General Surgical Devices Market Report

Published Date: 31 January 2026 | Report Code: general-surgical-devices

General Surgical Devices Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the General Surgical Devices market, covering insights on market size, growth trends, and forecasts through 2033. It includes detailed segmentation and regional analysis, along with an overview of key players and emerging technologies impacting the industry.

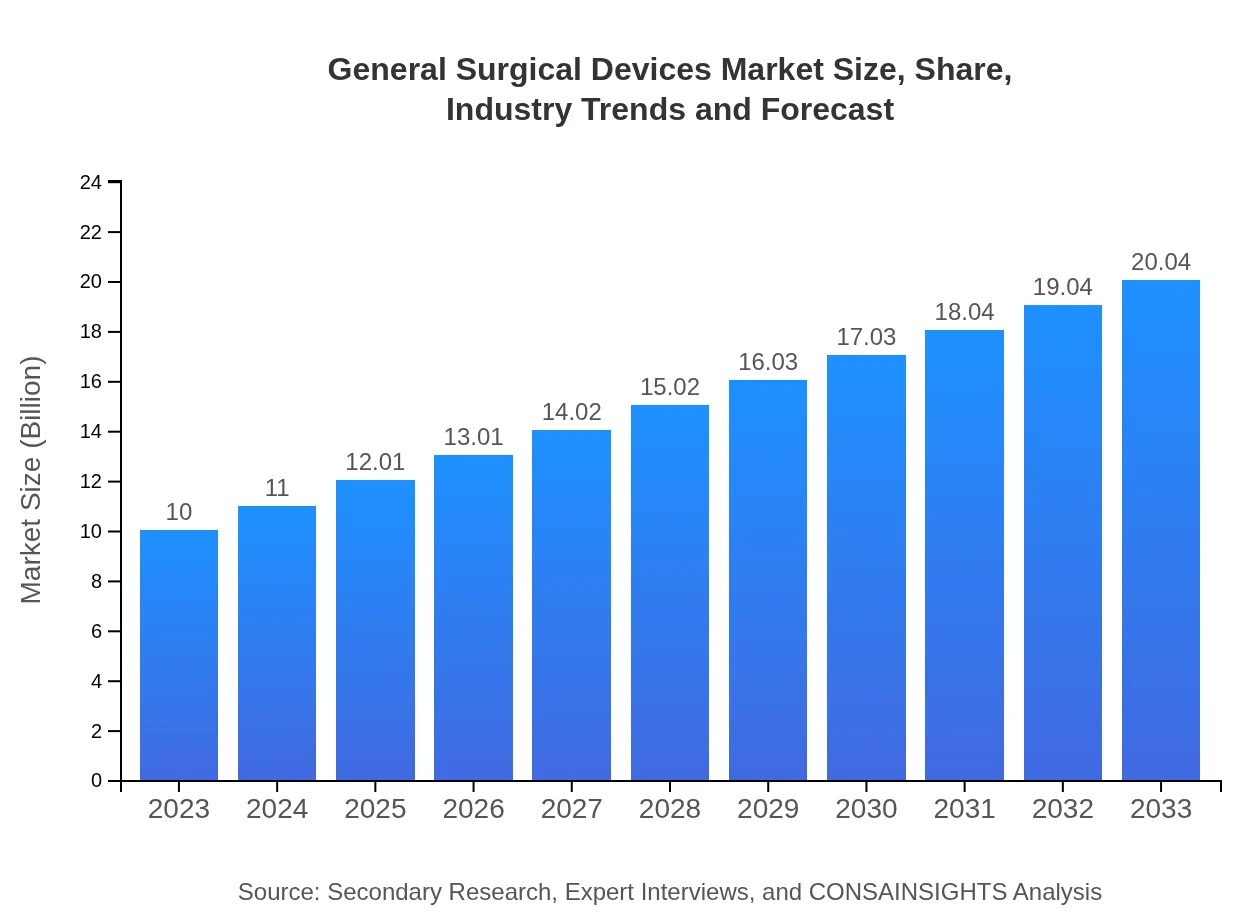

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 7% |

| 2033 Market Size | $20.04 Billion |

| Top Companies | Medtronic , Johnson & Johnson, Boston Scientific, Stryker Corporation, B.Braun Melsungen AG |

| Last Modified Date | 31 January 2026 |

General Surgical Devices Market Overview

Customize General Surgical Devices Market Report market research report

- ✔ Get in-depth analysis of General Surgical Devices market size, growth, and forecasts.

