Gin Market Report

Published Date: 31 January 2026 | Report Code: gin

Gin Market Size, Share, Industry Trends and Forecast to 2033

This report analyzes the global Gin market, covering key trends, market insights, and forecasts between 2023 and 2033. It includes a detailed examination of market size, regional performance, consumer preferences, and competitive landscape.

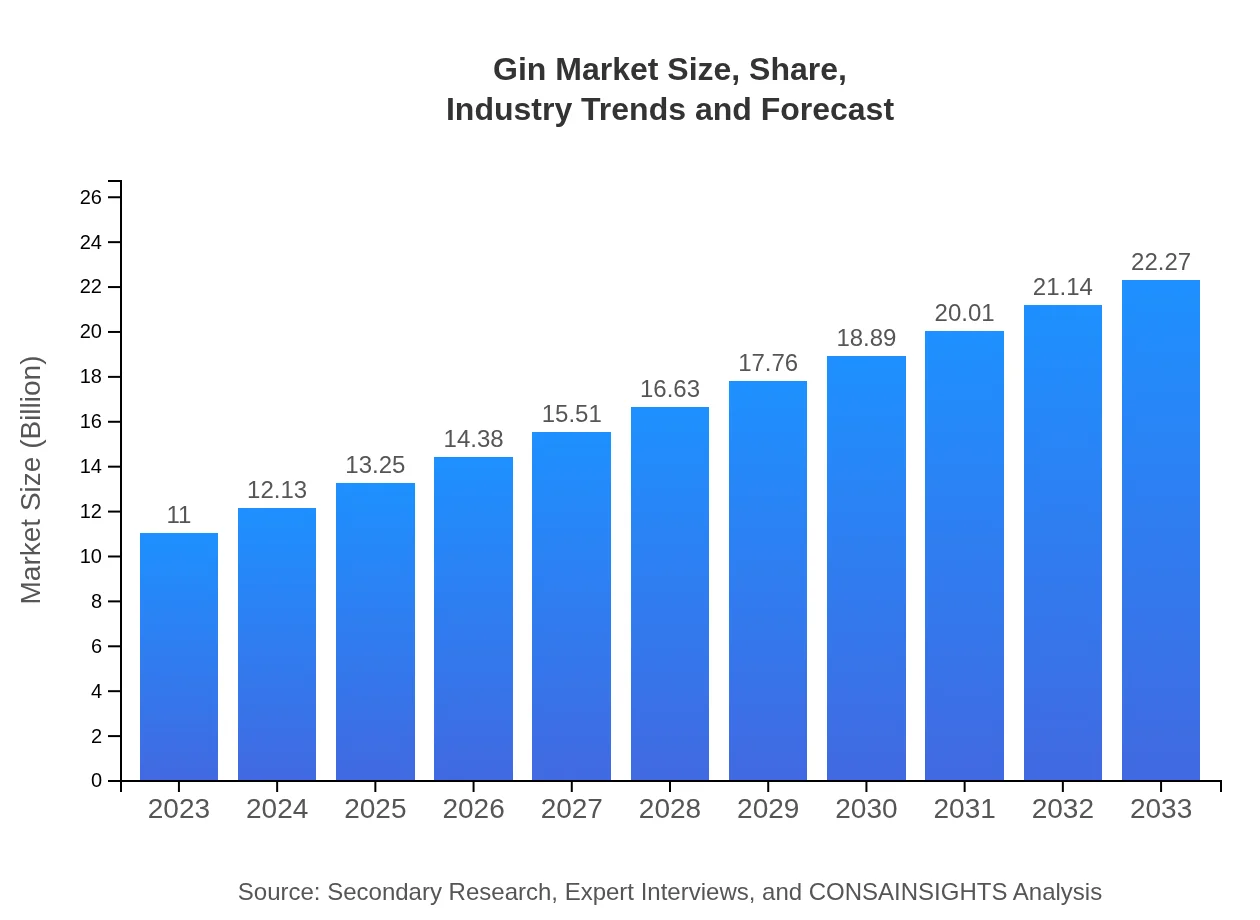

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $11.00 Billion |

| CAGR (2023-2033) | 7.1% |

| 2033 Market Size | $22.27 Billion |

| Top Companies | Diageo, Pernod Ricard, Bacardi Limited, Whitley Neill |

| Last Modified Date | 31 January 2026 |

Gin Market Overview

Customize Gin Market Report market research report

- ✔ Get in-depth analysis of Gin market size, growth, and forecasts.

