Gastrointestinal Endoscopy Devices Market Report

Published Date: 31 January 2026 | Report Code: gastrointestinal-endoscopy-devices

Gastrointestinal Endoscopy Devices Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Gastrointestinal Endoscopy Devices market covering key insights, market dynamics, and comprehensive data for 2023-2033. It evaluates market size, growth trends, regional analysis, and future forecasts.

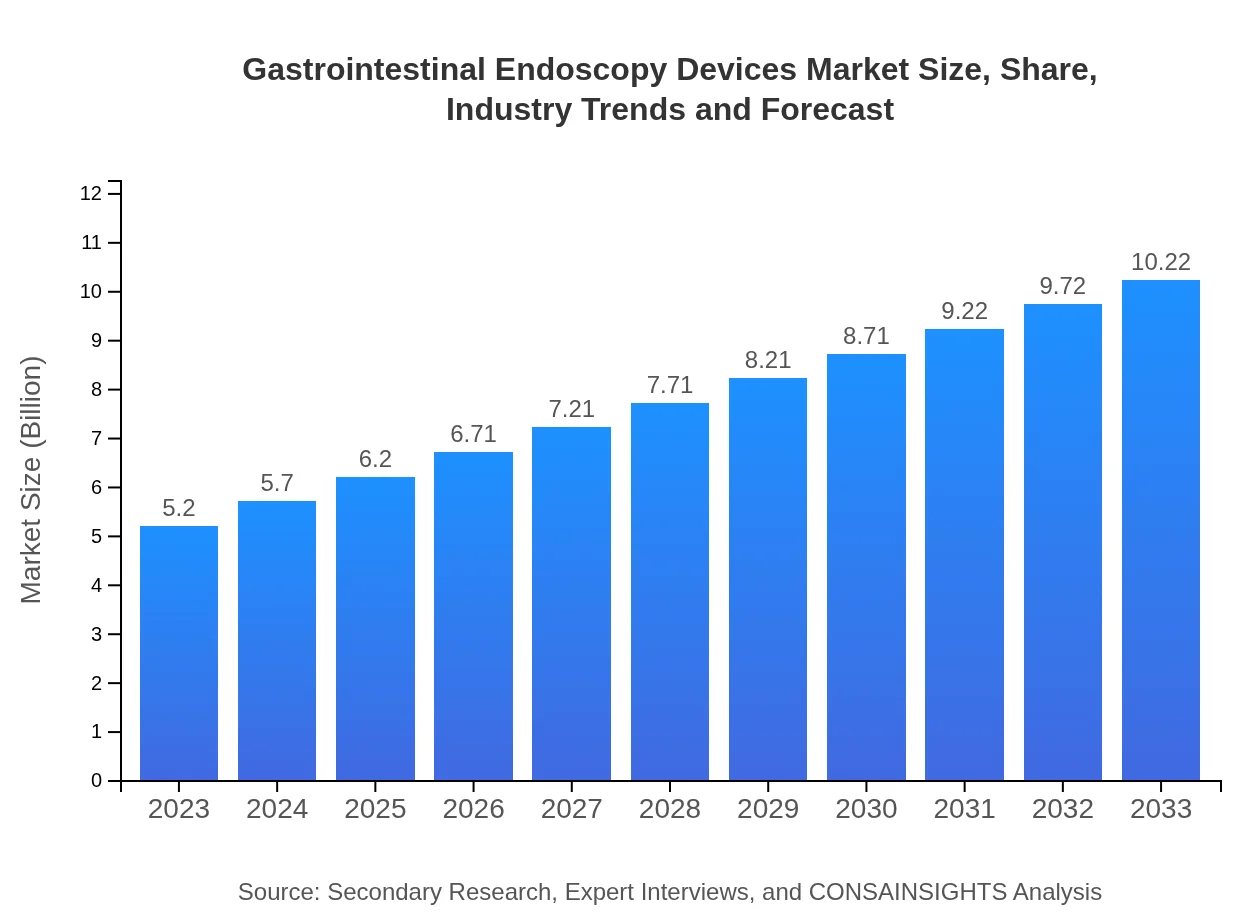

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.20 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $10.22 Billion |

| Top Companies | Olympus Corporation, Fujifilm Holdings Corporation, Boston Scientific Corporation, Medtronic plc |

| Last Modified Date | 31 January 2026 |

Gastrointestinal Endoscopy Devices Market Overview

Customize Gastrointestinal Endoscopy Devices Market Report market research report

- ✔ Get in-depth analysis of Gastrointestinal Endoscopy Devices market size, growth, and forecasts.

