Gi Stool Testing Market Report

Published Date: 31 January 2026 | Report Code: gi-stool-testing

Gi Stool Testing Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Gi Stool Testing market from 2023 to 2033, focusing on market size, trends, regional insights, segmentation, and key players in the industry.

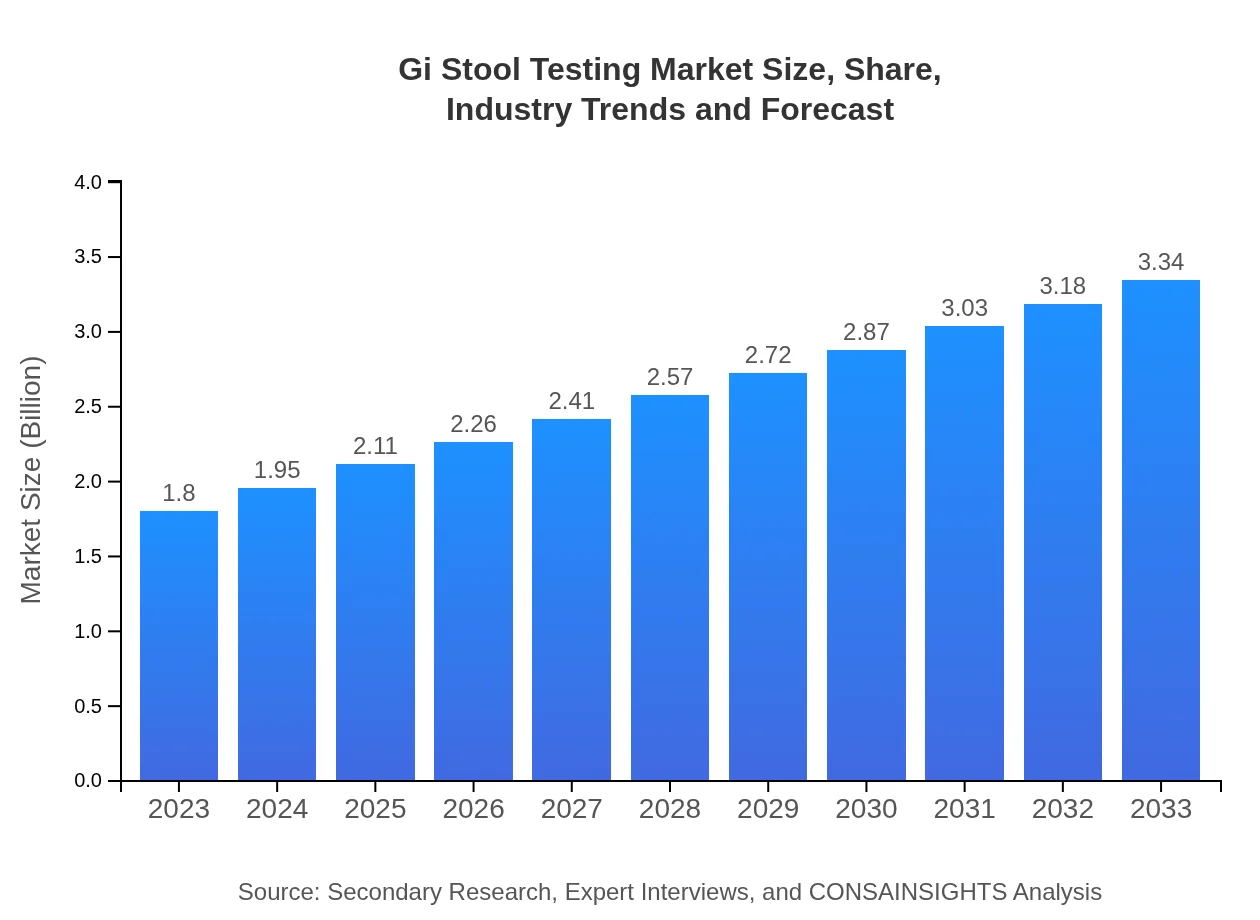

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.80 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $3.34 Billion |

| Top Companies | Abbott Laboratories, Roche Diagnostics, F. Hoffmann-La Roche AG, bioMérieux SA, Siemens Healthineers |

| Last Modified Date | 31 January 2026 |

Gi Stool Testing Market Overview

Customize Gi Stool Testing Market Report market research report

- ✔ Get in-depth analysis of Gi Stool Testing market size, growth, and forecasts.