- ✔ Understand Gin's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Gin

What is the Market Size & CAGR of Gin market in 2023?

Gin Industry Analysis

Gin Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Gin Market Analysis Report by Region

Europe Gin Market Report:

In Europe, the Gin market is set at USD 3.50 billion in 2023 and is expected to rise to USD 7.09 billion by 2033. The United Kingdom remains the leading market for Gin, with traditional and craft varieties gaining significant consumer interest, while regulations promoting quality and local products bolster the market.Asia Pacific Gin Market Report:

In 2023, the Gin market in the Asia Pacific region is valued at approximately USD 2.02 billion, expected to grow to USD 4.10 billion by 2033. The rise of cocktail culture and an increasing number of distilleries are driving this growth, particularly in countries like Japan and Australia, which are embracing artisan gin production and unique flavor profiles.North America Gin Market Report:

North America's Gin market is valued at approximately USD 3.83 billion in 2023, projected to reach USD 7.75 billion by 2033. The region shows a strong preference for craft and premium gins, fueled by innovative marketing strategies and the growing trend of mixology in bars and households.South America Gin Market Report:

The South American Gin market is currently valued at around USD 1.09 billion in 2023, with projections of an increase to USD 2.20 billion by 2033. Consumption is being driven by the popularity of gin-based cocktails and the emergence of local distilleries infusing traditional botanicals unique to the region.Middle East & Africa Gin Market Report:

The Middle East and African Gin market is valued at USD 0.56 billion in 2023, anticipated to grow to USD 1.14 billion by 2033. The growth is attributed to increasing urbanization, exposure to global drinking trends, and the legal easing of alcohol restrictions in certain countries.Tell us your focus area and get a customized research report.

