Glucose Dextrose And Maltodextrin Market Report

Published Date: 31 January 2026 | Report Code: glucose-dextrose-and-maltodextrin

Glucose Dextrose And Maltodextrin Market Size, Share, Industry Trends and Forecast to 2033

This report covers an in-depth analysis of the Glucose, Dextrose, and Maltodextrin market from 2023 to 2033, focusing on market size, growth trends, regional insights, and a comprehensive overview of key industry segments and players.

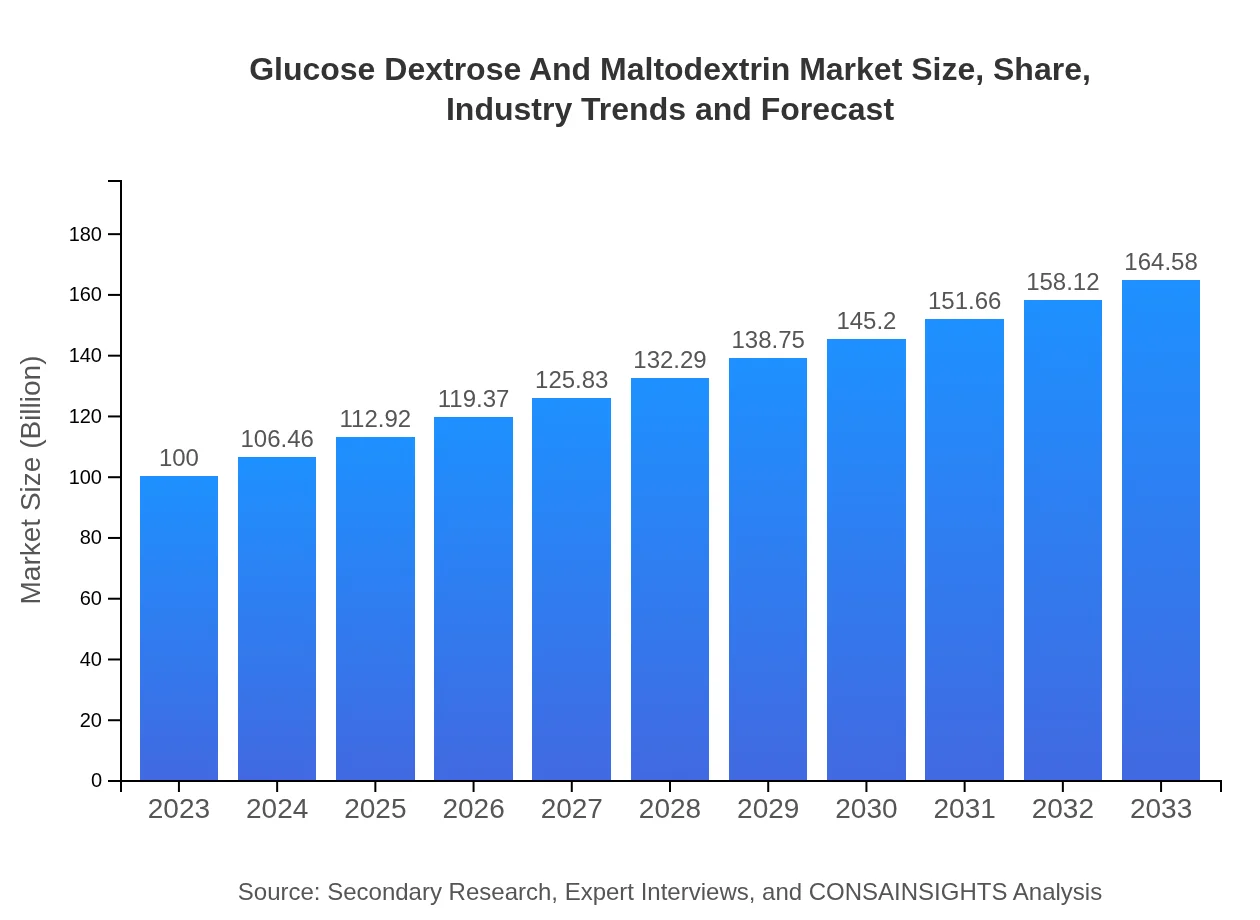

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $100.00 Million |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $164.58 Million |

| Top Companies | Cargill , Archer Daniels Midland Company (ADM), Roquette Frères |

| Last Modified Date | 31 January 2026 |

Glucose Dextrose And Maltodextrin Market Overview

Customize Glucose Dextrose And Maltodextrin Market Report market research report

- ✔ Get in-depth analysis of Glucose Dextrose And Maltodextrin market size, growth, and forecasts.

