Gige Camera Market Report

Published Date: 02 February 2026 | Report Code: gige-camera

Gige Camera Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Gige Camera market, including insights on market size, growth forecast, regional analysis, industry trends, and competitive landscape from 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

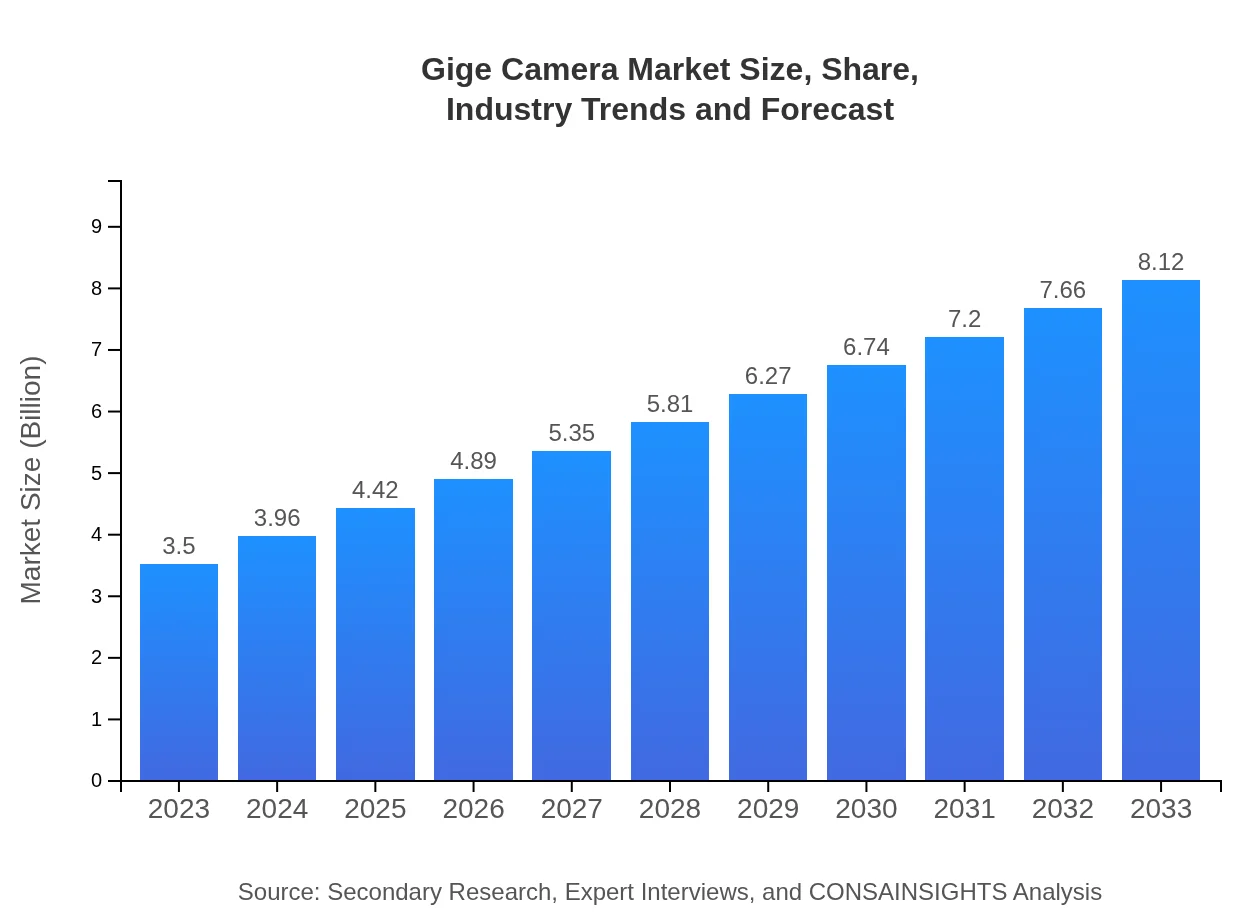

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 8.5% |

| 2033 Market Size | $8.12 Billion |

| Top Companies | Basler AG, FLIR Systems, Teledyne DALSA, Cannon Inc. |

| Last Modified Date | 02 February 2026 |

Gige Camera Market Overview

Customize Gige Camera Market Report market research report

- ✔ Get in-depth analysis of Gige Camera market size, growth, and forecasts.