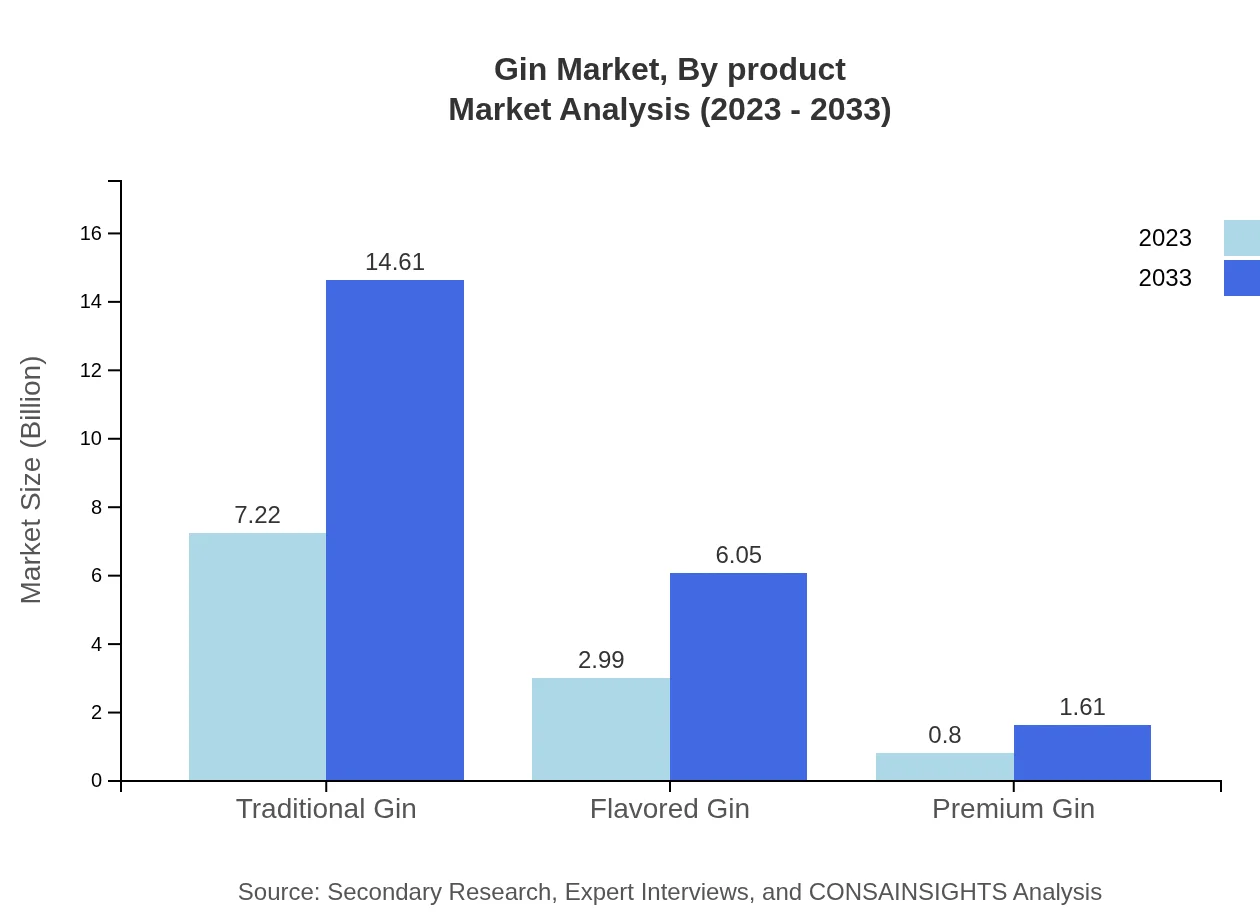

Gin Market Analysis By Product

The product type segment reveals a strong preference for Traditional Gin, valued at USD 7.22 billion in 2023, projected to grow to USD 14.61 billion by 2033. Flavored Gin also shows significant growth, with a market size of USD 2.99 billion in 2023 and an expected growth to USD 6.05 billion by 2033. Premium Gins stand at USD 0.80 billion in 2023, growing to USD 1.61 billion by 2033 as consumers increasingly seek quality over quantity.

