share of 84.18%. Portable Gas Detectors, although smaller at $0.55 billion in 2023, are expected to reach $1.06 billion by 2033, holding a 15.82% market share.

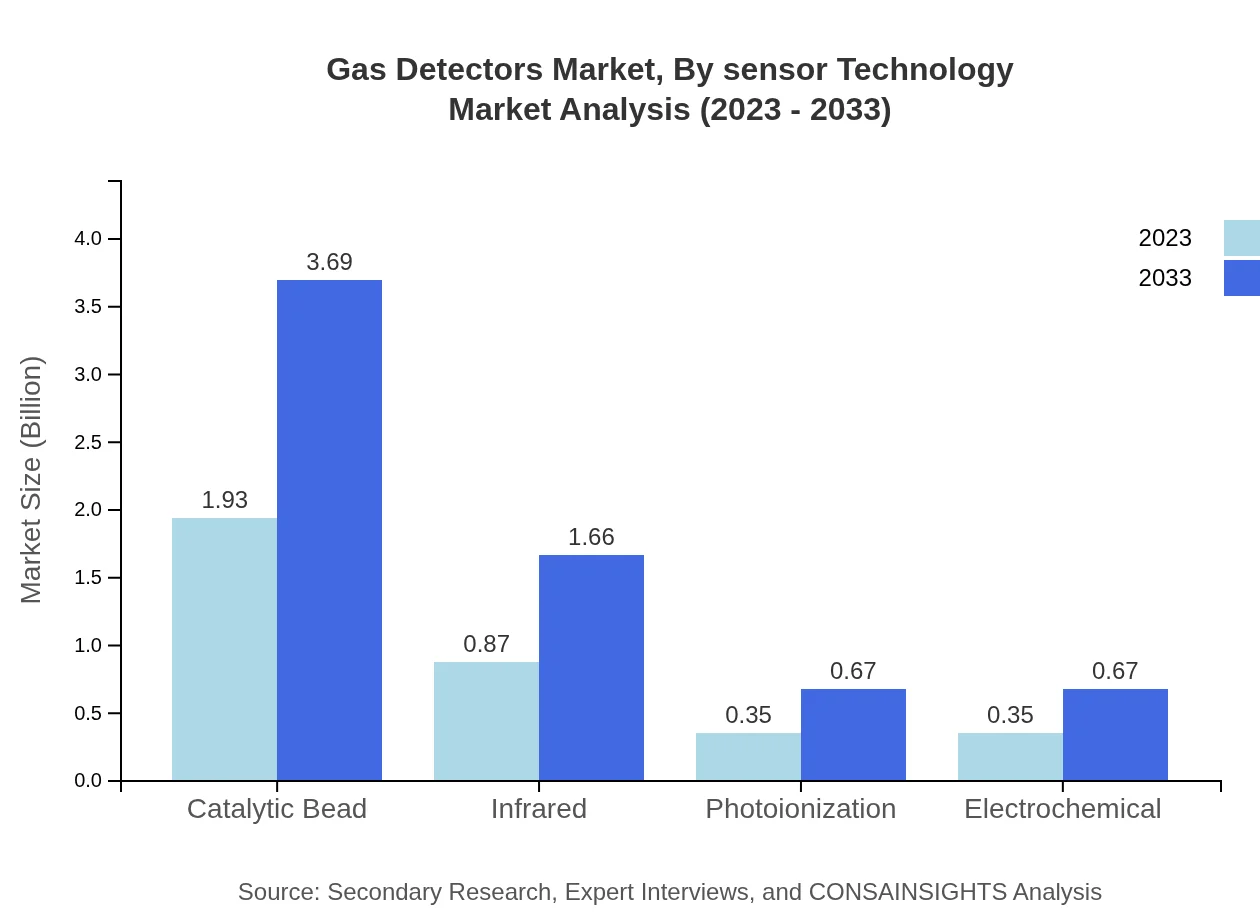

Gas Detectors Market Analysis By Sensor Technology

Catalytic Bead sensors are currently the most dominant, with a market size projected to increase from $1.93 billion in 2023 to $3.69 billion by 2033, maintaining a market share of 55.18%. Infrared sensors are steadily growing, expected to rise from $0.87 billion to $1.66 billion.

