General Aviation Engines Market Report

Published Date: 03 February 2026 | Report Code: general-aviation-engines

General Aviation Engines Market Size, Share, Industry Trends and Forecast to 2033

This report extensively covers the General Aviation Engines market, providing forecasts from 2023 to 2033. It presents insights into market dynamics, trends, segmentation, regional analyses, and key players shaping the industry's future.

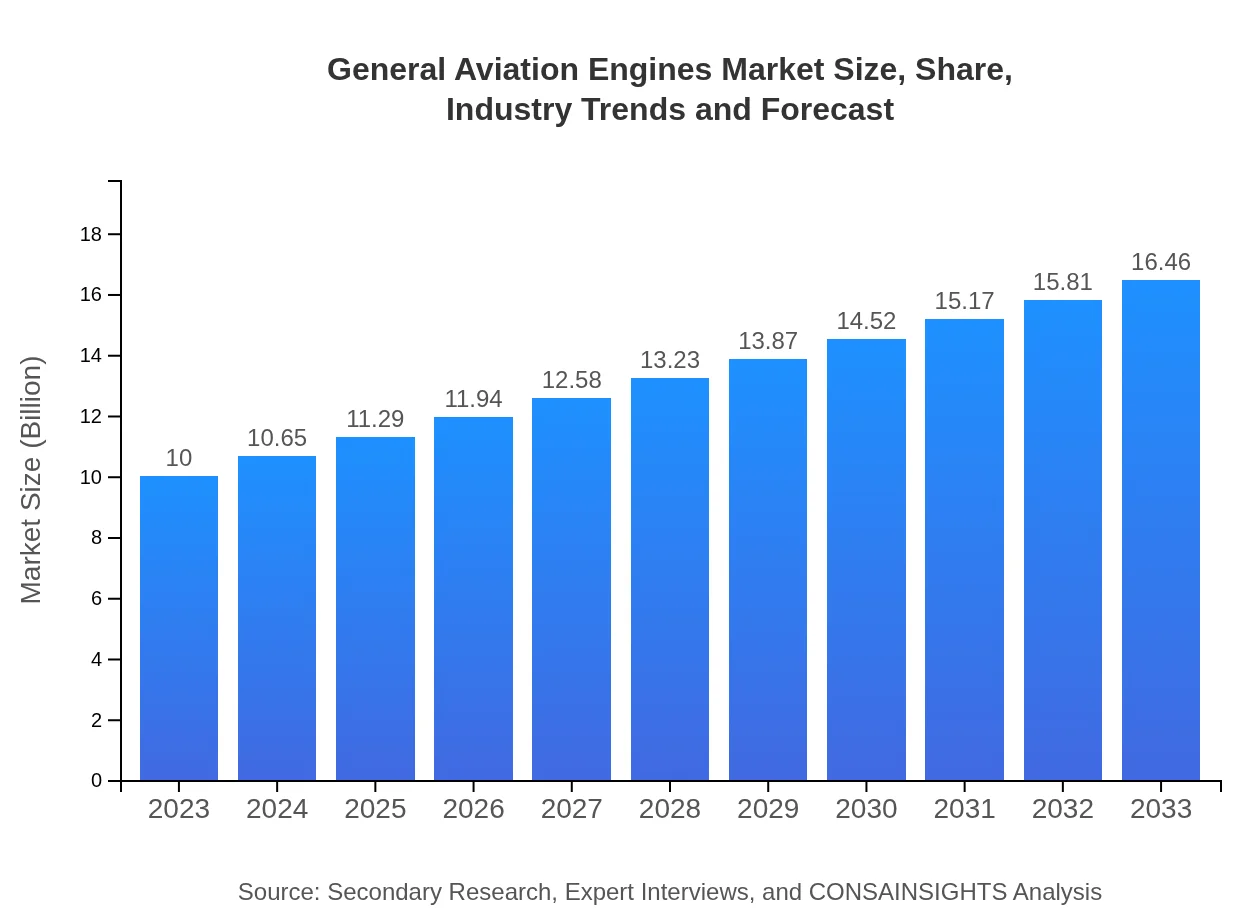

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $16.46 Billion |

| Top Companies | Textron Aviation, Piper Aircraft, Inc., Lycoming Engines, Continental Motors |

| Last Modified Date | 03 February 2026 |

General Aviation Engines Market Overview

Customize General Aviation Engines Market Report market research report

- ✔ Get in-depth analysis of General Aviation Engines market size, growth, and forecasts.

