Gas Separation Membranes Market Report

Published Date: 22 January 2026 | Report Code: gas-separation-membranes

Gas Separation Membranes Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Gas Separation Membranes market, including market trends, growth forecast from 2023 to 2033, regional insights, and segmentation analysis across various parameters.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

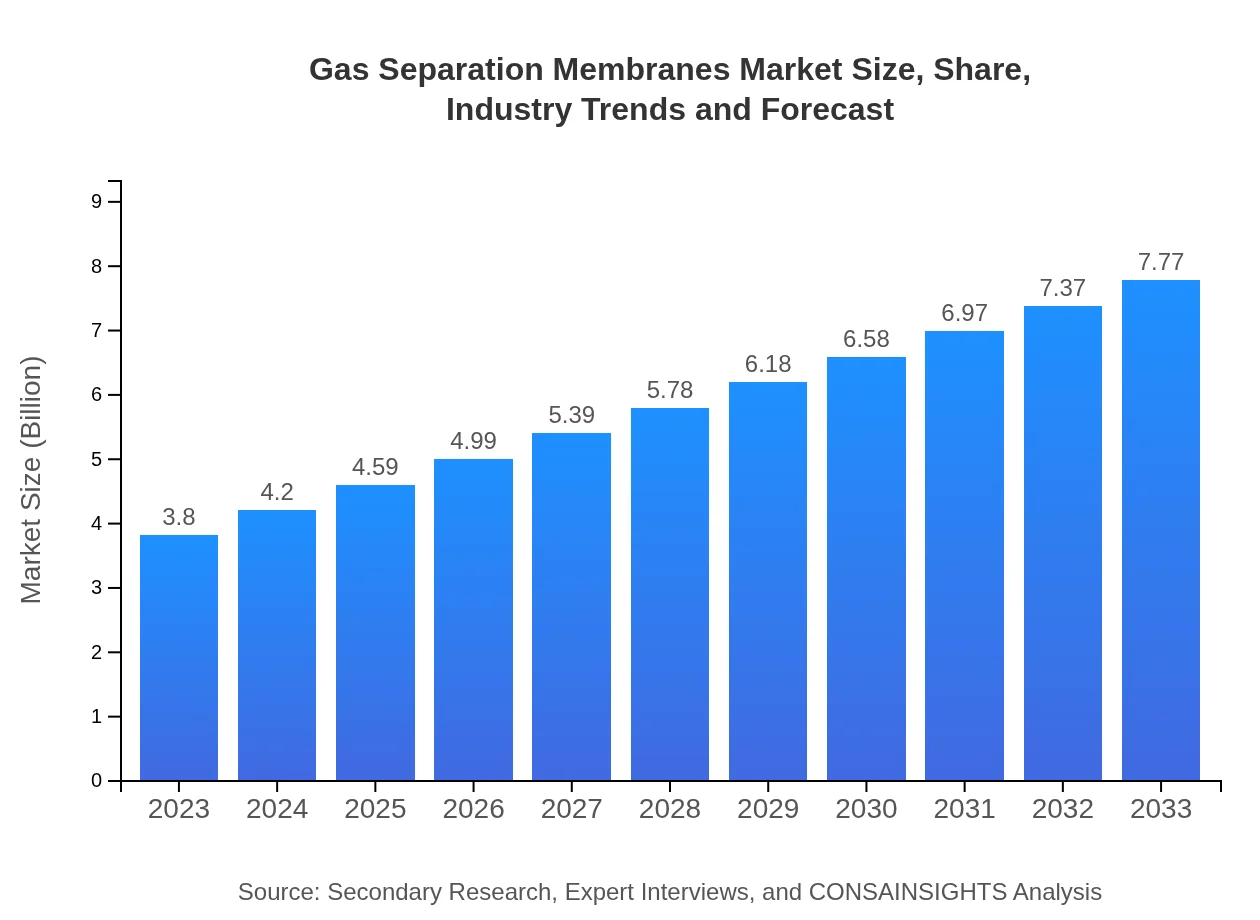

| 2023 Market Size | $3.80 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $7.77 Billion |

| Top Companies | Membrane Technology and Research, Inc., Air Products and Chemicals, Inc., Siemens AG |

| Last Modified Date | 22 January 2026 |

Gas Separation Membranes Market Overview

Customize Gas Separation Membranes Market Report market research report

- ✔ Get in-depth analysis of Gas Separation Membranes market size, growth, and forecasts.

