Gis In Telecom Sector Market Report

Published Date: 31 January 2026 | Report Code: gis-in-telecom-sector

Gis In Telecom Sector Market Size, Share, Industry Trends and Forecast to 2033

This market report provides an in-depth analysis of the GIS in the telecom sector, offering insights on market trends, sizes, segmentation, and forecasts from 2023 to 2033.

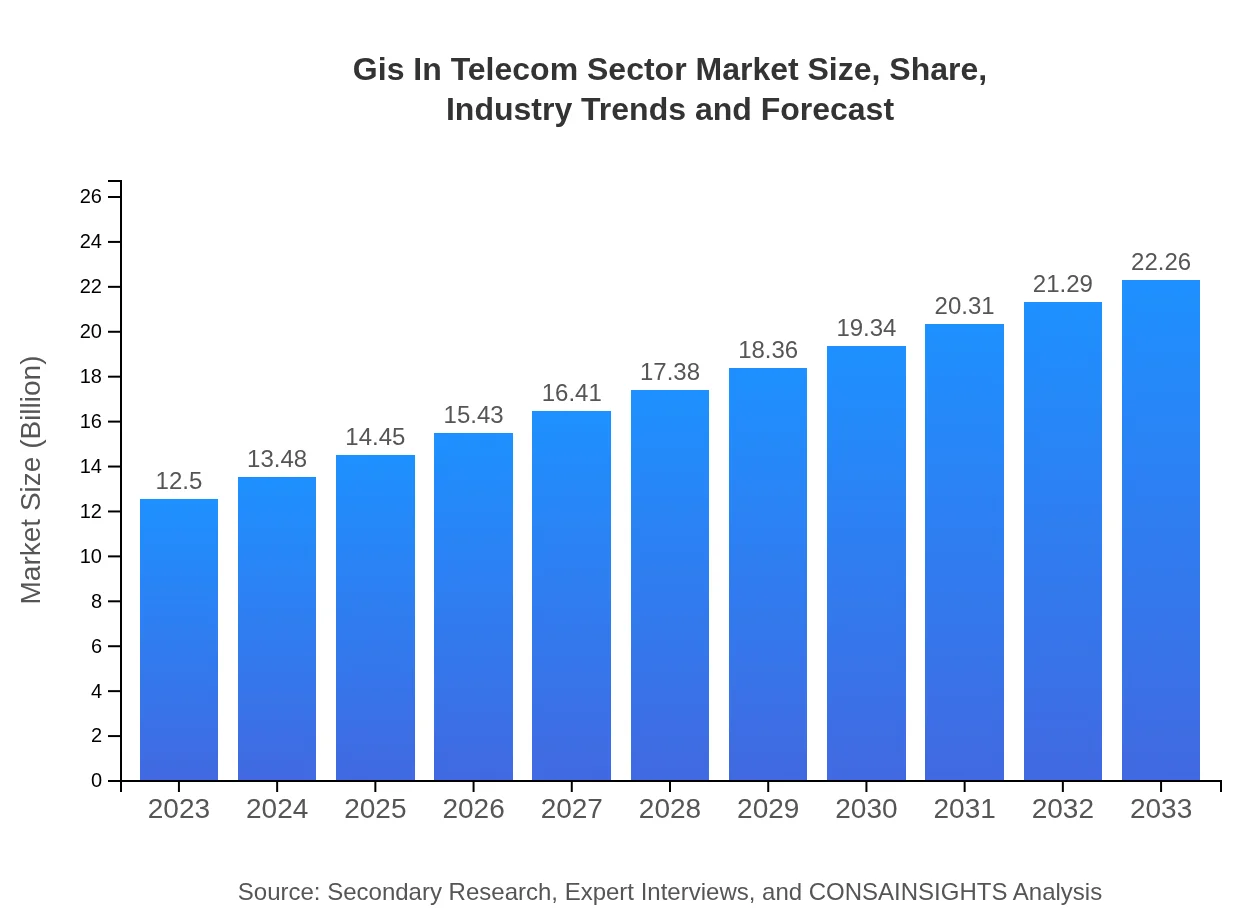

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.50 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $22.26 Billion |

| Top Companies | Esri, Hexagon AB, SAP SE |

| Last Modified Date | 31 January 2026 |

GIS In Telecom Sector Market Overview

Customize Gis In Telecom Sector Market Report market research report

- ✔ Get in-depth analysis of Gis In Telecom Sector market size, growth, and forecasts.