- ✔ Understand Gastrointestinal Endoscopy Devices's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Gastrointestinal Endoscopy Devices

What is the Market Size & CAGR of Gastrointestinal Endoscopy Devices market in 2023?

Gastrointestinal Endoscopy Devices Industry Analysis

Gastrointestinal Endoscopy Devices Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Gastrointestinal Endoscopy Devices Market Analysis Report by Region

Europe Gastrointestinal Endoscopy Devices Market Report:

The European market will see growth from USD 1.29 billion in 2023 to USD 2.54 billion in 2033. Increasing investments in healthcare technology, supportive regulations, and the rising number of endoscopic procedures are significant contributors.Asia Pacific Gastrointestinal Endoscopy Devices Market Report:

The Asia Pacific region exhibits tremendous growth potential for the gastrointestinal endoscopy devices market, expected to grow from USD 1.12 billion in 2023 to USD 2.20 billion by 2033. Factors driving this growth include increasing healthcare expenditures, advancements in medical technology, and rising incidences of gastrointestinal diseases.North America Gastrointestinal Endoscopy Devices Market Report:

North America dominates the gastrointestinal endoscopy devices market, with a significant increase from USD 1.76 billion in 2023 to USD 3.46 billion by 2033. This growth is driven by high prevalence rates of GI disorders, a well-established healthcare system, and technological advancements.South America Gastrointestinal Endoscopy Devices Market Report:

The South American market is projected to double from USD 0.38 billion in 2023 to USD 0.76 billion in 2033. Improved healthcare infrastructure and rising health awareness are pivotal in propelling market growth in this region.Middle East & Africa Gastrointestinal Endoscopy Devices Market Report:

The market for gastrointestinal endoscopy devices in the Middle East and Africa is expected to increase from USD 0.65 billion in 2023 to USD 1.27 billion by 2033, driven by improving healthcare facilities, increased awareness, and government initiatives to enhance medical standards.Tell us your focus area and get a customized research report.