- ✔ Understand Gige Camera's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Gige Camera

What is the Market Size & CAGR of Gige Camera market in 2023?

Gige Camera Industry Analysis

Gige Camera Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Gige Camera Market Analysis Report by Region

Europe Gige Camera Market Report:

The European Gige Camera market is expected to increase from $0.96 billion in 2023 to $2.23 billion by 2033, propelled by a focus on advanced manufacturing processes and high-tech production capabilities in Germany and France.Asia Pacific Gige Camera Market Report:

In the Asia Pacific region, the Gige Camera market is projected to grow from $0.75 billion in 2023 to $1.75 billion in 2033. The increase is driven by expanding automation in industries, a growing healthcare sector, and the rise of advanced technology in countries like Japan, China, and India.North America Gige Camera Market Report:

North America represents a significant market for Gige Cameras, anticipated to expand from $1.25 billion in 2023 to $2.89 billion in 2033. The region is witnessing heightened demand from sectors such as industrial automation and healthcare, particularly in the U.S.South America Gige Camera Market Report:

The South American Gige Camera market is estimated to grow from $0.32 billion in 2023 to $0.73 billion by 2033. The growth is being fueled by increasing investments in smart surveillance systems and enhanced infrastructural projects across the region.Middle East & Africa Gige Camera Market Report:

In the Middle East and Africa, the market is expected to grow from $0.23 billion in 2023 to $0.52 billion by 2033. The rise in security and surveillance applications and investments in healthcare infrastructure are primary growth factors.Tell us your focus area and get a customized research report.

