Gcc Structural Steel Fabrication Market Report

Published Date: 22 January 2026 | Report Code: gcc-structural-steel-fabrication

Gcc Structural Steel Fabrication Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the GCC structural steel fabrication market from 2023 to 2033, covering market dynamics, size, growth trends, technology advancements, segmentation, and regional insights. The report aims to equip stakeholders with actionable insights for strategic decision-making.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

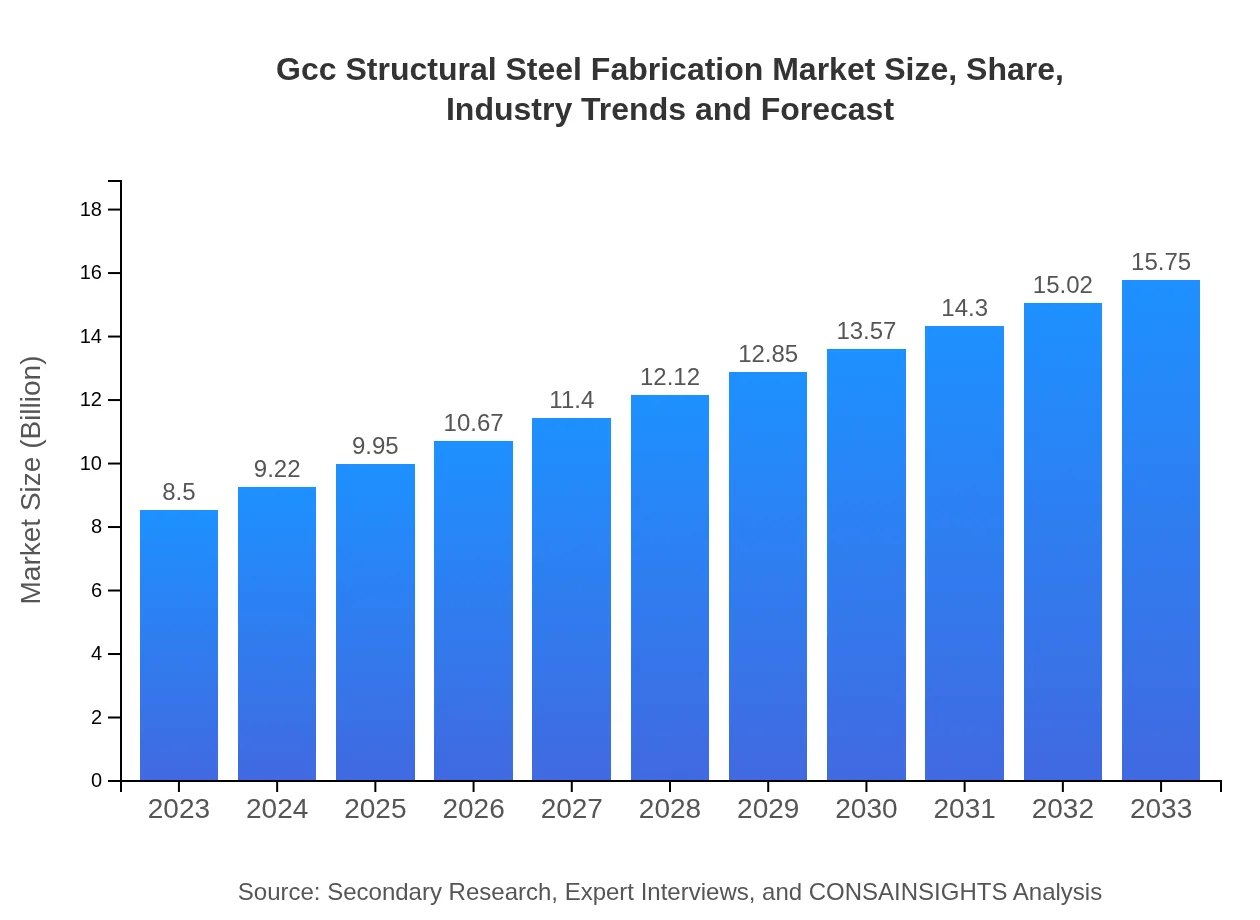

| 2023 Market Size | $8.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $15.75 Billion |

| Top Companies | Al Jazeera Steel Products Company, Arabian Metal Industries, EGA (Emirates Global Aluminium), Gulf Steel Works, Zamil Steel |

| Last Modified Date | 22 January 2026 |

GCC Structural Steel Fabrication Market Overview

Customize Gcc Structural Steel Fabrication Market Report market research report

- ✔ Get in-depth analysis of Gcc Structural Steel Fabrication market size, growth, and forecasts.