- ✔ Understand Gi Stool Testing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Gi Stool Testing

What is the Market Size & CAGR of Gi Stool Testing market in 2023?

Gi Stool Testing Industry Analysis

Gi Stool Testing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Gi Stool Testing Market Analysis Report by Region

Europe Gi Stool Testing Market Report:

Europe is also experiencing substantial growth, with the market size standing at USD 0.54 billion in 2023, expected to double to USD 1.00 billion by 2033. Increased government initiatives to promote colorectal cancer screenings and advancements in diagnostic technology bolster the market.Asia Pacific Gi Stool Testing Market Report:

In the Asia Pacific region, the Gi Stool Testing market was valued at USD 0.34 billion in 2023 and is expected to reach USD 0.64 billion by 2033. The growth is driven by increased awareness of gastrointestinal health and improved healthcare infrastructure across countries like India and China.North America Gi Stool Testing Market Report:

North America accounts for the largest share of the market, with a size of USD 0.64 billion in 2023, projected to grow to USD 1.19 billion by 2033. Strong demand for advanced diagnostics and a high incidence of gastrointestinal diseases drive this growth.South America Gi Stool Testing Market Report:

The South American market is comparatively smaller, with a value of USD 0.11 billion in 2023, growing to USD 0.20 billion by 2033. Limited accessibility to healthcare services and rising awareness of gastrointestinal disorders play vital roles in this development.Middle East & Africa Gi Stool Testing Market Report:

In the Middle East and Africa, the market is forecasted to expand from USD 0.16 billion in 2023 to USD 0.30 billion by 2033. The region sees growth through emerging healthcare markets and rising awareness surrounding gastrointestinal health.Tell us your focus area and get a customized research report.

