Gas Sensors Market Report

Published Date: 31 January 2026 | Report Code: gas-sensors

Gas Sensors Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Gas Sensors market from 2023 to 2033. It includes insights into market trends, segmentation, regional analysis, and forecasts, along with a detailed overview of current market conditions.

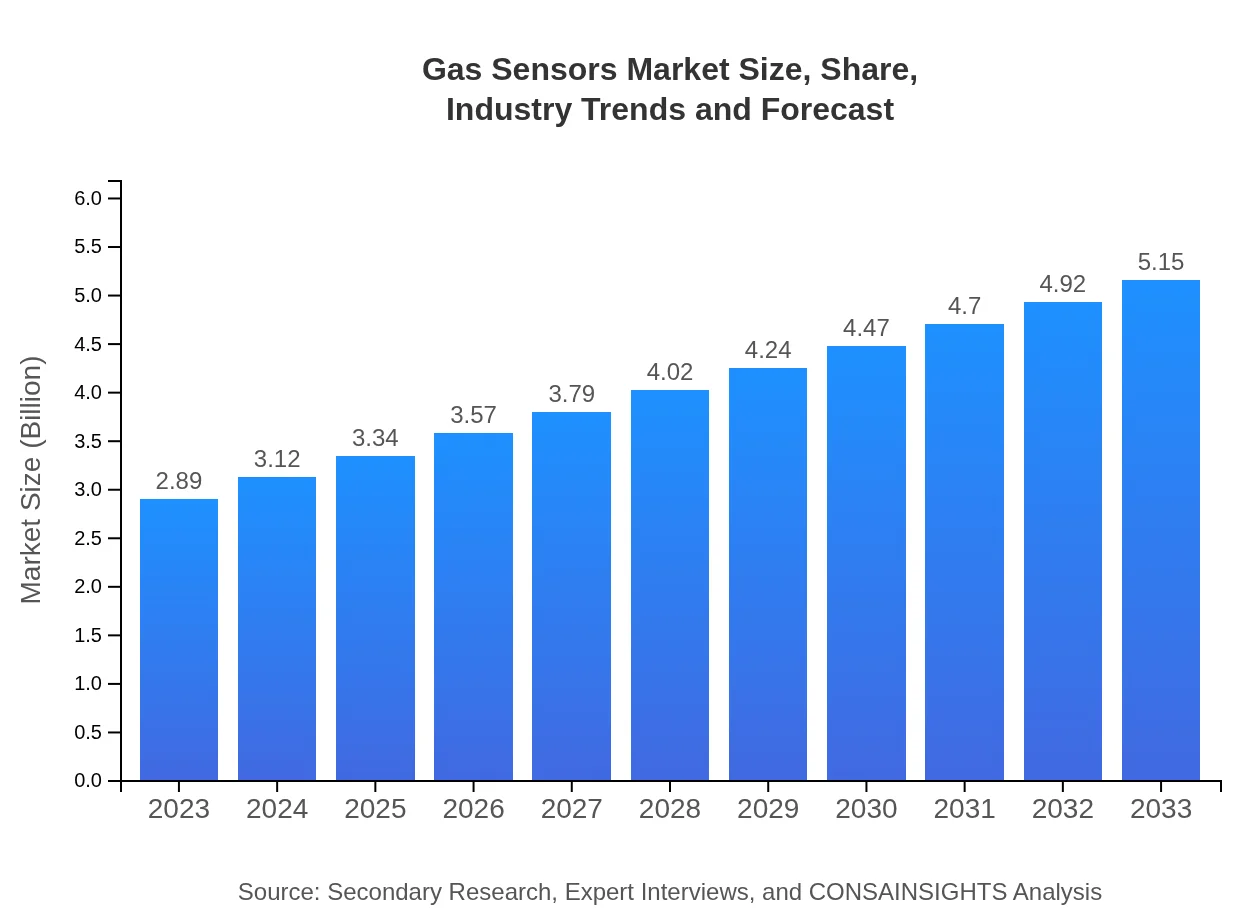

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.89 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $5.15 Billion |

| Top Companies | Honeywell International Inc., MSA Safety Incorporated, Figaro Engineering Inc., Dragerwerk AG & Co. KGaA, Sensirion AG |

| Last Modified Date | 31 January 2026 |

Gas Sensors Market Overview

Customize Gas Sensors Market Report market research report

- ✔ Get in-depth analysis of Gas Sensors market size, growth, and forecasts.