- ✔ Understand Gis In Telecom Sector's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Gis In Telecom Sector

What is the Market Size & CAGR of GIS In Telecom Sector market in 2023?

GIS In Telecom Sector Industry Analysis

GIS In Telecom Sector Market Segmentation and Scope

Tell us your focus area and get a customized research report.

GIS In Telecom Sector Market Analysis Report by Region

Europe Gis In Telecom Sector Market Report:

Europe's market was valued at USD 4.07 billion in 2023 and is forecasted to grow to USD 7.25 billion by 2033, driven by strict regulations on data management and the high demand for efficient network solutions.Asia Pacific Gis In Telecom Sector Market Report:

In the Asia-Pacific region, the GIS in telecom market was valued at USD 2.17 billion in 2023 and is expected to reach USD 3.86 billion by 2033. Factors such as urbanization, rising smartphone penetration, and government investments in smart city initiatives are key drivers.North America Gis In Telecom Sector Market Report:

North America holds a significant market value of USD 4.45 billion in 2023, expected to reach USD 7.92 billion by 2033. The presence of major telecom operators and a highly developed infrastructure contribute to this robust market scenario.South America Gis In Telecom Sector Market Report:

South America’s GIS in telecom market stood at USD 0.53 billion in 2023 and is projected to grow to USD 0.94 billion by 2033. Increasing internet coverage and digital service expansion are pivotal in driving this growth.Middle East & Africa Gis In Telecom Sector Market Report:

The Middle East and Africa region recorded a market size of USD 1.28 billion in 2023, anticipated to increase to USD 2.28 billion by 2033. Factors influencing this growth include rising mobile connectivity and increasing investments in telecom infrastructure.Tell us your focus area and get a customized research report.

