General Anesthesia Drugs Market Report

Published Date: 31 January 2026 | Report Code: general-anesthesia-drugs

General Anesthesia Drugs Market Size, Share, Industry Trends and Forecast to 2033

This report analyzes the General Anesthesia Drugs market from 2023 to 2033, covering market size, growth rates, trends, and regional insights, as well as detailing key industry players and future forecasts.

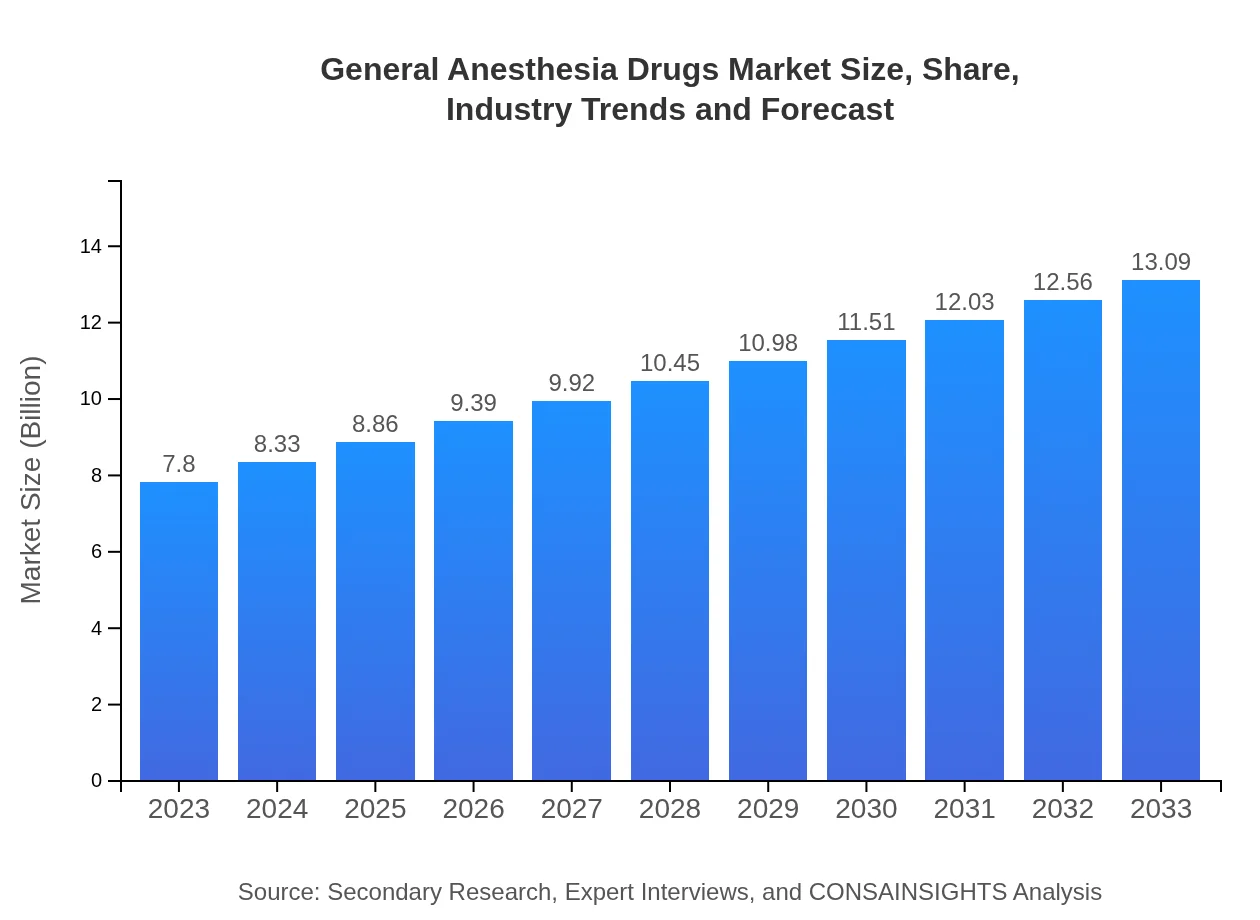

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $7.80 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $13.09 Billion |

| Top Companies | Fresenius Kabi AG, AbbVie Inc., Baxter International Inc., AstraZeneca PLC |

| Last Modified Date | 31 January 2026 |

General Anesthesia Drugs Market Overview

Customize General Anesthesia Drugs Market Report market research report

- ✔ Get in-depth analysis of General Anesthesia Drugs market size, growth, and forecasts.