- ✔ Understand Glucose Dextrose And Maltodextrin's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Glucose Dextrose And Maltodextrin

What is the Market Size & CAGR of Glucose Dextrose And Maltodextrin market in 2023?

Glucose Dextrose And Maltodextrin Industry Analysis

Glucose Dextrose And Maltodextrin Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Glucose Dextrose And Maltodextrin Market Analysis Report by Region

Europe Glucose Dextrose And Maltodextrin Market Report:

The European market is also witnessing robust growth, projected to escalate from $32.68 million in 2023 to $53.78 million in 2033. Key trends influencing this region include clean label product demands and innovations in food formulation techniques.Asia Pacific Glucose Dextrose And Maltodextrin Market Report:

In Asia Pacific, the market for Glucose, Dextrose, and Maltodextrin is projected to see significant growth, from $15.62 million in 2023 to $25.71 million by 2033. This growth is stimulated by rising disposable income and changing dietary habits, leading to increased consumption of processed foods.North America Glucose Dextrose And Maltodextrin Market Report:

North America leads the market with a value of $36.84 million in 2023, projected to reach $60.63 million by 2033. The region's growth is supported by a strong focus on food safety regulations and rising consumer awareness about healthy eating habits.South America Glucose Dextrose And Maltodextrin Market Report:

The South American market is smaller, estimated to grow from $1.80 million in 2023 to $2.96 million by 2033. The growth is driven by escalating demand for health and wellness products, with dextrose and maltodextrin being incorporated into nutritional supplements.Middle East & Africa Glucose Dextrose And Maltodextrin Market Report:

The Middle East and Africa market is anticipated to grow from $13.06 million in 2023 to $21.49 million by 2033, driven by increasing urbanization and growth in convenience food demand.Tell us your focus area and get a customized research report.