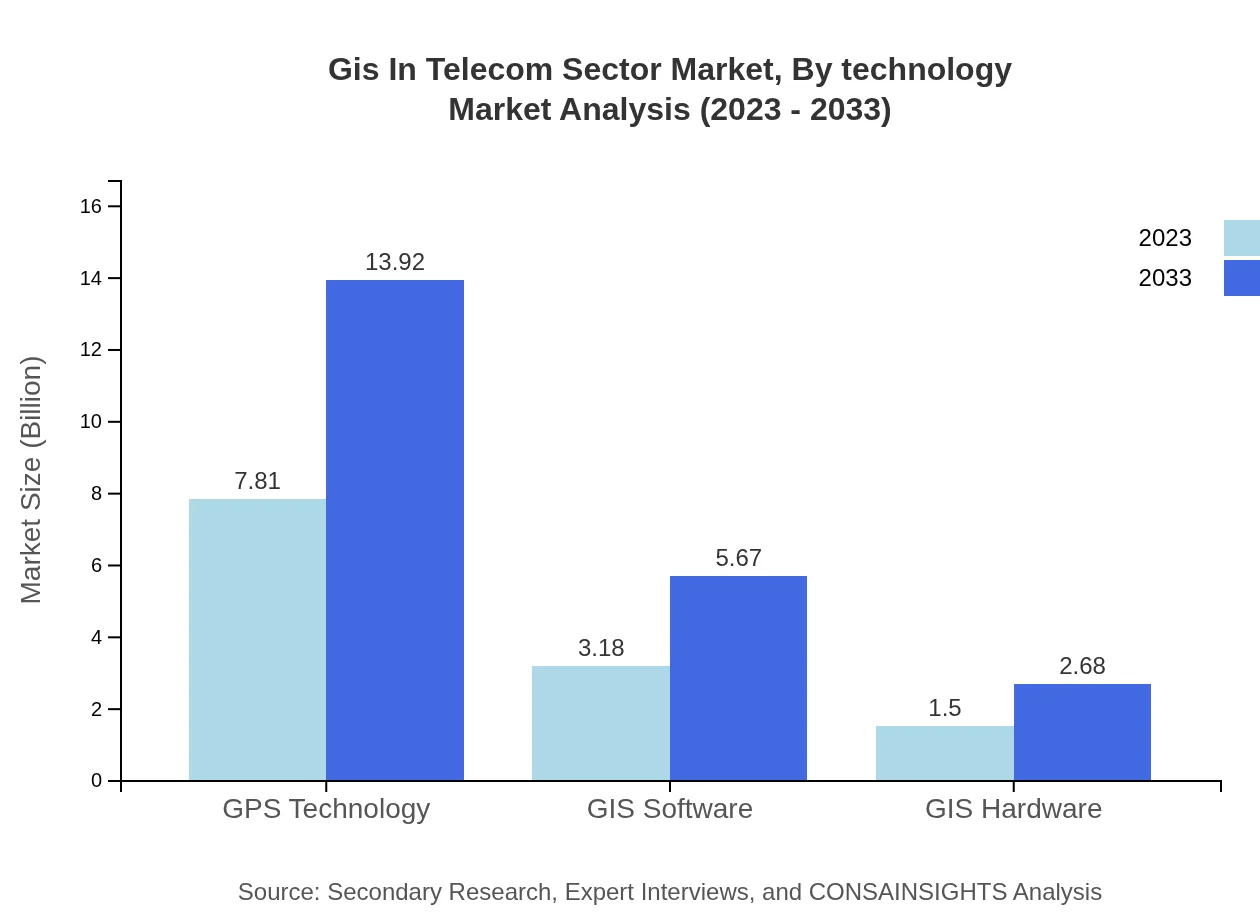

Gis In Telecom Sector Market Analysis By Technology

The GIS market in telecom is heavily influenced by technology types such as GPS, GIS software, and GIS hardware, with mobile operators dominating sales. In 2023, the segment accounted for USD 7.81 billion, projected to grow to USD 13.92 billion by 2033.

