Glass Substrate Market Report

Published Date: 02 February 2026 | Report Code: glass-substrate

Glass Substrate Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Glass Substrate market, covering insights on market size, growth trends, segmentation, and region-specific data from 2023 to 2033.

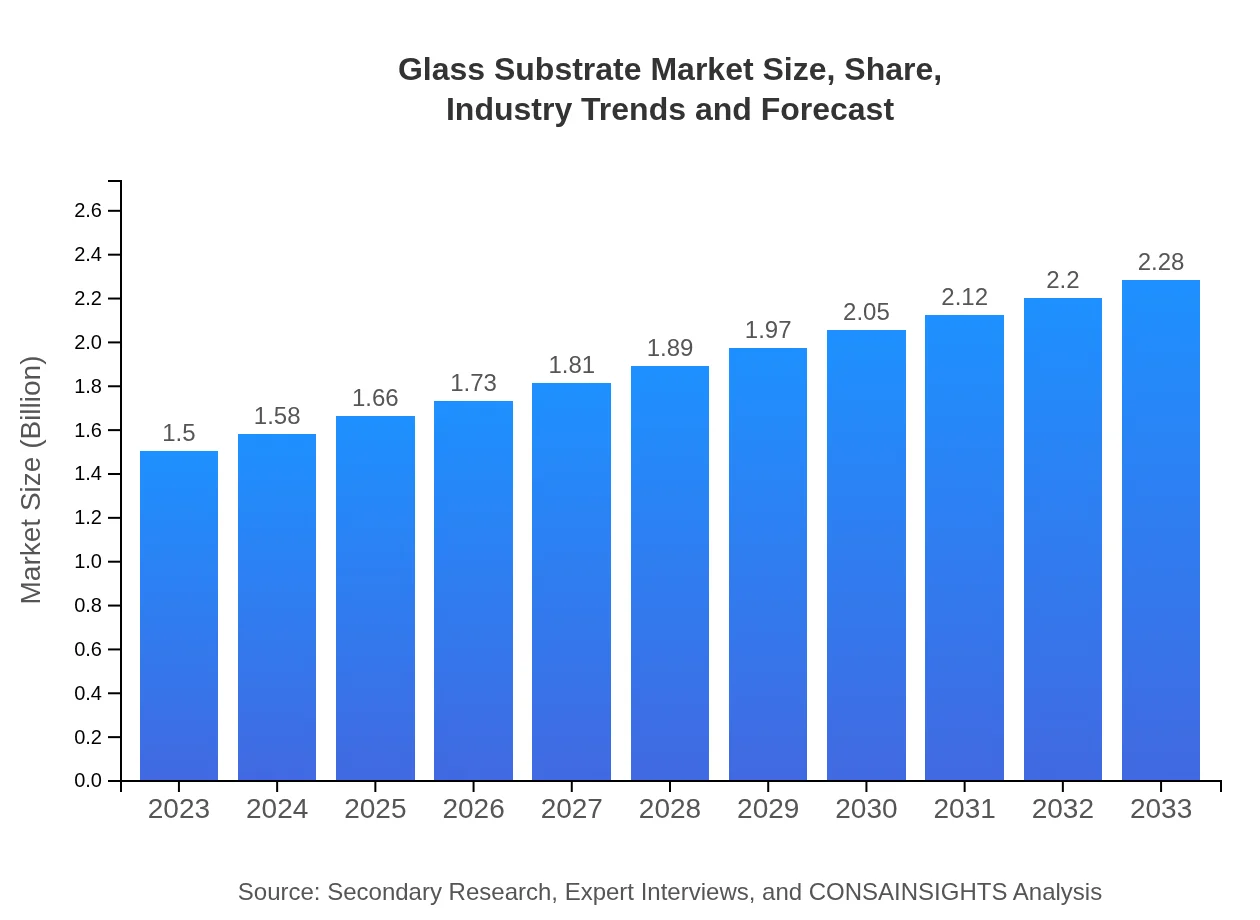

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 4.2% |

| 2033 Market Size | $2.28 Billion |

| Top Companies | Corning Inc., AGC Inc., Asahi Glass Co., Saint-Gobain |

| Last Modified Date | 02 February 2026 |

Glass Substrate Market Overview

Customize Glass Substrate Market Report market research report

- ✔ Get in-depth analysis of Glass Substrate market size, growth, and forecasts.

