Genotyping Assay Market Report

Published Date: 31 January 2026 | Report Code: genotyping-assay

Genotyping Assay Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive overview of the Genotyping Assay market trends, size, segments, and regional breakdown, forecasting developments from 2023 to 2033. Insights into key players, industry analysis, and market forecasts are included for stakeholders' decision-making support.

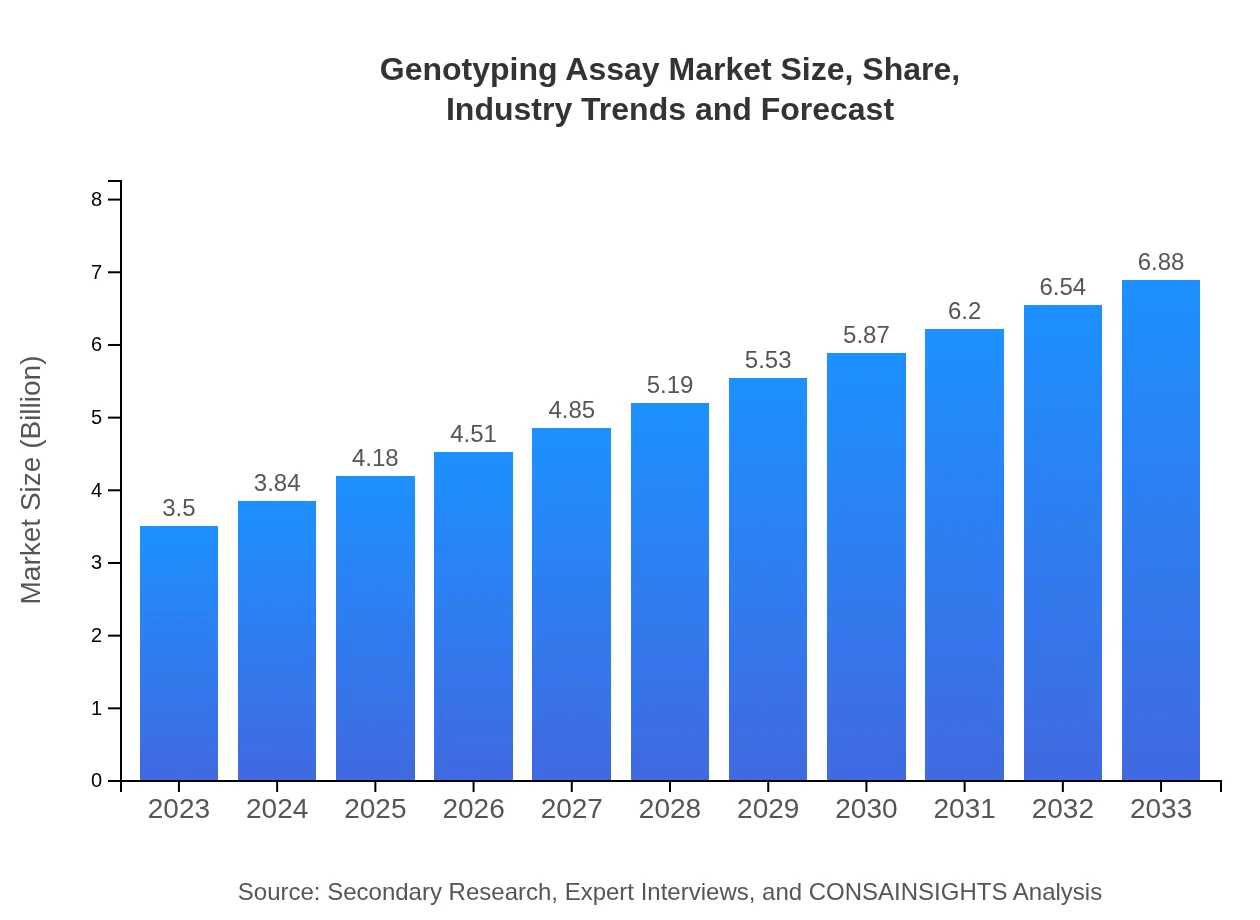

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $6.88 Billion |

| Top Companies | Thermo Fisher Scientific, Illumina, Inc., Agilent Technologies, QIAGEN N.V., Promega Corporation |

| Last Modified Date | 31 January 2026 |

Genotyping Assay Market Overview

Customize Genotyping Assay Market Report market research report

- ✔ Get in-depth analysis of Genotyping Assay market size, growth, and forecasts.

