Geriatric Medicines Market Report

Published Date: 31 January 2026 | Report Code: geriatric-medicines

Geriatric Medicines Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report explores the Geriatric Medicines market, focusing on size, segmentation, trends, and forecasts from 2023 to 2033. In-depth regional insights and analysis of market dynamics provide critical information for stakeholders in this evolving sector.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

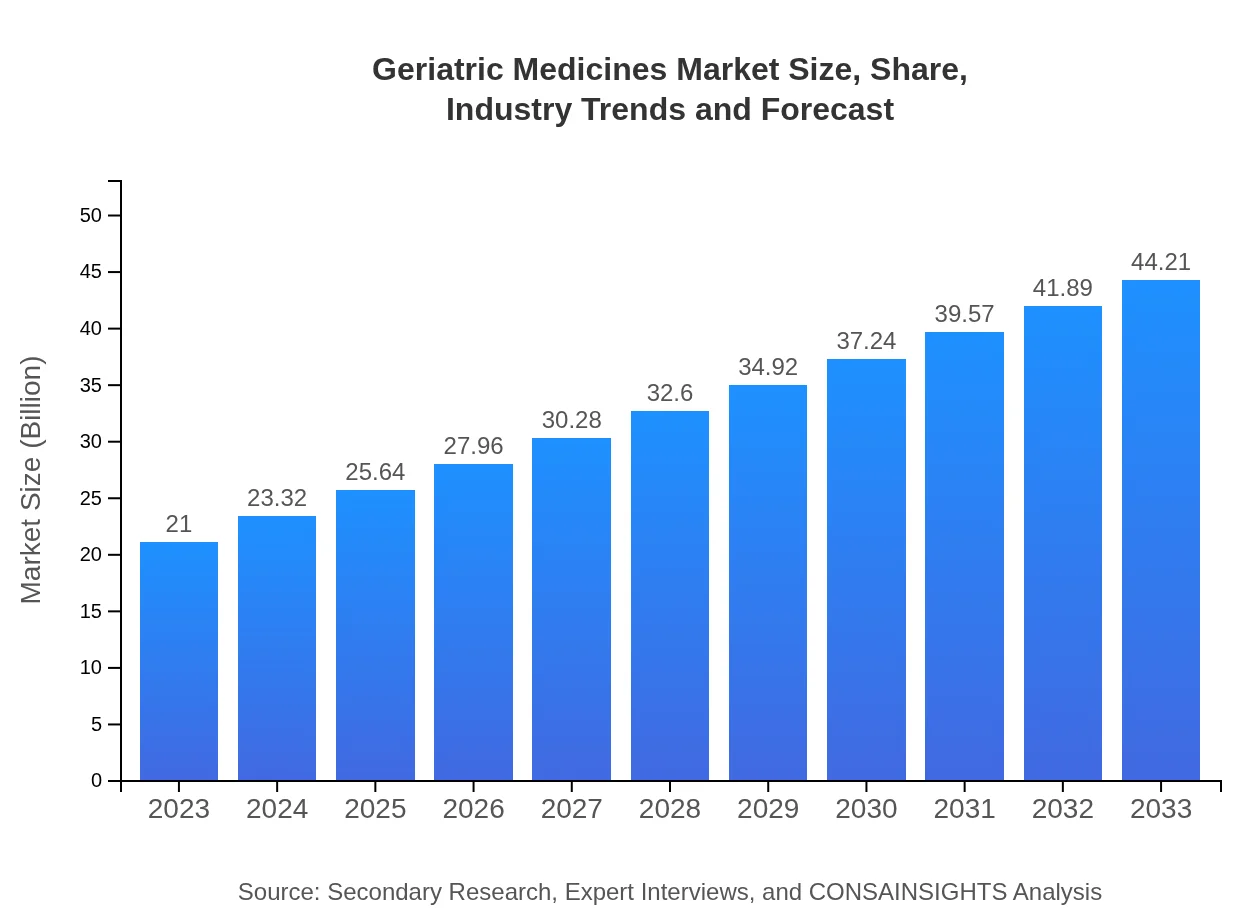

| 2023 Market Size | $21.00 Billion |

| CAGR (2023-2033) | 7.5% |

| 2033 Market Size | $44.21 Billion |

| Top Companies | Pfizer Inc., Novartis AG, Johnson & Johnson, Bristol-Myers Squibb |

| Last Modified Date | 31 January 2026 |

Geriatric Medicines Market Overview

Customize Geriatric Medicines Market Report market research report

- ✔ Get in-depth analysis of Geriatric Medicines market size, growth, and forecasts.

