Gastric Band Devices Market Report

Published Date: 31 January 2026 | Report Code: gastric-band-devices

Gastric Band Devices Market Size, Share, Industry Trends and Forecast to 2033

This report offers a comprehensive analysis of the Gastric Band Devices market, covering insights into market trends, segmentation, regional analysis, and growth forecasts from 2023 to 2033.

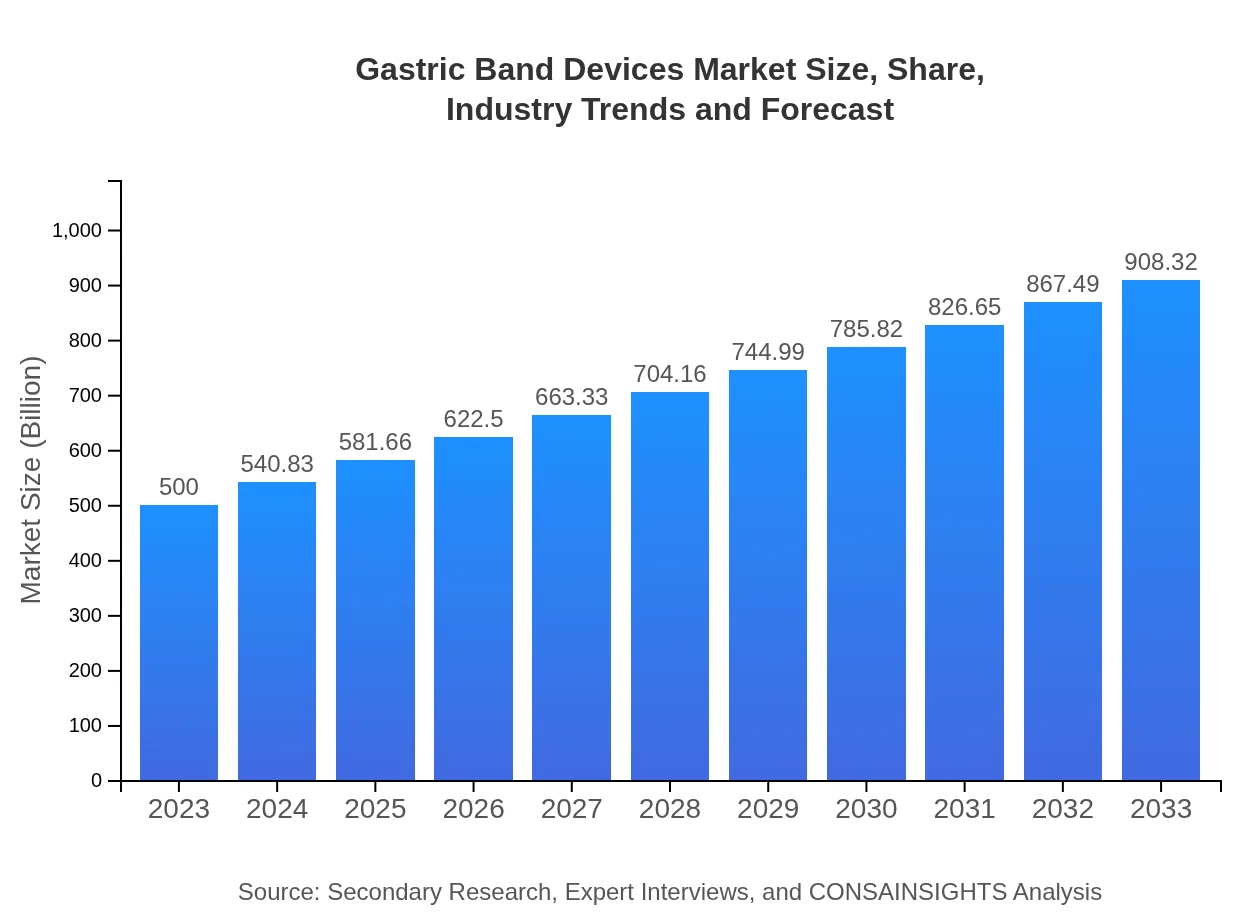

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $500.00 Million |

| CAGR (2023-2033) | 6% |

| 2033 Market Size | $908.32 Million |

| Top Companies | Allergan, Medtronic , Apollo Endosurgery, Ethicon |

| Last Modified Date | 31 January 2026 |

Gastric Band Devices Market Overview

Customize Gastric Band Devices Market Report market research report

- ✔ Get in-depth analysis of Gastric Band Devices market size, growth, and forecasts.

