Gcc Aircraft Mro Market Report

Published Date: 03 February 2026 | Report Code: gcc-aircraft-mro

Gcc Aircraft Mro Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the Gcc Aircraft Maintenance, Repair, and Overhaul (MRO) market, covering forecast data from 2023 to 2033, market trends, regional analysis, segmentation, and a deep dive into leading industry players.

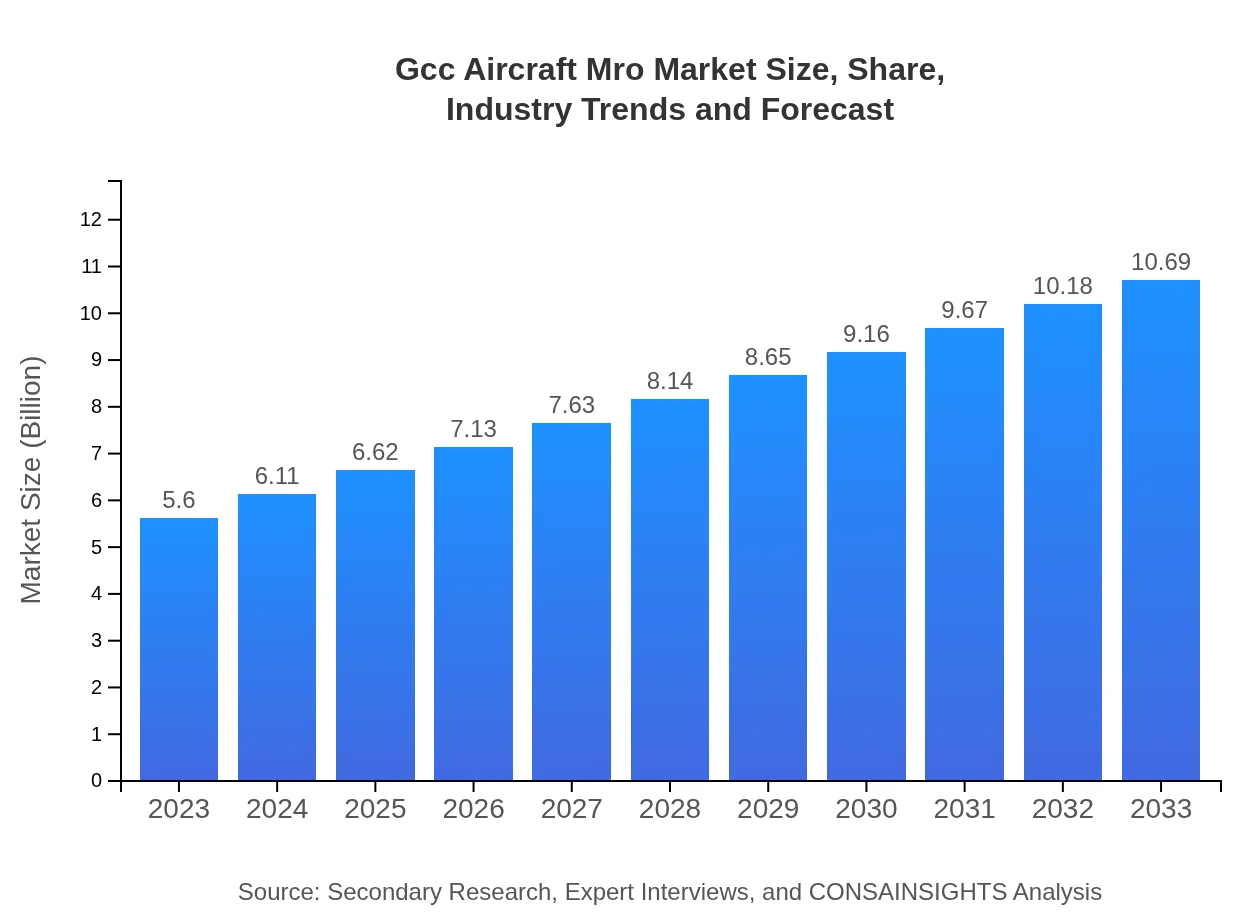

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 6.5% |

| 2033 Market Size | $10.69 Billion |

| Top Companies | Etihad Airways Engineering, Saudi Arabian Airlines, Gulf Air, Airbus Services, Boeing Global Services |

| Last Modified Date | 03 February 2026 |

Gcc Aircraft Mro Market Overview

Customize Gcc Aircraft Mro Market Report market research report

- ✔ Get in-depth analysis of Gcc Aircraft Mro market size, growth, and forecasts.