- ✔ Understand Gcc Structural Steel Fabrication's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Gcc Structural Steel Fabrication

What is the Market Size & CAGR of GCC Structural Steel Fabrication market in 2023?

GCC Structural Steel Fabrication Industry Analysis

GCC Structural Steel Fabrication Market Segmentation and Scope

Tell us your focus area and get a customized research report.

GCC Structural Steel Fabrication Market Analysis Report by Region

Europe Gcc Structural Steel Fabrication Market Report:

The European market for structural steel fabrication is projected to grow from USD 2.63 billion in 2023 to USD 4.87 billion by 2033, indicating a growing demand due to increased construction activities and a shift towards sustainable practices.Asia Pacific Gcc Structural Steel Fabrication Market Report:

The Asia Pacific region represents a growing market for GCC structural steel fabrication with a market size of USD 1.61 billion in 2023, expanding to USD 2.99 billion by 2033. This growth is supported by increasing construction activities and foreign investments in infrastructure projects.North America Gcc Structural Steel Fabrication Market Report:

North America shows a robust structural steel fabrication market valued at USD 2.98 billion in 2023, set to increase to USD 5.52 billion by 2033. The ongoing technological advancements and heavy investments in building projects, particularly in energy and infrastructure sectors, are key growth drivers.South America Gcc Structural Steel Fabrication Market Report:

In South America, the market for structural steel fabrication is smaller, with an estimated size of USD 0.68 billion in 2023, reaching USD 1.26 billion by 2033. The potential for growth is tied to the region's recovery in infrastructure development and public-private partnerships.Middle East & Africa Gcc Structural Steel Fabrication Market Report:

The Middle East and African markets are estimated at USD 0.59 billion in 2023 and expected to grow to USD 1.10 billion by 2033. The growth is primarily fuelled by infrastructural development, especially in the construction and energy sectors.Tell us your focus area and get a customized research report.