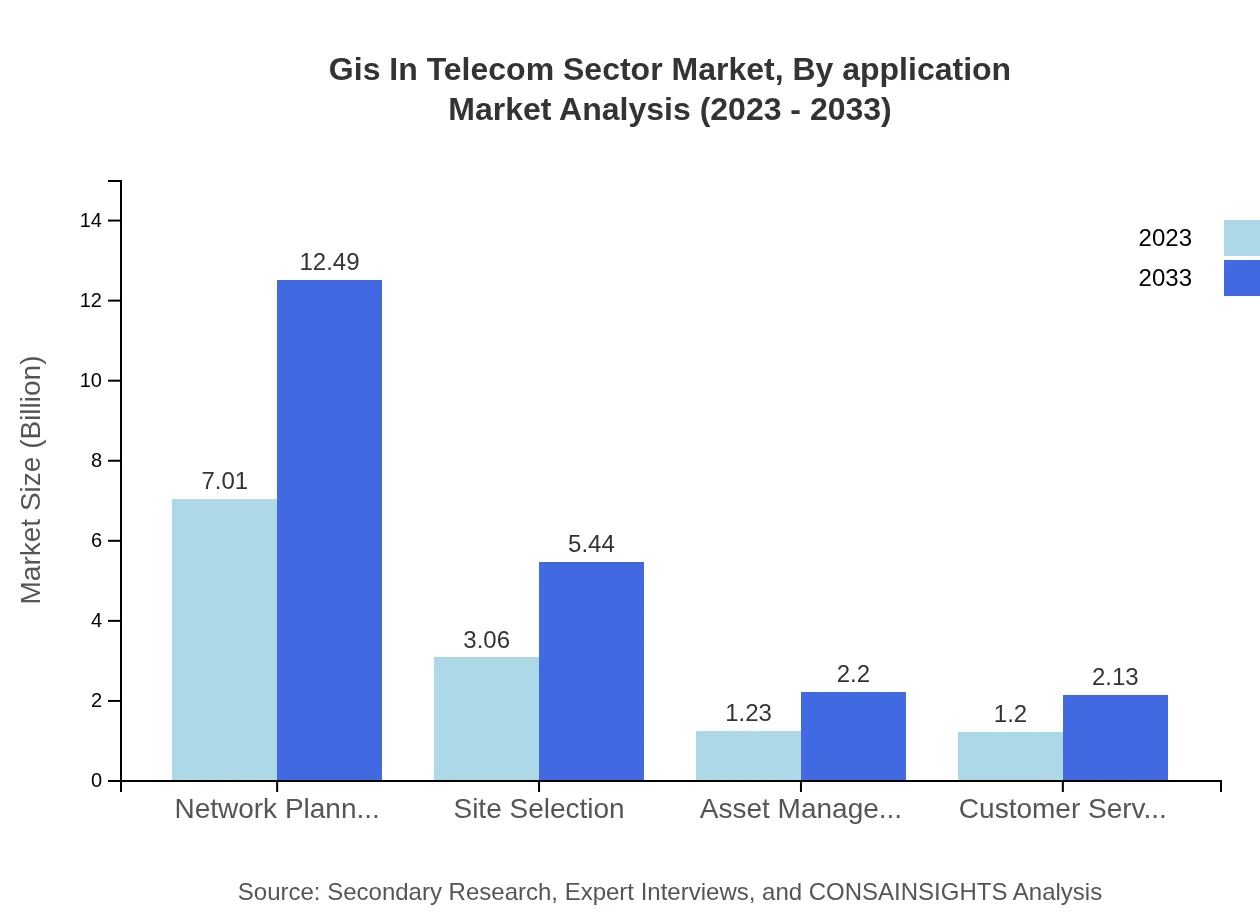

Gis In Telecom Sector Market Analysis By Application

Applications of GIS in telecom include network planning, asset management, and customer service. The network planning segment is expected to dominate with USD 7.01 billion in 2023 and is projected to reach USD 12.49 billion by 2033.