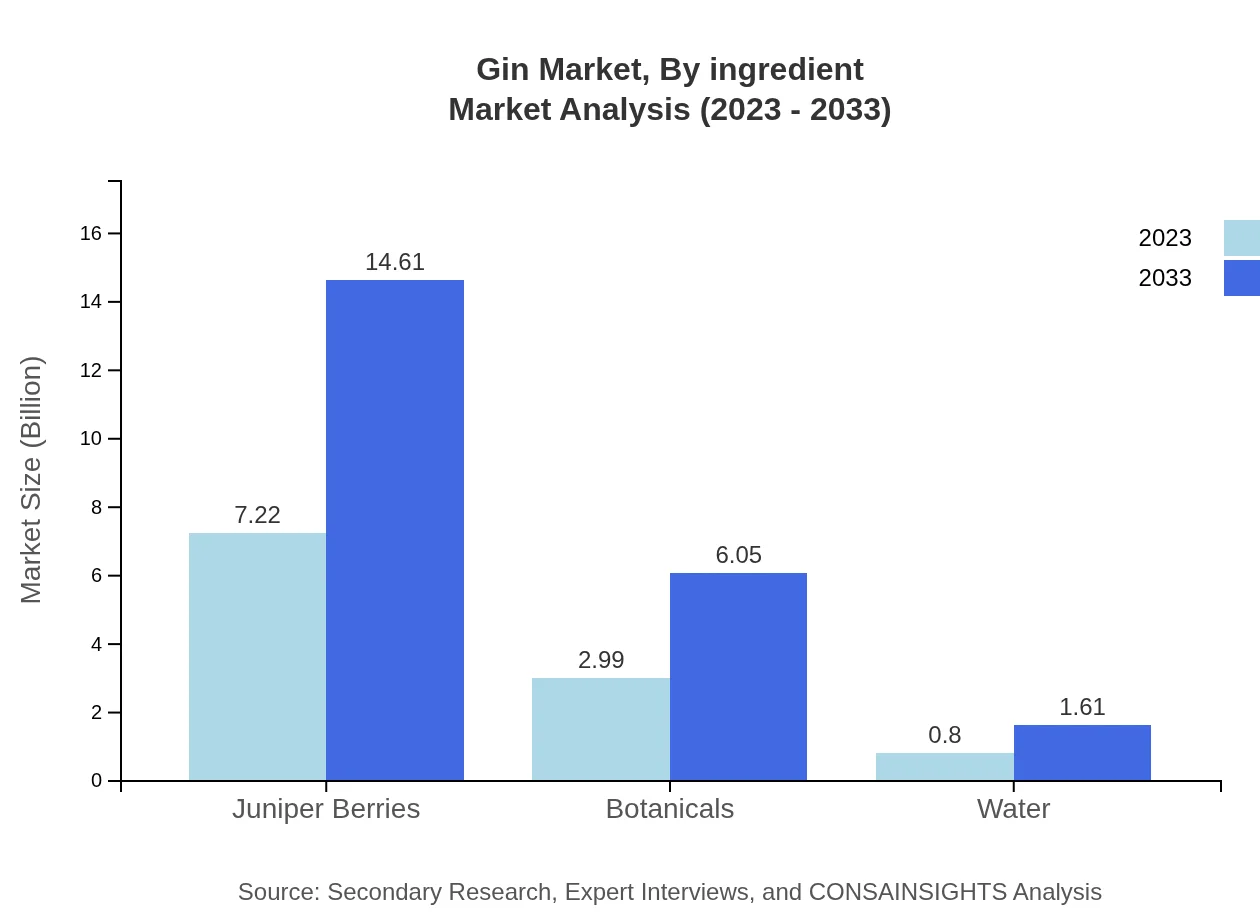

Gin Market Analysis By Ingredient

The Gin market is predominantly based on key ingredients like Juniper Berries, Botanicals, and Water. Juniper Berries account for USD 7.22 billion in 2023, projected to sustain a robust growth to USD 14.61 billion by 2033. Botanicals, known for their flavor enhancement, hold USD 2.99 billion in 2023 and are expected to reach USD 6.05 billion by 2033. Water's contribution is significant as well at USD 0.80 billion, likely to double by 2033.