- ✔ Understand General Surgical Devices's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in General Surgical Devices

What is the Market Size & CAGR of General Surgical Devices market in 2023?

General Surgical Devices Industry Analysis

General Surgical Devices Market Segmentation and Scope

Tell us your focus area and get a customized research report.

General Surgical Devices Market Analysis Report by Region

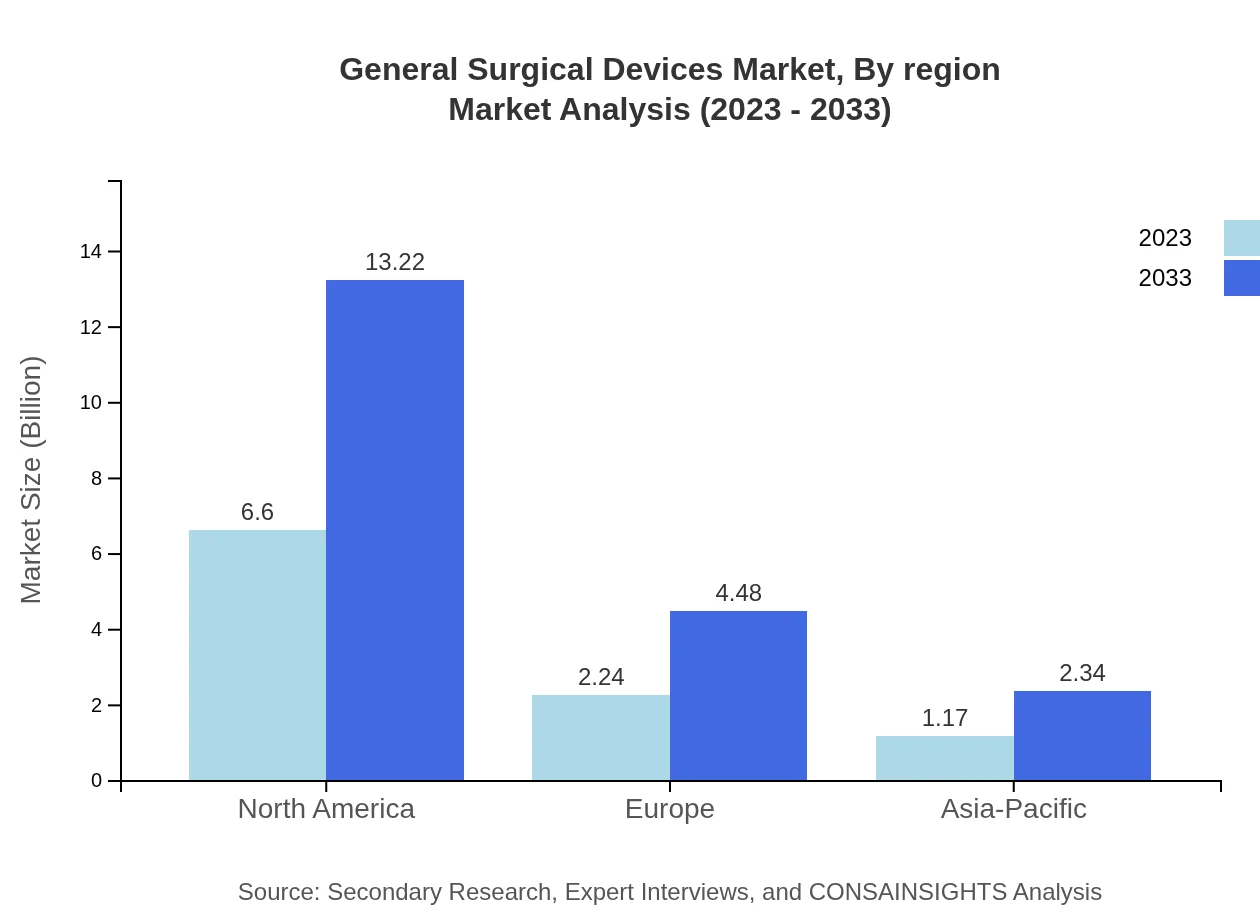

Europe General Surgical Devices Market Report:

