Generic Injectables Market Report

Published Date: 31 January 2026 | Report Code: generic-injectables

Generic Injectables Market Size, Share, Industry Trends and Forecast to 2033

This report offers a comprehensive analysis of the Generic Injectables market, covering its size, growth projections, industry dynamics, and regional insights from 2023 to 2033.

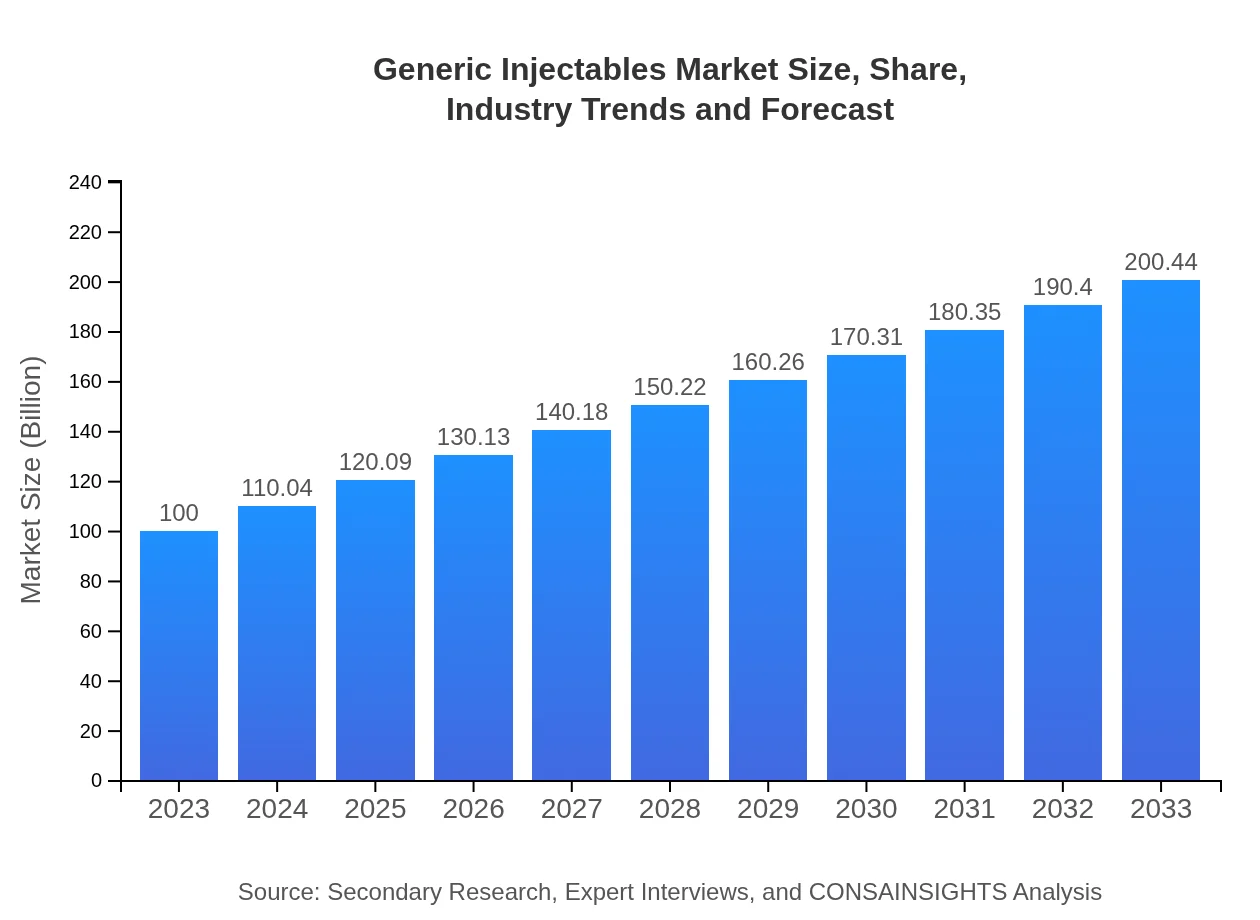

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $100.00 Billion |

| CAGR (2023-2033) | 7% |

| 2033 Market Size | $200.44 Billion |

| Top Companies | Teva Pharmaceutical Industries Ltd., Sandoz (Novartis) |

| Last Modified Date | 31 January 2026 |

Generic Injectables Market Overview

Customize Generic Injectables Market Report market research report

- ✔ Get in-depth analysis of Generic Injectables market size, growth, and forecasts.