- ✔ Understand Gcc Aircraft Mro's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Gcc Aircraft Mro

What is the Market Size & CAGR of Gcc Aircraft Mro market in 2023?

Gcc Aircraft Mro Industry Analysis

Gcc Aircraft Mro Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Gcc Aircraft Mro Market Analysis Report by Region

Europe Gcc Aircraft Mro Market Report:

The European MRO market size is estimated to grow from $1.72 billion in 2023 to $3.27 billion by 2033, emphasized by stringent safety regulations and a mature aviation market that demands high-level MRO services.Asia Pacific Gcc Aircraft Mro Market Report:

In the Asia Pacific region, the Gcc Aircraft MRO market is projected to grow from $0.99 billion in 2023 to $1.89 billion by 2033. Factors driving this growth include increasing air passenger traffic and regional aircraft fleet expansions.North America Gcc Aircraft Mro Market Report:

North America's market is substantial, projected to escalate from $2.10 billion in 2023 to $4.01 billion by 2033. This growth is propelled by robust regulatory standards and a large fleet of aging aircraft necessitating extensive maintenance services.South America Gcc Aircraft Mro Market Report:

The South American market is expected to grow from $0.55 billion in 2023 to $1.05 billion by 2033, with a focus on improving air transport infrastructure and increased connectivity leading to a surge in demand for MRO services.Middle East & Africa Gcc Aircraft Mro Market Report:

The Middle East and Africa market is anticipated to increase from $0.24 billion in 2023 to $0.46 billion by 2033, driven by the expansion of the Middle Eastern airlines and the Gulf region's strategic positioning as a global aviation hub.Tell us your focus area and get a customized research report.

