Gas Sensor Detector And Analyzer Market Report

Published Date: 31 January 2026 | Report Code: gas-sensor-detector-and-analyzer

Gas Sensor Detector And Analyzer Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Gas Sensor Detector and Analyzer market, covering market size, segmentation, industry trends, and regional insights for the forecast period of 2023-2033.

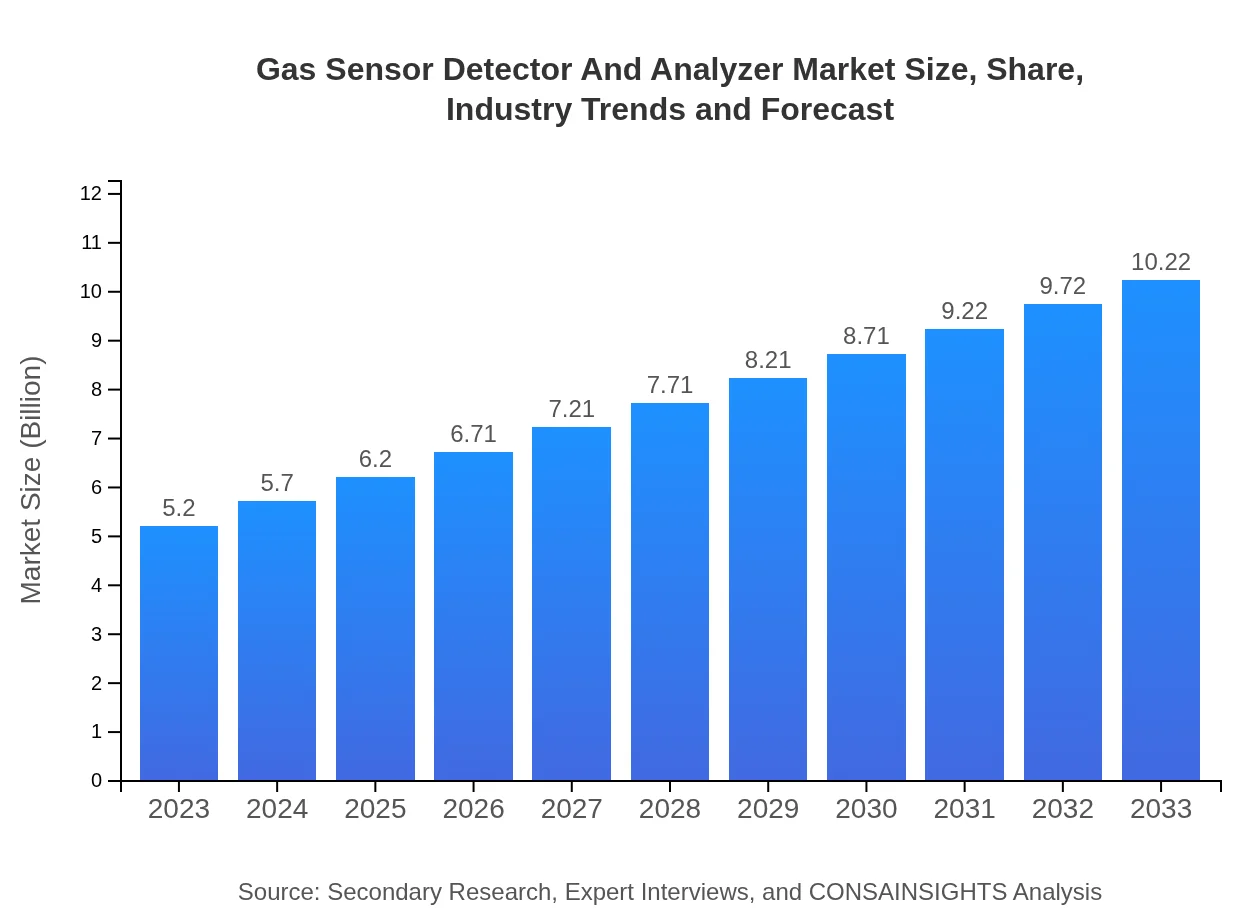

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.20 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $10.22 Billion |

| Top Companies | Honeywell , General Electric, Drägerwerk, MSA Safety |

| Last Modified Date | 31 January 2026 |

Gas Sensor Detector And Analyzer Market Overview

Customize Gas Sensor Detector And Analyzer Market Report market research report

- ✔ Get in-depth analysis of Gas Sensor Detector And Analyzer market size, growth, and forecasts.