- ✔ Understand General Aviation Engines's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in General Aviation Engines

What is the Market Size & CAGR of General Aviation Engines market in 2023?

General Aviation Engines Industry Analysis

General Aviation Engines Market Segmentation and Scope

Tell us your focus area and get a customized research report.

General Aviation Engines Market Analysis Report by Region

Europe General Aviation Engines Market Report:

The European market is forecast to grow from $2.66 billion in 2023 to $4.38 billion by 2033. Strict environmental regulations are pushing innovations in engine technologies, and a growing number of consumers are shifting towards private aviation for convenience and efficiency.Asia Pacific General Aviation Engines Market Report:

In the Asia Pacific region, the General Aviation Engines market is projected to grow from $2.05 billion in 2023 to $3.38 billion by 2033. This growth can be attributed to increasing investments in aviation infrastructure and rising disposable incomes, facilitating the expansion of private air travel options.North America General Aviation Engines Market Report:

North America represents the largest market, estimated at $3.73 billion in 2023 and projected to reach $6.14 billion by 2033. Factors such as a well-established aviation sector, high demand for private flying, and technological advancements contribute to this robust growth.South America General Aviation Engines Market Report:

The South American market is expected to increase modestly, from $0.18 billion in 2023 to $0.29 billion by 2033. Challenging economic conditions and regulatory hurdles may impede faster growth, although regional improvements in aviation regulations suggest potential for expansion.Middle East & Africa General Aviation Engines Market Report:

In the Middle East and Africa, the market size is expected to grow from $1.38 billion in 2023 to $2.27 billion by 2033. The growth factors include increasing tourism and investment in business infrastructures that stimulate demand for general aviation services.Tell us your focus area and get a customized research report.

