Gear Motors Market Report

Published Date: 22 January 2026 | Report Code: gear-motors

Gear Motors Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Gear Motors market, covering market size, growth forecast from 2023 to 2033, industry trends, regional insights, and competitive landscape. Detailed segments are analyzed to offer a well-rounded perspective for stakeholders and investors.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $9.50 Billion |

| CAGR (2023-2033) | 7.0% |

| 2033 Market Size | $19.04 Billion |

| Top Companies | Siemens AG, Danfoss, Nord Drivesystems |

| Last Modified Date | 22 January 2026 |

Gear Motors Market Overview

Customize Gear Motors Market Report market research report

- ✔ Get in-depth analysis of Gear Motors market size, growth, and forecasts.

- ✔ Understand Gear Motors's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Gear Motors

What is the Market Size & CAGR of the Gear Motors market in 2023?

Gear Motors Industry Analysis

Gear Motors Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Gear Motors Market Analysis Report by Region

Europe Gear Motors Market Report:

The European Gear Motors market is set to expand from $2.53 billion in 2023 to $5.07 billion by 2033. The region is emphasizing energy-efficient technologies and sustainable manufacturing practices, thus spurring market demand.Asia Pacific Gear Motors Market Report:

In the Asia Pacific region, the Gear Motors market is projected to grow from $1.82 billion in 2023 to $3.65 billion by 2033, driven by increased industrialization and government initiatives promoting automation. Countries like China and India are at the forefront, investing heavily in manufacturing and infrastructure.North America Gear Motors Market Report:

North America has a robust Gear Motors market, estimated at $3.21 billion in 2023, with a forecast to reach $6.44 billion by 2033. The region's growth is propelled by advancements in automation technology and a strong focus on research and development in various sectors including automotive and aerospace.South America Gear Motors Market Report:

South America is witnessing moderate growth in the Gear Motors market, expected to rise from $0.93 billion in 2023 to $1.87 billion by 2033. This growth is primarily due to an increasing focus on renewable energy projects and modernization of industrial processes.Middle East & Africa Gear Motors Market Report:

The Middle East and Africa market for Gear Motors is anticipated to grow from $1.00 billion in 2023 to $2.01 billion by 2033, driven by increasing investments in infrastructure and industrial automation initiatives across various sectors.Tell us your focus area and get a customized research report.

