Glucose Monitoring Device Market Report

Published Date: 31 January 2026 | Report Code: glucose-monitoring-device

Glucose Monitoring Device Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Glucose Monitoring Device market from 2023 to 2033, focusing on market size, growth trends, regional insights, technological advancements, and competitive landscape.

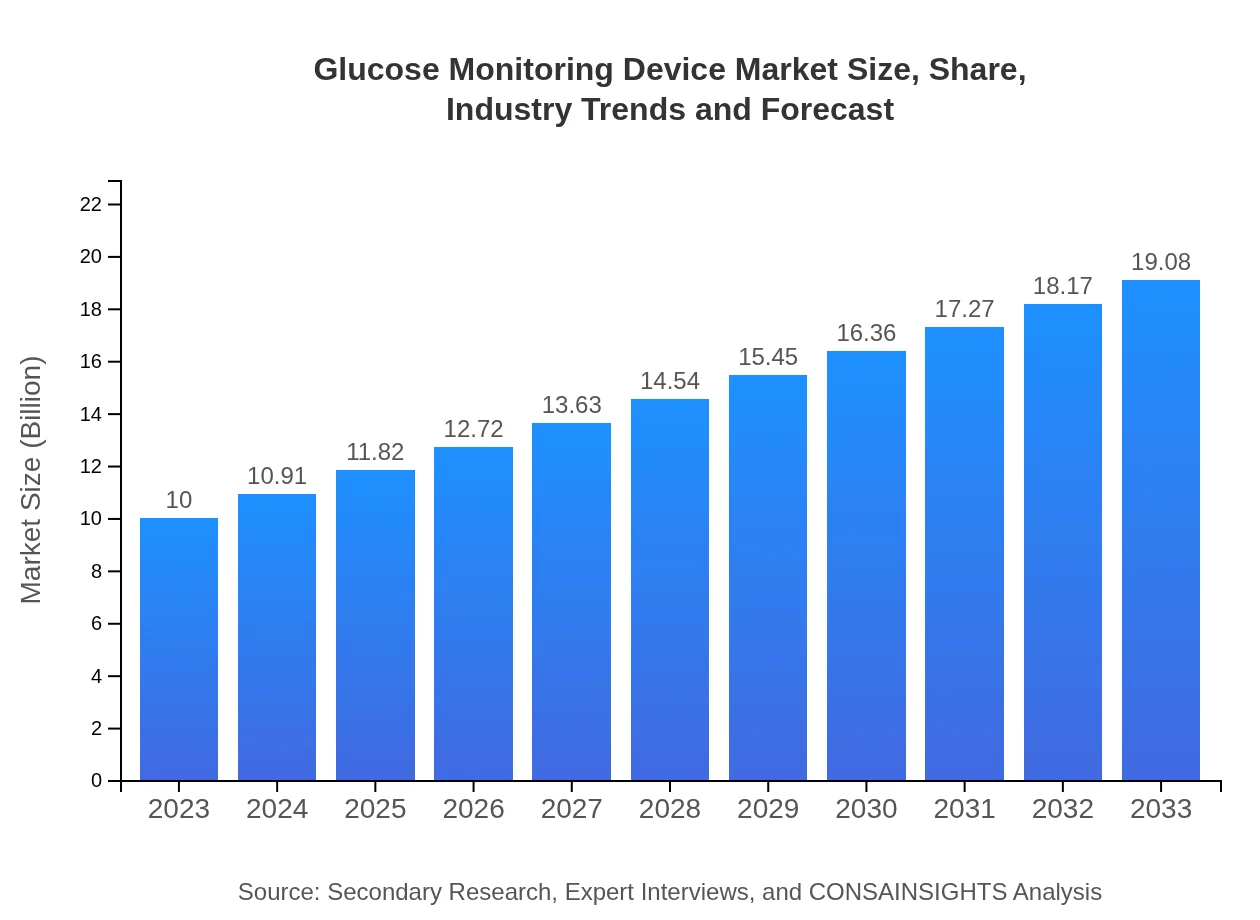

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 6.5% |

| 2033 Market Size | $19.08 Billion |

| Top Companies | Abbott Laboratories, Dexcom, Inc., Medtronic , Roche, Johnson & Johnson |

| Last Modified Date | 31 January 2026 |

Glucose Monitoring Device Market Overview

Customize Glucose Monitoring Device Market Report market research report

- ✔ Get in-depth analysis of Glucose Monitoring Device market size, growth, and forecasts.