- ✔ Understand Generic Injectables's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Generic Injectables

What is the Market Size & CAGR of Generic Injectables market in 2023?

Generic Injectables Industry Analysis

Generic Injectables Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Generic Injectables Market Analysis Report by Region

Europe Generic Injectables Market Report:

The European market for Generic Injectables is anticipated to double, growing from $26.10 billion in 2023 to $52.32 billion by 2033. The robust regulatory framework and emphasis on patient safety drive this market increase.Asia Pacific Generic Injectables Market Report:

The Asia Pacific region is anticipated to experience remarkable growth, with the market projected to expand from $20.61 billion in 2023 to $41.31 billion by 2033. This growth is fueled by increased healthcare expenditure, population growth, and advancements in healthcare infrastructure.North America Generic Injectables Market Report:

North America leads the market with a size of $36.02 billion in 2023, projected to reach $72.20 billion by 2033. This dominance is due to high healthcare standards, established pharmaceutical companies, and significant investments in healthcare innovation.South America Generic Injectables Market Report:

In South America, the Generic Injectables market is expected to grow from $8.85 billion in 2023 to $17.74 billion by 2033. This growth is attributed to rising health concerns and increased demand for cost-effective healthcare solutions.Middle East & Africa Generic Injectables Market Report:

The Middle East and Africa's market for Generic Injectables is forecasted to rise from $8.42 billion in 2023 to $16.88 billion by 2033, supported by improving healthcare infrastructure and governmental initiatives aimed at enhancing health service delivery.Tell us your focus area and get a customized research report.