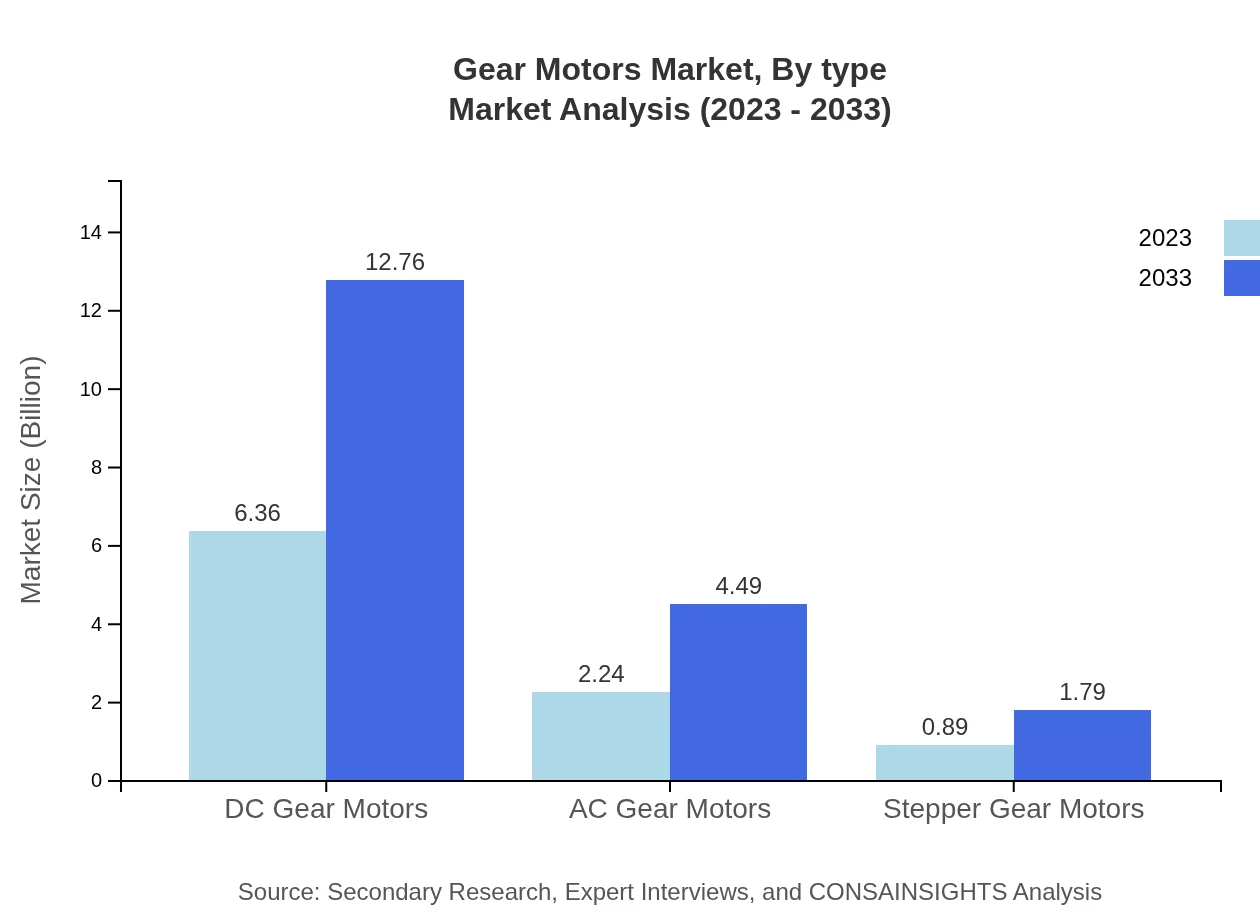

Gear Motors Market Analysis By Type

The Gear Motors market analysis by type reveals the dominance of DC Gear Motors, representing approximately 66.99% of the market share in 2023, projected to remain stable over the next decade. AC Gear Motors and Stepper Gear Motors follow, accounting for 23.59% and 9.42% respectively, each demonstrating steady growth due to evolving consumer demands.