- ✔ Understand General Anesthesia Drugs's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in General Anesthesia Drugs

What is the Market Size & CAGR of General Anesthesia Drugs market in 2023?

General Anesthesia Drugs Industry Analysis

General Anesthesia Drugs Market Segmentation and Scope

Tell us your focus area and get a customized research report.

General Anesthesia Drugs Market Analysis Report by Region

Europe General Anesthesia Drugs Market Report:

The European market is forecasted to grow from $2.10 billion in 2023 to $3.52 billion in 2033, with strong influences from regulations promoting improved patient safety and efficacy of anesthetic drugs.Asia Pacific General Anesthesia Drugs Market Report:

The Asia Pacific region is experiencing rapid growth, expected to expand from $1.69 billion in 2023 to $2.84 billion in 2033. Factors such as increasing surgical procedures, improvements in healthcare infrastructure, and a growing elderly population contribute to this growth.North America General Anesthesia Drugs Market Report:

In North America, the market is projected to grow substantially, increasing from $2.53 billion in 2023 to $4.24 billion in 2033, supported by technological advancements, high healthcare expenditures, and a robust research and development environment.South America General Anesthesia Drugs Market Report:

In South America, the market is designed to grow from $0.76 billion in 2023 to $1.28 billion in 2033, driven by rising awareness of advanced surgical practices and increasing healthcare spending in emerging economies.Middle East & Africa General Anesthesia Drugs Market Report:

The Middle East and Africa market, while smaller, is expected to witness growth from $0.72 billion in 2023 to $1.21 billion in 2033, as regional healthcare systems develop and demand for surgical procedures increases.Tell us your focus area and get a customized research report.