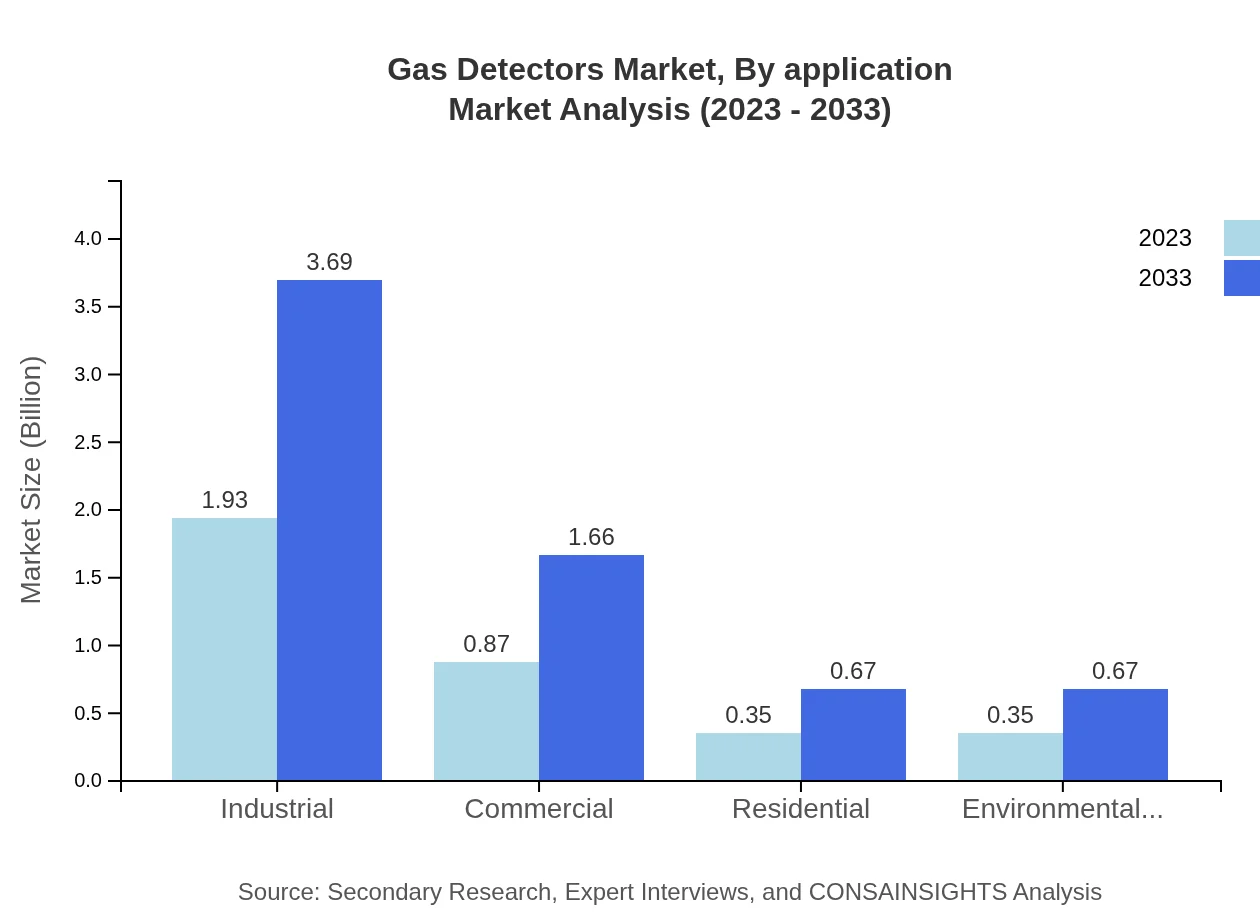

Gas Detectors Market Analysis By Application

In applications, the Industrial segment dominates with a market size increase from $1.93 billion in 2023 to $3.69 billion by 2033, claiming a share of 55.18%. Commercial applications follow with notable growth from $0.87 billion to $1.66 billion.