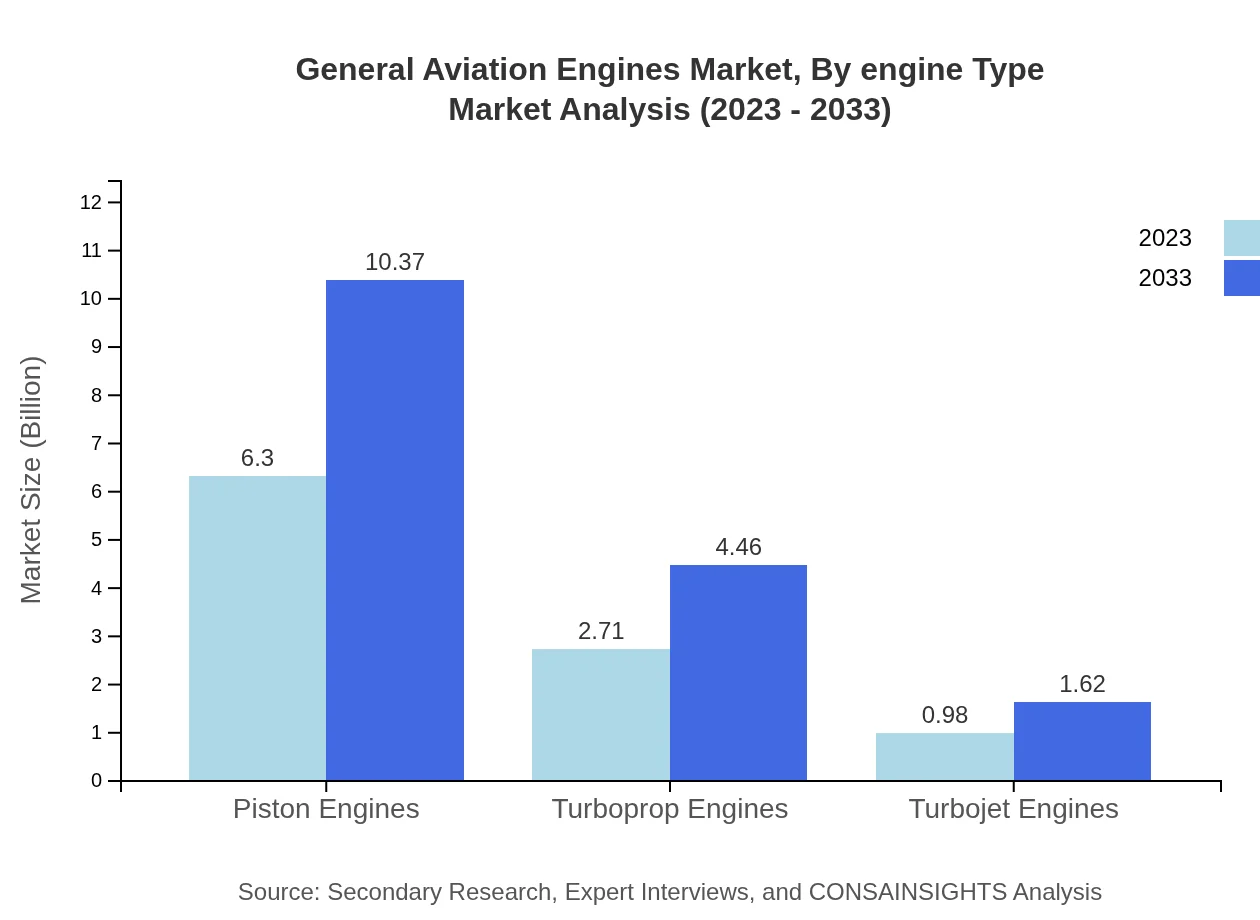

General Aviation Engines Market Analysis By Engine Type

Piston engines dominate the market with a share of 63.04% in 2023, valued at $6.30 billion, and forecasted to increase to $10.37 billion by 2033. Turboprop engines hold a 27.11% market share, rising from $2.71 billion in 2023 to $4.46 billion by 2033. Turbojet engines account for the remaining 9.85%, with values shifting from $0.98 billion to $1.62 billion in the same period.

