Gas Turbine Services Market Report

Published Date: 22 January 2026 | Report Code: gas-turbine-services

Gas Turbine Services Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the Gas Turbine Services market, providing comprehensive insights into market size, trends, and forecasts from 2023 to 2033, alongside detailed regional analysis and competitive landscape.

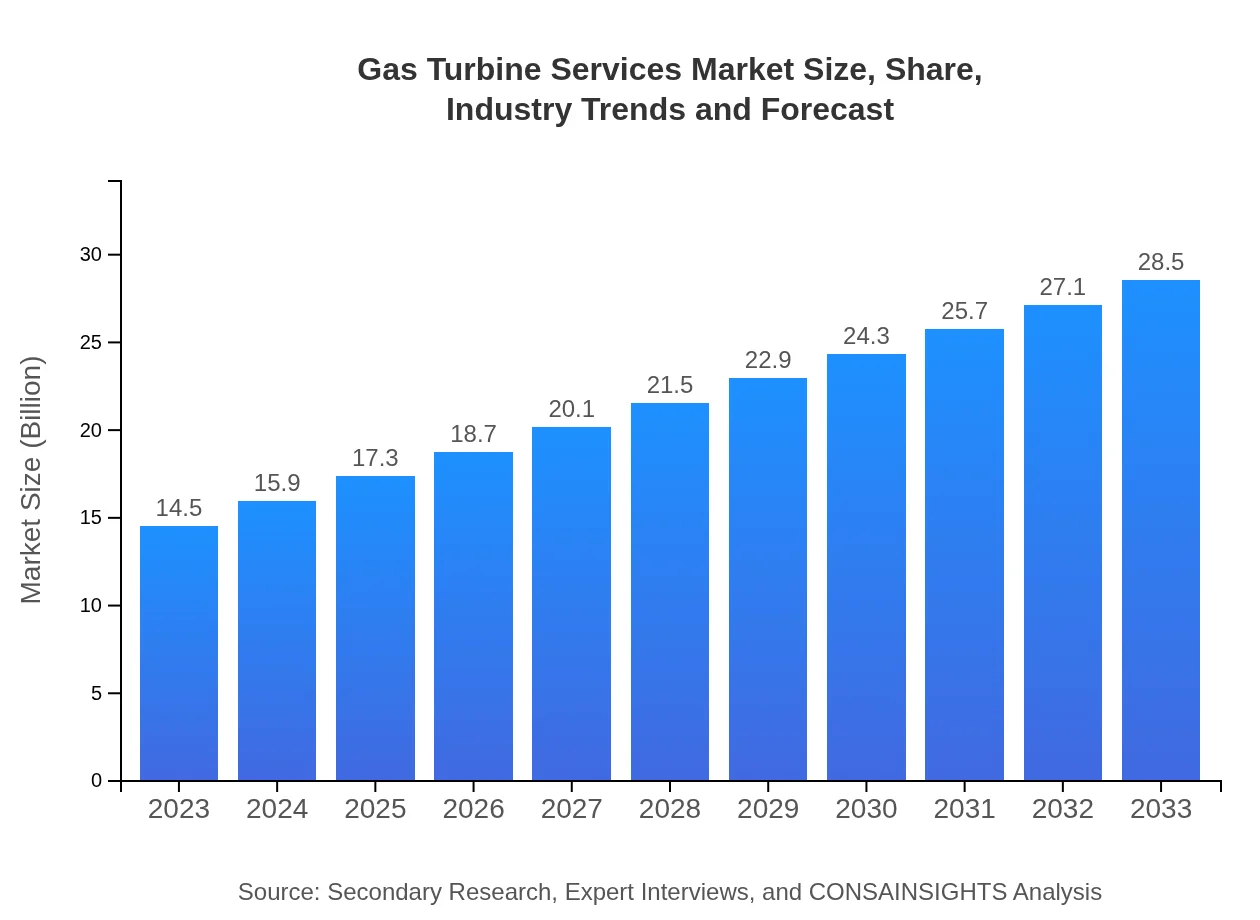

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $14.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $28.50 Billion |

| Top Companies | General Electric, Siemens Energy, Mitsubishi Power, Baker Hughes |

| Last Modified Date | 22 January 2026 |

Gas Turbine Services Market Overview

Customize Gas Turbine Services Market Report market research report

- ✔ Get in-depth analysis of Gas Turbine Services market size, growth, and forecasts.