- ✔ Understand Gastric Band Devices's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Gastric Band Devices

What is the Market Size & CAGR of Gastric Band Devices market in 2023-2033?

Gastric Band Devices Industry Analysis

Gastric Band Devices Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Gastric Band Devices Market Analysis Report by Region

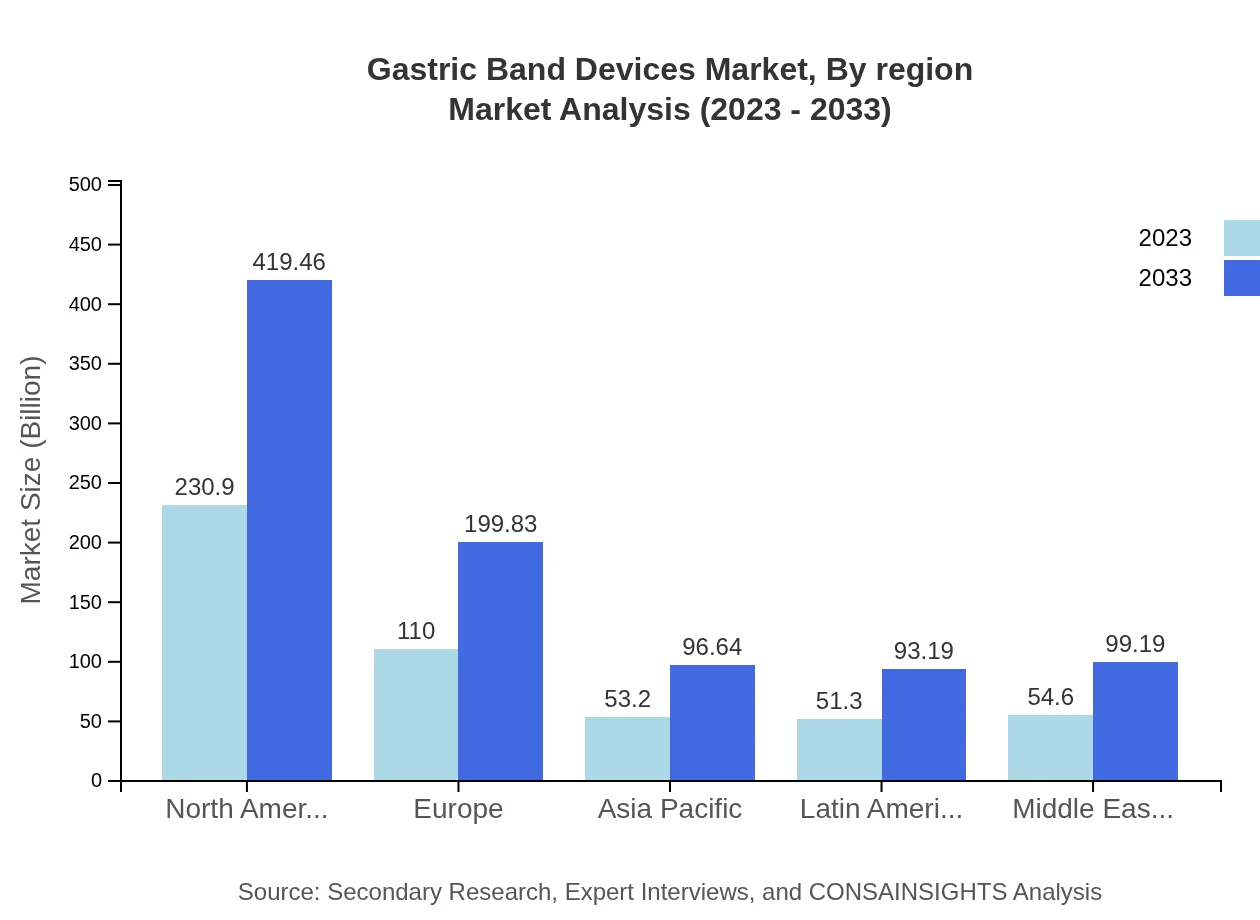

Europe Gastric Band Devices Market Report:

