Gas Engines Market Report

Published Date: 02 February 2026 | Report Code: gas-engines

Gas Engines Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Gas Engines market, covering its size, trends, industry insights, and forecasts from 2023 to 2033. It aims to equip stakeholders with valuable data for informed decision-making regarding market investments and opportunities.

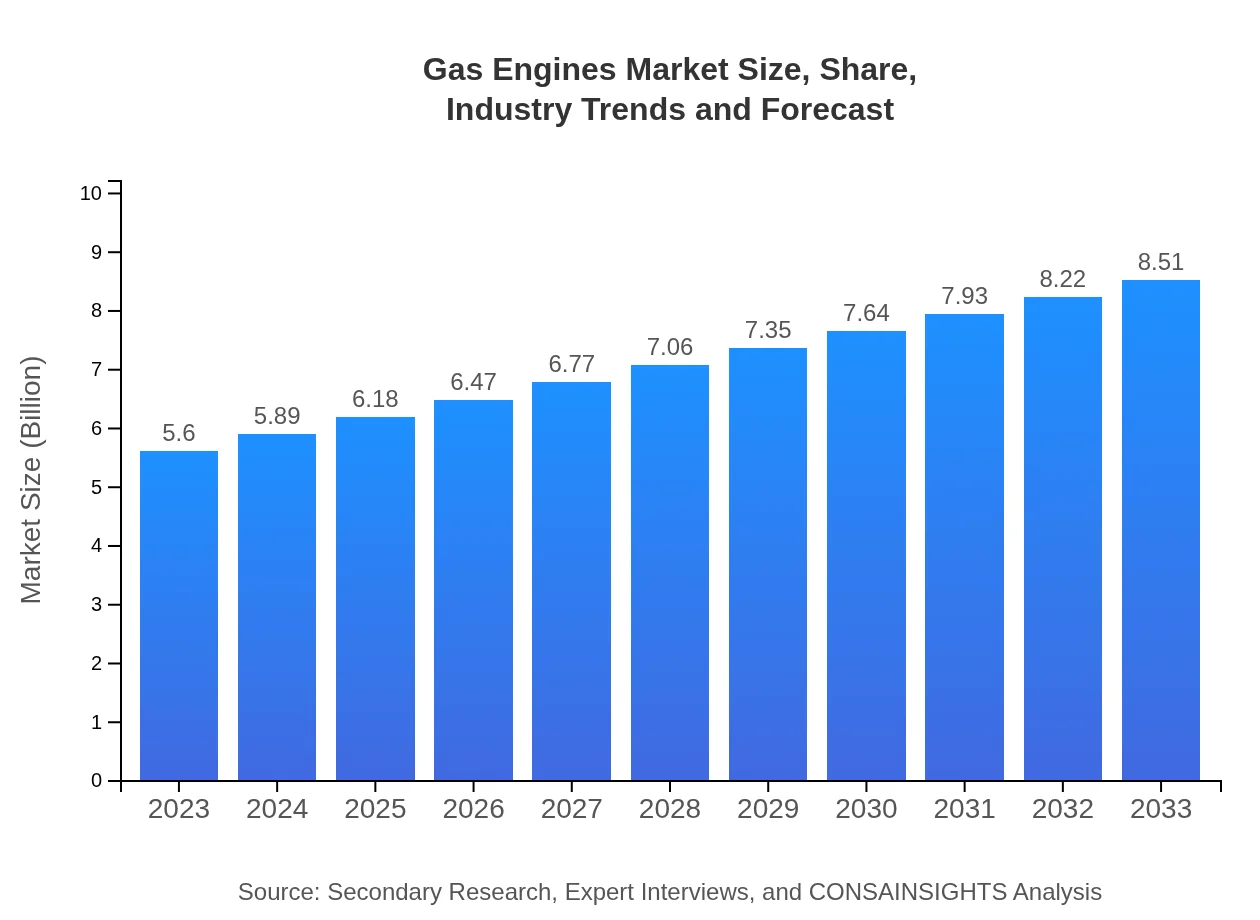

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 4.2% |

| 2033 Market Size | $8.51 Billion |

| Top Companies | Caterpillar Inc., General Electric, Wärtsilä, Rolls-Royce |

| Last Modified Date | 02 February 2026 |

Gas Engines Market Overview

Customize Gas Engines Market Report market research report

- ✔ Get in-depth analysis of Gas Engines market size, growth, and forecasts.