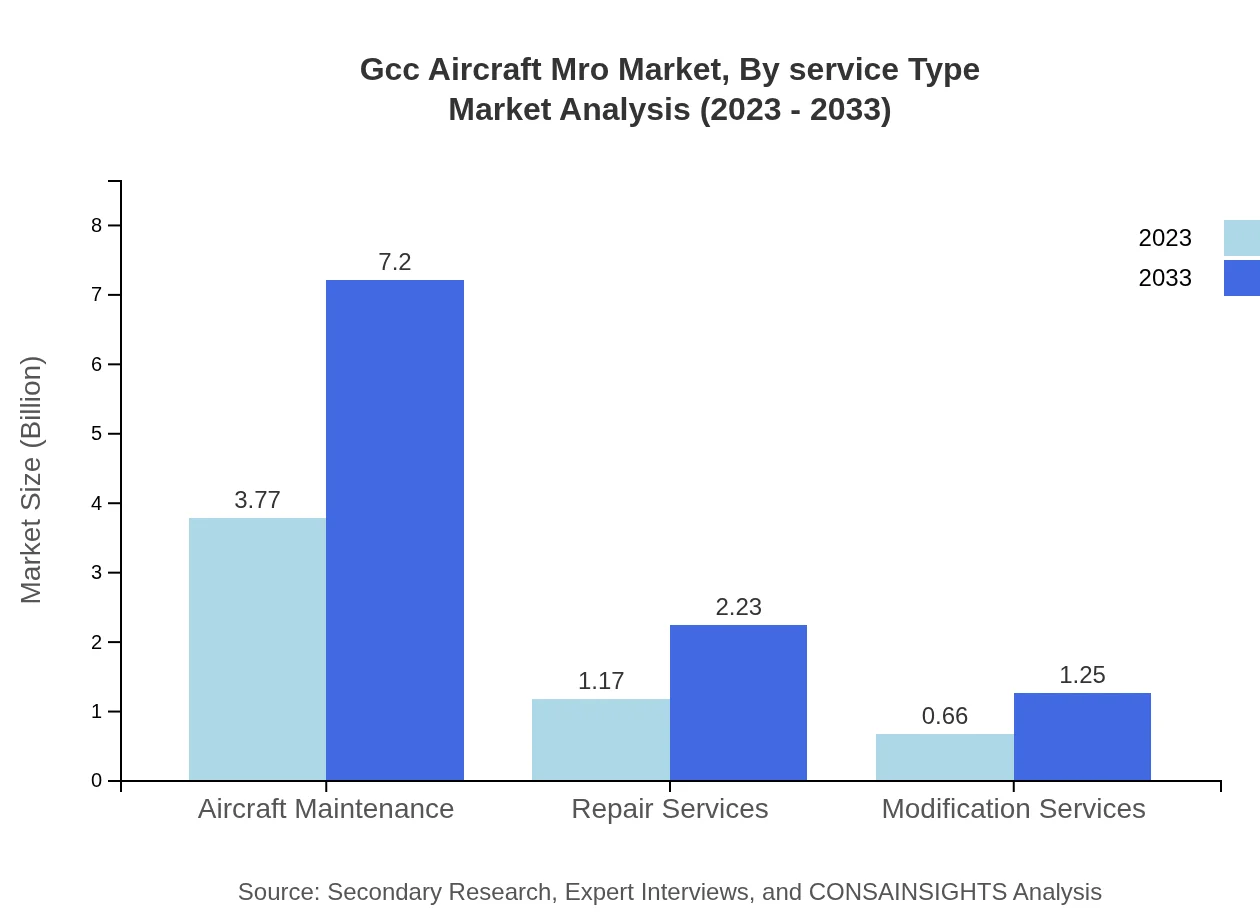

Gcc Aircraft Mro Market Analysis By Service Type

The market is dominated by Traditional MRO Technology, accounting for $4.59 billion in 2023 and expected to grow to $8.75 billion by 2033. Advanced MRO Technology currently stands at $1.01 billion in 2023, with projections to reach $1.93 billion. Aircraft Maintenance comprises $3.77 billion in 2023, while Repair and Modification Services are valued at $1.17 billion and $0.66 billion, respectively. These segments are essential in addressing diverse maintenance needs and embodying the market's adaptability.