Europe's gastric band device market is also robust, starting with a size of $124.15 million in 2023 and projected to grow to $225.54 million by 2033. The region benefits from a well-established healthcare system and increasing acceptance of bariatric surgeries.Asia Pacific Gastric Band Devices Market Report:

The Asia Pacific region is expected to witness significant growth, driven by a rising prevalence of obesity and increased surgical interventions. The market size estimated at $101.30 million in 2023 is projected to grow to $184.03 million by 2033, reflecting a strong demand for gastric band devices.North America Gastric Band Devices Market Report:

North America holds a substantial share of the Gastric Band Devices market, with a market size of $170.65 million in 2023, forecasting growth to $310.01 million by 2033. High obesity rates, advanced healthcare infrastructure, and prominent bariatric centers drive this expansion.South America Gastric Band Devices Market Report:

In South America, market progress is steady, primarily influenced by an increase in healthcare access and awareness of obesity-related health risks. The market size of $40.95 million in 2023 is expected to reach $74.39 million by 2033.Middle East & Africa Gastric Band Devices Market Report:

In the Middle East and Africa, the market is expanding due to increasing healthcare investments and rising obesity rates. The market is forecasted to grow from $62.95 million in 2023 to $114.36 million by 2033.Tell us your focus area and get a customized research report.