- ✔ Understand Gas Sensors's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Gas Sensors

What is the Market Size & CAGR of Gas Sensors market in 2023 and 2033?

Gas Sensors Industry Analysis

Gas Sensors Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Gas Sensors Market Analysis Report by Region

Europe Gas Sensors Market Report:

Europe’s market is poised for growth from USD 0.86 billion in 2023 to USD 1.54 billion by 2033. The European Union's stringent safety regulations are accelerating the adoption of gas sensors, particularly in hazardous environments.Asia Pacific Gas Sensors Market Report:

The Asia Pacific region is anticipated to witness robust growth owing to rapid industrialization and urbanization. The market is projected to grow from USD 0.56 billion in 2023 to USD 1.00 billion by 2033, driven by increasing environmental regulations and a growing focus on air quality control.North America Gas Sensors Market Report:

North America is estimated to lead the market with a growth from USD 1.03 billion in 2023 to USD 1.84 billion by 2033, fueled by high demand in oil and gas, manufacturing, and governmental regulations concerning safety and emissions.South America Gas Sensors Market Report:

In South America, the Gas Sensors market, while smaller, is expected to grow steadily from USD 0.04 billion in 2023 to USD 0.08 billion by 2033. The increase is driven by national initiatives aimed at improving industrial safety standards and environmental protection efforts.Middle East & Africa Gas Sensors Market Report:

The Middle East and Africa region is expected to experience growth from USD 0.39 billion in 2023 to USD 0.70 billion by 2033, driven by increased investments in oil and gas exploration and a growing focus on improving workplace safety standards.Tell us your focus area and get a customized research report.