- ✔ Understand Gas Separation Membranes's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Gas Separation Membranes

What is the Market Size & CAGR of Gas Separation Membranes market in 2023?

Gas Separation Membranes Industry Analysis

Gas Separation Membranes Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Gas Separation Membranes Market Analysis Report by Region

Europe Gas Separation Membranes Market Report:

The European market for Gas Separation Membranes is expected to reach $2.03 billion by 2033, up from $0.99 billion in 2023. Heavy investments in carbon capture technologies and the implementation of policies favoring low-carbon technologies are propelling market growth in this region.Asia Pacific Gas Separation Membranes Market Report:

The Asia Pacific region is anticipated to witness significant growth in the Gas Separation Membranes market, increasing from $0.77 billion in 2023 to $1.57 billion by 2033. Rising industrialization in countries like China and India, coupled with the need for efficient energy applications, is boosting demand for gas separation technologies.North America Gas Separation Membranes Market Report:

North America is projected to expand significantly, with market size increasing from $1.38 billion in 2023 to $2.82 billion by 2033. The presence of key players, technological innovations, and stringent environmental regulations are driving the adoption of gas separation membranes in various applications.South America Gas Separation Membranes Market Report:

In South America, the market is expected to grow from $0.23 billion in 2023 to $0.47 billion by 2033. The region’s increasing focus on renewable energy sources and its rich natural gas reserves contribute to the growth of the gas separation membranes industry.Middle East & Africa Gas Separation Membranes Market Report:

The Middle East and Africa market is projected to witness growth from $0.43 billion in 2023 to $0.88 billion by 2033, driven by an increasing need for natural gas processing and enhanced recovery techniques amid fluctuating fossil fuel prices.Tell us your focus area and get a customized research report.