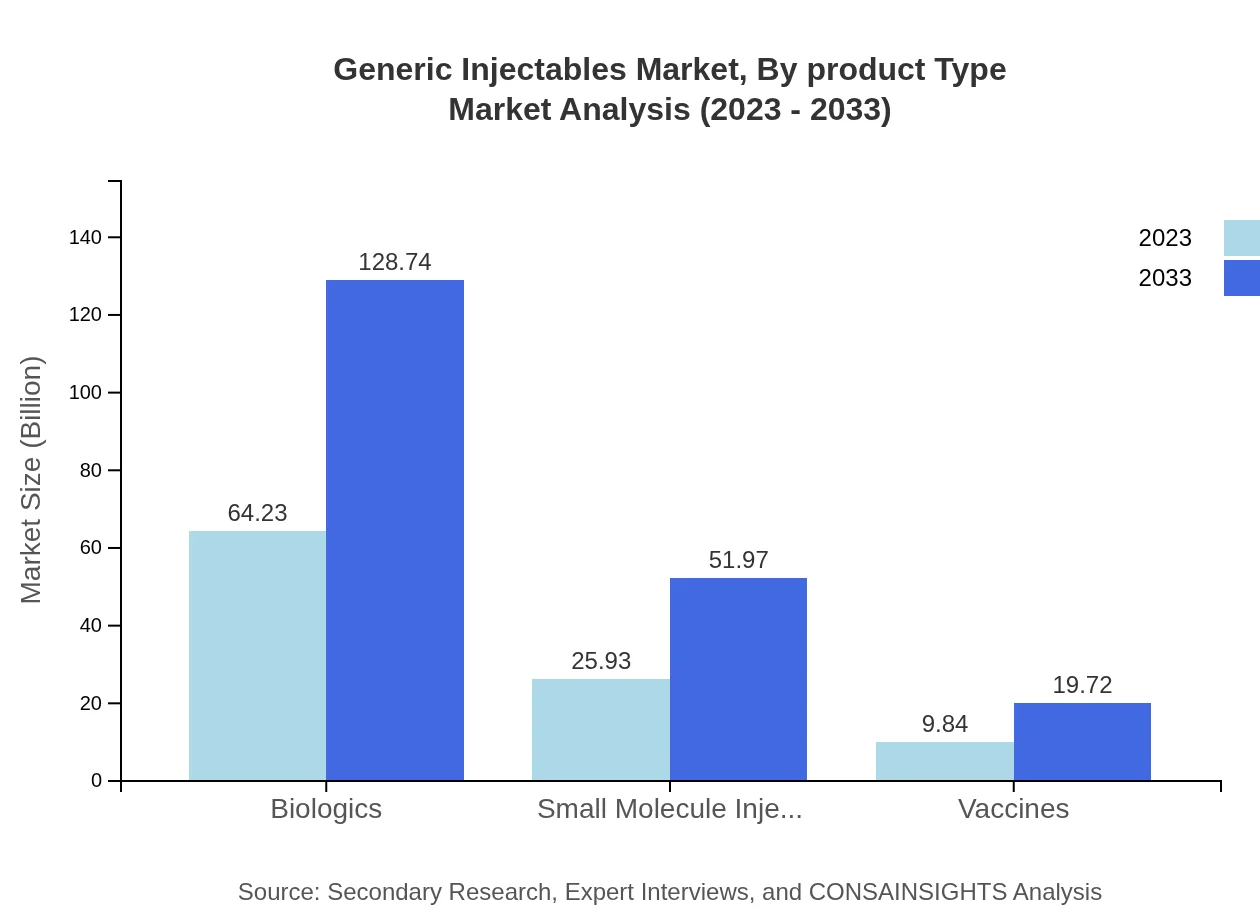

Generic Injectables Market Analysis By Product Type

The market for Generic Injectables can be further analyzed through product types such as biologics, small molecule injectables, and vaccines. Among these, biologics dominate the market, projected to grow from $64.23 billion in 2023 to $128.74 billion by 2033, showcasing a high demand for innovative therapies.