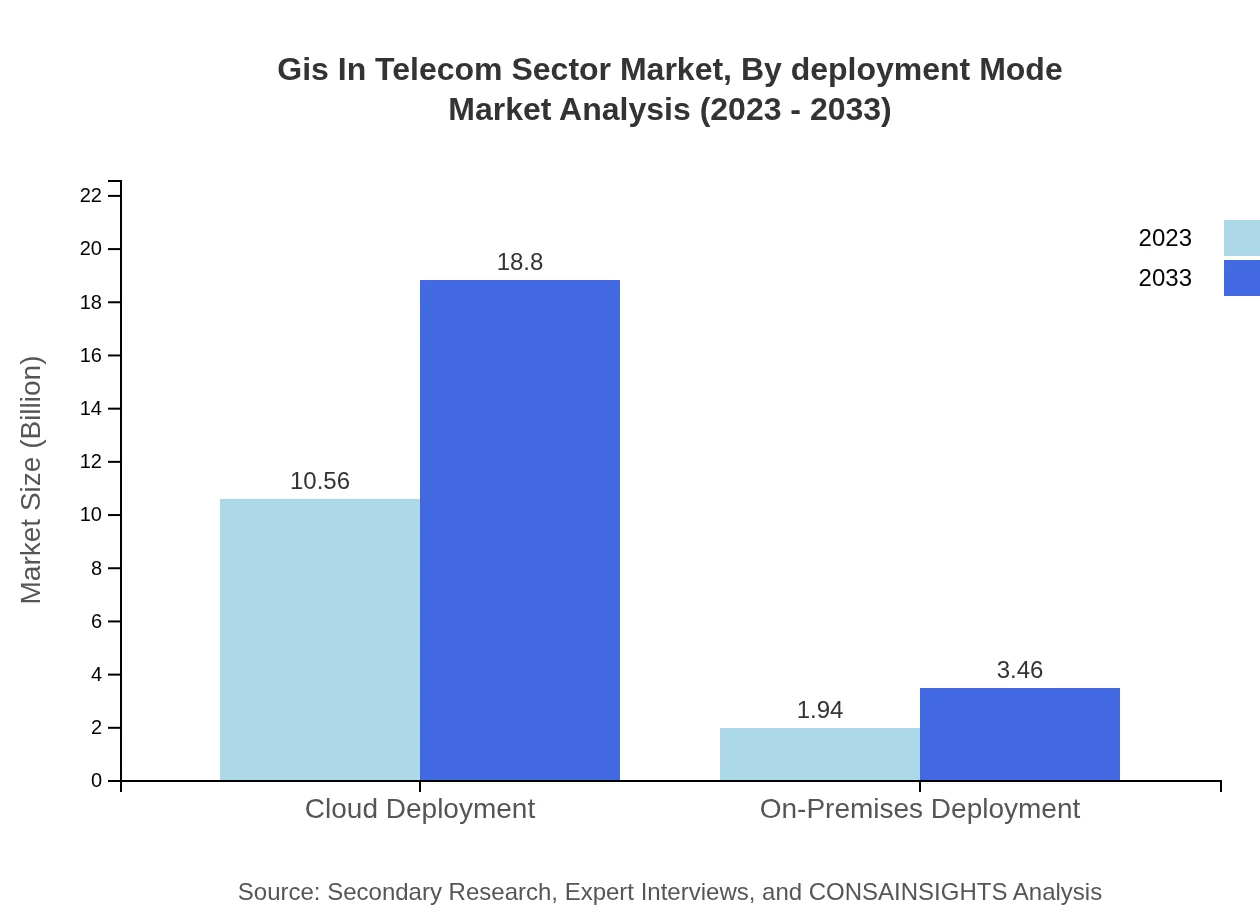

Gis In Telecom Sector Market Analysis By Deployment Mode

Deployment modes are categorized into cloud and on-premises. The cloud deployment segment leads in adoption due to scalability and cost-effectiveness, anticipated to grow from USD 10.56 billion in 2023 to USD 18.80 billion by 2033.

