Gas Insulated Switchgear Market Report

Published Date: 22 January 2026 | Report Code: gas-insulated-switchgear

Gas Insulated Switchgear Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Gas Insulated Switchgear (GIS) market, encompassing market trends, size, growth forecasts up to 2033, and comprehensive regional insights. It also details market segmentation and key players influencing market dynamics.

| Metric | Value |

|---|---|

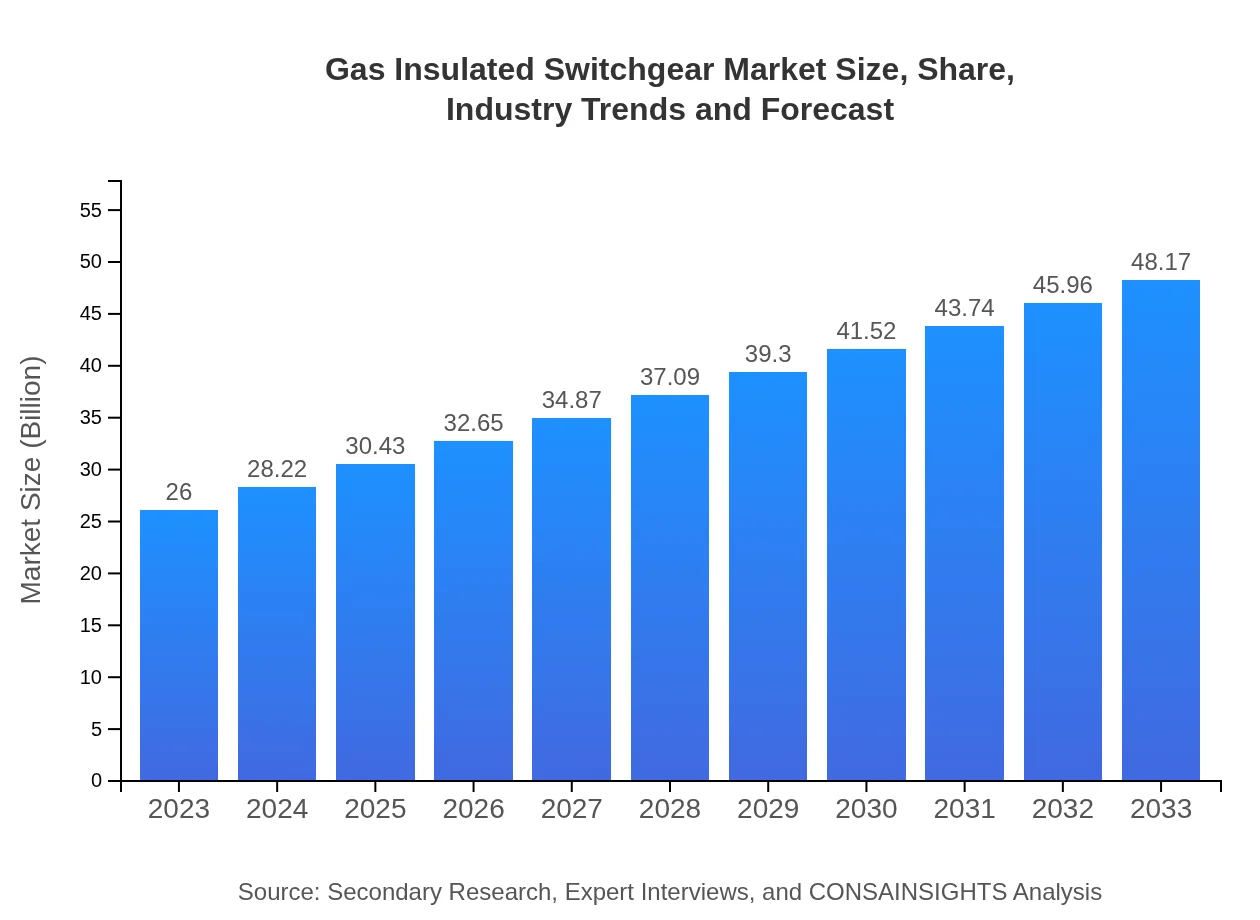

| Study Period | 2023 - 2033 |

| 2023 Market Size | $26.00 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $48.17 Billion |

| Top Companies | Schneider Electric, Siemens AG, General Electric (GE), Hitachi ABB Power Grids, Toshiba Corporation |

| Last Modified Date | 22 January 2026 |

Gas Insulated Switchgear Market Overview

Customize Gas Insulated Switchgear Market Report market research report

- ✔ Get in-depth analysis of Gas Insulated Switchgear market size, growth, and forecasts.