The European market is projected to grow from $2.90 billion in 2023 to $5.81 billion by 2033. Increasing investments in healthcare, combined with a shift towards minimally invasive surgical techniques, drive this market. Regulatory support for innovative surgical solutions also plays a crucial role.Asia Pacific General Surgical Devices Market Report:

The Asia Pacific region is expected to witness significant growth, with market size projected to increase from $1.83 billion in 2023 to $3.67 billion by 2033. Factors contributing to this growth include a rising patient population, improving healthcare infrastructures, and growing disposable incomes that enable more healthcare expenditure on advanced surgical procedures.North America General Surgical Devices Market Report:

North America dominates the General Surgical Devices market, expected to expand from $3.80 billion in 2023 to $7.62 billion by 2033. The region is characterized by advanced healthcare technologies, high surgical volumes, and a strong focus on research and development. The prevalence of chronic conditions necessitating surgical interventions continues to rise.South America General Surgical Devices Market Report:

In South America, the market is projected to grow from $0.78 billion in 2023 to $1.56 billion by 2033. The growth is driven by increasing healthcare investments and a rising number of surgical procedures as part of enhanced healthcare delivery systems in the region.Middle East & Africa General Surgical Devices Market Report:

The Middle East and Africa market is anticipated to grow from $0.69 billion in 2023 to $1.39 billion by 2033. Growth factors include improving healthcare infrastructure, rising disposable incomes, and increasing adoption of advanced surgical technologies.Tell us your focus area and get a customized research report.