- ✔ Understand Glucose Monitoring Device's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Glucose Monitoring Device

What is the Market Size & CAGR of Glucose Monitoring Device market in 2023?

Glucose Monitoring Device Industry Analysis

Glucose Monitoring Device Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Glucose Monitoring Device Market Analysis Report by Region

Europe Glucose Monitoring Device Market Report:

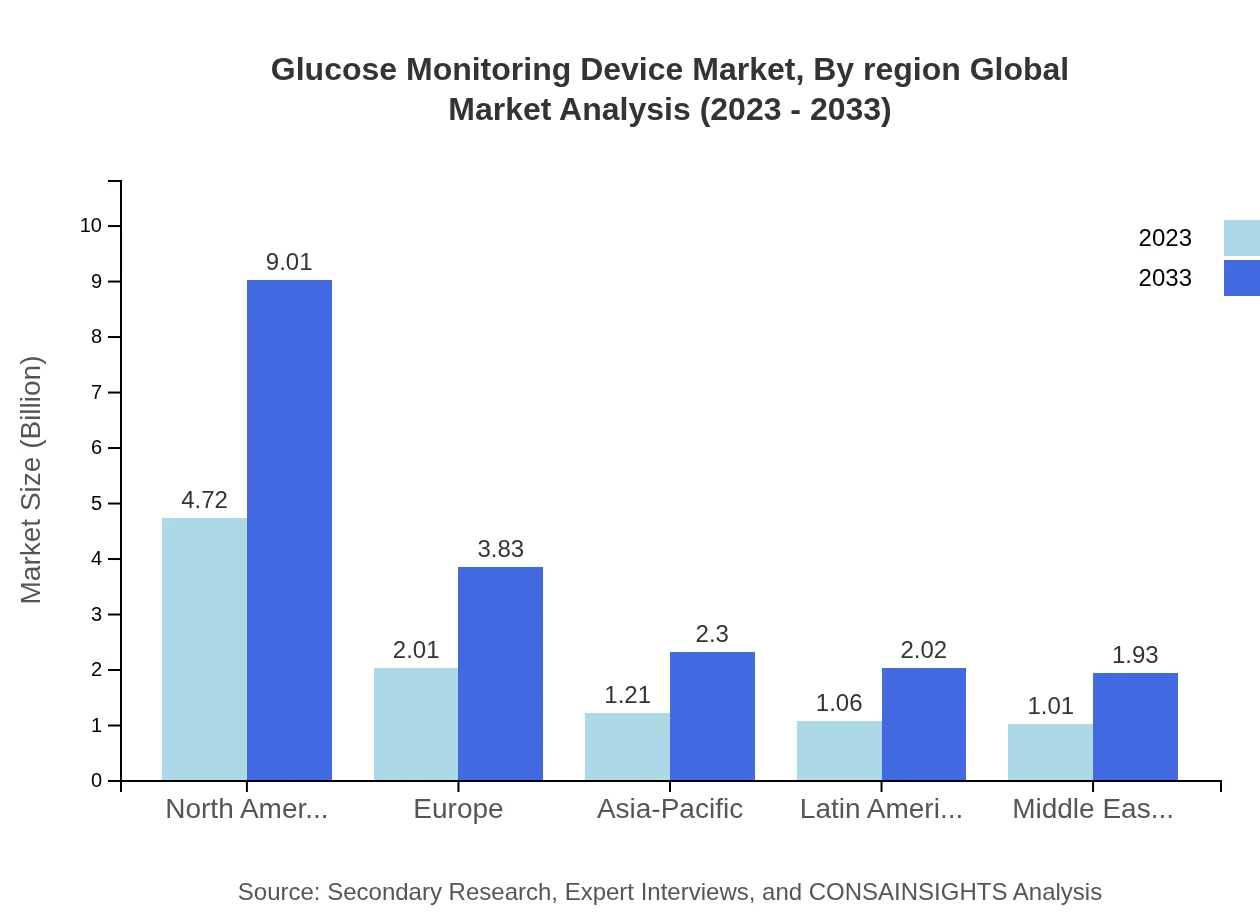

In the European market, the value is estimated at $3.46 billion in 2023 and is expected to grow to $6.60 billion by 2033. The increased emphasis on preventive healthcare and patient-centered services is propelling demand for advanced monitoring solutions. Countries like Germany and France lead in market participation due to robust healthcare systems.Asia Pacific Glucose Monitoring Device Market Report:

The Asia Pacific region is witnessing considerable market growth, with the market valued at approximately $1.88 billion in 2023, projected to grow to $3.58 billion by 2033. The rising diabetic population, increasing healthcare investments, and adoption of advanced monitoring technologies are key drivers. Countries like China and India are significantly contributing to the market's expansion through healthcare initiatives.North America Glucose Monitoring Device Market Report:

North America holds the largest market share, valued at approximately $3.27 billion in 2023, and is projected to reach $6.23 billion by 2033. The region's growth is driven by a high prevalence of diabetes, strong healthcare infrastructure, and rapid technological advancements in glucose monitoring devices. Additionally, a large base of healthcare providers facilitates widespread adoption.South America Glucose Monitoring Device Market Report:

In South America, the glucose monitoring device market is estimated at $0.99 billion in 2023 and is expected to reach $1.89 billion by 2033. Growing awareness about diabetes management and the introduction of affordable monitoring devices are fostering market growth in this region, along with government efforts to address healthcare challenges.Middle East & Africa Glucose Monitoring Device Market Report:

The Middle East and Africa market stands at approximately $0.41 billion in 2023, projected to double to $0.78 billion by 2033. The market is relatively smaller, but increasing healthcare initiatives and investments in diabetes management solutions are anticipated to drive growth in the coming years.Tell us your focus area and get a customized research report.