- ✔ Understand Geriatric Medicines's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Geriatric Medicines

What is the Market Size & CAGR of Geriatric Medicines market in 2023?

Geriatric Medicines Industry Analysis

Geriatric Medicines Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Geriatric Medicines Market Analysis Report by Region

Europe Geriatric Medicines Market Report:

The European market was valued at $5.27 billion in 2023, projected to nearly double to $11.09 billion by 2033. The rapid growth in Europe is attributed to a higher proportion of elderly people, along with stringent regulations encouraging pharmaceutical innovation tailored for older populations.Asia Pacific Geriatric Medicines Market Report:

In the Asia Pacific region, the Geriatric Medicines market is projected to grow from $4.09 billion in 2023 to approximately $8.60 billion by 2033. The growth is driven by increasing geriatric populations and governmental initiatives to improve healthcare infrastructure. Countries like China and Japan are leading this growth due to their significant elderly demographics.North America Geriatric Medicines Market Report:

North America holds the largest share of the Geriatric Medicines market, valued at $8.08 billion in 2023 and forecasted to grow to $17.01 billion by 2033. The region's growth is supported by advancements in healthcare technology, a robust pharmaceutical industry, and increasing healthcare expenditure for managed care in senior populations.South America Geriatric Medicines Market Report:

The South American Geriatric Medicines market, valued at $0.66 billion in 2023, is anticipated to reach $1.39 billion by 2033. Key market drivers include rising healthcare awareness, improved access to medicines, and an increase in the elderly population, particularly in Brazil and Argentina.Middle East & Africa Geriatric Medicines Market Report:

In the Middle East and Africa, the Geriatric Medicines market is expected to increase from $2.90 billion in 2023 to $6.11 billion by 2033, fueled by enhancements in healthcare facilities and an increasing awareness of geriatric healthcare needs across various nations.Tell us your focus area and get a customized research report.