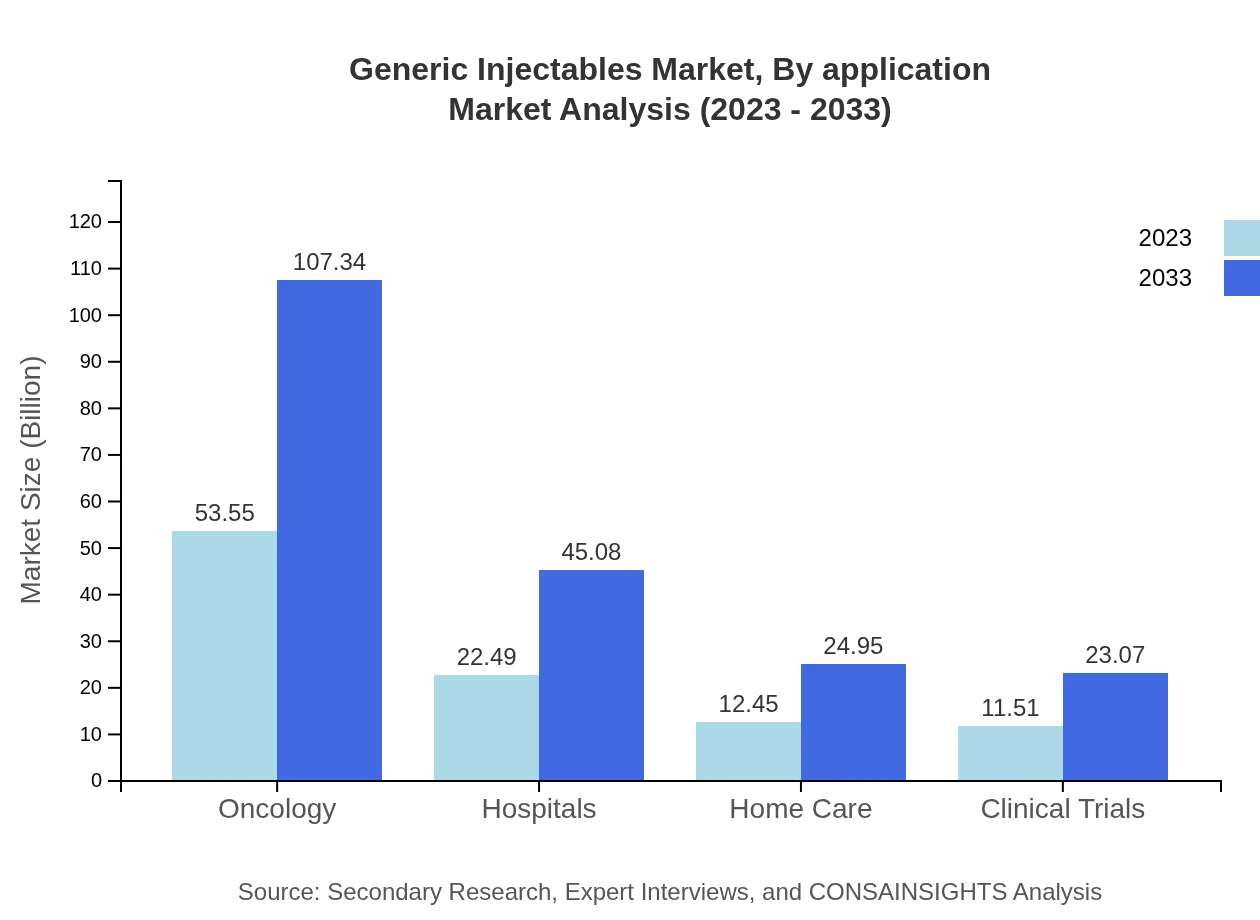

Generic Injectables Market Analysis By Application

In terms of applications, the oncology sector leads, growing from $53.55 billion in 2023 to $107.34 billion by 2033. This segment highlights the increasing use of injectables in cancer treatment protocols, reflecting the industry's focus on critical health issues.