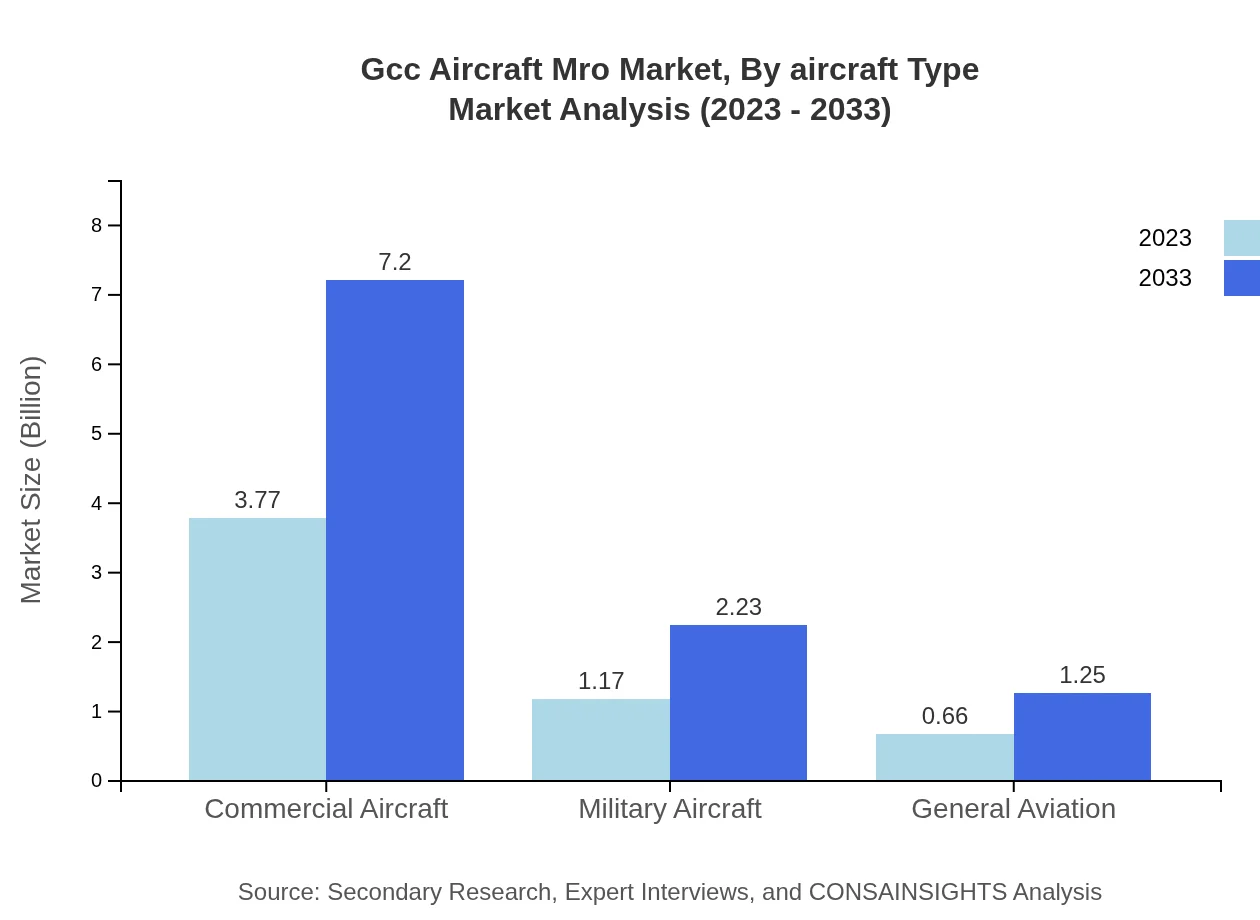

Gcc Aircraft Mro Market Analysis By Aircraft Type

Commercial Aircraft lead the segment, constituting $3.77 billion in 2023, likely to rise to $7.20 billion by 2033. Military Aircraft follow with $1.17 billion, anticipated to grow to $2.23 billion, while General Aviation, currently valued at $0.66 billion, is expected to reach $1.25 billion. This segmentation reflects the varied maintenance requirements driven by different operational contexts.

