General Aviation Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the General Aviation market, providing comprehensive insights and data on current trends, future forecasts, and competitive landscape from 2023 to 2033.

| Metric | Value |

|---|---|

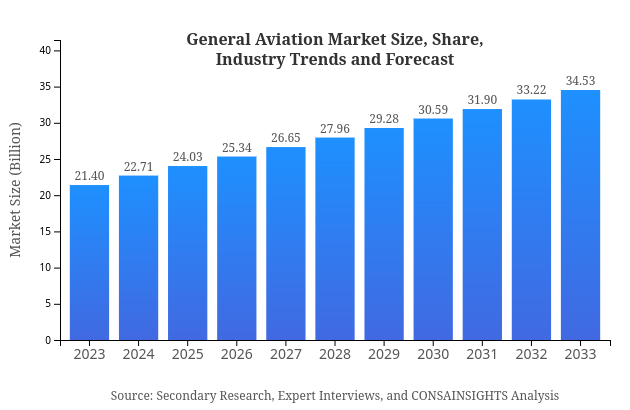

| Study Period | 2023 - 2033 |

| 2023 Market Size | $21.40 Billion |

| CAGR (2023-2033) | 4.8% |

| 2033 Market Size | $34.53 Billion |

| Top Companies | Textron Aviation, Bombardier, Gulfstream Aerospace, Piper Aircraft |

| Last Modified Date | 27 February 2025 |

General Aviation Market Overview

What is the Market Size & CAGR of General Aviation market in 2033?

General Aviation Industry Analysis

General Aviation Market Segmentation and Scope

Request a custom research report for industry.

General Aviation Market Analysis Report by Region

Europe General Aviation Market Report:

The General Aviation market in Europe is projected to expand from $6.76 billion in 2023 to $10.91 billion by 2033, driven by advanced aviation technology, stringent safety regulations, and growing demand for private travel solutions amid increasing wealth across various demographics.Asia Pacific General Aviation Market Report:

The Asia-Pacific General Aviation market is essential, projected to rise from $4.06 billion in 2023 to $6.55 billion in 2033, spurred by soaring demand for business aviation, flight training, and MRO services. Increasingwealth in countries like China and India is creating opportunities for market growth.North America General Aviation Market Report:

North America continues to dominate the General Aviation market, expected to grow from $7.38 billion in 2023 to around $11.91 billion by 2033. The robust presence of major manufacturers and a stable regulatory environment create a favorable landscape for growth, while demand for business jets and MRO services remains strong.South America General Aviation Market Report:

In South America, the General Aviation market is expected to grow from $1.93 billion in 2023 to $3.12 billion by 2033. Economic growth and investments in aviation infrastructure are key drivers, alongside the increasing usage of aircraft for agribusiness and medical services.Middle East & Africa General Aviation Market Report:

In the Middle East and Africa, the markets for General Aviation are on the rise, growing from $1.27 billion in 2023 to approximately $2.04 billion in 2033. Increasing investments in infrastructure, rising oil revenues, and demand for luxury travel contribute to this growth.Request a custom research report for industry.

General Aviation Market Analysis By Aircraft Type

Global General Aviation Market, By Aircraft Type Analysis (2024 - 2033)

Within the aircraft type segment, the fixed-wing aircraft market is the largest, anticipated to reach $21.71 billion by 2033, reflecting a significant share of 62.88% in the overall market. Rotorcraft and drones also show promising growth rates, backed by increasing demand for versatile and efficient aircraft in various operational realms.

General Aviation Market Analysis By Application

Global General Aviation Market, By Application Analysis (2024 - 2033)

Applications such as charter services and business aviation largely drive growth in the General Aviation market, with business aviation expected to reach a market size of $14.69 billion by 2033, commanding a 42.53% share. MRO and flight training services are also integral components, with MRO projected to dominate with $21.71 billion by 2033.

General Aviation Market Analysis By Distribution Channel

Global General Aviation Market, By Distribution Channel Analysis (2024 - 2033)

Sales channels are evolving, with direct sales remaining the most prevalent and expected to grow from $18.56 billion in 2023 to $29.94 billion by 2033. While online sales remain a smaller segment, they are projected to increase steadily as digitalization alters purchasing behaviors.

General Aviation Market Analysis By Service

Global General Aviation Market, By Service Analysis (2024 - 2033)

Services such as flight training and medical evacuation are vital, with flight training representing a $5.35 billion market in 2023, anticipated to grow to $8.63 billion by 2033. The MRO segment is the largest service type with a market size of $13.46 billion in 2023 and a projected size of $21.71 billion by 2033.

General Aviation Market Analysis By Technology

Global General Aviation Market, By Technology Analysis (2024 - 2033)

Technological advancements are transforming the General Aviation landscape, especially in avionics where the market is projected to reach $29.94 billion by 2033. Innovative safety systems and approaches to eco-friendly technologies are gaining traction, impacting operational efficiency and pilot training programs.

General Aviation Market Trends and Future Forecast

Request a custom research report for industry.

Global Market Leaders and Top Companies in General Aviation Industry

Textron Aviation:

Textron Aviation, known for its Cessna and Beechcraft brands, leads in manufacturing business jets and propeller-driven aircraft, providing diverse aviation solutions and services.Bombardier:

Bombardier is a prominent aerospace manufacturer focusing on producing business jets and commercial aircraft, recognized globally for their innovative technologies and customer-centric approach.Gulfstream Aerospace:

Part of General Dynamics, Gulfstream specializes in designing and manufacturing high-performance business jets, catering to an affluent clientele.Piper Aircraft:

Piper Aircraft produces general aviation aircraft and is known for its innovation in pilot training and personal flying solutions.We're grateful to work with incredible clients.

Related Industries

FAQs

What is the market size of general Aviation?

The general aviation market is estimated to reach a size of approximately $21.4 billion by 2033, growing at a CAGR of 4.8%. This growth is driven by increasing demand in various aviation segments and services.

What are the key market players or companies in the general Aviation industry?

Key players in the general aviation industry include companies engaged in aircraft manufacturing, flight training, and services. Their innovations and market strategies significantly influence industry dynamics and growth.

What are the primary factors driving the growth in the general aviation industry?

Growth in the general aviation sector is fueled by rising individual wealth, increasing air travel demand, and advancements in technology. Additionally, government investments in aviation infrastructure are key drivers.

Which region is the fastest Growing in the general aviation market?

The North America region is the fastest-growing in the general aviation market, projected to expand from $7.38 billion in 2023 to $11.91 billion by 2033. Europe and Asia-Pacific are also seeing significant growth.

Does ConsInsights provide customized market report data for the general Aviation industry?

Yes, ConsInsights offers customized market report data tailored to specific client needs within the general aviation industry, providing insights that reflect individual business objectives.

What deliverables can I expect from this general Aviation market research project?

Expect comprehensive reports including market analysis, segmentation insights, competitive landscape details, and forecasts that enhance understanding of trends and opportunities in general aviation.

What are the market trends of general aviation?

Current trends in general aviation include a shift towards sustainable aviation, increased use of drones for various applications, and a rebound in private flying as leisure travel options expand.