- ✔ Understand Genotyping Assay's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Genotyping Assay

What is the Market Size & CAGR of Genotyping Assay market in 2023?

Genotyping Assay Industry Analysis

Genotyping Assay Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Genotyping Assay Market Analysis Report by Region

Europe Genotyping Assay Market Report:

The European Genotyping Assay market is anticipated to grow from USD 1.16 billion in 2023 to USD 2.28 billion by 2033. Factors driving this growth include increasing acceptance of personalized medicine, advancements in genetic testing technologies, and substantial investments in genomic research by countries like Germany and the UK.Asia Pacific Genotyping Assay Market Report:

In the Asia Pacific region, the Genotyping Assay market is projected to grow from USD 0.67 billion in 2023 to USD 1.32 billion by 2033. This growth is fueled by increasing investments in biotechnology R&D, an expanding healthcare infrastructure, and a rising population engaging in genetic testing. Countries like China and India are becoming prominent players, driven by a surge in research initiatives and collaborations with global institutions.North America Genotyping Assay Market Report:

North America holds a significant share of the Genotyping Assay market, with an estimated value of USD 1.14 billion in 2023, projected to reach USD 2.23 billion by 2033. Factors such as a strong R&D framework, high adoption of genetic testing, and the presence of leading market players significantly contribute to growth, along with increasing government funding for genetic research.South America Genotyping Assay Market Report:

The South American market for Genotyping Assays is expected to expand from USD 0.20 billion in 2023 to USD 0.38 billion by 2033. Although the market is relatively smaller compared to others, growing awareness of genetic disorders, advancements in healthcare technology, and governmental support for biotechnology are driving growth in this region.Middle East & Africa Genotyping Assay Market Report:

In the Middle East and Africa, the market is projected to increase from USD 0.34 billion in 2023 to USD 0.66 billion by 2033. The growing medical research landscape and initiatives aimed at enhancing healthcare delivery are pivotal, although the market's growth may be moderated by inconsistencies in healthcare infrastructure in certain regions.Tell us your focus area and get a customized research report.