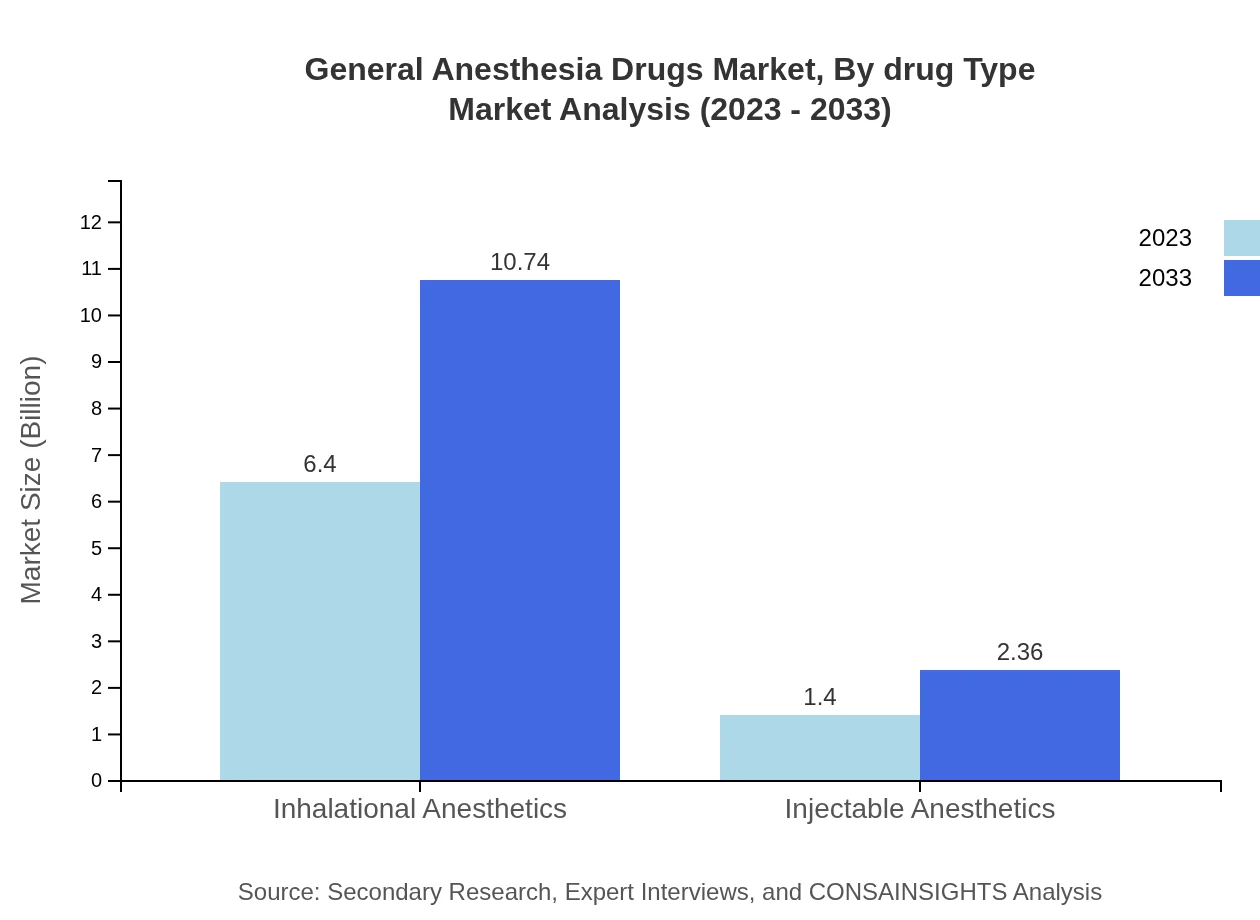

General Anesthesia Drugs Market Analysis By Drug Type

The General Anesthesia Drugs market by drug type is primarily divided into inhalational and injectable anesthetics. Inhalational anesthetics are significantly large, growing from $6.40 billion in 2023 to $10.74 billion in 2033, commanding an 82% market share. Injectable anesthetics, while smaller, show robust growth from $1.40 billion to $2.36 billion, maintaining an 18% share.