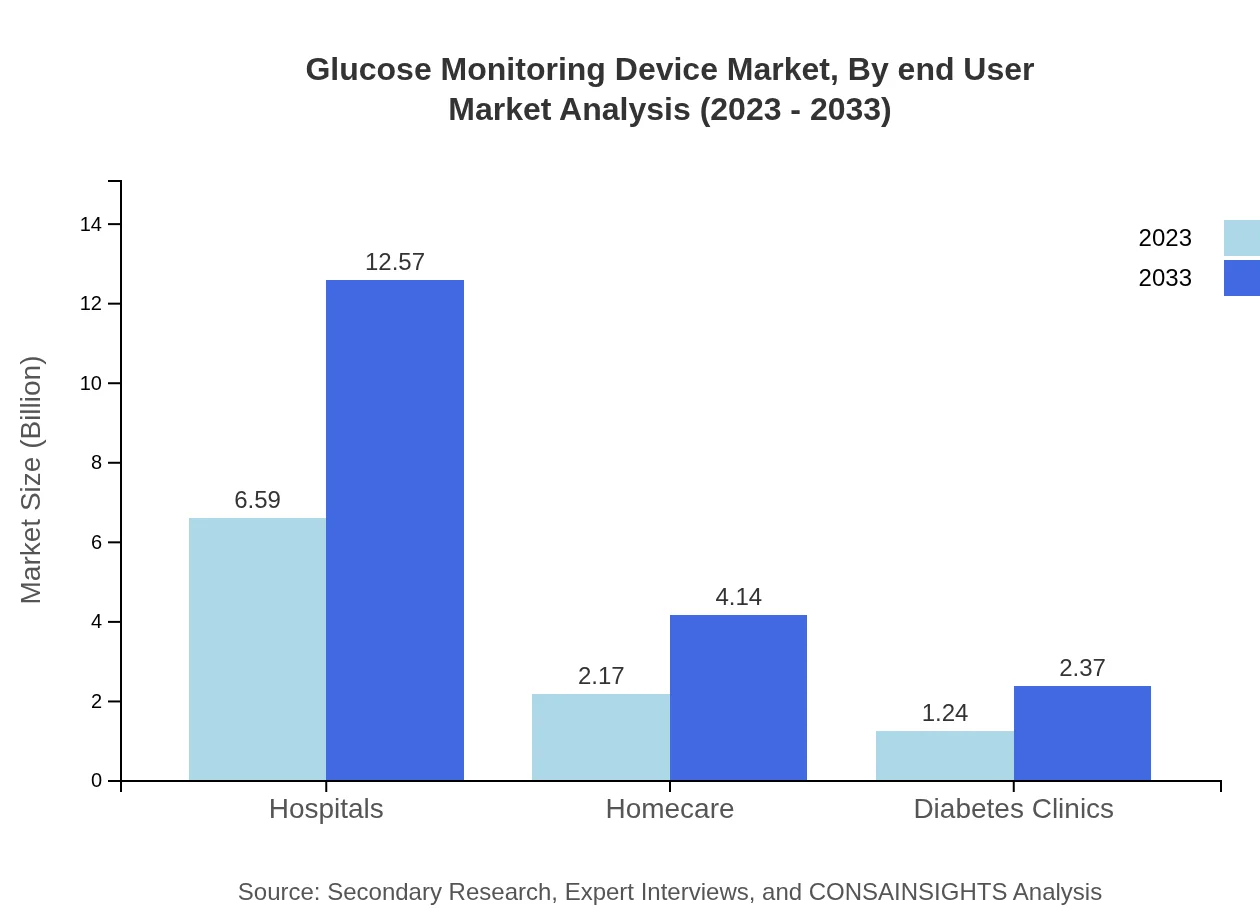

Glucose Monitoring Device Market Analysis By End User

The glucose monitoring device market by end-user includes hospitals, homecare settings, and diabetes clinics. The hospital segment dominates the market with a share of 65.88% and a size projected to grow from $6.59 billion in 2023 to $12.57 billion by 2033. Homecare solutions are also expanding, with a share of approximately 21.71%. The increasing preference for at-home diabetes management solutions is critical, especially among elderly patients seeking convenience.