- ✔ Understand Gas Sensor Detector And Analyzer's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Gas Sensor Detector And Analyzer

What is the Market Size & CAGR of Gas Sensor Detector And Analyzer market in 2023-2033?

Gas Sensor Detector And Analyzer Industry Analysis

Gas Sensor Detector And Analyzer Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Gas Sensor Detector And Analyzer Market Analysis Report by Region

Europe Gas Sensor Detector And Analyzer Market Report:

Europe's market is projected to increase from $1.60 billion in 2023 to $3.15 billion by 2033, spurred by stringent regulations and a high focus on workplace safety and environmental sustainability.Asia Pacific Gas Sensor Detector And Analyzer Market Report:

In the Asia-Pacific region, the market is set to grow from $0.96 billion in 2023 to $1.88 billion by 2033, driven by urbanization, industrialization, and increasing energy consumption. The region is also seeing rapid adoption of smart technologies in safety systems.North America Gas Sensor Detector And Analyzer Market Report:

North America leads the market, with values expected to rise from $2.00 billion in 2023 to $3.94 billion by 2033. The presence of key players, combined with increasing safety regulations, serves as a significant driver.South America Gas Sensor Detector And Analyzer Market Report:

The South American market is evolving, with a forecast growth from $0.28 billion in 2023 to $0.55 billion by 2033. Factors include environmental regulations and the growing oil and gas sector pushing for better gas detection solutions.Middle East & Africa Gas Sensor Detector And Analyzer Market Report:

In the Middle East and African markets, growth from $0.36 billion in 2023 to $0.71 billion by 2033 is anticipated, driven by rising awareness regarding industrial safety and an increased emphasis on environmental protection.Tell us your focus area and get a customized research report.