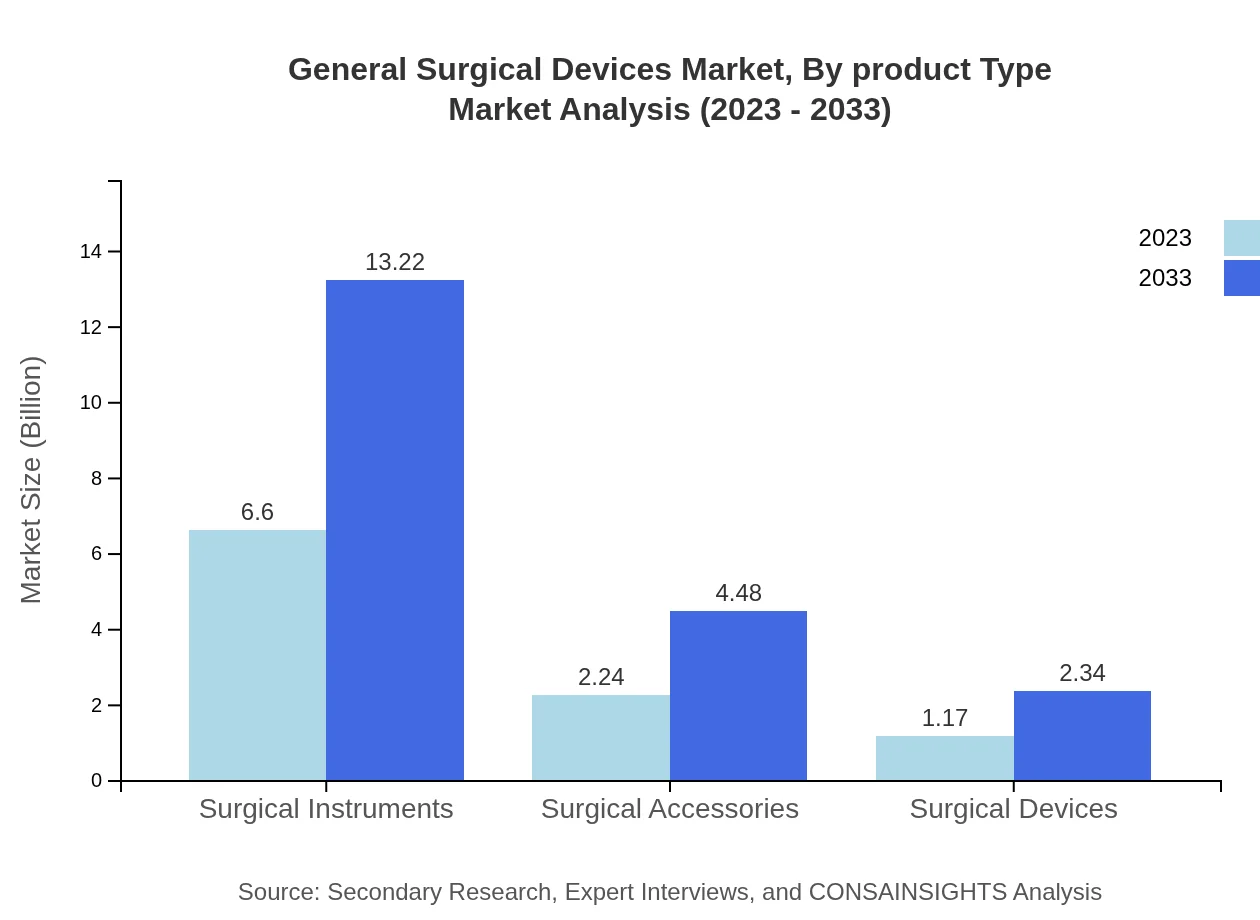

General Surgical Devices Market Analysis By Product Type

The General Surgical Devices market is primarily categorized into surgical instruments, surgical accessories, and surgical devices. Surgical instruments, including scalpels and forceps, are expected to maintain the largest market share due to their fundamental role in surgery. Surgical accessories, like sutures and staples, are also significant contributors as they complement surgical instruments. Advances in surgical devices are leading to increased prominence of robotics and image-guided technologies in surgical settings, offering greater precision and improved outcomes.