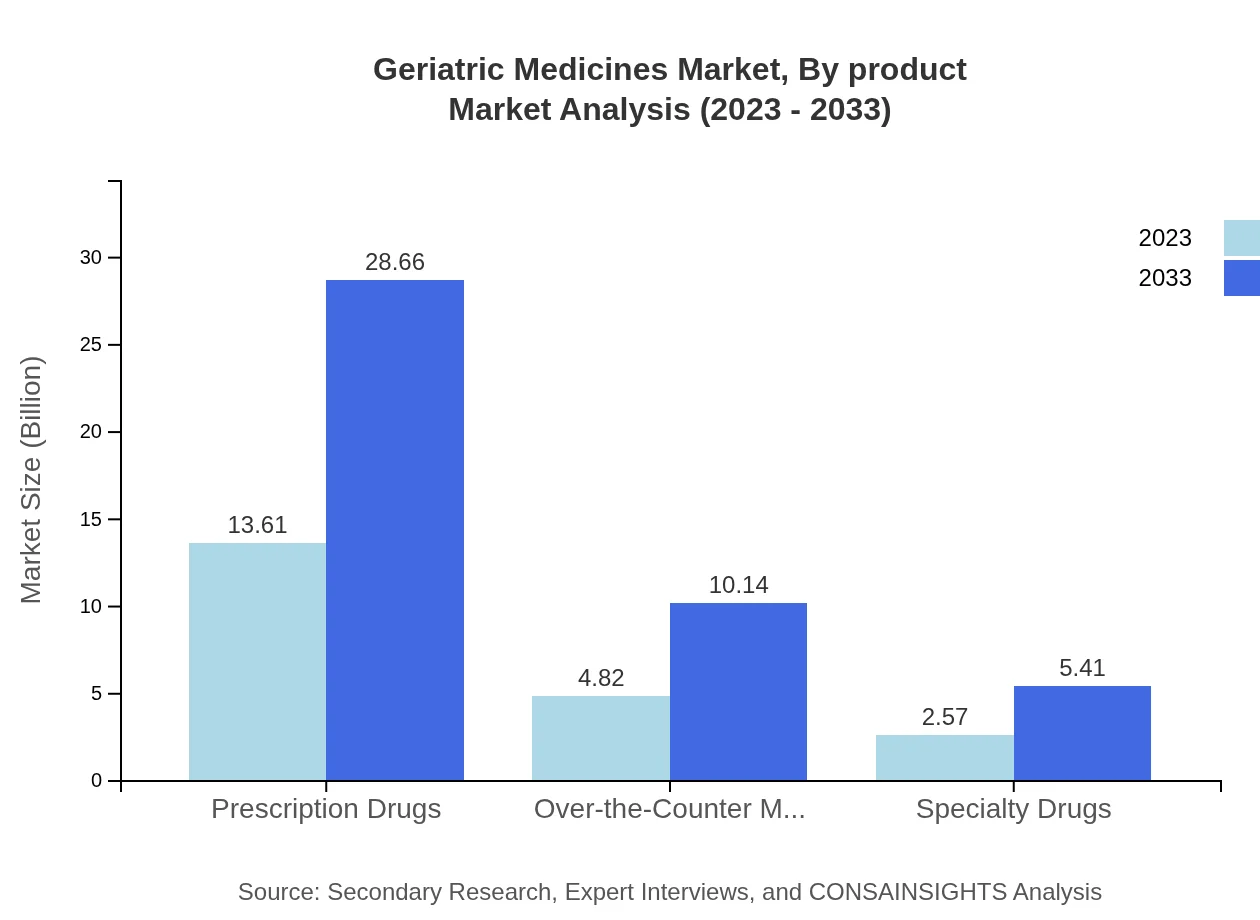

Geriatric Medicines Market Analysis By Product

The analysis reveals that the market for prescription drugs dominates the Geriatric Medicines sector, valued at $13.61 billion in 2023 and expected to grow to $28.66 billion by 2033. Over-the-counter medicines and specialty drugs also contribute significantly, indicating a diverse portfolio required to address the varying needs of geriatric patients.

