Gluten Feed Market Report

Published Date: 31 January 2026 | Report Code: gluten-feed

Gluten Feed Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Gluten Feed market, covering essential insights and forecasts from 2023 to 2033, including market size, segmentation, regional insights, and leading manufacturers.

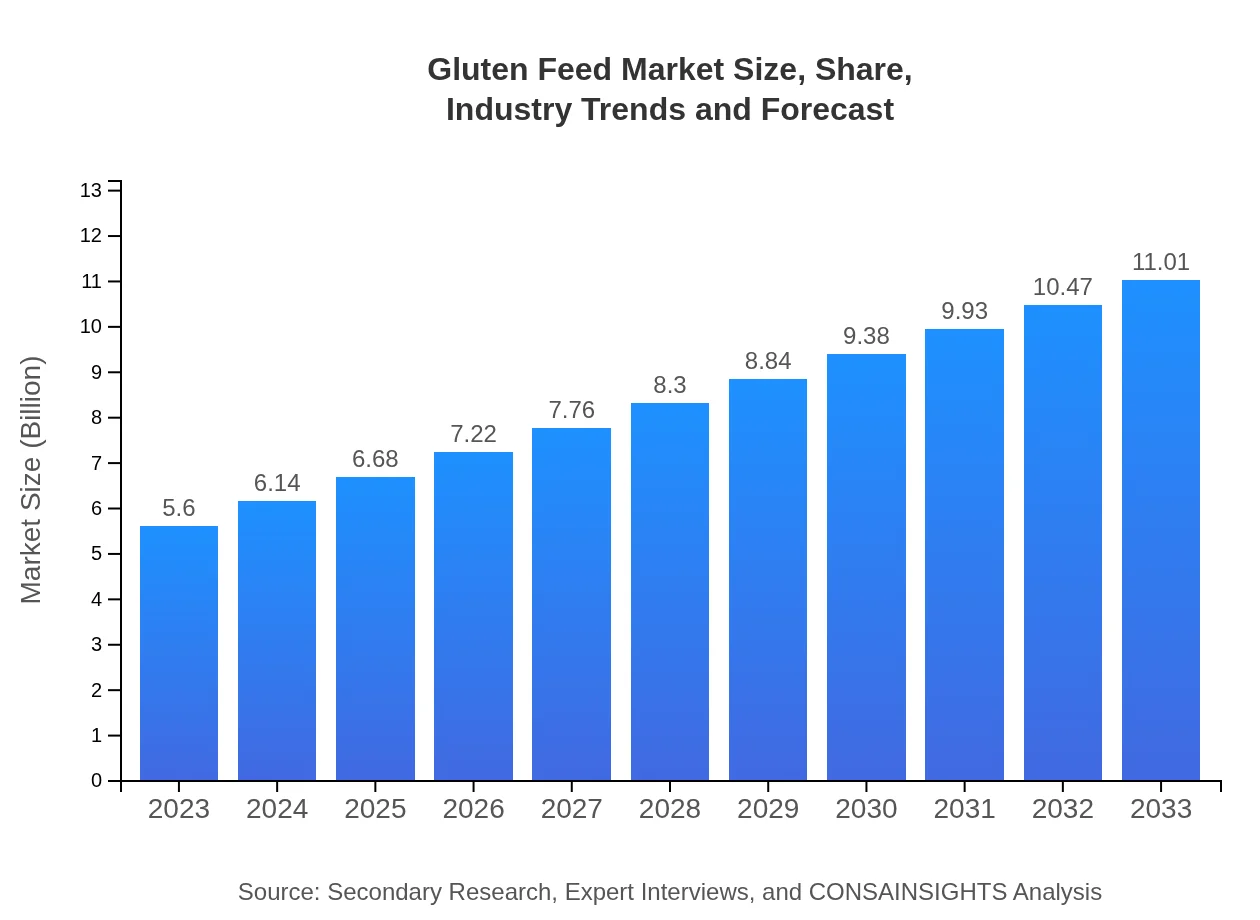

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $11.01 Billion |

| Top Companies | Cargill, Inc., Archer Daniels Midland Company (ADM), Tate & Lyle, Bunge Limited |

| Last Modified Date | 31 January 2026 |

Gluten Feed Market Overview

Customize Gluten Feed Market Report market research report

- ✔ Get in-depth analysis of Gluten Feed market size, growth, and forecasts.