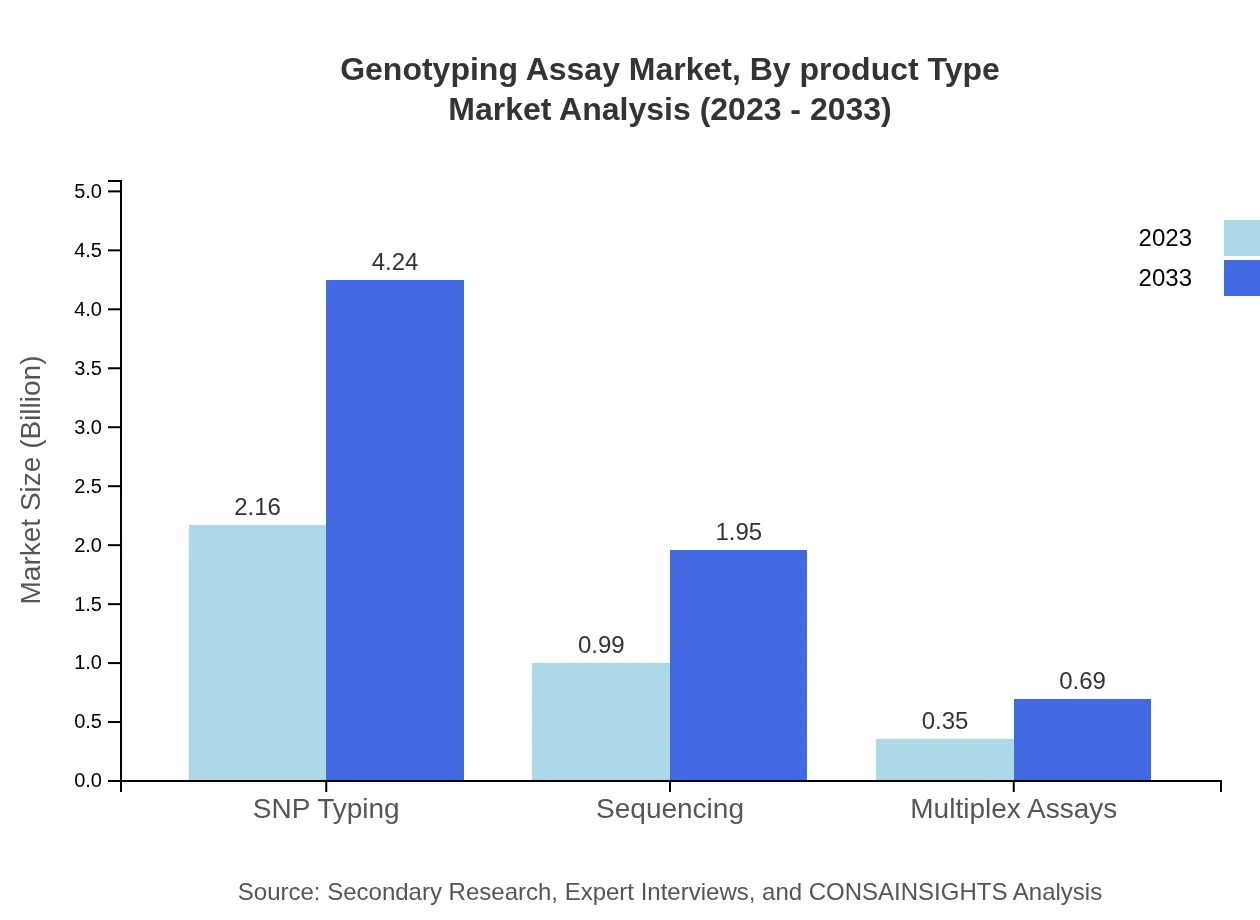

Genotyping Assay Market Analysis By Product Type

The product type segment includes dominant categories such as SNP typing, which accounted for 61.61% share in 2023 with a market size of USD 2.16 billion, projected to grow to USD 4.24 billion by 2033. Other notable segments include clinical diagnostics, digital PCR, and nucleic acid sequencing, contributing significantly to the overall market size due to their diverse applications in research and clinical settings.