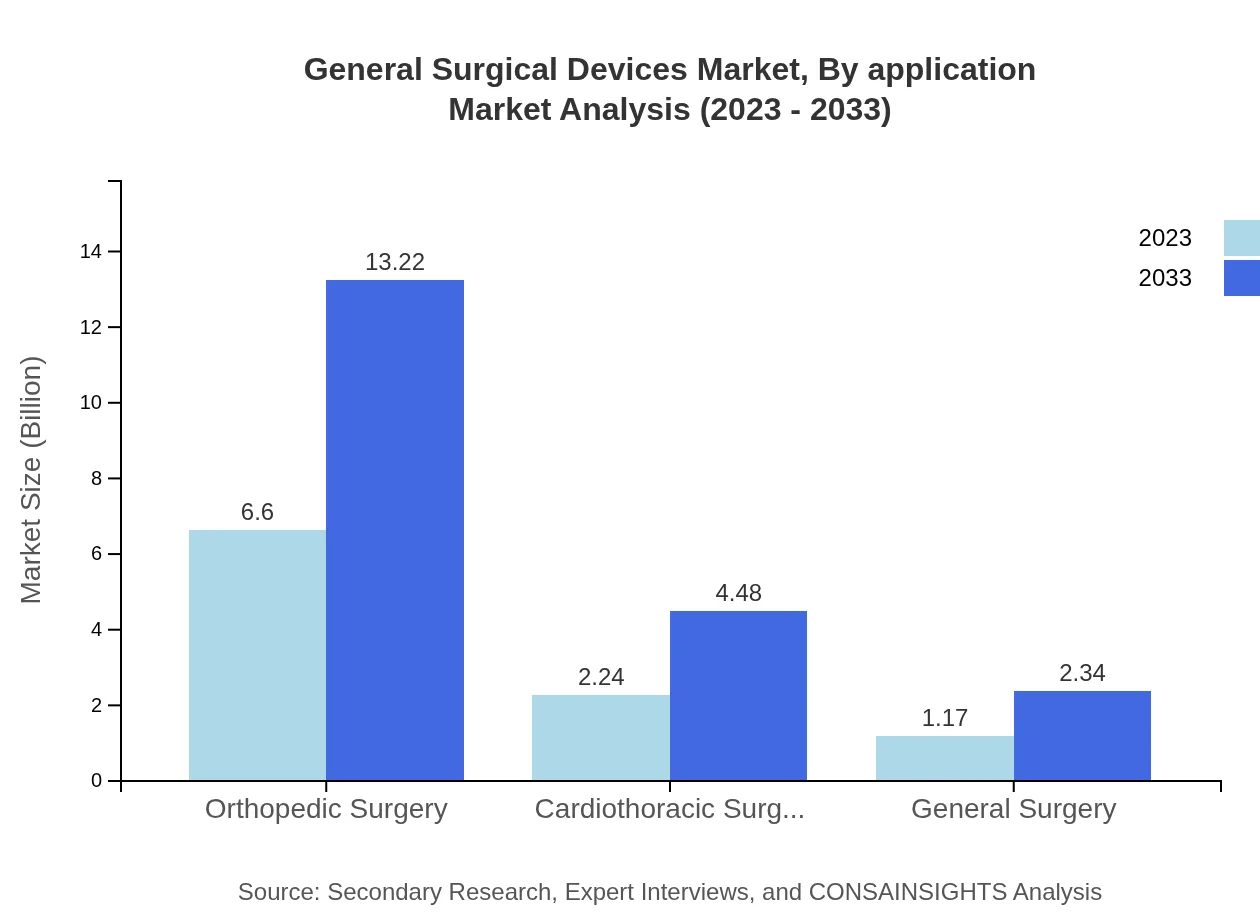

General Surgical Devices Market Analysis By Application

Applications range across various specialties including orthopedic, cardiothoracic, and general surgery, with general surgery accounting for the largest share owing to the extensive range of procedures performed. The orthopedic segment is also witnessing notable growth, driven by the rising number of orthopedic surgeries due to aging populations and increased injury incidence. Technologies supporting minimally invasive techniques continue to emerge, reshaping application trends in different surgical specialties.