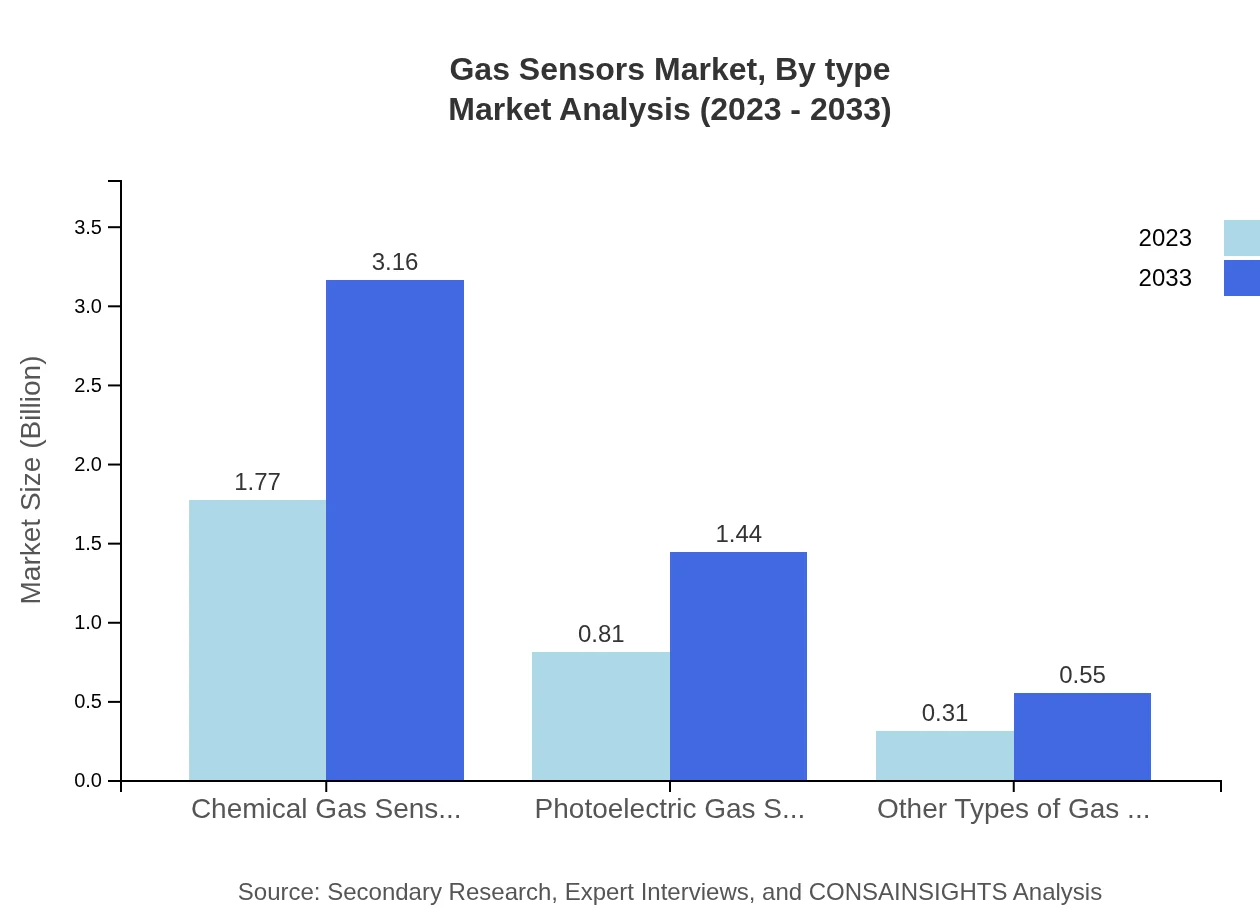

Gas Sensors Market Analysis By Type

The Gas Sensors market by type includes Chemical Gas Sensors, Photoelectric Gas Sensors, and Other types. The Chemical Gas Sensors segment dominates the market size with values of USD 1.77 billion in 2023, growing to USD 3.16 billion by 2033. Photoelectric Gas Sensors follow with growth from USD 0.81 billion to USD 1.44 billion in the same period, indicating a growing reliance on optical sensor technologies. Other types capture a smaller market share but are essential for niche applications.

