Gelling Agents Market Report

Published Date: 31 January 2026 | Report Code: gelling-agents

Gelling Agents Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Gelling Agents market, including forecasts from 2023 to 2033. It covers market size, growth potential, industry dynamics, segmentation, regional insights, key players, and emerging trends shaping the future of this industry.

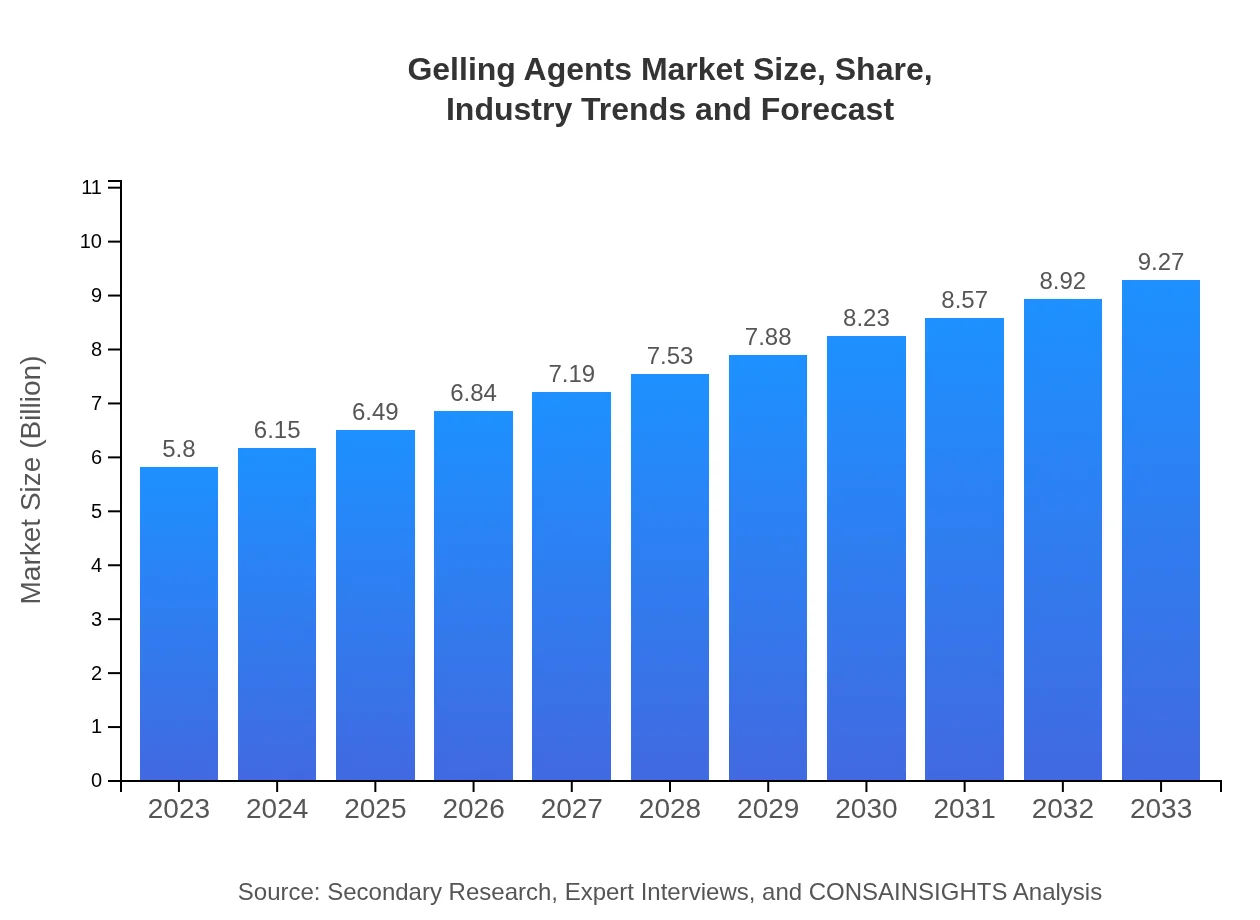

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.80 Billion |

| CAGR (2023-2033) | 4.7% |

| 2033 Market Size | $9.27 Billion |

| Top Companies | Du Pont de Nemours, Inc., Cargill, Incorporated, Kerry Group, Tate & Lyle |

| Last Modified Date | 31 January 2026 |

Gelling Agents Market Overview

Customize Gelling Agents Market Report market research report

- ✔ Get in-depth analysis of Gelling Agents market size, growth, and forecasts.