- ✔ Understand Glass Substrate's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Glass Substrate

What is the Market Size & CAGR of Glass Substrate market in 2023?

Glass Substrate Industry Analysis

Glass Substrate Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Glass Substrate Market Analysis Report by Region

Europe Glass Substrate Market Report:

Europe is anticipated to grow from $0.48 billion in 2023 to $0.73 billion by 2033. The region’s focus on energy-efficient materials and smart technology integration significantly advances glass substrate adoption in various industries.Asia Pacific Glass Substrate Market Report:

The Asia Pacific region is projected to grow from $0.25 billion in 2023 to $0.38 billion by 2033. Factors contributing to this growth include expanding electronics manufacturing in countries like China and Japan, alongside a rising middle-class population demanding high-tech products.North America Glass Substrate Market Report:

North America, with a market size of $0.57 billion in 2023, is projected to reach $0.86 billion by 2033, driven by robust demand for consumer electronics and automotive sectors, particularly in the United States.South America Glass Substrate Market Report:

South America’s market is expected to increase from $0.12 billion in 2023 to $0.18 billion in 2033. The growth is driven by increased investments in renewable energy and improved manufacturing capabilities across countries like Brazil and Argentina.Middle East & Africa Glass Substrate Market Report:

The Middle East and Africa are projected to grow from $0.08 billion in 2023 to $0.12 billion by 2033, bolstered by ongoing construction projects and increasing demand for modern building materials.Tell us your focus area and get a customized research report.