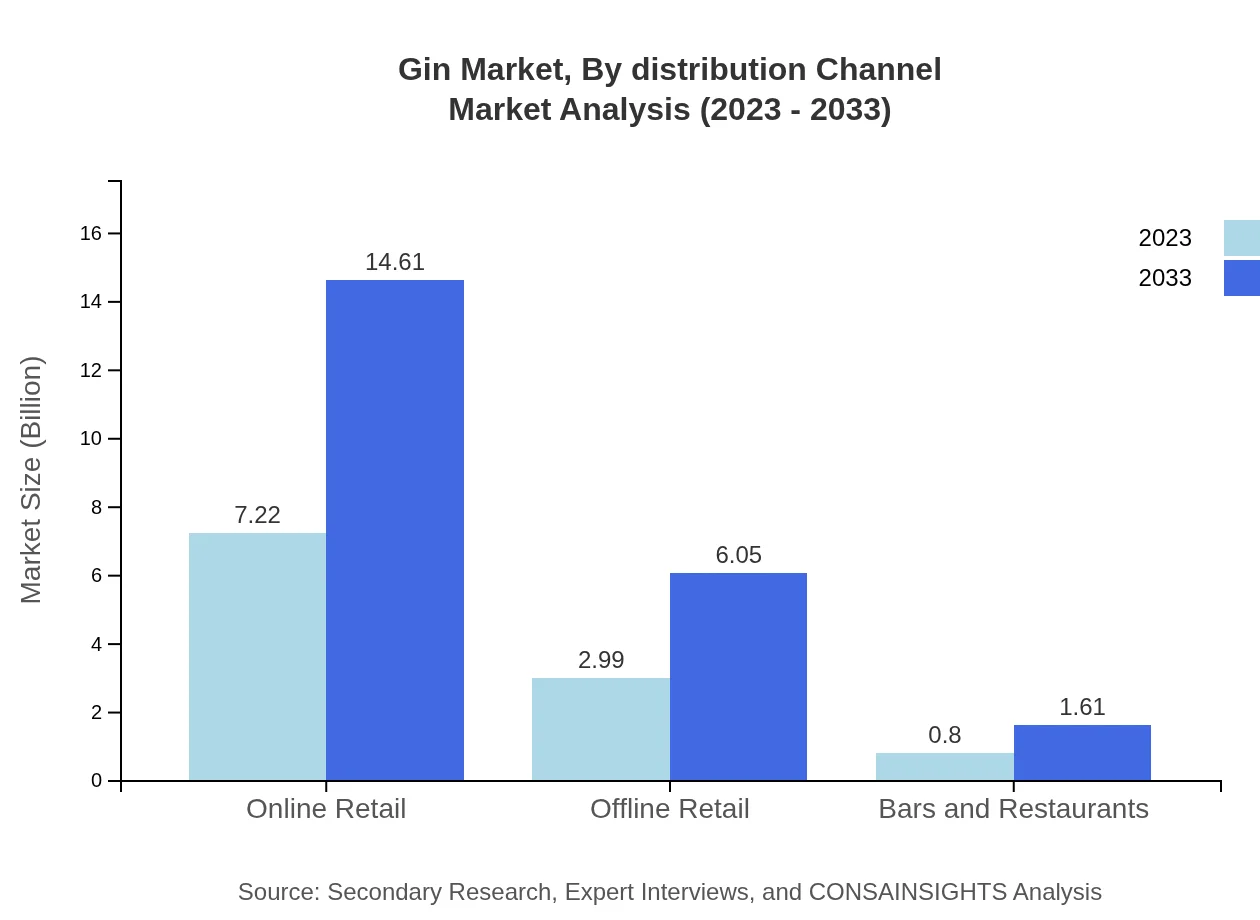

Gin Market Analysis By Distribution Channel

Distribution of Gin is largely split between Online and Offline channels. Online Retail shows substantial growth from USD 7.22 billion in 2023 to USD 14.61 billion by 2033, reflecting changing consumer purchasing habits. Offline Retail currently holds at USD 2.99 billion, projected to grow to USD 6.05 billion, with Bars and Restaurants contributing another USD 0.80 billion, expected to rise to USD 1.61 billion as social spaces thrive.