- ✔ Understand Gas Turbine Services's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Gas Turbine Services

What is the Market Size & CAGR of Gas Turbine Services market in 2023?

Gas Turbine Services Industry Analysis

Gas Turbine Services Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Gas Turbine Services Market Analysis Report by Region

Europe Gas Turbine Services Market Report:

In Europe, the market is valued at $3.53 billion in 2023, forecasted to advance to $6.93 billion by 2033. The shift towards decarbonization and renewable technologies is pushing the demand for efficient gas turbine operations, complemented by stringent regulations that necessitate advanced service solutions.Asia Pacific Gas Turbine Services Market Report:

In 2023, the Asia Pacific Gas Turbine Services market is valued at approximately $3.04 billion and is projected to reach $5.98 billion by 2033. The region’s growth is spurred by rising energy demand, driven by industrial activities and urbanization. Additionally, government-led initiatives towards renewable energy integration are expected to promote further investments in gas turbine services.North America Gas Turbine Services Market Report:

North America dominates the Gas Turbine Services market with a size of $5.24 billion in 2023, projected to grow to $10.29 billion by 2033. The region benefits from a mature energy market with extensive gas infrastructure and leading technological innovations. Ongoing investments in energy efficiency and sustainability initiatives are driving the market forward.South America Gas Turbine Services Market Report:

The South American Gas Turbine Services market is valued at $0.94 billion in 2023 and is anticipated to grow to $1.84 billion by 2033. The region’s growth potential is attributed to increased reliance on cleaner energy solutions and infrastructure modernizations, particularly in Brazil and Argentina, aimed at reducing carbon footprints.Middle East & Africa Gas Turbine Services Market Report:

The Middle East and Africa's Gas Turbine Services market is valued at $1.76 billion in 2023, with a projected increase to $3.46 billion by 2033. The region’s heavy investment in energy and petrochemical sectors, coupled with a lucrative market for gas turbine technology and services, showcases significant growth opportunities.Tell us your focus area and get a customized research report.