- ✔ Understand Gas Insulated Switchgear's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Gas Insulated Switchgear

What is the Market Size & CAGR of Gas Insulated Switchgear market in 2023 and 2033?

Gas Insulated Switchgear Industry Analysis

Gas Insulated Switchgear Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Gas Insulated Switchgear Market Analysis Report by Region

Europe Gas Insulated Switchgear Market Report:

The European GIS market, valued at $6.48 billion in 2023, is projected to double to $12.00 billion by 2033. Stringent regulations on emissions and a strong shift towards renewable energy are propelling the demand for GIS solutions in this region.Asia Pacific Gas Insulated Switchgear Market Report:

The Asia Pacific region, valued at approximately $5.11 billion in 2023, is expected to grow to $9.48 billion by 2033. This growth is driven by rapid industrialization, government initiatives to modernize infrastructure, and increasing investments in renewable energy projects.North America Gas Insulated Switchgear Market Report:

North America holds a significant market share with a value of $9.67 billion in 2023, anticipated to reach $17.92 billion by 2033. The emphasis on grid modernization, along with extensive investments in renewable energy, supports this growth.South America Gas Insulated Switchgear Market Report:

In South America, the GIS market is projected to expand from $1.99 billion in 2023 to $3.69 billion by 2033. Increasing demand for reliable power distribution in growing urban areas and investments in sustainable energy contribute to this growth.Middle East & Africa Gas Insulated Switchgear Market Report:

The Middle East and Africa market is valued at $2.74 billion in 2023 and is expected to reach $5.08 billion by 2033. Growth is fueled by investments in smart grid technologies and the expansion of energy projects in the region.Tell us your focus area and get a customized research report.