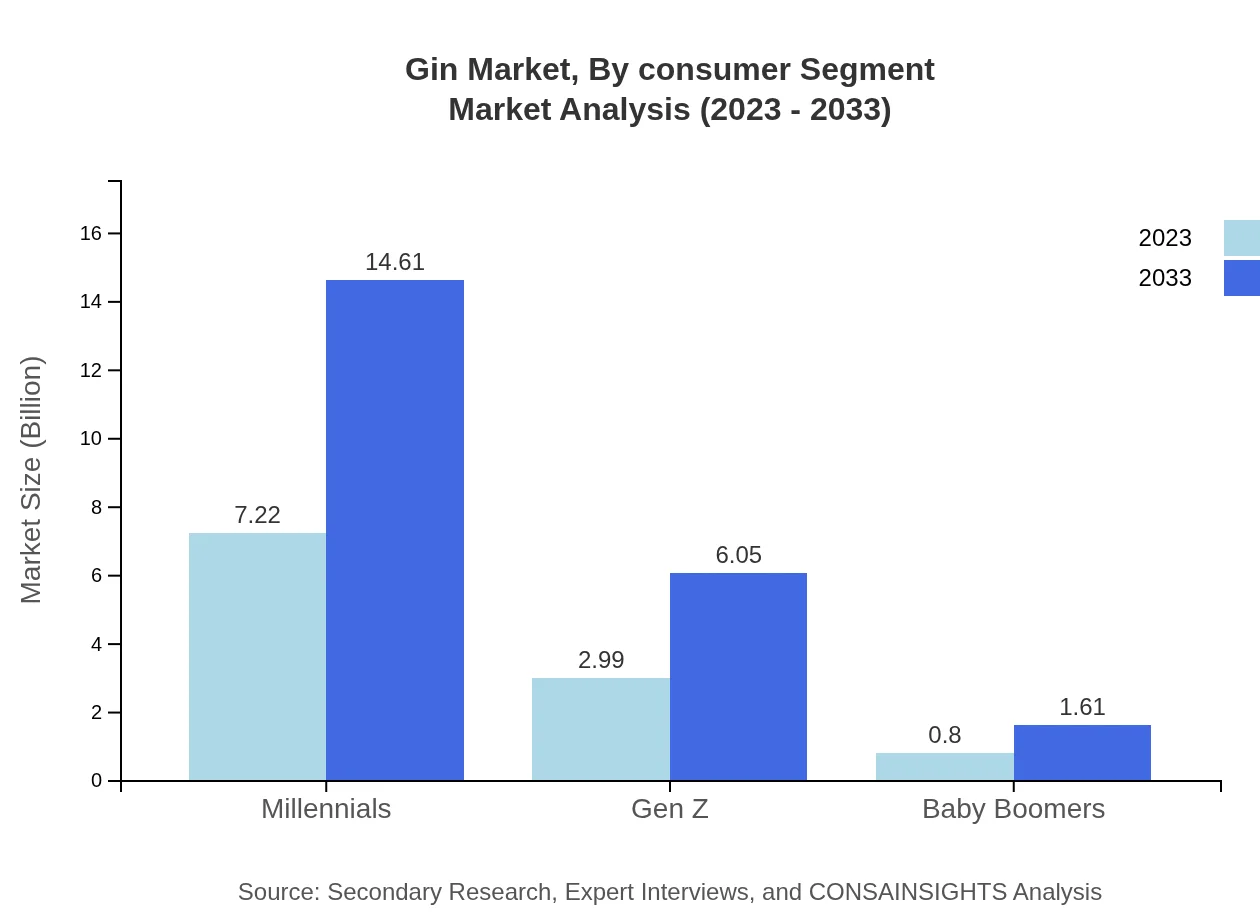

Gin Market Analysis By Consumer Segment

The consumer segment analysis indicates Millennials drive the Gin market, holding a major chunk at USD 7.22 billion in 2023, expected to peak at USD 14.61 billion by 2033. Gen Z follows with substantial representation at USD 2.99 billion and expected growth to USD 6.05 billion. Meanwhile, Baby Boomers have a smaller share of USD 0.80 billion, likely to grow to USD 1.61 billion as trends evolve.