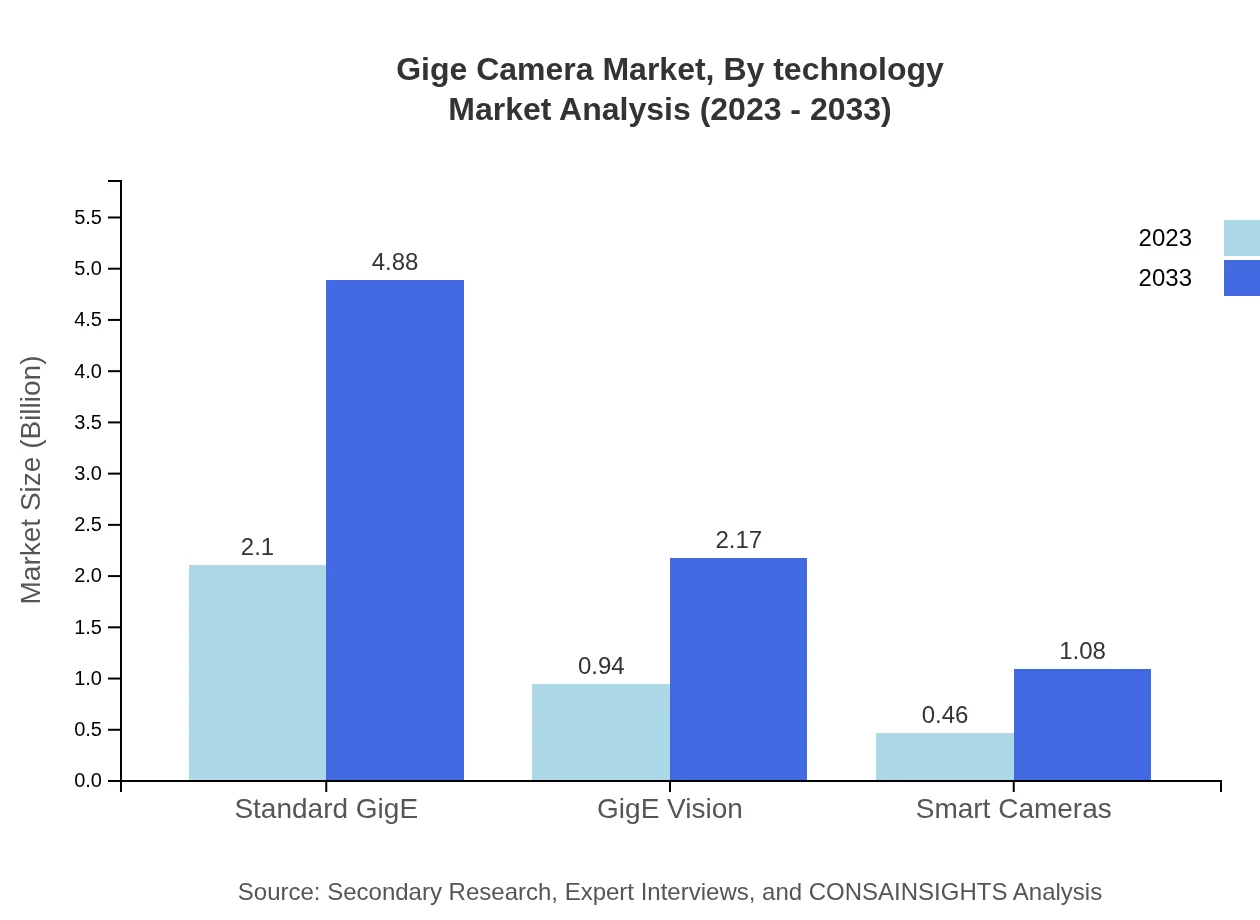

Gige Camera Market Analysis By Technology

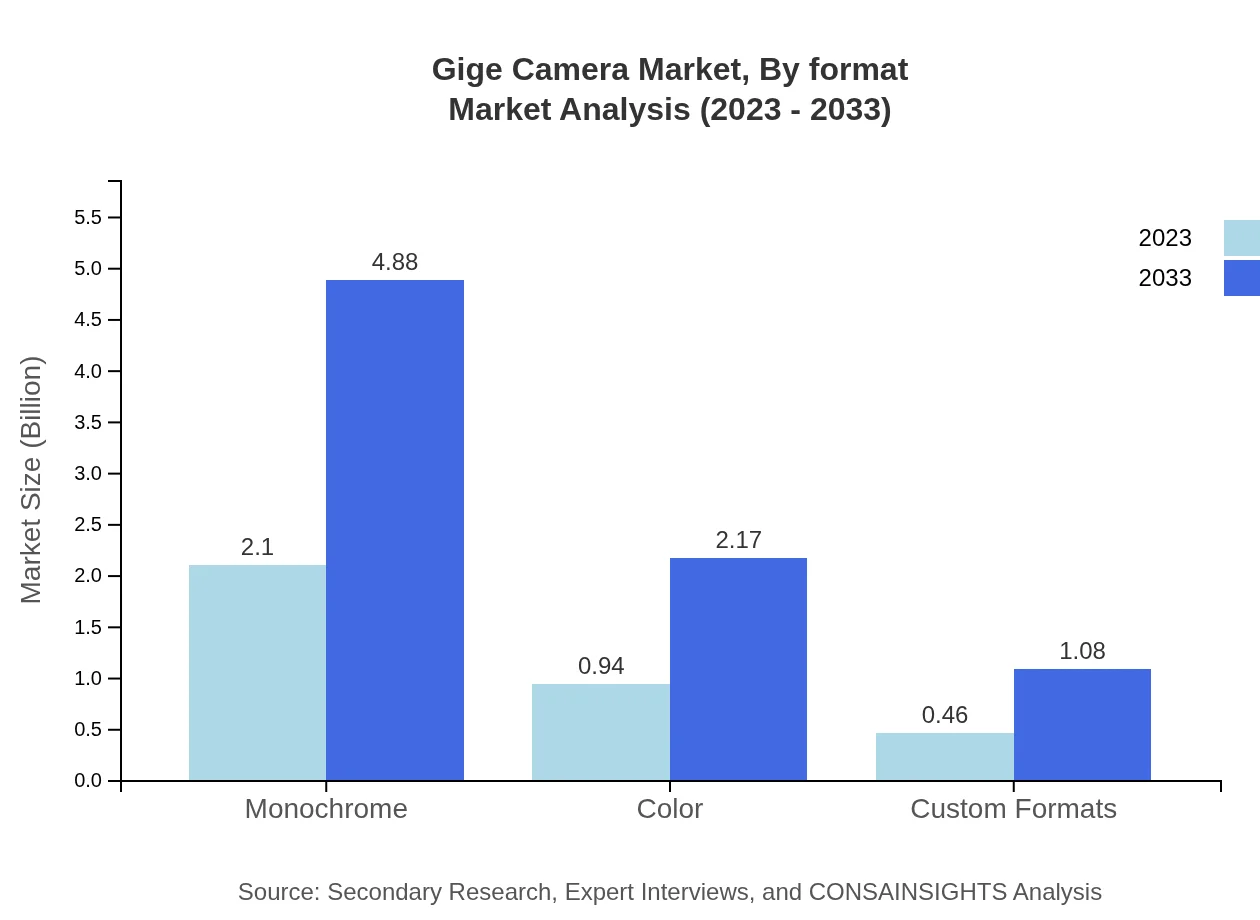

In 2023, the Monochrome segment is expected to dominate the Gige camera market with a size of $2.10 billion, increasing to $4.88 billion by 2033, maintaining its market share at 60.02%. The Color segment is projected to grow from $0.94 billion in 2023 to $2.17 billion in 2033, holding a 26.74% market share throughout the forecast period.