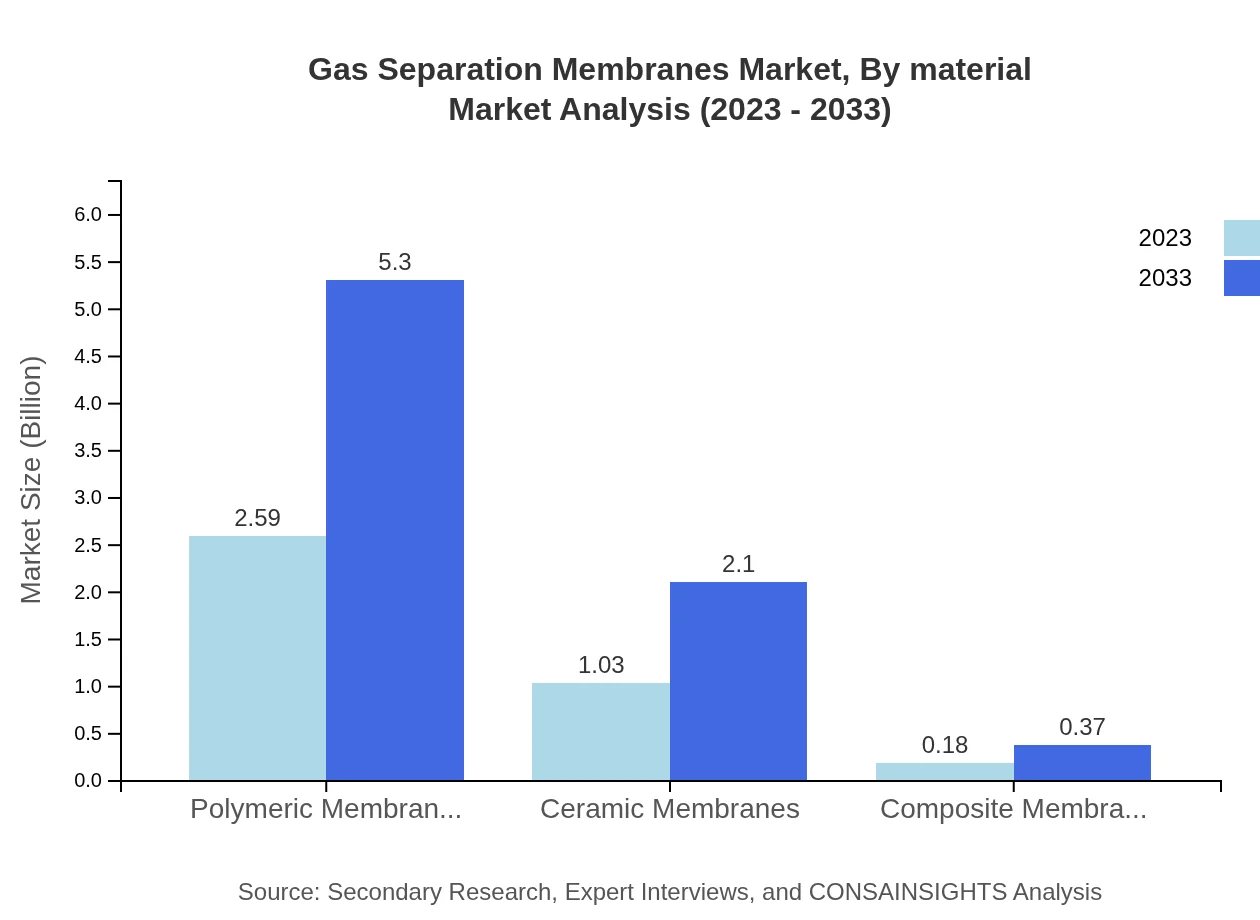

Gas Separation Membranes Market Analysis By Material

Polymeric membranes dominate the market, accounting for 68.21% of the total market share in 2023 due to their widespread adoption in various applications, mostly in the natural gas sector. Ceramic membranes, with a 27.06% share, are emerging due to their thermal and chemical stability, making them suitable for harsh environments.