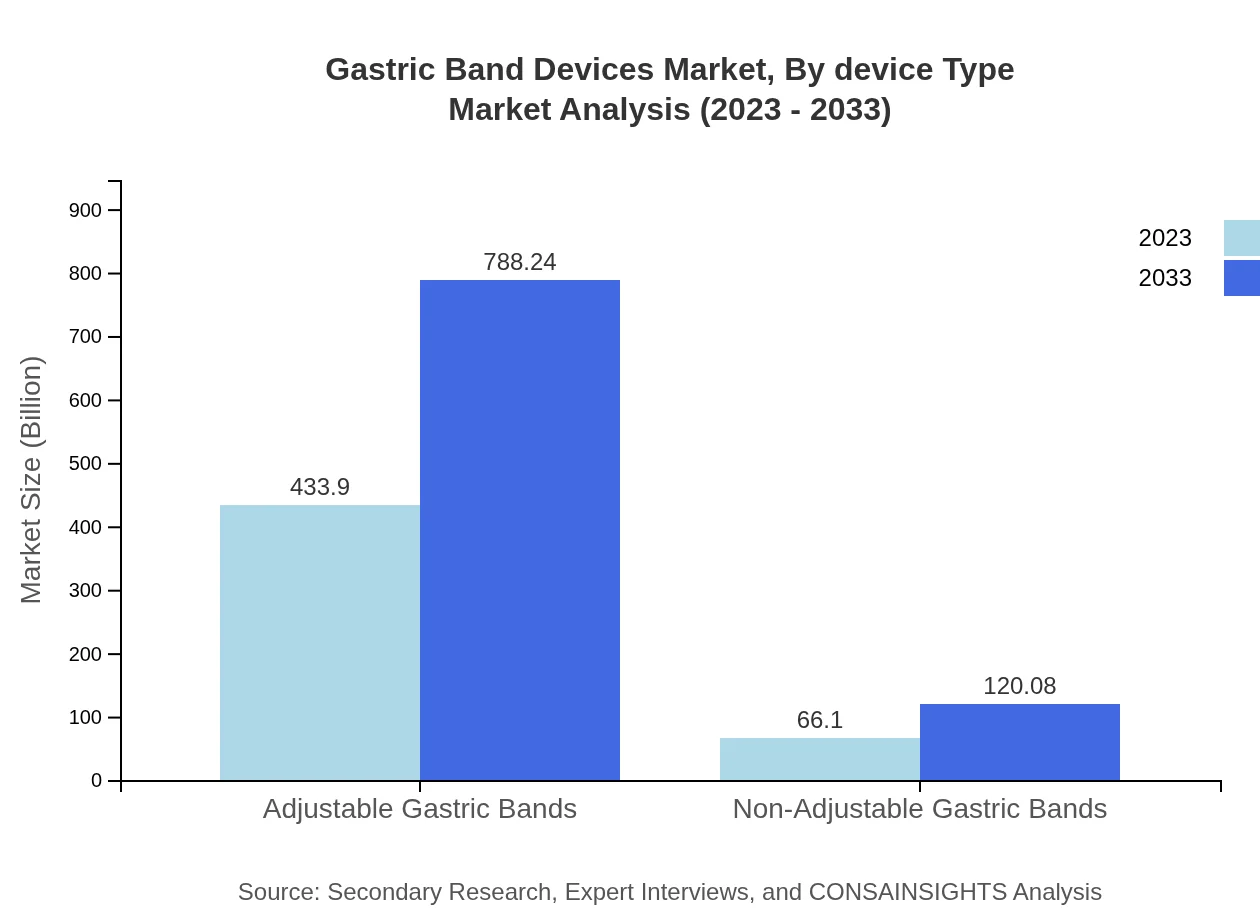

Gastric Band Devices Market Analysis By Device Type

The market for Gastric Band Devices by device type is dominated by adjustable gastric bands, which account for approximately 86.78% of the market share in 2023, expected to maintain this position through 2033 with a market size increase from $433.90 million to $788.24 million. Non-adjustable gastric bands, while accounting for a smaller share at 13.22%, are projected to grow from $66.10 million to $120.08 million.