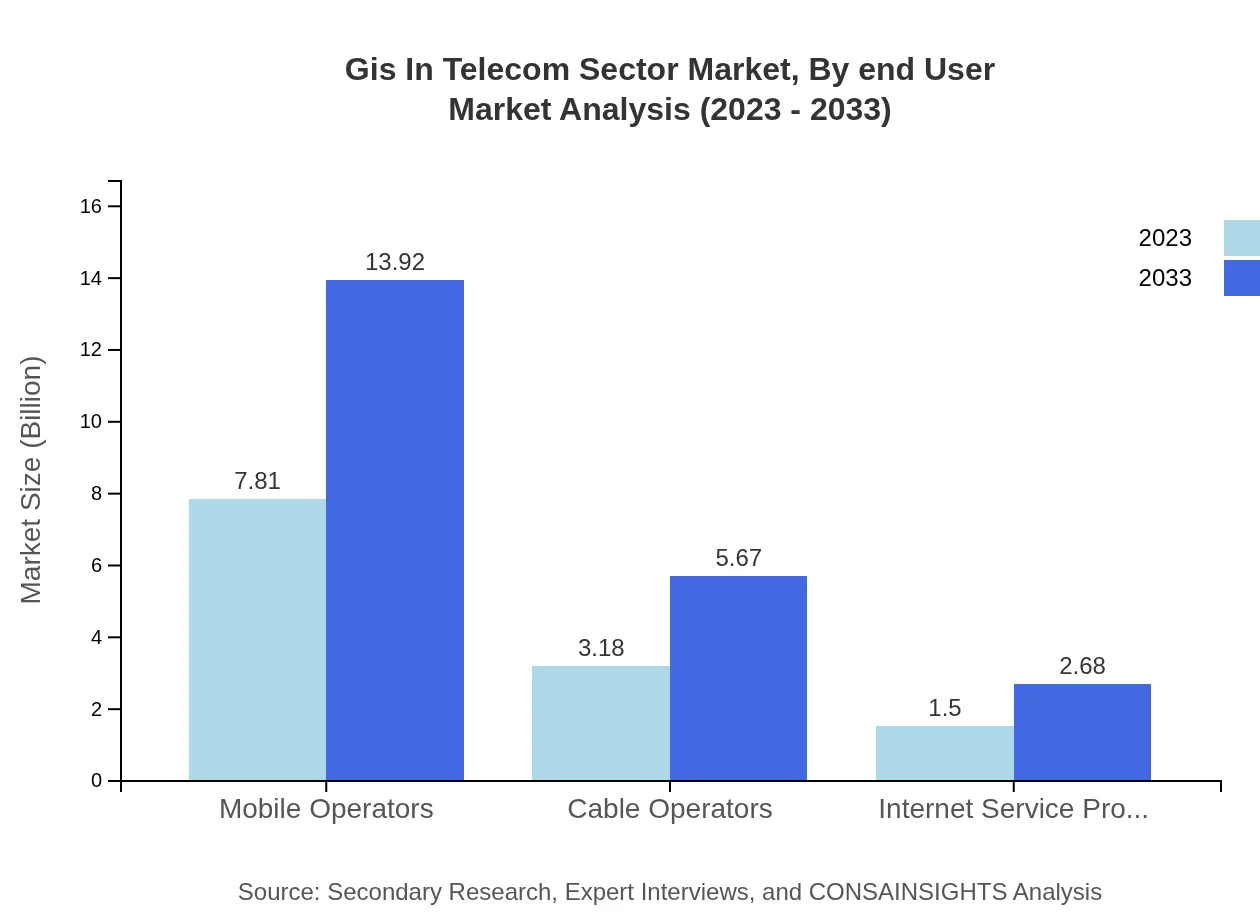

Gis In Telecom Sector Market Analysis By End User

End-users primarily include mobile operators and internet service providers (ISPs), with mobile operators controlling a dominant market share and revenue stream. The segment generated USD 7.81 billion revenue in 2023, expecting consistent growth.