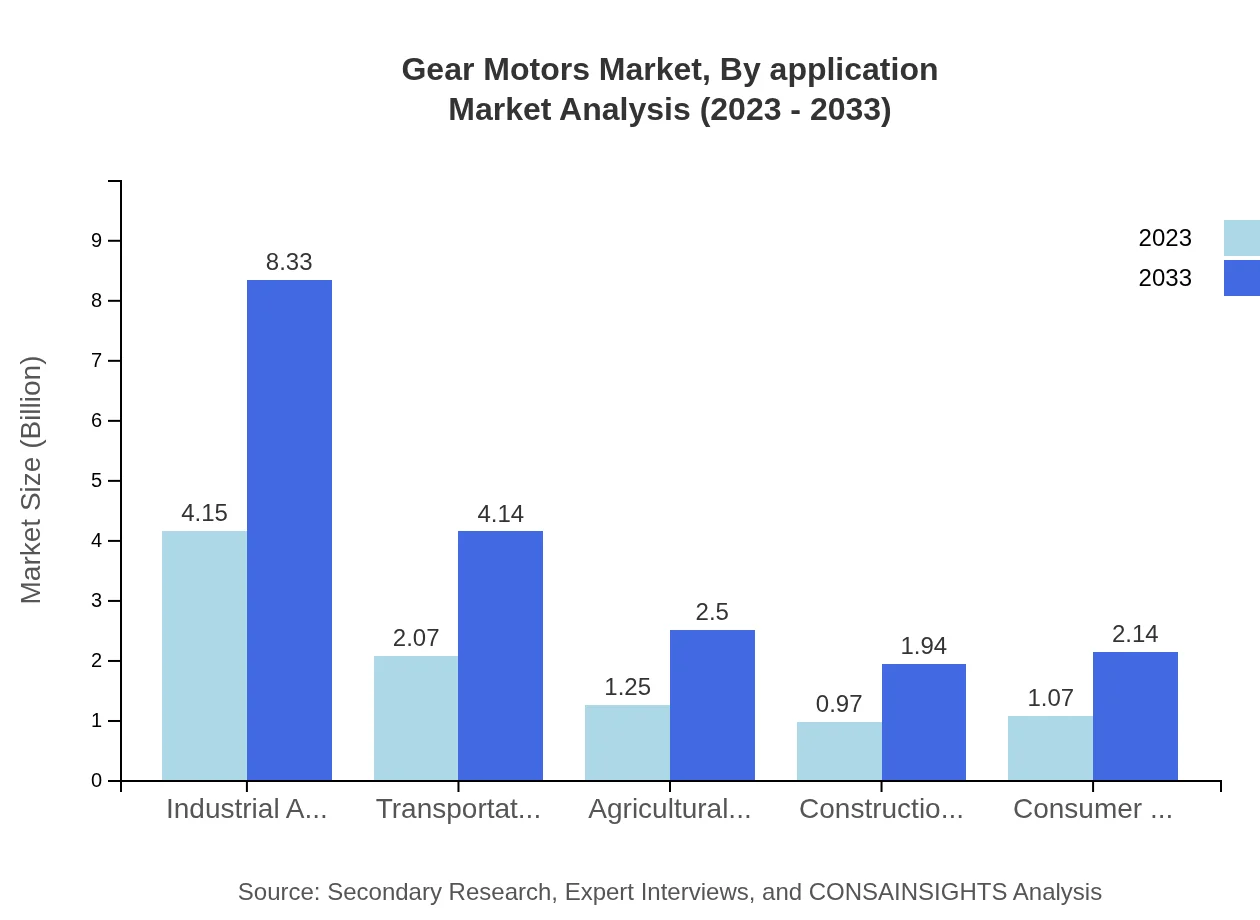

Gear Motors Market Analysis By Application

The application analysis highlights manufacturing and industrial automation as key segments, holding 43.72% of the market share in 2023. The automotive sector follows closely, representing 21.75% of the market. As industries continue to modernize, applications in electronics and renewable energy are expected to gain traction, enhancing the overall market potential.