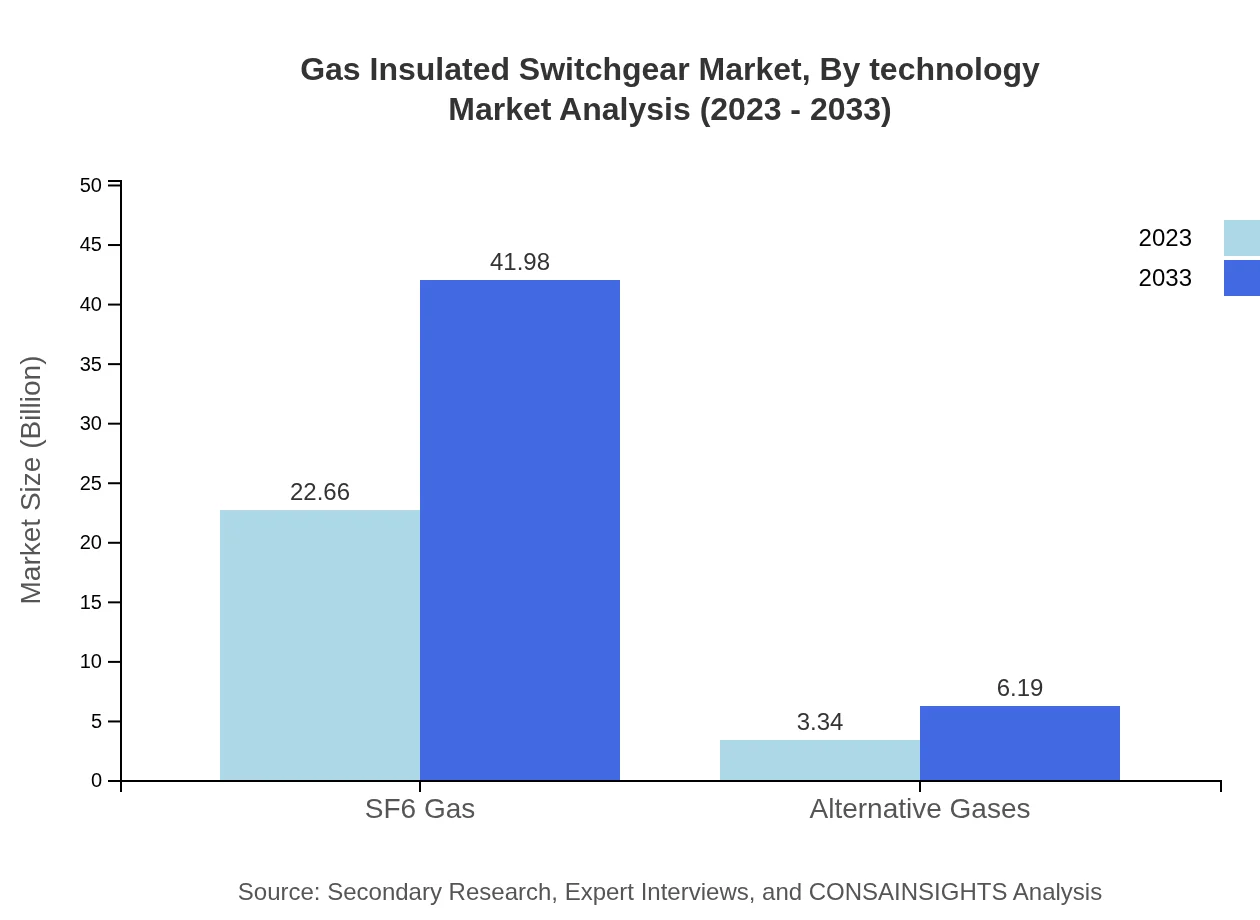

Gas Insulated Switchgear Market Analysis By Technology

The technology segment is split between SF6 gas and alternative gases. SF6 dominated the market due to its superior insulating properties, accounting for an 87.15% market share in 2023, while the alternative gases segment is witnessing growth as companies seek sustainable solutions.