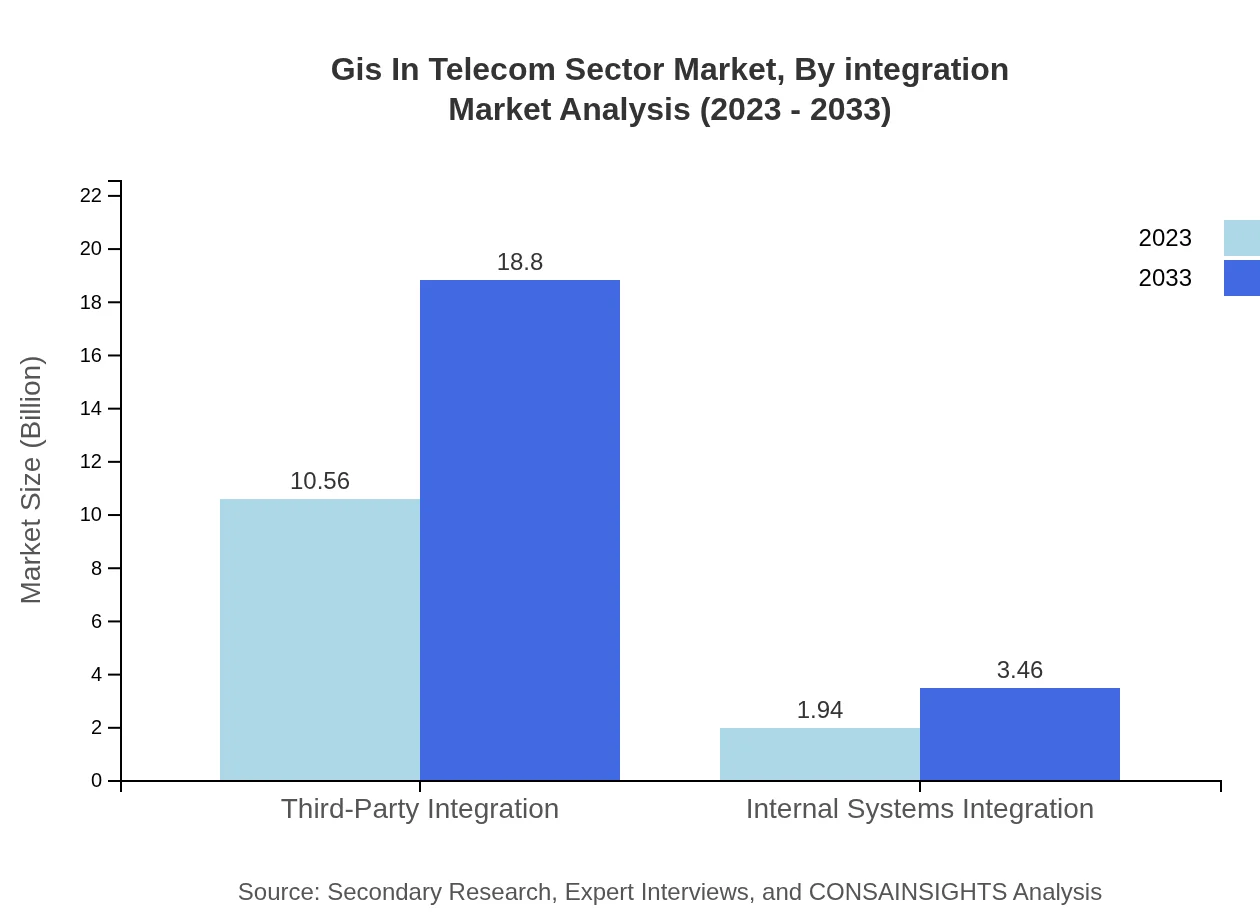

Gis In Telecom Sector Market Analysis By Integration

Integration of cloud and internal systems is crucial for successful GIS implementation in telecom. With third-party integration leading in adoption due to flexibility, the segment is set to rise from USD 10.56 billion in 2023 to USD 18.80 billion by 2033.

GIS In Telecom Sector Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in GIS In Telecom Sector Industry

Esri:

A leader in GIS software development, Esri provides tools for spatial analysis crucial for telecom operators looking to enhance service delivery.Hexagon AB:

Hexagon specializes in sensor, software, and autonomous solutions, aiding telecom firms to optimize network architectures.SAP SE:

SAP offers integrated solutions ensuring optimal asset management and efficacy in telecommunications operations, contributing significantly to the sector.We're grateful to work with incredible clients.

FAQs

What is the market size of GIS in the telecom sector?

The GIS in Telecom sector market size is projected to reach $12.5 billion by 2033, with a compound annual growth rate (CAGR) of 5.8% from its current valuation in 2023.

What are the key market players or companies in the GIS in telecom sector industry?

Key players in the GIS in telecom sector include leading software firms, telecom service providers, and hardware manufacturers, each contributing to the advancement of geographical data technologies and their integration into telecommunications.

What are the primary factors driving the growth in the GIS in telecom sector industry?

The growth is primarily driven by increasing demand for efficient network planning, asset management, customer service enhancements, and the integration of GIS technologies to optimize telecommunication operations.

Which region is the fastest Growing in the GIS in telecom sector?

The fastest-growing region in the GIS in telecom sector is projected to be Europe, expanding from $4.07 billion in 2023 to $7.25 billion in 2033, reflecting a significant upward trend in investment and technological adoption.

Does ConsaInsights provide customized market report data for the GIS in telecom sector industry?

Yes, ConsaInsights offers customized market report data for the GIS in the telecom sector, ensuring clients receive tailored insights and analytics specific to their needs and market interests.

What deliverables can I expect from this GIS in telecom sector market research project?

Deliverables include comprehensive market analysis reports, trend forecasts, segmentation data, competitive landscape reviews, and insights on regional dynamics to support strategic decision-making.

What are the market trends of GIS in the telecom sector?

Market trends include the adoption of advanced GPS technology, increased cloud deployment, and a focus on third-party integration, all designed to improve efficiency and service delivery in the telecom industry.