- ✔ Understand Gluten Feed's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Gluten Feed

What is the Market Size & CAGR of Gluten Feed market in 2023?

Gluten Feed Industry Analysis

Gluten Feed Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Gluten Feed Market Analysis Report by Region

Europe Gluten Feed Market Report:

Europe's Gluten Feed market size stands at $1.51 billion in 2023, anticipated to grow to $2.96 billion by 2033 owing to the rising demand for organic and sustainable animal feed solutions, alongside stringent regulatory standards governing feed safety.Asia Pacific Gluten Feed Market Report:

In 2023, the Asia Pacific Gluten Feed market is valued at $1.16 billion and is expected to grow to $2.29 billion by 2033. Key growth drivers include increasing livestock population and rising consumption of poultry products, alongside advancements in feed formulation technologies.North America Gluten Feed Market Report:

The North American market is expected to grow from $2.01 billion in 2023 to $3.96 billion by 2033. The region's robust meat production industry and innovations in animal feed formulations bolster the demand for high-quality gluten feed.South America Gluten Feed Market Report:

Latin America shows a market size of $0.39 billion in 2023, projected to reach $0.77 billion by 2033. The region's growth is supported by a thriving agriculture sector, with Argentina and Brazil being notable players in the livestock feed industry.Middle East & Africa Gluten Feed Market Report:

This region is projected to experience growth from $0.52 billion in 2023 to $1.03 billion by 2033, primarily driven by increasing livestock farming and heightened awareness of animal nutrition, supported by international trade agreements facilitating feed imports.Tell us your focus area and get a customized research report.