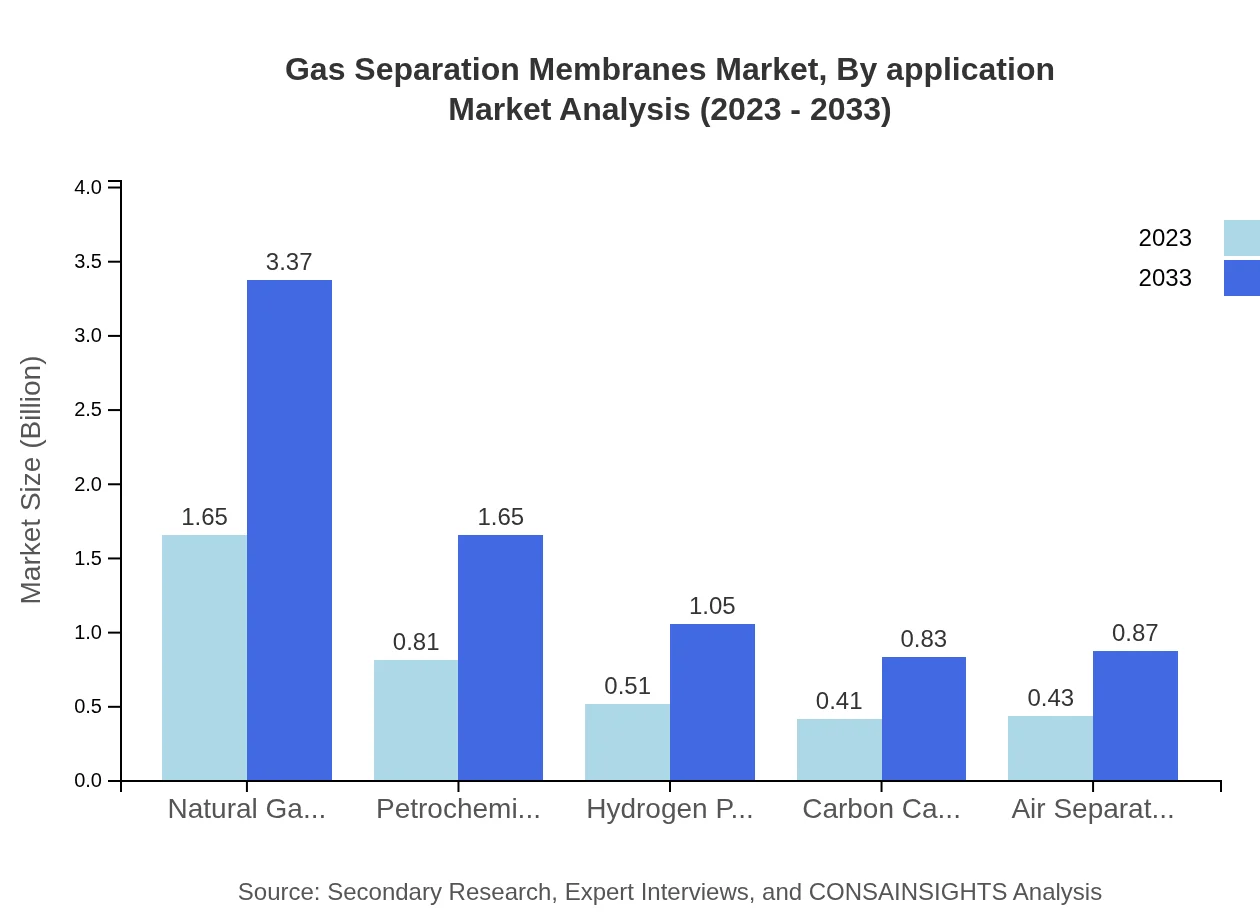

Gas Separation Membranes Market Analysis By Application

The industrial application segment, which includes natural gas processing, accounts for a significant share of the market. By 2033, it is expected to grow from 43.37% share in 2023, emphasizing the role of membranes in energy-intensive applications.