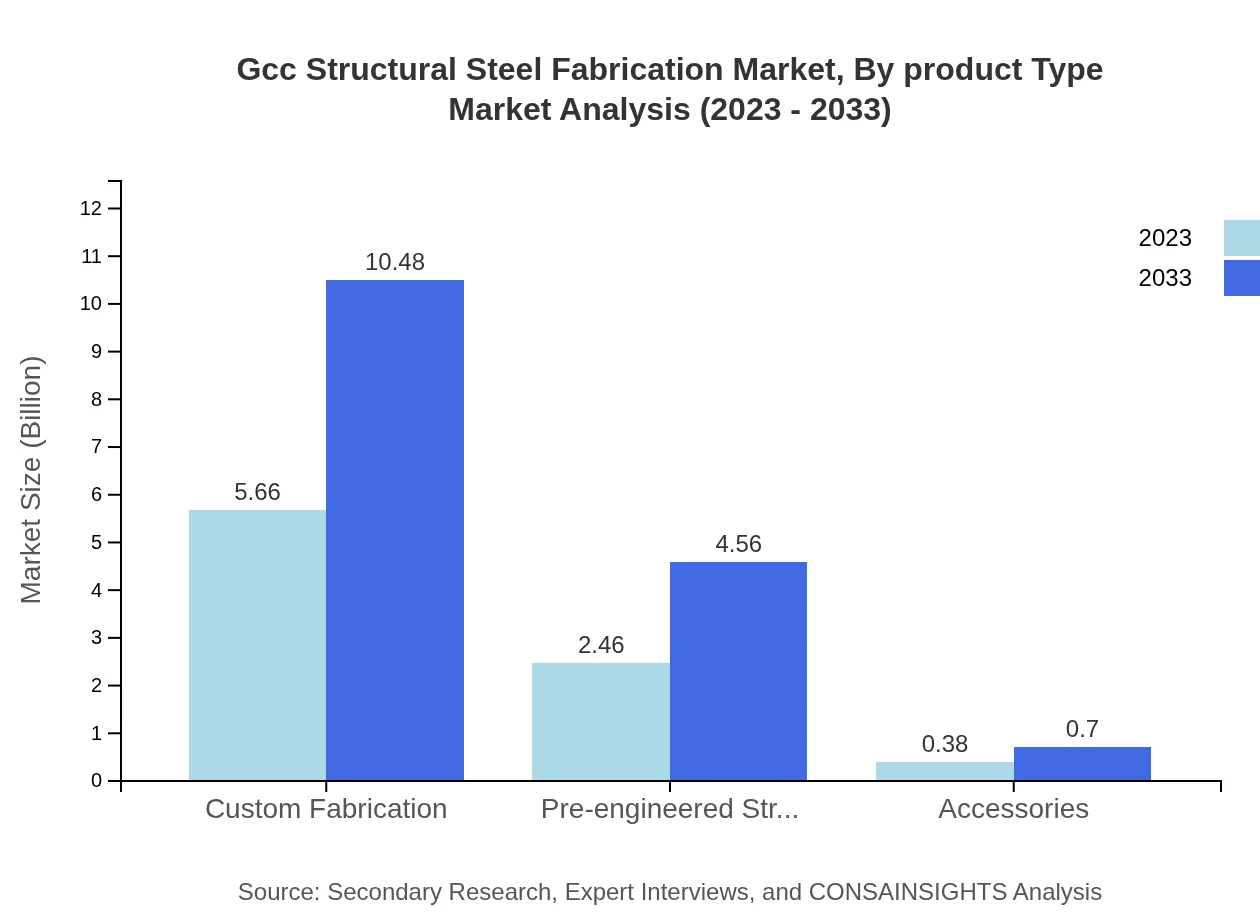

Gcc Structural Steel Fabrication Market Analysis By Product Type

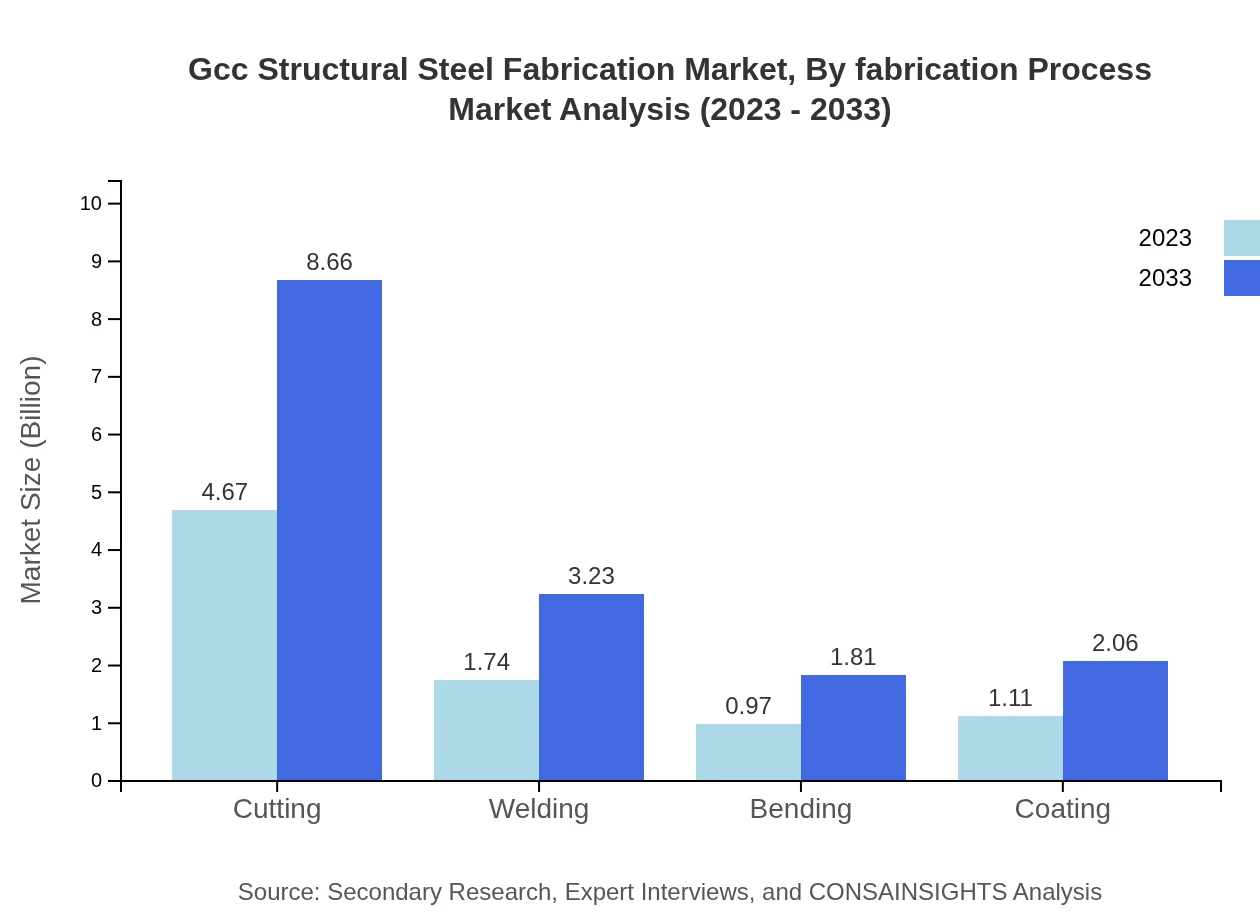

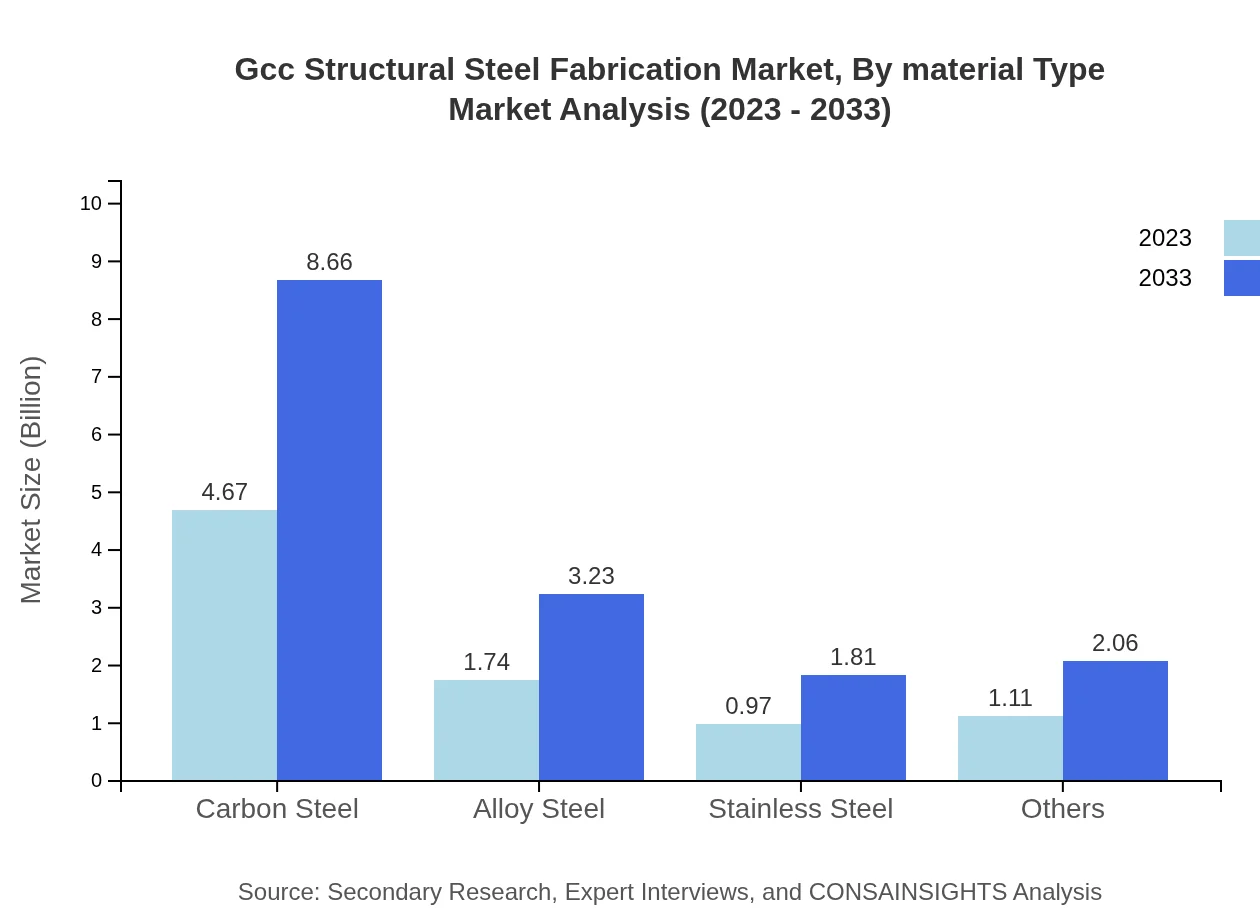

In 2023, the market for various product types is broken down into carbon steel, alloy steel, and stainless steel. The carbon steel segment dominates, worth approximately USD 4.67 billion, while alloy steel stands at USD 1.74 billion and stainless steel at USD 0.97 billion. By 2033, we expect carbon steel to reach USD 8.66 billion, with alloy steel growing to USD 3.23 billion and stainless steel to USD 1.81 billion.