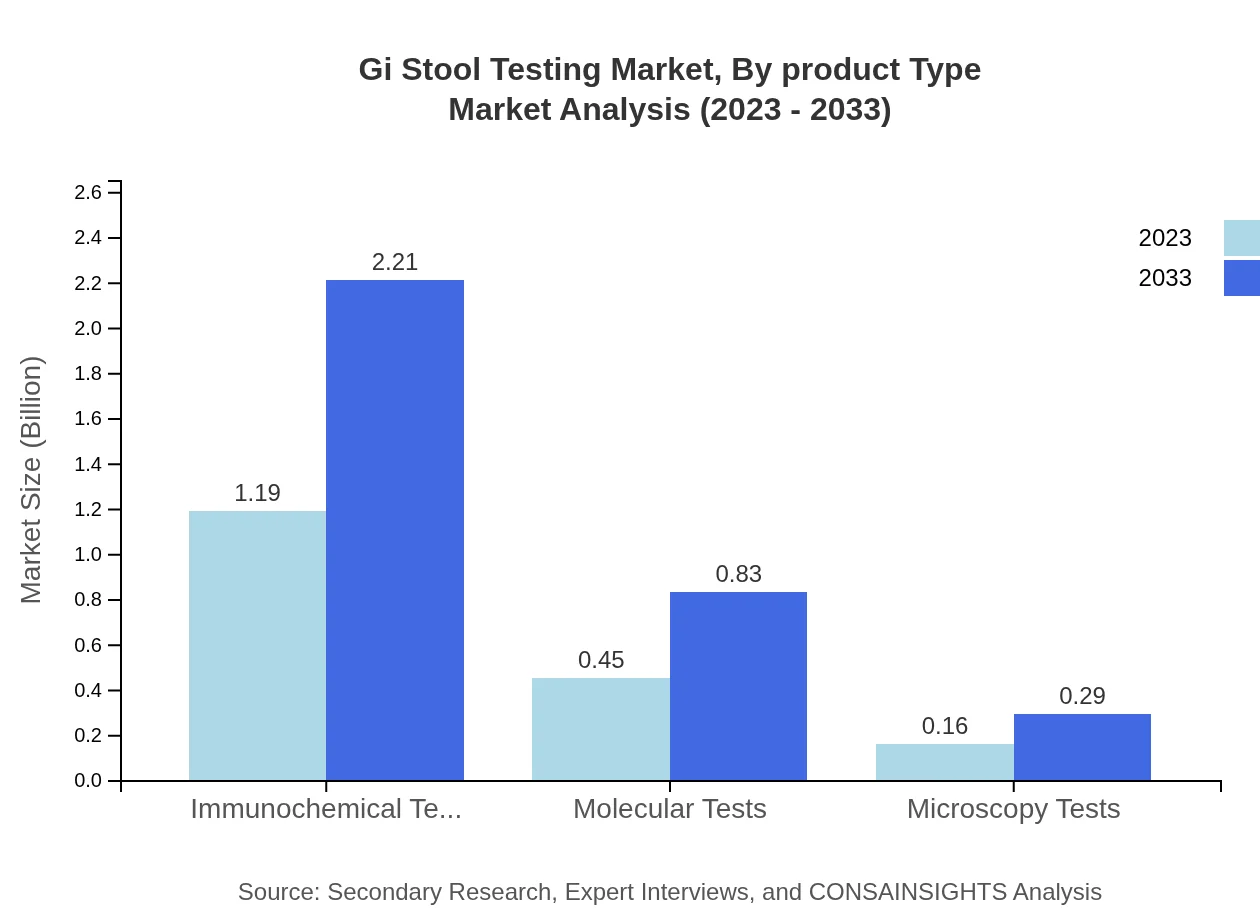

Gi Stool Testing Market Analysis By Product Type

The GI Stool Testing market segment categorized by product type shows that immunochemical tests represent the largest share, valued at USD 1.19 billion in 2023 and projected to reach USD 2.21 billion by 2033. Molecular tests and microscopy tests contribute significantly, demonstrating growth due to technological advancements and the increasing need for rapid diagnostics.