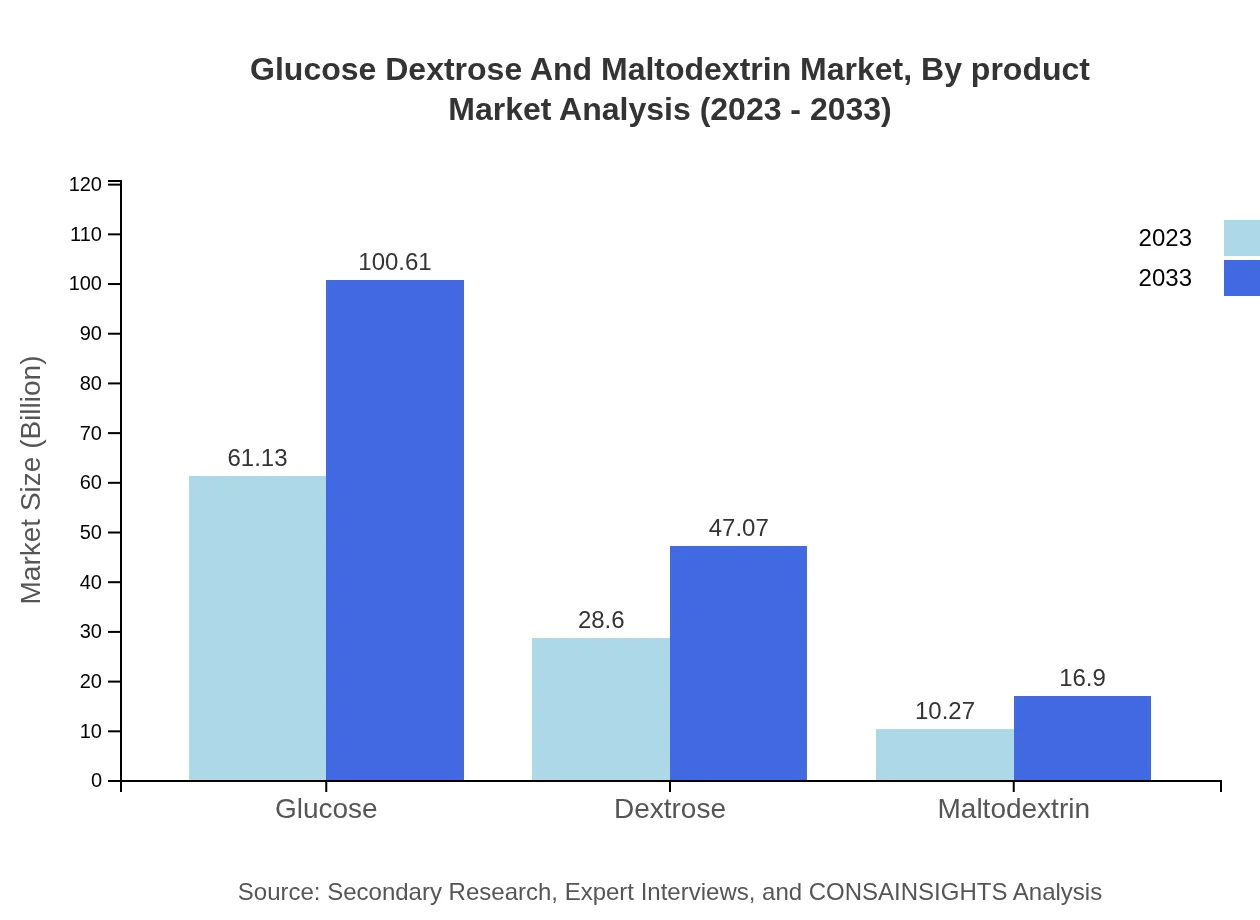

Glucose Dextrose And Maltodextrin Market Analysis By Product

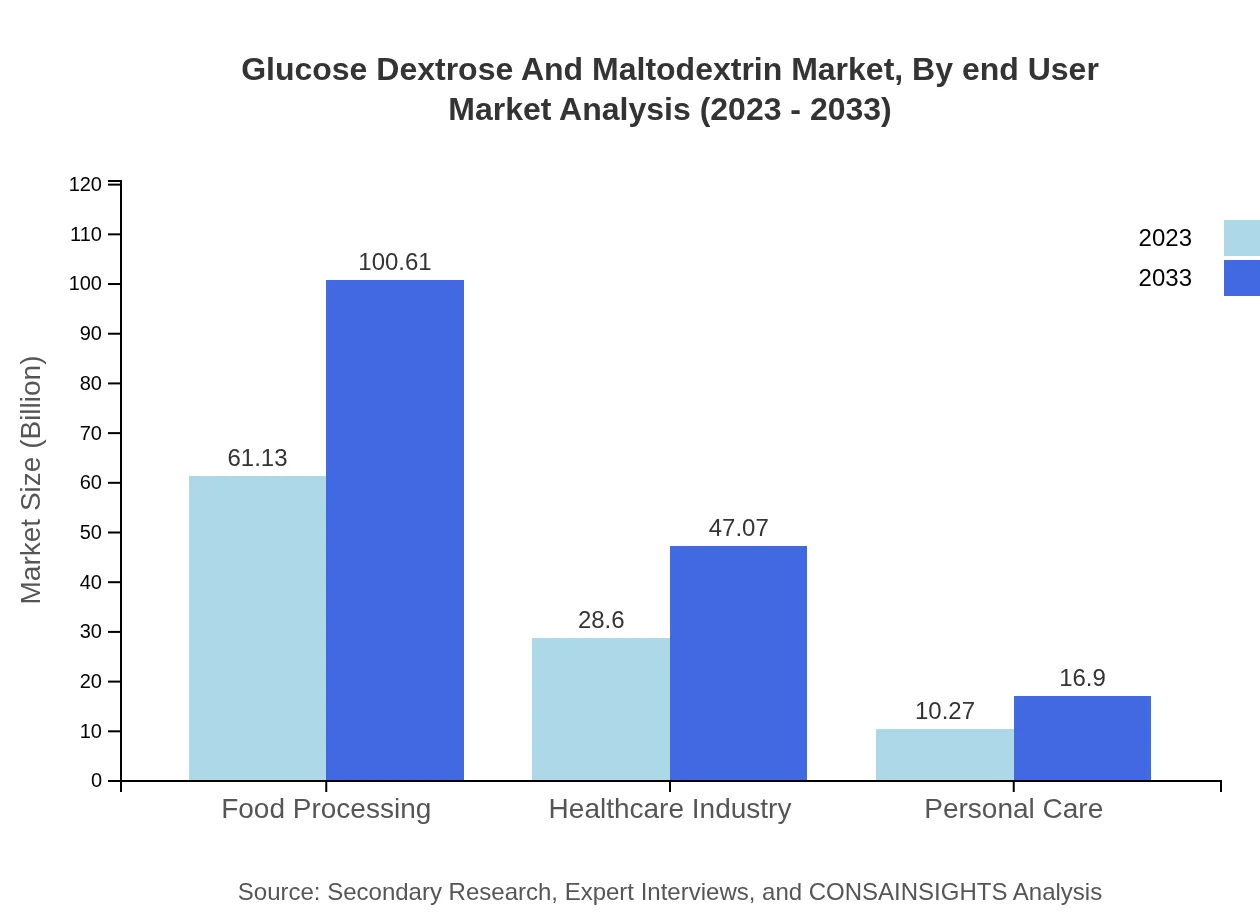

The product segment is dominated by glucose, dextrose, and maltodextrin. With glucose leading the charge at $61.13 million in 2023 and expected to grow to $100.61 million in 2033, representing a critical component for energy in food and beverage applications. Dextrose follows at $28.60 million, projected to reach $47.07 million, whereas maltodextrin will expand from $10.27 million to $16.90 million over the same period.