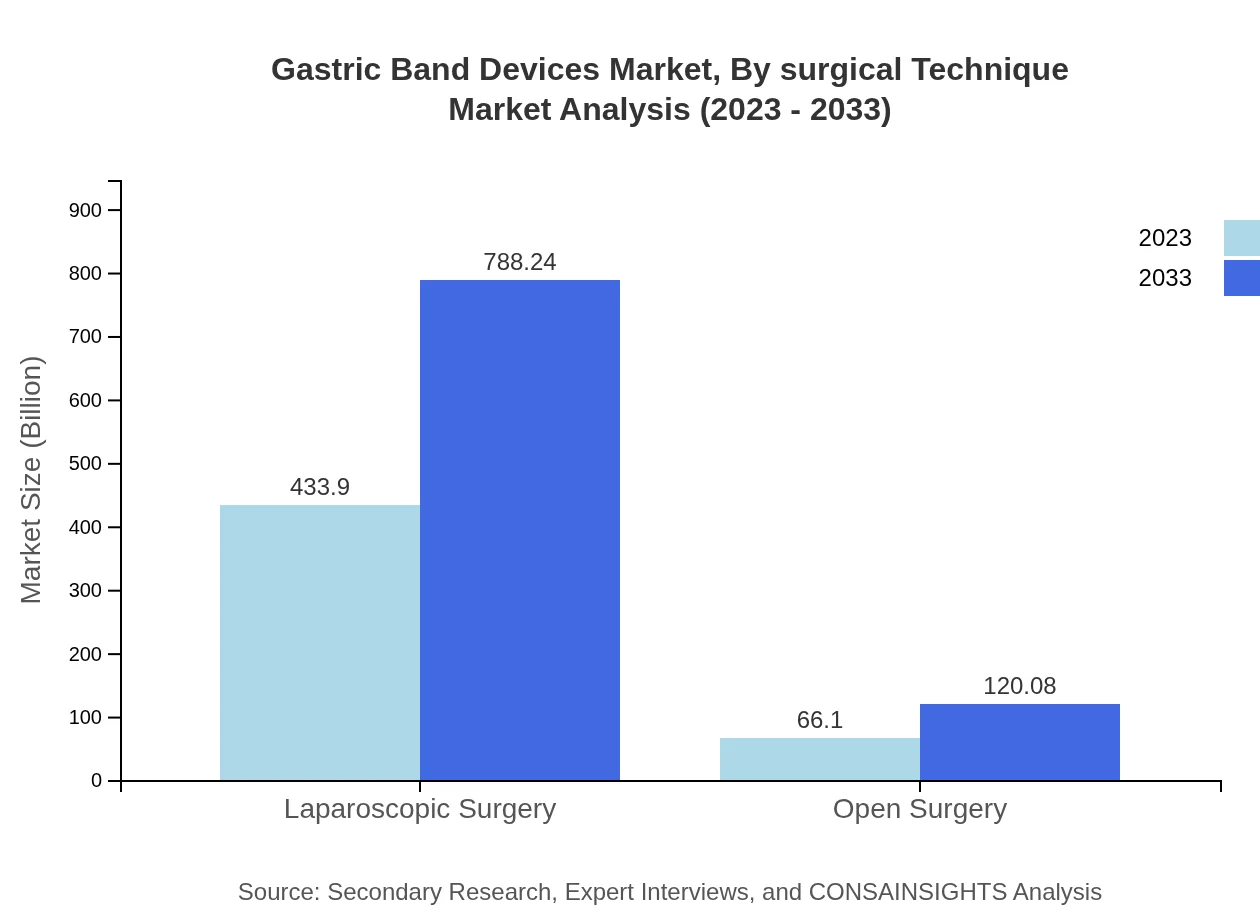

Gastric Band Devices Market Analysis By Surgical Technique

Laparoscopic surgery is the leading surgical technique segment within the Gastric Band Devices market, representing about 86.78% of the market in 2023 and anticipated to grow in response to minimal recovery times and lower complication rates. Open surgery comprises the remaining share, projected to increase from $66.10 million to $120.08 million.