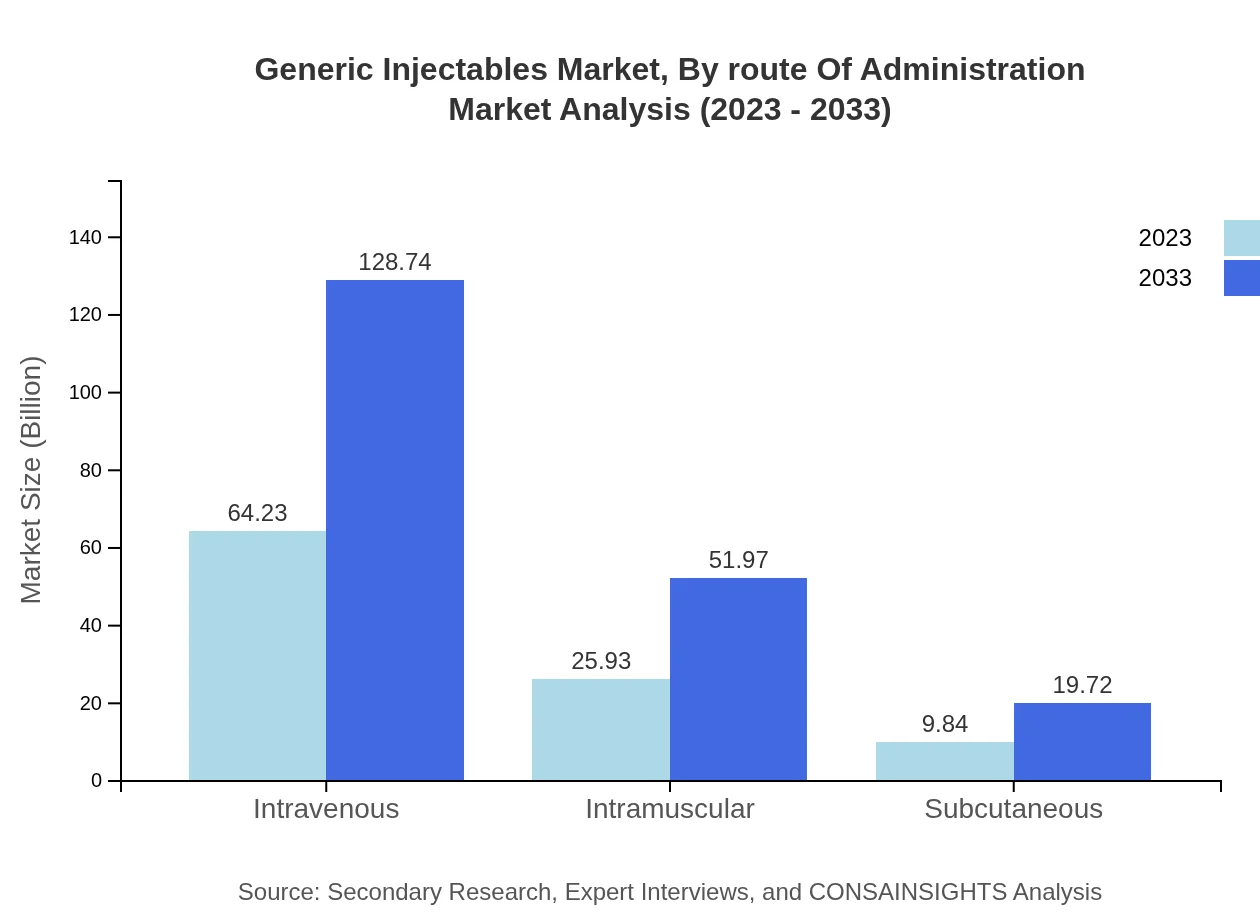

Generic Injectables Market Analysis By Route Of Administration

The route of administration analysis reveals that intravenous injectables are the largest segment, with a size of $64.23 billion in 2023, expected to reach $128.74 billion by 2033. This indicates a growing preference for intravenous treatments among healthcare providers.