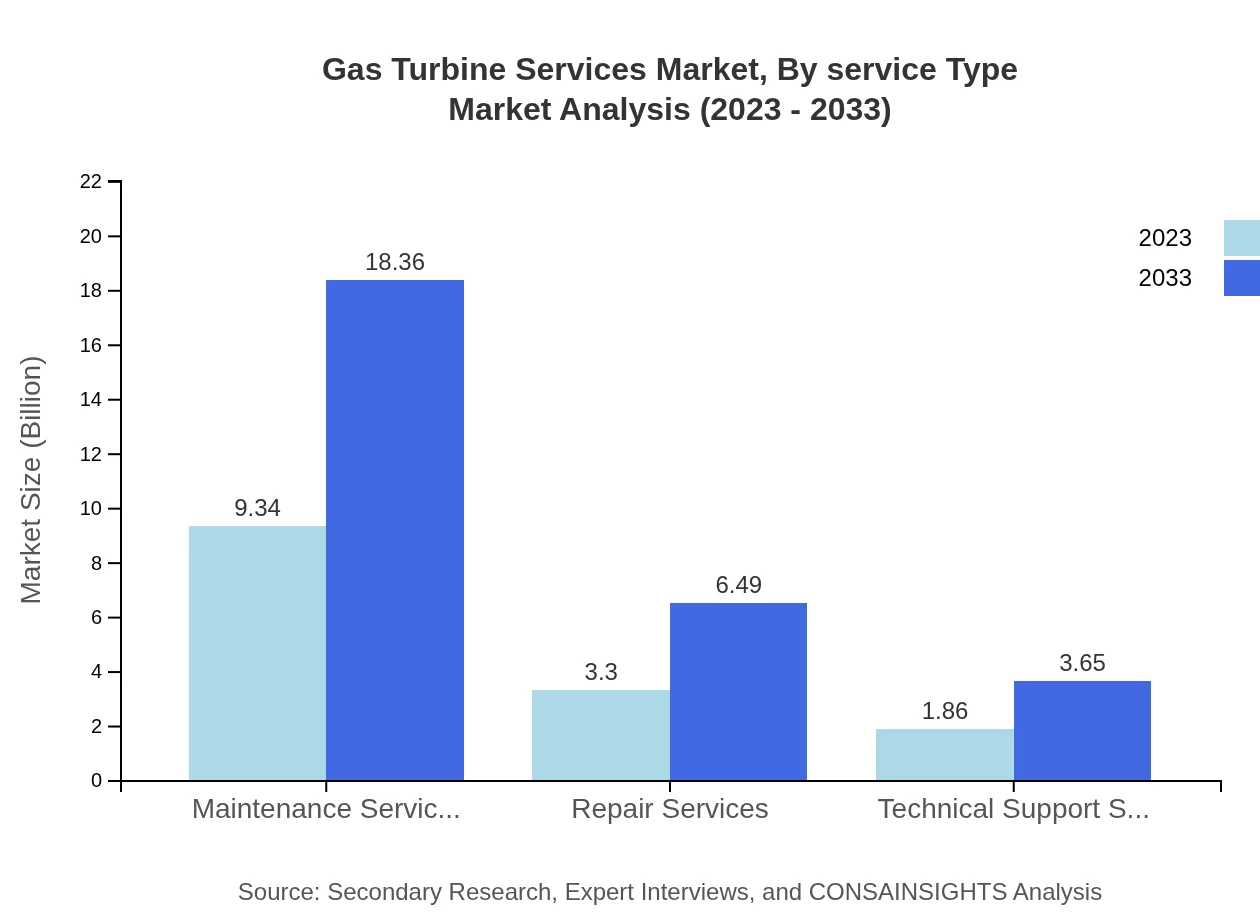

Gas Turbine Services Market Analysis By Service Type

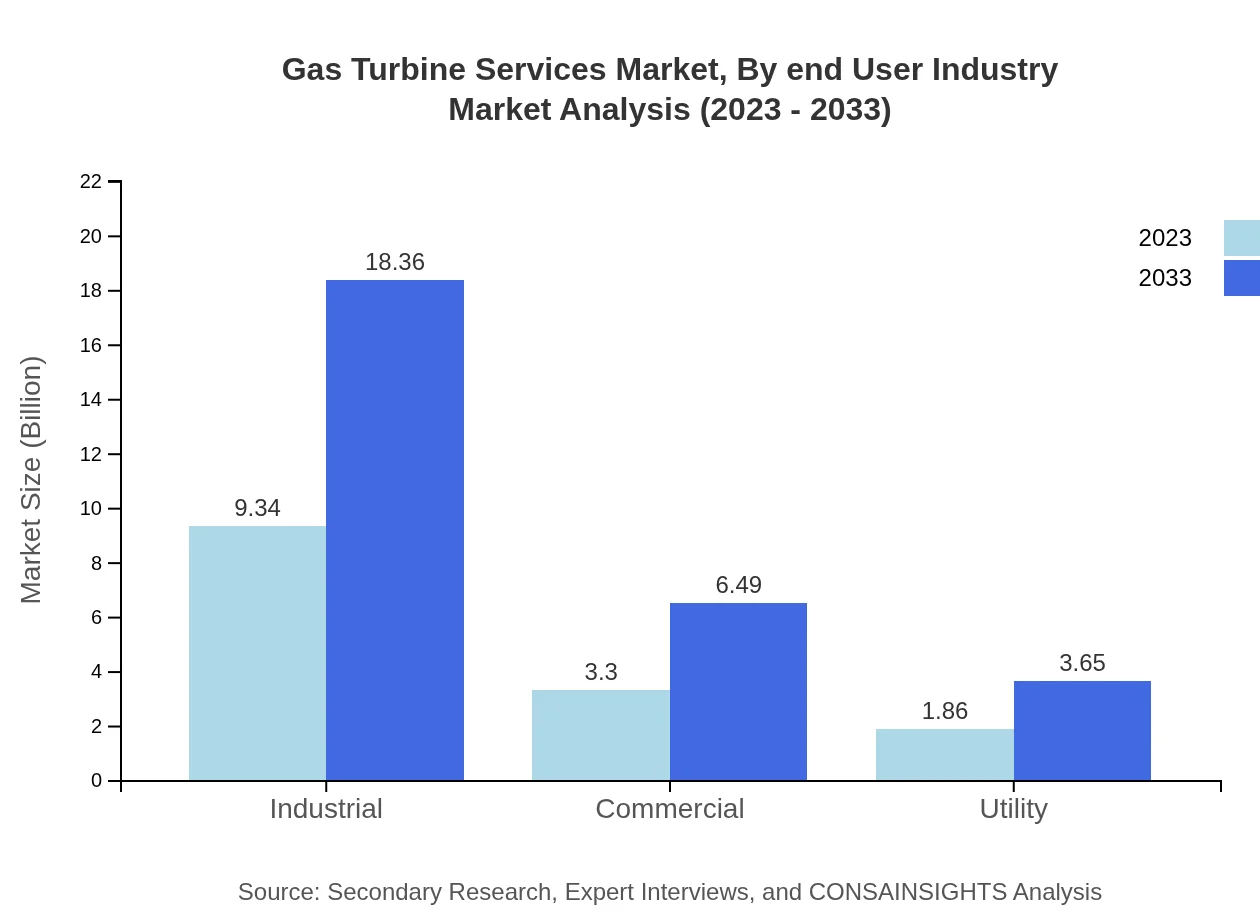

The Gas Turbine Services market, segmented by service type, illustrates a significant concentration in maintenance and repair services. Maintenance services dominate the market, with a size of $9.34 billion in 2023, projected to grow to $18.36 billion by 2033. This segment accounts for 64.42% in market share, representing its crucial role in sustaining turbine performance. Repair services, valued at $3.30 billion in 2023, are also essential, anticipated to rise to $6.49 billion by the forecast period.