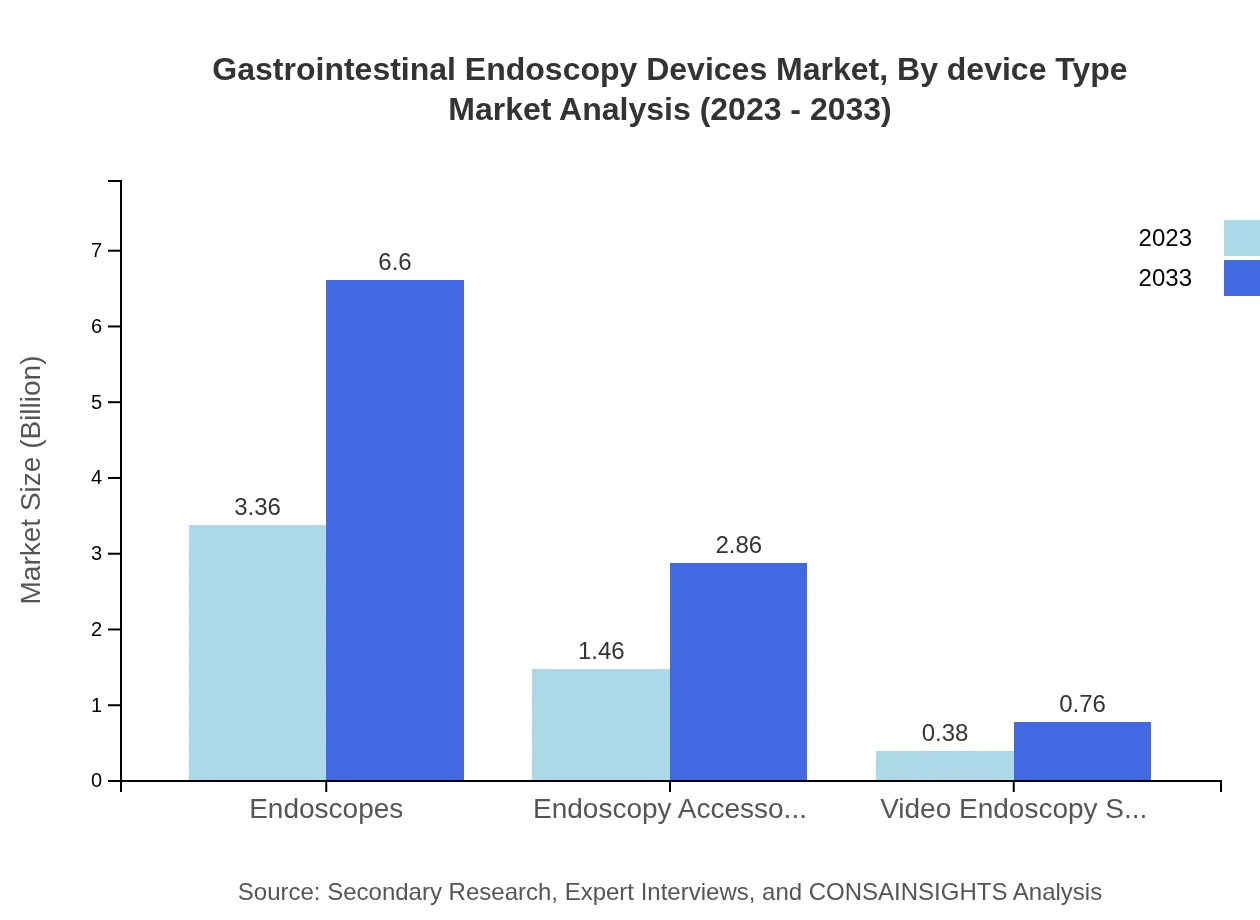

Gastrointestinal Endoscopy Devices Market Analysis By Device Type

By device type, endoscopes hold the largest market share at 64.6%, projected to grow from USD 3.36 billion in 2023 to USD 6.60 billion in 2033. Endoscopy accessories follow, making up 28% of the market with substantial growth expected. Video endoscopy systems represent the smallest share (7.4%), valued at USD 0.38 billion in 2023 and projected to double by 2033.