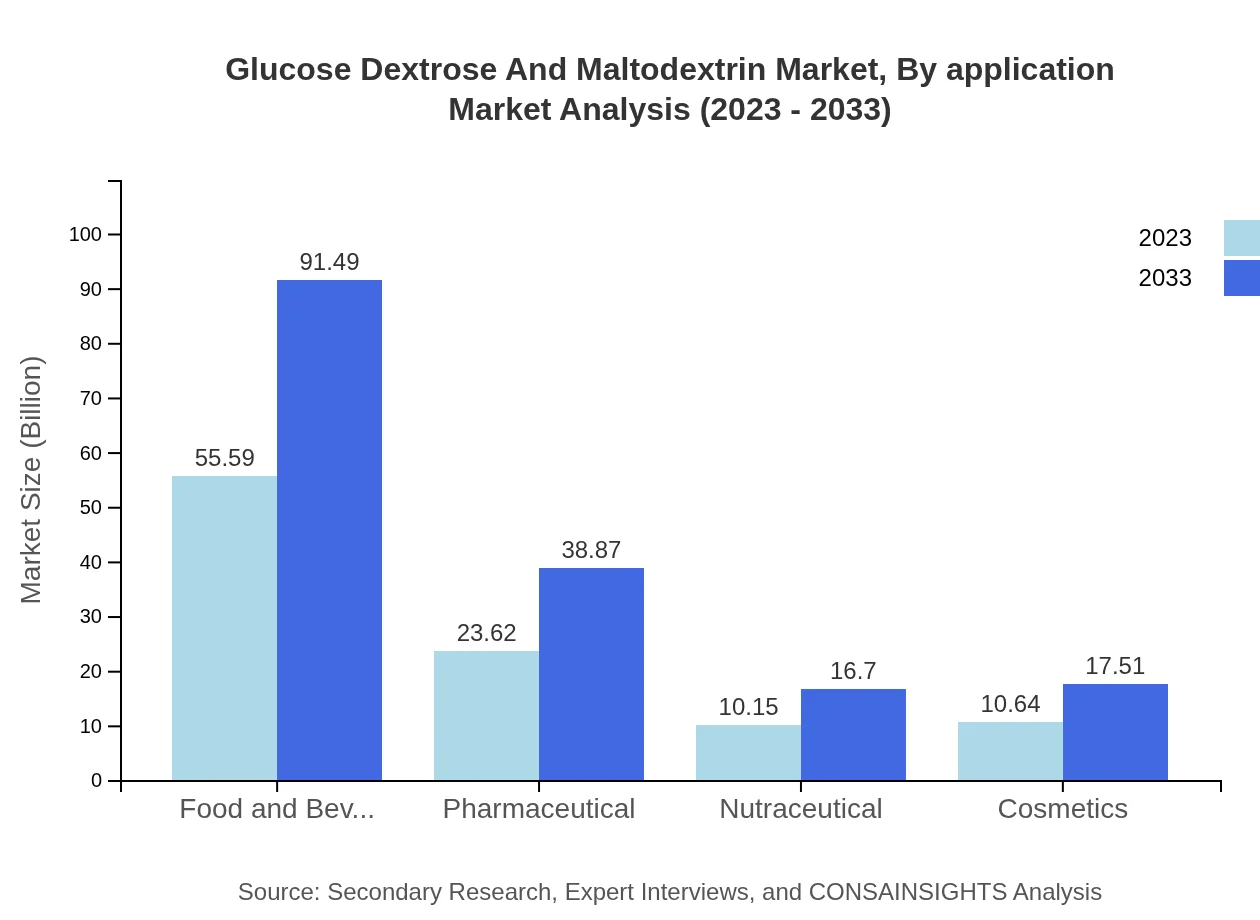

Glucose Dextrose And Maltodextrin Market Analysis By Application

Within applications, the food and beverage sector holds significant dominance, valued at $55.59 million in 2023 and forecasted to grow to $91.49 million. The healthcare sector is also a notable segment, leveraging dextrose's role in clinical nutrition and IV solutions, currently valued at $28.60 million and expected to surge to $47.07 million by 2033.