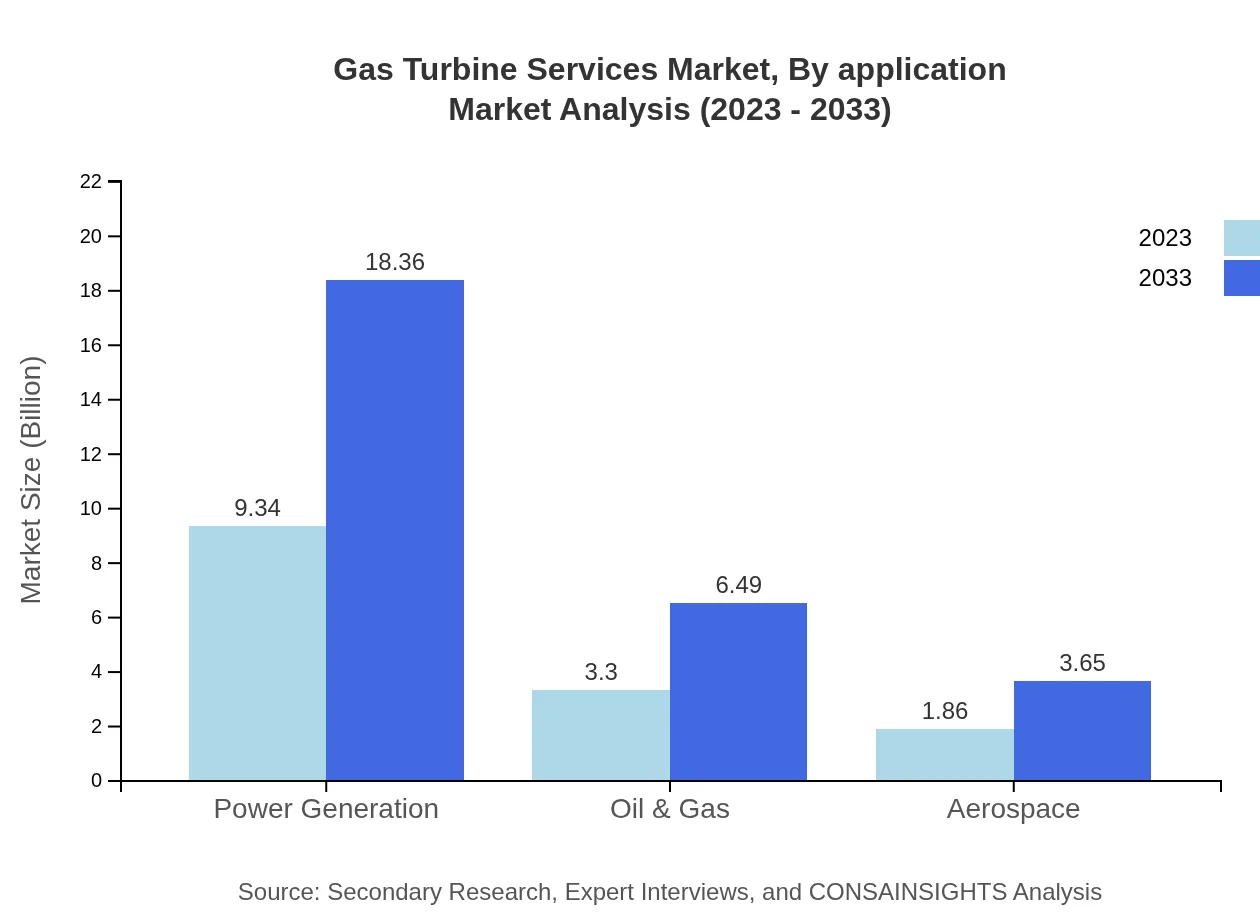

Gas Turbine Services Market Analysis By Application

The market, segmented by application, highlights its diversified use across power generation, oil and gas, and aerospace industries. Power Generation remains the most significant segment with a market size of $9.34 billion in 2023 and a steady share of 64.42%. The oil and gas segment follows with $3.30 billion, expected to grow similarly. Each application segment plays a unique role in the overall market dynamics.