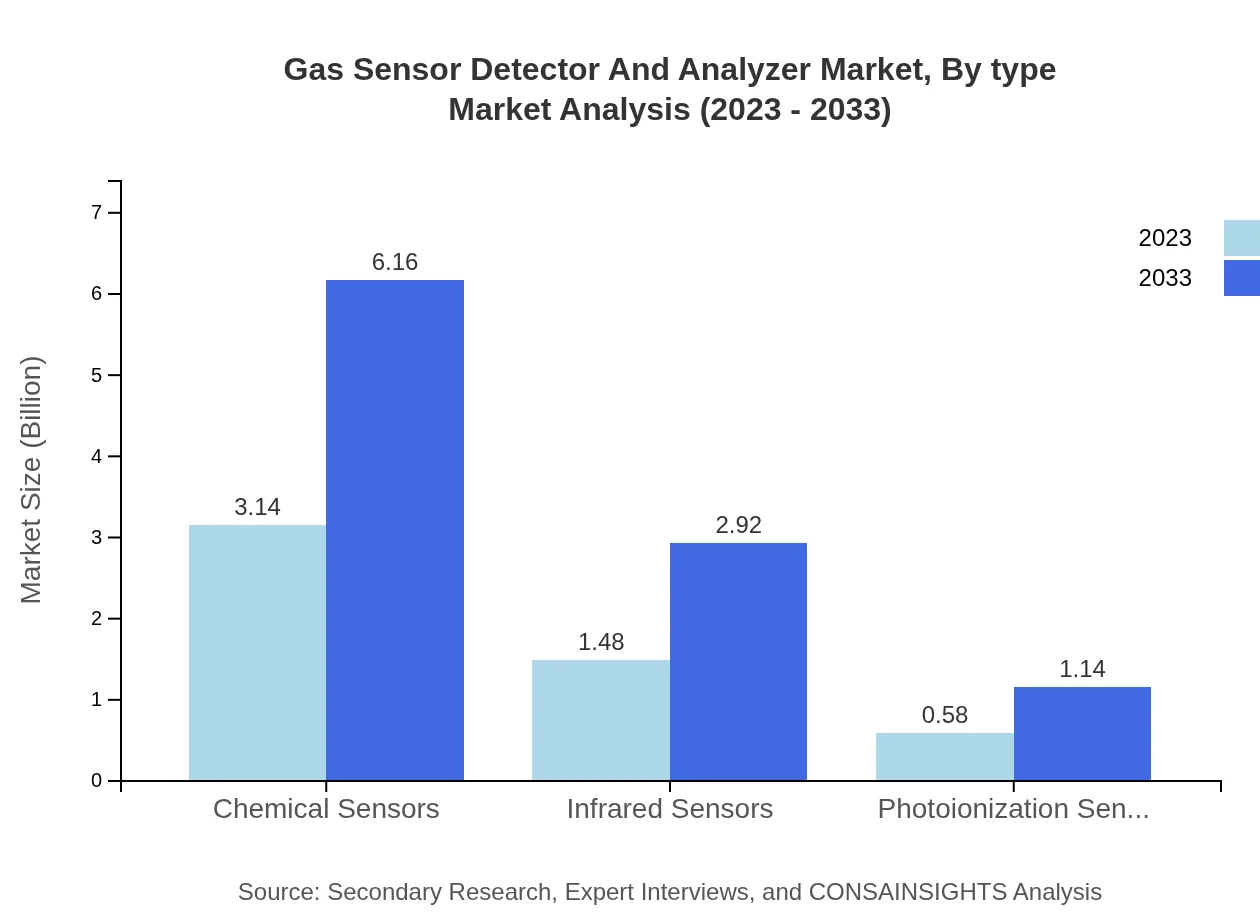

Gas Sensor Detector And Analyzer Market Analysis By Type

The Gas Sensor Detector and Analyzer market, by type, includes Chemical Sensors, Infrared Sensors, and Photoionization Sensors. Chemical Sensors dominate the market, valued at $3.14 billion in 2023 and expected to grow to $6.16 billion by 2033, maintaining a significant share. Infrared Sensors and Photoionization Sensors also show growth, with projected values of $2.92 billion and $1.14 billion respectively by 2033.