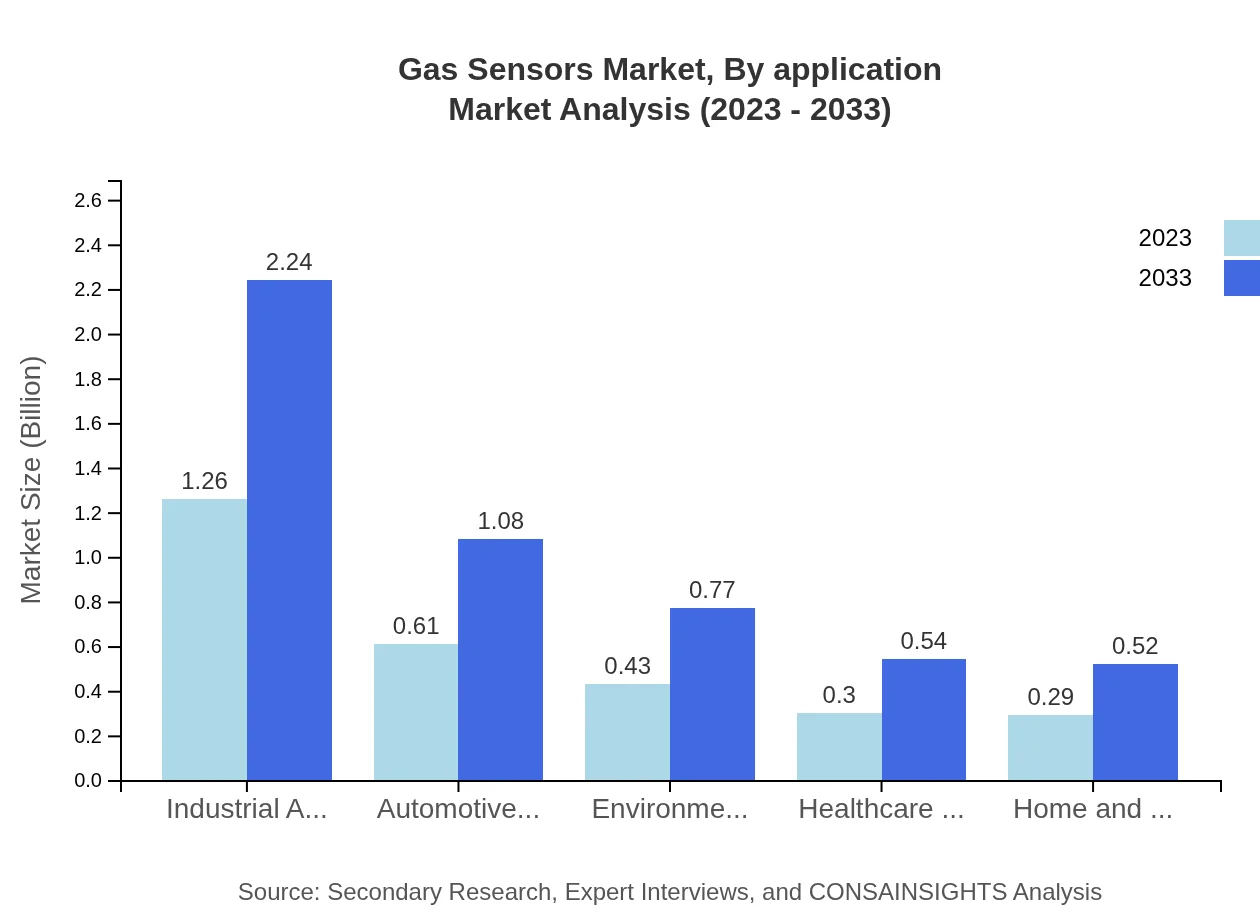

Gas Sensors Market Analysis By Application

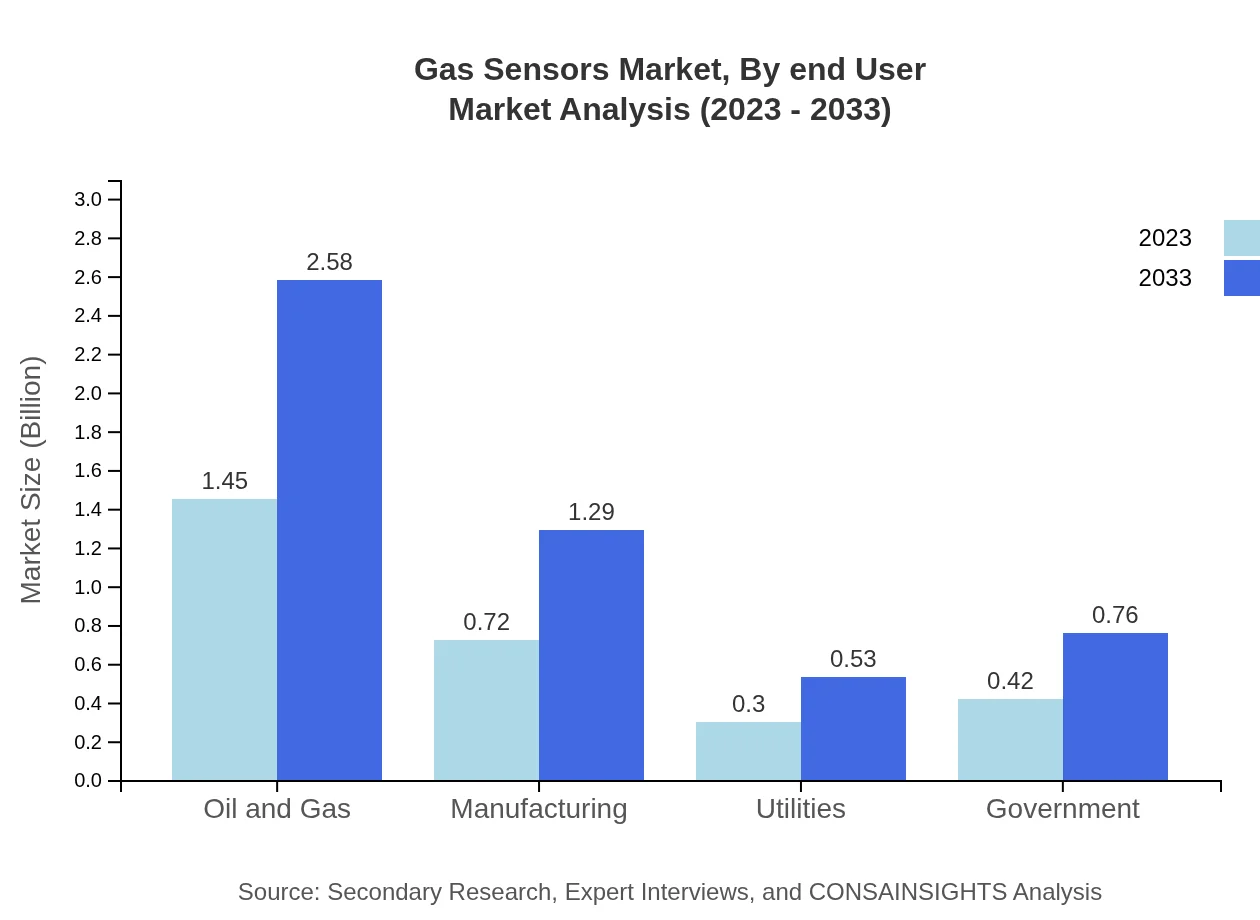

Applications of gas sensors span multiple sectors including Oil and Gas, Manufacturing, Utilities, Government, Healthcare, and Environmental Monitoring. The Oil and Gas sector leads with a market size of USD 1.45 billion in 2023, expected to rise to USD 2.58 billion by 2033, highlighting its crucial role in safety and environmental compliance.