- ✔ Understand Gelling Agents's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Gelling Agents

What is the Market Size & CAGR of Gelling Agents market in 2023?

Gelling Agents Industry Analysis

Gelling Agents Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Gelling Agents Market Analysis Report by Region

Europe Gelling Agents Market Report:

Europe's market stands at $1.62 billion in 2023, expected to reach $2.59 billion by 2033, driven by a growing preference for natural food additives and stringent regulations favoring clean-label products.Asia Pacific Gelling Agents Market Report:

In 2023, the Asia Pacific market is valued at $1.09 billion, projected to grow to $1.75 billion by 2033. Rapid urbanization, along with increasing disposable income levels, contribute to the rising demand for packaged food products and natural ingredients.North America Gelling Agents Market Report:

In North America, the market is valued at $2.23 billion in 2023 and is set to grow to $3.56 billion by 2033. The region is witnessing significant demand for plant-based gelling agents fueled by the vegan food trend.South America Gelling Agents Market Report:

The South American market is valued at $0.53 billion in 2023, with expectations to reach $0.84 billion by 2033. Economic development and a rising trend in health-consciousness are helping to boost the market.Middle East & Africa Gelling Agents Market Report:

The market in the Middle East and Africa is valued at $0.33 billion in 2023, with projections suggesting it will reach approximately $0.53 billion by 2033. Growth in this region is attributed to increasing food processing activities and a rise in health awareness.Tell us your focus area and get a customized research report.