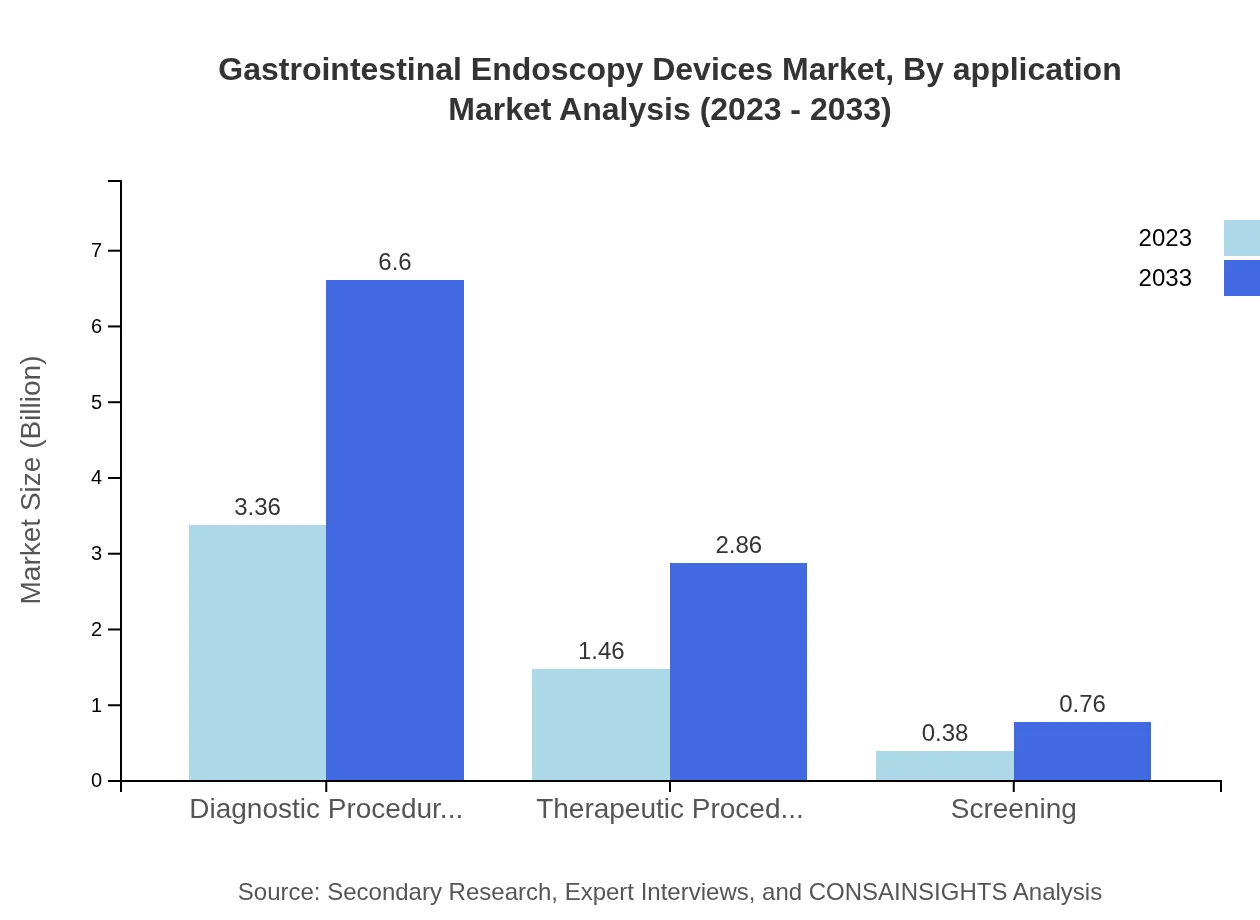

Gastrointestinal Endoscopy Devices Market Analysis By Application

In the application segment, diagnostic procedures dominate the market with a 64.6% share, forecasted to grow from USD 3.36 billion to USD 6.60 billion by 2033. Therapeutic procedures account for 28% of the market, experiencing similar growth, while screening applications also contribute with 7.4% share and expected to grow steadily.