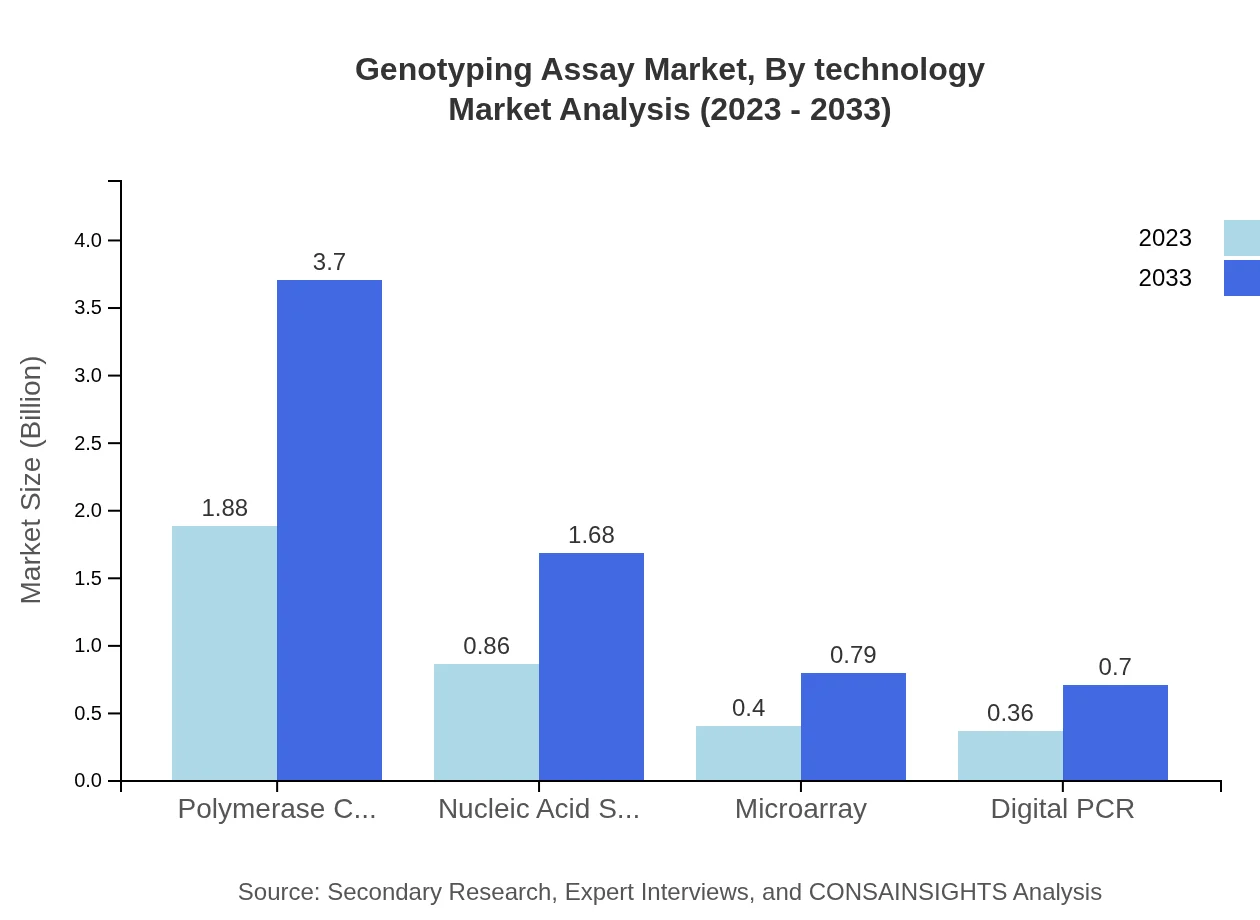

Genotyping Assay Market Analysis By Technology

The analysis by technology reveals that Polymerase Chain Reaction (PCR) holds the largest market share at 53.82% in 2023, valued at USD 1.88 billion, expected to rise to USD 3.70 billion in 2033. Other technologies, such as Nucleic Acid Sequencing and Microarray, also play a crucial role, addressing specific needs across different genomic applications and contributing to market growth.