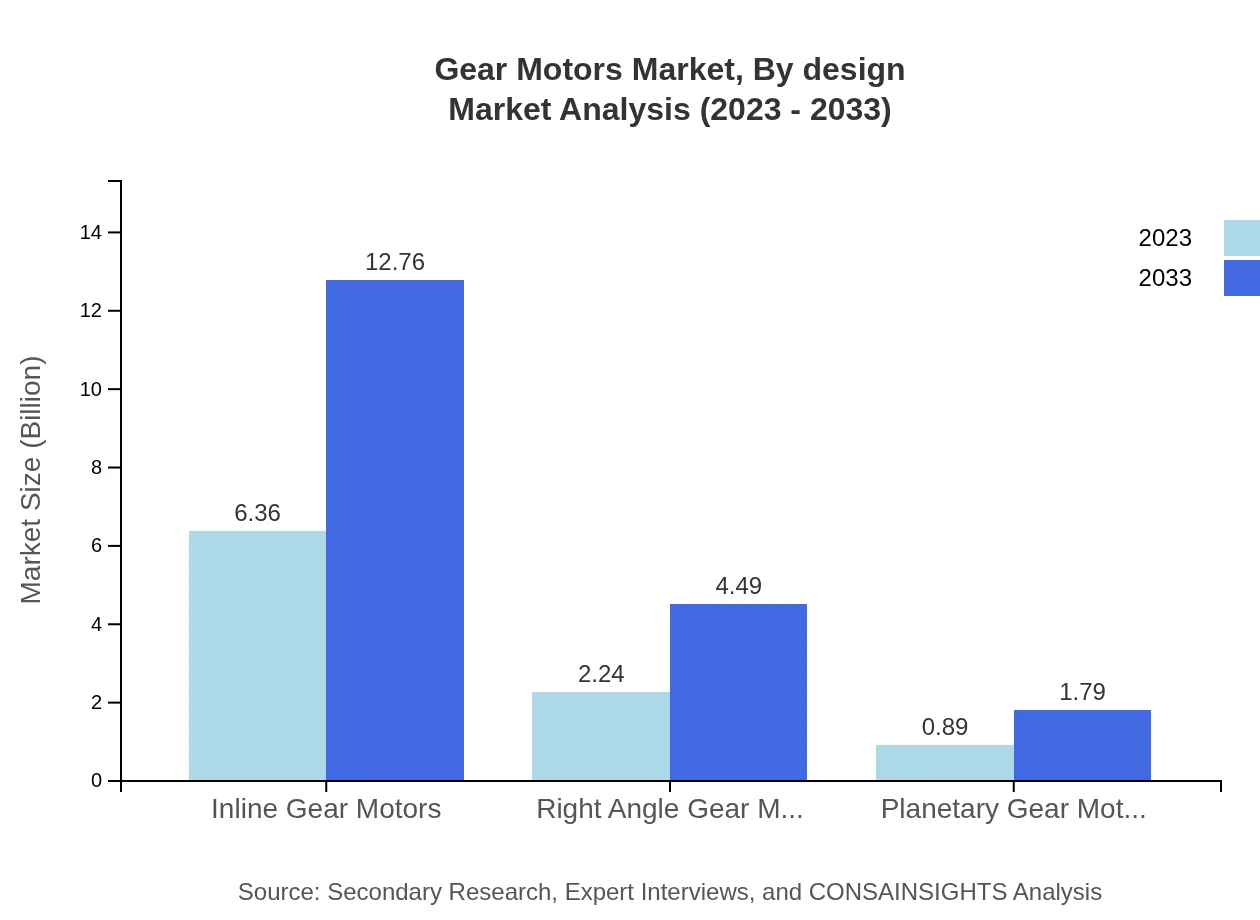

Gear Motors Market Analysis By Design

Design plays a crucial role in the performance and efficiency of Gear Motors. Current trends reveal increased demand for compact, high-torque designs that cater to application needs in confined spaces. This segment is anticipated to witness significant innovations to improve operational dynamics.