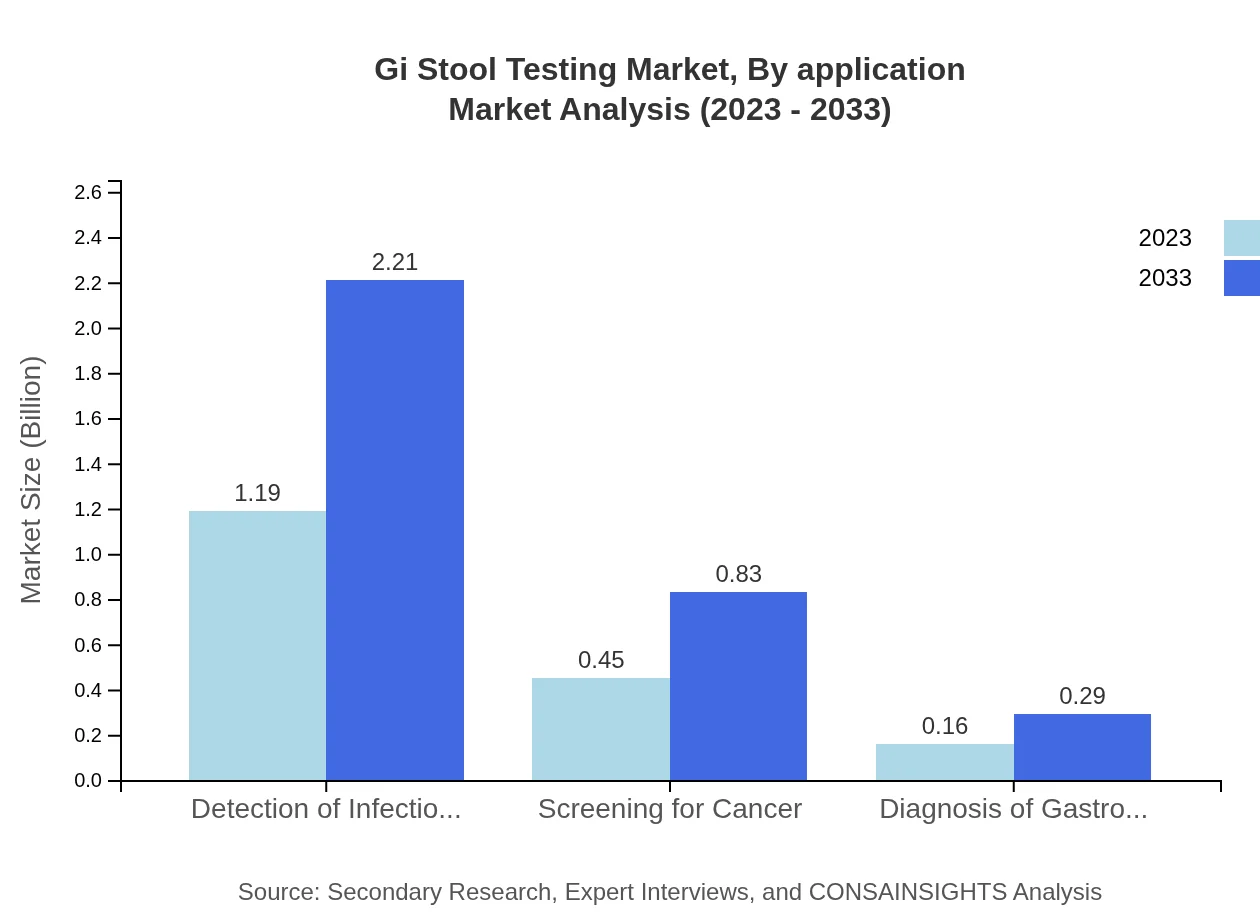

Gi Stool Testing Market Analysis By Application

In the application segment, detection of infections dominates the market with a share of 66.28% in 2023, projected to hold the same share by 2033. Screening for cancer has gained prominence, showing a significant market size of USD 0.45 billion in 2023, expanding to USD 0.83 billion by 2033.