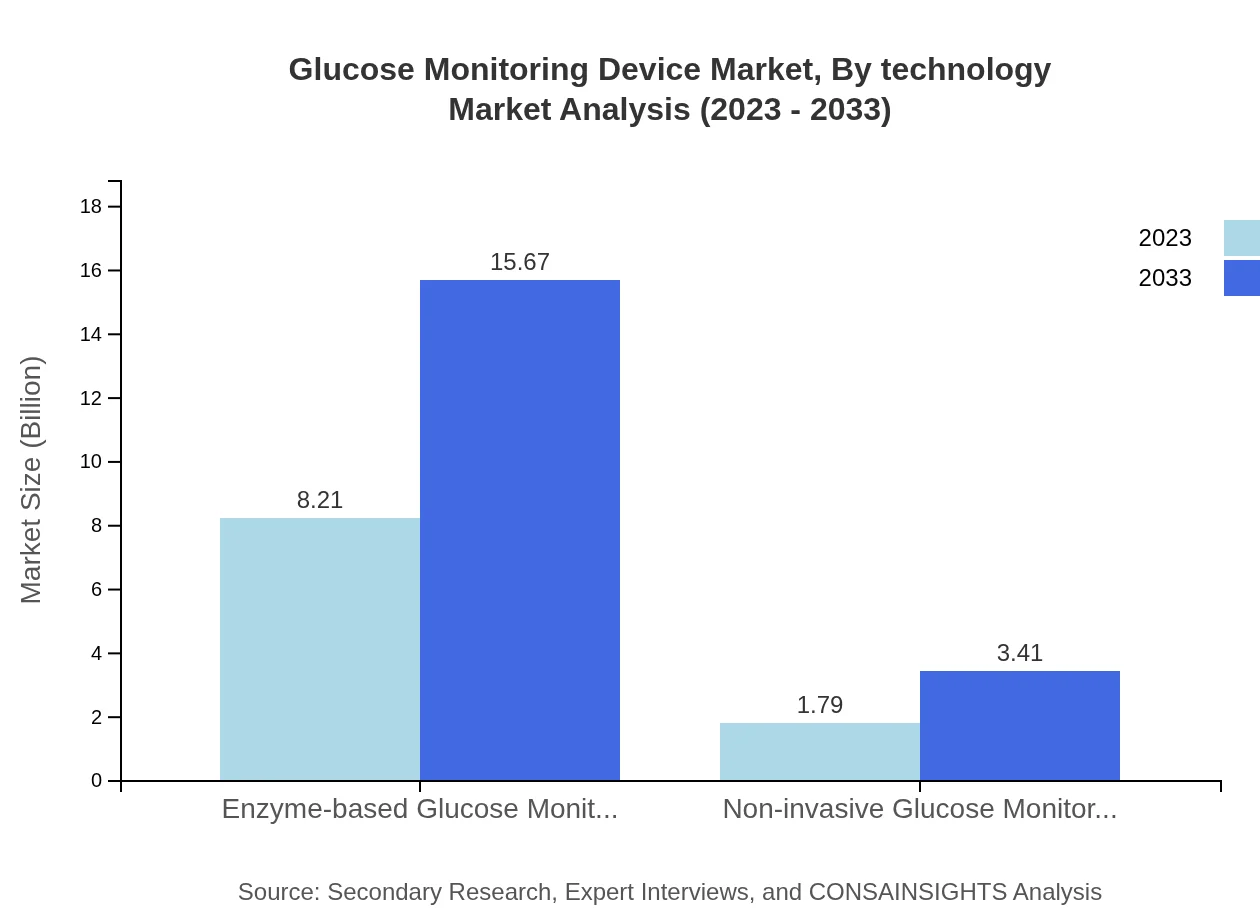

Glucose Monitoring Device Market Analysis By Technology

The market segmentation based on technology highlights two primary types: enzyme-based and non-invasive monitoring technologies. Enzyme-based devices capture a significant market share, accounting for 82.13% with values projected to grow from $8.21 billion in 2023 to $15.67 billion by 2033. Non-invasive technologies, while growing, represent a smaller segment with 17.87% market share, expected to reach $3.41 billion from $1.79 billion in 2023.