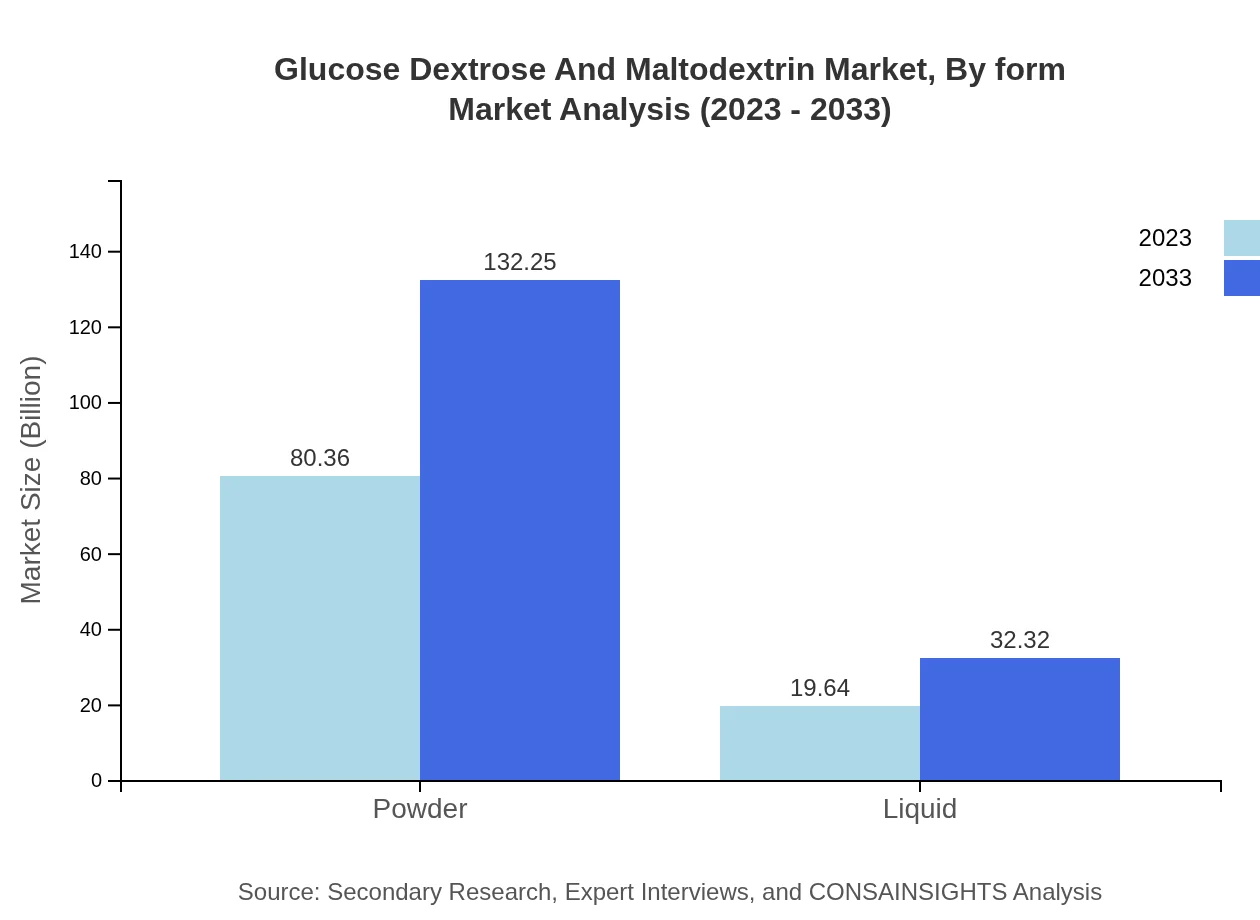

Glucose Dextrose And Maltodextrin Market Analysis By Form

In terms of form, the powder form is notably preeminent, with valuations of $80.36 million in 2023, growing to $132.25 million by 2033. The liquid form also sees growth, expanding from $19.64 million to $32.32 million as the demand for ready-to-use formulations rises.

Glucose Dextrose And Maltodextrin Market Analysis By End User

End-user industries predominantly include food processing, healthcare, and pharmaceuticals. The food processing industry, with a market size of $61.13 million, is anticipated to grow to $100.61 million. The healthcare industry follows closely, set to grow from $28.60 million to $47.07 million reflecting the rising application of dextrose in health-related solutions.

Glucose Dextrose And Maltodextrin Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Glucose Dextrose And Maltodextrin Industry

Cargill :

Cargill is a prominent player in the agro-food space, focusing on the production of high-quality glucose and maltodextrin products used widely across food and beverage industries.Archer Daniels Midland Company (ADM):

ADM has a significant presence in the carbohydrate market, manufacturing dextrose and maltodextrin that cater to a broad customer base including food manufacturers and healthcare providers.Roquette Frères:

Roquette is a global leader providing innovative carbohydrate solutions including a wide range of glucose and maltodextrin products tailored for food processing and pharmaceutical applications.We're grateful to work with incredible clients.

FAQs

What is the market size of glucose Dextrose And Maltodextrin?

The glucose, dextrose, and maltodextrin market is currently valued at $100 million and is expected to grow at a CAGR of 5% from 2023 to 2033, indicating increasing demand and application across various industries.

What are the key market players or companies in this glucose Dextrose And Maltodextrin industry?

Key players in the glucose, dextrose, and maltodextrin market include prominent food and beverage manufacturers, pharmaceutical companies, and nutraceutical firms, all competing to innovate and expand their product portfolios to meet rising consumer needs.

What are the primary factors driving the growth in the glucose Dextrose And Maltodextrin industry?

Growth drivers include the increasing demand for natural sweeteners, rising health consciousness leading to nutritious products, and the expansion of the food and beverage sector looking for versatile ingredients to enhance formulations.

Which region is the fastest Growing in the glucose Dextrose And Maltodextrin market?

North America is the fastest-growing region, with projected market growth from $36.84 million in 2023 to $60.63 million in 2033. Europe and Asia Pacific also show significant growth potential, driven by their large consumer bases.

Does ConsaInsights provide customized market report data for the glucose Dextrose And Maltodextrin industry?

Yes, ConsaInsights offers tailored market reports according to specific client requirements, focusing on niche segments, regional insights, and competitive analysis in the glucose, dextrose, and maltodextrin market.

What deliverables can I expect from this glucose Dextrose And Maltodextrin market research project?

Expected deliverables include detailed market analysis, growth forecasts, segment breakdowns, competitive landscape assessments, and strategic recommendations tailored to your business goals in the glucose, dextrose, and maltodextrin market.

What are the market trends of glucose Dextrose And Maltodextrin?

Current market trends encompass a shift towards cleaner labels, the rising popularity of plant-based and organic products, and the growing application of glucose, dextrose, and maltodextrin in dietary supplements, indicating a robust future.