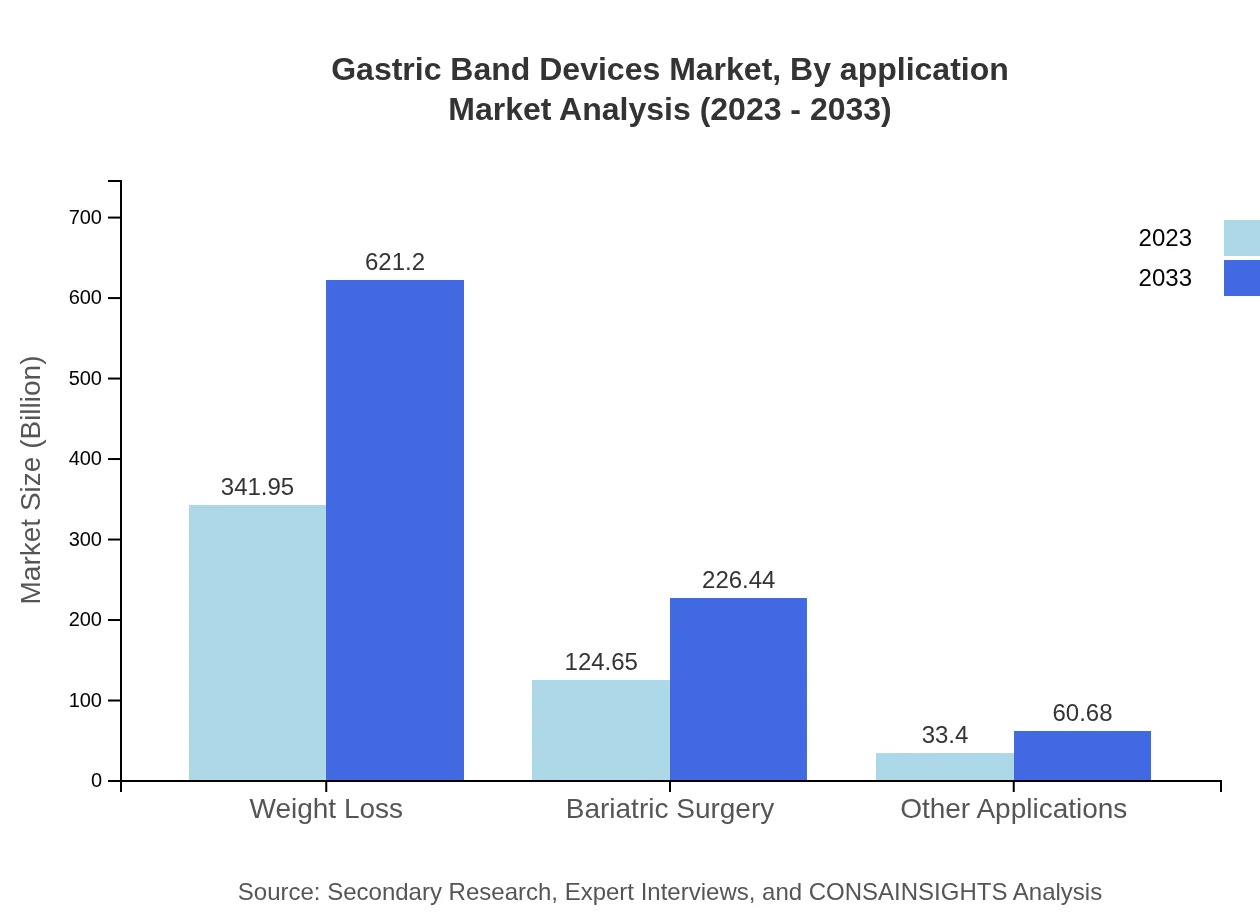

Gastric Band Devices Market Analysis By Application

In terms of applications, the weight loss segment dominates, currently holding 68.39% of the market share in 2023, expected to maintain its share through 2033. Bariatric surgery and other applications, such as specialized obesity treatments, also contribute effectively to market growth.