Gige Camera Market Analysis By End User

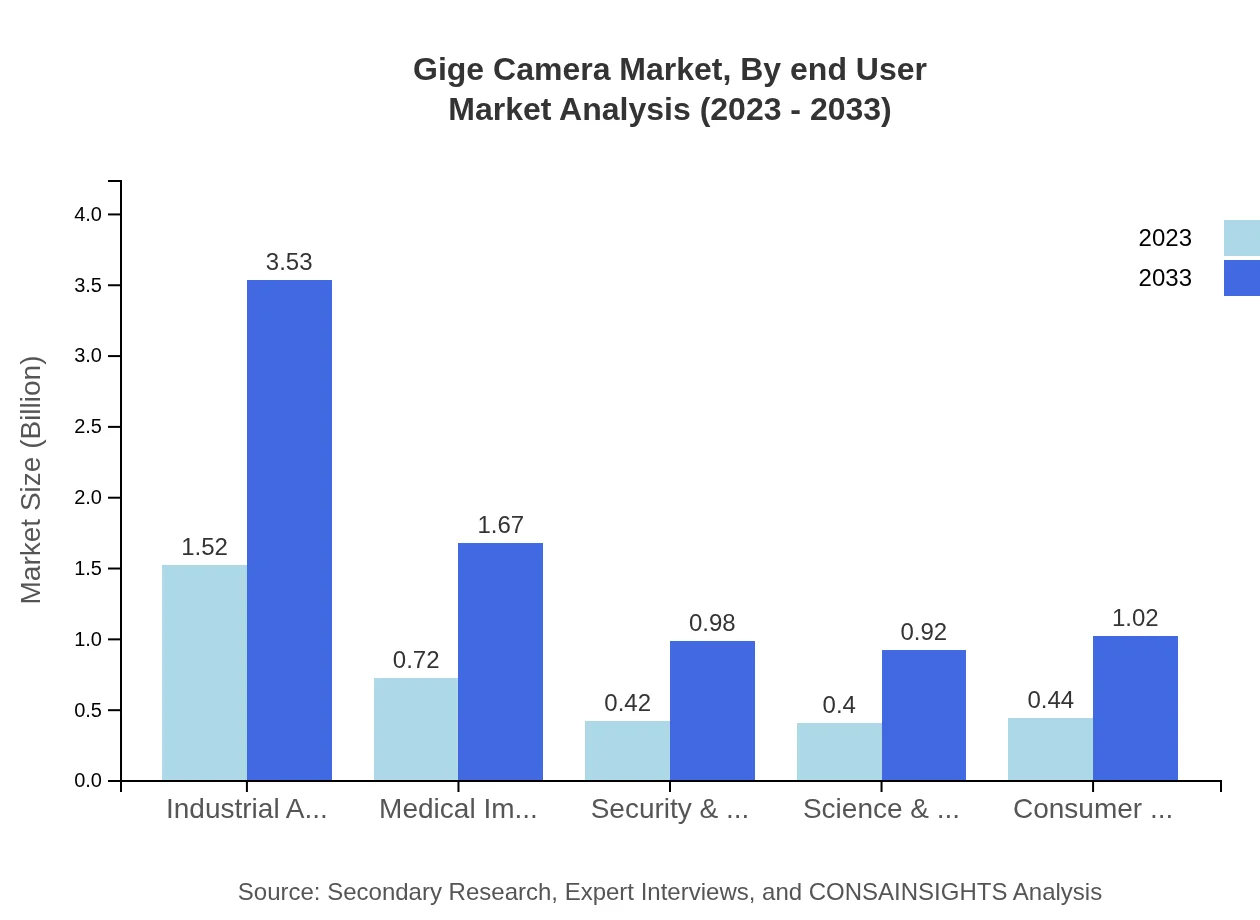

The Industrial Automation segment will lead with a revenue growth from $1.52 billion in 2023 to $3.53 billion in 2033, representing a 43.47% market share. Medical Imaging holds a notable share, likely increasing from $0.72 billion to $1.67 billion, or 20.55% share in the overall market by 2033.