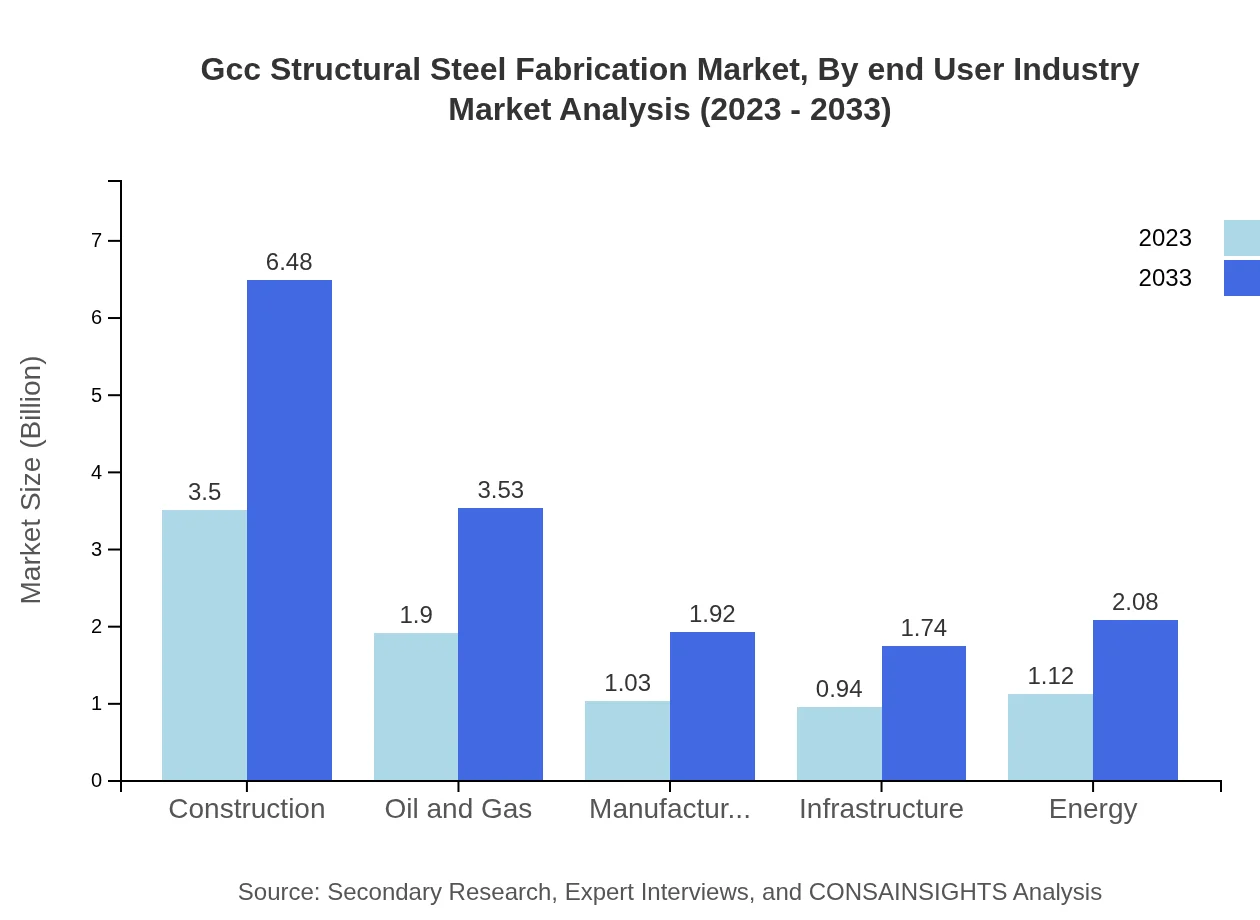

Gcc Structural Steel Fabrication Market Analysis By End User Industry

The major end-user industries include construction, oil and gas, manufacturing, infrastructure, and energy. In 2023, construction leads with a market share of 41.12% valued at USD 3.50 billion, followed by oil and gas at USD 1.90 billion (22.41% share). By 2033, construction is projected at USD 6.48 billion, with oil and gas reaching USD 3.53 billion.

Gcc Structural Steel Fabrication Market Analysis By Fabrication Process

The key fabrication processes include cutting, welding, bending, and coating. Cutting represents the largest segment with a market size of USD 4.67 billion in 2023. By 2033, it is expected to grow to USD 8.66 billion. Welding follows with USD 1.74 billion growing to USD 3.23 billion, while bending and coating segments also show promising growth.

Gcc Structural Steel Fabrication Market Analysis By Material Type

Carbon steel remains the predominant material type used in structural steel fabrication, holding a market share of 54.96% in 2023. As the demand for durable and robust structures increases, carbon steel is anticipated to maintain its lead. Other material types such as alloy and stainless steel serve niche applications, catering to specific industry requirements.