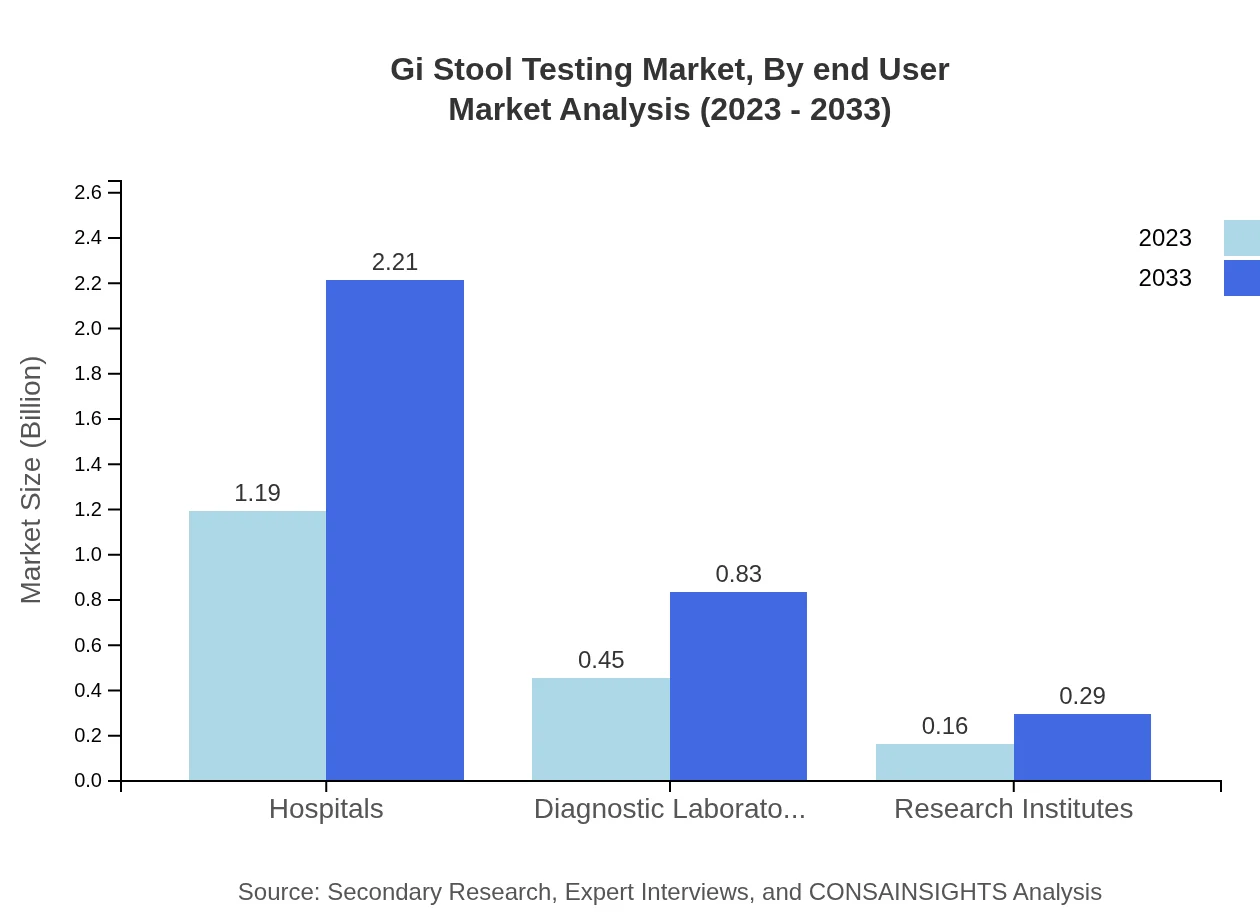

Gi Stool Testing Market Analysis By End User

Hospitals lead as the primary end-user in the GI Stool Testing market, commanding 66.28% of the share in 2023, with expectations to maintain this dominance by 2033. Diagnostic laboratories account for approximately 24.93% of the market throughout the forecast period, showcasing their crucial role in patient care.