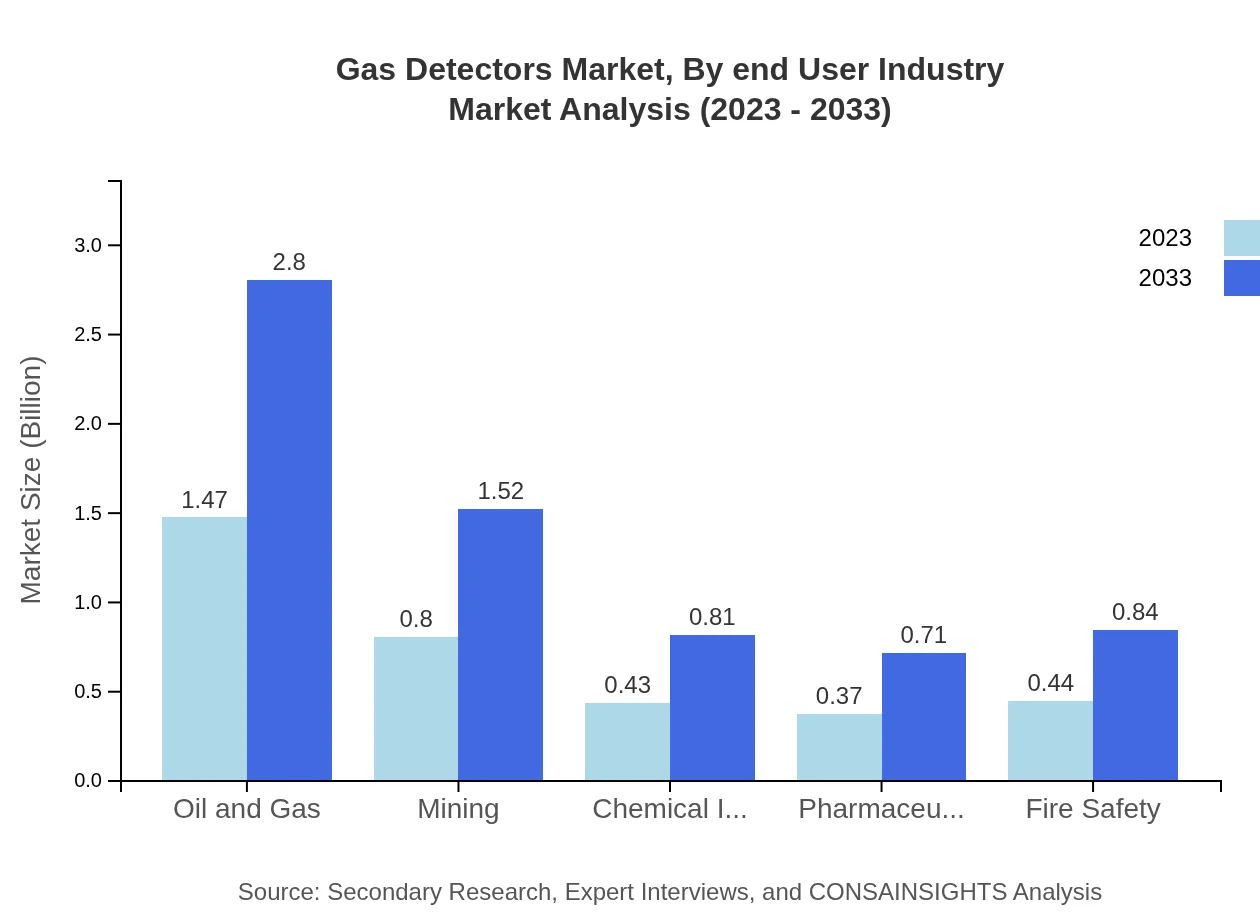

Gas Detectors Market Analysis By End User Industry

The Oil and Gas industry represents a significant portion of the market, anticipated to grow from $1.47 billion in 2023 to $2.80 billion by 2033, with a market share of 41.94%. Other key sectors include the Mining and Chemical industries, which also see substantial growth.