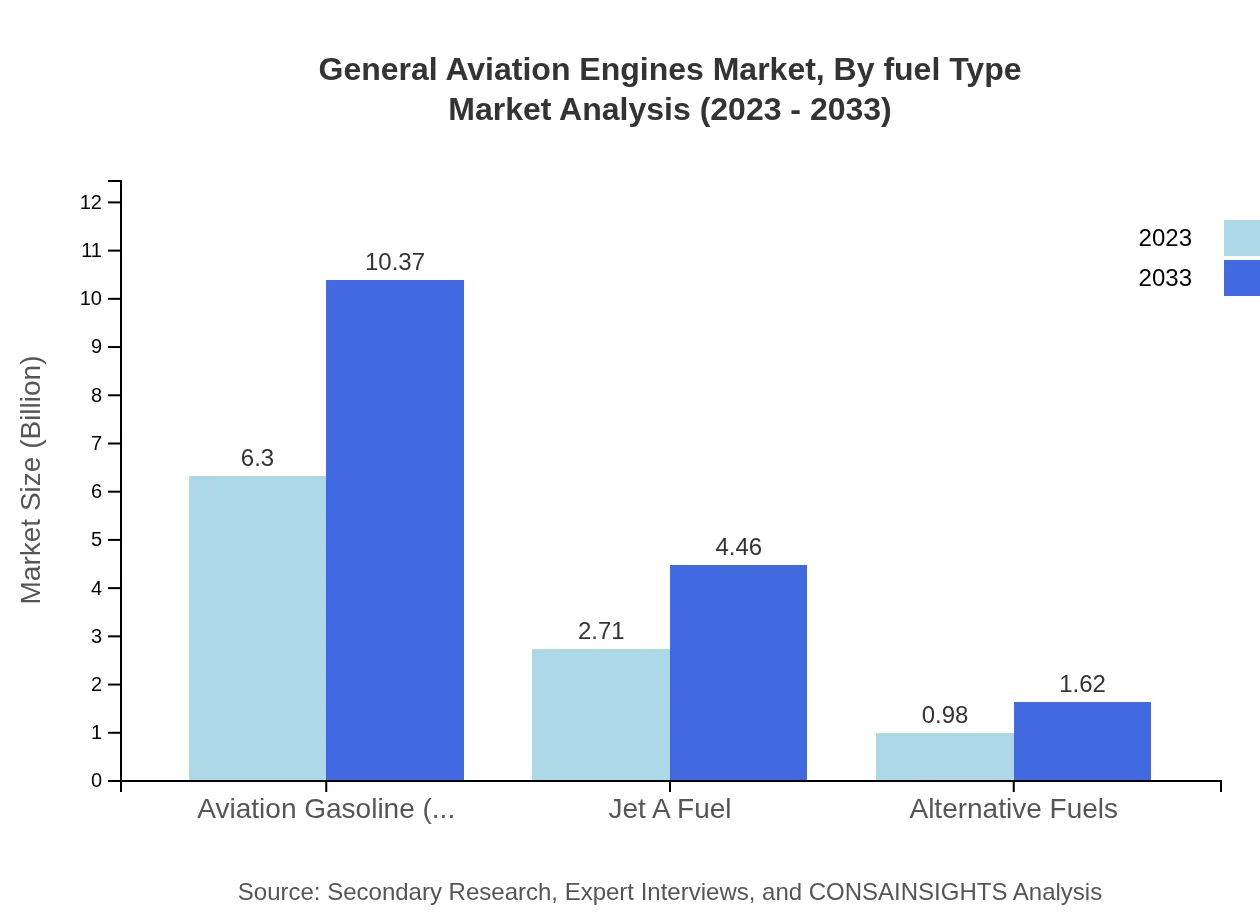

General Aviation Engines Market Analysis By Fuel Type

Aviation gasoline (Avgas) remains the primary fuel type with a significant market size of $6.30 billion in 2023, showing an increasing trend to $10.37 billion by 2033. Jet A fuel follows, starting at $2.71 billion and expected to reach $4.46 billion. Alternative fuels, although currently lower at $0.98 billion, show promise with expectations to grow to $1.62 billion.