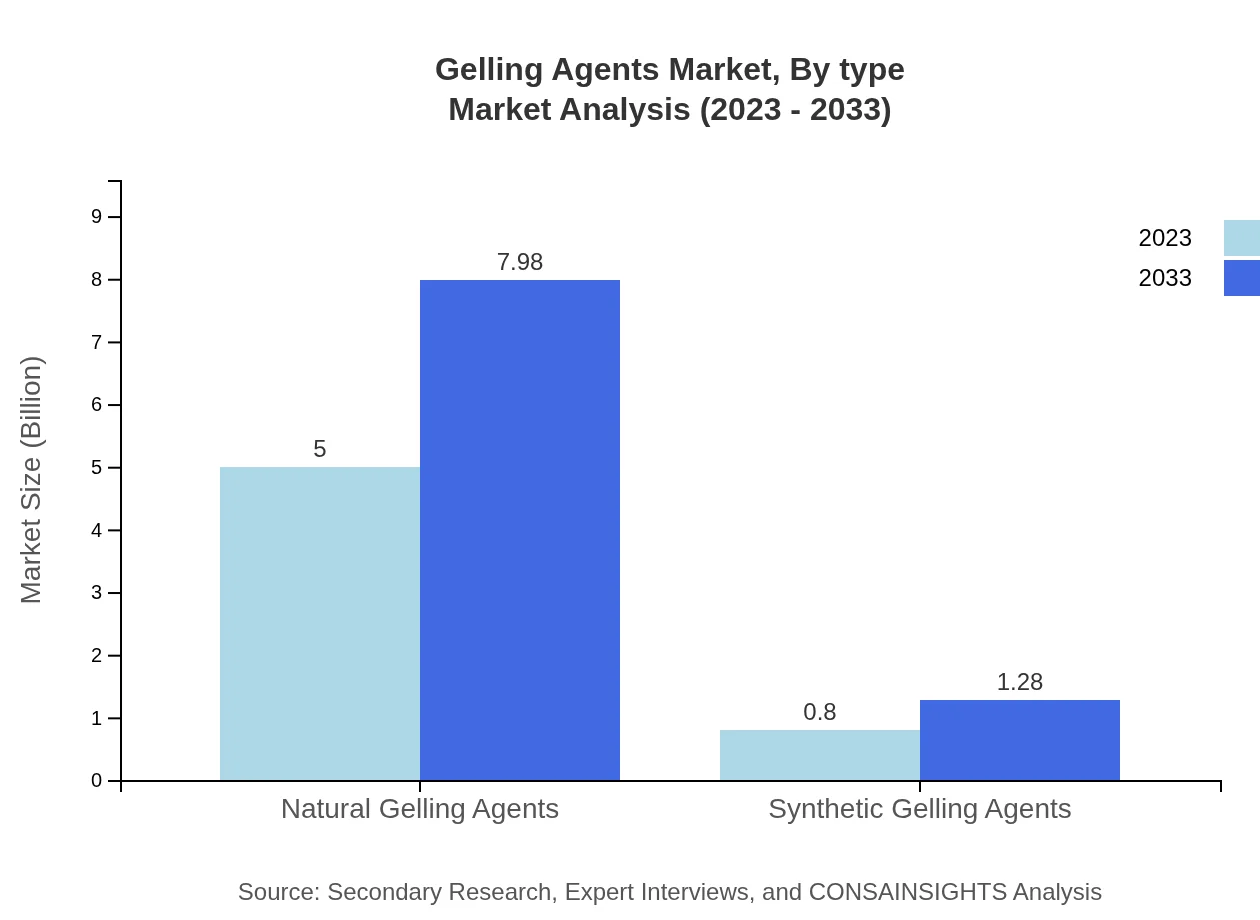

Gelling Agents Market Analysis By Type

Natural Gelling Agents dominate the market, valued at $5.00 billion in 2023, climbing to $7.98 billion by 2033, holding 86.14% of the market share. Synthetic Gelling Agents contribute $0.80 billion, expected to grow to $1.28 billion (13.86% share). The increasing preference for natural ingredients is driving the demand for natural over synthetic gelling agents.