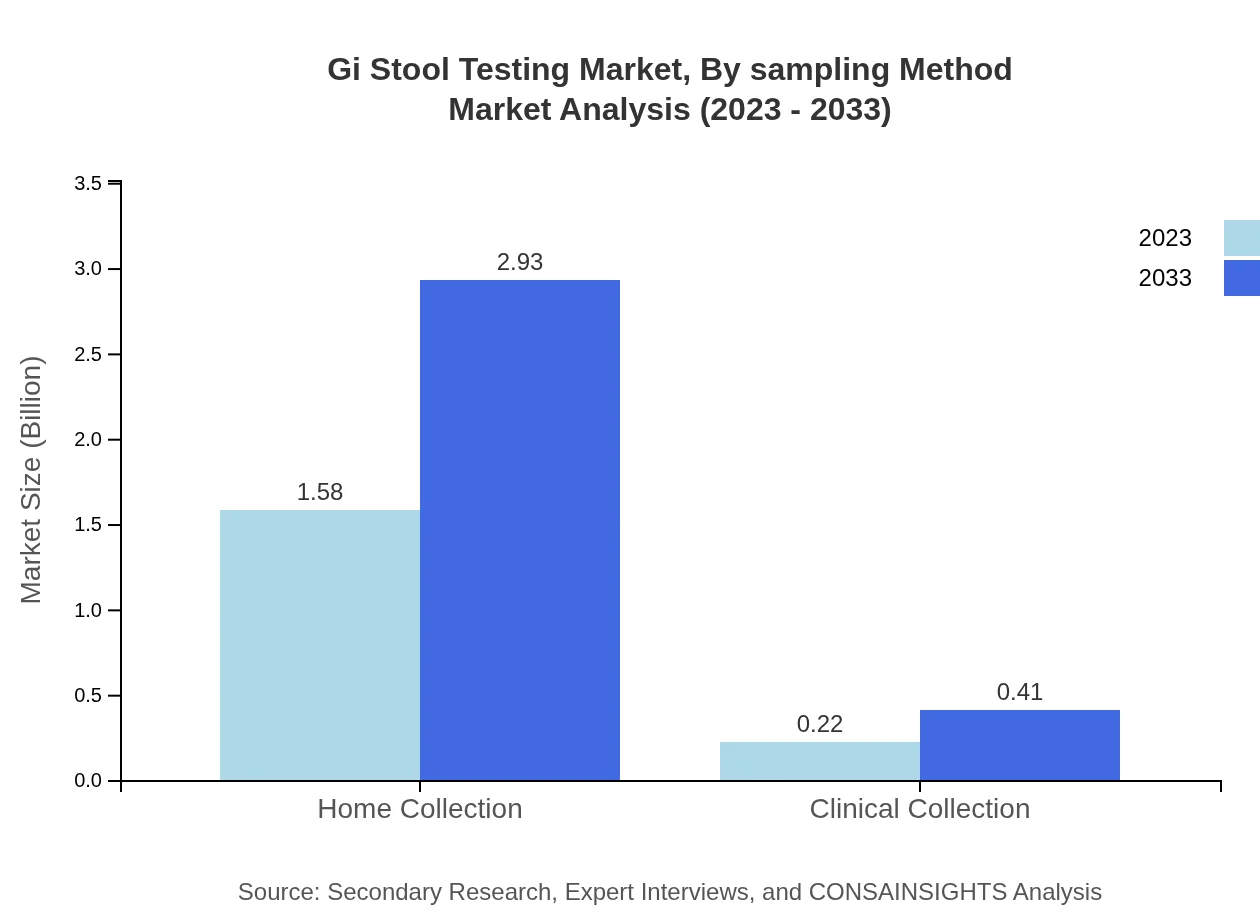

Gi Stool Testing Market Analysis By Sampling Method

Sampling methods are classified into home collection and clinical collection, with home collection accounting for a remarkable 87.8% market share in 2023, continuing to dominate through 2033. Clinical collection is projected to remain significantly less preferred at 12.2%.