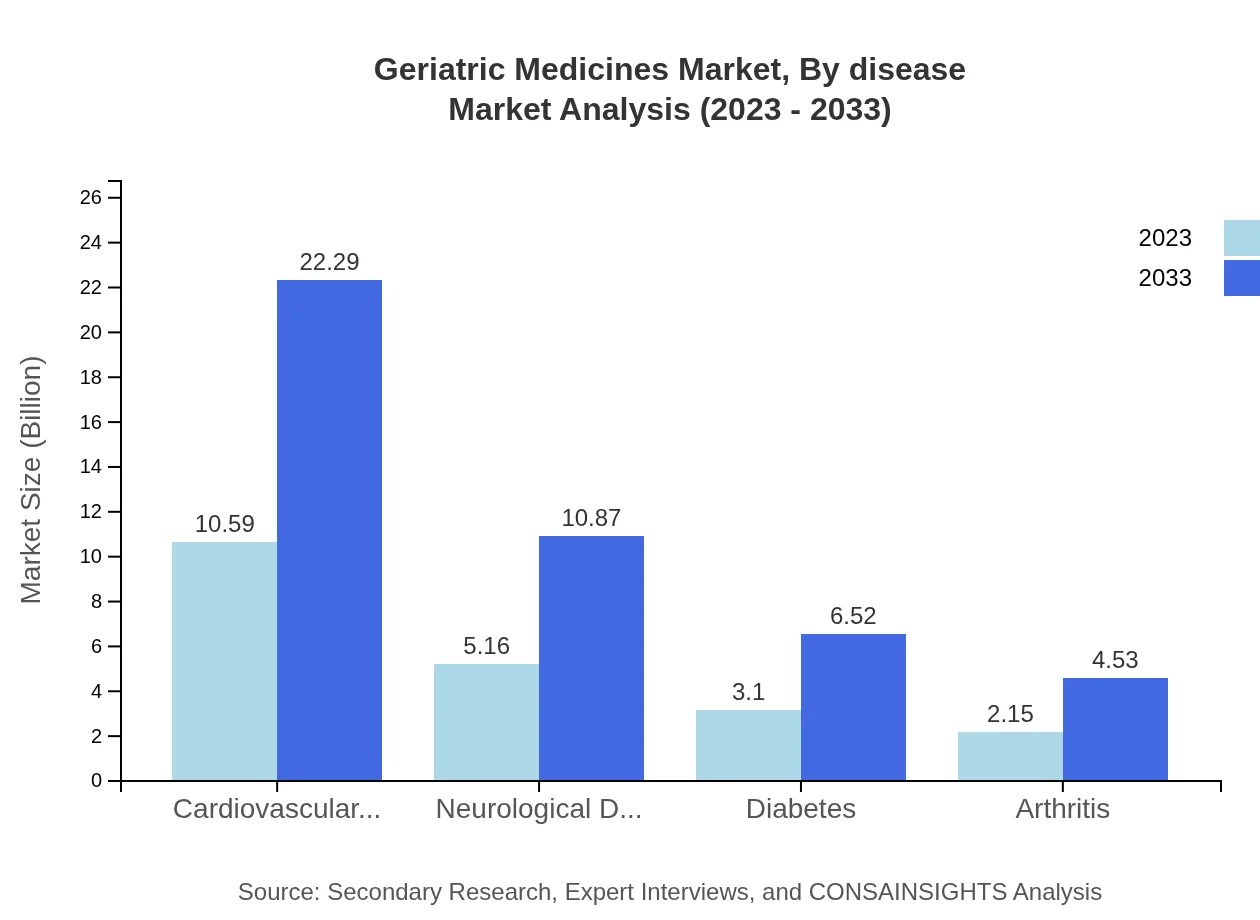

Geriatric Medicines Market Analysis By Disease

The cardiovascular diseases segment leads with a market size of $10.59 billion in 2023, anticipated to grow to $22.29 billion by 2033. Neurological disorders and diabetes also represent key disease segments, underlining the urgency of targeted geriatric care.