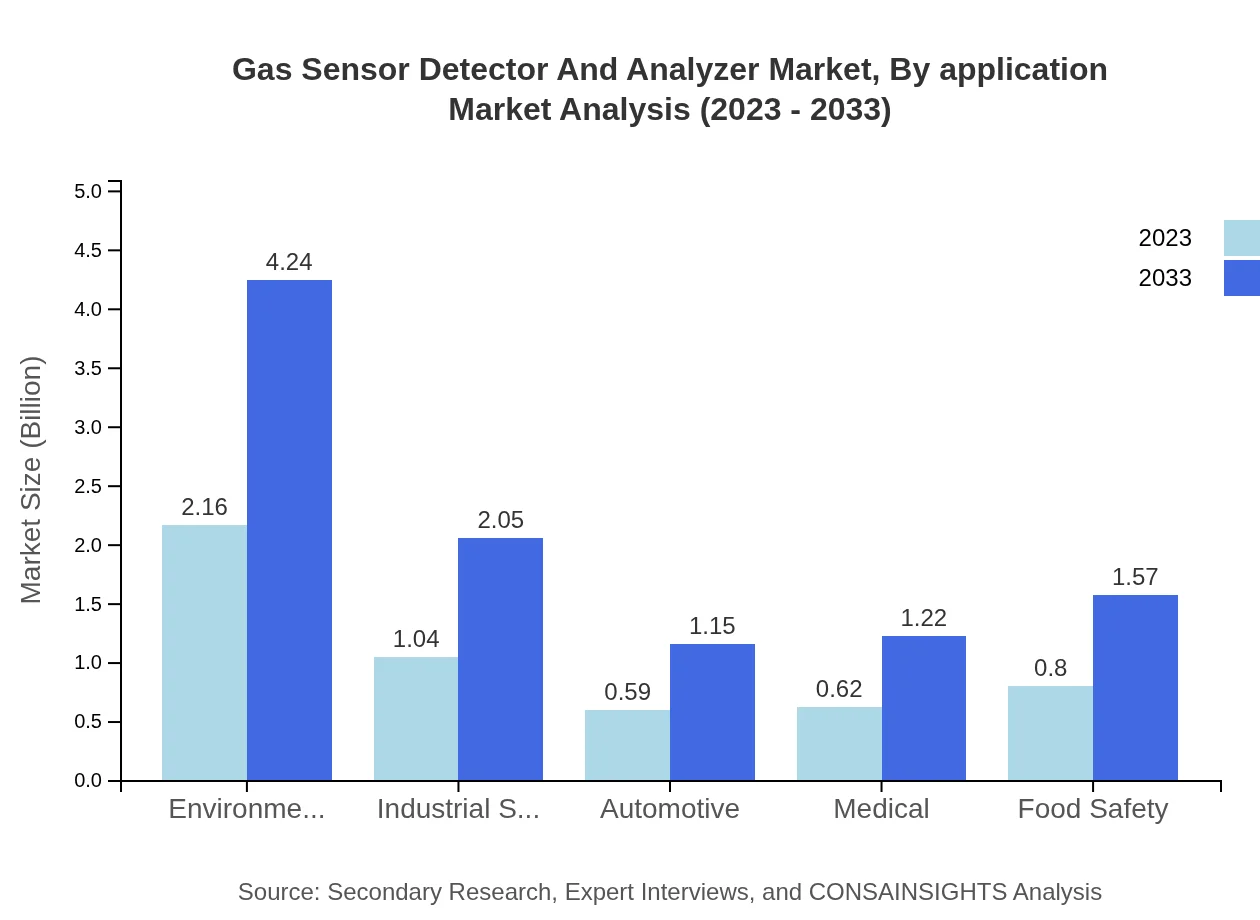

Gas Sensor Detector And Analyzer Market Analysis By Application

The applications segment includes Industrial Safety, Environmental Monitoring, Automotive, and Healthcare. Environmental Monitoring, a leading application, represented a market size of $2.16 billion in 2023, expected to rise to $4.24 billion by 2033. Industrial Safety also plays a critical role, anticipated to grow from $1.04 billion to $2.05 billion in the same period.