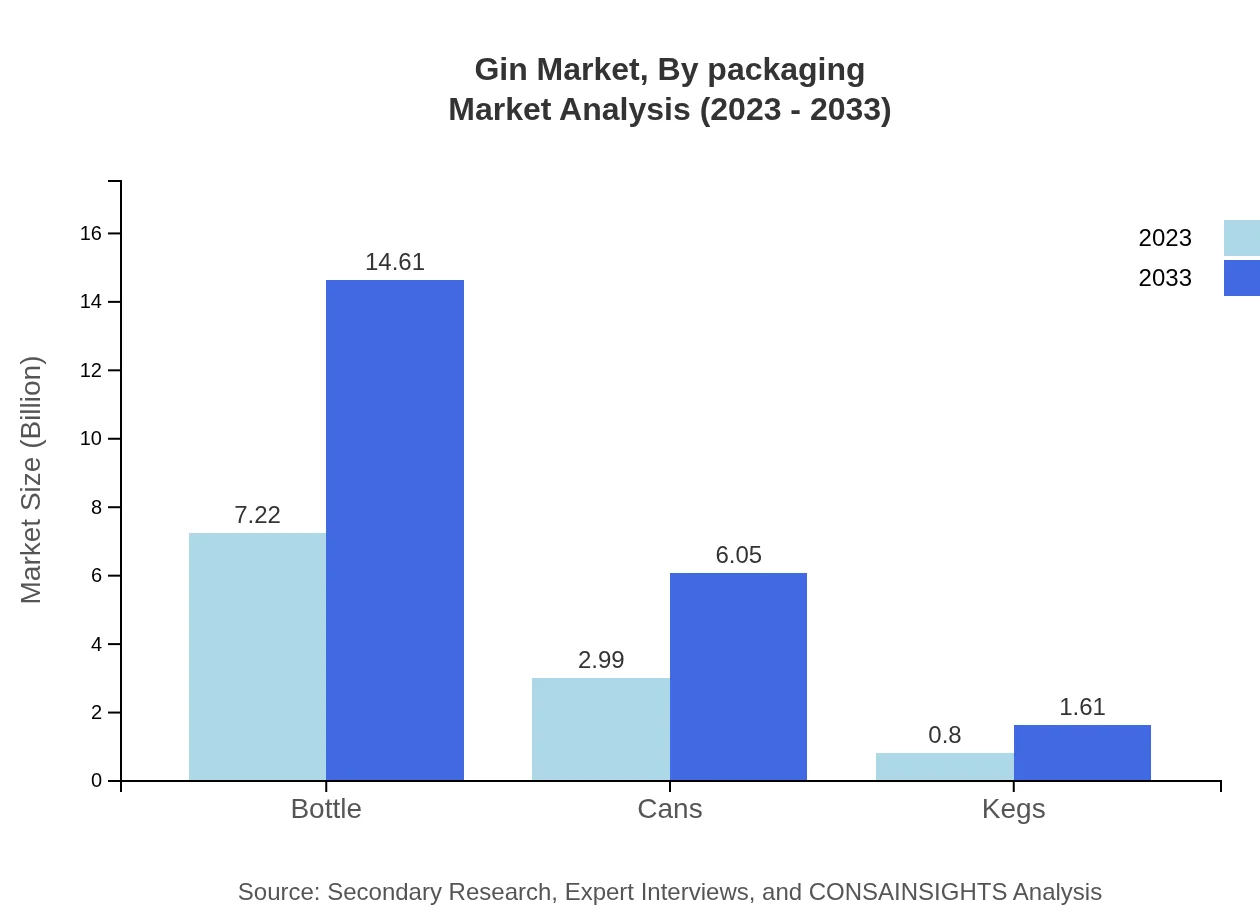

Gin Market Analysis By Packaging

Packaging formats are diversifying; Bottles maintain a stronghold at USD 7.22 billion in 2023, projected to rise to USD 14.61 billion by 2033. Cans are increasingly popular, growing from USD 2.99 billion to USD 6.05 billion, appealing particularly to younger audiences seeking convenience. Kegs, while less common, nonetheless show growth from USD 0.80 billion to USD 1.61 billion as bars cater to changing preferences.

Gin Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Gin Industry

Diageo:

A global leader in alcoholic beverages, Diageo owns several iconic gin brands including Tanqueray and Gordon's, recognized for their premium quality and innovative flavors.Pernod Ricard:

A key player in the spirits industry, Pernod Ricard markets well-known gin brands such as Beefeater, known for its traditional London Dry gin.Bacardi Limited:

Bacardi produces a range of spirits and owns Bombay Sapphire, a gin brand famed for its distinctive botanicals and blue bottle design.Whitley Neill:

An award-winning British gin brand known for its craft production and unique flavors inspired by the founder's global travels.We're grateful to work with incredible clients.

FAQs

What is the market size of gin?

The global gin market is valued at approximately $11 billion in 2023, with a projected compound annual growth rate (CAGR) of 7.1%. This growth is anticipated to expand the market significantly by 2033.

What are the key market players or companies in the gin industry?

Key players in the gin industry include renowned brands such as Diageo, Pernod Ricard, Bacardi, and William Grant & Sons. These companies dominate with innovative products and extensive distribution networks, shaping market trends and consumer preferences.

What are the primary factors driving the growth in the gin industry?

Growth in the gin industry is driven by rising consumer interest in premium and craft spirits, increased demand for innovative flavors, and the popularity of gin-based cocktails. Additionally, the trend towards artisanal production has boosted market engagement.

Which region is the fastest Growing in the gin market?

The fastest-growing region in the gin market is North America, projected to grow from $3.83 billion in 2023 to $7.75 billion by 2033. Europe follows closely, with growth from $3.50 billion to $7.09 billion, indicating strong market potential.

Does ConsaInsights provide customized market report data for the gin industry?

Yes, ConsaInsights offers customized market reports tailored to client specifications in the gin industry. Clients can request specific data points and insights that align with their business objectives and market needs.

What deliverables can I expect from this gin market research project?

From the gin market research project, clients can expect detailed reports including market size, growth projections, segment analysis, competitive landscape, and consumer trends, providing a comprehensive overview for informed decision-making.

What are the market trends of gin?

Current market trends for gin include the rising popularity of flavored gin varieties, sustainable production practices, and the shift towards online retail channels. Millennial and Gen Z consumers seek unique, high-quality experiences, driving innovation in product development.