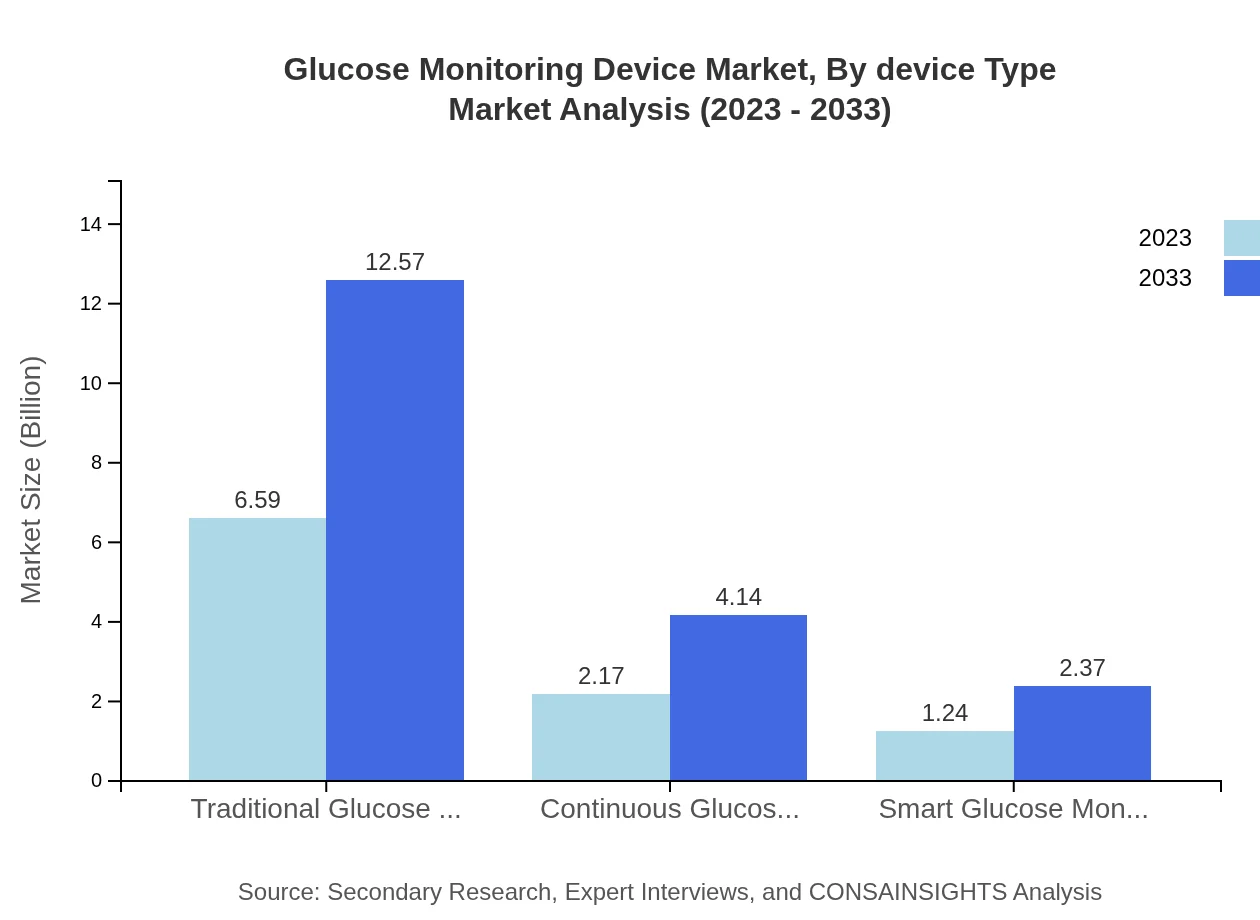

Glucose Monitoring Device Market Analysis By Device Type

In the glucose monitoring device market by device type, traditional glucose meters remain a mainstay, holding a share of approximately 65.88%. Their market size is projected to grow from $6.59 billion in 2023 to $12.57 billion by 2033. Continuous glucose monitors and smart glucose monitors, although smaller segments at 21.71% and 12.41%, respectively, indicate significant growth potential influenced by increasing consumer preference for technology-driven solutions.