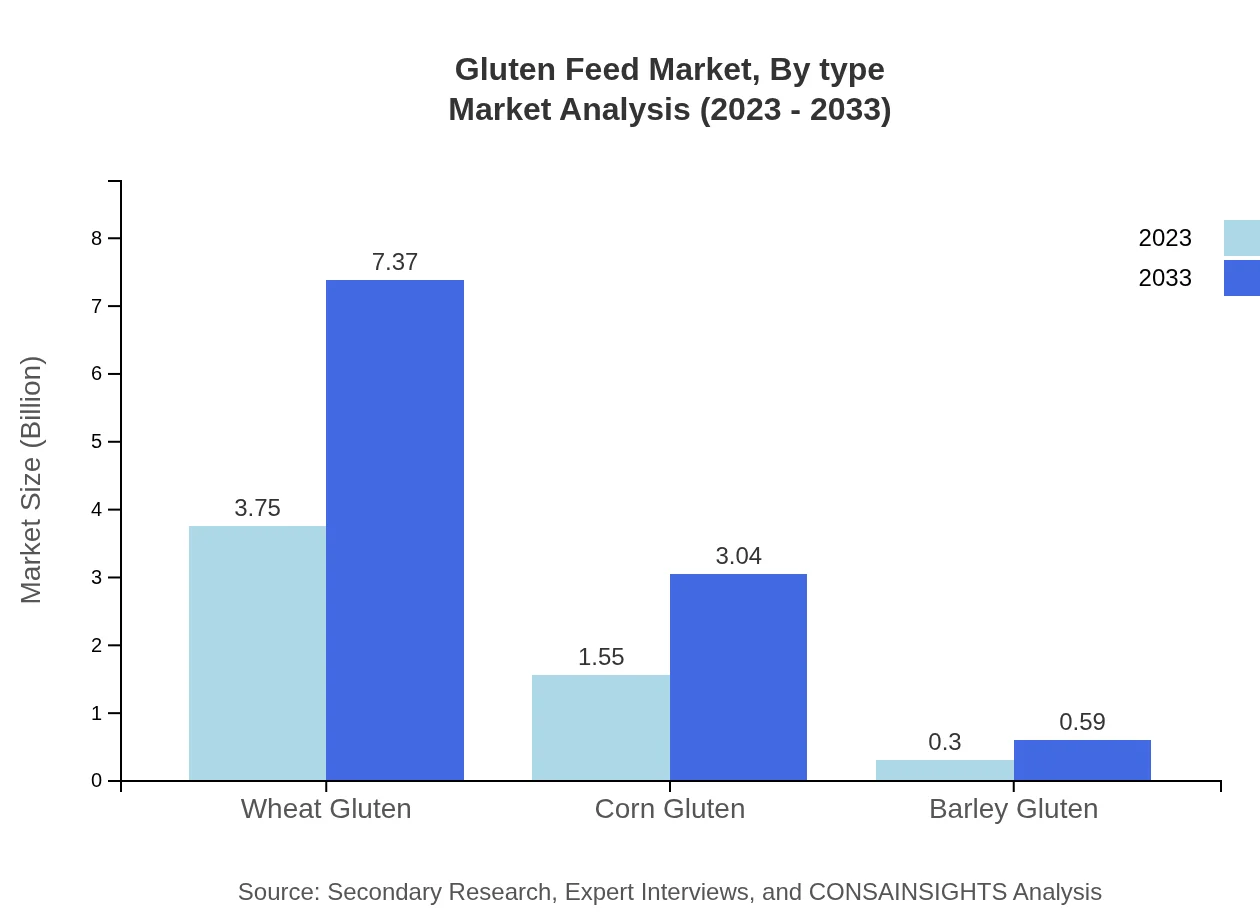

Gluten Feed Market Analysis By Type

The Gluten Feed market is dominated by the Wheat Gluten segment, which contributes significantly to the overall market size. As of 2023, Wheat Gluten accounts for $3.75 billion, projected to reach $7.37 billion by 2033, holding a market share of 66.96%. Corn Gluten follows with a market value of $1.55 billion in 2023, likely to grow to $3.04 billion by 2033, securing a 27.66% share. Lastly, Barley Gluten holds a smaller share of 5.38%, with current values expected to rise from $0.30 billion in 2023 to $0.59 billion by 2033.