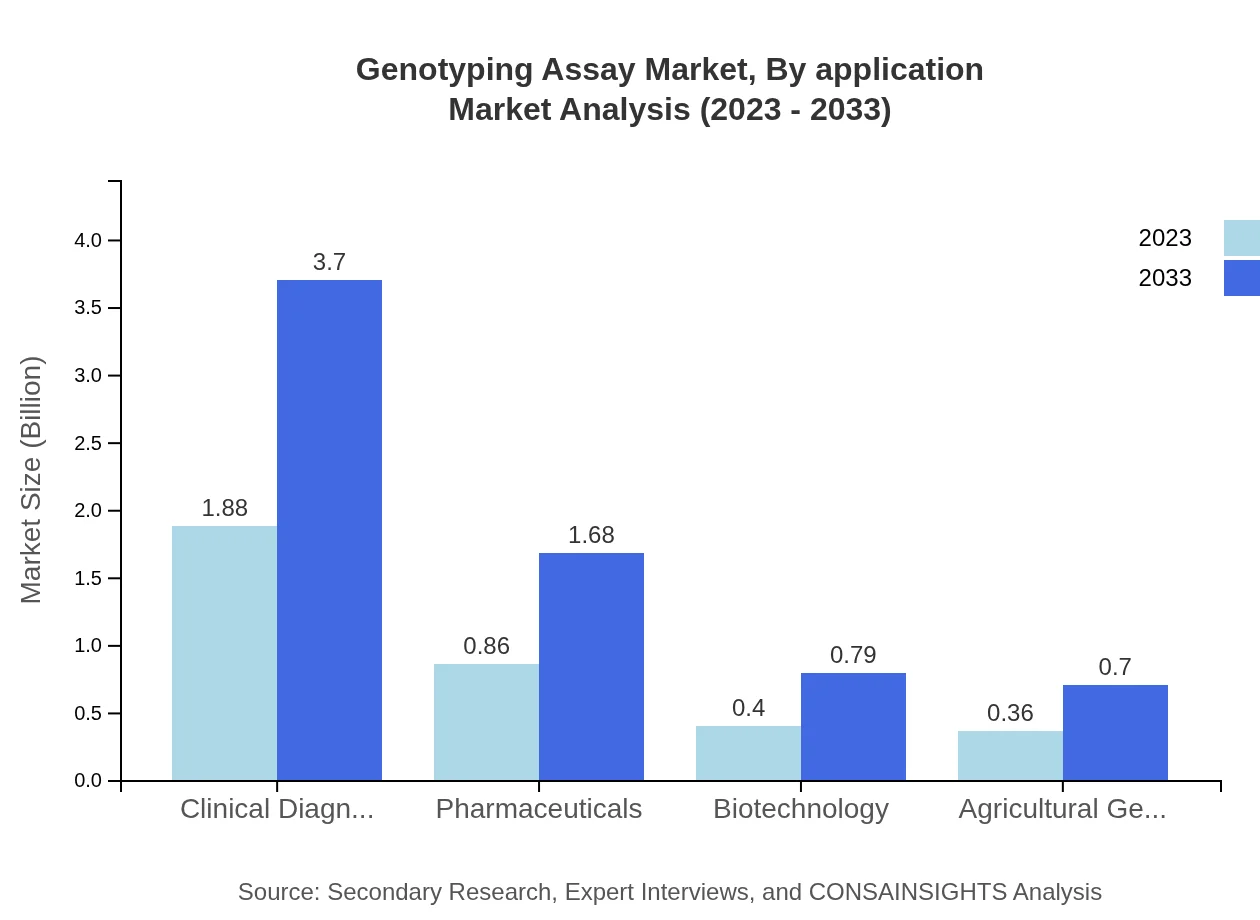

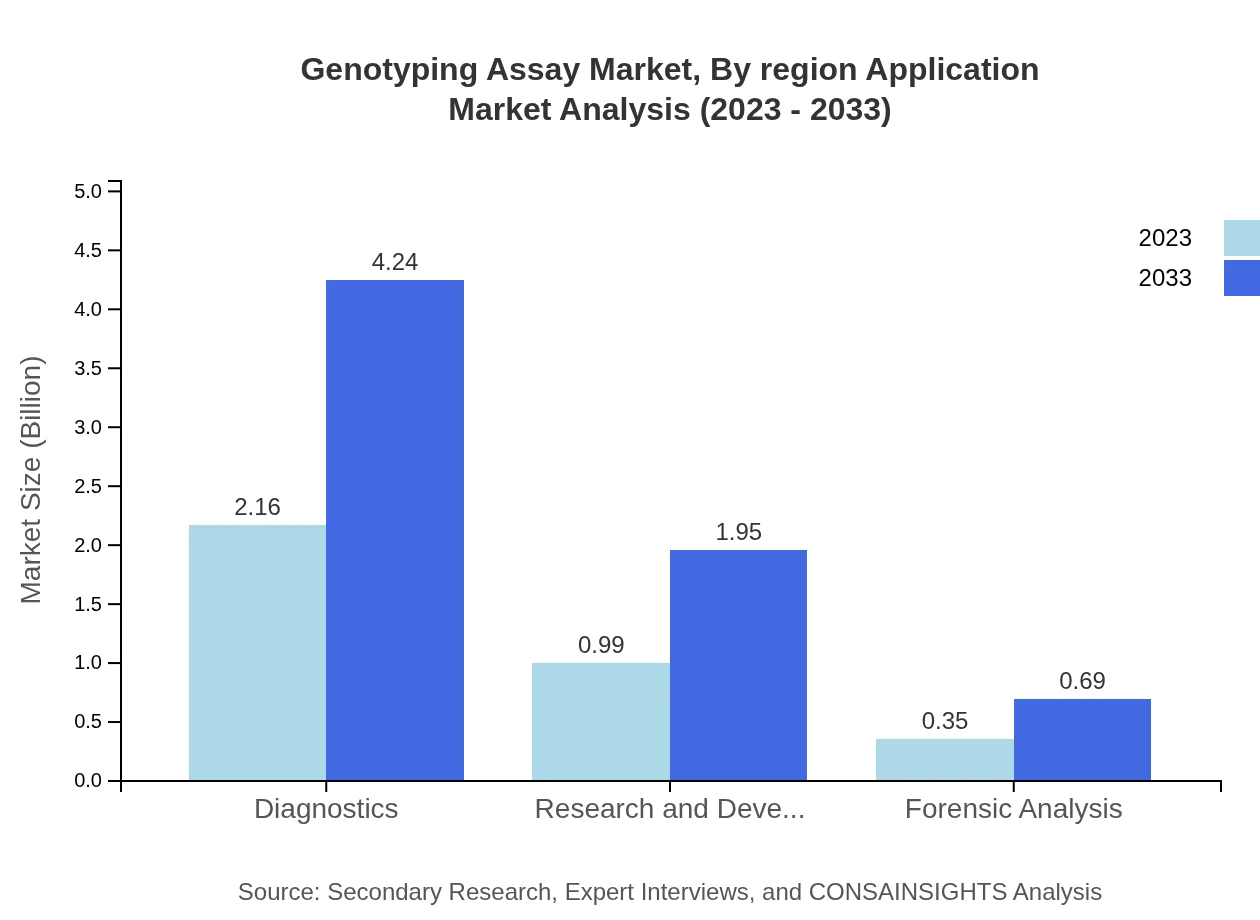

Genotyping Assay Market Analysis By Application

By application, the clinical diagnostics segment leads with a 53.82% market share, amounting to USD 1.88 billion in 2023, increasing to USD 3.70 billion by 2033. The pharmaceutical and biotechnology sector, as well as forensic analysis, are significant contributors, showcasing the versatility of genotyping assays in various essential fields.