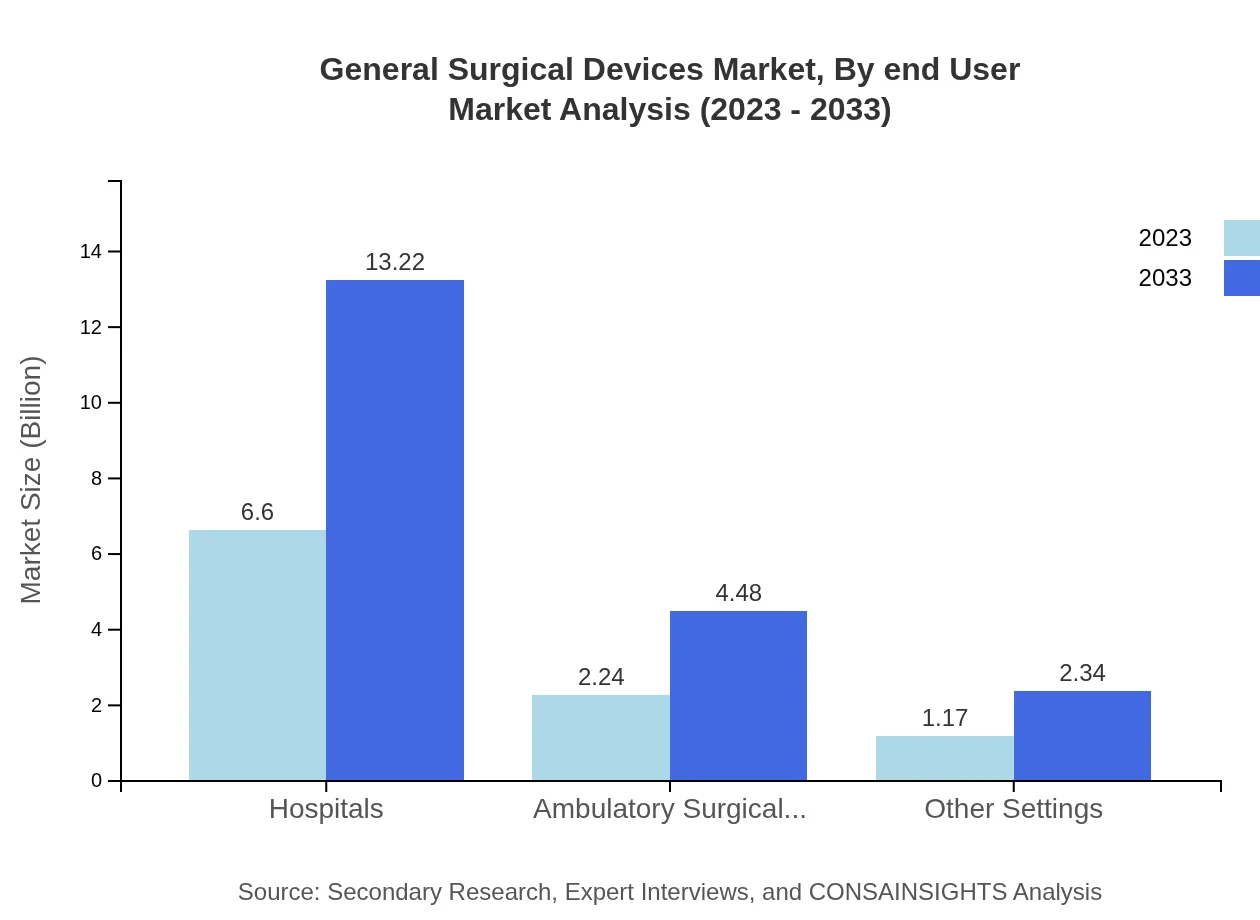

General Surgical Devices Market Analysis By End User

The end-user segment includes hospitals, ambulatory surgical centers, and other specialized clinics. Hospitals represent the largest segment due to their capacity for performing high volumes of surgeries and investments in advanced surgical technologies. Ambulatory surgical centers are gaining traction through the adoption of outpatient procedures that facilitate faster recovery times, appealing to both clinicians and patients seeking efficiency.