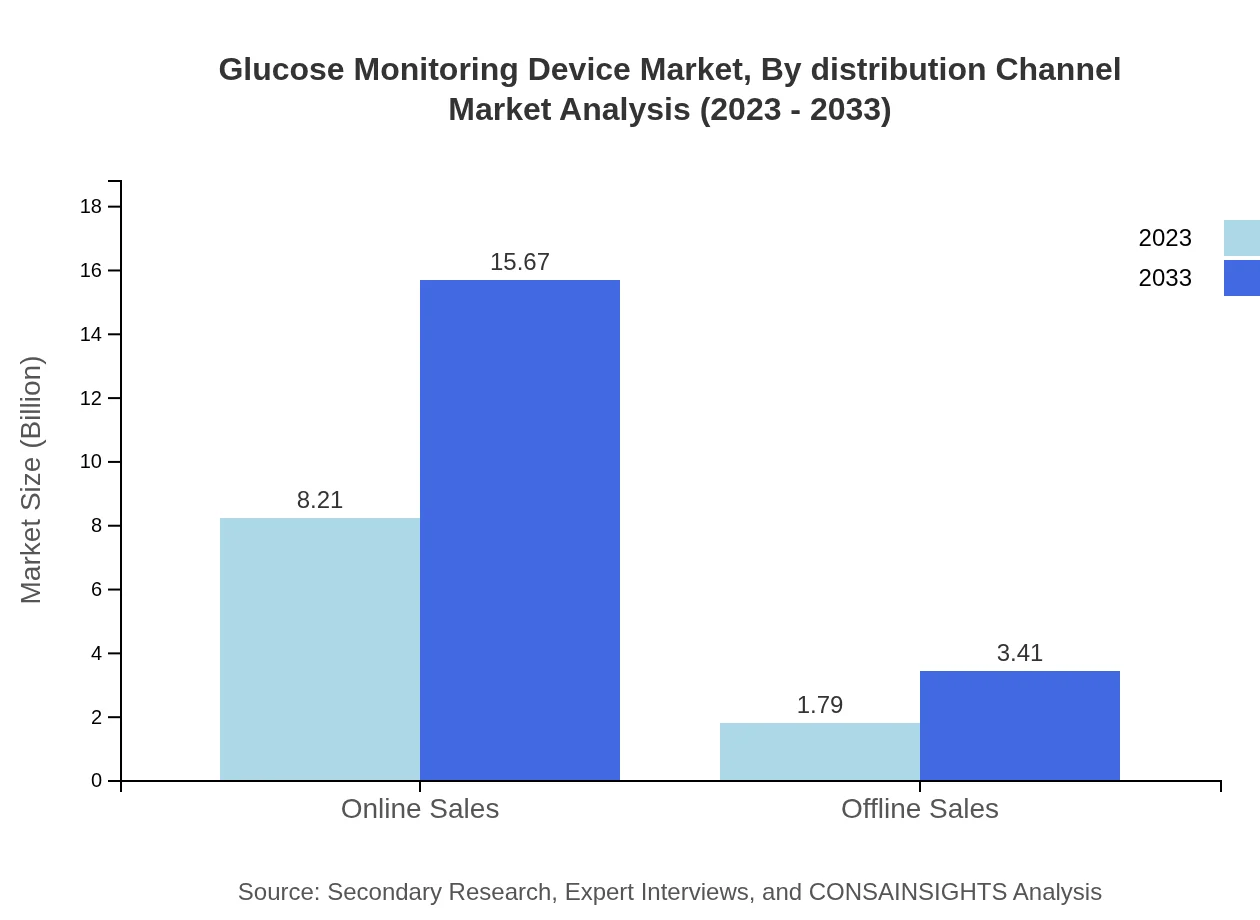

Glucose Monitoring Device Market Analysis By Distribution Channel

The glucose monitoring device market distribution channel analysis reveals a bifurcation into online and offline sales. Online sales dominate with a share of 82.13%, projected to rise from $8.21 billion in 2023 to $15.67 billion by 2033 due to an increase in e-commerce and direct-to-consumer sales. Offline sales, while growing, hold a lesser share of 17.87%, signifying a shift in consumer buying behavior towards digital platforms.

Glucose Monitoring Device Market Analysis By Region Global

The global analysis of the glucose monitoring device market indicates robust growth across various regions, with North America leading in both market size and share. As new technologies and devices emerge, regions like Asia-Pacific are gaining traction, driven by rising health awareness and investment in healthcare infrastructure. The overall dynamic landscape offers diverse opportunities for innovation and expansion for market players.

Glucose Monitoring Device Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Glucose Monitoring Device Industry

Abbott Laboratories:

A global healthcare company known for its advanced glucose monitoring systems including the FreeStyle Libre product line that allows for continuous glucose monitoring.Dexcom, Inc.:

Specializes in continuous glucose monitoring products and is known for its innovative technology providing real-time glucose data for diabetes management.Medtronic :

A leader in medical technologies, including the Guardian Connect continuous glucose monitor, bridging diabetes management with insulin delivery systems.Roche:

Offers a range of traditional glucose meters and the Accu-Chek range, providing comprehensive diabetes management solutions.Johnson & Johnson:

Through its LifeScan division, offers OneTouch glucose monitoring systems, demonstrating commitment to empowering diabetes patients.We're grateful to work with incredible clients.

FAQs

What is the market size of the glucose Monitoring Device?

The glucose monitoring device market size reached approximately $10 billion in 2023, with an expected CAGR of 6.5% from 2023 to 2033. This growth is driven by increasing diabetes prevalence and advancements in monitoring technologies.

What are the key market players or companies in the glucose Monitoring Device industry?

Key players in the glucose monitoring device industry include Abbott Laboratories, Medtronic, Dexcom, and Roche. These companies are at the forefront of technological innovations, offering a range of products catering to diverse consumer needs.

What are the primary factors driving the growth in the glucose Monitoring Device industry?

Primary factors driving growth include rising diabetes cases, technological advancements in monitoring devices, increased health awareness, and a growing preference for homecare solutions. These elements collectively enhance the demand and accessibility of glucose monitoring.

Which region is the fastest Growing in the glucose Monitoring Device market?

Among global regions, North America is the fastest-growing in the glucose monitoring device market, projected to expand from $4.72 billion in 2023 to $9.01 billion by 2033, driven by innovations and increasing diabetes prevalence.

Does ConsaInsights provide customized market report data for the glucose Monitoring Device industry?

Yes, ConsaInsights offers customized market report data for the glucose monitoring device industry, tailored to client-specific needs, including segmentation by region, type, and market trends, ensuring comprehensive insights for strategic decision-making.

What deliverables can I expect from this glucose Monitoring Device market research project?

Expect comprehensive deliverables including market size estimates, growth projections, segment analyses, competitive landscape overviews, and insights on consumer preferences, along with tailored recommendations for market entry strategies.

What are the market trends of the glucose Monitoring Device?

Current market trends include rising demand for smart and continuous glucose monitors, increased adoption of non-invasive methods, a focus on online sales channels, and advancements in sensor technologies, catering to the growing health technology consumer base.