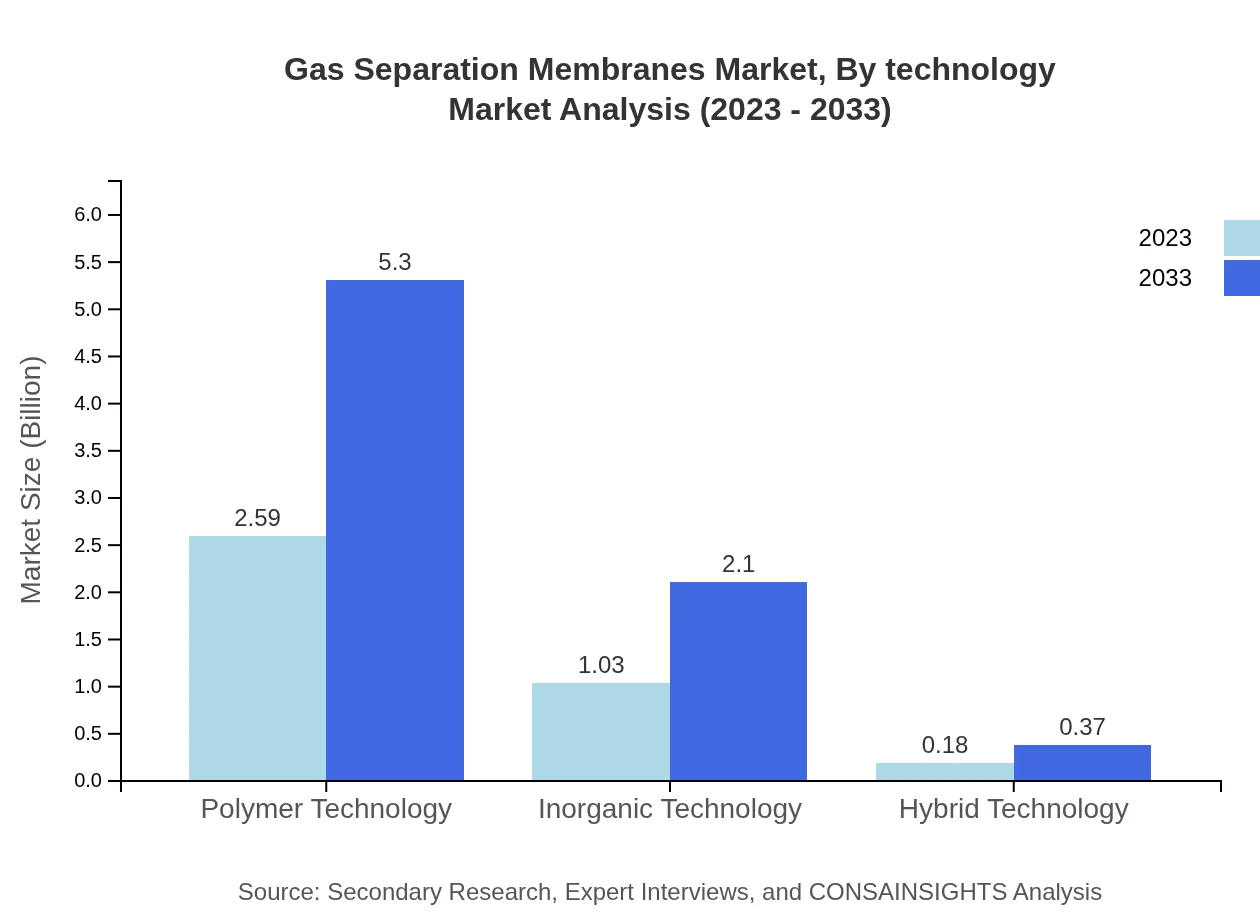

Gas Separation Membranes Market Analysis By Technology

Advancements in polymer, inorganic, and hybrid technologies are shaping the market landscape. Polymer-based technologies dominate due to their cost-effectiveness and ease of manufacturing, while inorganic technologies are gaining traction for their high performance in demanding applications.