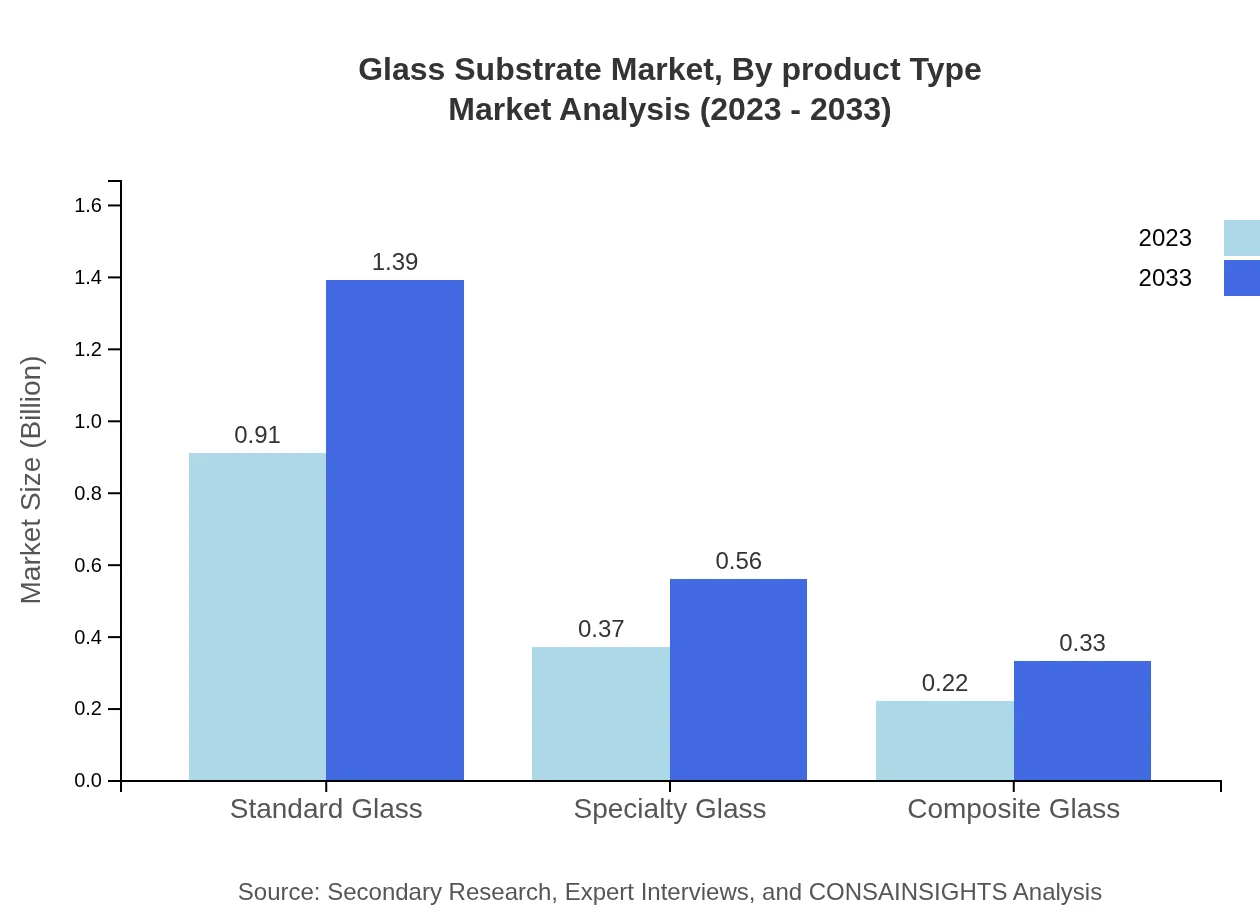

Glass Substrate Market Analysis By Product Type

In 2023, standard glass holds a dominant market share, valued at $0.91 billion and expected to reach $1.39 billion in 2033, accounting for 60.99% of the market share. Specialty and composite glass are also significant, showing steady growth due to varied applications.