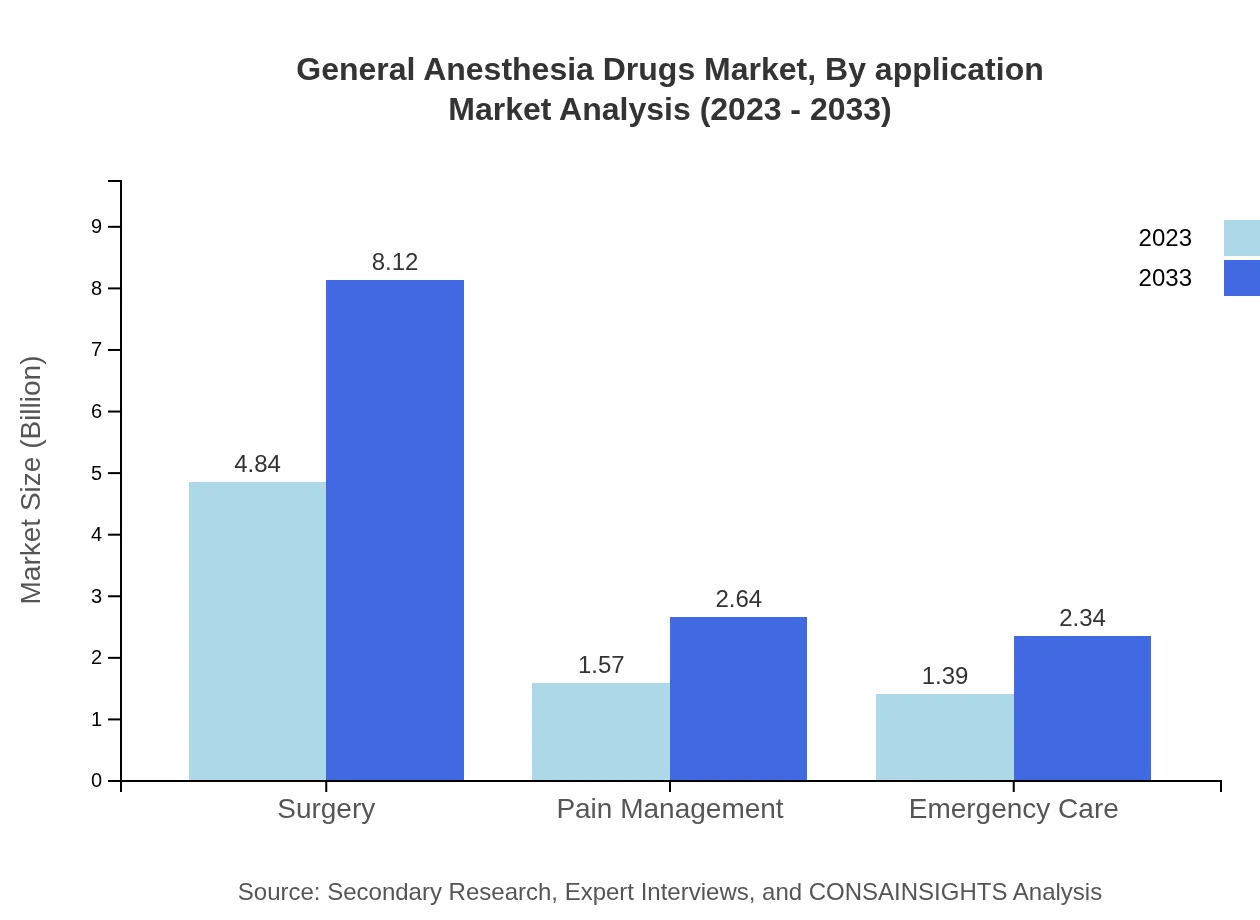

General Anesthesia Drugs Market Analysis By Application

The market by application reveals Surgery as a leading segment, increasing from $4.84 billion to $8.12 billion, with a consistent share of 62.02%. Pain management and Emergency care are significant segments as well, projected to grow steadily, with pain management rising from $1.57 billion to $2.64 billion, alongside emergency care escalating from $1.39 billion to $2.34 billion.