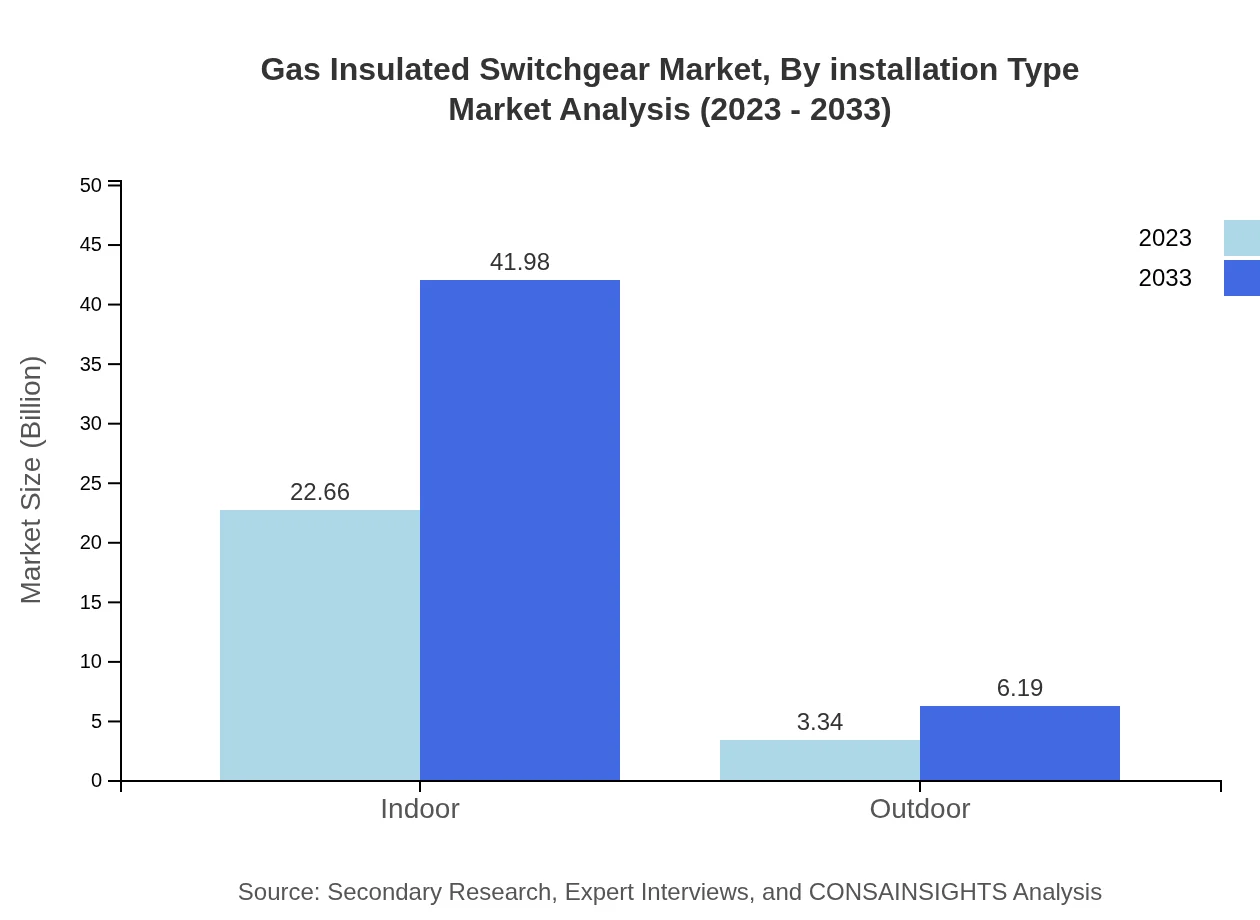

Gas Insulated Switchgear Market Analysis By Installation Type

Indoor installations represent a significant share of the market, attributed to space efficiency, with a 87.15% market share in 2023. Conversely, outdoor installations are also growing due to the need for substations in larger infrastructural projects.