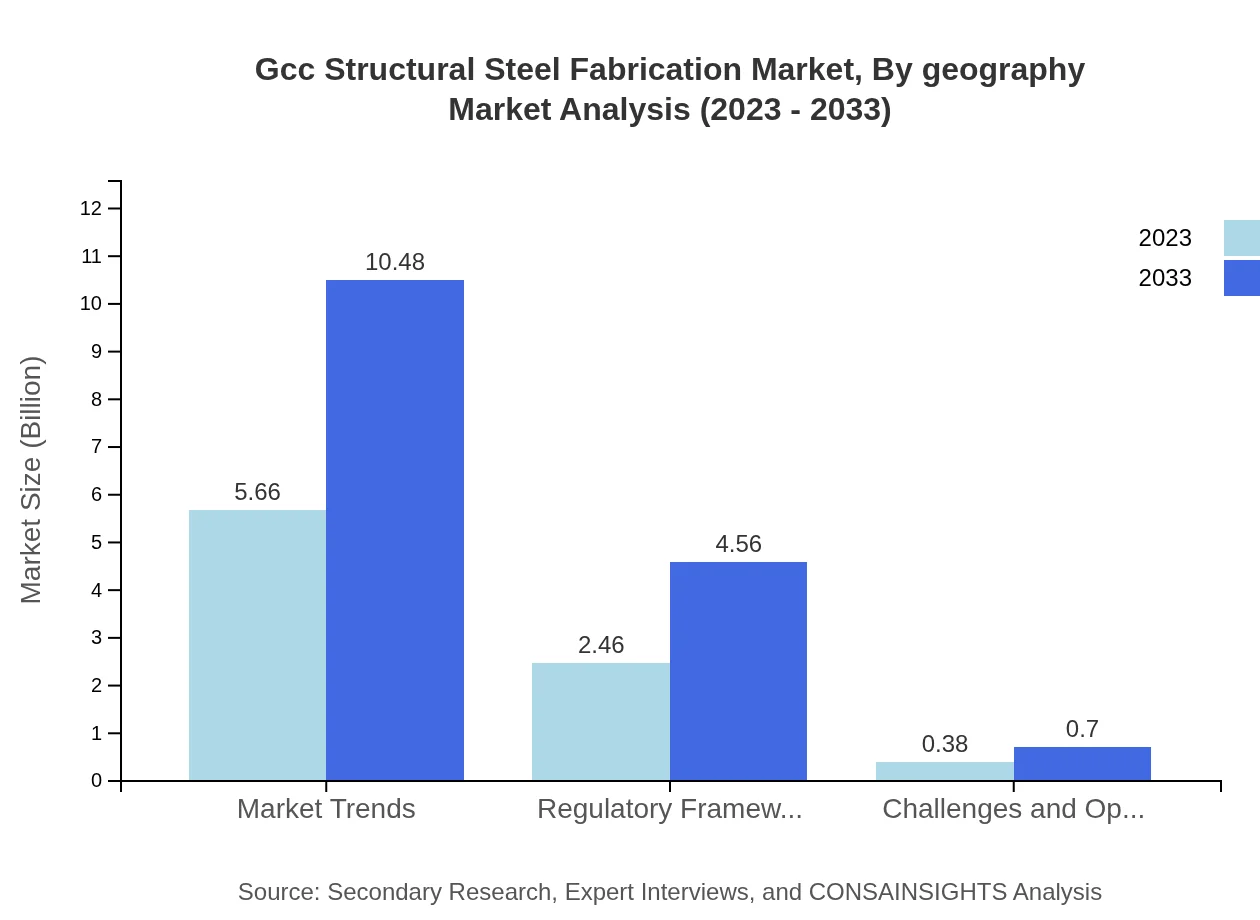

Gcc Structural Steel Fabrication Market Analysis By Geography

Geographically, the GCC region showcases diverse growth dynamics in structural steel fabrication. Each country has its key projects which influence market trends, with the UAE and Saudi Arabia being prominent due to their extensive investment in mega-infrastructure projects. This diversity necessitates localized strategies for market players.

GCC Structural Steel Fabrication Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in GCC Structural Steel Fabrication Industry

Al Jazeera Steel Products Company:

A major player in the GCC region specializing in the production of high-quality steel products. They focus on innovation and sustainability in manufacturing processes.Arabian Metal Industries:

Known for its exceptional fabrication capabilities, Arabian Metal Industries provides a range of structural steel services across various sectors, contributing significantly to local projects.EGA (Emirates Global Aluminium):

One of the world's largest aluminium producers with growing involvement in the fabrication industry, focusing on high-performance materials for construction.Gulf Steel Works:

This company is recognized for its advanced fabrication technologies and its commitment to meeting international standards in the steel fabrication sector.Zamil Steel:

A leading fabricator of pre-engineered steel buildings, actively engaging in sustainable and innovative practices within the fabrication industry.We're grateful to work with incredible clients.

FAQs

What is the market size of gcc Structural Steel Fabrication?

The GCC Structural Steel Fabrication market is projected to reach $8.5 billion by 2033, growing at a CAGR of 6.2%. This growth is attributed to rising construction activities and infrastructure projects in the region.

What are the key market players or companies in the gcc Structural Steel Fabrication industry?

Key players include major fabrication firms specializing in steel structures, such as Spantech, MABCO, and Al Mufeed. These companies lead the market by providing innovative solutions and maintaining quality standards within the GCC region.

What are the primary factors driving the growth in the gcc Structural Steel Fabrication industry?

The growth is primarily driven by increasing infrastructural development, urbanization, and substantial investments in the oil and gas sector, fostering demand for structural steel in construction and fabrication projects across the GCC.

Which region is the fastest Growing in the gcc Structural Steel Fabrication?

The fastest-growing region in the GCC Structural Steel Fabrication market is North America, projected to grow from $2.98 billion in 2023 to $5.52 billion by 2033, driven by booming construction projects and energy sector expansions.

Does ConsaInsights provide customized market report data for the gcc Structural Steel Fabrication industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the GCC structural steel fabrication industry, providing insights into market trends, segment analysis, and competitive landscapes.

What deliverables can I expect from this gcc Structural Steel Fabrication market research project?

Expected deliverables include comprehensive reports detailing market trends, segments, player analysis, growth forecasts, and regional insights, helping stakeholders make informed strategic decisions.

What are the market trends of gcc Structural Steel Fabrication?

Market trends indicate a growing demand for custom fabrication services and pre-engineered structures, reflecting shifts towards efficiency and sustainability in construction practices within the GCC region.