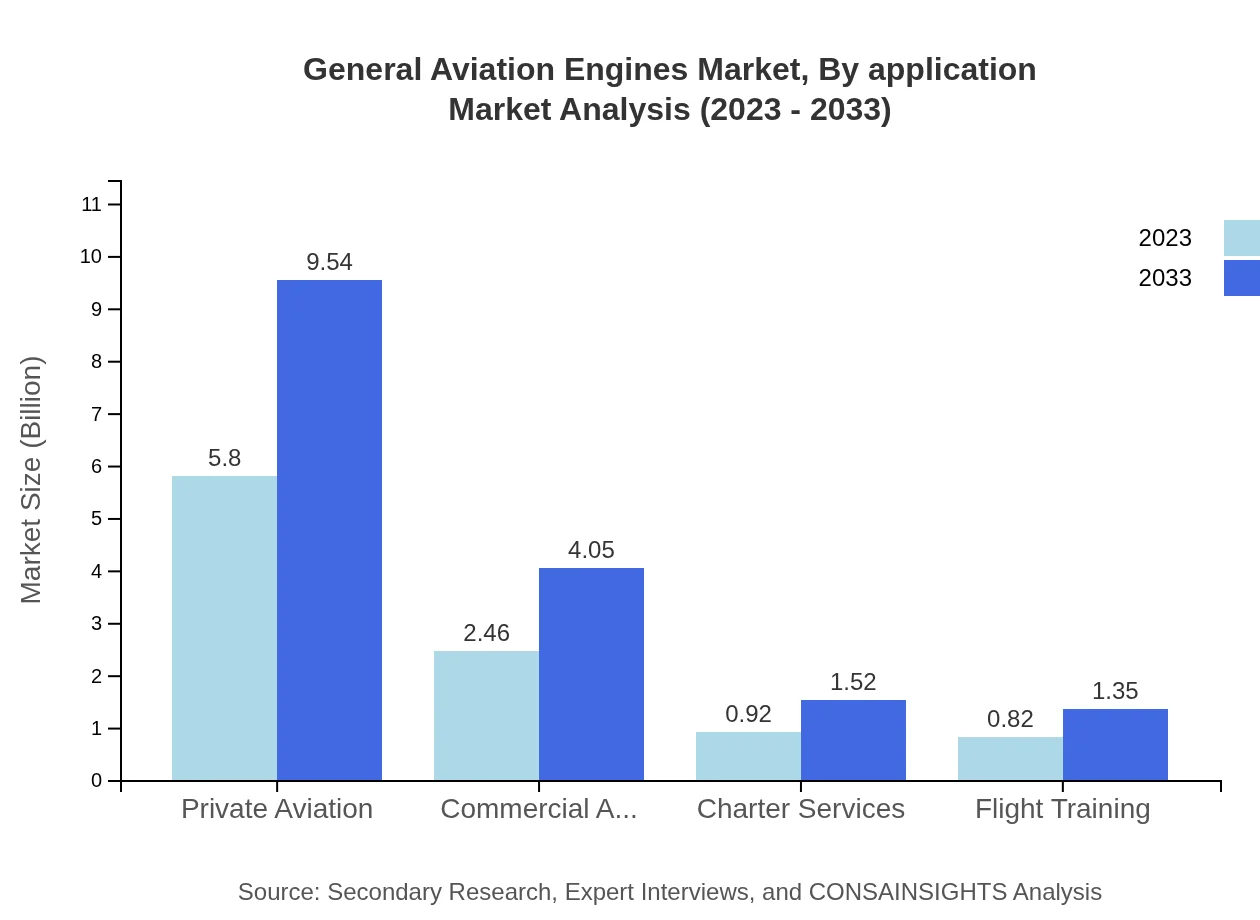

General Aviation Engines Market Analysis By Application

Private aviation captures the largest market share, valued at $5.80 billion in 2023, and growing to $9.54 billion by 2033. Commercial aviation and charter services contribute a significant portion as well, with expected growth reflecting the demand for operational flexibility and air travel alternatives.