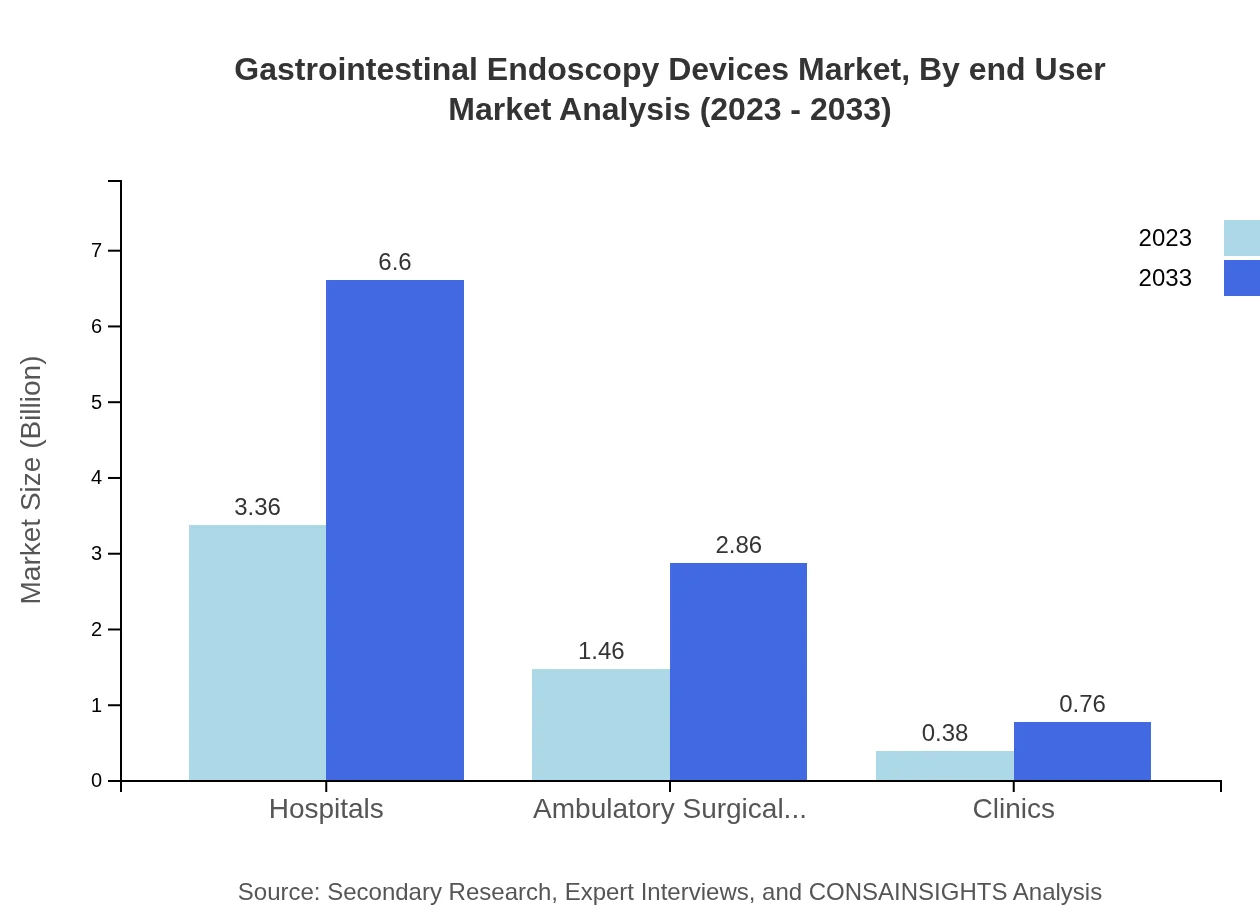

Gastrointestinal Endoscopy Devices Market Analysis By End User

Hospitals represent the largest end-user segment, holding a significant market size of USD 3.36 billion in 2023, expected to reach USD 6.60 billion by 2033. Ambulatory surgical centers and clinics also form important segments, with respective market sizes of USD 1.46 billion and USD 0.38 billion in 2023.