Gige Camera Market Analysis By Application

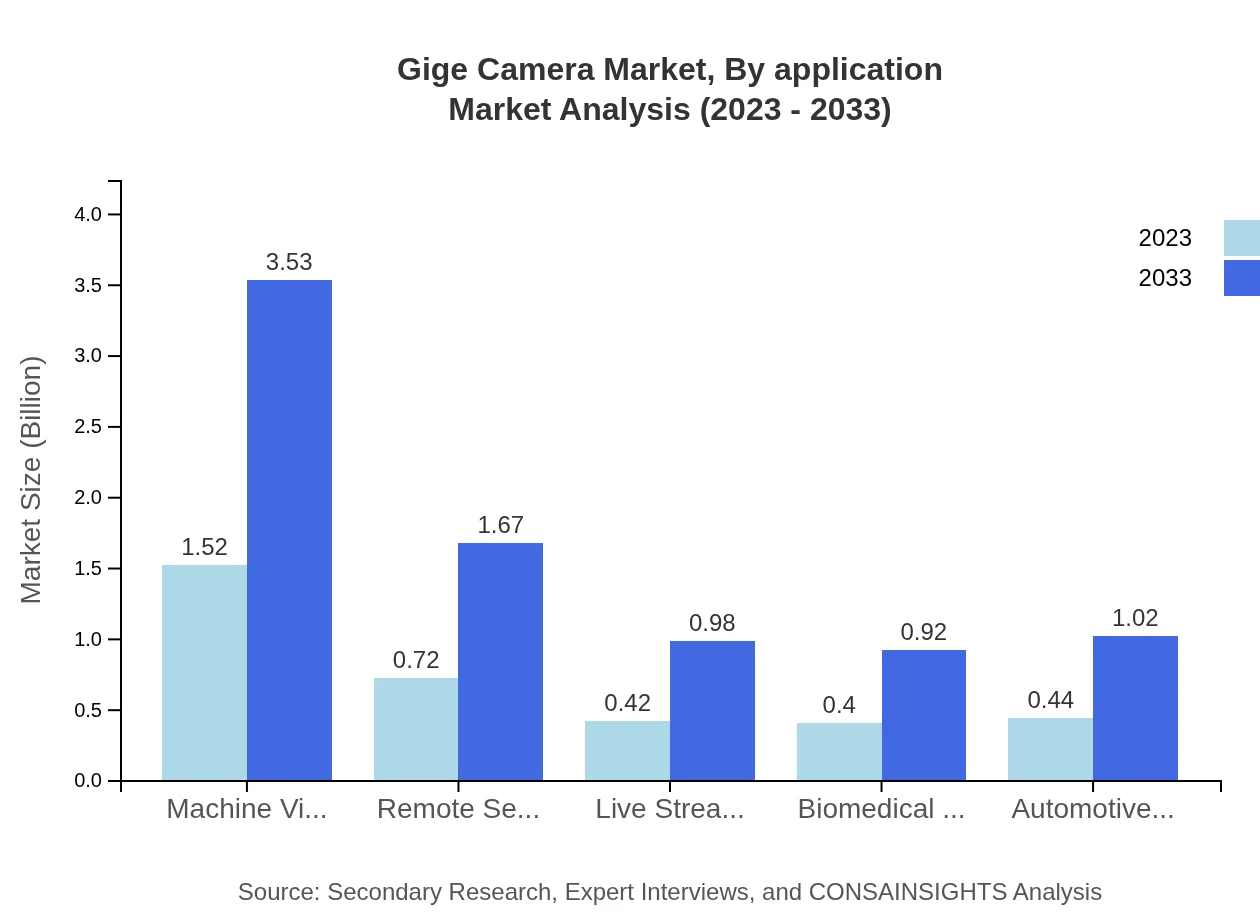

Applications in the field of Machine Vision are expected to maintain a 43.47% market share, expanding from $1.52 billion in 2023 to $3.53 billion in 2033. Remote Sensing and Biomedical Imaging applications will also see significant growth throughout the forecast period.

Gige Camera Market Analysis By Format

The Standard GigE format will continue to dominate, escalating from $2.10 billion in 2023 to $4.88 billion in 2033 at a consistent 60.02% market share, reflecting its reliability and widespread application. Custom Formats also show promise, increasing from $0.46 billion to $1.08 billion.

Gige Camera Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Gige Camera Industry

Basler AG:

Basler AG is a leading manufacturer of high-quality digital cameras for the industrial and medical industries, known for its innovative imaging solutions.FLIR Systems:

FLIR Systems specializes in imaging technologies, particularly Gige cameras, used in advanced surveillance and public safety applications.Teledyne DALSA:

Teledyne DALSA is a key player in the vision industry, offering Gige cameras for various sectors, including industrial automation and transportation.Cannon Inc.:

Cannon Inc. provides advanced digital imaging solutions, including Gige cameras, tailored for research and industrial applications.We're grateful to work with incredible clients.

FAQs

What is the market size of gige Camera?

The global GigE Camera market is valued at approximately $3.5 billion in 2023, with a projected compound annual growth rate (CAGR) of 8.5%, expected to continue through 2033.

What are the key market players or companies in the gige Camera industry?

Key players in the GigE Camera industry include industry leaders in manufacturing, imaging technology, and integrated solutions, which significantly drive innovation and competition within the market.

What are the primary factors driving the growth in the gige Camera industry?

Growth in the GigE Camera industry is largely driven by advancements in imaging technology, increasing industrial automation, demand for high-speed data transfer, and applications across various sectors including medical imaging and security.

Which region is the fastest Growing in the gige Camera?

The Asia Pacific region is witnessing rapid growth in the GigE Camera market, expanding from $0.75 billion in 2023 to an estimated $1.75 billion by 2033, reflecting strong industrial and technological advancements.

Does ConsaInsights provide customized market report data for the gige Camera industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the GigE Camera industry, ensuring comprehensive insights and strategic analysis for clients.

What deliverables can I expect from this gige Camera market research project?

Deliverables typically include a detailed market analysis report, segmentation data, regional breakdowns, competitive landscape insights, and future growth forecasts tailored to client requirements.

What are the market trends of gige Camera?

Market trends for GigE Cameras highlight increased adoption of smart cameras, enhanced sensor technologies, and a growing focus on automation and quality in manufacturing processes across industries.