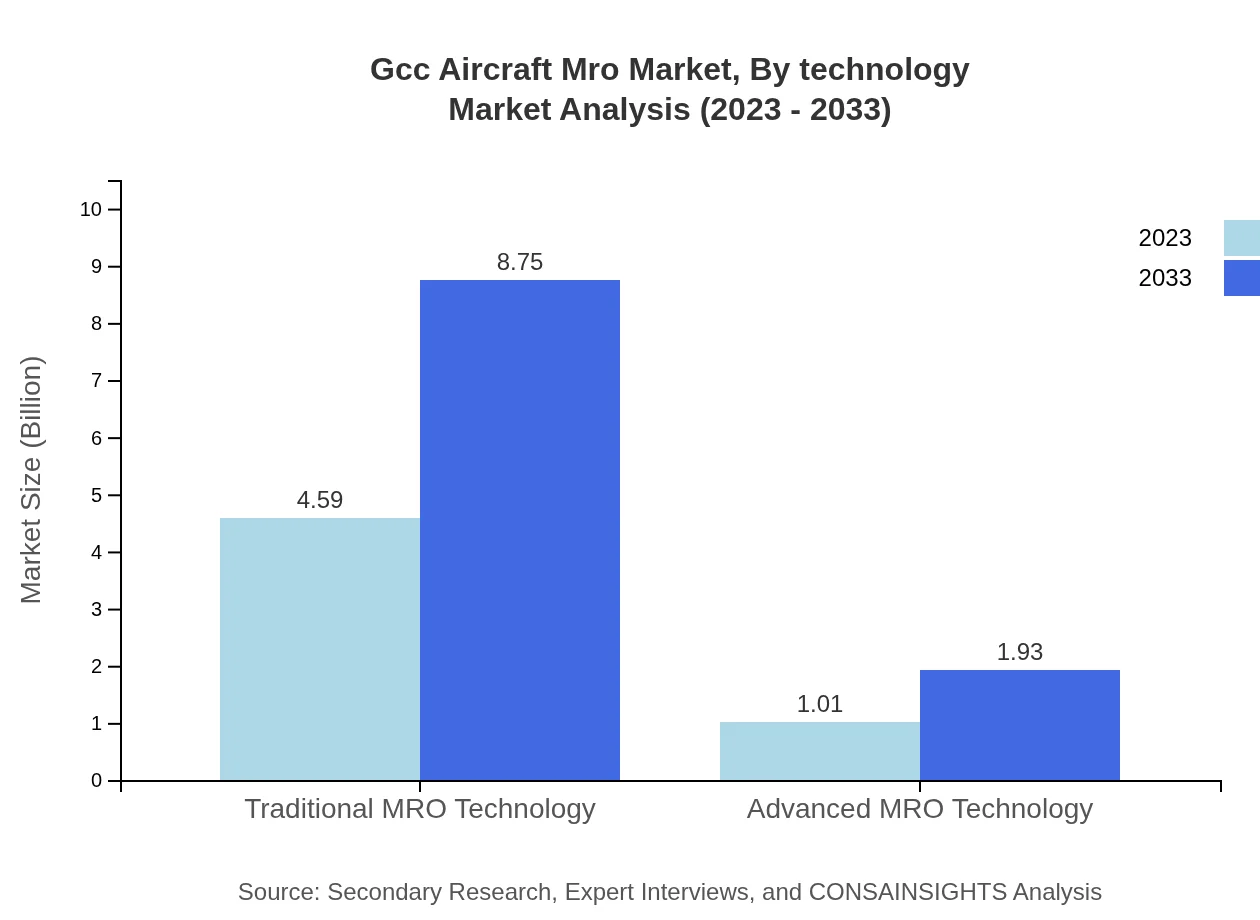

Gcc Aircraft Mro Market Analysis By Technology

The market is currently dominated by conventional methods labeled under Traditional MRO Technology, representing 81.9% share as of 2023 and projected to remain the same in 2033. In contrast, Advanced MRO Technology takes an 18.1% share, and both segments are essential in the evolution of operational practices towards higher efficiencies and enhanced safety standards.