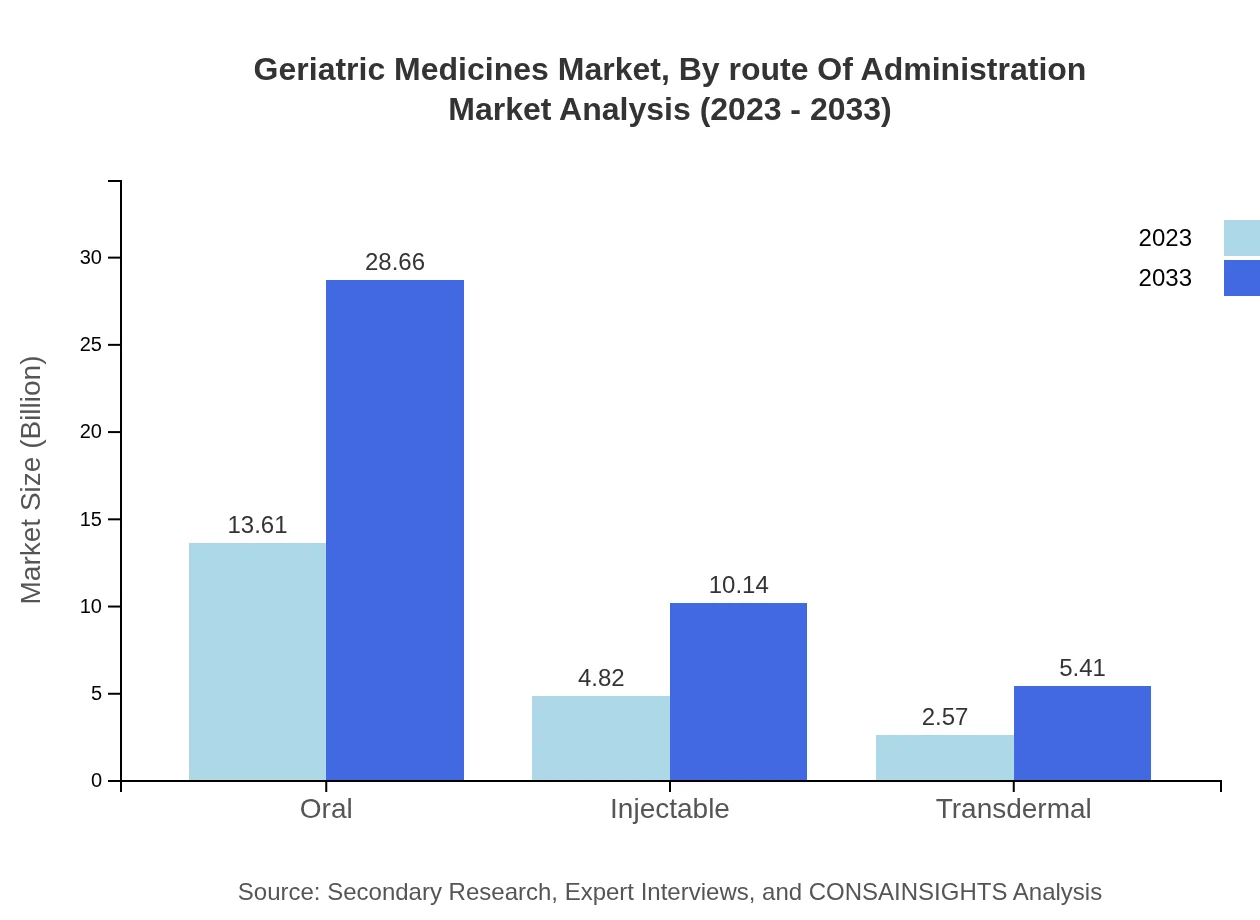

Geriatric Medicines Market Analysis By Route Of Administration

In 2023, oral medications dominate the route of administration with a market share of $13.61 billion, expected to grow equivalently until 2033. Injectable and transdermal administrations are crucial alternatives, emphasizing the need for varied medication delivery methods to enhance patient adherence.