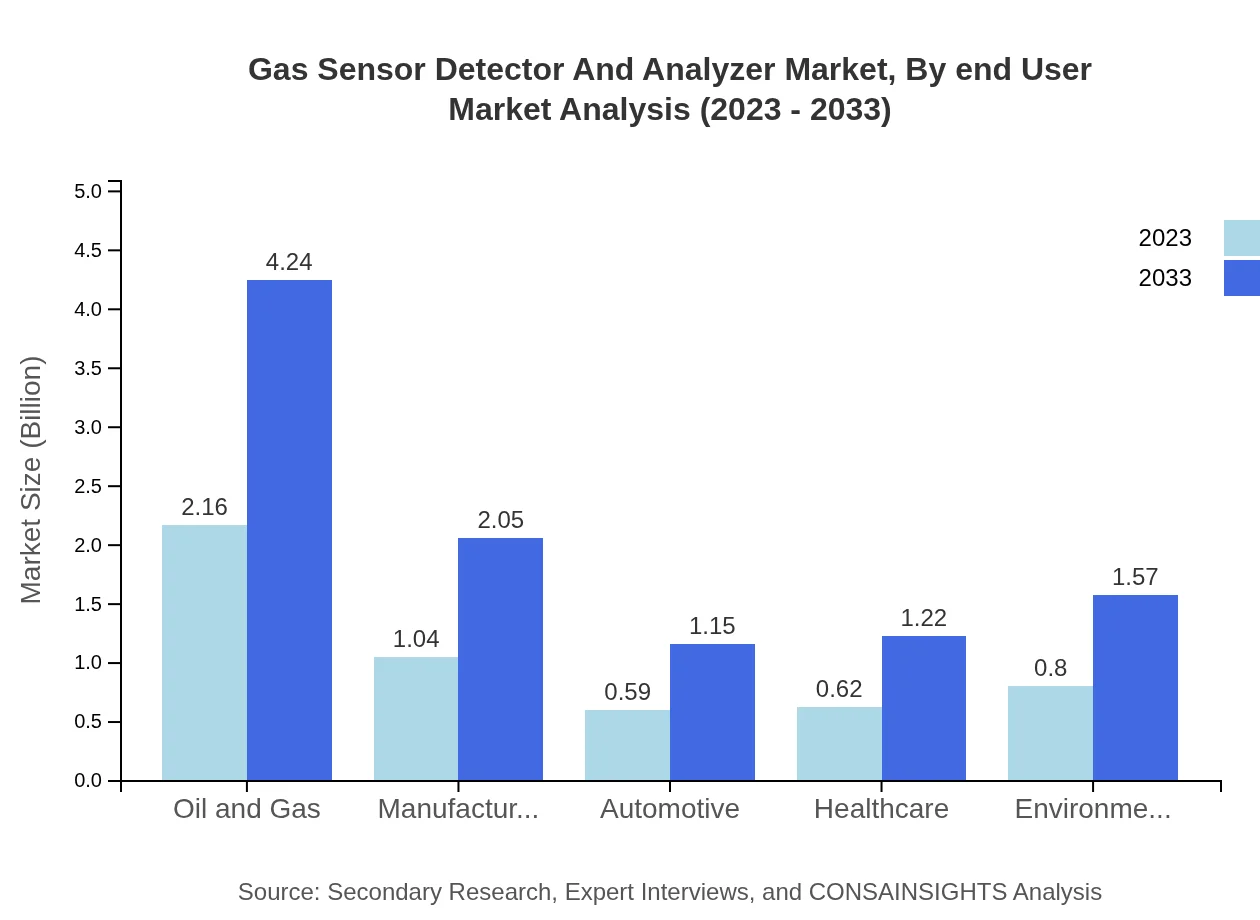

Gas Sensor Detector And Analyzer Market Analysis By End User

Key end-user industries include Oil and Gas, Manufacturing, Healthcare, and Environmental Agencies. The Oil and Gas sector leads with a market size of $2.16 billion in 2023, expected to expand to $4.24 billion by 2033, indicating a strong reliance on accurate gas detection systems for safety.