- ✔ Understand Gas Engines's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Gas Engines

What is the Market Size & CAGR of Gas Engines market in 2023?

Gas Engines Industry Analysis

Gas Engines Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Gas Engines Market Analysis Report by Region

Europe Gas Engines Market Report:

The European Gas Engines market is valued at $1.50 billion in 2023 and is set to grow to $2.28 billion by 2033. The European Union's aggressive climate targets and policies promoting green energy initiatives enhance the adoption of gas engines across various sectors.Asia Pacific Gas Engines Market Report:

The Asia Pacific region, valued at $1.22 billion in 2023, is projected to grow to $1.85 billion by 2033. The rapid industrialization, coupled with an increase in energy demand, positions this region as a lucrative market for gas engines, particularly in power generation and transportation sectors.North America Gas Engines Market Report:

North America leads the Gas Engines market with a size of $2.02 billion in 2023, forecasted to expand to $3.08 billion by 2033. The region's strong energy policies supporting natural gas utilization and a significant focus on reducing carbon emissions bolster market growth.South America Gas Engines Market Report:

South America’s Gas Engines market is currently valued at $0.09 billion, expected to reach $0.13 billion by 2033. Growth is driven by the region's efforts to enhance energy infrastructure and reduce reliance on traditional fossil fuels.Middle East & Africa Gas Engines Market Report:

The Middle East and Africa market, at $0.77 billion in 2023, is expected to rise to $1.17 billion by 2033 as nations in the region seek to diversify their energy mix and lessen dependence on crude oil.Tell us your focus area and get a customized research report.