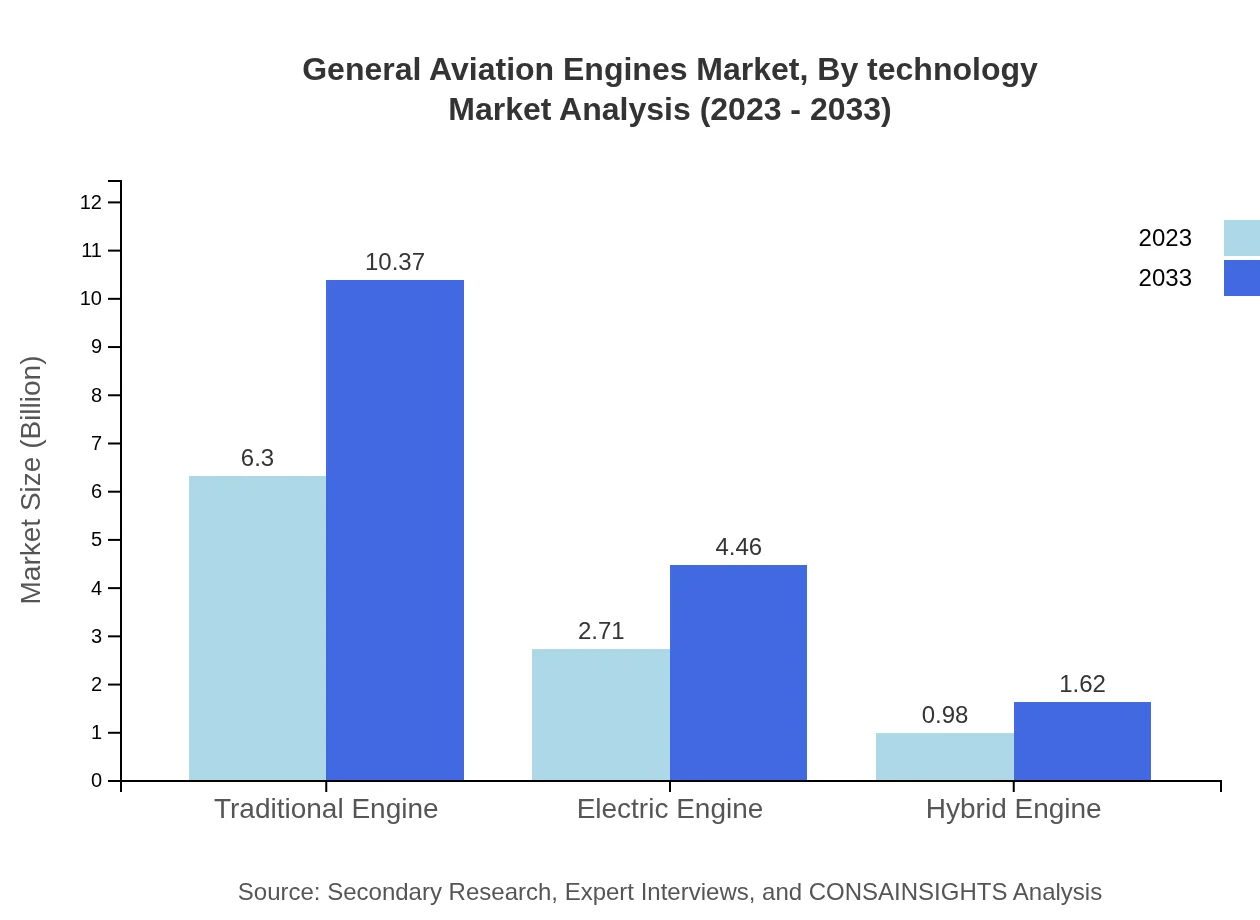

General Aviation Engines Market Analysis By Technology

Traditional engines, particularly piston types, compose the majority share while electric engine technologies are emerging rapidly. The transition toward hybrid engines also indicates a progressive shift driven by regulatory requirements and sustainability goals.