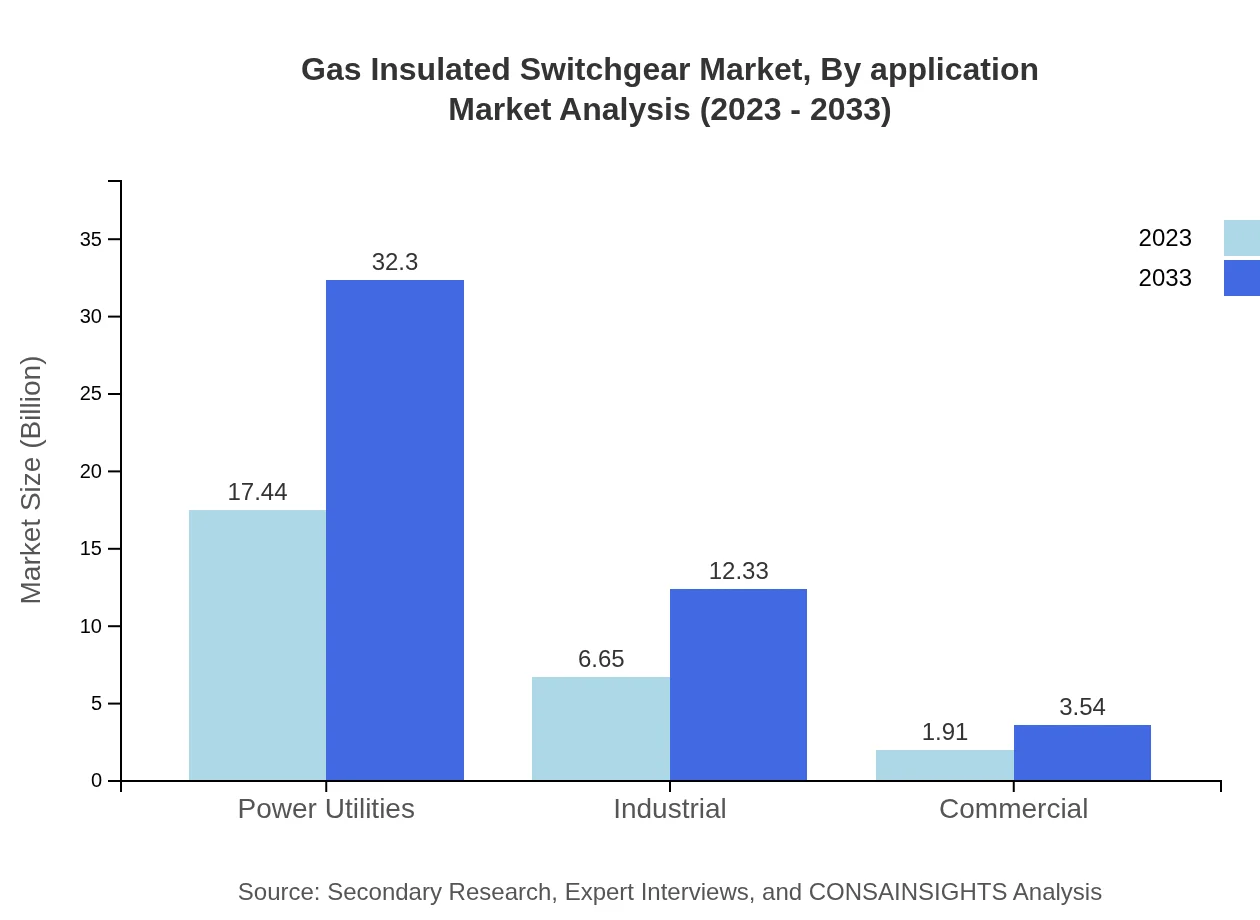

Gas Insulated Switchgear Market Analysis By Application

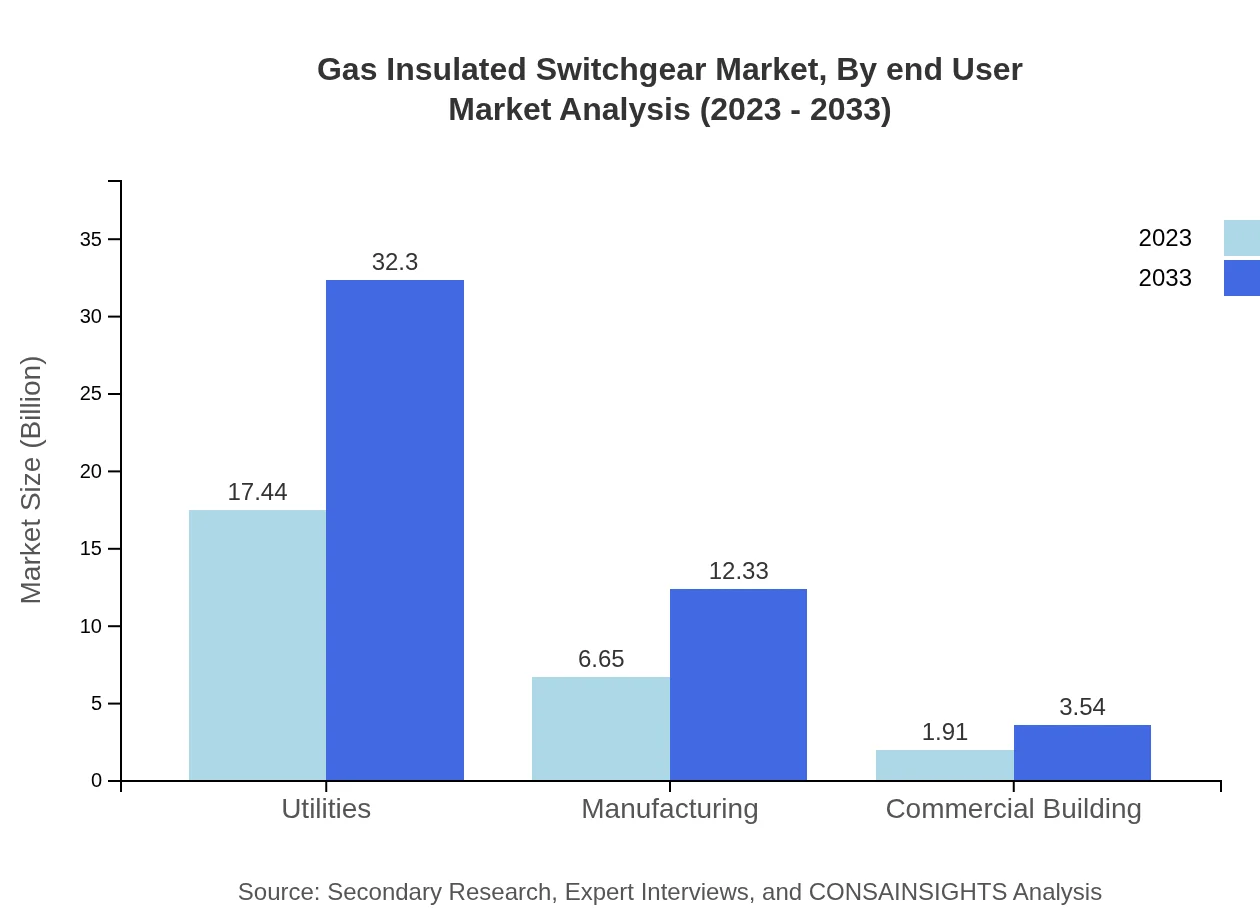

Utilities dominate the application segment with a corroborative market share of 67.06%, as they require robust and reliable systems for power distribution. Industrial and commercial applications are also expanding, indicative of a growing market presence.