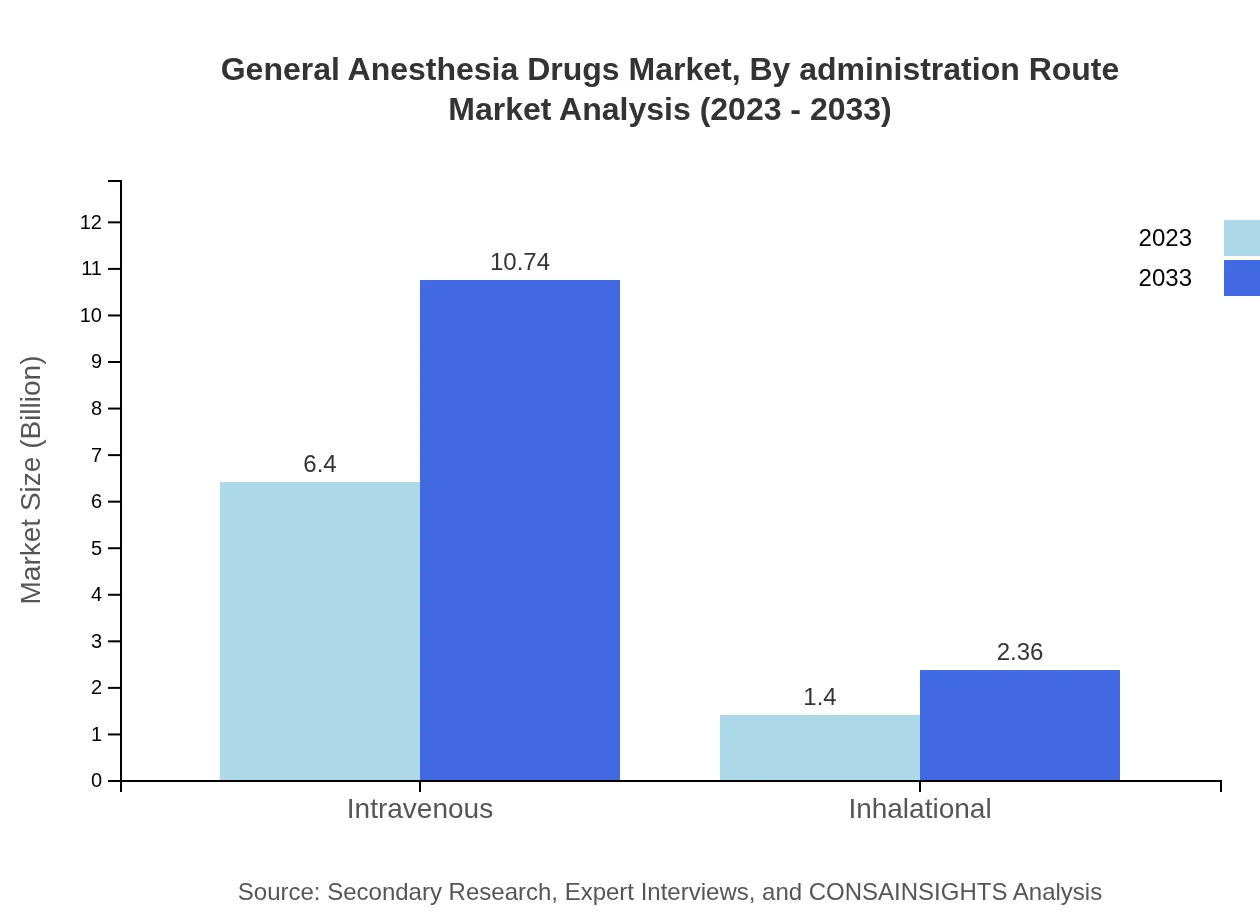

General Anesthesia Drugs Market Analysis By Administration Route

Analyzing the market by administration route, intravenous anesthetics dominate with a share of 82%, reflecting a market growth from $6.40 billion to $10.74 billion. Inhalational anesthetics, although demonstrating strong performance, account for 18% of the market with growth from $1.40 billion to $2.36 billion.