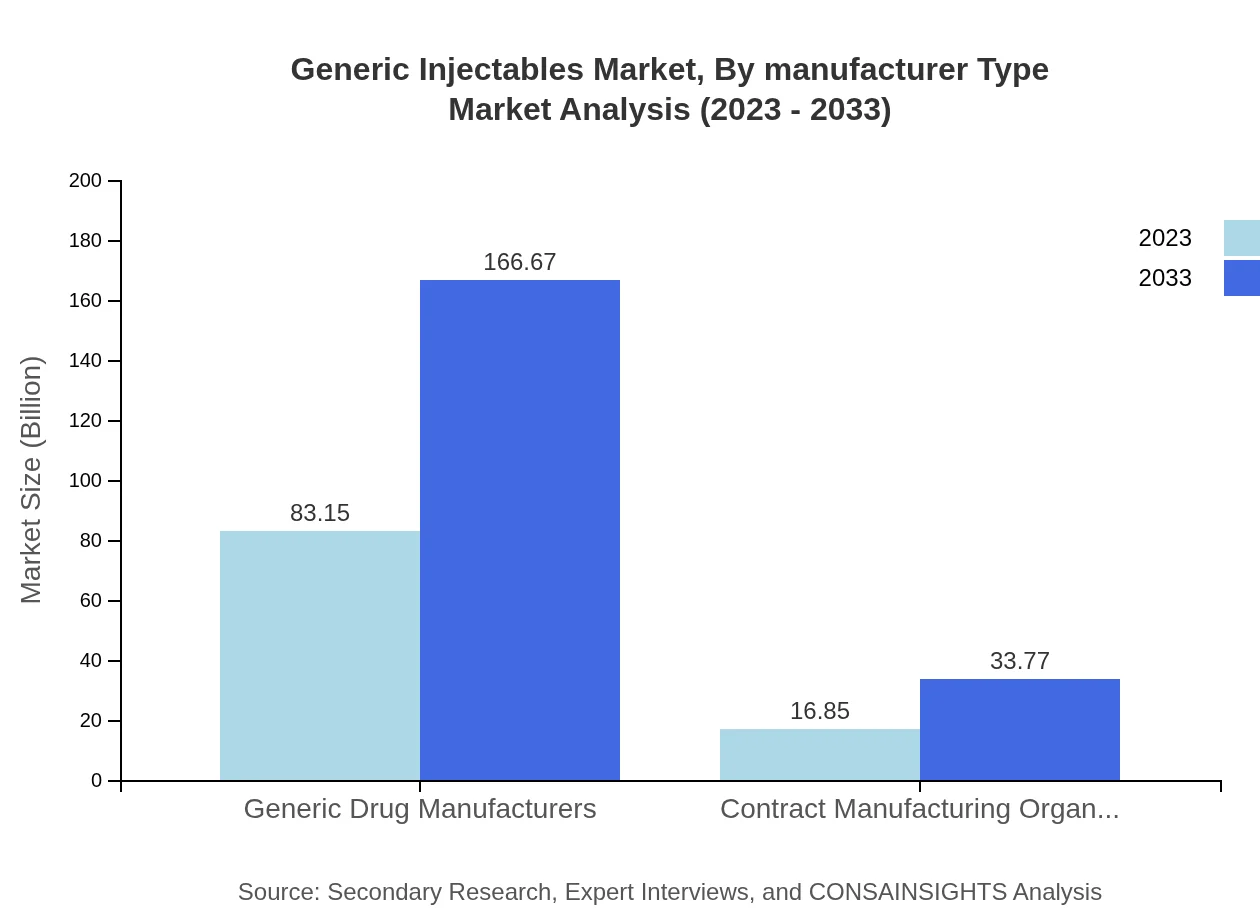

Generic Injectables Market Analysis By Manufacturer Type

Generic Drug Manufacturers are significantly leading, demonstrating a market size of $83.15 billion in 2023, projected to double by 2033. Contract Manufacturing Organizations (CMOs) also exhibit steady growth from $16.85 billion to $33.77 billion over the next decade, underpinning the increasing outsourcing of manufacturing processes.