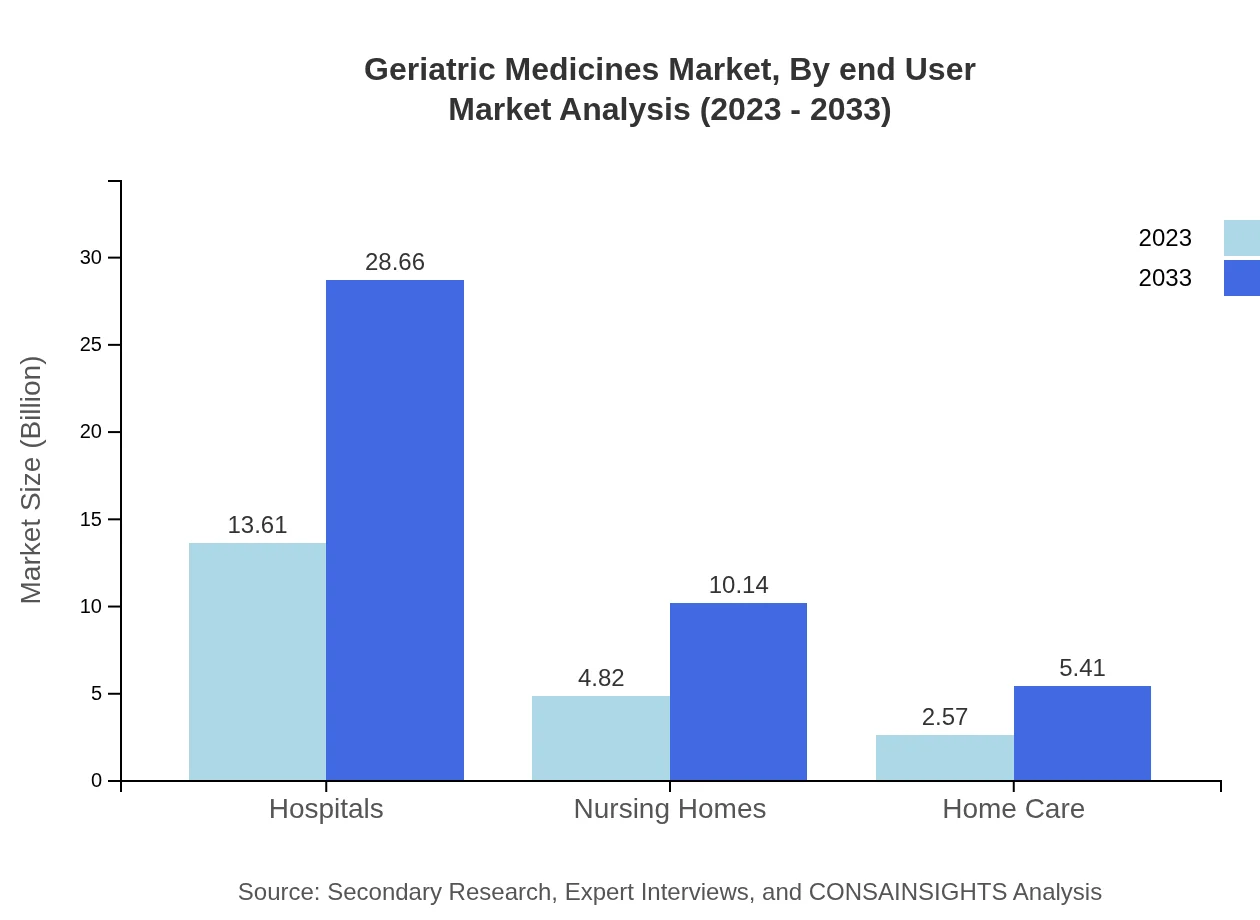

Geriatric Medicines Market Analysis By End User

Hospitals are expected to maintain their dominant position, with a projected market size of $13.61 billion in 2023, growing to $28.66 billion by 2033. The nursing homes and home care segments are also significant, showcasing the comprehensive nature of geriatric care needed across various healthcare settings.