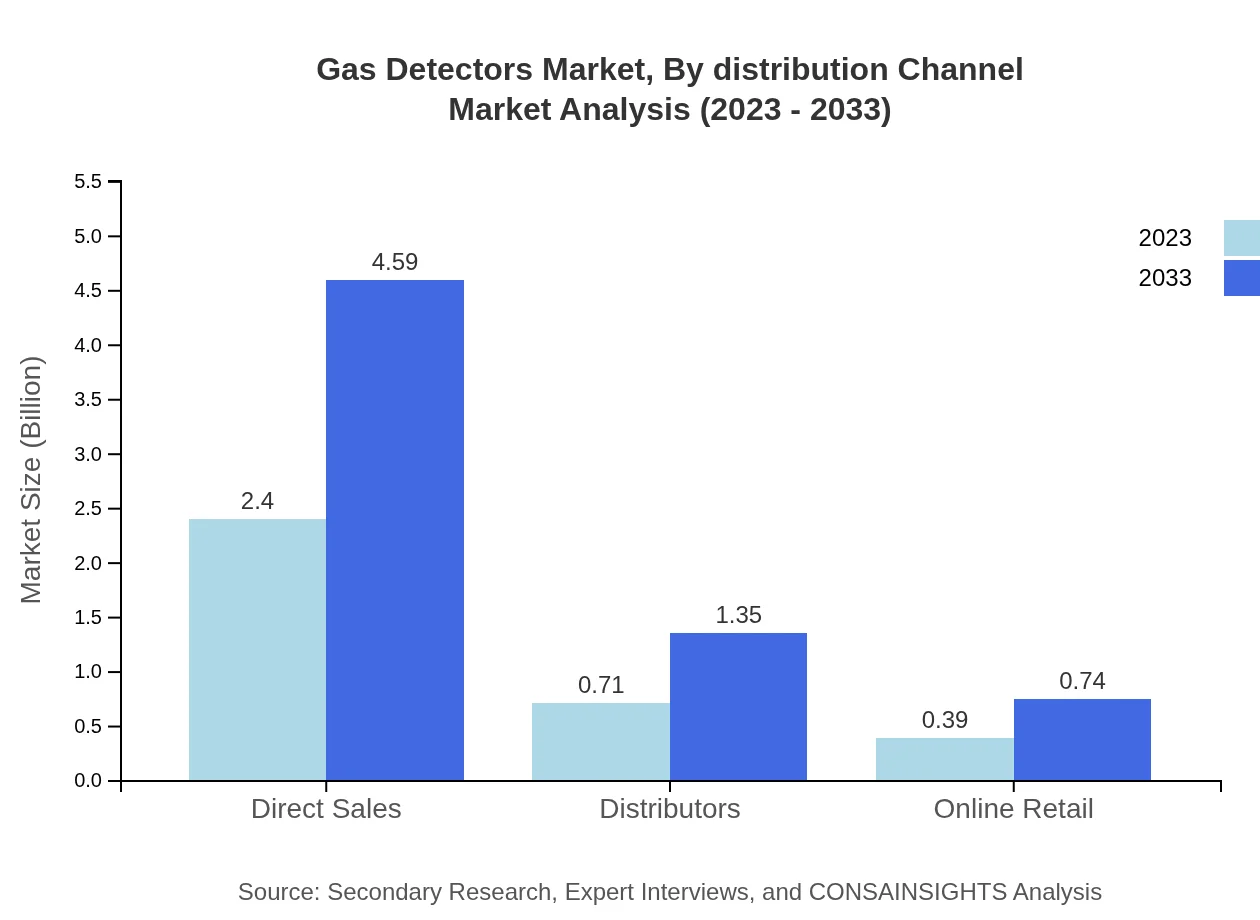

Gas Detectors Market Analysis By Distribution Channel

Direct Sales channels are currently leading the market with revenues projected to grow from $2.40 billion to $4.59 billion between 2023 and 2033, representing a share of 68.66%. Online Retail and Distributors also play crucial roles in expanding market access.

Gas Detectors Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Gas Detectors Industry

Honeywell International Inc.:

A leader in engineering and technology solutions, Honeywell offers a range of gas detectors known for their reliability and advanced safety features, serving various sectors from industrial to residential.MSA Safety Incorporated:

MSA Safety is synonymous with safety equipment and offers a wide selection of gas detection products tailored for high-performance environments, ensuring workplace safety and compliance.Drägerwerk AG & Co. KGaA:

Dräger specializes in medical and safety technology, manufacturing advanced gas detection equipment for industrial applications, renowned for precision and reliability.Industrial Scientific Corporation:

Focused on portable gas detection solutions, Industrial Scientific leads in innovation, providing real-time gas monitoring tools that enhance safety in various industrial settings.We're grateful to work with incredible clients.

FAQs

What is the market size of gas Detectors?

The global gas detectors market has a size of approximately $3.5 billion in 2023 with a projected CAGR of 6.5% through to 2033. This growth is driven by increasing safety regulations and the demand for effective monitoring solutions.

What are the key market players or companies in the gas Detectors industry?

Key players in the gas detectors market include Honeywell Analytics, Drägerwerk AG, MSA Safety, and RKI Instruments. These companies lead the market through innovation and expanded product lines targeting industrial, commercial, and residential sectors.

What are the primary factors driving the growth in the gas detectors industry?

The gas detectors market is driven by factors such as stringent safety regulations, advancements in technology, and increased awareness regarding worker safety. The rise in industrialization and urbanization also significantly contributes to market expansion.

Which region is the fastest Growing in the gas detectors market?

The fastest-growing region in the gas detectors market is Asia Pacific, projected to grow from $0.58 billion in 2023 to $1.10 billion by 2033. This growth is driven by industrial expansion and increased investments in safety solutions.

Does ConsaInsights provide customized market report data for the gas detectors industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the gas detectors industry. This service helps companies gain unique insights and strategies aligned with market trends.

What deliverables can I expect from this gas detectors market research project?

From the gas detectors market research project, you can expect comprehensive reports, detailed market analyses, trend forecasts, and actionable insights, along with segmentation data on industrial, commercial, and residential applications.

What are the market trends of gas detectors?

Current market trends in the gas detectors industry include an increasing focus on smart technologies and IoT integration, the rise of portable gas detectors, and heightened emphasis on compliance with safety regulations across various sectors.