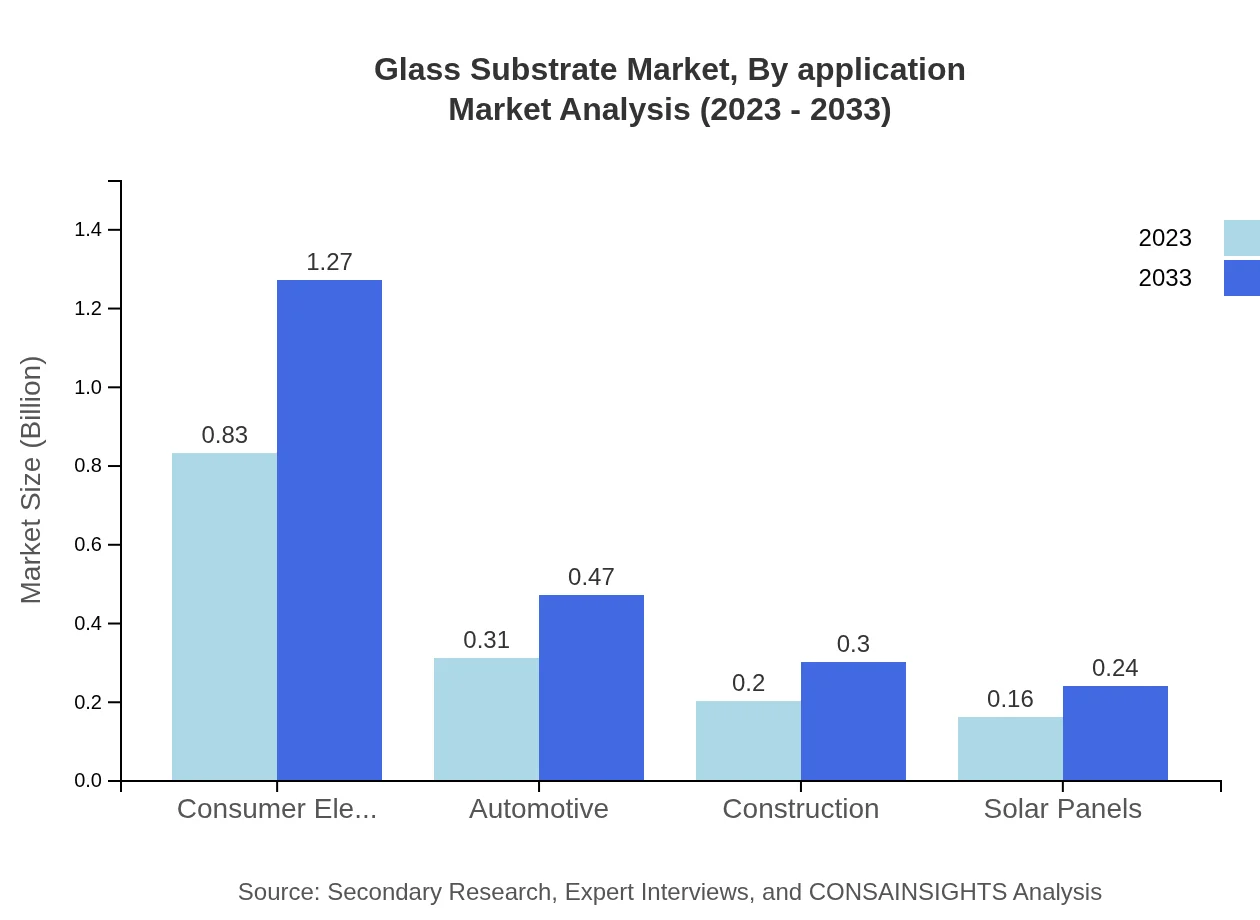

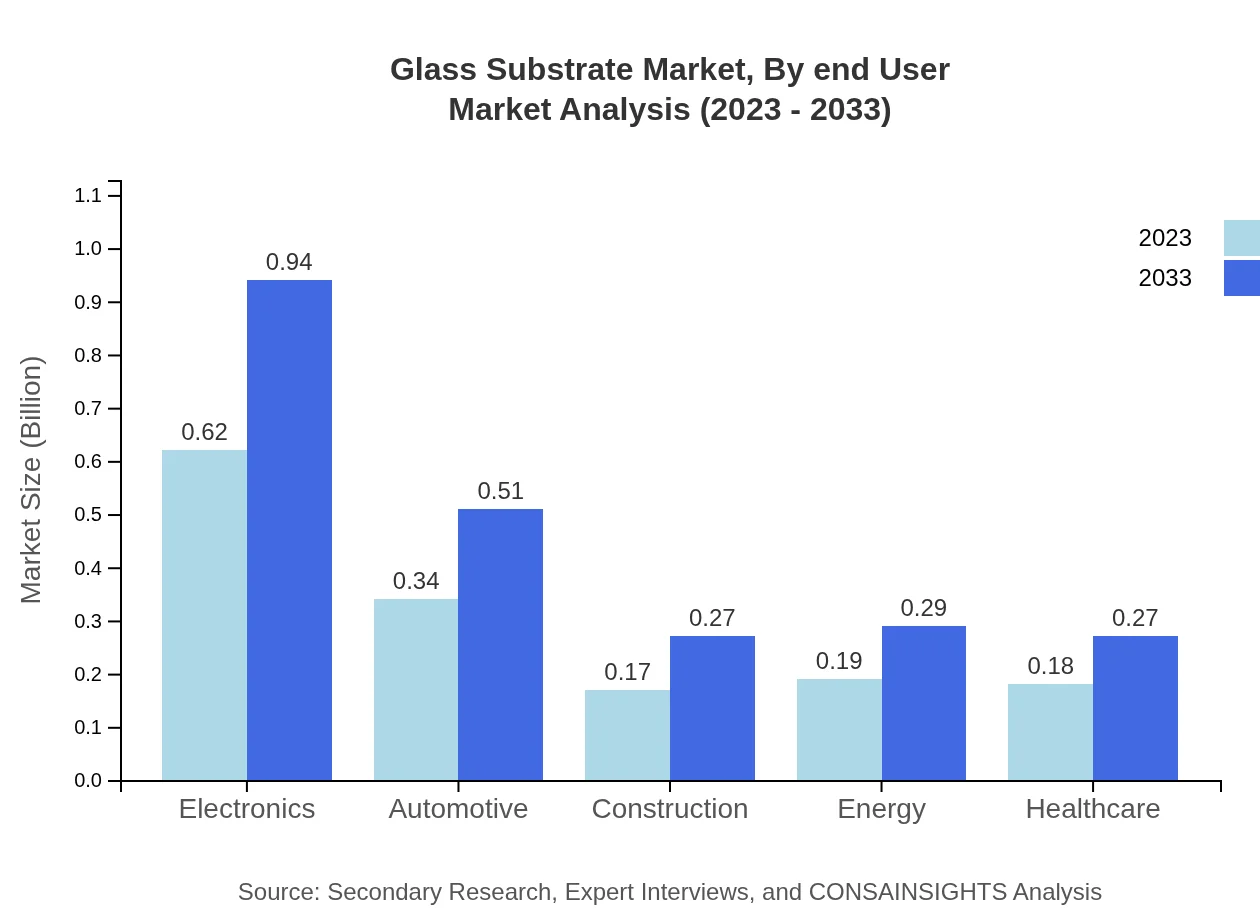

Glass Substrate Market Analysis By Application

Electronics remain the leading application segment with a market size of $0.62 billion in 2023, projected to increase to $0.94 billion by 2033. Automotive and construction applications follow, highlighting the versatility of glass substrates across industries.