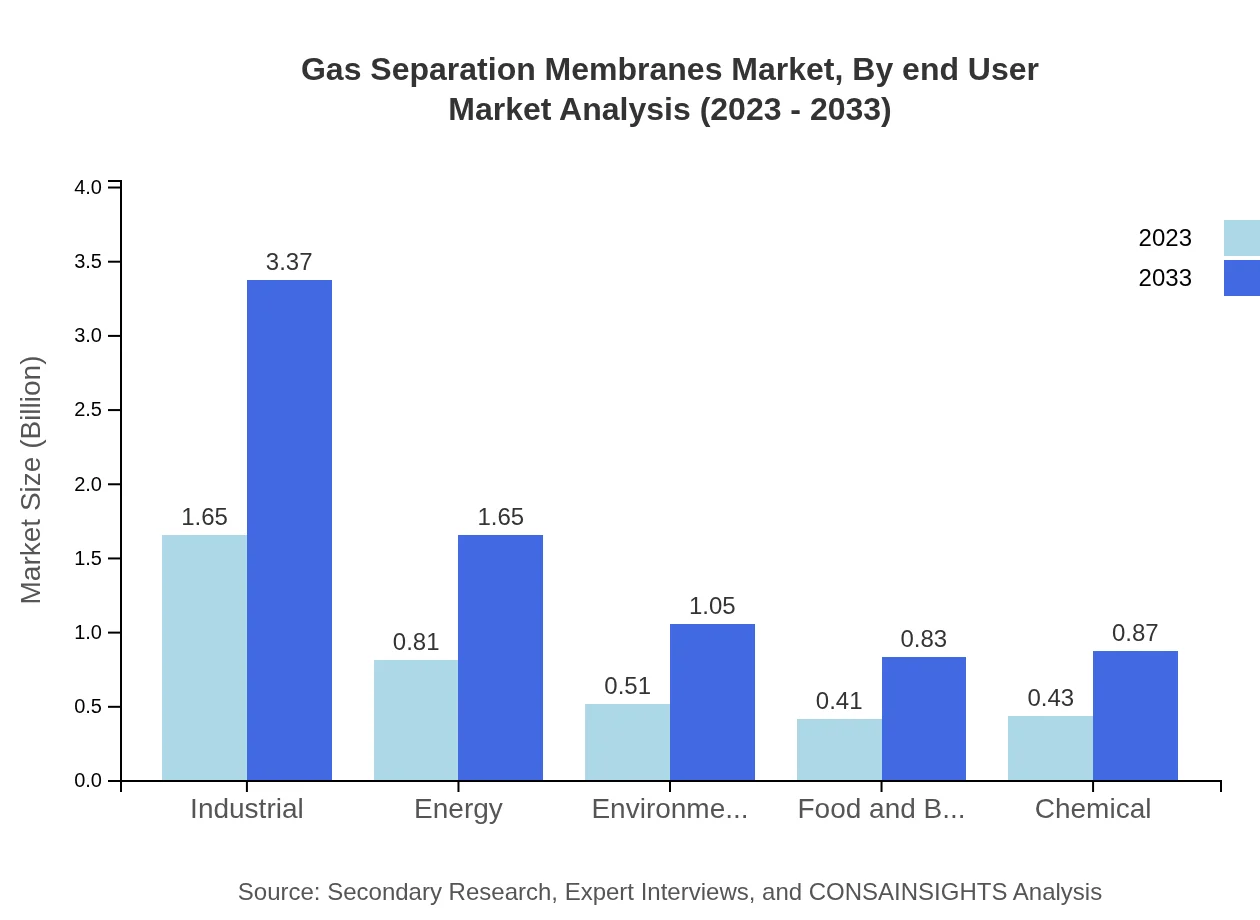

Gas Separation Membranes Market Analysis By End User

The energy sector is the largest end-user segment, driven by natural gas processing and petrochemical recovery applications, accounting for 21.24% of the market share in 2023, with expectations of similar trends continuing through 2033.