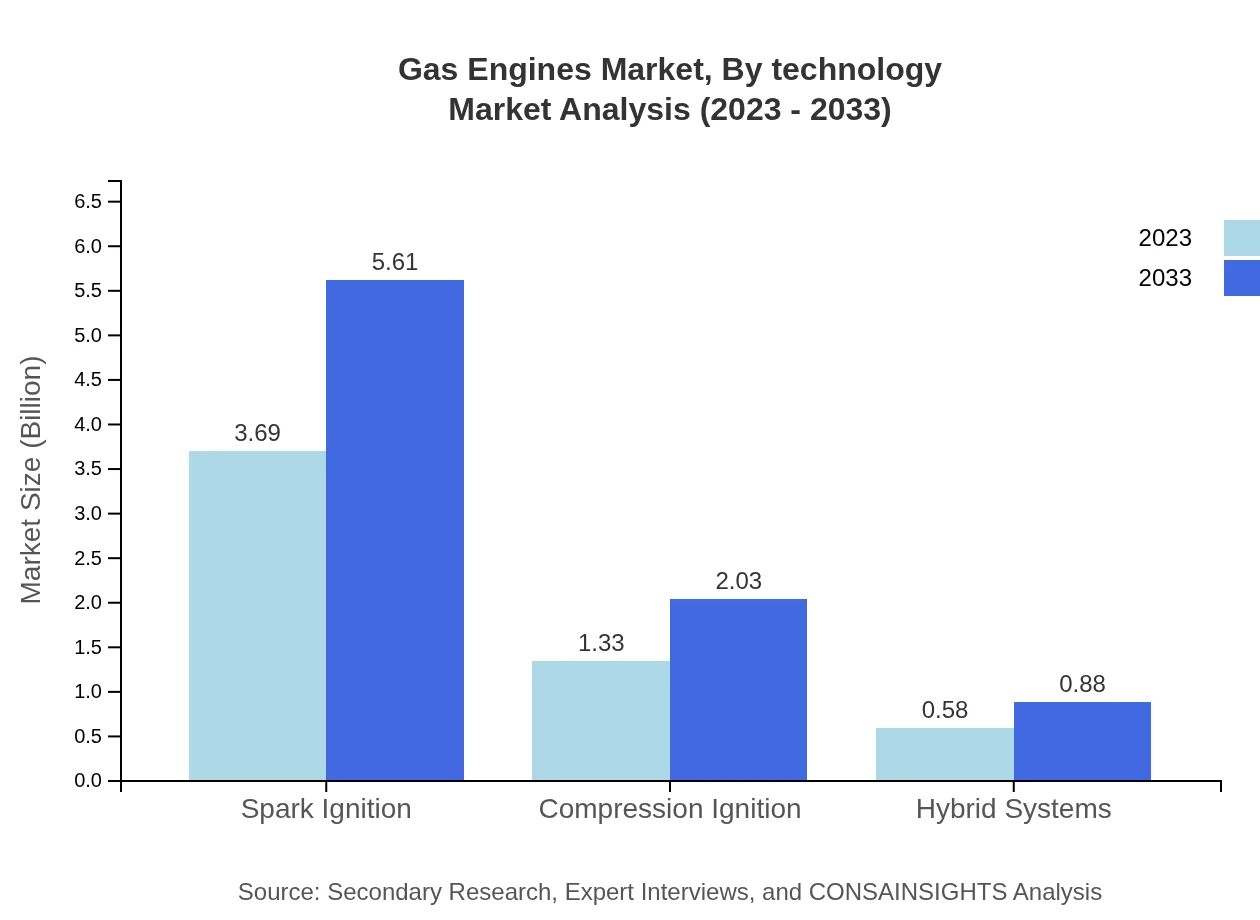

Gas Engines Market Analysis By Technology

In 2023, the Spark Ignition segment dominates the market, sized at $3.69 billion. This segment is expected to grow to $5.61 billion by 2033, accounting for approximately 65.89% share of the Gas Engines market. Other technologies such as Compression Ignition and Hybrid Systems are also gaining traction, predicted to expand in line with technological advancements.