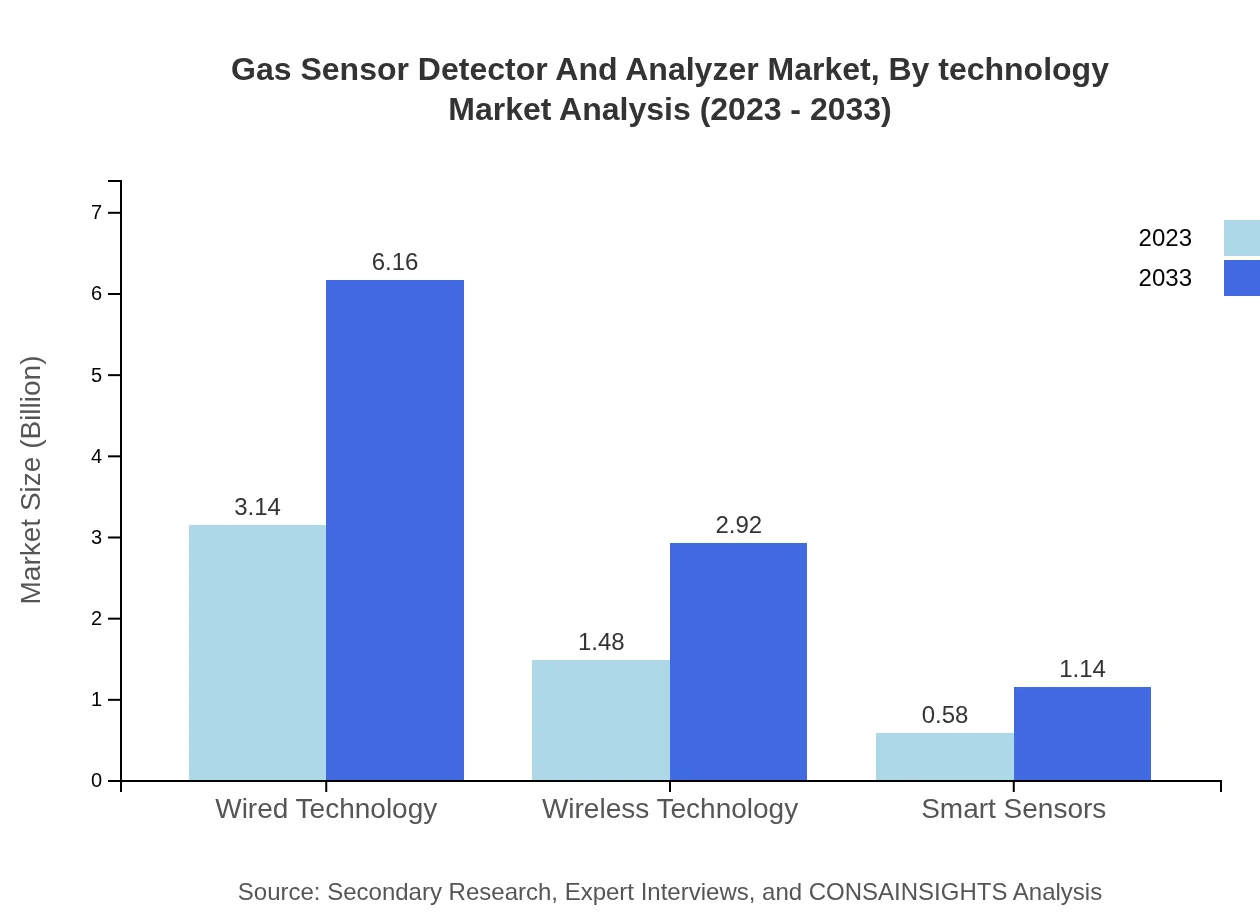

Gas Sensor Detector And Analyzer Market Analysis By Technology

Technology-wise, the market bifurcates into Wired and Wireless Technologies. Wired Technology represents the majority market share of $3.14 billion in 2023, projected to ascend to $6.16 billion by 2033, while Wireless Technology is gaining traction, growing from $1.48 billion to $2.92 billion over the same time frame.

Gas Sensor Detector And Analyzer Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Gas Sensor Detector And Analyzer Industry

Honeywell :

A global leader in gas detection technologies, Honeywell offers advanced sensor solutions across various sectors, emphasizing safety and compliance.General Electric:

Known for its innovative technologies and services, GE's gas detectors are utilized extensively in industrial applications, enhancing safety measures.Drägerwerk:

Dräger is a pioneer in medical and safety technology, providing specialized gas detection solutions for healthcare and industrial applications.MSA Safety:

MSA Safety specializes in protective equipment and gas detection systems, focusing on improving workplace safety in hazardous environments.We're grateful to work with incredible clients.

FAQs

What is the market size of gas Sensor Detector And Analyzer?

The global gas sensor detector and analyzer market size is estimated at $5.2 billion in 2023. It is projected to grow at a CAGR of 6.8% through to 2033, indicating a strong demand in various sectors like environmental monitoring and industrial safety.

What are the key market players or companies in this gas Sensor Detector And Analyzer industry?

Key players in the gas sensor detector and analyzer market include established companies specializing in environmental sensors, industrial automation, and smart gas detection technologies. These companies provide innovative solutions to meet the increasing demand for safety and monitoring across multiple sectors.

What are the primary factors driving the growth in the gas Sensor Detector And Analyzer industry?

Growth in the gas sensor detector and analyzer industry is driven by increasing regulatory emphasis on environmental safety, rising concerns over air quality, and advancements in sensor technologies. The push toward industrial automation also contributes significantly to market expansion.

Which region is the fastest Growing in the gas Sensor Detector And Analyzer?

The fastest-growing region for the gas sensor detector and analyzer market is Europe, with its market size projected to increase from $1.60 billion in 2023 to $3.15 billion by 2033, reflecting robust growth in environmental monitoring and safety regulations.

Does ConsaInsights provide customized market report data for the gas Sensor Detector And Analyzer industry?

Yes, ConsaInsights offers customized market report data tailored specifically to the gas sensor detector and analyzer industry. This allows stakeholders to access pertinent insights and data suited to their strategic needs.

What deliverables can I expect from this gas Sensor Detector And Analyzer market research project?

Expect comprehensive deliverables including detailed market analysis, growth forecasts, key player profiles, regional insights, and trend analysis. Reports can be customized to highlight specific segments relevant to your interests or operations.

What are the market trends of gas Sensor Detector And Analyzer?

Current market trends in the gas sensor detector and analyzer sector include the growing adoption of smart sensors, increased investment in environmental monitoring technologies, and a shift towards integration of wireless technologies to enhance data collection and analysis.