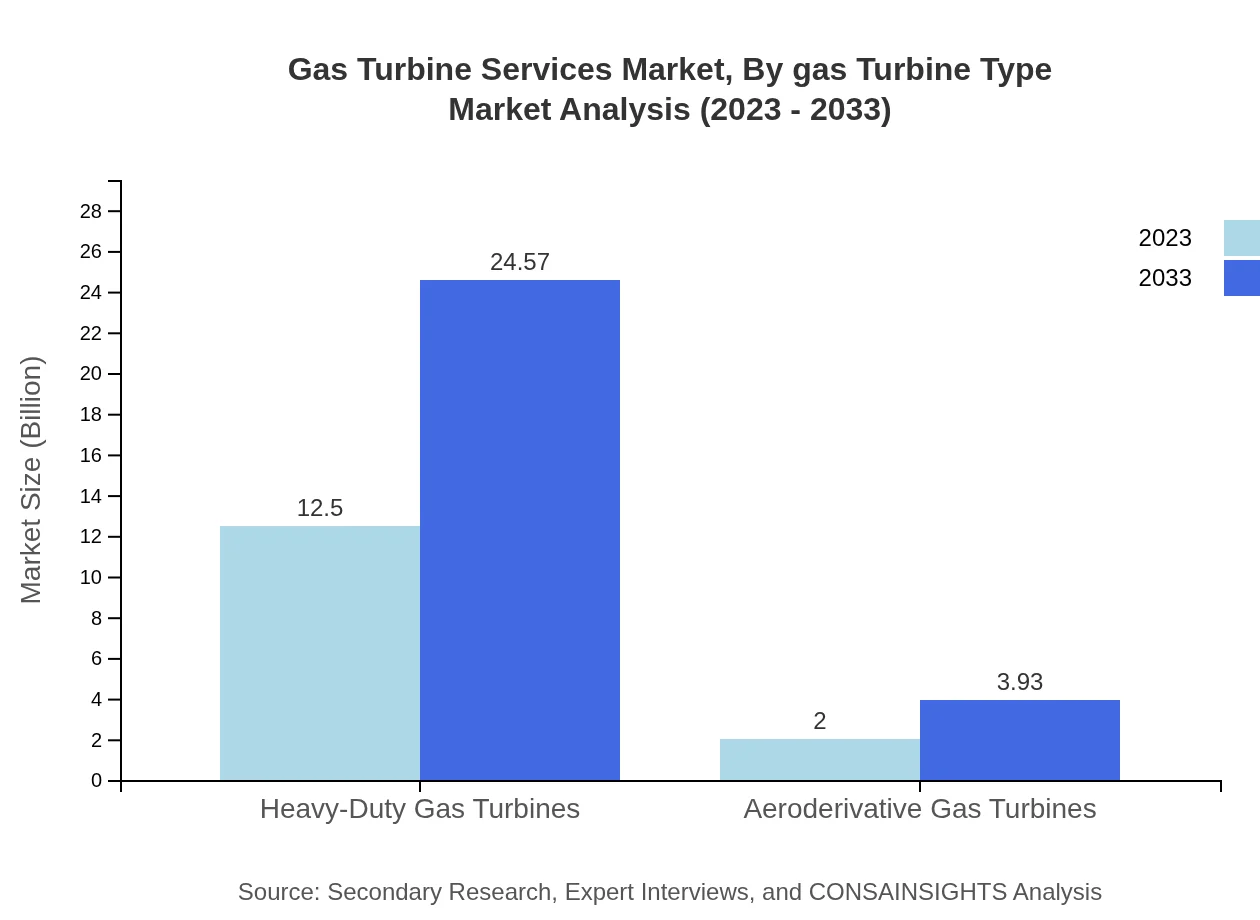

Gas Turbine Services Market Analysis By Gas Turbine Type

The Gas Turbine Services market is categorized by type into Heavy-Duty Gas Turbines and Aeroderivative Gas Turbines. Heavy-Duty Gas Turbines dominate with a size of $12.50 billion in 2023 and expected growth to $24.57 billion by 2033, accounting for 86.2% of the market share. Aeroderivative Gas Turbines, though smaller at $2.00 billion, are projected to increase as well, driven by their applications in flexibility and efficiency in various sectors.

Gas Turbine Services Market Analysis By End User Industry

Segmented by end-user industry, the market showcases energy production as the leading user, coupled with increased demand from industrial applications. The industrial sector holds a notable market size of $9.34 billion, anticipated to maintain a significant share through 2033, while the commercial and utility sectors contribute positively, reflecting the essential role of gas turbines across various industries.

Gas Turbine Services Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Gas Turbine Services Industry

General Electric:

General Electric is a leader in gas turbine manufacturing and services, renowned for its advanced technologies and innovative solutions that enhance turbine performance and reliability.Siemens Energy:

Siemens Energy plays a pivotal role in the global gas turbine services market, offering a wide range of services promoting efficiency and sustainability across gas turbine operations.Mitsubishi Power:

Mitsubishi Power provides comprehensive gas turbine solutions, focusing on technological advancements that lead to high-efficiency and environmentally friendly energy solutions.Baker Hughes:

Baker Hughes offers integrated gas turbine services, focusing on optimization and digital solutions designed to improve operational efficiencies and reduce emissions.We're grateful to work with incredible clients.

FAQs

What is the market size of gas Turbine Services?

The global gas turbine services market is valued at approximately $14.5 billion in 2023, with a projected CAGR of 6.8% through 2033, indicating robust growth and demand for timely maintenance, repair, and operational services.

What are the key market players or companies in this gas Turbine Services industry?

Key players in the gas turbine services industry include General Electric, Siemens, Mitsubishi Hitachi Power Systems, and Ansaldo Energia, along with several regional companies that specialize in service provision and maintenance across various markets.

What are the primary factors driving the growth in the gas Turbine Services industry?

The growth in gas turbine services is primarily driven by increasing electricity demand, aging infrastructure, and the push for efficiency improvements across power generation sectors. Innovations in service technologies also enhance service offerings.

Which region is the fastest Growing in the gas Turbine Services?

Asia Pacific is one of the fastest-growing regions in the gas turbine services market, expected to grow from $3.04 billion in 2023 to $5.98 billion by 2033, reflecting significant investments in infrastructure and energy sectors.

Does ConsaInsights provide customized market report data for the gas Turbine Services industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs within the gas turbine services industry, ensuring clients receive relevant insights for strategic decision-making.

What deliverables can I expect from this gas Turbine Services market research project?

Deliverables typically include comprehensive market analysis reports, segmentation data, competitive landscape insights, and actionable recommendations tailored to the needs of the gas turbine services sector.

What are the market trends of gas Turbine Services?

Current market trends in gas turbine services include increased digitalization, adoption of predictive maintenance technologies, and a focus on sustainable and efficient operational practices as industries respond to global energy demands.