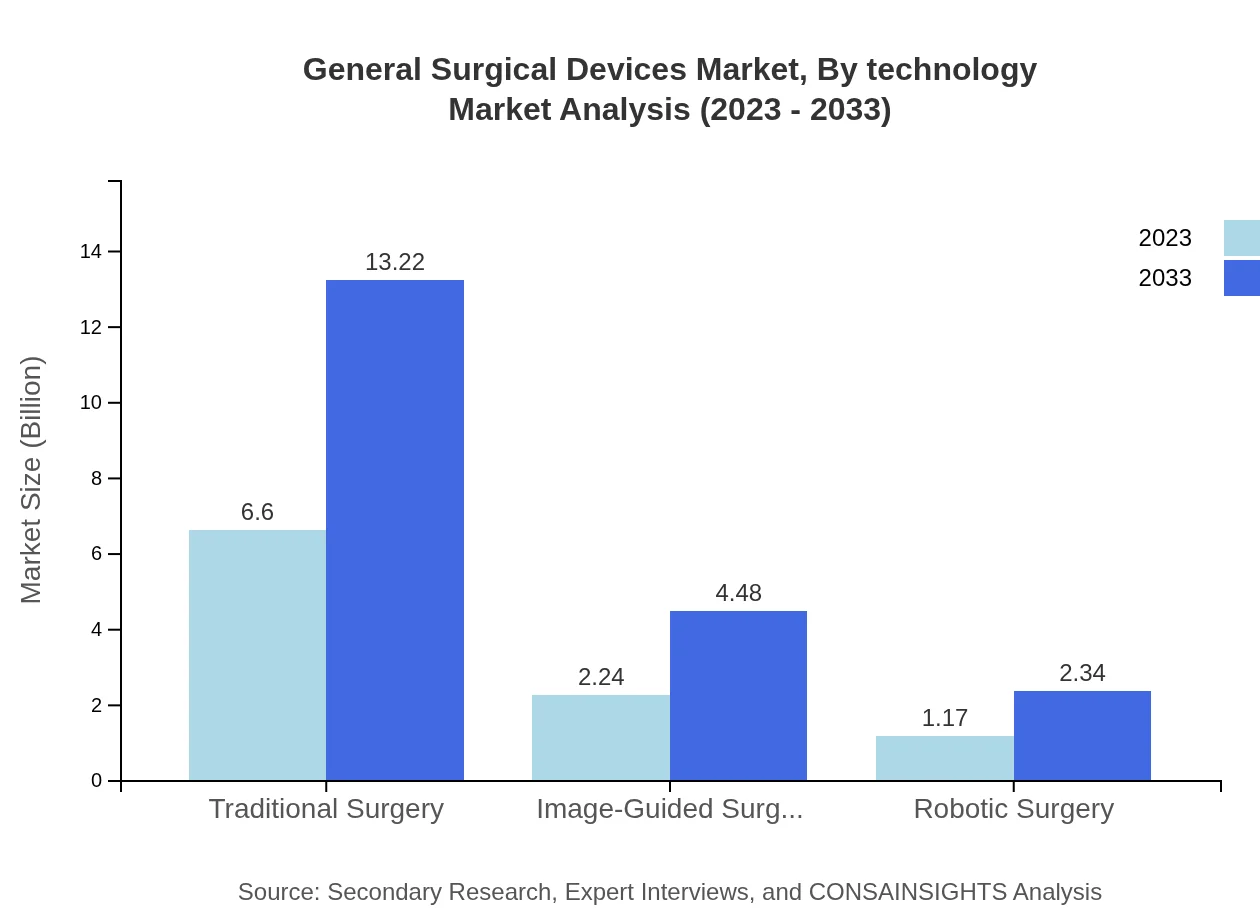

General Surgical Devices Market Analysis By Technology

Technological advancements are at the forefront of driving the General Surgical Devices market. Innovations in robotic-assisted surgery, minimally invasive techniques, and the use of smart instruments equipped with AI for better outcomes are becoming prevalent. The integration of IT solutions in surgical devices for real-time monitoring and improved decision-making is enhancing surgical precision and effectiveness.

General Surgical Devices Market Analysis By Region

Regional dynamics play a vital role in the General Surgical Devices market. In North America, technological advancements and high healthcare expenditure sustain market leadership. Europe follows with its push for innovation in surgical procedures due to stringent regulations. The Asia Pacific region is emerging rapidly, propelled by economic growth and healthcare investments. The Middle East and Africa are poised for growth as healthcare access and quality improve, and South America shows promise with rising healthcare infrastructure developments.

General Surgical Devices Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in General Surgical Devices Industry

Medtronic :

A leader in the medical technology field, Medtronic provides innovative surgical devices that enhance the quality of surgical care and patient outcomes.Johnson & Johnson:

With a broad range of surgical instruments and advanced technologies, Johnson & Johnson is pivotal in transforming surgical practices across various specialties.Boston Scientific:

Boston Scientific specializes in medical devices that provide innovative solutions for various surgical specialties, contributing significantly to market advancements.Stryker Corporation:

Known for its cutting-edge technology in surgical instruments and robotic surgery, Stryker continuously set standards for surgical device excellence in the industry.B.Braun Melsungen AG:

B.Braun focuses on developing surgical accessories and instruments that prioritize patient safety and improve surgical efficacy.We're grateful to work with incredible clients.

FAQs

What is the market size of general Surgical Devices?

The global market size for general surgical devices in 2023 is estimated at $10 billion, with a projected CAGR of 7% from 2023 to 2033. This growth indicates a robust expansion in surgical technologies and increasing surgeries worldwide.

What are the key market players or companies in this general Surgical Devices industry?

Key players in the general surgical devices market include established medical device manufacturing companies known for their innovative surgical tools, instruments, and technologies. Major firms dominate this market segment, ensuring the availability of cutting-edge devices for surgeons.

What are the primary factors driving the growth in the general surgical devices industry?

The growth in the general surgical devices market is driven by increased surgical procedures, advancements in medical technology, a rising geriatric population, and the prevalence of chronic diseases necessitating surgical interventions.

Which region is the fastest Growing in the general surgical devices?

The fastest-growing region for general surgical devices is North America, with a market size of $3.80 billion in 2023, expected to reach $7.62 billion by 2033. This growth is attributed to advanced healthcare infrastructure and innovative surgical practices.

Does ConsaInsights provide customized market report data for the general surgical devices industry?

Yes, ConsaInsights offers customized market report data for the general surgical devices industry. This tailored approach helps businesses gain valuable insights specific to their needs and market segments.

What deliverables can I expect from this general surgical devices market research project?

From the general surgical devices market research project, expect comprehensive reports, insights on market trends, segmentation analysis, competitive landscape, and forecasts that can guide strategic decision-making.

What are the market trends of general surgical devices?

Current trends in the general surgical devices market include the integration of robotic-assisted surgeries, minimally invasive techniques, and the increasing use of imaging technologies to enhance surgical outcomes and patient recovery.