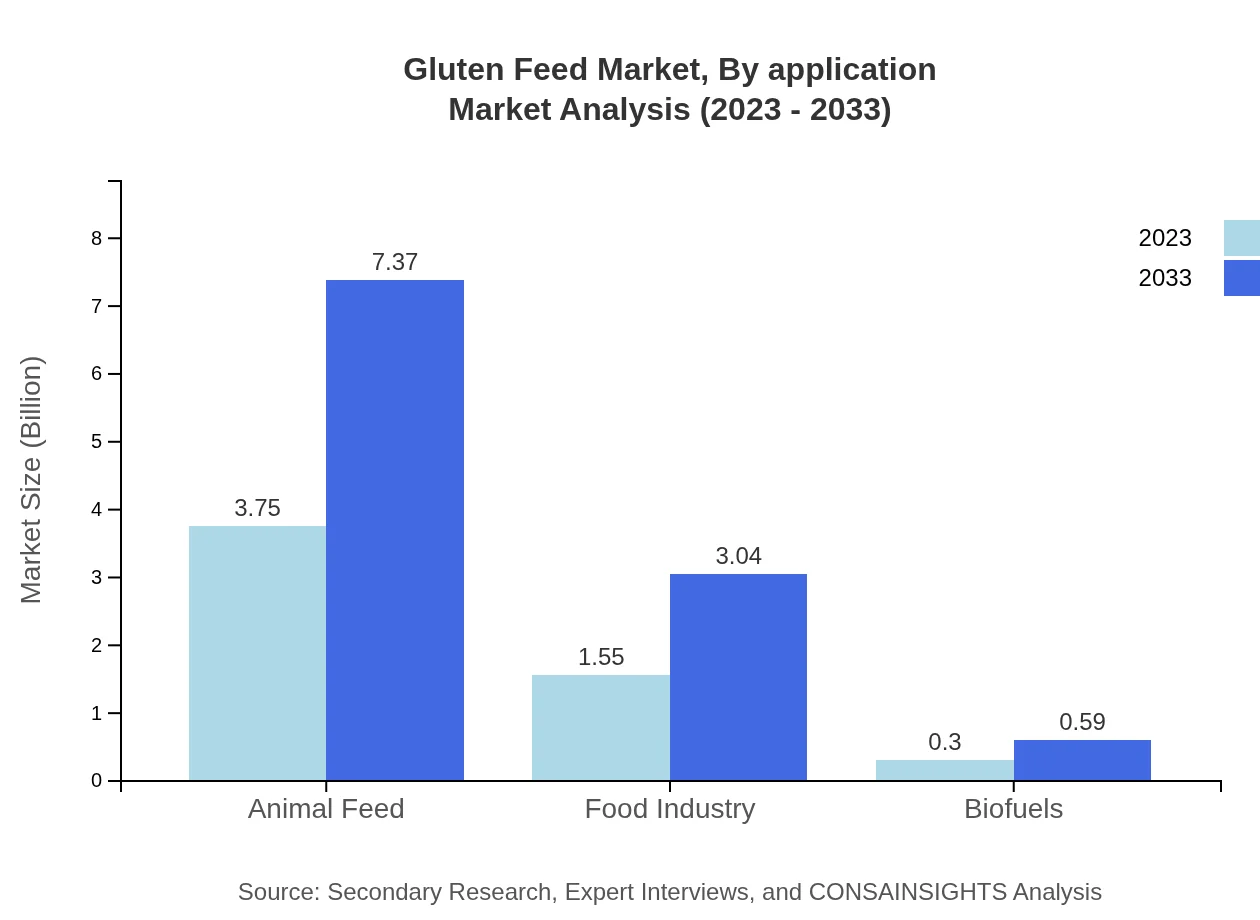

Gluten Feed Market Analysis By Application

The application of gluten feed spans multiple sectors. The Animal Feed segment, valued at $3.75 billion in 2023, dominates the space with expectations of reaching $7.37 billion by 2033, reflecting a 66.96% share. The Food Industry, with a market share of 27.66%, sees growth from $1.55 billion to $3.04 billion during the same period. Biofuels exhibit a smaller but significant segment, with growth predicted from $0.30 billion to $0.59 billion.