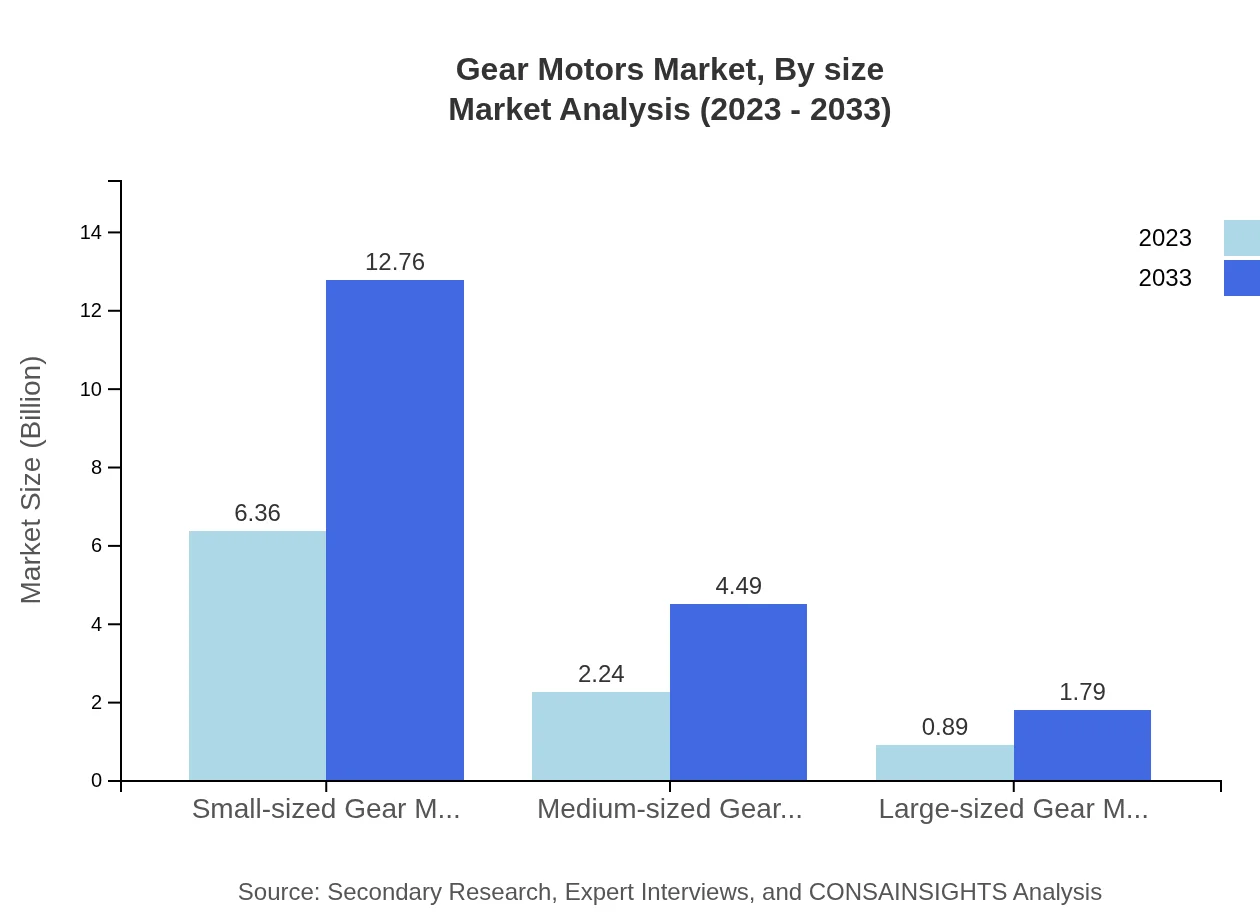

Gear Motors Market Analysis By Size

In 2023, small-sized Gear Motors dominate the space with a market size of $6.36 billion, expected to grow to $12.76 billion by 2033. Medium-sized and large-sized motors follow with significantly smaller shares, thus indicating a concentrated demand for compact and efficient designs across various sectors.