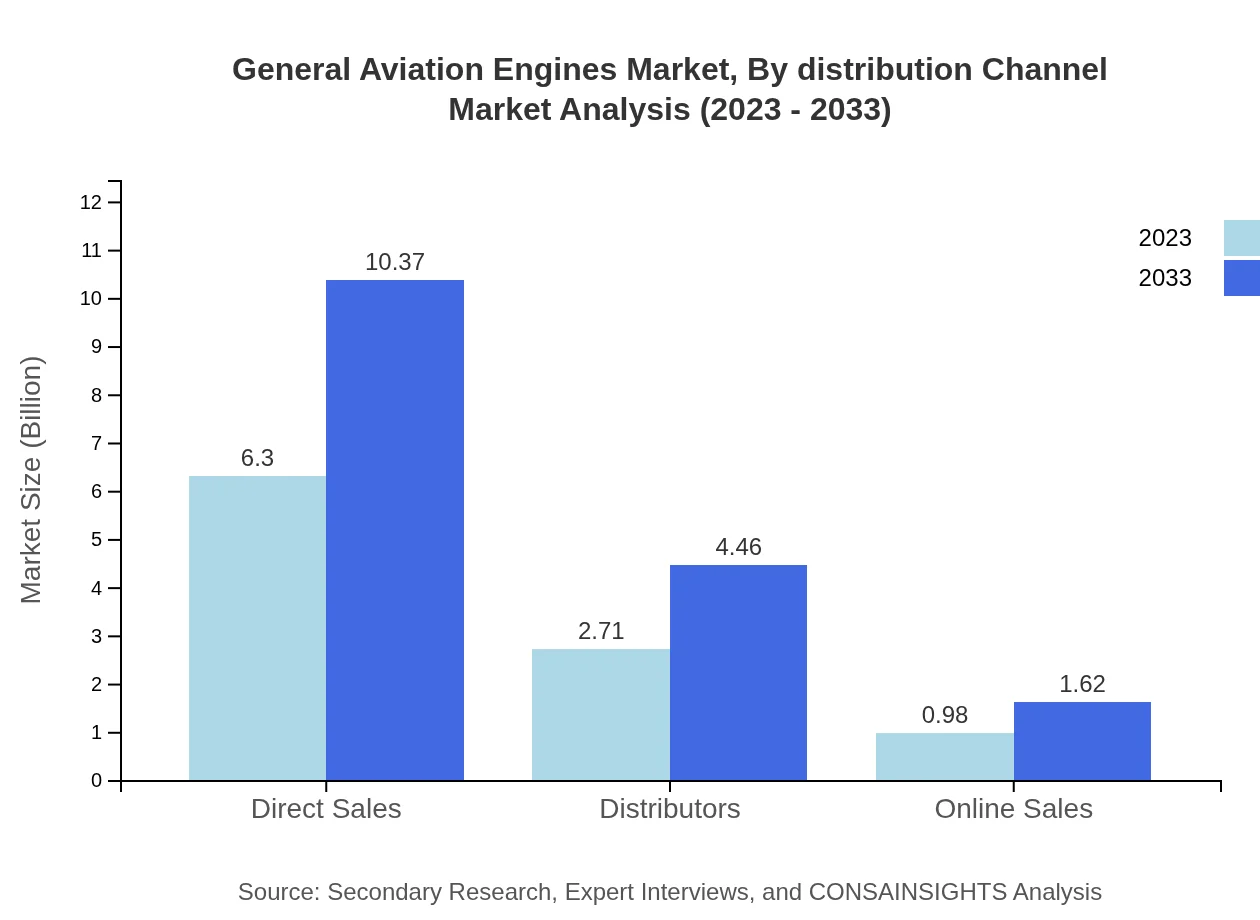

General Aviation Engines Market Analysis By Distribution Channel

Direct sales dominate the distribution market with a share of 63.04%, while distributor channels contribute 27.11%, showing strong growth with an increasing emphasis on online sales channels which are predicted to rise from $0.98 billion to $1.62 billion by 2033.

General Aviation Engines Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in General Aviation Engines Industry

Textron Aviation:

Textron Aviation is a leading manufacturer of general aviation aircraft and engines, known for its Cessna and Beechcraft brands. The company is recognized for integrating advanced technologies and focusing on customer-driven innovations.Piper Aircraft, Inc.:

Piper Aircraft, Inc. specializes in manufacturing general aviation airplanes, particularly single-engine and multi-engine planes that are favored for personal and business aviation.Lycoming Engines:

Lycoming Engines, a division of Avco Corporation, is renowned for its piston engines in light aircraft, being one of the long-standing and most relied-upon names in the industry.Continental Motors:

Continental Motors manufactures a variety of piston engines widely used in general aviation. The company focuses on quality and advancements in product performance to meet market demands.We're grateful to work with incredible clients.

FAQs

What is the market size of General Aviation Engines?

The General Aviation Engines market was valued at approximately $10 billion in 2023, with a projected CAGR of 5% leading to significant growth by 2033. The market size reflects the industry's expanding demand and technological advancements.

What are the key market players or companies in the General Aviation Engines industry?

Key players in the General Aviation Engines market include major manufacturers such as Lycoming Engines, Continental Motors, Pratt & Whitney, and Safran. These companies play pivotal roles through innovation and product diversity.

What are the primary factors driving the growth in the General Aviation Engines industry?

The growth of the General Aviation Engines market is primarily driven by increasing demand for general aviation, rising disposable incomes, advancements in engine technologies, and a growing preference for personal and business aviation.

Which region is the fastest Growing in the General Aviation Engines?

The North American region is the fastest-growing market for General Aviation Engines, expected to grow from $3.73 billion in 2023 to $6.14 billion by 2033, reflecting a strong interest in private and business aviation.

Does ConsaInsights provide customized market report data for the General Aviation Engines industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the General Aviation Engines industry, ensuring businesses receive deep insights relevant to their market questions and strategic goals.

What deliverables can I expect from this General Aviation Engines market research project?

Deliverables from this market research project typically include comprehensive market analysis, trend insights, regional performance data, competitive landscape summaries, and strategic recommendations specific to the General Aviation Engines sector.

What are the market trends of General Aviation Engines?

Current market trends in General Aviation Engines include a rising shift towards electric and hybrid engines, growing interest in alternative fuels, and increasing investment in innovation to enhance fuel efficiency and reduce emissions.