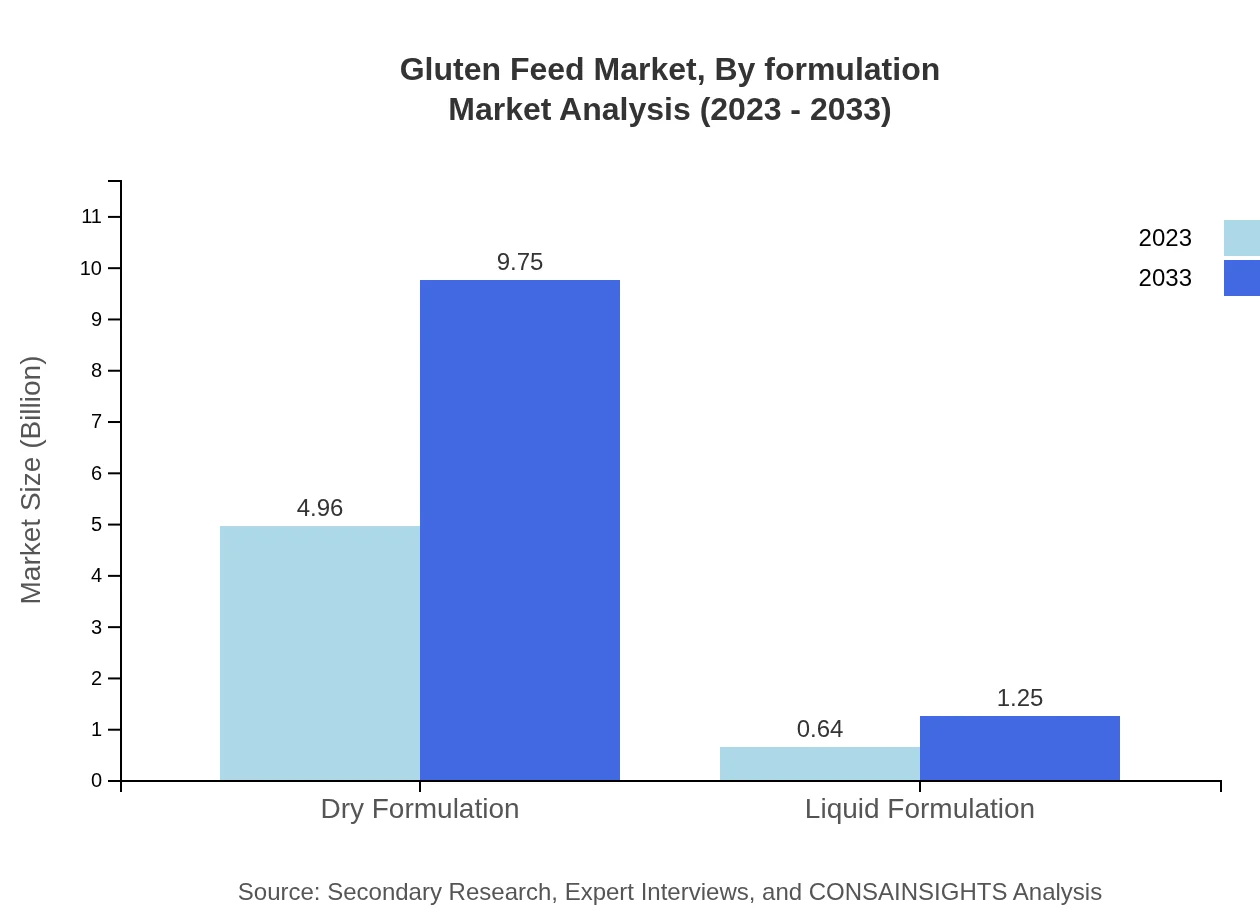

Gluten Feed Market Analysis By Formulation

The market is primarily defined by Dry and Liquid formulations. Dry formulation leads with a substantial market size of $4.96 billion in 2023, projected to rise to $9.75 billion by 2033, holding an impressive 88.61% market share. Liquid formulation, although smaller, is anticipated to escalate from $0.64 billion to $1.25 billion, representing an 11.39% share.