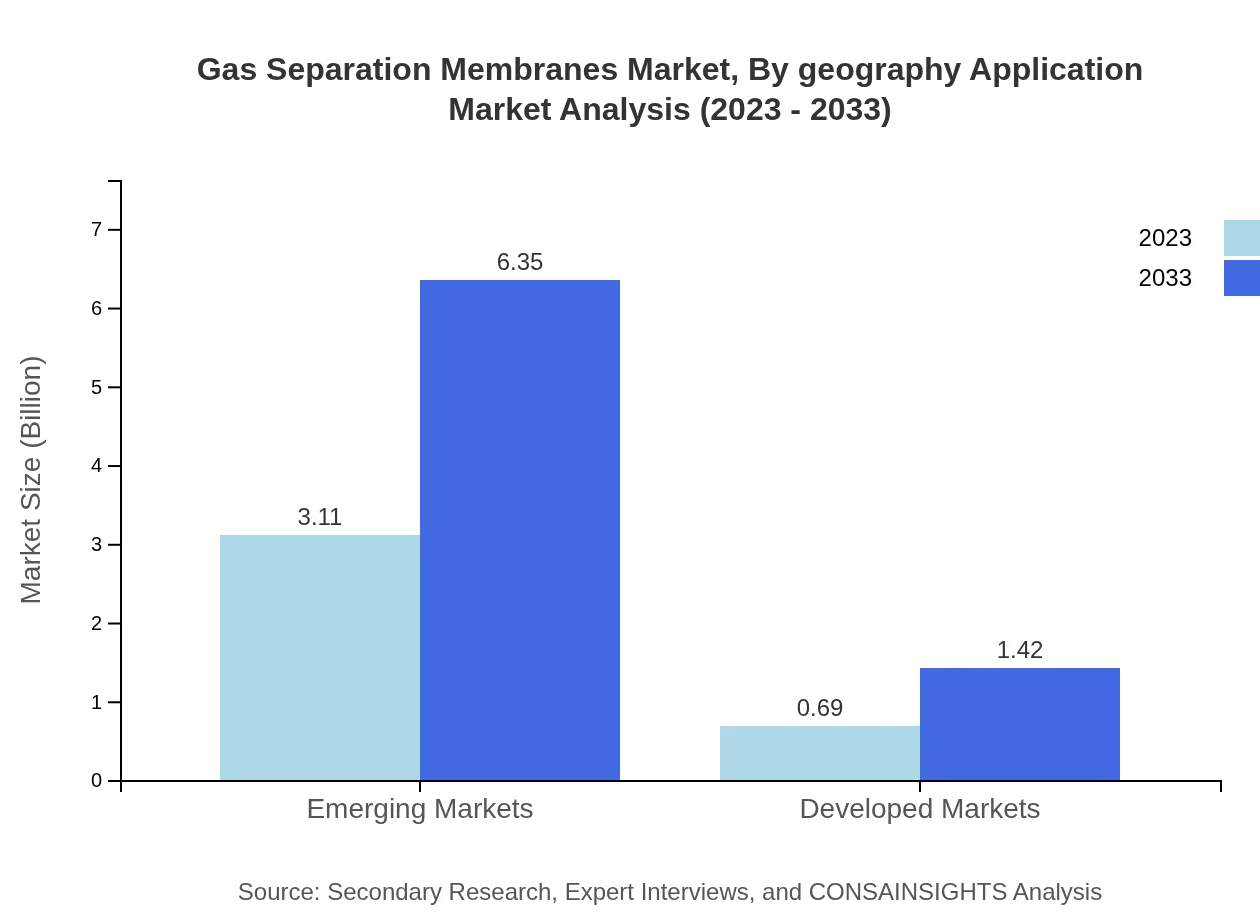

Gas Separation Membranes Market Analysis By Geography Application

Emerging markets are projected to see robust growth, driven by increasing investments in clean energy technologies and infrastructure. The market share of emerging applications is expected to rise significantly, indicating a shift in dynamics across regions, particularly in Asia-Pacific and Latin America.

Gas Separation Membranes Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Gas Separation Membranes Industry

Membrane Technology and Research, Inc.:

A leader in the development and supply of membrane-based solutions for natural gas processing and industrial separation applications.Air Products and Chemicals, Inc.:

A major player in the gas separation industry, providing advanced membrane technology for various applications, including hydrogen purification and carbon capture.Siemens AG:

Involved in developing innovative gas separation solutions with a strong focus on environmental technologies and efficient energy usage.We're grateful to work with incredible clients.

FAQs

What is the market size of gas Separation Membranes?

The gas separation membranes market is currently valued at approximately $3.8 billion and is projected to grow at a compound annual growth rate (CAGR) of 7.2% from 2023 to 2033.

What are the key market players or companies in the gas Separation Membranes industry?

Key players in the gas separation membranes market include global leaders specializing in membrane technology, such as Air Products and Chemicals, Inc., Membrana, and Parker Hannifin Corporation, known for their innovative advancements.

What are the primary factors driving the growth in the gas Separation Membranes industry?

The growth in the gas separation membranes market is primarily driven by increasing demand for energy-efficient solutions, stringent environmental regulations, and the exploration of renewable energy sources, enhancing membrane technology adoption.

Which region is the fastest Growing in the gas Separation Membranes market?

North America is the fastest-growing region in the gas separation membranes market, with economic values projected to rise from $1.38 billion in 2023 to $2.82 billion in 2033, highlighting a strong demand for advanced membrane technology.

Does ConsaInsights provide customized market report data for the gas Separation Membranes industry?

Yes, Consainsights offers customized market report data tailored to specific needs in the gas separation membranes industry, providing insights on market trends, regional analysis, and shifting consumer demands.

What deliverables can I expect from this gas Separation Membranes market research project?

Deliverables from the gas separation membranes market research project include detailed reports on market size, growth forecasts, competitive analysis, and segmented insights by application and region.

What are the market trends of gas Separation Membranes?

Current trends in the gas separation membranes market include increasing focus on sustainability, technological advancements in polymeric and ceramic membranes, and expanding applications in hydrogen purification and carbon capture.