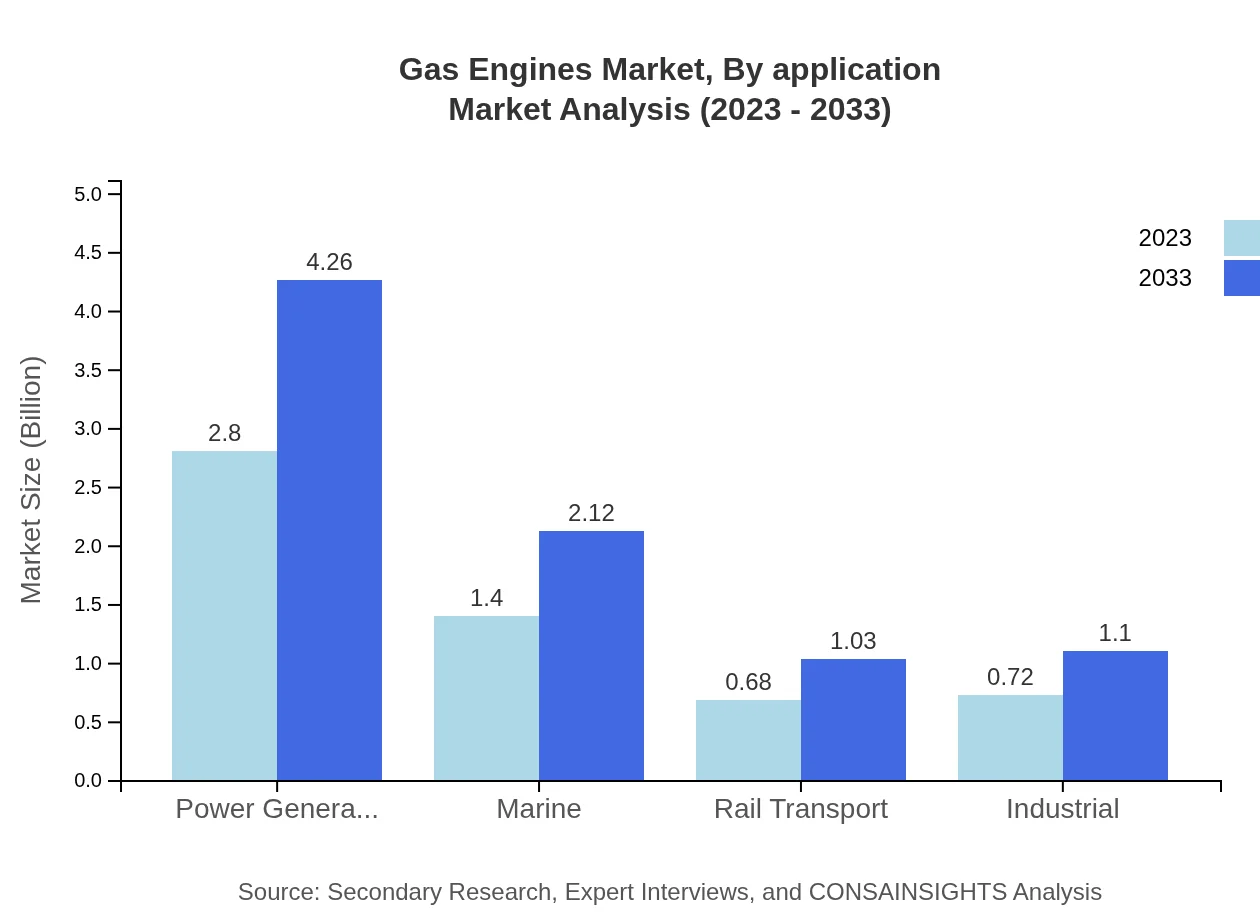

Gas Engines Market Analysis By Application

The Power Generation application holds a significant share at $2.80 billion in 2023 and is projected to reach $4.26 billion by 2033. This segment, constituting 50.08% of the market, reflects the increasing reliance on gas engines for efficient energy generation, particularly in regions moving away from coal.