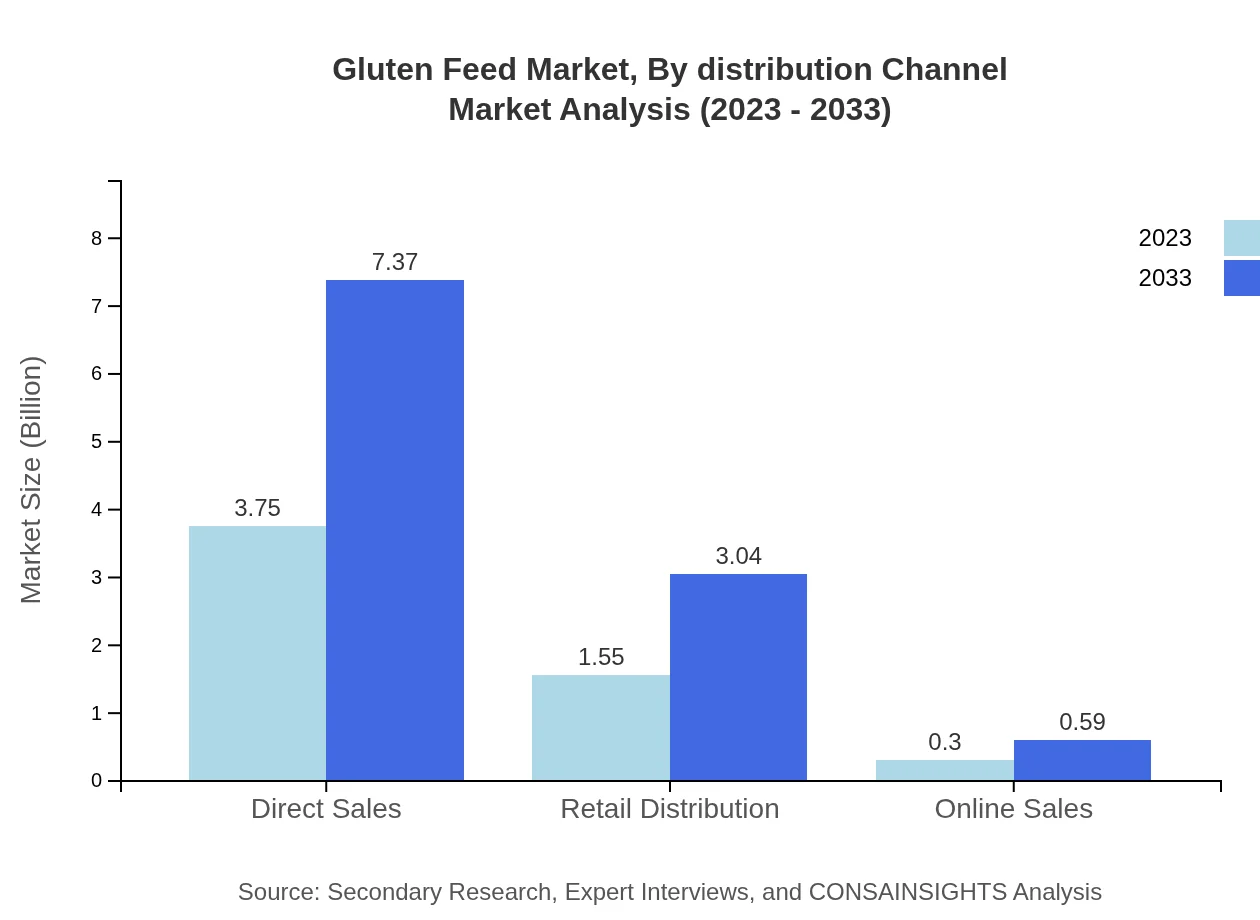

Gluten Feed Market Analysis By Distribution Channel

Direct sales dominate the distribution channel, accounting for $3.75 billion in 2023 with projections of $7.37 billion by 2033, sustaining a 66.96% market share. Retail distribution follows closely with $1.55 billion, expected to reach $3.04 billion, while online sales, though smaller at $0.30 billion, are anticipated to grow to $0.59 billion.