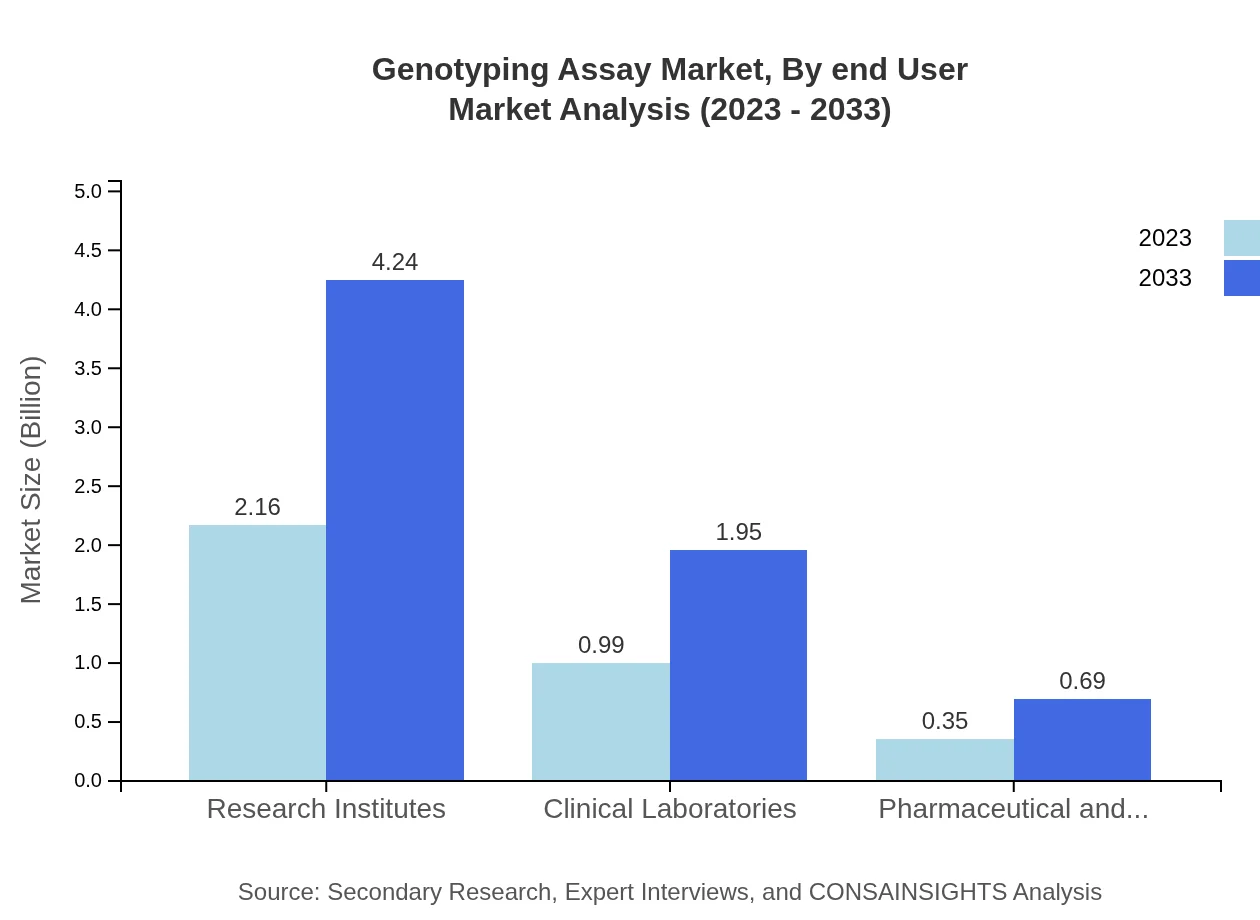

Genotyping Assay Market Analysis By End User

The primary end-users include research institutions, which dominate the market with a 61.61% share, valued at USD 2.16 billion in 2023. Clinical laboratories and pharmaceutical and biotechnology companies follow, indicating growing reliance on genotyping techniques across these sectors for effective decision-making grounded in genetic data.

Genotyping Assay Market Analysis By Region Application

The application segment analytics reveal tailored applications of genotyping assays across regions. North America leads in applications within clinical diagnostics and pharmaceutical development. In contrast, regions like Asia Pacific and Latin America showcase growing trends in agricultural genomics, driven by localized research needs and advancements in biotechnology.

Genotyping Assay Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Genotyping Assay Industry

Thermo Fisher Scientific:

A leading player in the field, Thermo Fisher provides a wide array of genotyping assay products and services, leveraging advanced technologies to enhance research capabilities.Illumina, Inc.:

Illumina is prominent for its cutting-edge next-generation sequencing technology and genotyping platforms, significantly impacting genetic research and diagnostics.Agilent Technologies:

Agilent offers innovative and high-quality genotyping products that cater to multiple fields, including pharmaceuticals and environmental genomics.QIAGEN N.V.:

QIAGEN specializes in sample and assay technologies, providing essential tools for genotyping and enhancing the precision of genetic testing in clinical and research settings.Promega Corporation:

Promega is known for its contributions to biotechnology solutions, offering various genotyping assays that advance research in medical and forensic applications.We're grateful to work with incredible clients.

FAQs

What is the market size of genotyping Assay?

The global genotyping assay market is valued at approximately $3.5 billion in 2023 and is projected to grow at a CAGR of 6.8%, aiming for significant expansion at $6.9 billion by 2033.

What are the key market players or companies in the genotyping Assay industry?

Key players in the genotyping assay market include established firms in biotechnology, diagnostics, and pharmaceuticals, providing a diverse array of technologies and services. These companies lead innovation, enhancing the market's competitive edge.

What are the primary factors driving the growth in the genotyping Assay industry?

Growth drivers for the genotyping assay market include increasing demand for personalized medicine, advancements in genomic technologies, rising research and development activities, and expanding applications in various fields such as agriculture and forensics.

Which region is the fastest Growing in the genotyping Assay?

The fastest-growing region in the genotyping assay market is projected to be Europe, expanding from $1.16 billion in 2023 to $2.28 billion by 2033, showcasing a strong compound annual growth rate.

Does ConsaInsights provide customized market report data for the genotyping Assay industry?

Yes, ConsaInsights specializes in customized market report data, tailored to specific client needs in the genotyping assay industry, ensuring relevant and actionable insights.

What deliverables can I expect from this genotyping Assay market research project?

Expected deliverables include comprehensive market analysis reports, segment-specific data, regional insights, and strategic recommendations that help stakeholders understand market dynamics and make informed decisions.

What are the market trends of genotyping Assay?

Current trends in the genotyping assay market reflect technological advancements, with a notable shift towards automation and high-throughput systems, coupled with an increased focus on precision agriculture and genetic research.