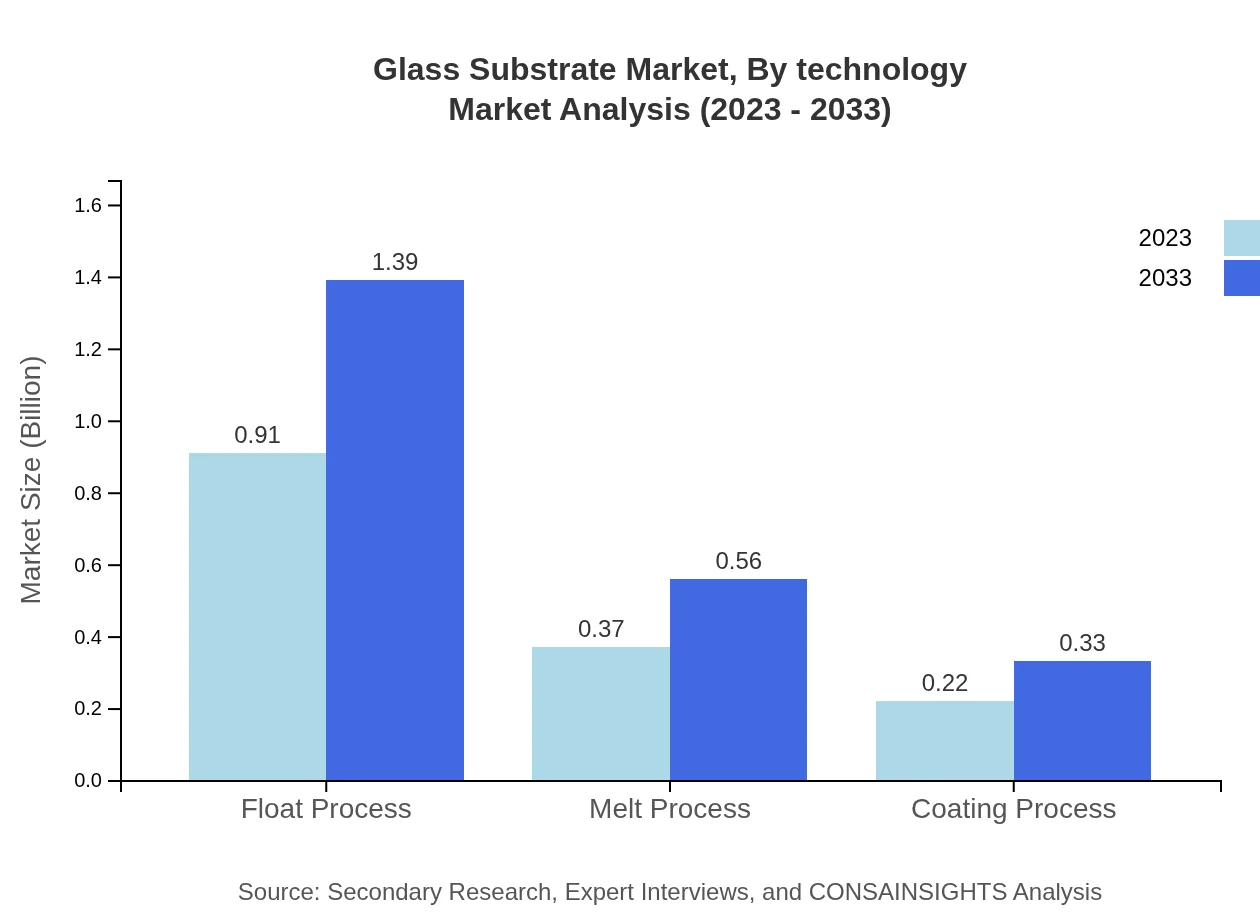

Glass Substrate Market Analysis By Technology

The float process dominates glass substrate manufacturing, projected to reach $1.39 billion in 2033. Alternative technologies such as melt and coating processes are also emerging, offering innovations in durability and application-specific uses.