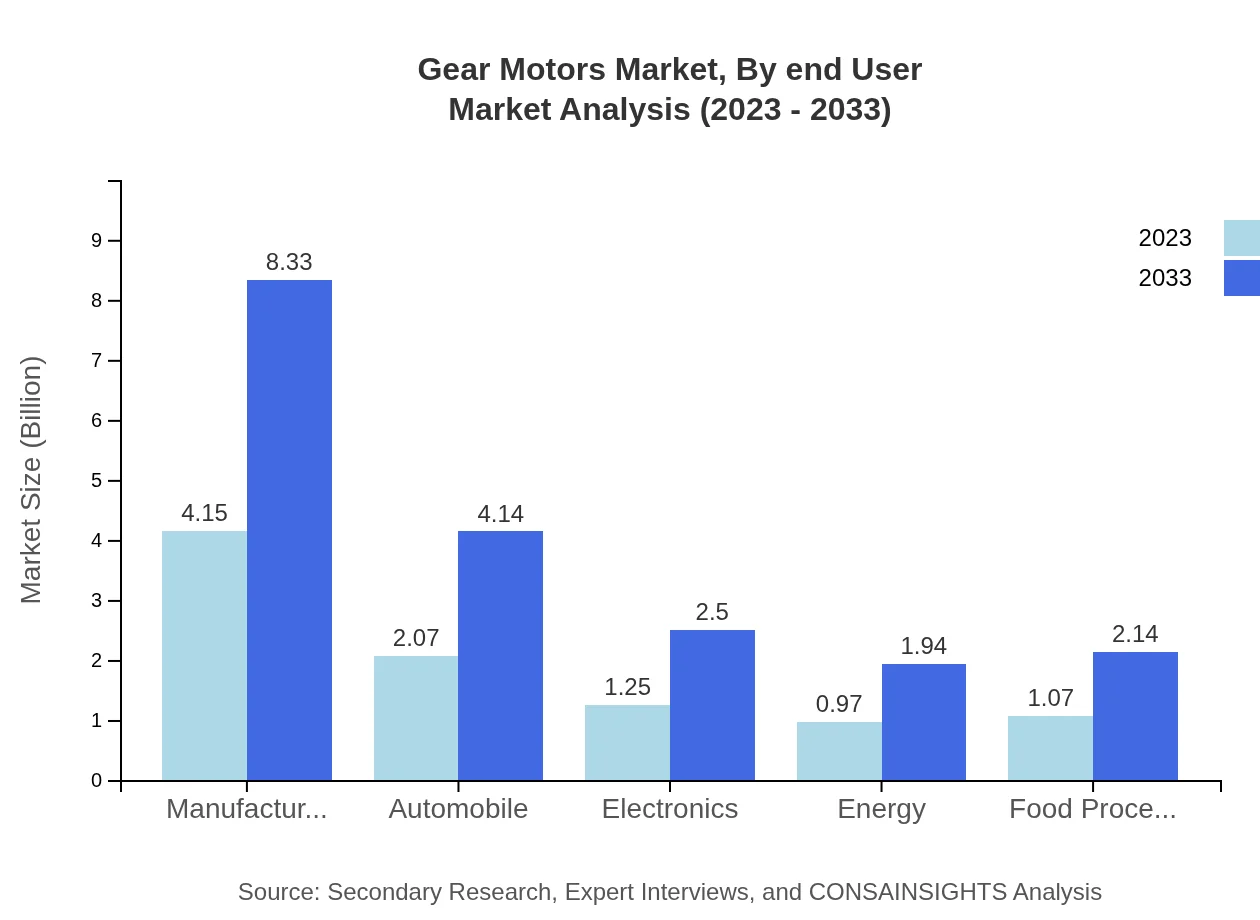

Gear Motors Market Analysis By End User

The Gear Motors market is prominently driven by end-user industries such as manufacturing, automotive, electronics, and renewable energy, each demonstrating distinct growth trajectories. Manufacturing leads with 43.72% market share, followed by automotive at 21.75%, reflecting their critical reliance on advanced motion control technologies.

Gear Motors Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Gear Motors Industry

Siemens AG:

Siemens is a global leader in industrial automation and drives, producing a wide range of Gear Motors recognized for their reliability and efficiency, significantly impacting various industrial applications.Danfoss:

Danfoss specializes in energy-efficient solutions, including high-performance Gear Motors that cater to the needs of manufacturing and HVAC industries, driving innovation through sustainable practices.Nord Drivesystems:

Nord Drivesystems is known for its extensive range of Gear Motors tailored for diverse applications, emphasizing customizability and efficiency, making it a prominent player in the market.We're grateful to work with incredible clients.

FAQs

What is the market size of gear Motors?

The global gear motors market is valued at approximately $9.5 billion in 2023, and it is expected to grow at a CAGR of 7.0% through 2033. This reflects significant demand across various industries utilizing gear motors.

What are the key market players or companies in this gear Motors industry?

The gear motors industry comprises several key players, including Siemens AG, NORD Drivesystems, and Bonfiglioli Group. These companies manufacture a wide array of gear motor solutions, contributing to market innovation and competition.

What are the primary factors driving the growth in the gear Motors industry?

Key factors driving growth in the gear motors industry include increasing automation, demand for energy efficiency, and expansion in sectors like manufacturing and transportation. Technological advancements also play a crucial role in enhancing product offerings.

Which region is the fastest Growing in the gear Motors market?

The Asia Pacific region is the fastest-growing market for gear motors, projected to expand from $1.82 billion in 2023 to $3.65 billion by 2033. This growth is fueled by rising industrialization and manufacturing activities in countries like China and India.

Does ConsaInsights provide customized market report data for the gear Motors industry?

Yes, ConsaInsights offers customized market report data tailored to your specific needs in the gear-motors industry. This can include detailed regional insights, segment analysis, and forecasts to support strategic decision-making.

What deliverables can I expect from this gear Motors market research project?

Deliverables from the gear-motors market research project typically include detailed market reports, segment analysis, regional breakdowns, competitive landscape insights, and growth forecasts, equipping you with valuable market intelligence.

What are the market trends of gear Motors?

Current trends in the gear motors market include a shift towards energy-efficient designs, the integration of IoT technology for smart applications, and a growing demand in renewable energy sectors due to sustainability objectives.