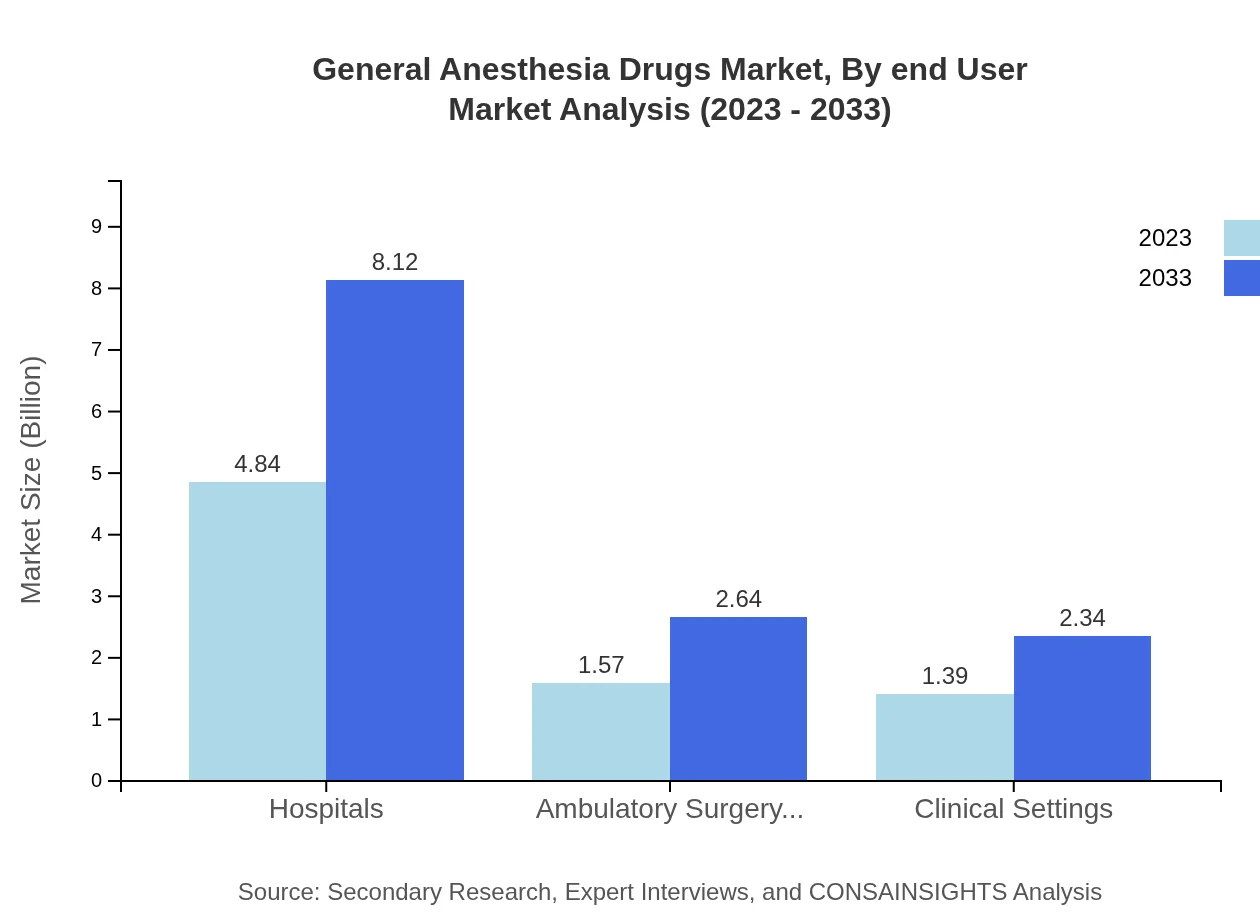

General Anesthesia Drugs Market Analysis By End User

By end-user, hospitals maintain a significant lead with a market size projected to rise from $4.84 billion in 2023 to $8.12 billion in 2033, comprising 62.02% of the market. Ambulatory Surgery Centers and Clinical Settings also have notable shares, indicating the versatility of general anesthesia applications across diverse healthcare environments.

General Anesthesia Drugs Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in General Anesthesia Drugs Industry

Fresenius Kabi AG:

Fresenius Kabi is a global healthcare company that specializes in lifesaving medicines and technologies, leading in the production of injectable anesthetics and infusion therapies.AbbVie Inc.:

AbbVie specializes in immunology, hematologic oncology, and neuroscience treatments, contributing significantly to the market with their innovative anesthetic solutions.Baxter International Inc.:

Baxter focuses on medical products distributed worldwide, and their portfolio includes a wide range of anesthetics, making them key players in expanding the market.AstraZeneca PLC:

AstraZeneca is a biopharmaceutical company that develops a broad range of medicines, including anesthetic drugs, making substantial contributions to industry advancements.We're grateful to work with incredible clients.

FAQs

What is the market size of general Anesthesia Drugs?

The global market size for general anesthesia drugs is approximately $7.8 billion in 2023, with a projected growth at a CAGR of 5.2% leading to an estimated market size in 2033. This growth reflects the increasing demand for surgical procedures requiring anesthesia.

What are the key market players or companies in the general Anesthesia Drugs industry?

Key players in the general anesthesia drugs market include prominent pharmaceutical companies focused on developing effective anesthesia solutions. These companies invest significantly in research and development to advance anesthetic formulations and are pivotal in shaping the market landscape.

What are the primary factors driving the growth in the general Anesthesia Drugs industry?

Growth in the general anesthesia drugs market is driven by several factors including the rising number of surgical procedures worldwide, advancements in anesthetic technology, and increasing awareness of patient safety during surgeries which bolsters demand for effective anesthesia solutions.

Which region is the fastest Growing in the general Anesthesia Drugs?

The North American region is currently the fastest-growing market for general anesthesia drugs, with a market size projected to reach $4.24 billion by 2033. This growth is attributed to the high prevalence of surgical procedures and advanced healthcare infrastructure in the region.

Does ConsaInsights provide customized market report data for the general Anesthesia Drugs industry?

Yes, ConsaInsights offers customized market reports tailored to the specific needs of clients in the general anesthesia drugs industry. These reports can provide detailed insights reflecting unique market challenges and opportunities relevant to various stakeholders.

What deliverables can I expect from this general Anesthesia Drugs market research project?

Expect comprehensive deliverables including detailed market analysis reports, trend assessments, competitive landscape evaluations, and segmented data insights. You'll gain valuable perspectives to inform strategic decisions and navigate market dynamics effectively.

What are the market trends of general Anesthesia Drugs?

Current trends in the general anesthesia drugs market include a shift towards minimal invasive surgeries, increasing use of inhalational anesthetics, and the growing demand for ambulatory surgery centers which significantly impacts market dynamics and growth.