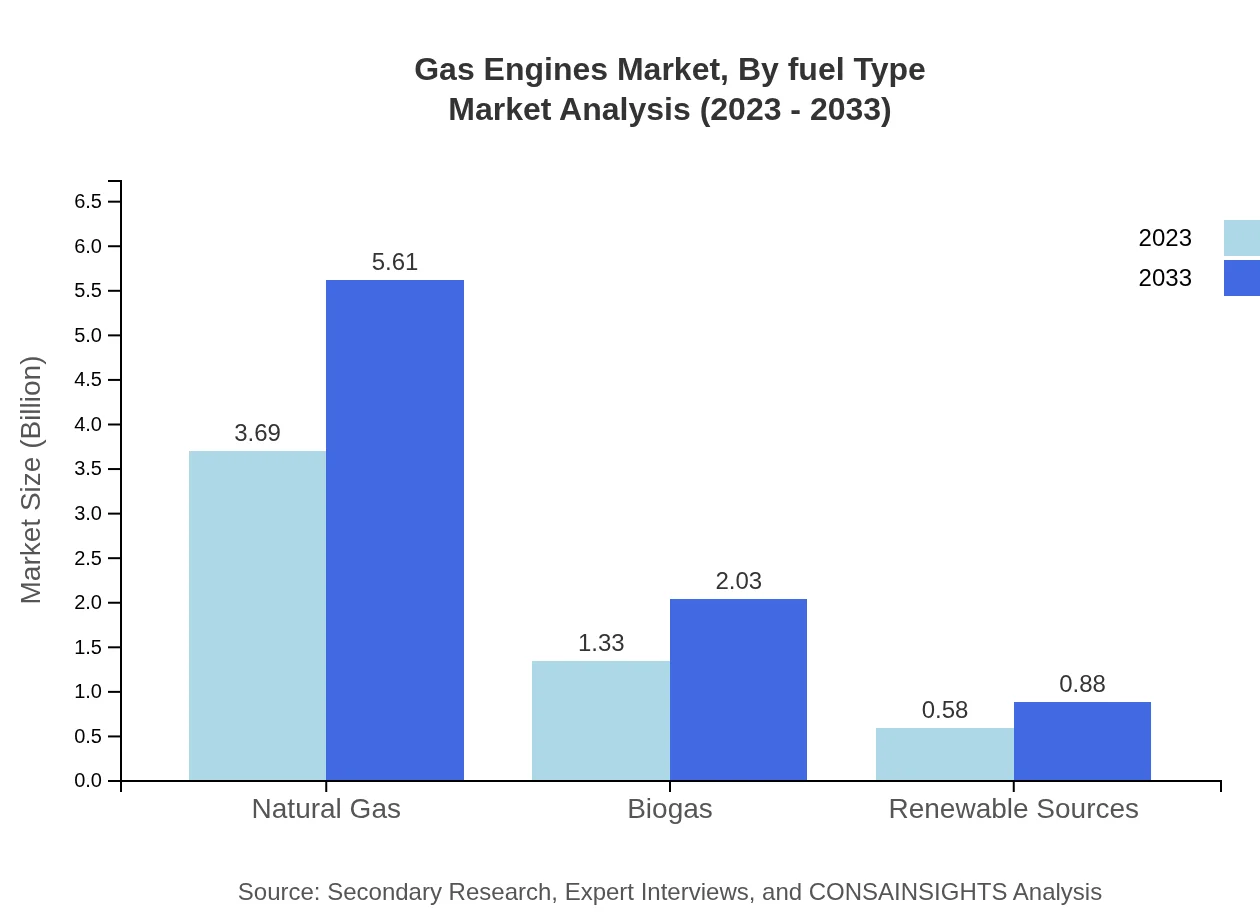

Gas Engines Market Analysis By Fuel Type

Natural Gas remains the leading fuel type, sized at $3.69 billion in 2023 and expected to grow to $5.61 billion by 2033, commanding a 65.89% market share. Emerging trends in biogas utilization are also noticeable as industries shift toward more sustainable fuel alternatives.