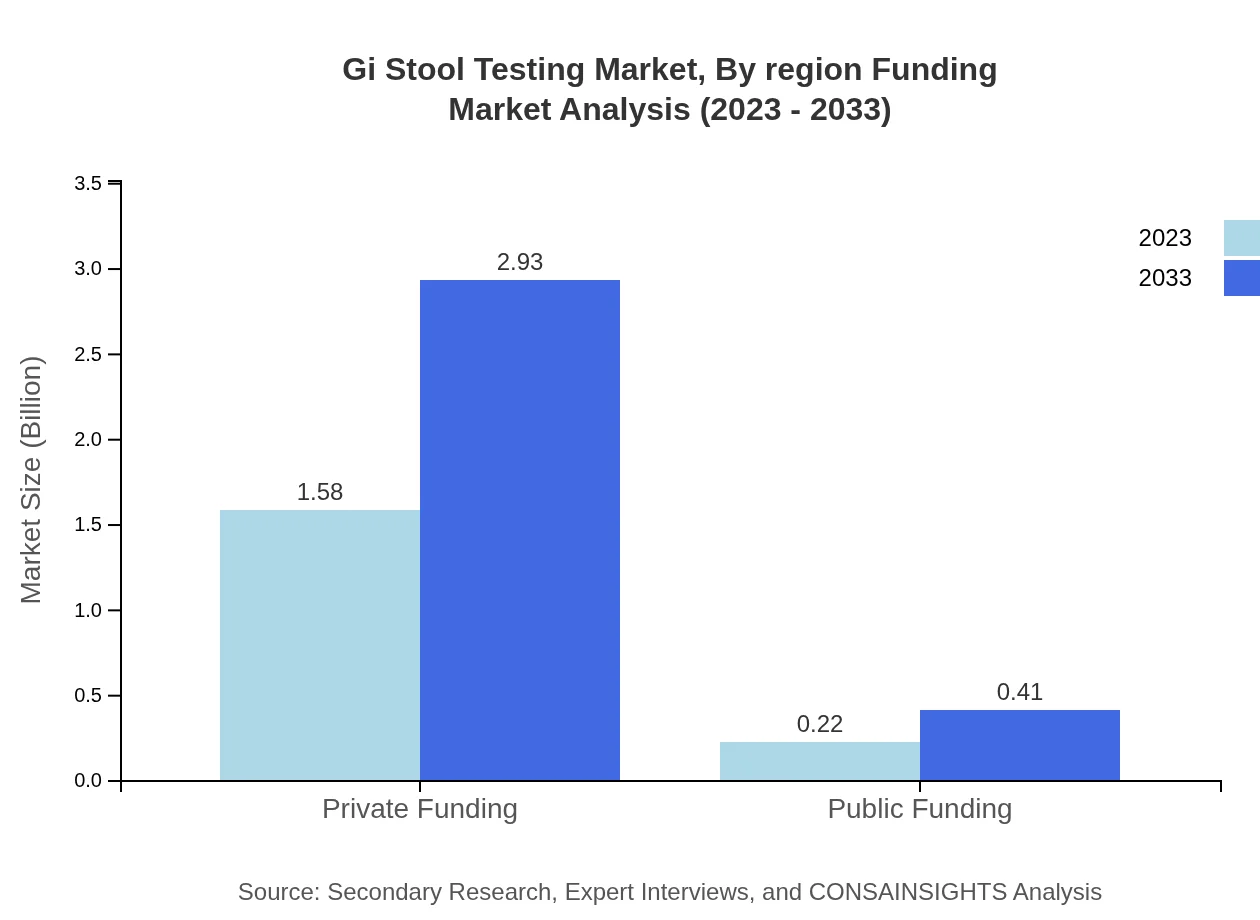

Gi Stool Testing Market Analysis By Region Funding

The market is also categorized based on funding sources, with private funding accounting for 87.8% in 2023, forecasted to rise to 87.8% by 2033. Public funding remains significantly lower at 12.2%, highlighting a strong reliance on private sectors in advancing GI stool testing.

Gi Stool Testing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Gi Stool Testing Industry

Abbott Laboratories:

Abbott Laboratories offers pioneering immunochemical tests for GI stool testing, leading the market with a robust research and development pipeline.Roche Diagnostics:

Roche Diagnostics is known for its advanced molecular diagnostic testing technology that has transformed the GI stool testing landscape.F. Hoffmann-La Roche AG:

This company emphasizes on the development of personalized medicine solutions improving gastrointestinal disease diagnosis.bioMérieux SA:

bioMérieux focuses on providing innovative diagnostic solutions and possesses a significant portfolio in stool analysis.Siemens Healthineers:

Siemens Healthineers integrates advanced technologies into their GI stool testing products, enhancing diagnostic accuracy.We're grateful to work with incredible clients.

FAQs

What is the market size of gi Stool Testing?

The global gi-stool-testing market is valued at approximately $1.8 billion in 2023 and is projected to grow at a CAGR of 6.2%, reaching a significantly larger size by 2033, reflecting increased demand and technological advancements.

What are the key market players or companies in this gi Stool Testing industry?

Key players in the gi-stool-testing industry include major diagnostic laboratories, private healthcare organizations, and research institutes focusing on gastrointestinal health solutions that drive innovation and market growth.

What are the primary factors driving the growth in the gi Stool Testing industry?

The gi-stool-testing market growth is driven by increasing awareness of gastrointestinal diseases, advancing technology in non-invasive testing methods, and rising healthcare expenditures, enhancing the demand for effective diagnostic solutions.

Which region is the fastest Growing in the gi Stool Testing?

The fastest-growing region in the gi-stool-testing market is North America, projected to rise from $0.64 billion in 2023 to $1.19 billion by 2033, driven by increasing healthcare access and advancements in diagnostic technologies.

Does ConsaInsights provide customized market report data for the gi Stool Testing industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the gi-stool-testing industry, enabling businesses to gain insights relevant to their strategic objectives.

What deliverables can I expect from this gi Stool Testing market research project?

Deliverables from the gi-stool-testing market research project typically include detailed market analysis, forecasts by region and segment, competitive landscape insights, and comprehensive reports summarizing key findings.

What are the market trends of gi Stool Testing?

Current trends in the gi-stool-testing market include the rise of home testing kits, integration of advanced technologies like molecular and immunochemical tests, and a shift towards personalized healthcare solutions.