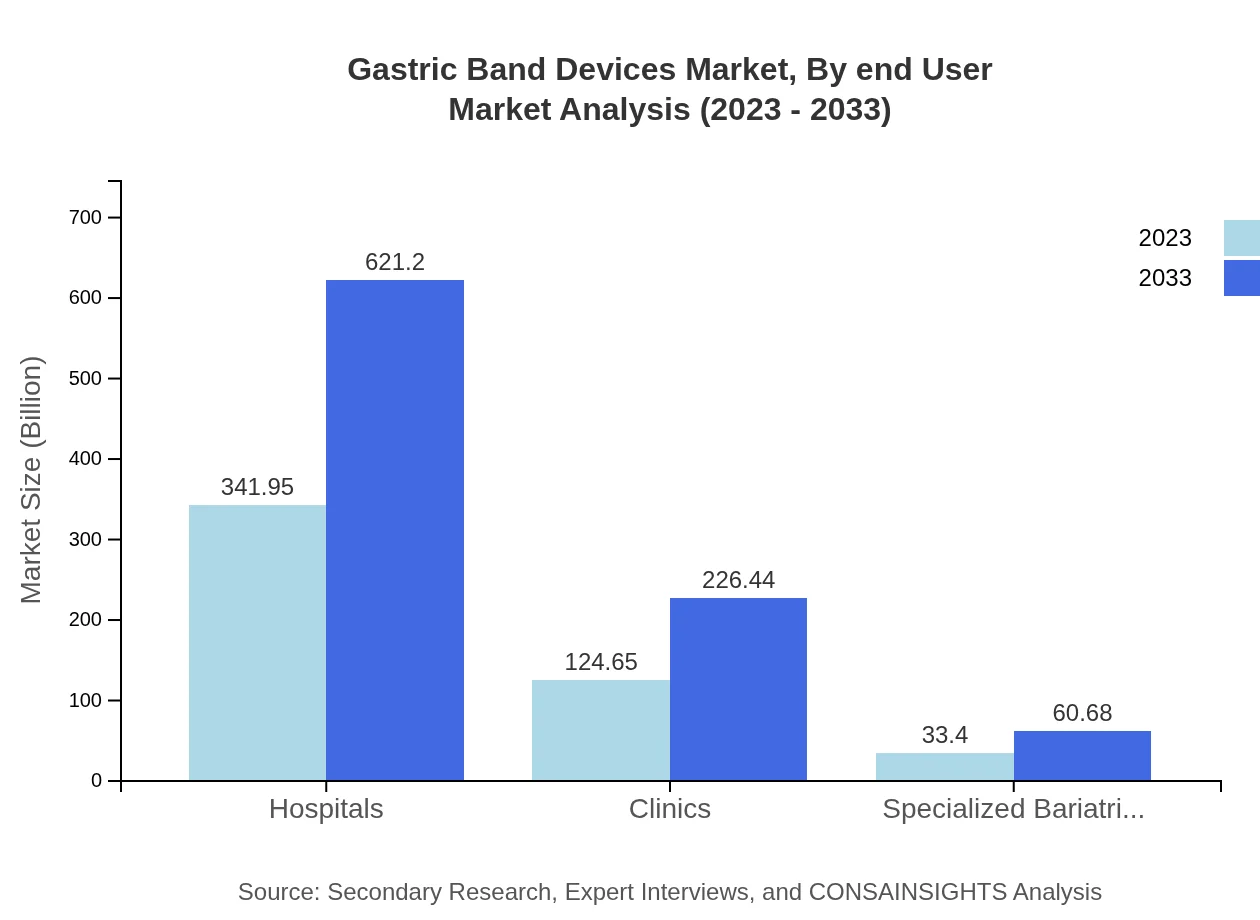

Gastric Band Devices Market Analysis By End User

Hospitals are the primary end-user for Gastric Band Devices, making up approximately 68.39% of the market share in 2023, predicted to grow from $341.95 million to $621.20 million. Clinics constitute a significant share as well, benefiting from advancements in outpatient surgeries.

Gastric Band Devices Market Analysis By Region

Each region presents unique dynamics affecting the Gastric Band Devices market, with North America and Europe leading due to advanced healthcare and higher obesity rates. Emerging regions like Asia Pacific show promising potential due to rising awareness and increased health expenditures.

Gastric Band Devices Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Gastric Band Devices Industry

Allergan:

A leader in the gastric band device manufacturing sector, Allergan has developed innovative adjustable gastric bands, contributing significantly to market growth.Medtronic :

Medtronic specializes in advanced medical technologies and has a strong portfolio of bariatric solutions, including laparoscopic gastric band devices, enhancing patient outcomes.Apollo Endosurgery:

Apollo Endosurgery provides minimally invasive surgical solutions for weight loss, offering a range of gastric band products tailored for individualized patient care.Ethicon:

A part of Johnson & Johnson, Ethicon develops surgical devices and tools and has a strong presence in the market through its innovative bariatric solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of gastric band devices?

The gastric band devices market is currently valued at approximately $500 million and is expected to grow at a CAGR of 6%. The market is projected to expand significantly over the next decade, reaching new heights as awareness of obesity treatments increases.

What are the key market players or companies in the gastric band devices industry?

Key players in the gastric band devices market include Medtronic, Johnson & Johnson, and Ethicon. These companies are major contributors to technological advancements and innovative solutions in the industry, ensuring high standards of safety and effectiveness in obesity treatments.

What are the primary factors driving the growth in the gastric band devices industry?

Growth in the gastric band devices industry is driven by the rising prevalence of obesity, increasing health awareness, and advancements in surgical technologies. Additionally, a growing focus on minimally invasive procedures bolsters market demand and consumer acceptance.

Which region is the fastest Growing in the gastric band devices market?

North America emerges as the fastest-growing region in the gastric band devices market, projected to expand from $170.65 million in 2023 to $310.01 million by 2033. Its rapid growth is fueled by high healthcare expenditure and advanced surgical facilities.

Does ConsaInsights provide customized market report data for the gastric band devices industry?

Yes, ConsaInsights specializes in providing customized market reports tailored to specific needs within the gastric band devices industry. Clients can obtain detailed analytics and insights depending on unique factors such as geography, market segmentation, and emerging trends.

What deliverables can I expect from this gastric band devices market research project?

Expect comprehensive reports detailing market size, growth projections, competitive analysis, and regional breakdowns. Our deliverables also include actionable insights, market trends, and customized recommendations based on your specific needs and objectives.

What are the market trends of gastric band devices?

The gastric band devices market is witnessing trends such as increased adoption of adjustable gastric bands and the rising influence of telemedicine in patient management. Moreover, there is a shift towards outpatient surgeries, promoting patient convenience and better post-operative care.