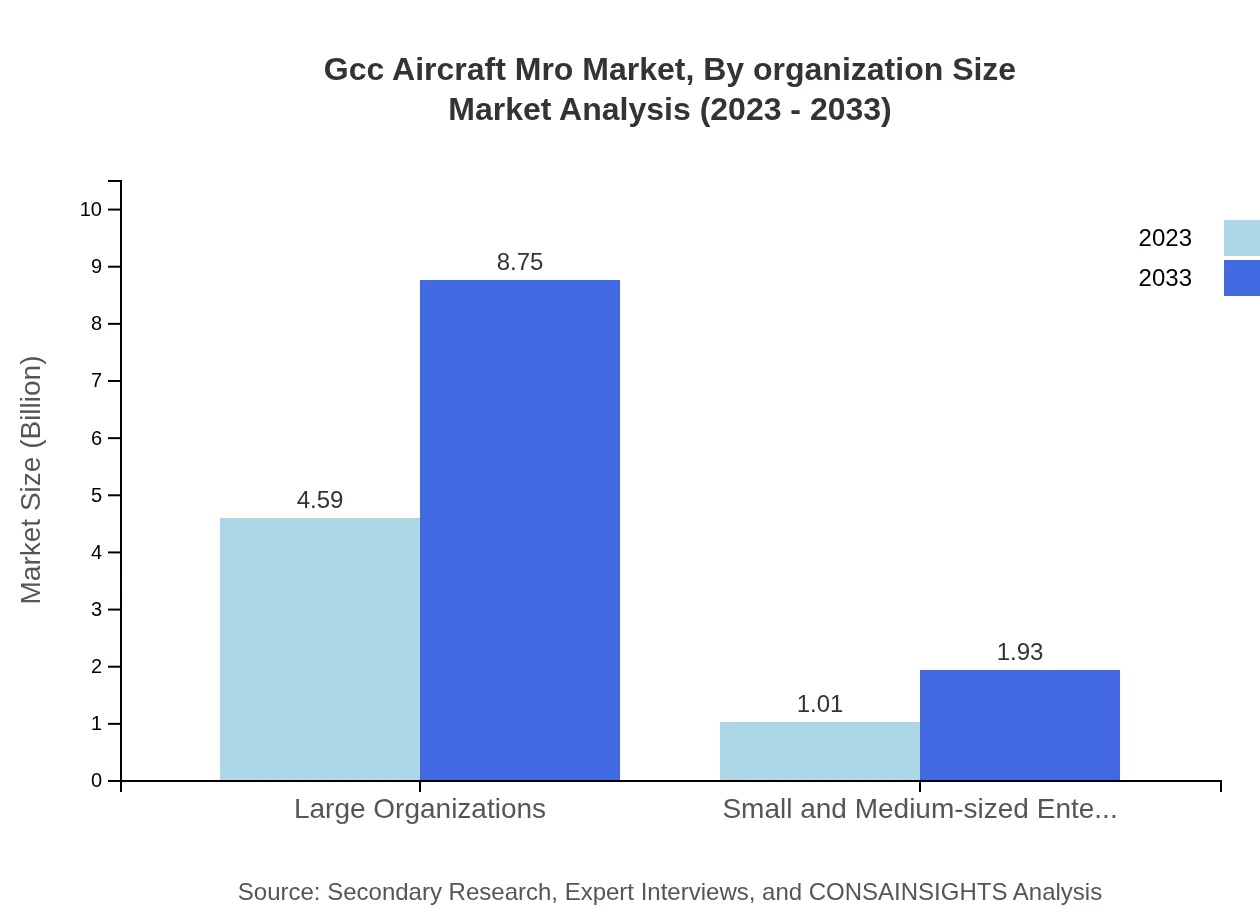

Gcc Aircraft Mro Market Analysis By Organization Size

Large Organizations dominate, capturing an 81.9% market share and valued at $4.59 billion in 2023, expected to increase to $8.75 billion. Small and Medium-sized Enterprises comprise 18.1% of the market, starting at $1.01 billion and projected to become $1.93 billion, reflecting a growing diversity in the MRO landscape.

Gcc Aircraft Mro Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Gcc Aircraft Mro Industry

Etihad Airways Engineering:

A key player in the MRO sector within the region, renowned for its comprehensive maintenance services tailored for commercial and private aircraft.Saudi Arabian Airlines:

The airline's MRO division provides extensive repair and overhaul services, notably supporting domestic and international fleet maintenance.Gulf Air:

Offers high-quality MRO services, specializing in aircraft modification and upgrades to enhance safety and compliance with modern standards.Airbus Services:

With vast expertise, Airbus provides MRO solutions that span several regions, focusing on technological advancements and efficient service delivery.Boeing Global Services:

Known for its innovative service solutions, Boeing caters to various sectors within the aircraft maintenance landscape.We're grateful to work with incredible clients.

FAQs

What is the market size of GCC Aircraft MRO?

The GCC Aircraft MRO market is currently valued at approximately $5.6 billion in 2023, with a significant growth forecast, expecting a CAGR of 6.5% through 2033.

What are the key market players or companies in this GCC Aircraft MRO industry?

The GCC Aircraft MRO industry is led by key players including Airbus, Boeing, Lockheed Martin, and major regional companies that specialize in aircraft maintenance, repair, and overhaul services.

What are the primary factors driving growth in the GCC Aircraft MRO industry?

Key drivers for growth in the GCC Aircraft MRO industry include increasing air travel demand, expansion of aircraft fleets, advancements in MRO technologies, and stringent regulatory requirements for aircraft maintenance.

Which region is the fastest Growing in the GCC Aircraft MRO?

The Asia-Pacific region is emerging as the fastest-growing area in the GCC Aircraft MRO market, with projected growth from $0.99 billion in 2023 to $1.89 billion by 2033, fueled by rising aviation activities.

Does ConsaInsights provide customized market report data for the GCC Aircraft MRO industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients within the GCC Aircraft MRO industry, ensuring relevant insights and actionable recommendations.

What deliverables can I expect from this GCC Aircraft MRO market research project?

Deliverables from the GCC Aircraft MRO market research project include comprehensive reports, market forecasts, competitive analysis, and data segmentation covering key trends and growth opportunities.

What are the market trends of GCC Aircraft MRO?

Current market trends in GCC Aircraft MRO include the adoption of advanced maintenance technologies, increased focus on sustainability, and a notable shift towards outsourcing MRO services among airlines.