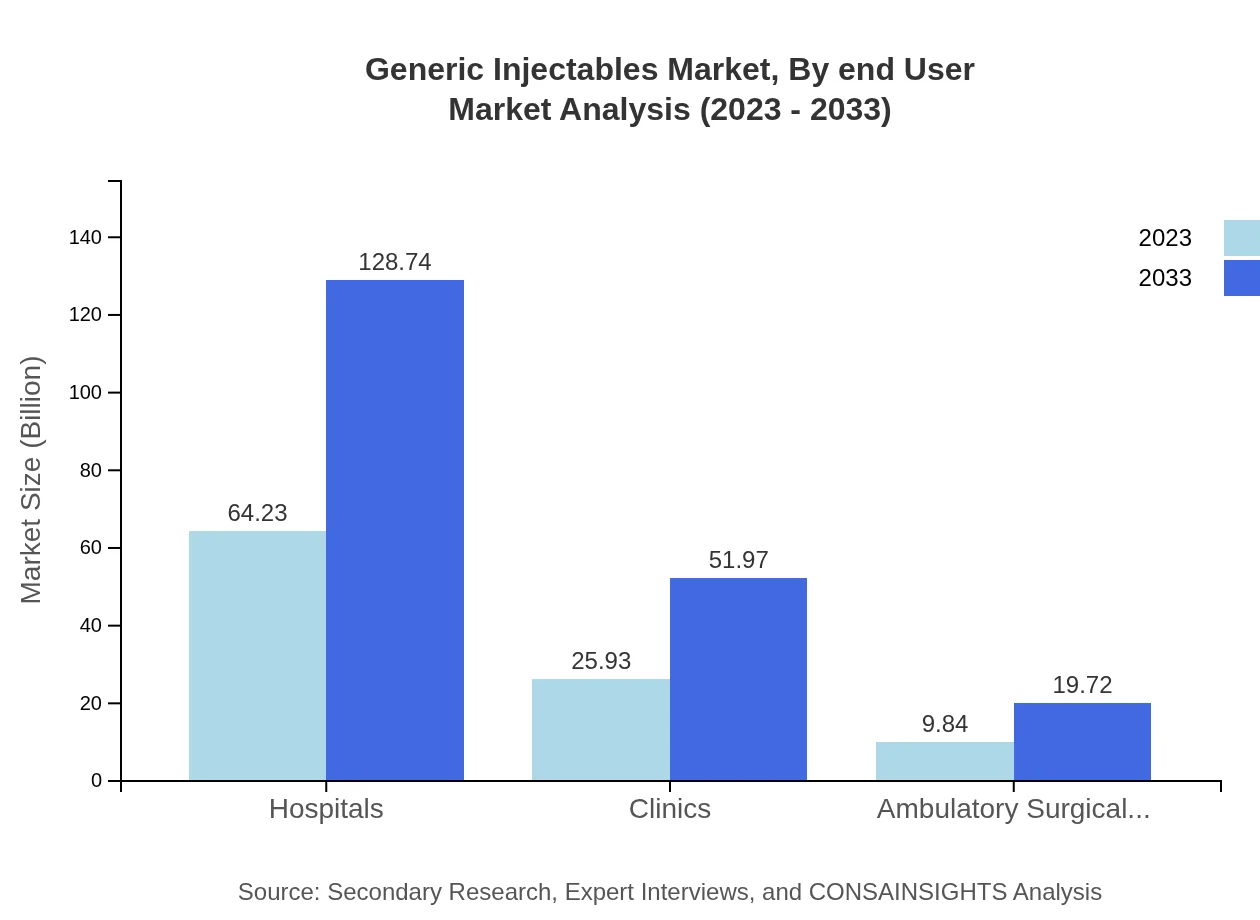

Generic Injectables Market Analysis By End User

Hospitals remain the primary end-user segment, with a projected market size of $64.23 billion in 2023, reflecting their extensive use of injectable medications in patient care. Clinics and home care settings also show promising growth, capitalizing on the trend towards decentralized healthcare.

Generic Injectables Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Generic Injectables Industry

Teva Pharmaceutical Industries Ltd.:

Teva is a leading generic drug manufacturer focusing on high-quality, cost-effective medicines, including a substantial portfolio of injectable products.Sandoz (Novartis):

Sandoz is renowned for its generics and biosimilars, offering a wide range of injectables that cater to diverse healthcare needs globally.We're grateful to work with incredible clients.

FAQs

What is the market size of generic Injectables?

The global generic injectables market is valued at approximately $100 billion in 2023, with a projected growth rate of 7% CAGR, expected to reach significant heights by 2033. This growth demonstrates the increasing adoption and reliance on these vital medical products.

What are the key market players or companies in the generic Injectables industry?

The giants in the generic injectables market encompass renowned pharmaceutical companies and contract manufacturers. Key players include Pfizer, Teva Pharmaceuticals, and Mylan, who leverage advanced manufacturing techniques to secure their position in this competitive landscape.

What are the primary factors driving the growth in the generic injectables industry?

Factors fueling growth in the generic injectables market comprise rising healthcare expenditures, increasing demand for affordable medications, and advancements in injection technologies that enhance efficacy and patient compliance across various treatment regimens.

Which region is the fastest Growing in the generic injectables market?

The fast-growing region in the generic injectables market is Asia Pacific, with its market projected to grow from $20.61 billion in 2023 to $41.31 billion by 2033, fueled by expanding healthcare infrastructure and increasing access to medications.

Does ConsaInsights provide customized market report data for the generic injectables industry?

Yes, ConsaInsights offers tailored market report data, ensuring clients receive insights specific to their needs and interest areas within the generic injectables industry, thus empowering strategic decision-making and addressing unique market challenges.

What deliverables can I expect from this generic Injectables market research project?

Clients can expect comprehensive market analysis reports, including detailed market size, growth forecasts, regional insights, competitive analysis, and segment performance, enabling informed strategic decision-making within the generic injectables market.

What are the market trends of generic injectables?

Current market trends for generic injectables include a rise in biologics, innovative packaging solutions, expansion of telemedicine, and increasing emphasis on biosimilars, reflecting an evolving landscape aiming to meet diverse patient and healthcare provider needs.