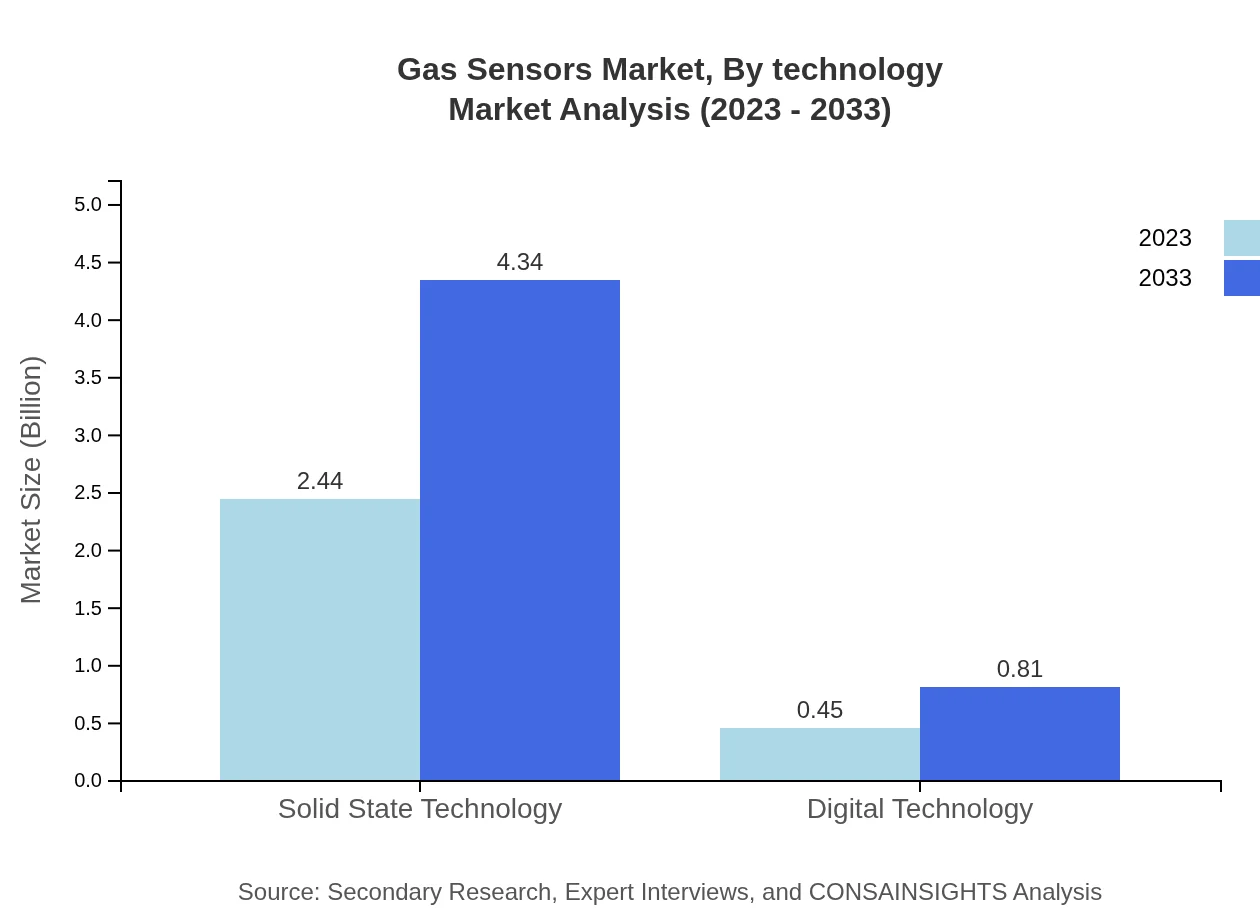

Gas Sensors Market Analysis By Technology

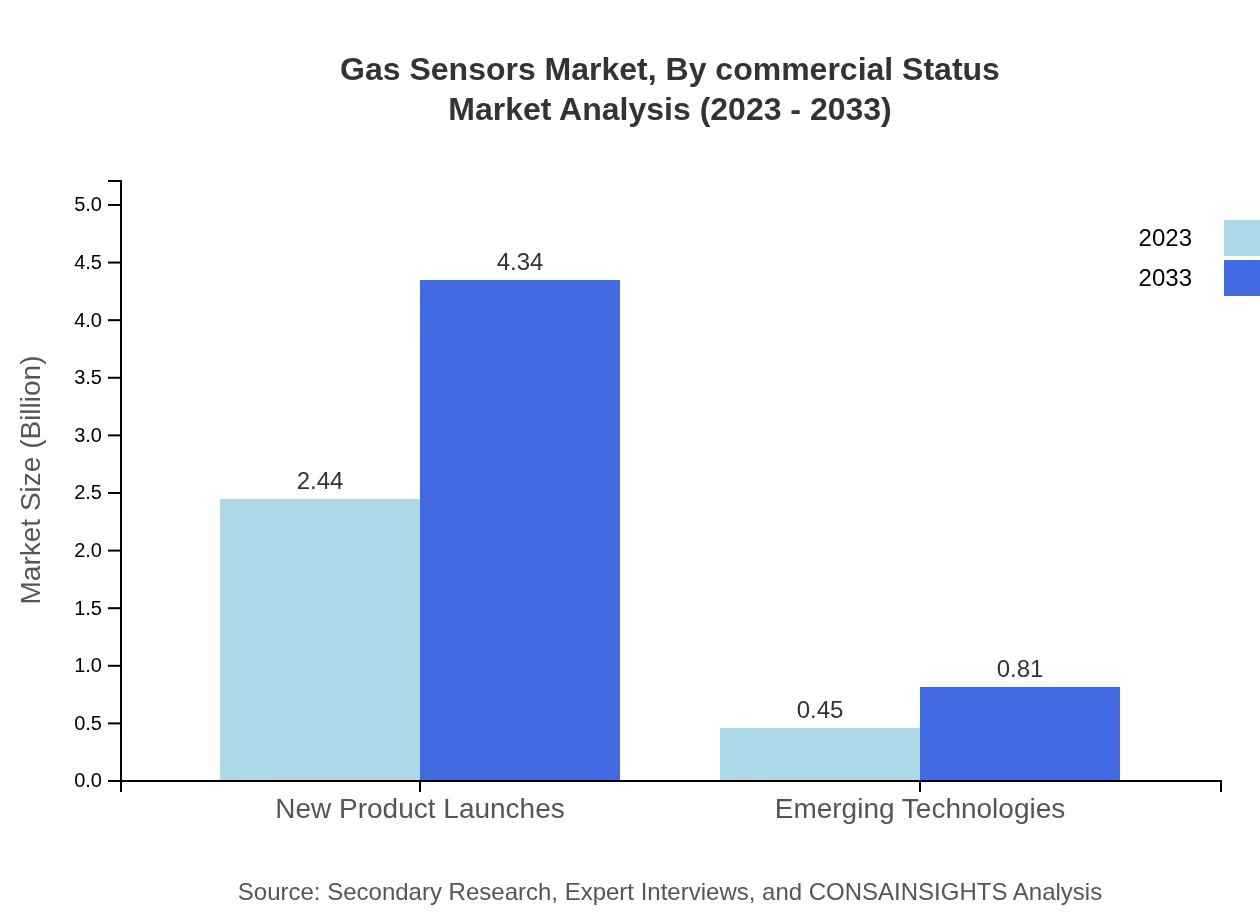

The market is influenced significantly by technology trends. Solid State Technology currently affects the market size, capturing USD 2.44 billion in 2023 and anticipated to reach USD 4.34 billion by 2033, thanks to its high reliability and durability in industrial applications. Digital technology is expected to expand from USD 0.45 billion to USD 0.81 billion reflective of the industry's shift towards smart monitoring solutions.

Gas Sensors Market Analysis By End User

End-user industries consist of Commercial, Industrial, and Residential applications. Industrial Applications account for a significant share, showing a size of USD 1.26 billion in 2023, growing to USD 2.24 billion by 2033, indicating heightened safety measures across factories and processing units.

Gas Sensors Market Analysis By Commercial Status

Commercially available gas sensors dominate the market, reflecting high adoption rates due to established technology and reliability. Market segments based on commercial status are pivotal in understanding market dynamics, with well-known products constituting the larger share.

Gas Sensors Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Gas Sensors Industry

Honeywell International Inc.:

A leading manufacturer of gas sensors known for its innovative solutions for industrial and residential safety applications.MSA Safety Incorporated:

Specializing in safety products, MSA offers high-performance gas detection systems utilized in various industries.Figaro Engineering Inc.:

Figaro is recognized for its extensive range of gas sensors, particularly for precision applications in environmental monitoring.Dragerwerk AG & Co. KGaA:

Drager specializes in respiratory protection and gas detection technology for industrial and emergency response applications.Sensirion AG:

Famed for producing high-quality gas flow and environmental sensors, Sensirion serves automotive and consumer markets.We're grateful to work with incredible clients.

FAQs

What is the market size of gas Sensors?