Glass Substrate Market Analysis By End User

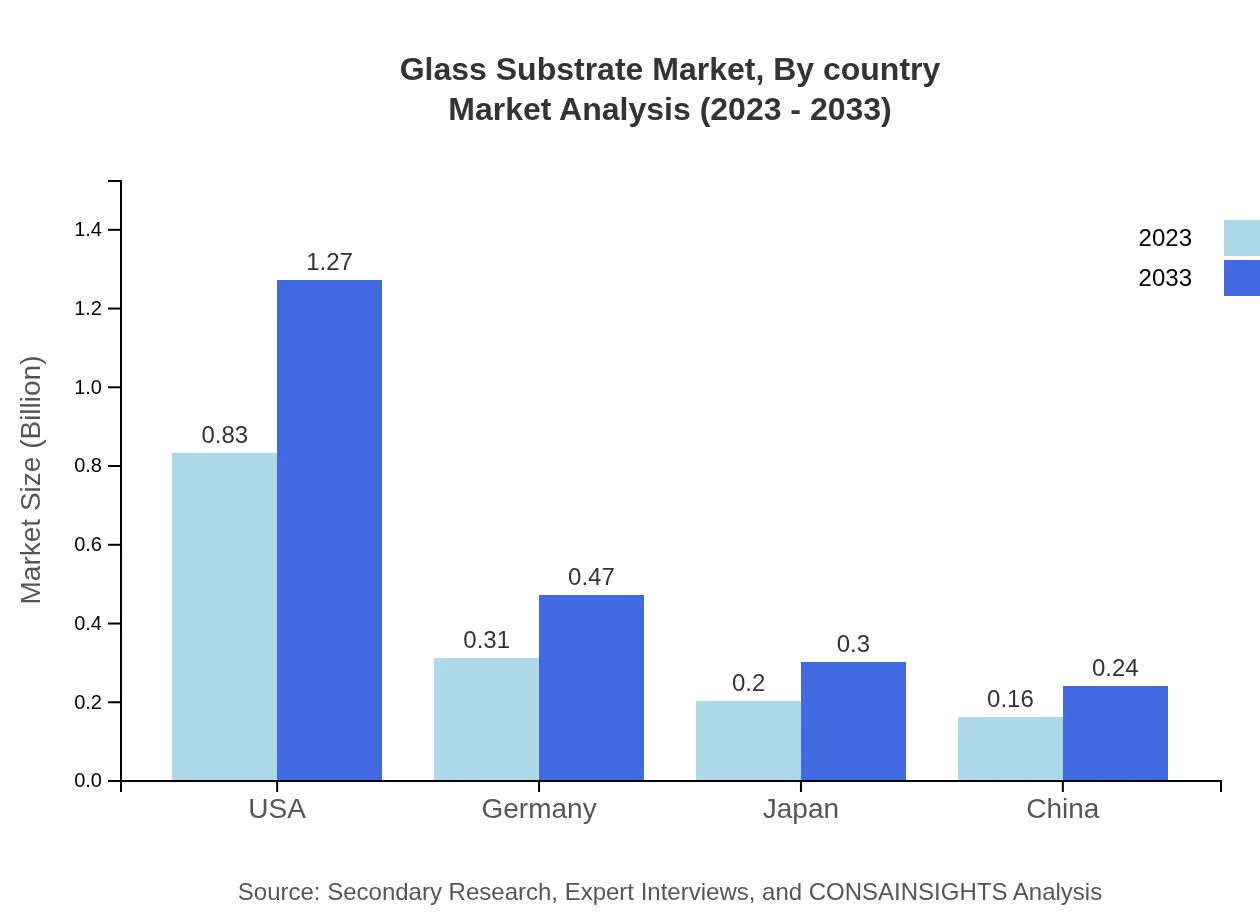

The consumer electronics sector accounts for the largest share, valued at $0.83 billion in 2023 and projected to grow to $1.27 billion by 2033. The automotive and healthcare sectors also present considerable demand, fostering growth across diverse platforms.

Glass Substrate Market Analysis By Country

In the USA, the market is expected to grow from $0.83 billion in 2023 to $1.27 billion by 2033, with a stable market share of 55.57%. Germany and Japan also show significant market potential, supported by technological advancements and industrial growth.

Glass Substrate Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Glass Substrate Industry

Corning Inc.:

A leader in specialty glass and ceramics, Corning is instrumental in glass technology for consumer electronics and advanced displays.AGC Inc.:

AGC is a major player in the glass and ceramics industry, providing innovative glass solutions for various applications including automotive and electronics.Asahi Glass Co.:

A significant manufacturer of flat glass and advanced glass substrates, contributing technological enhancements across industries.Saint-Gobain:

Focused on construction materials and glass production, Saint-Gobain plays a vital role in the European and global markets.We're grateful to work with incredible clients.

FAQs

What is the market size of glass Substrate?

The glass substrate market is projected to reach $1.5 billion by 2033, with a Compound Annual Growth Rate (CAGR) of 4.2%. The increasing demand in electronics and consumer goods is driving this growth.

What are the key market players or companies in the glass Substrate industry?

Key players in the glass substrate industry include prominent manufacturers such as Corning Inc., AGC Inc., and SCHOTT AG. These companies are investing heavily in R&D and expansion to capture a larger market share.

What are the primary factors driving the growth in the glass Substrate industry?

The growth of the glass substrate industry is driven by rising demand in sectors like electronics, automotive, and solar energy. Technological advancements and increasing applications in consumer electronics also contribute to market expansion.

Which region is the fastest Growing in the glass Substrate?

The Asia Pacific region is the fastest-growing area in the glass substrate market, projected to grow from $0.25 billion in 2023 to $0.38 billion by 2033, reflecting a robust demand for electronics and automotive applications.

Does ConsaInsights provide customized market report data for the glass Substrate industry?

Yes, ConsaInsights offers customized market report data tailored to client specifications in the glass substrate industry. This includes detailed analysis, forecasts, and insights specific to regions, segments, and timeframes.

What deliverables can I expect from this glass Substrate market research project?

Deliverables from the glass substrate market research project include comprehensive reports, market size assessments, trend analyses, segmentation data, and actionable insights tailored for strategic decision-making.

What are the market trends of glass Substrate?

Current trends in the glass substrate market include increasing focus on eco-friendly materials, advancements in manufacturing processes, and growing adoption of smart technologies in consumer electronics.