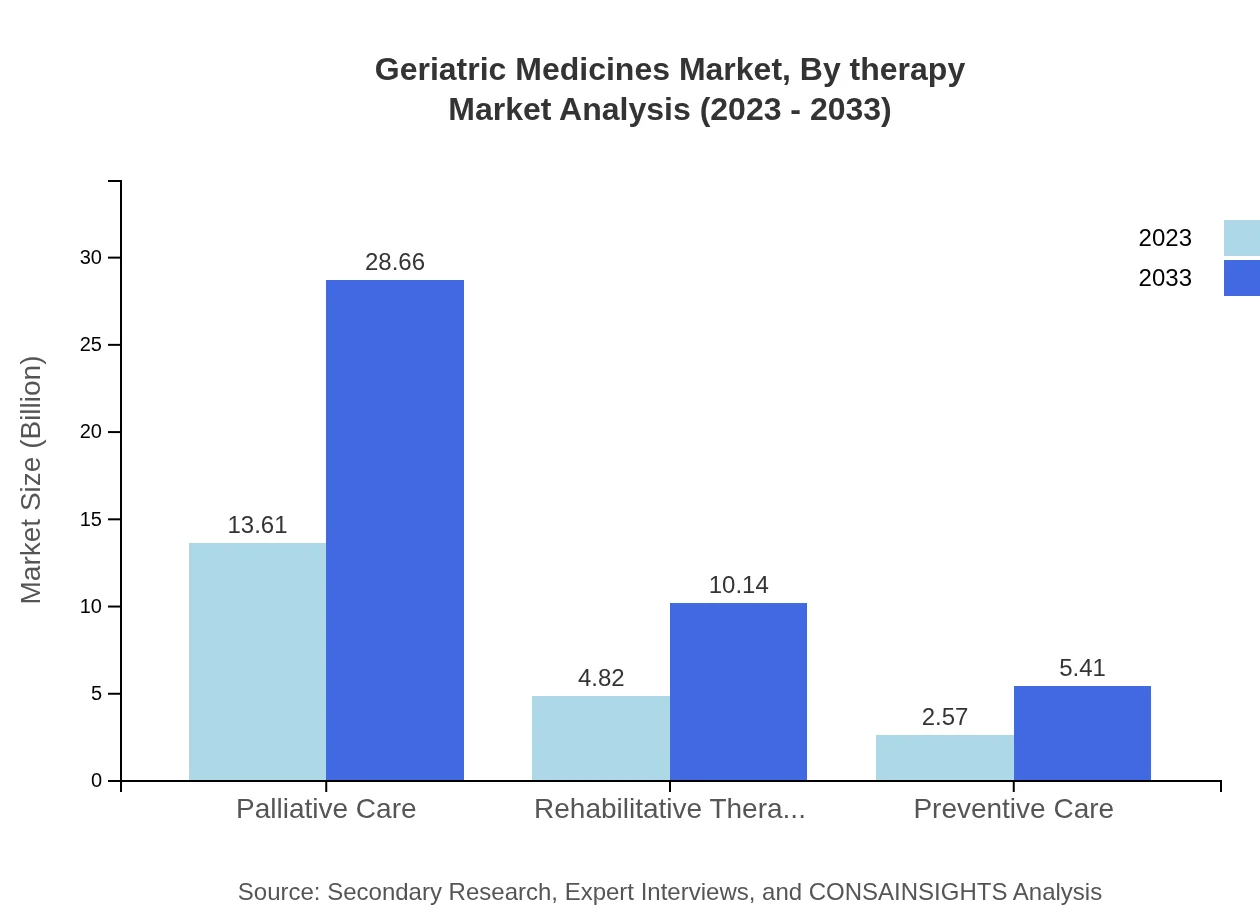

Geriatric Medicines Market Analysis By Therapy

Palliative care continues to be a crucial aspect of Geriatric Medicines, accounting for significant market share. The segment size in 2023 is approximately $13.61 billion, illustrating the prioritization of comfort and quality of life for older adults during treatment.

Geriatric Medicines Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Geriatric Medicines Industry

Pfizer Inc.:

A leading global pharmaceutical company, Pfizer focuses on developing medications that address chronic diseases prevalent in older adults, with a robust pipeline aimed at enhancing geriatric care.Novartis AG:

Novartis specializes in innovative healthcare solutions, creating therapies that improve quality of life for geriatric patients, particularly in areas such as cardiovascular health and pain management.Johnson & Johnson:

With a diverse portfolio, Johnson & Johnson is committed to supporting healthy aging through the development of products and therapies specifically designed for elderly patients.Bristol-Myers Squibb:

Bristol-Myers Squibb is dedicated to biotech innovations that play a crucial role in treating age-related health issues, making it a key player in the Geriatric Medicines landscape.We're grateful to work with incredible clients.

FAQs

What is the market size of geriatric Medicines?

The geriatric medicines market is currently valued at approximately $21 billion, with a projected CAGR of 7.5% from 2023 to 2033, indicating robust growth as the aging population increases and the demand for specialized care rises.

What are the key market players or companies in this geriatric Medicines industry?

Key players in the geriatric medicines market include pharmaceutical giants like Pfizer, Merck, and Johnson & Johnson. These companies are known for their extensive portfolios that cater to age-related health challenges, advancing the development of targeted therapies for elderly patients.

What are the primary factors driving the growth in the geriatric medicines industry?

The growth of the geriatric medicines industry is primarily driven by an increasing elderly population, rising prevalence of chronic diseases, advancements in drug formulations, and a greater focus on improved patient care tailored to geriatric needs.

Which region is the fastest Growing in the geriatric medicines?

North America is the fastest-growing region in the geriatric medicines market, with a market size projected to increase from $8.08 billion in 2023 to $17.01 billion by 2033, showcasing significant investment and demand for eldercare solutions.

Does ConsaInsights provide customized market report data for the geriatric Medicines industry?

Yes, Consainsights offers customized market report data tailored to the geriatric medicines industry, allowing clients to gain insights specific to their needs, including in-depth analysis and forecasts based on various factors affecting the market.

What deliverables can I expect from this geriatric Medicines market research project?

Deliverables from the geriatric medicines market research project typically include comprehensive reports, detailed market analyses, growth forecasts, regional insights, and strategic recommendations tailored to your business objectives.

What are the market trends of geriatric Medicines?

Current trends in the geriatric medicines market include increased investment in research and development of age-specific drugs, growing emphasis on preventive care, and advancements in telemedicine, making healthcare more accessible for the elderly.