The gas sensors market is valued at $2.89 billion in 2023, with expectations to grow at a CAGR of 5.8% over the next decade. Significant growth is anticipated, reflecting increased demand across various applications.

What are the key market players or companies in the gas Sensors industry?

Key players in the gas sensors market include industry leaders known for innovative technologies and extensive product offerings, enhancing their market positions. Companies like Digi International, Figaro Engineering, and Honeywell are pivotal, driving advancements and competition.

What are the primary factors driving growth in the gas sensors industry?

Factors driving growth include increasing demand for environmental monitoring, industrial safety regulations, and technological advancements. The rise in automotive applications and the need for improved air quality control further contribute to market expansion.

Which region is the fastest Growing in the gas sensors market?

Asia Pacific is projected to be the fastest-growing region in the gas sensors market, with growth expected from $0.56 billion in 2023 to $1.00 billion by 2033. Other regions, such as Europe and North America, also contribute significantly to growth.

Does ConsaInsights provide customized market report data for the gas sensors industry?

Yes, ConsaInsights offers customized market report data tailored to specific requirements in the gas sensors industry. Clients can request targeted insights, including niche markets, emerging trends, and specific regional analyses.

What deliverables can I expect from this gas sensors market research project?

Deliverables from the gas sensors market research project include detailed market analysis reports, segmentation data, competitive landscape insights, regional growth forecasts, and comprehensive trend analyses, tailored to client needs.

What are the market trends of gas sensors?

Current trends in the gas sensors market involve increasing integration of IoT technologies, adoption of smart sensors, and advancements in solid-state technology, enhancing performance and driving demand across various sectors.