Gluten Feed Market Analysis By End User

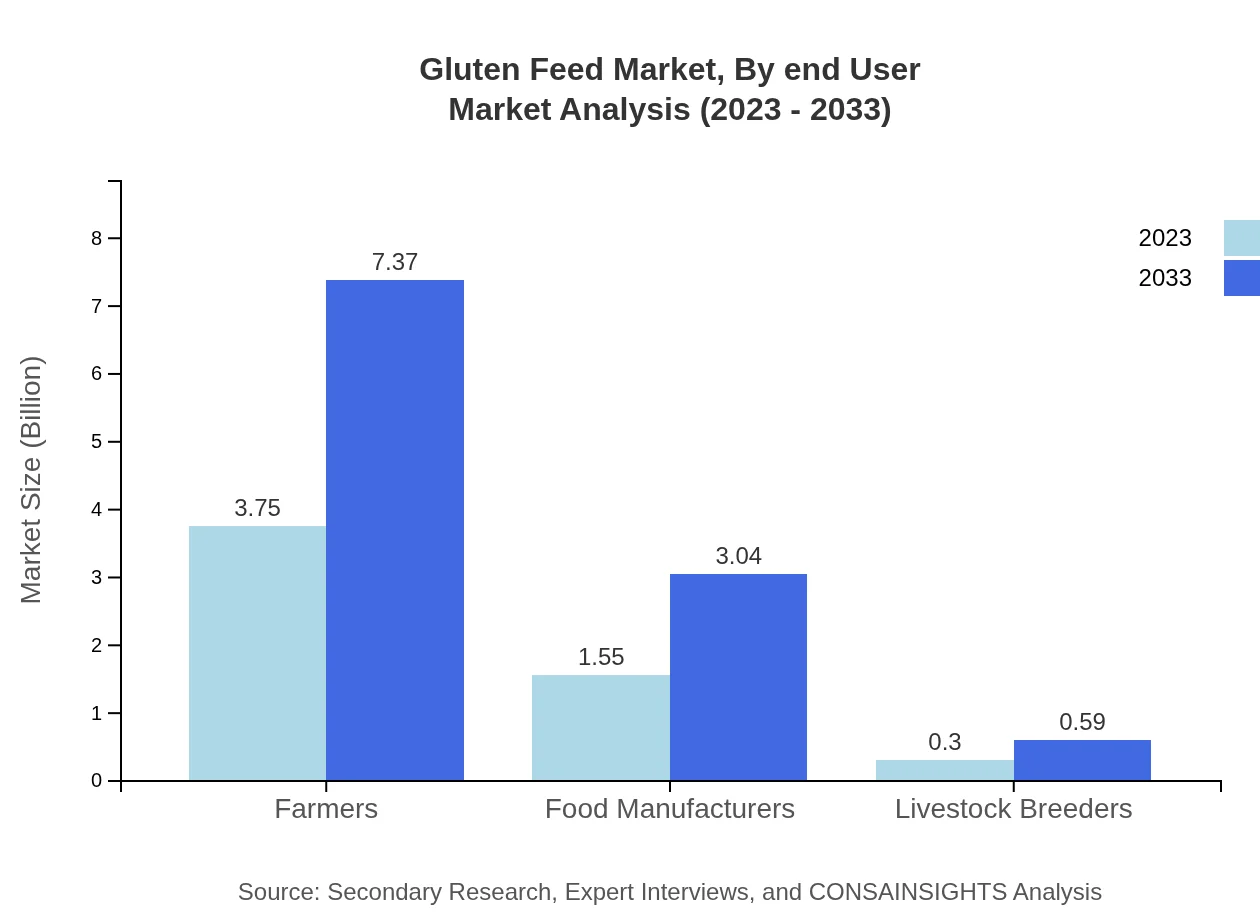

Farmers constitute the largest end-user segment with values reaching $3.75 billion in 2023 and projected to grow to $7.37 billion by 2033, maintaining a significant 66.96% market share. Food manufacturers exhibit a market value of $1.55 billion, expected to reach $3.04 billion, while Livestock breeders hold a smaller share, growing from $0.30 billion to $0.59 billion.

Gluten Feed Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Gluten Feed Industry

Cargill, Inc.:

A leading global player in food production and agricultural services, Cargill is known for its high-quality gluten feed products that cater to both animal feed and food manufacturing sectors.Archer Daniels Midland Company (ADM):

ADM is a prominent multinational involved in food processing and commodities trading, providing a wide range of animal feed solutions, including significant gluten feed products.Tate & Lyle:

An international provider of food ingredients and solutions, Tate & Lyle offers innovative gluten-based products, emphasizing sustainability and nutrition.Bunge Limited:

Bunge is a global agribusiness company producing food and feed ingredients, diversifying into gluten feed segments to meet evolving market demands.We're grateful to work with incredible clients.

FAQs

What is the market size of gluten Feed?

The global gluten feed market is projected to grow from $5.6 billion in 2023 to a larger size by 2033, with a compound annual growth rate (CAGR) of 6.8%. This reflects growing demand across multiple sectors.

What are the key market players or companies in the gluten Feed industry?

Key players in the gluten-feed market include major suppliers and manufacturers engaged in producing and distributing gluten-based products for food processing and animal feed, significantly impacting market dynamics and strategies.

What are the primary factors driving the growth in the gluten Feed industry?

The growth of the gluten-feed industry is primarily driven by increased demand for high-protein livestock feed, advancements in production technology, and a rising trend towards sustainable agricultural practices reinforcing market expansion.

Which region is the fastest Growing in the gluten Feed market?

The fastest-growing region in the gluten feed market is projected to be North America, with the market increasing from $2.01 billion in 2023 to $3.96 billion by 2033, reflecting robust demand in animal husbandry.

Does ConsaInsights provide customized market report data for the gluten Feed industry?

Yes, ConsaInsights offers customized market report data tailored specifically to the gluten-feed industry, enabling stakeholders to access insights and analyses beyond standard reports for informed decision-making.

What deliverables can I expect from this gluten Feed market research project?

Deliverables from this gluten-feed market research project include comprehensive market insights, analysis by segment and region, growth forecasts, competitive landscape assessments, and actionable recommendations for business strategies.

What are the market trends of gluten Feed?

Current market trends in gluten-feed highlight a shift towards organic and sustainable sourcing, increased ingredient diversification in animal nutrition, and the rising importance of gluten as a valued protein source across food and feed applications.