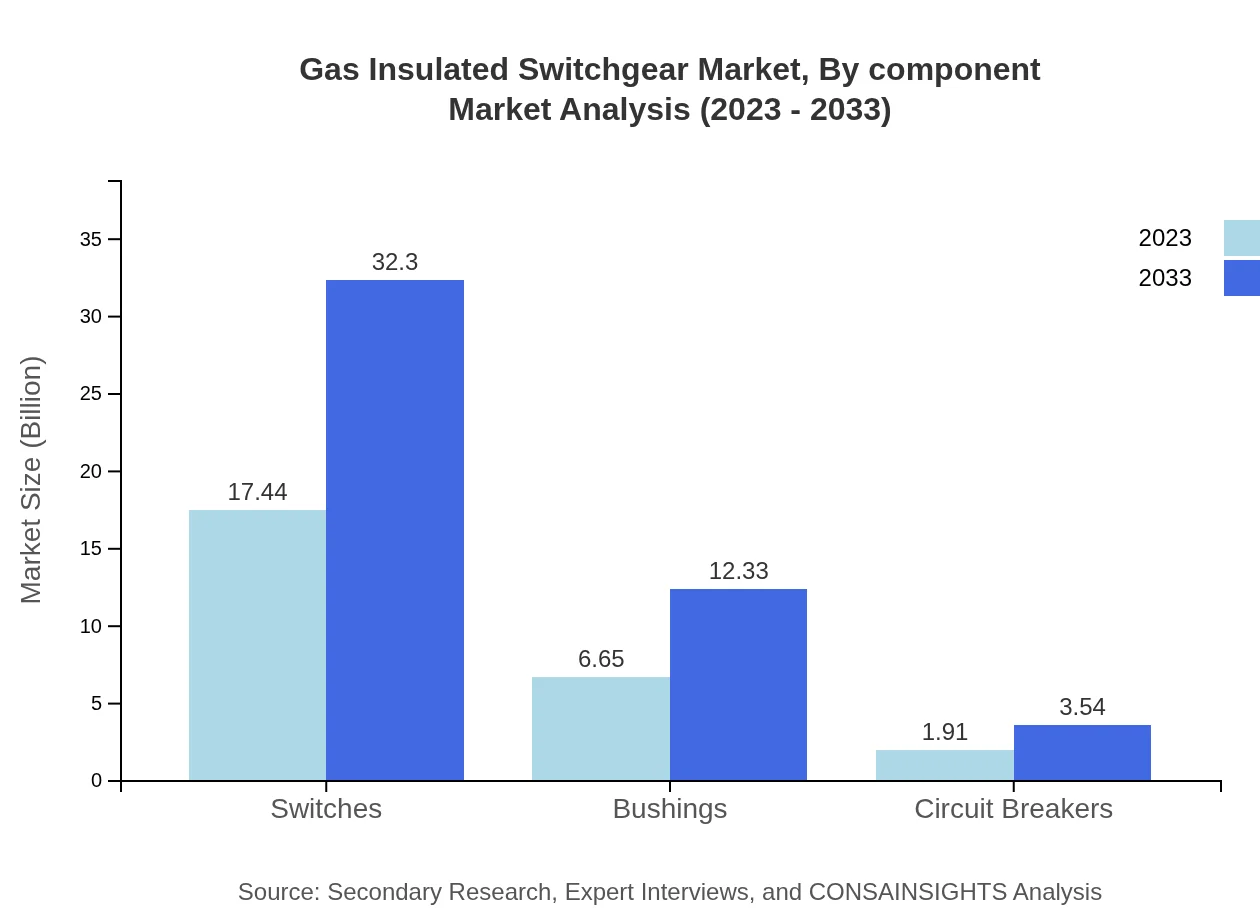

Gas Insulated Switchgear Market Analysis By Component

Key components include switches, busbars, circuit breakers, and bushings. Switches predominantly lead the market with a share of 67.06% in 2023, indicating their crucial role in efficiency and reliability.

Gas Insulated Switchgear Market Analysis By End User

Power utilities lead the market share at 67.06%, driven by infrastructure demands. Industrial applications are also significant, comprising 25.59% of the share, as industries move towards more efficient energy solutions.

Gas Insulated Switchgear Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Gas Insulated Switchgear Industry

Schneider Electric:

A French multinational corporation that specializes in energy management and automation solutions, Schneider Electric provides innovative GIS solutions aimed at optimizing energy usage and improving efficiency.Siemens AG:

A global engineering and technology company, Siemens is known for its cutting-edge technology in the GIS sector, focusing on sustainable energy solutions and smart grid technologies.General Electric (GE):

General Electric offers a range of products in the GIS market with an emphasis on high voltage equipment and solutions designed to modernize power distribution systems efficiently.Hitachi ABB Power Grids:

A joint venture that combines the strengths of Hitachi and ABB, this company offers advanced GIS technologies with a focus on reliability, sustainability, and energy efficiency in power distribution.Toshiba Corporation:

Toshiba specializes in energy systems and provides GIS technology with an emphasis on enhancing the performance and safety of electrical grid operations.We're grateful to work with incredible clients.

FAQs

What is the market size of gas Insulated Switchgear?

The global gas-insulated switchgear market is valued at approximately $26 billion in 2023, with a robust CAGR of 6.2% projected until 2033, indicating significant growth and investment opportunities in this essential industry.

What are the key market players or companies in the gas Insulated Switchgear industry?

Key players in the gas-insulated switchgear market include Schneider Electric, Siemens AG, ABB Ltd., General Electric, and Mitsubishi Electric. These companies lead the industry with innovative technologies and extensive market presence.

What are the primary factors driving the growth in the gas Insulated Switchgear industry?

The growth of the gas-insulated switchgear industry is driven by increasing demand for reliable power distribution, advancements in smart grid technologies, and a shift towards renewable energy sources, particularly in urban areas.

Which region is the fastest Growing in the gas Insulated Switchgear market?

Asia Pacific is emerging as the fastest-growing region in the gas-insulated switchgear market, with projected market growth from $5.11 billion in 2023 to $9.48 billion by 2033, driven by rapid industrialization and energy needs.

Does ConsaInsights provide customized market report data for the gas Insulated Switchgear industry?

Yes, ConsaInsights offers customized market report data for the gas-insulated switchgear industry. Clients can request tailored insights and analysis to meet specific business needs and strategic objectives.

What deliverables can I expect from this gas Insulated Switchgear market research project?

Deliverables from the gas-insulated switchgear market research project typically include comprehensive market reports, analysis of key trends, competitive landscape insights, and detailed segmented data across various regions.

What are the market trends of gas Insulated Switchgear?

Current trends in the gas-insulated switchgear market include an increasing shift towards environmentally friendly alternatives, rising adoption of digital solutions for monitoring and management, and significant growth in the renewable energy sector.