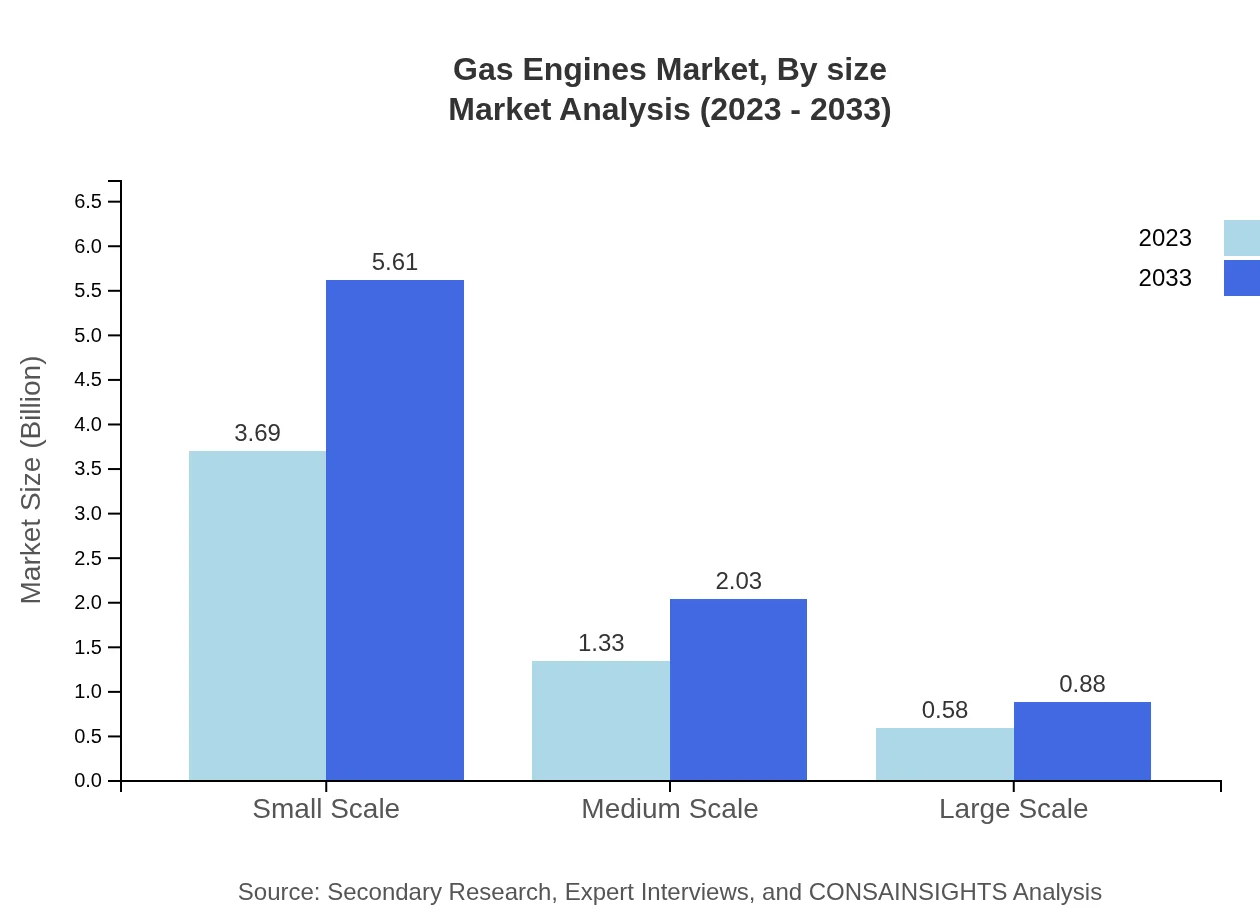

Gas Engines Market Analysis By Size

Small Scale gas engines, valued at $3.69 billion in 2023, showcase remarkable growth potential, projected to reach $5.61 billion by 2033. The segment caters to specific applications in localized energy production, supporting the growing demand for decentralized energy systems.