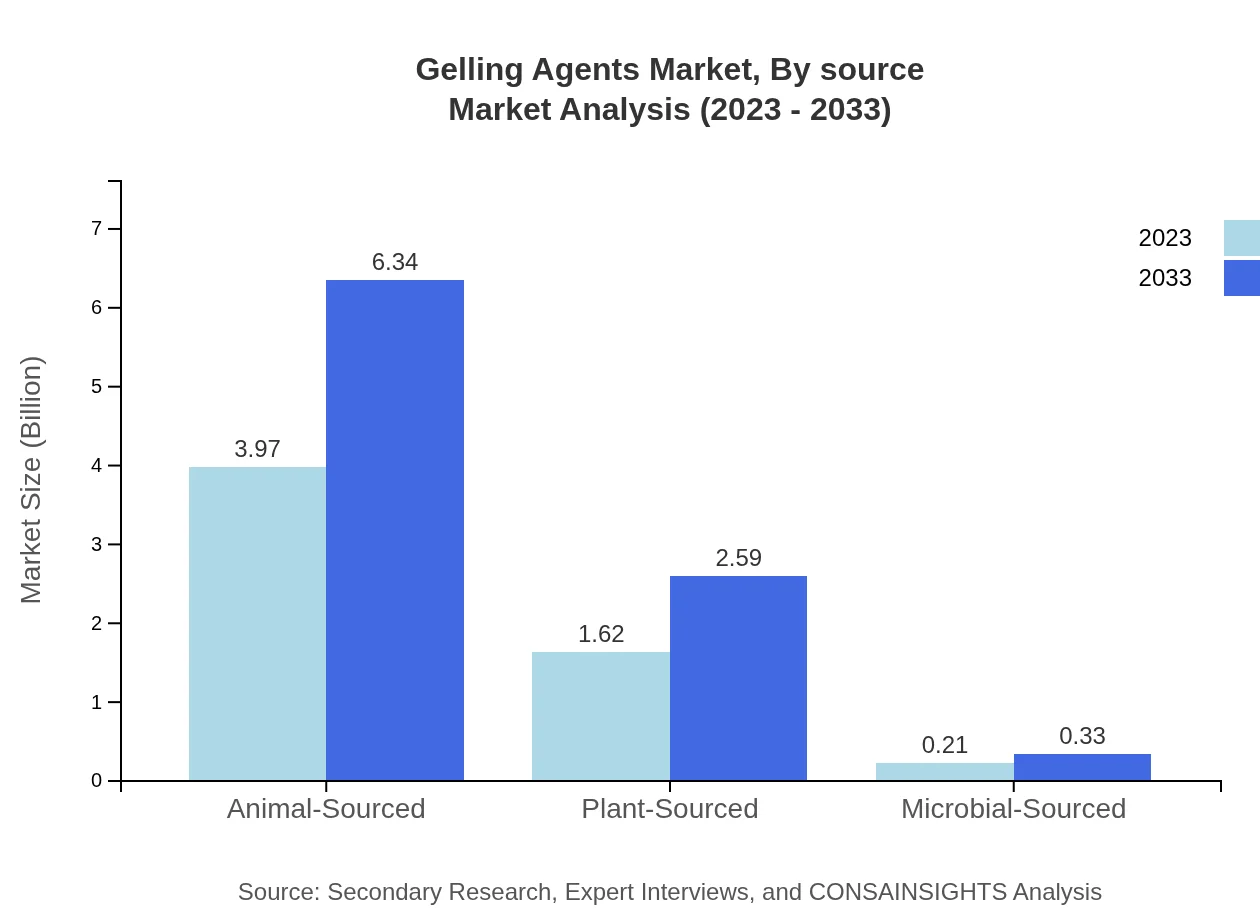

Gelling Agents Market Analysis By Source

Animal-sourced gelling agents currently stand at $3.97 billion (68.44% share), projected to reach $6.34 billion by 2033. Plant-sourced gelling agents are valued at $1.62 billion (27.98% share), expected to grow to $2.59 billion. Microbial-sourced agents, although smaller in share, show potential for growth, especially in niche applications.

Gelling Agents Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Gelling Agents Industry

Du Pont de Nemours, Inc.:

A leading player providing a wide range of natural and synthetic gelling agents, known for their innovations and extensive R&D capabilities.Cargill, Incorporated:

They focus on sustainable solutions and are agile in meeting the trends in plant-based and clean-label products.Kerry Group:

An established player specializing in food ingredients, including gelling agents, emphasizing innovation in food processing.Tate & Lyle:

This company is significant for its contribution to plant-based agents and continuous development of functional food ingredients.We're grateful to work with incredible clients.

FAQs

What is the market size of gelling Agents?

The global gelling agents market is projected to reach USD 5.8 billion by 2033, growing at a CAGR of 4.7% from its current valuation. This growth reflects rising applications across diverse industries.

What are the key market players or companies in this gelling Agents industry?

Key players in the gelling agents industry include multinational corporations that specialize in food additives and ingredients, such as Ashland Global Holdings, DuPont, and Kerry Group, among others, providing a broad range of gelling solutions.

What are the primary factors driving the growth in the gelling Agents industry?

Significant factors driving growth include increasing demand for natural ingredients in food, expanding pharmaceutical uses, and innovations in bioengineering, which together enhance gelling agents' application scope across various sectors.

Which region is the fastest Growing in the gelling Agents?

North America leads as the fastest-growing region in the gelling agents market, forecasted to rise from USD 2.23 billion in 2023 to USD 3.56 billion by 2033, driven by consumer demand for diverse food products.

Does ConsaInsights provide customized market report data for the gelling Agents industry?

Yes, ConsaInsights offers tailored market reports for the gelling agents industry, allowing clients to access specific data and insights fitting their business needs and strategic objectives.

What deliverables can I expect from this gelling Agents market research project?

Deliverables include comprehensive market analysis reports, segmented data by source and application, regional insights, strategic recommendations, and competitive landscape assessments maximizing decision-making capabilities.

What are the market trends of gelling Agents?

Current trends highlight a shift towards natural gelling agents, increasing use in the food & beverage industry, and innovations in gel formulations, reflecting changing consumer preferences for healthier products.