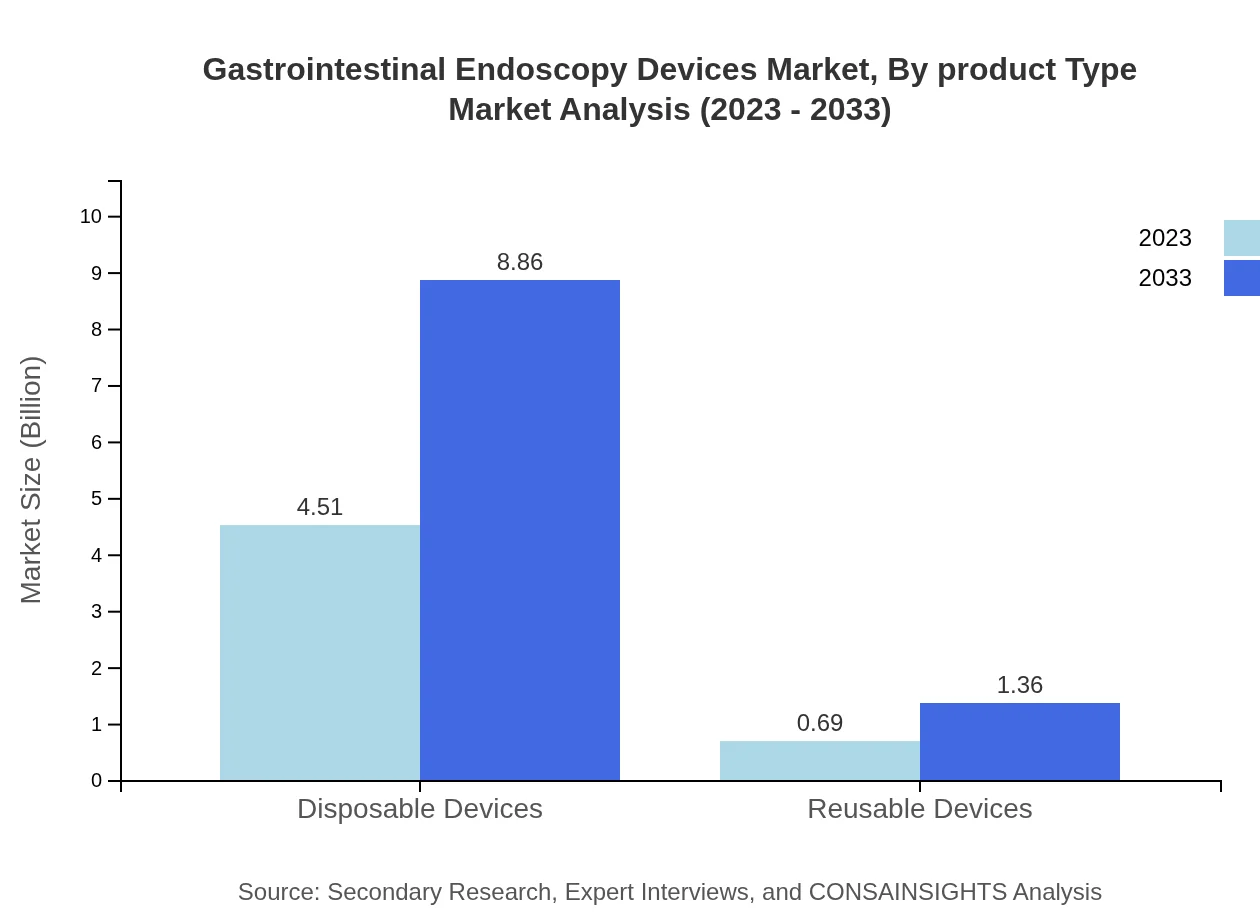

Gastrointestinal Endoscopy Devices Market Analysis By Product Type

The product type segment reveals that disposable devices account for an impressive 86.68% market share, growing from USD 4.51 billion to USD 8.86 billion by 2033. Reusable devices play a smaller role, holding 13.32% of the market, but are not expected to grow as rapidly.

Gastrointestinal Endoscopy Devices Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Gastrointestinal Endoscopy Devices Industry

Olympus Corporation:

A leading manufacturer specializing in medical instruments for flexible endoscopy, and known for its innovative technological advancements.Fujifilm Holdings Corporation:

Innovates in imaging technology, providing high-quality endoscopic devices and focusing on patient safety and efficacy.Boston Scientific Corporation:

Provides a broad range of innovative solutions in the field of gastrointestinal endoscopy, focusing on enhancing patient care through advanced endoscopic techniques.Medtronic plc:

A global leader in medical technology, specializes in endoscopic surgeries, continuously innovating its product portfolio.We're grateful to work with incredible clients.

FAQs

What is the market size of gastrointestinal endoscopy devices?

The gastrointestinal endoscopy devices market is projected to reach approximately $5.2 billion by 2033, with a CAGR of 6.8% from 2023. This growth reflects increased demand for minimally invasive procedures globally.

What are the key market players or companies in this gastrointestinal endoscopy devices industry?

Key players in the gastrointestinal endoscopy devices market include leading medical technology companies, specialized manufacturers, and innovative startups that are continuously developing advanced devices to enhance diagnostic and therapeutic capabilities.

What are the primary factors driving the growth in the gastrointestinal endoscopy devices industry?

Several factors drive growth in the gastrointestinal endoscopy devices market, including the rising prevalence of gastrointestinal disorders, advancements in endoscopic technology, and increasing awareness about early diagnosis and treatment options among patients.

Which region is the fastest Growing in the gastrointestinal endoscopy devices market?

The fastest-growing region for gastrointestinal endoscopy devices is Europe, projected to increase from $1.29 billion in 2023 to $2.54 billion by 2033, reflecting a significant growth trajectory amid rising healthcare investments and technological advancements.

Does ConsaInsights provide customized market report data for the gastrointestinal endoscopy devices industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs, providing comprehensive insights and analyses on various segments and geographical trends within the gastrointestinal endoscopy devices industry.

What deliverables can I expect from this gastrointestinal endoscopy devices market research project?

Deliverables from the gastrointestinal endoscopy devices market research project typically include detailed market analysis reports, segmented data by region and type, forecasts, competitive landscape assessments, and strategic recommendations for stakeholders.

What are the market trends of gastrointestinal endoscopy devices?

Key market trends include a shift towards minimally invasive procedures, increasing adoption of disposable devices, technological advancements in endoscopy equipment, and growing emphasis on patient-centered healthcare solutions in gastrointestinal diagnostics and treatments.