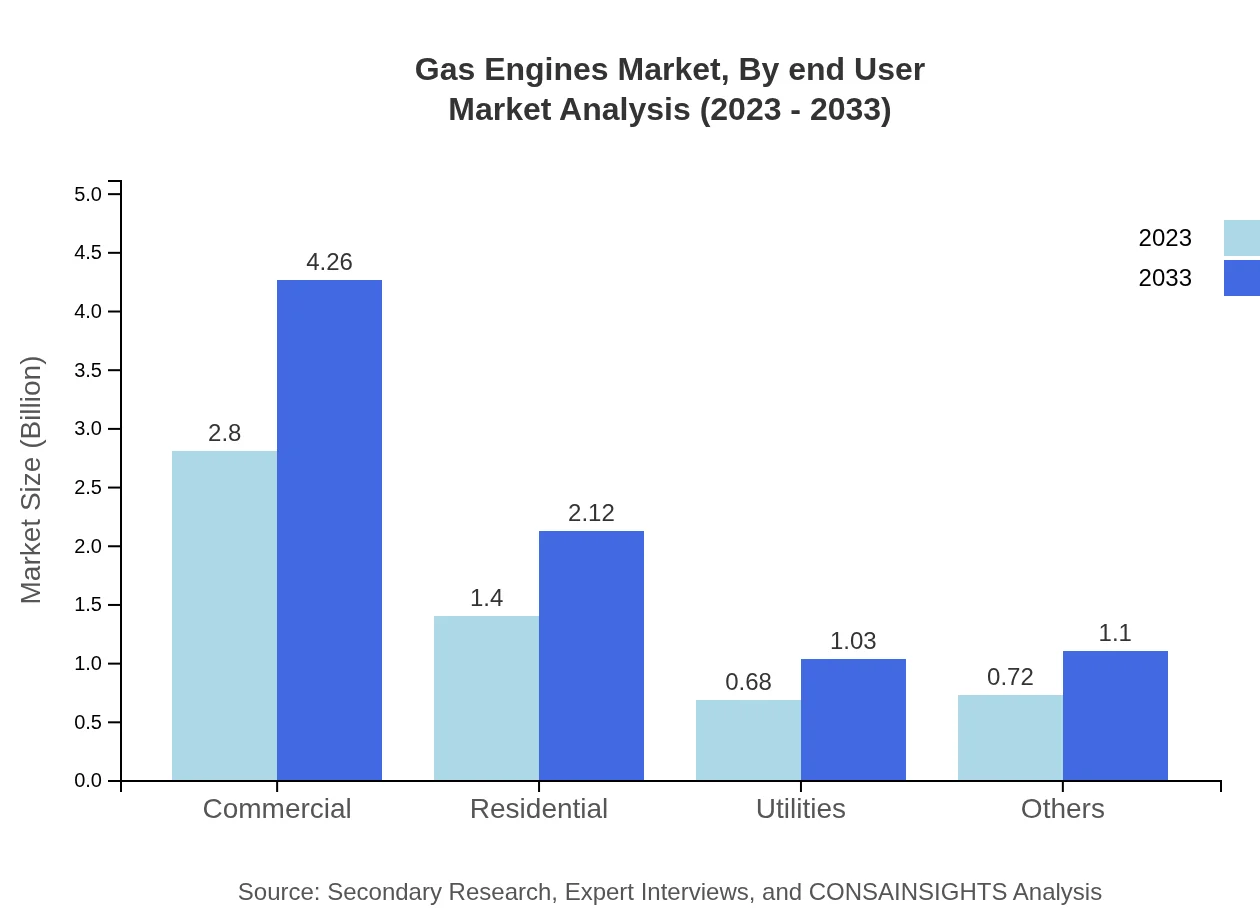

Gas Engines Market Analysis By End User

In the end-user sector, the Commercial segment leads the market at $2.80 billion in 2023, anticipated to reach $4.26 billion by 2033. It represents 50.08% of the market, driven by energy-efficient solutions increasingly being adopted in commercial applications.

Gas Engines Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Gas Engines Industry

Caterpillar Inc.:

Caterpillar is a leading global manufacturer of gas engines and related technologies, renowned for its innovative and efficient gas-powered solutions across various industries.General Electric:

GE is a key player in the gas engines market, offering advanced technology and expertise in energy, enabling efficient and environmentally friendly gas engine power solutions.Wärtsilä:

Wärtsilä specializes in sustainable technology and services for the marine and energy markets, focusing on high-efficiency gas engines driving operational sustainability.Rolls-Royce:

Rolls-Royce is an established player providing state-of-the-art gas engines for various applications, ensuring high-performance and low emission standards.We're grateful to work with incredible clients.

FAQs

What is the market size of gas engines?

The global gas engines market is valued at approximately $5.6 billion in 2023, with a projected Compound Annual Growth Rate (CAGR) of 4.2% until 2033. This growth reflects the key role of gas engines in energy generation.

What are the key market players or companies in the gas engines industry?

Key players in the gas engines market include renowned manufacturers such as General Electric, Cummins Inc., and MAN Energy Solutions. These companies are pivotal in driving innovation and enhancing the efficiency and sustainability of gas engine technologies.

What are the primary factors driving the growth in the gas engines industry?

The growth in the gas engines industry is primarily driven by increasing energy demand, a shift towards cleaner fuels, and advancements in technology that improve efficiency. Additionally, regulatory initiatives promoting natural gas usage further stimulate market expansion.

Which region is the fastest Growing in the gas engines?

North America is the fastest-growing region for gas engines, projected to grow from $2.02 billion in 2023 to $3.08 billion by 2033. This growth is fueled by rising energy demands and favorable government policies promoting natural gas.

Does ConsaInsights provide customized market report data for the gas engines industry?

Yes, ConsaInsights offers customized market report data specifically tailored to the gas engines industry. Clients can receive personalized insights, data segments, and analytical reports that meet unique requirements.

What deliverables can I expect from this gas engines market research project?

From the gas engines market research project, you can expect detailed reports including market analysis, segment data, competitor landscape, forecasts, and actionable insights to assist in strategic planning and decision-making.

What are the market trends of gas engines?

Current trends in the gas engines market include increasing adoption of hybrid systems, a surge in demand for renewable energy sources, and a focus on eco-friendly fuels. Moreover, technological advancements are driving efficiency and reliability in gas engine operations.